Quick Data Snack US China and Inflation

- Clifford Bennett, Chief Economist at ACY Securities

- 16.09.2021 12:00 pm trading

Breakfast by the sea.

No harm in a little inspiration.

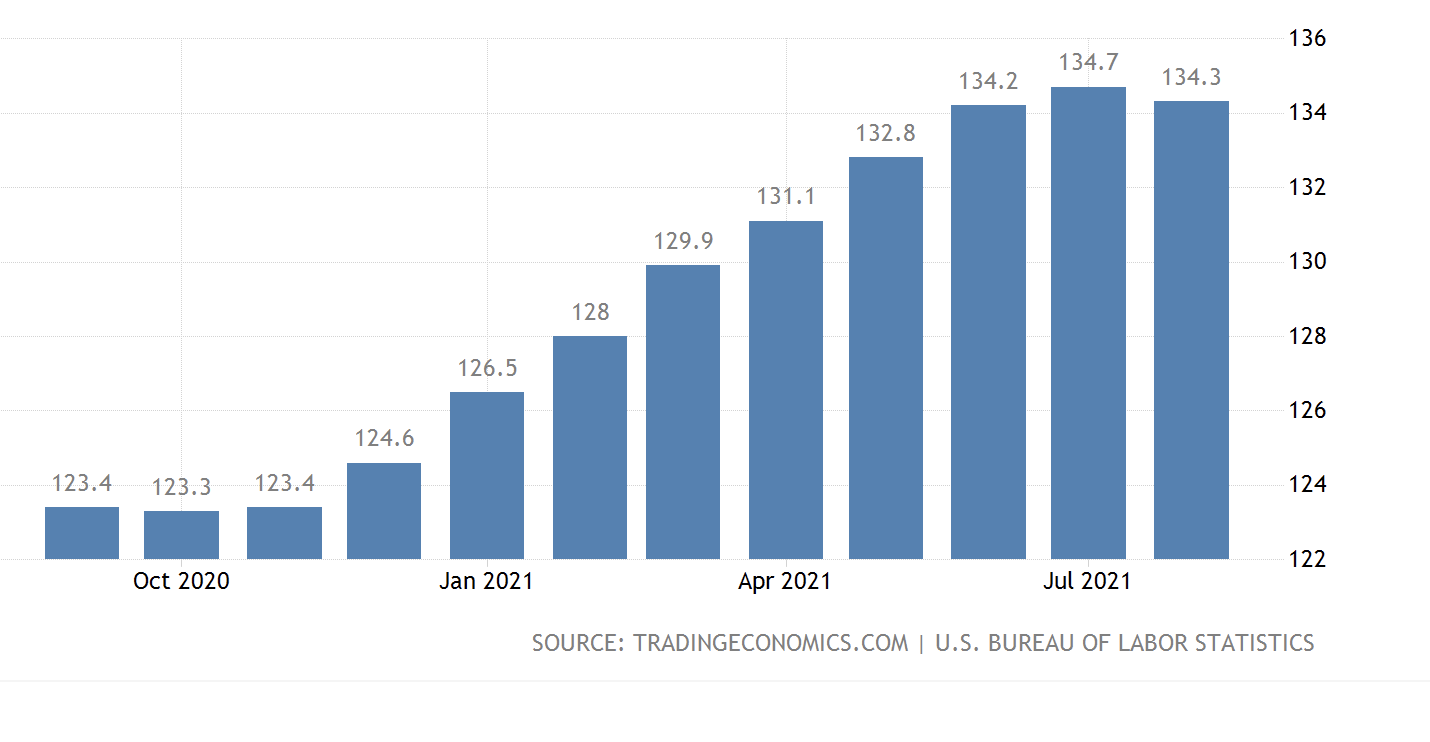

US Industrial Production

Clearly rolling over under the weight of Delta. As the economic impact of the virus and the hangover effect of stimulus measures, not to mention high inflation, all hit at the same time.

Muchado over lower US Import Prices

Any positivity a little overdone, as these prices are still through the roof, to use a technical term. Up 9% from a year ago.

