Mobile Web App

Product Profile

Screenshots

Product/Service Description

Compliance for Mobile Messaging KyoLAB bridges the gap between compliance and mobile messaging for regulated financial services. KyoLAB’s platform offers monitoring and archiving, as well as real-time Compliance alerts and analytics, for popular mobile messaging apps such as WhatsApp, WeChat, Facebook Messenger, Skype Mobile, Yahoo Mobile, iMessage, and others. Our aim is to be the reference solution for popular mobile messaging with respect to compliant audit trail and dispute resolution.

Customer Overview

Features

- Monitoring

- Archiving

- Analytics

Benefits

- Compliant messaging

- Customer engagement

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

Validate is the leading API based realtime payment beneficiary validation solution for Banks, NBFI's and Corporates. It will validate single and bulk payments and suggest changes and enrichment to make sure its users achieve near 100% STP, dramatically lower operation costs caused by payment failures and improve client relationships.

Customer Overview

Features

- the product features a simple to deploy REST API and complimentary browser that allows our clients to build end to end payment soultions with no manual intervention. the product also provides a realtime reportnig suite that allows clients to fine tune the

Benefits

- saves large amounts of operational time and cost whilst providing end users with inutitive tips to making clean payments.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

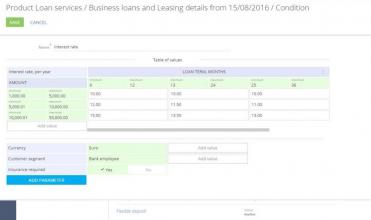

Screenshots

Product/Service Description

Bpm’online is a global provider of award-winning CRM software that streamlines customer-facing processes and improves operational efficiency. Bpm'online financial services is a powerful CRM designed for corporate and retail banks and financial institutions to manage a complete customer journey and enhance customer experience. The users of bpm’online financial services highly value its process-driven CRM functionality, out-of-the box best practice processes and agility to change processes on the fly. Bpm’online financial services offers products that are seamlessly integrated on one platform connecting the dots between banks’ business areas: retail banking and front-office, corporate banking, marketing.

Customer Overview

Features

- 360° customer view

- Customer segmentation

- Opportunity management

- Product management; product-segment matrix

- Customer weight ranking

- Account management

- Customer lifecycle management

- Omnichannel communications

- Product catalog with the possibility to configure product and pricing parameters

- Consulting and transaction contact-center with the workplaces for bank tellers, agents, supervisors

- Case management

- Knowledge management

- Contracts and documents

- Loan origination processes: unsecured loans, mortgage, auto loans, and others

- Lending application processing, managing loan applications from agents or partners

- Fraud prevention

- Verification and underwriting

- Loan maintenance

- Monitoring pledged assets

- Managing loan paperwork

Benefits

- Align marketing, sales and service on a single CRM platform for banks' business processes

- Gain the agility to change processes in the CRM faster than ever

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots & Video

Product/Service Description

Cash pooling and treasury management are key focus areas for corporate treasuries, with many corporates looking to their banks to offer these services. Additionally, regulations such as Basel III are changing bank-client relationships, putting more pressure on corporates to more effectively handle their cash positions. However, developing new banking services in-house can be time-consuming and expensive.

For banks interested in advancing their corporate banking services, the Reval INSIDE package integrates cash and liquidity management functionality seamlessly into the bank's platform and web portal. This integration provides a superior experience to corporate clients, a fast and cost-effective way for banks to differentiate themselves, and to win and retain clients.

Customer Overview

Features

- Cash Concentration: Provide your corporate clients with true end-of-day cash concentration. Enable multi-level cash pools across borders, entities and banks with one global, integrated solution

- Notional Pooling: Set up single or multi-level notional pools with cascading interest reallocation at arm's length principle. Provide full offsetting and interest enhancement schemes with optional physical interest settlement

- Investment Sweeping: Automatically repatriate idle cash on corporate accounts to on-balance sheet and off-balance sheet vehicles. Offer your corporate clients compliance reporting and analysis of their trade portfolio as a self-service within bank portal

- Intercompany Loans: As part of the cash concentration process, automatically create and update intercompany loans in real-time. Calculate and book intercompany interest based on your clients' preferences

- Incentive Management: Build incentive campaigns and reward programs to attract corporate deposits. Use a flexible product configurator to overtake competitors with a short time to market

- Cash Positioning: Offer your clients more than just cash management. Extend your value proposition with global cash visibility

- Cash Forecasting: Enable clients to forecast cash flows, using best practice categories. Pre-populate data, for your bank only

