South America

Product Profile

Screenshots

Product/Service Description

The Gem platform provides simple and secure management of cryptocurrency wallets.

Simple: because GEM API and client libraries manage the complexity of working with a digital currency, while presenting a high level interface that is easy to use.

Secure: because Gem wallets use multi-signature and Hierarchical Deterministic Wallets with granular rulesets and multi-factor authentication.

Customer Overview

Features

- Transactions from a Gem wallet require two signatures for authorization, one from a private key held by Gem, and one from a private key held by the wallet owner.

- The wallet owner also has a third private key, intended for offline backup, that allows the cosigning of transactions without Gem involvement.

- Multisignature scheme for cryptocurrency processing

Benefits

- The risk of theft is mitigated, because it requires compromising two keys.

- Gem cannot spend from a wallet without the owner’s authorization since we hold only one key.

- The wallet owner does not require Gem’s authorization for expenditures.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Protegent Surveillance from SunGard represents a combined solution for enterprise-wide supervision and compliance management, specifically within trade and account review processes. SunGard’s automated supervision system empowers financial institutions to detect, prevent and document potential regulatory violations. Firms can monitor trading activity of the following products: equities, options, fixed income, mutual funds, ETFs, structured products, futures & commodities, fixed and variable annuities, equity indexed annuities, term and whole life.

Customer Overview

Features

- Protegent Surveillance can be easily integrated with Protegent Compliance platform, Trade Review, Account Review, Rep Review, Anti-Money Laundering, Audit.

- Protegent Surveillance assists in detection of the following issues: commissions, concentration, suitability, licensing, breakpoints, AML, restricted holdings and many others.

- Customized alert library consists of more than 160 configurable alerts.

- Support of personal and shared watch lists is also available.

Benefits

- Regularly updated with the latest regulatory changes.

- Speeds up field supervision processes and field audits.

- Helps to react quickly to regulatory and legal inquiries.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Financial Crime Risk Management platform from Fiserv allows financial institutions to minimize the cost and risk in their FATCA regulatory compliance. With Fiserv AML solution companies can find, review, decision, document and report customers who meet certain criteria.

Customer Overview

Features

- The solution enables to determine U.S. taxpayer status and FATCA status through a structured workflow

- Option to capture data fields, statuses and documentation in customer-centric FATCA case files.

- Streamlined monitoring and reporting process.

Benefits

- A centralized solution for compliance that includes tax evasion, money laundering, terrorist financing, sanctions, corruption and fraud.

- The ability to leverage a single investment in customer, product and transaction data for detection, investigation and resolution of specific entities and activities as required for different regulations.

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

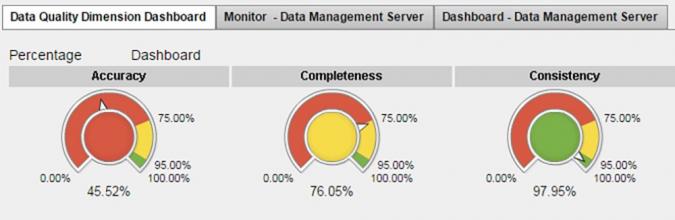

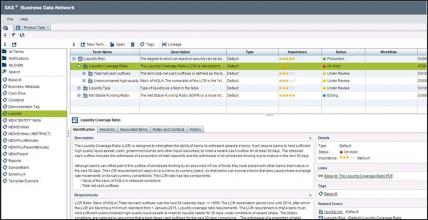

Product Profile

Screenshots

Product/Service Description

SAS delivers a single solution that combines powerful analytics and visualization with robust data management capabilities, providing a solid foundation for all facets of risk data aggregation, governance and reporting – and enhancing your ability to identify and manage risk. SAS Risk Data Aggregation and Reporting connects data silos across your bank for a single, consolidated look at all your data.

Customer Overview

Features

- A comprehensive data store for all regulatory requirements.

- The ability to aggregate risk data using nonlinear methodologies

- Data quality rules for multiple dimensions

- Self-service visual analytics to convert data into meaningful metrics and information for a holistic view of your bank’s risk.

- Centralized capability for business analysts to develop and refine business rules that govern their data.

