Reconciliation

Product Profile

iSHRAQ Advanced Investment & Financing Management Model

Product/Service Description

iSHRAQ provides Islamic based Financial and Investment solutions to clients, specializing in Sharia investments to bring the best of Stock Markets, Mutual Funds, Portfolio Management Services, Real Estate Investment, and Wealth Management Services in a Sharia-compliant way. Consisting of 6 modules: iSHRAQ*Invest, Finance, Sukuk, Fund Management, Treasury and General Ledger covering all aspects of investment, finance and banking available on the market, while providing a user-friendly interface with the ultimate performance and an accurate calculation and speedy data retrieval.

iSHRAQ’s in-depth research, technical analysis and powerful trading tools coupled with highest standards of service are tailored to suit the requirements of financial institutions. iSHRAQ is a reliable, flexible and innovative platform that delivers an unparalleled client experience.

Customer Overview

Features

Enables customers to invest in most asset classes, in multiple markets, using one or more currencies.

Improved operational performance and productivity through its fully centralized database along with full scalability for unlimited growth and large volume processing capabilities.

Offers comprehensive and consolidated reports, market updates, and portfolio yields.

Enables portfolio managers to manage money of one or more portfolios in a specified currency which saves front officers of all back office accounting details.

Stock markets support in single and multi-currencies including setting deals, commission and fees rates in each currency allowed by the dealing market.

Automatic calculation of fees at specified periods or with each transaction, whether it is per-transaction, fixed amount or fixed lump sum at a specific period.

Fully integrated web based application allowing employees and customers real time access to investment information.

Ability to maintain several transactions simultaneously with independency in saving different forms allowing users to create, edit and save several records at once.

Murabaha

Mudaraba

Musharaka

Deminishing Musharaka

Tawarruq

Qard Hassan

Musawma

Ar-Rahnu

Istisnaa

Leasing

No collaterals, guarantors, or bank accounts

No penalties for late payments

Loan full or partial dropping in case of customer death or inability to repay

Grouping concept to mitigate collection risk

Takaful concept: Customer performance tracking for further loan programs.

iSHRAQ*Invest provides real time access to investment information through a user friendly web interface that offers 3 levels of information in a single page as well as a multi tabbing feature that makes the navigating experience through the system more effective while saving all the data coherently. Every transaction applied on the system is calculated and reflected automatically, minimizing the overall time consumed to run the portfolio calculations and enhancing the system performance. This advantage is useful when generating reports in previous dates since these reports take almost the same time to generate as the current report.

Key benefits are:

iSHRAQ*Finance provides financial facilitators with a comprehensive Islamic finance platform rich in tools to maximize investment performance through a wide range of Islamic products that are specially tailored to meet the diverse needs of their corporate and retail customers, while being fully compliant with the Sharia regulations. It is a complete customizable and innovative solution that includes all the finance facility cycles starting from the approval workflow, managing legal entities, setting repayment plans, connecting the business parties with the following Islamic products:

iSHRAQ*Microfinance Loan Programs Business Features:

Benefits

Back date facility that can undo the effect of posting transactions backward until a specific date; to add missed transactions in the past and affect balances in the past and update or delete one or more posted transaction.

Built-in data mart for quick generation of complex and multiple-domain reports without affecting the application performance. The data mart also allows getting reports as of any date in the past with the same performance as of current date.

Friendly user interface in terms of facilitating application usage through multi-pages, multi-tabs and customizable favorite list for quick and easy access of day-to-day tasks.

Solid approval workflow engine to guarantee that each transaction has its own approval path, starting from the transaction submission until the final decision is made.

Allows remote approval for application requests.

Task list that shows the current transaction pending for action from the current user. When a transaction is done, it disappears from the list, saving the user from searching, with the option of creating a mass action for bulk transactions.

N-tier architecture with two common presentation and database tiers, in addition to the middle-tier which is composed of control-logic enabling data-access tier directly or through the business tier.

Fully web based structure that grants access to any location (branch) without any installation or maintenance efforts.