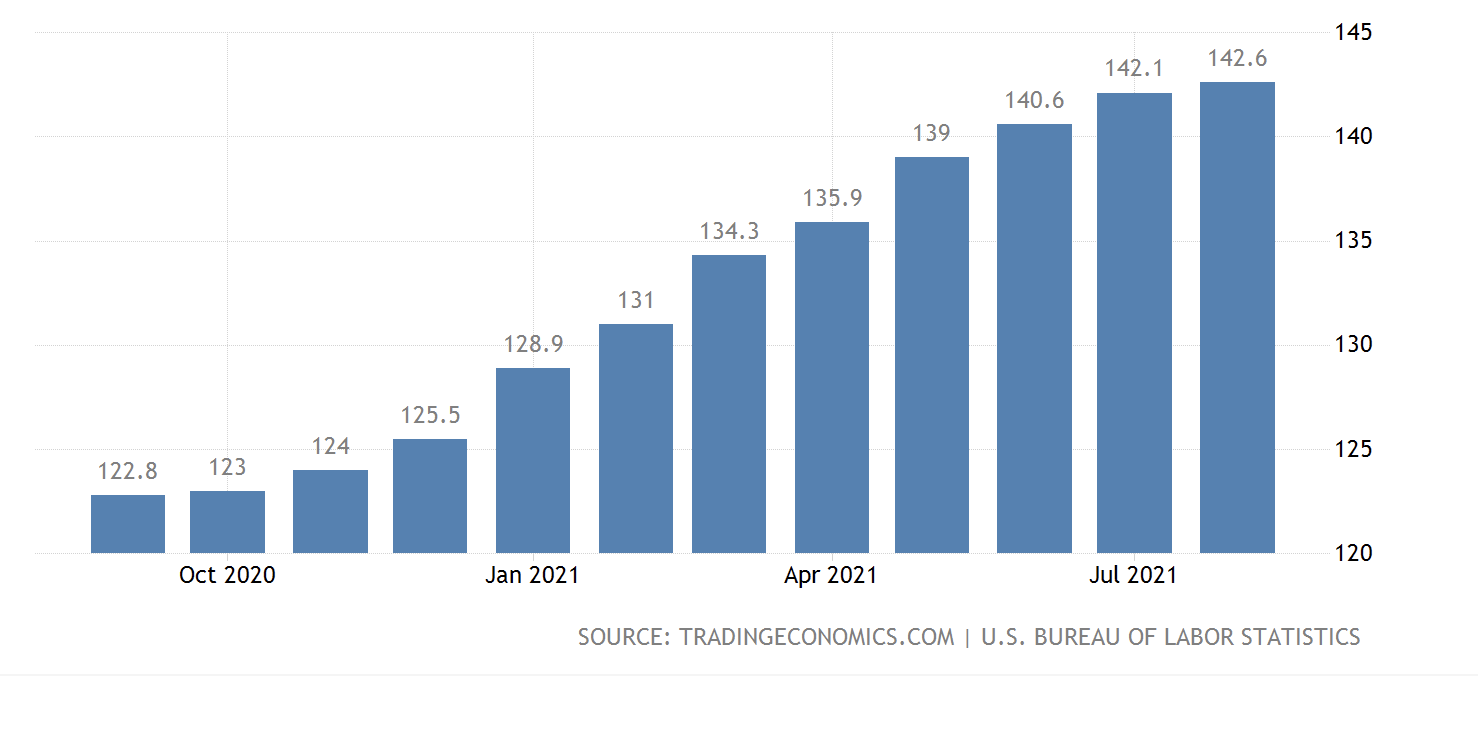

US Export Prices continue to rise alarmingly

Up 0.4% in August, and a huge 16.8% on the year.

