Watch Out For US Inflation and Apple 13.

- Clifford Bennett, Chief Economist at ACY Securities

- 14.09.2021 07:45 am trading

Click on image or use this link to view: https://youtu.be/j8ViPsvbuz8

US Inflation Risks.

Biden confuses China.

The Europeans have been complaining, that while it is nice to be treated with respect at last and President Biden says all the right things in their meetings, afterwards, he seems to completely forget about them when making decisions. For instance, European leaders only heard about the snap US withdrawal from Afghanistan at the very last moment.

Now, China is saying that after a very positive phone discussion between the two leaders, Biden has immediately back tracked in announcing a further trade enquiry against them.

Relations may well improve between the US and China, but any immediate enthusiasm over such a pathway is waning.

From an Australian perspective, we should not at all anticipate an improvement in our relationship with China, just because the US may have that experience. Australia's relationship was a special friendship, that has been fractured, and may well take longer to repair.

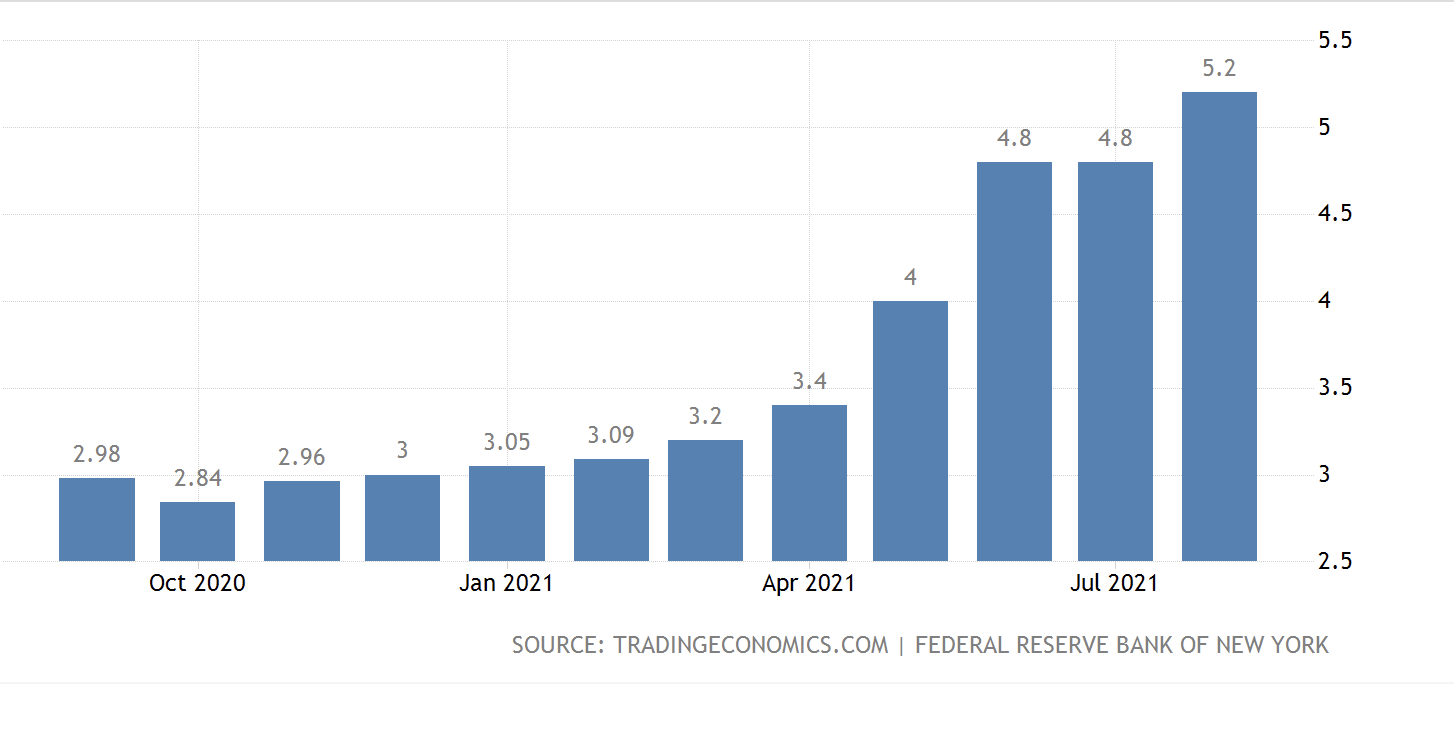

US Inflation Expectations hit new record high.