SOA (Services-Oriented Architecture) compliant which allows exposing web services to bank clients in order to create application requests, application follow-ups, or any other inquiries.

Fully compliant with Sharia principles.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

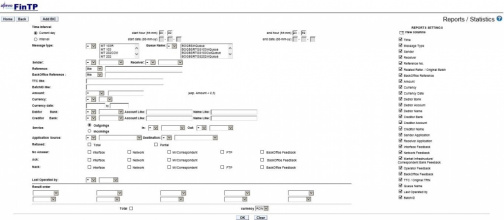

Screenshots

Product/Service Description

FinTP is a versatile open source solution for flow automation and seamless integration between various internal systems/applications and external market infrastructures or networks, providing operators with relevant information in a one-window approach (acting like a financial middleware), which allows banks to focus less on their internal processes, and more on designing attractive client-oriented services and products.

On top of its core function, FinTP provides support for the most used funds transfer instruments (credit transfer, direct debit, debit instruments) and includes features for operational risk containment (transaction filtering, duplicate detection, accounting reconciliation), liquidity reporting, treasury operations management, end-to-end management of remittances, competitive reporting and SEPA & TARGET2 compliance.

FinTP use cases are in solutions for transaction broker, payment factories, corporation financial consolidation, management of microfinance operations, optimization of payment flows for public administrations, public debt management etc.

Customer Overview

Features

- Financial instruments:

- Funds transfer (MT, MX message types)

- Direct debit

- Debit instruments

- Remittances

- Treasury operations

- SEPA (credit transfer – SCT ; direct debit – SDD) compliance

- SEPA for corporates

- Statements (MT940/MT950, MT900/MT910)

- Corporate to bank connectivity

- Operational features:

- Duplicate detection

- Accounts reconciliation

- Transactions filtering

- Competitive reports & alerts

- Liquidity reporting and forecasting

- Business continuity

- Loan disbursements and repayment matching

Benefits

FinTP lowers the total cost of ownership (ensuring nil capital expenses and optimized operational expenses – via shared development and maintenance), while eliminating the common vendor lock-in dependence and aiming to achieve a better level of interoperability - by encouraging a wide adoption, due to financial attractively and short time-to market.

The innovation factor consists in its open source distribution model, allowing banks/corporations/public institutions who use it to contribute updates and improvements to benefit all users. This enables an unprecedented level of transparency and collaboration between clients, being possible because middleware is not a competitive differentiator for them. It is in the best interest of all involved parties that this collaboration happens, so that everyone can focus on primary client oriented attractive services.

Last, but not least, FinTP is highly flexible and configurable and can be adjusted to fit the exact needs of the customer.

Platform & Workflow

Custom reporting capabilities: users can tailor their own reports. A set of standard reports already is available in the application, as most frequently asked by bank or treasury operators

Competitive reports: offers several analyses and reports of the market trends, along with early alerts

Liquidity reporting: ensures real-time cash reports and forecasts using several reporting criteria, in a consolidated view

Auditing: detailed logs of user activity, payment status updates with full information on timestamps, originating application, end application, device information, etc.

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

iMAL Enterprise Islamic Banking & Investment System

Product/Service Description

iMAL Enterprise Islamic Banking & Investment System is a powerful core banking platform specifically built from the ground up to support Sharia banking operations. It is truly geared to address country and region-specific Islamic banking requirements. It is offered to high-end Islamic banking, investment and financing institutions, based on an advanced open architecture with a robust integration platform.

iMAL is the only 100% Islamic banking solution as certified by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) in 2008.

All iMAL modules adhere to the Islamic law and are in full compliance with IAS (International Accounting Standards). The system is based on the Sharia guidelines for the purpose of financing related to Murabaha, Mudaraba, Ijara, Istisnaa, Salam, project financing, real estate and others.

Customer Overview

Pricing model is based on the modular capability available in iMAL core banking system, whereby each module is priced separately providing a flexible costing structure to fulfill the following goals:

1- iMAL provides a full suite of modules that address different business requirements for the banking industry. These modules have been packaged to focus on the different business areas in a bank.