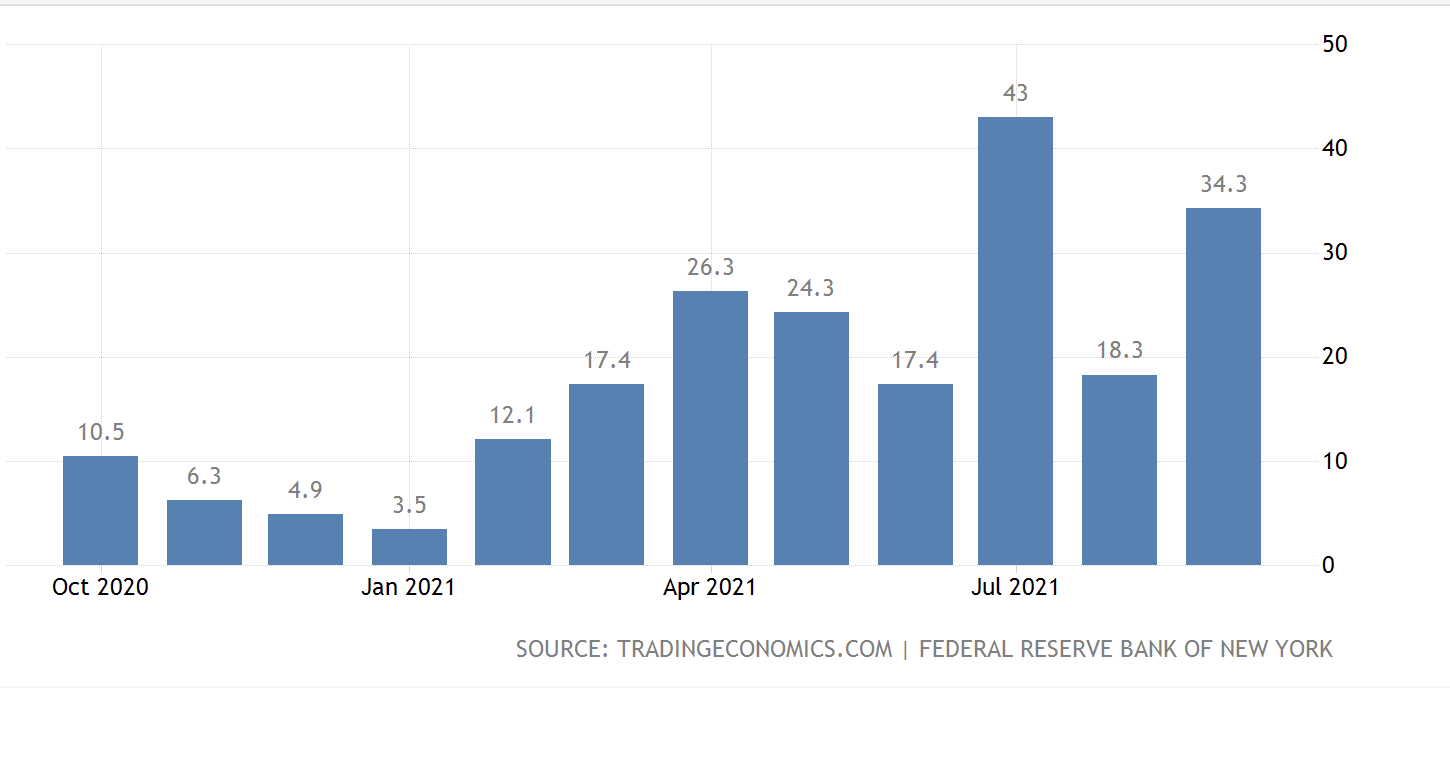

NY Empire State Manufacturing Index

This surge is in line with the general re-opening now occurring in that state, and particularly the re-opening of schools allowing more work time for parents. Unlikely to be a trend, but certainly great to see further recovery toward some form of the new normal.