- Investments & Debt: Providing corporate clients with an online platform to centrally manage their derivative, debt, investment and trade portfolios

- Risk Management: Provide your clients with a platform to capture exposures and derivatives, including integrated FX and interest rate feeds

Benefits

- Be the primary bank through best practice cash concentration and cash pooling services

- Creating a powerful value proposition with true end-of-day cash concentration

- Share interest benefits with your corporate clients and help them minimize idle cash without building complex inter-company loan structures

- Create additional bank revenue through effective use of corporate cash, while automating investments based on your client's individual preferences

- Attract new deposits through targeted incentive campaigns

- Offer better pricing to corporate clients, depending on the value of their deposits

- Reward customers for keeping funds on operating accounts, adding funds or showing transactional activity

- Flexibly build new products, overtaking competitors with a short time to market

- Extend your value proposition with global cash positioning and corporate cash forecasting

- Partner with corporate clients in their treasury transformation, helping them centralize and automate cash, liquidity and risk management

- Differentiate the bank through a superior banking experience

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

MoneyRouter is an AML on-boarding and transaction monitoring system designed specifically for banks to use in monitoring money transfers. It integrates both a money transfer and risk assessment and scoring system with a bank’s core banking application to give the banks full end-to-end view of the money transfer process and allowing it to set AML rules which money transfer transactions and businesses have to meet before they can be processed for payment abroad.

Customer Overview

Features

- Real-time transaction monitoring and Customer On-boarding

- Risk scoring and categorization

- CDD Case management work flows

- Both Money Transfer and AML risk assessment and monitoring capabilities

- Implements the risk-based approach

Benefits

- Makes money remittances more secure for banks, MSBs and customers

- Helps financial institutions protect their brands by preventing money laundering leading to reputational risk

- Substantially reduces client on-boarding time and lead to faster client acquisition, whilst still improving the client experience

- Reduces manual intervention and the amount of compliance resources required to implement an AML compliance regime.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

The Pendo Data Platform (PDP)

Screenshots & Video

Product/Service Description

The Pendo Data Platform (PDP) is a data management and intelligence solution that provides exploration and discovery capabilities across multiple disparate data sources. It is used by large financial institutions to quickly complete incremental projects focused on “dark data” -- data held in legacy systems across the organization where there is little to no transparency. Our Platform and self-service model focus on extraction of metadata from systems, indexing source systems, and quickly gaining insight into how these systems align in a taxonomy. Once in place, we determine if existing relationships endure or if they need reconstructing. Based on decades of experience in approximate matching of data, our algorithms create match sets that align all data sources. Our Platform is shining the light on “dark data”. Finding insight and valuable information enabling financial institutions to provide required transparency. A component to assist in the “Living Will” - our solution can provide the intelligence in the data to free up capital that has a positive impact on Shareholder value. The most critical component of the PDP is the open API’s that enable not only data extraction, but the overhaul of business models and elimination of massive investments in core functional system replacements. PDP will pave the way for disintermediation of legacy systems, processes and workflows. It delivers data that can provide not only the regulatory insight for executives and customers but the ability to understand capital requirements and mitigate fines. Ultimately, our data platform can provide the insight to create more shareholder value.

Customer Overview

Features

- Viewing of structured and unstructured data

- Structure multiple data types into table form

- Universal Search through all data

- Automatically create profile of data set: dimensions, attributes, hierarchy

- Visually identify and associate common relationships across multiple datasets.

- Identify & associate attributes and index

- Create a logical data mode

- Extract tables and/or targeted data from unstructured sources and create tables and fields.

- User-generated data cleansing

- Machine Learning capabilities

- Data quality detection

- Provide banking / financial service domain expertise, particularly familiarity with industry issues, data and processes

- Provide expertise with banking / FS industry data models and integration to address industry issues I opportunities

- Machine learning techniques for anomaly, identification, classification and mapping

Benefits

- We believe we can have a social impact on global financial services.

- Our business has the ability to grow trust in banks, governments and larger establishments as a whole.

- We focus on matters requiring attention and speed and agility in data exploration, discovery and matching.

- The PDP will expose suspect data that is not visible through manual, human intervention.

- We shine the light on the dark data held hostage in legacy systems and processes throughout the financial industry.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FICO®Siron® Anti-Financial Crime Solutions

Product/Service Description

FICO® Siron® Anti-Financial Crime Solutions consists of flexible and highly integrated software modules for:

• Anti-Money Laundering

• Tax Compliance (FATCA, CRS/AEOI)

• Counter-Terrorism Financing

• Know Your Customer

• Business Partner Due Diligence

The building-block design allows variable combination of the products. This paves the way to genuine cost efficiency, transparent total cost of ownership and solutions that can grow along with the challenges of our customers.