2- Provide a product-based configuration of the different core modules, whereby a base license is provided for the main module feature, and subsequently the client can select additional products to be added to the base license. This aims to optimize the product offering to the client and provide a cost effective offering.

3- Regarding the deployment in branches, Path Solutions adopts a flexible branch deployment strategy, whereby the option is availed to the Sales team to configure the deployment offering by choosing one of the following scenarios:

a. Combination of number of branches and number of users

b. Adopting the pricing based on the number of branches only

c. Adopting the pricing based on the number of users only

d. Adopting the pricing based on the projected number of customer accounts.

The above options provide the flexibility to select the most suited selling approach depending on the target market and client expectations, and accordingly provide a cost effective offering to the potential clients.

4- In addition to the above approach, an embedded quantity discount brackets is adopted to apply a reduced unit cost for the different selection criteria, which again provides a reasonable pricing for the banks operating a big branch network, or projecting a huge number of customers.

Features

- Supports all known Islamic banking instruments

- Web interface, N-Tier Java based, SOA architecture

- With high parameterization capabilities; greater process efficiency, better risk mitigation

- Multi-currency, multi-branch, multi-company enabled accounting backbone

- With strong product definition features

- Fully integrated yet modularized, with Model Bank

- Highly automated and flexible system

- Ensures quick time to market products.

The iMAL core strengths:

iMAL employs multi-tier architecture using the latest JAVA technology with either Oracle or SAP Sybase as core database servers. These powerful and at the same time affordable Relational Database Management Systems (RDBMS) provide sophisticated data protection and high-speed access to information.

The system runs on all the main platforms and operating systems requiring only an up-to-date internet browser at the client side.

iMAL is rich in opportunities for increasing revenue through cross-selling and upselling. It also enables a 360° view which enhances customer service.

It is also cloud ready and deployable on a fully scalable, multi-server n-tier architecture. It includes out-of-the-box, industry best practice processes that further support rapid implementation, team knowledge transfer and sustainable business processes.

The fully integrated front, middle and back office Islamic core banking platform, running 24/7 in real-time -iMAL- combines comprehensive business functionality with an advanced, secure, scalable and modular architecture proven to meet the market toughest challenges of today and tomorrow.

Benefits

- Built-in Islamic operations standard compliant workflows and system controls

- Various delivery channels

- Faster time to market

- Exact fit to business requirements

- Phased migration and implementation approach

- Running businesses in real-time mode

- Higher operational efficiency:

- Single integrated platform for all banking activities

- Flexibility to meet change and growth requirements

- Cost reduction by implementing STP

- Optimized business performance

- Superior customer service

- Efficient speed of service

- Precision of documentary cycle

- Electronic reconciliation (quick notices)

- Prompt dispute resolution: Legal, collection, valuation, procedures, etc.

iMAL enables Islamic financial institutions to carry out essential tasks across retail, corporate and investment banking including core banking, transaction banking, online and mobile, payments & financial messaging, trade services and cash management. These applications help Islamic financial institutions to meet business needs in areas like streamlining operations, introducing new products, improving efficiencies and customer service, and ultimately increasing revenues while reducing risk.

iMAL provides platform independence, real-time interfaces, extreme usability, full scalability, high-performance, excellent productivity for configuration and deployment, and modular components.

With iMAL, Islamic financial institutions are empowered to achieve:

iMAL is based upon customers’ serviceability. One of these backbones is the production of multilingual statements to customers of the Islamic financial institutions. This is done with minimal data entry at the outset of the system’s parameterization, whilst the production of the various statements, advices, is done automatically by the system without manual intervention by the end-user.

iMAL, which is in compliance with Basel II/III & AML, enables Islamic financial institutions to contain the risk element before they get exposed to a higher degree of risk through effective risk management built into every single transaction that is undertaken in the system.

In addition, iMAL helps Islamic financial institutions implement a flexible, cost-efficient infrastructure with instant access to accurate, up-to-the minute financial updating in order to make informed operational and strategic decisions at a moment’s notice. This comprehensive approach produces a higher Return On Investment to our clients.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Real-time, instant or immediate payments describes the capability to transfer funds between two parties making funds available to the payee almost instantly, with instant confirmation. Typical processing models consist of a hub-and-spoke model such as ISO 20022 to connect financial institutions or corporations to one another through a central infrastructure (CI).