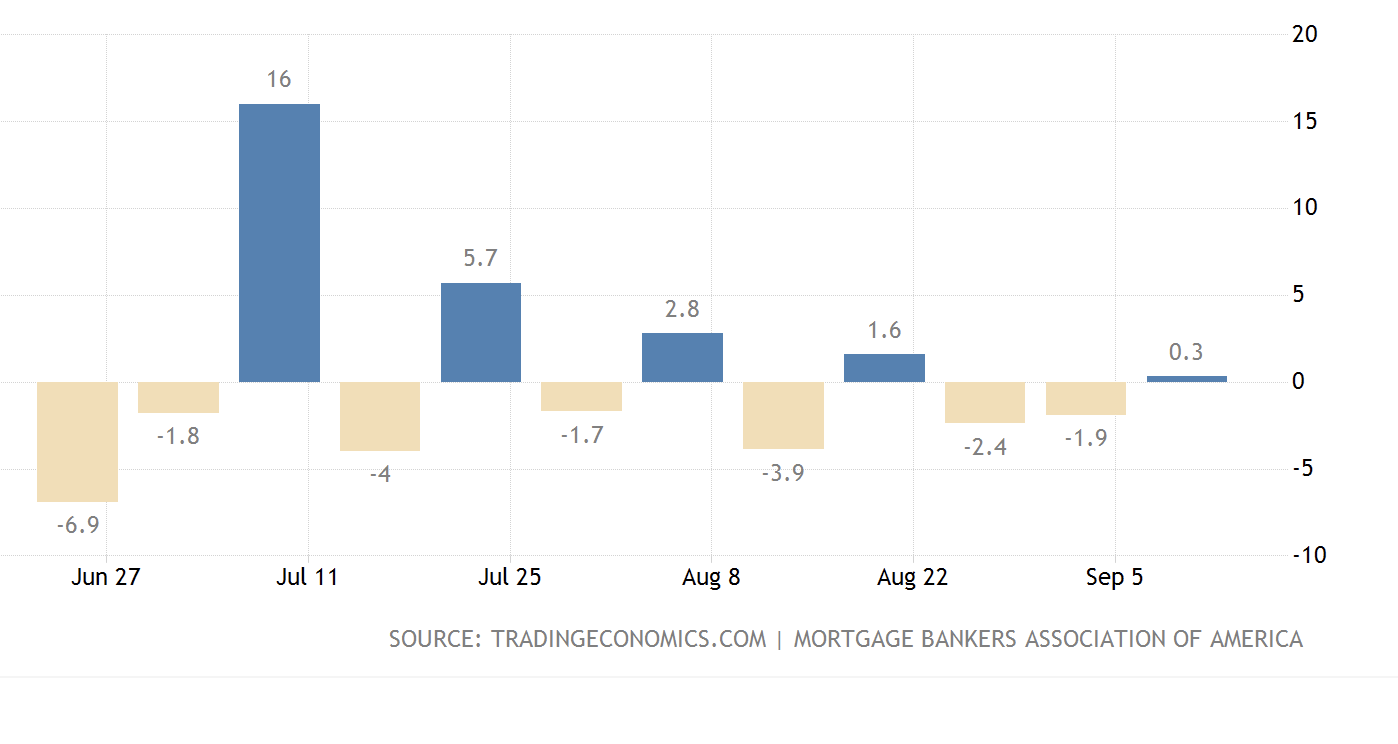

US Mortgage Applications remain dire

Japan Exports

Some steadying of export levels is good to see. Japan is not out of the volatility of an on-going recovery, but there are increasing signs of a sustainable growth trajectory growth.

