Australia Data Digs Deeper

- Clifford Bennett, Chief Economist at ACY Securities

- 07.09.2021 05:15 am trading

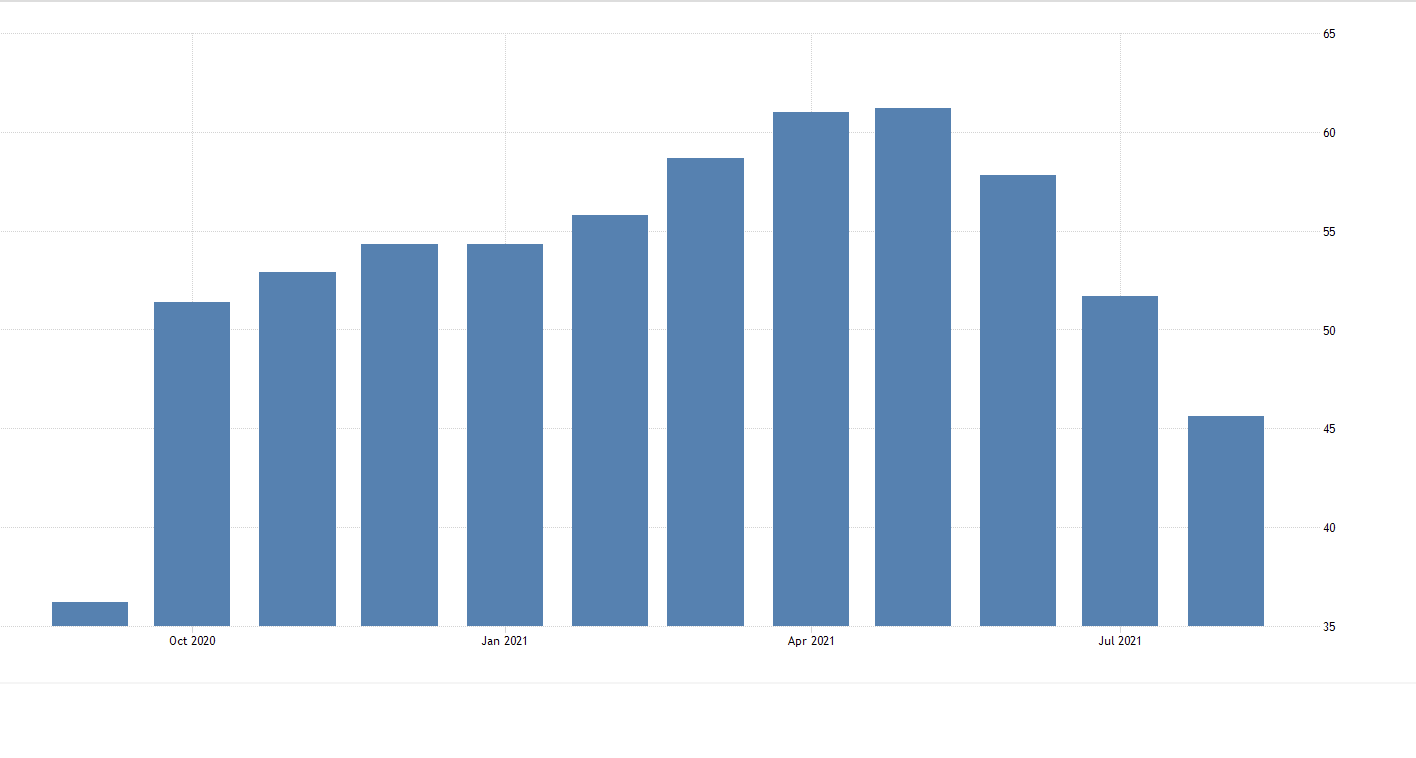

AIG Australia's Services Index continues to plummet.

Australia is in economic free fall.

The services sector is in a sustained free fall, and this is the world from home sector?

No need to say it all again. 100 ICU nurses wrote to the NSW Premier saying, as we have, that the hospital system will not cope. A day after the Head of the Australian Medial Association wrote to the Prime Minister saying the same thing. All the economic data was starting to roll over even before locxkdowns began. Everyone is acting as if the economy is naturally strong. It was below trend before Covid hut in the first place, struggling to achieve 2% GDP. Then, we have the world's highest stimulus per capita in put, and delude ourselves that our economy is a bastion of excellence. The post initial pandemic party is over, the hangover from this lockdown season will be long lasting.

