Set Your Business Up For Sales Success In A Post-Pandemic World

Dean Fiveash Head of FinTech Sales, IFX Without doubt the Coronavirus pandemic impacted every aspect of our lives and fundamentally changed the way in which we all conduct business.

1 in 3 British Consumers Formed a New Banking Relationship During the Pandemic

Key facts · 29 percent of UK consumers have started a new banking relationship in the past year. · Young millennials (age 25-29) are most likely to switch to a new bank (46 percent), followed by over a third of senior millennials and Gen Zers (both 39 percent).

Claranova (CLA): Adapting to Post-pandemic Normal

- 4 years 1 month ago

- Covid-19, Consultancy

Claranova reported Q122 revenue of €88m (-2% y-o-y), slightly better than its end-September expectation of a 5% decline. Now that the transition to subscription licensing is complete, Avanquest is seeing revenue growth accelerate. PlanetArt saw organic revenue declines in the last two quarters, but management is confident of a return to growth in Q222. We have revised our forecasts to reflect FY21 results and the Q1 revenue update.

Partnerships Between Schemes, Networks and Banks Are Boosting Card Acceptance Worldwide

Regulations, COVID-19, and an increasing number of partnerships are driving card acceptance across all regions. Further growth in traditional card acceptance is forecast but will be tempered by the rising popularity of alternative options COVID-19 leads many outlets to start accepting card payments for the first time

Smart Engines Launches New Barcode Scanning AI-powered Modes to Strengthen Security and Preventative Measures for Covid-19

- 4 years 1 month ago

- Artificial Intelligence, Covid-19

Smart Engines scientists have developed multi-code and continuous session scanning in anticipation of a challenging epidemiological situation worldwide. In particular, now the mandatory Covid-19 QR code scanning required for entering certain premises in some countries is greatly simplified for staff and customers. If identity confirmation is necessary for the QR code, the Smart Engines solution also allows ID scanning.

New Research Finds Almost Half of Financial Executives Expect a Return to Normal Growth by 2022

CFOs expect continued inflation and supply chain shortages, turn to predictive technology to support positive business outcomes

CFPB Takes Action to Prevent Avoidable Foreclosures

- 4 years 1 month ago

- Covid-19

Agencies Will Examine for Compliance with COVID-19 Protections

No one Left Behind - the Bristol Businesses Emerging from the Pandemic

- 4 years 1 month ago

- Covid-19

As we emerge from the pandemic, businesses are still not out of the woods yet. Effects of Brexit are being felt with supply chains and recruitment at breaking point for some sectors. It’s been a tough 18 months for four Bristol-based businesses who all chose to take a positive mindset over the lockdown periods. Alastair Donnelly, co-owner of Inside Travel Group, a worldwide Asian specialist travel company, had to adjust massively to the... more

VisionLabs’ New Biometric Payment Terminal Transforms Payments Industry

- 4 years 2 months ago

- Covid-19, Payments, Credit Cards

LUNA POS Terminal is the world’s first payment solution to offer both contactless facial recognition payments and traditional card payments to consumers

The COVID-19 Pandemic and its Impact on Financial Crime

- 4 years 2 months ago

- Covid-19

The outbreak of COVID-19 has seen the world face extraordinary challenges to public health and the global economy. The pandemic has also driven unprecedented levels of cyber and financial crime.

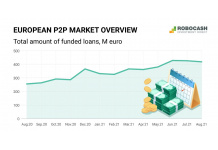

Mature P2P Platforms to Recover More Than 9% Above Average

- 4 years 2 months ago

- Covid-19, Investment, P2P Lending

During the market recovery after COVID-19 outbreak, European P2P platforms that emerged by 2017 have rebounded at above-market growth rate. The calm upward trend is supported by a 2% increase in monthly financed loans in 2021. To assess the growth rate of P2P platforms, Robocash analysts studied 43 platforms that are present in 16 European countries and operating mainly in the consumer and business segments.

PCI Pal® announces Amazon Connect Integration and AWS Marketplace Availability

Amazon Connect users across the globe can now leverage PCI Pal’s secure payments solutions for additional payment security and compliance options the global provider of secure payment solutions – today announced a new integration with Amazon Connect to offer its customers worldwide with additional options for payment security and compliance with PCI Pal omnichannel secure payment solutions.

The Importance of Integrated Payment Solutions for the Hospitality Industry

The importance of integrated payment solutions for the hospitality industry By Dean Farley, Global Business Development Manager – Travel & Hospitality – GSV at Worldline Hospitality merchants looking to bounce back from the damaging effects of the pandemic to their industry must swiftly invest in new payments infrastructure available to them. This will help them increase revenue and keep pace with their rivals following a rapid, necessary... more

World’s Banks Accelerate Shift to Digital After COVID-19

- 4 years 3 months ago

- Covid-19, Banking, Cybersecurity

Digital technology highlighted as key to meeting new decarbonization targets as Atos launches new Digital Vision: Digital Banking report Banks are rapidly accelerating their shift to digital channels as they seek to reinvent their business models in response to the COVID-19 pandemic, a new paper from Atos reveals.

Global Covid-19 FinTech Market Impact and Industry Resilience Survey

- 4 years 3 months ago

- Covid-19, Alternative Finance

Deutsch English - United Kingdom Español Français Italiano Português 日本語 简体中文 Thank you for participating in the Global Covid-19 FinTech Market Impact and Industry Resilience Survey, collected by the Cambridge Centre for Alternative Finance (CCAF) at the University of Cambridge Judge Business School, and undertaken in partnership with the World Bank Group and World Economic Forum.