Key Features:

• Coverage of all statutory requirements

• Risk-based approach according to FATF

• Full check of customers and transactions

• No IT-knowledge necessary to configure detection scenarios

• Best-practice research scenarios from more than 1,000 of customer installations

• Multi-clients and multi-lingual user interfaces

• Easy integration with existing systems through standardized and flexible interfaces

• 100% audit-proof documentation

FICO® Siron® solutions consistently follow the risk-based approach and support all phases of the compliance process with integrated solution modules: from business risk analysis and customer risk classification to monitoring of transactions and behavioral patterns, and central case management with risk and compliance dashboards.

FICO® Siron® products are highly standardized and parametrizable. They can be combined at will to create custom solutions. Numerous best-practice scenarios from a large number of customer installations have made their way into our standard research products. They guarantee fast roll-out of professional solutions based on the latest compliance knowledge.

FICO® Siron® technology is robust, interoperable, platform-independent and highly scalable. This facilitates integration of our products into existing system environments and provides seamless interaction with third-party applications and databases. The field of application of our products extends from the lean departmental to a cross- and multi-national group solution.

Customer Overview

Features

- Coverage of all statutory requirements

- Risk-based approach according to FATF

- Full check of customers and transactions

- No IT-knowledge necessary to configure detection scenarios

- Best-practice research scenarios from more than 1,000 of customer installations

- Multi-clients and multi-lingual user interfaces

- Easy integration with existing systems through standardized and flexible interfaces

- 100% audit-proof documentation

Benefits

- Largely automated driving the daily surveillance with as little effort as possible

- System-independently integrated into the IT-infrastructure – investments in additional hard- and software not necessarily needed

- Good performance even for high volume of data

- Easily adaptable to regulatory changes and highly flexible support of any individual definition of suspicion criteria according to the specific risk of the bank

- End user-friendly dialog to bring in the compliance officer’s experience and knowledge of what seems to be suspicious

- Audit trail protocols of all operations and definitions including changes - to protect employees from being accused of carelessness

- Reasonable costs for license and implementation

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

FlexFinance IFRS

Product/Service Description

FlexFinance IFRS. FERNBACH offers a modular solution system. It consists of several blueprints, which in their entirety cover the finance & risk process chain including valuation, financial accounting, reporting and analyses. Each of these blueprints consists of components (“calculation kernels”) which can easily be integrated. One can install selected individual components or the entire range of blueprints. The blueprints for IFRS include the latest rule sets such as IFRS 9 and IFRS 13.

Customer Overview

Features

- FlexFinance IFRS provides, for risk provisioning in particular, a comprehensive catalogue of instruments that includes calculation, simulation, accounting, analysis and reporting. Since different organisational units in a financial institution are usually

Benefits

- Comprehensive IFRS solution which includes valuation of financial instruments, calculation of impairment and hedge management; consolidation with multi-currency capability. • The IFRS solution supports FinRep in accordance with the European Banking Author

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

RSA SecurID is the authentication mechanism invented by RSA (currently part of EMC) based on the two – factor authentication with the use of software or hardware tokens. The solution helps organizations to solve complex and sensitive security challenges. The hardware tokens authenticate users by leveraging “something they know” (user name and passcode) and “something they have” (the PIN code on the token). On the top of that RSA SecurID operating model generates and displays new codes every 60 seconds for its hardware tokens.

Customer Overview

Features

- Cryptographic Token Key Initialization Protocol (CT-KIP)

- Basic token code functionality, or a USB form factor for additional smart card capabilities in hardware tokens

- Software tokens are secured on the user’s PC, smart phone or USB device

Benefits

- Support of the most widely deployed mobile and web platforms

- Reduction in the number of devices to manage for secure access

- Over 400 technology integrations

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

assetSERV™ represents a cloud-based preconfigured DAM platform to assist the enterprises in managing the end-to-end lifecycle of their digital assets and create a more robust Digital Experience Management (DXM) platform. Regardless where your organization is in the digital transformation journey assetSERV™ brings consistency in managing multiple channels, stakeholders, geographies and audiences while increasing the dynamics of digital customer experience.

Customer Overview

Features

- Easy Uploads

- Powerful Search

- Smart Governance

- Secure File Sharing

- Collaboration Platform

- Seamless Integration

- Simplified Distribution Network

Benefits

- Device & Format agnostic

- Collaborative workflows

- Role-based access

- Scalability to manage over 7.5 million assets across formats

- User Base to support more than 500,000 users