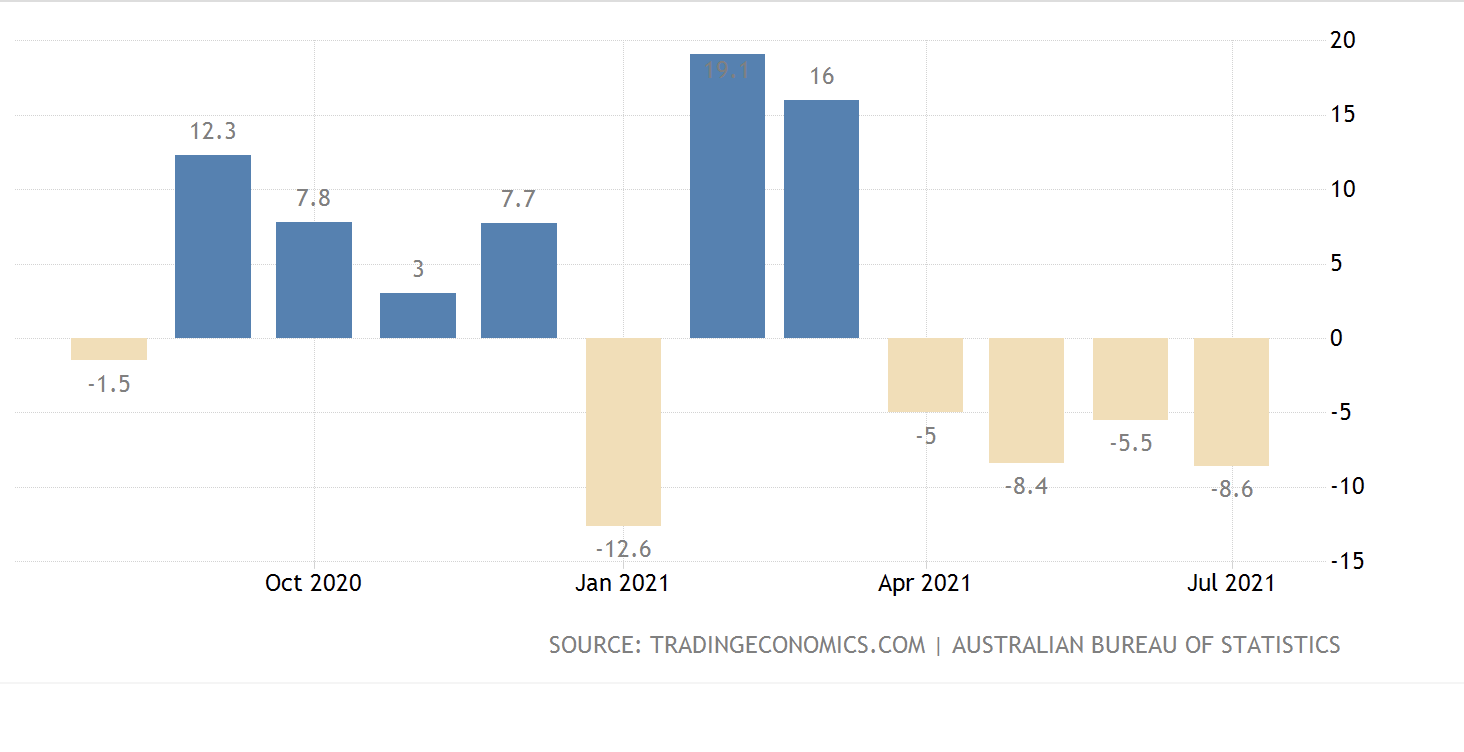

Australian Building Permits.

Continue an absolutely calamitous decline.

German factory Orders

Again moderating as the challenges of Delta begin to stretch around the globe.

This market has no business being where it is.

When will the penny drop?

The market seems to be clinging to the idea that it can rally with US gains, with no regard to the local economic catastrophe. The cloudy forces of realisation are gathering on the horizon however.

Stalling equity markets generally, will become the global equity theme in the weeks and perhaps months ahead.

The heightened illusion over vaccine efficacy, though helpful, could end in a market thud.