GBPUSD Weekly Double Top Pattern, Long Term Target 1.3100

- Duncan Cooper , Senior Market Strategist & Trading Mentor at ACY Securities

- 22.06.2021 02:00 pm trading

Overview:

Watch the video for a summary of today’s news releases, a review of the USD Index, and a complete Top Down Analysis of the GBPUSD.

GBPUSD Weekly:

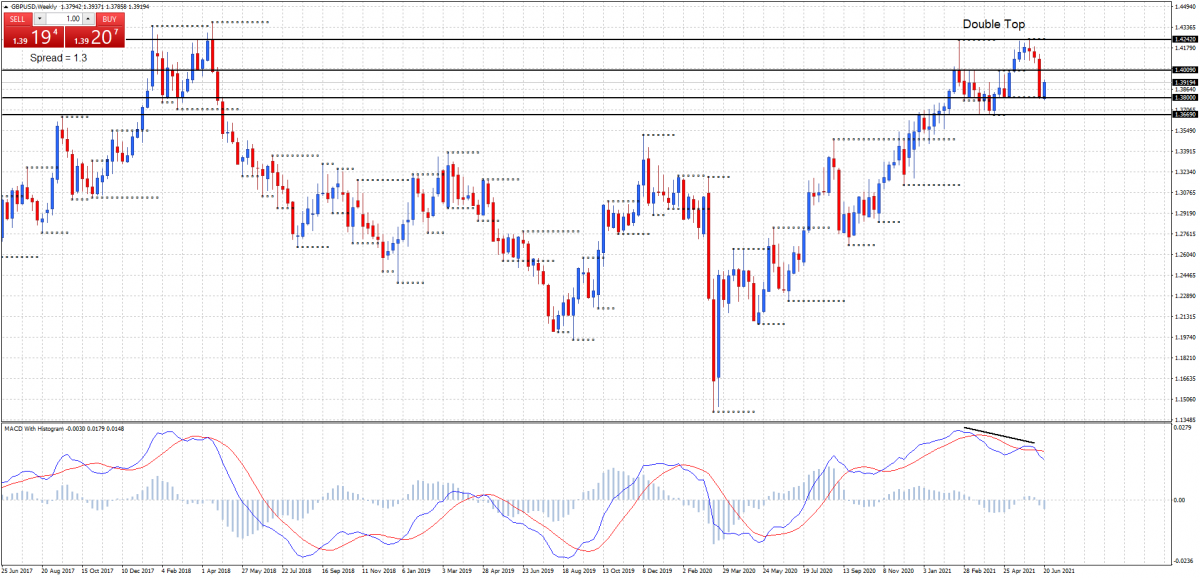

Weekly support at 1.3800 and 1.3669, resistance at 1.4009 and 1.4242.

Price last week broke below 1.4009 weekly support with strong conviction after the release of the US FOMC Statement. The weekly double top pattern is now forming and MACD is showing negative divergence confirming the reversal.

GBPUSD Daily:

Daily support at 1.3800, daily resistance at 1.4009 and 1.4063.

Price is in a clear downtrend on the daily chart showing a lower top and lower bottoms. Last week finished with 3 straight days down in a row showing heavy selling.

Ahead of the UK interest rate decision on Thursday price may rally back up. Expect the 1.4000 level to now act as a strong resistance level, offering the opportunity to take a position for the next decline.

Long term targets for the double top pattern would be 1.3669 weekly support and then 1.3100 should 1.3669 weekly support be taken out.

See my previous GBPUSD analysis on 8.6.21 where I discussed the possibility of a weekly double top pattern forming and selling at the 1.4200 level for a long term decline.