- Banks improve retention and open up new value added revenue streams

- Fintechs can use ACI’s 3rd party platform - New Access Model - to access Immediate Payments and offer services that were previously restricted to banks alone

- Consumers get faster, reliable transfers and instant, accurate account balances

- Merchants increase profits by getting paid sooner and eliminating interchange fees

Business customers can take advantage of better payment terms and improve their working capital

Customer Overview

Features

- •Payments management •Channel integration •Orchestration •CSM connectivity and compliance •Security and fraud checking •Exceptions handling •Liquidity management •FX payments •Flexible handling and special products management •Business intellige

Benefits

- •Deliver profitable services •Protect your investment by enabling real-time payments •Accelerate your time to market

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Compliance for Mobile Messaging KyoLAB bridges the gap between compliance and mobile messaging for regulated financial services. KyoLAB’s platform offers monitoring and archiving, as well as real-time Compliance alerts and analytics, for popular mobile messaging apps such as WhatsApp, WeChat, Facebook Messenger, Skype Mobile, Yahoo Mobile, iMessage, and others. Our aim is to be the reference solution for popular mobile messaging with respect to compliant audit trail and dispute resolution.

Customer Overview

Features

- Monitoring

- Archiving

- Analytics

Benefits

- Compliant messaging

- Customer engagement

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

FICO Falcon Fraud Manager provides core analytic processing power to handle an organization’s transactional fraud detection needs such as debt, credit, deposit, ePayments and mobile. It can be used to process events, develop strategies to detect fraud and create cases, and execute associated decisioning across an institution’s products, channels and customers.

FICO® Falcon® Fraud Manager provides deep insight into fraud trends and activity. Powered by FICO’s market-leading predictive analytics, it detects up to 50% more fraud than rules-based systems.

Customer Overview

Features

- Robust neural network models with patented service, account, and customer profiling and monitoring of global entities

- Real-time rule creation, rule simulation, and rule implementation

- Efficient investigations with sophisticated case management system

- Seamless integration with your authorization and payment systems for up to 100% real-time scoring

- Region and portfolio-specific fraud models leverage industry-wide consortium data

- Adaptive models generate fraud scores based on analyst feedback

Benefits

- Detects more fraud with lower false positives to provide minimal impact on good customers

- Delivers earliest possible warning of fraud activity

- Boosts analyst productivity and improves effectiveness of fraud operations

- Identifies fraud sooner to give you more opportunity to reduce losses

- Leverages known fraud patterns to achieve highest fraud detection levels

- Adjusts to your findings about fraud dispositions

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Product/Service Description

TCS BaNCS, from Tata Consultancy Services, is a globally acclaimed software brand that enables transformation in financial services through a superior and holistic suite of solutions for banks, capital market firms, insurance companies, and other diversified financial institutions.

Each solution in the TCS BaNCS family has been designed to fully integrate with existing business models, enterprise infrastructures and technology architectures. Adopted as a platform of choice by financial institutions around the world of all sizes, TCS BaNCS addresses critical industry needs and enables business transformation by providing customers with scalable, customizable, market-ready solutions.

Built on open architecture, this component-based product suite leverages service-oriented and event-driven architectures. Based on TCS’ in-depth market understanding through numerous interactions with more than 280 customers across 80 countries, this product suite offers one of the broadest end-to-end functionalities for financial services

Customer Overview

Features

- The TCS BaNCS platform for Banking encompasses an array of pre-configured, customizable banking products such as Universal Banking, Core Banking, Payments, Risk Management & Compliance, Financial Inclusion, Islamic Banking, Treasury, Wealth Management, Pr

Benefits

- Flexible configuration features.

- SOA-enabled infrastructure.

- Centralized Customer Information Facility and Risk Management.

- Cross channel communication within Branch,

- ATM/Kiosk

- IVRS/Contact Centre