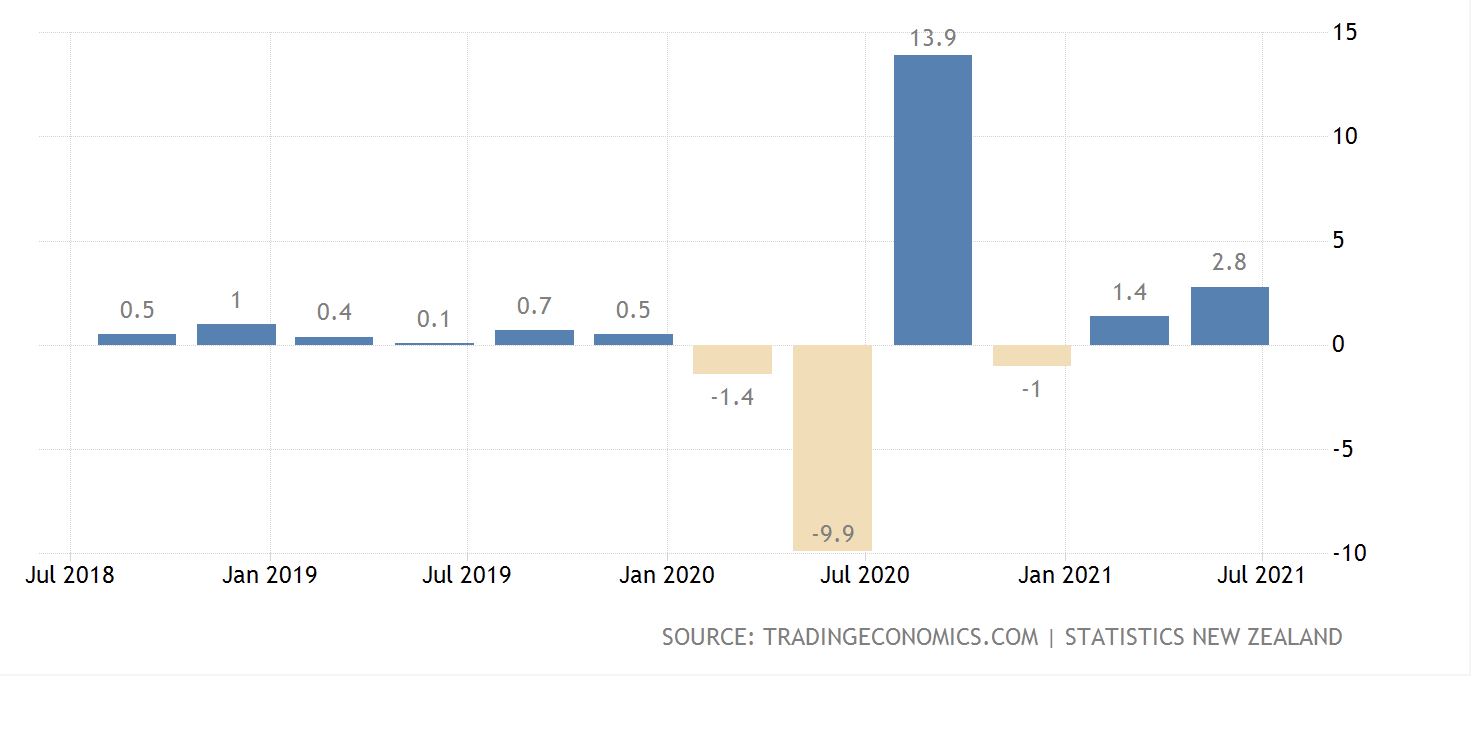

New Zealand GDP

Stabilising quite well after some lockdown volatility. Challenges persist, in this effort to maintain a zero tolerance for Delta. Nevertheless, generally performing economically better than most other nations.

