Ilya Kretov to lead Tinkoff E-commerce

- 4 years 4 months ago

- E-Commerce, Banking

Ilya Kretov has joined the Tinkoff team as Director of E-commerce. In this role, he will lead the new business line of Tinkoff E-commerce, an ecosystem of services for online businesses that operates within the scope of Tinkoff Business.

Drawbridge Names Thomas Fallucco Chief Revenue Officer

- 4 years 4 months ago

- Investment, Alternative Finance, Cybersecurity

Senior Business Development Professional Joins Drawbridge to Drive Continued Global Growth Drawbridge, a premier provider of cybersecurity software and solutions to the alternative investment industry, today announced the appointment of Thomas Fallucco as Chief Revenue Officer (CRO). Fallucco will be responsible for driving continued growth while expanding a global footprint through international business and enhancing client relationships and... more

Swedish Fintech Dreams Appoints Stefan Krafft as New VP of B2B Marketing to Boost Next Phase of International Expansion

- 4 years 4 months ago

- Payments, Banking, People Moves

Dreams (www.getdreams.com), the financial wellbeing platform and leader in engagement banking solutions, today announces the appointment of Stefan Krafft as its new VP of B2B Marketing, to further drive the company’s B2B customer acquisition strategy and help facilitate partnerships with some of the world’s largest financial institutions.

Luminor Bank Extends Partnership With Ondato to Enable Remote Opening of Business Accounts in Latvia

- 4 years 4 months ago

- Banking, Compliance

Luminor Bank, the third-largest bank in the Baltic region, and Ondato, the leading provider of compliance as a service, are partnering to allow companies the opening of Luminor business accounts remotely in Latvia.

Westerra Credit Union Partners with Backbase to Offer Cutting Edge Technology and Transform Members’ Digital Experience

New partnership with Backbase will allow Westerra Credit Union to scale digitally with increased flexibility and speed

GBB Goes Live on nCino to Enhance and Streamline Banking Workflow

Challenger bank utilising the nCino Bank Operating System® to bring easier access to funding to SME property developers nCino, Inc. a pioneer in cloud banking and digital transformation solutions for the global financial services industry, today announced that ‘champion for the North’ challenger bank GBB is live on the nCino Bank Operating System®.

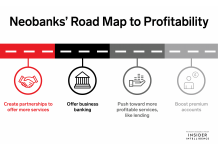

Nubank’s first profitable H1 in Brazil vindicates its scale-first approach

- 4 years 4 months ago

- Banking

Nubank revealed that it turned its first-ever half-year profit in Brazil, its home market and its biggest one, per Reuters. The neobank reported H1 2021 net income of BRL$76 million ($14.7 million), a year-over-year (YoY) surge from its H1 2020 loss of BRL$95 million ($18.4 million). (The update doesn’t include performance data for the company’s other markets, Mexico and Colombia.)

Zopa Raises $300 Million Led by Softbank Vision Fund 2 to Build the UK’s Best Bank for Lending and Savings

- 4 years 4 months ago

- Digital banking, Fundraising News, Banking

· Launched in June 2020, Zopa bank is one of the UK’s newest digital banks, built on its unique legacy as the world’s first Peer-to-Peer lender · It meets customer needs by focusing on how they borrow and save, the two things with the most impact on consumer finances · Latest financing is a clear validation of Zopa’s sustainable lending model and of its strong unit economics

Rosbank, Part of the Societe General Group, and Diasoft Named Finalists of the Global Banking Tech Awards 2021

- 4 years 4 months ago

- Banking, IT Innovations

The joint project of Rosbank, part of the Societe General Group, and Diasoft has been named finalist of the global Banking Tech Awards 2021 in the category “Best Use of IT for Lending”. The large-scale IT transformation project “Core Engine for Loans and Deposits” (CELD) based on Diasoft’s digital solutions allowed the bank to fully move its corporate lending business processes into the digital environment.

Chip closes the biggest equity crowdfund of the year; raises £11.5m from 12K investors

- 4 years 4 months ago

- Fundraising News, Banking

Chip, the digital savings account, has raised a total of £11.5 million from 12,954 investors, making it the biggest equity crowdfund of the year as well as the biggest equity crowdfund held on Crowdcube of all time. As part of the record-breaking round, Chip raised £1 million in under 10 minutes and hit £8.6+ million in under 48 hours. Off the back of the crowdfund, the company added 6,500 new investors, growing its shareholder community to over... more

BIAN Defines the Future of Banking with Development of their Coreless Banking Platform

- 4 years 4 months ago

- Banking, Infrastructure

Banks, fintechs, and software vendors collaborate to overcome obstacles surrounding interoperability BIAN, the independent not-for-profit standards association, is today announcing the second iteration of its ‘Coreless Bank’ initiative. Working with experts from DXC, IBM-Redhat, JPMorgan Chase, PNC, Salesforce, Tata Consultancy Services, Thought Machine and Zafin, the concept has been developed to overcome the common obstacles surrounding the... more

Banking Platform Launches to Power SME Lending Across Europe

- 4 years 4 months ago

- Digital banking, Lending, Banking

FIBR brings EUR 1bn of lending to help European SMEs thrive post-pandemic FIBR, the connected digital bank, has launched with the sole focus of servicing European SMEs, through combining the stability of a bank with the agility and technology of a fintech.

Telenor Microfinance Bank Goes Live on Temenos with NdcTech to Drive Digital Growth

- 4 years 4 months ago

- Payments, Banking, Core Banking

Temenos Transact core banking will enable fast product innovation and massive scalability and efficiency for Pakistan’s leading digital payments platform Easypaisa. Telenor Microfinance Bank, operator of Pakistan’s leading digital payments platform Easypaisa, has gone live on Temenos’ modern core banking platform with NdcTech to power its digital banking services.

Payally Chooses Nets for Issuer and Acquirer Processing

Payment services provider PayAlly, and Nets Group, one of Europe's leading PayTechs, have entered into a partnership for full issuing and acquiring processing services in the United Kingdom.

MoneyLIVE Autumn Festival: Launches both virtually and in-person this October and November, featuring all-star speaker line-up

- 4 years 4 months ago

- Banking

MarketforceLive is delighted to announce the launch of the MoneyLIVE Autumn Festival 2021! With virtual episodes PLUS the highly anticipated Big Meet-up, which will bring the banking community back together face-to-face, giving you the option to create the right festival experience for you this year.