- Risk aggregations for banking and trading book

- Updateing business rule logic within a single rule-management environment

- Ability to categorize and assign responsibility for data quality errors

- Top-down correlated aggregation

- Bottom-up approaches

Benefits

- A single foundation for a complete data governance platform of risk data governance, data quality information accuracy, integrity and completeness

- Integration with many major platforms with a flexible and adaptable architecture that doesn’t require replacing existing technology investments.

- Processing of risk data calculations with high-performance, in-memory aggregation of positions (banking and trading book), exposures and data to the highest level of detail

- A high-performance risk engine to aggregate risk measures on demand (VaR, ES, etc.)

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

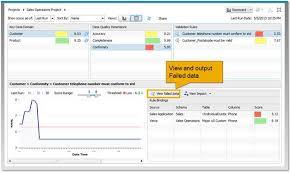

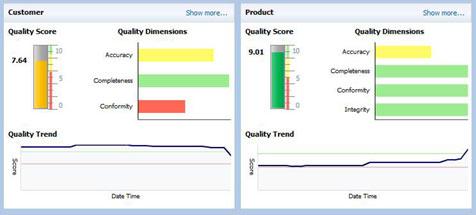

Product Profile

Screenshots

Product/Service Description

SAP data quality management for the enterprises consists of SAP® Data Services and SAP Information Steward software. Enhanced data profiling, quality metrics together with data matching and consolidation options enable financial institutions to make more informed decisions and speed up business processes. The solution is complemented with concise analytic tools for advanced data quality support.

Customer Overview

Features

- Data quality management functionality to support trusted data

- Data cleansing tools to parse, standardize, and cleanse data from any source, domain, or type

- Data profiling to enhance understanding of data

- Customized management of data policies, data quality

Benefits

- Easy and user friendly solution of data problems

- Deep view of data quality metrics with intuitive dashboards and scorecards

- Option to improve data by parsing, standardizing and cleansing data from any source, domain or type

- Numerous data enhancements with internal or external sources to maximize the value of your data

- Data consolidation to uncover hidden relationships and provide a single version of the truth

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Hyperion Financial Data Quality Management

Screenshots

Product/Service Description

Oracle Hyperion Financial Data Quality Management represents a packaged solution for finance users that helps develop standardized financial data management processes with its Web-based guided workflow user interface and powerful integration engine. Financial Data Quality Management's data preparation server can ease integrating and validating financial data from any source system. And to further reduce data integration costs and data mapping complexities, Hyperion Financial Data Quality Management includes prepackaged Enterprise Performance Management (EPM) adapters for Hyperion Financial Management, Hyperion Planning, Hyperion Enterprise, Hyperion Strategic Finance and Oracle Essbase.

Customer Overview

Features

- Guided workflow interface

- Complete data validations and error checking

- Automated data mapping and loading

- Prepackaged system adapters

- Detailed audit reviews and reconciliations.

- Support for standard file formats as well as direct connections to transaction systems.

Benefits

- Increase your confidence in the numbers.

- Lower the cost of compliance.

- Simplify financial data collection and transformation.

- Standardize with repeatable financial processes.

- Deliver process transparency through audit trails.

- Achieve timeliness of data with a Web-guided workflow process.

- Improve the productivity of finance

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Amazon Elastic Compute Cloud (Amazon EC2) represents a web service for cloud computing operations for all business sectors. EC2 offers a broad spectrum of service functionalities for work with virtual computers, developing and maintaining web applications and infrastructures.

Customer Overview

Features

- Google offers the option to create Custom Machine Types customized for specific needs. Another good feature is networking potential of the solution through Google's private global fiber network.

Benefits

- Auto Scaling feature, Free security tools, Economic pay per use pricing policy

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Product Profile

Screenshots

Product/Service Description

Clareti Transaction Control (CTC) has been designed to provide financial institutions with complete certainty in their reconciliation processing. CTC combines best-in-class performance with future-proofed technology, providing real-time reconciliation and matching based on business-driven controls. In short, CTC provides financial institutions with a robust, comprehensive and cost effective solution to meet the increased focus on real-time financial certainty.

Customer Overview

Features

- Very rapid reconciliation, verification and validation of transactions in real time

- The optimisation of business performance

- Quick and accurate identification of operational risks

- Prevention of data errors

Benefits

- Reduction of financial transaction loss events

- Reduced risk

- Quick launch of new financial products

- Reduction in deployment, hardware and operational costs

- Spreadsheet replacement