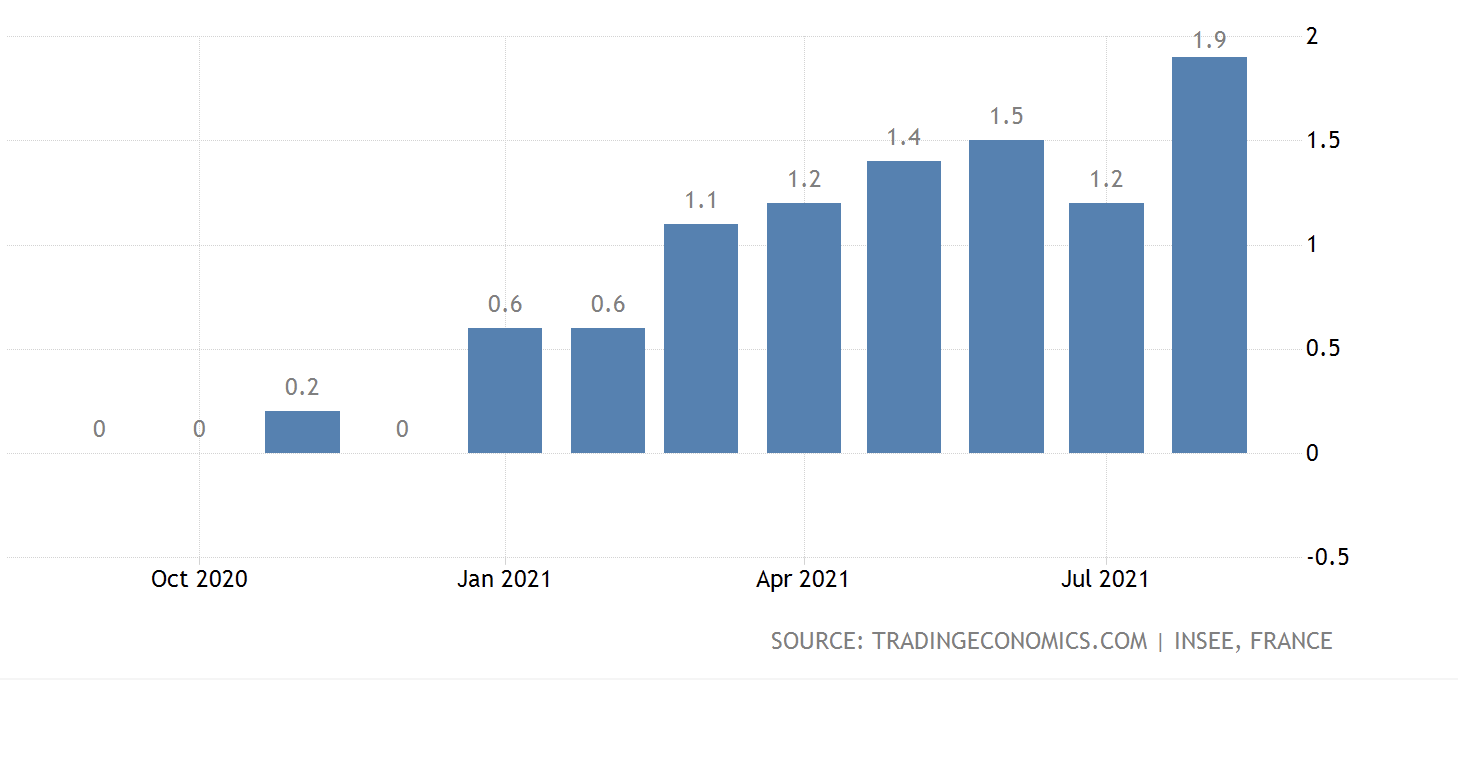

French Inflation 3 year high

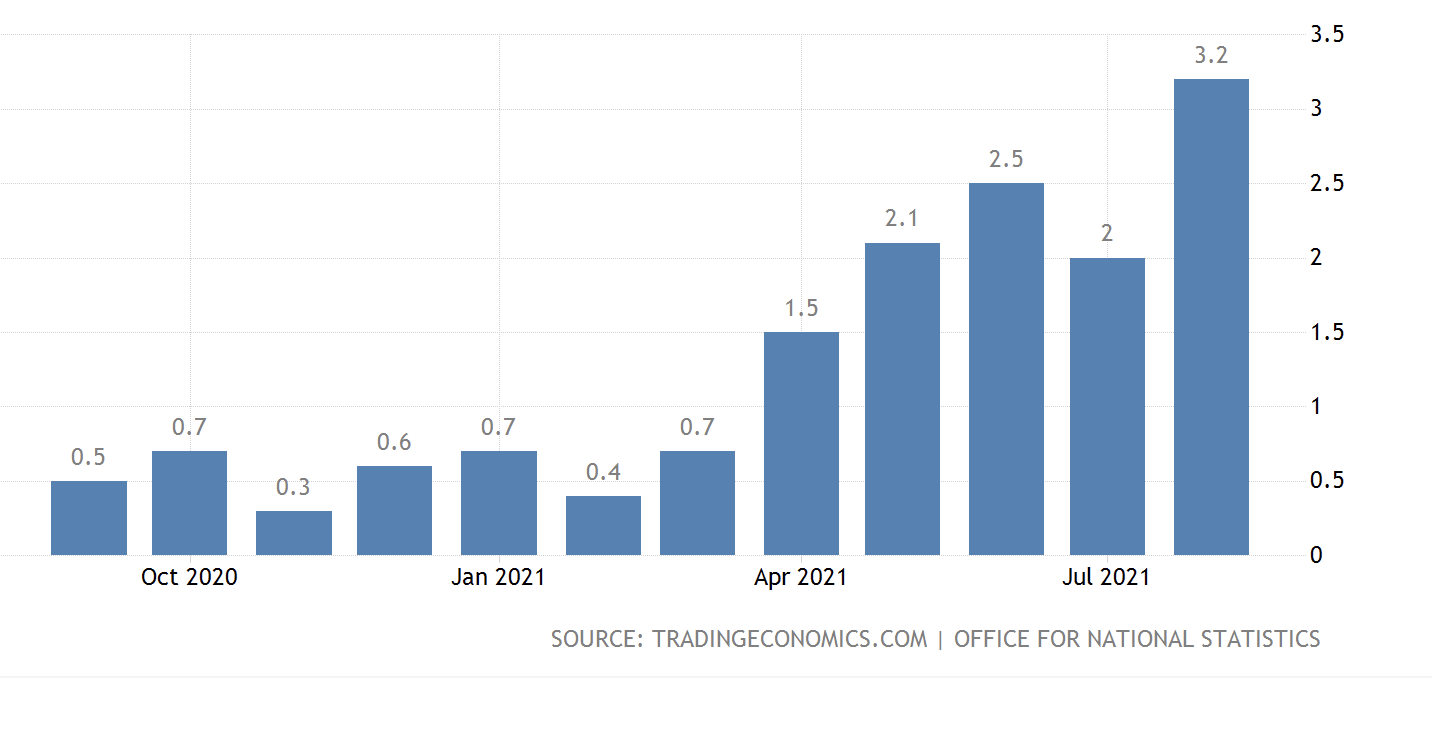

UK Inflation 9 year high

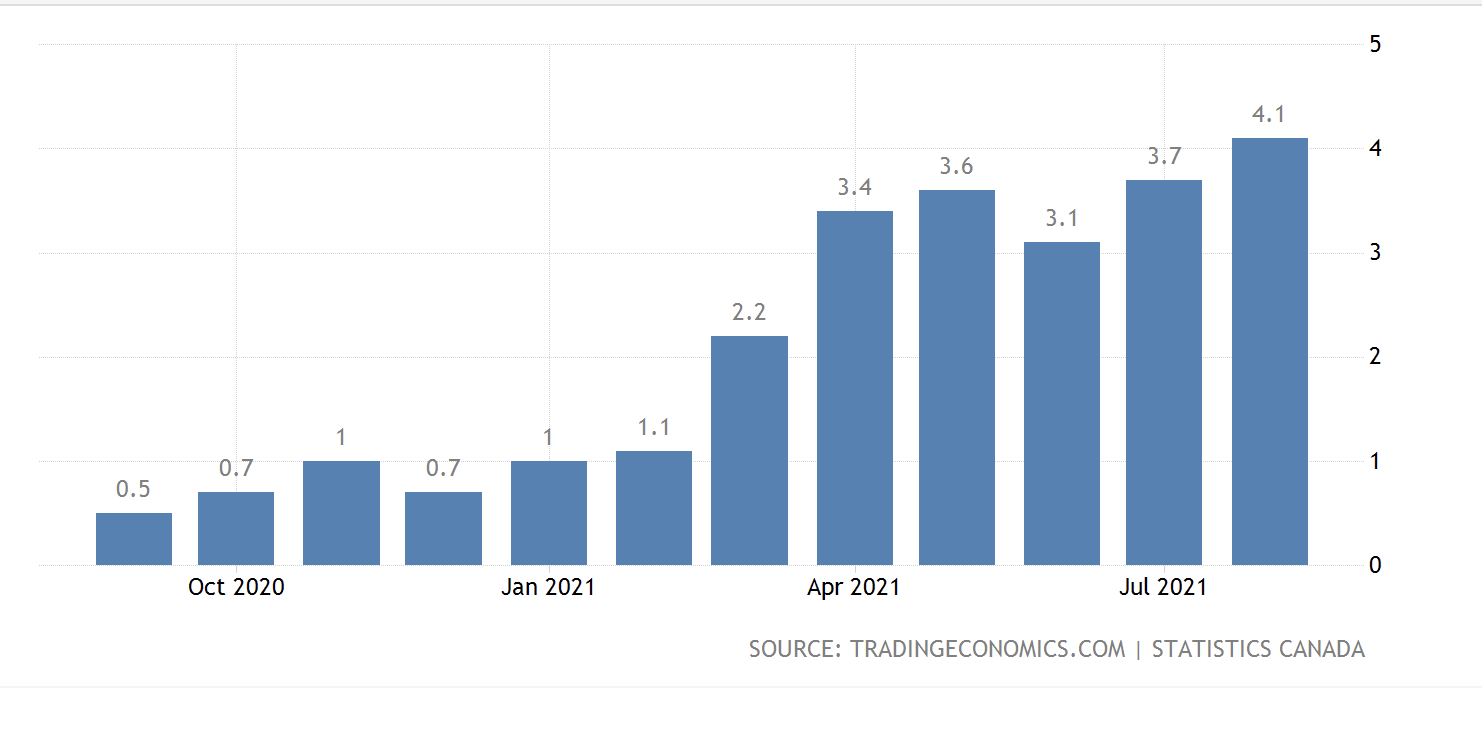

Canada Inflation 18 year high

Click on image to follow the link to watch now: https://youtu.be/MsByfPWdmX4

More in this afternoon's video update on the attempt by US stocks to rally. The daily price shift may sound large, but it is within the bounds of the trading of the past two days. That's how high the intra-day volatility is.