This is how people are feeling in the real world as they see the cost of living going up all around them.

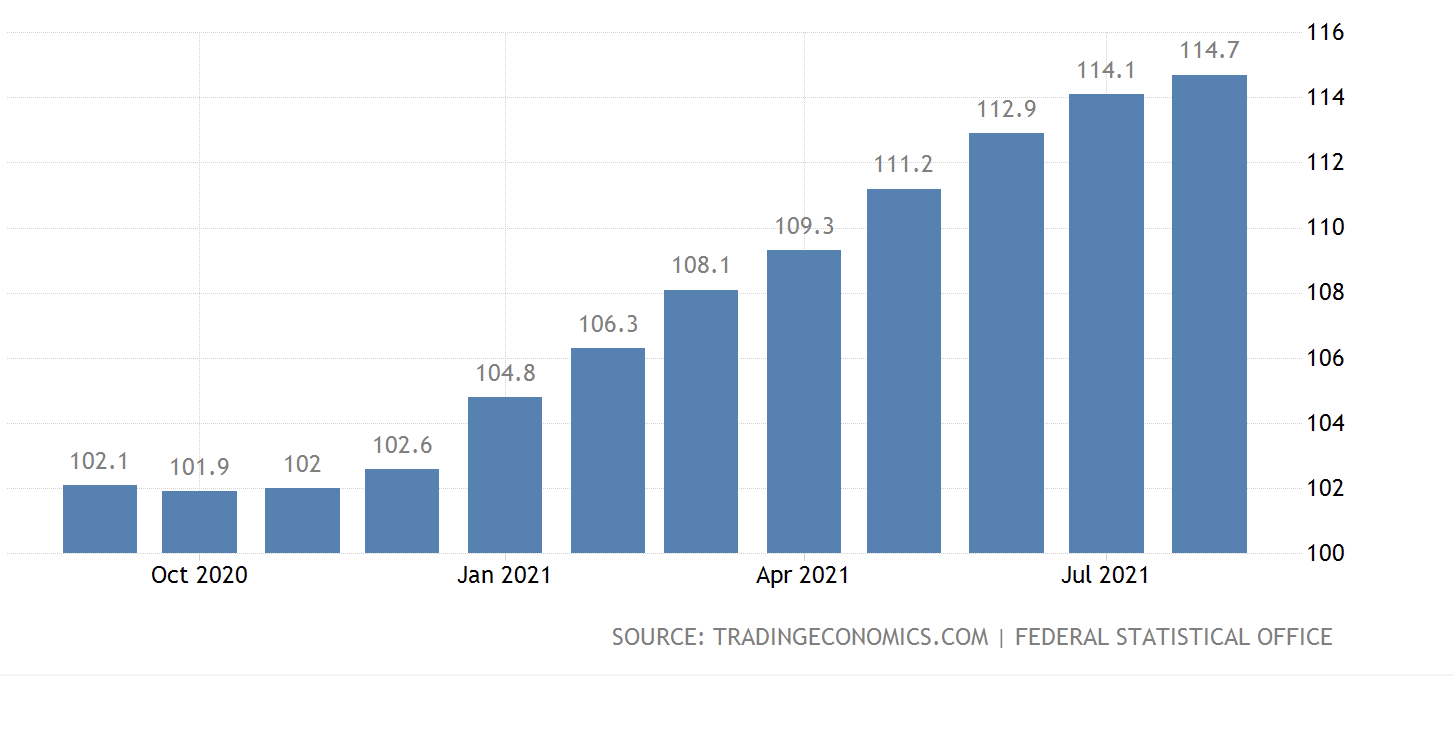

And to make the point that this is a global phenomenon, where inflationary pressures will infect other countries, look no further than yesterday's German Producer Price Inflation. Up 12% from a year ago, it was the biggest increase seen in 47 years.

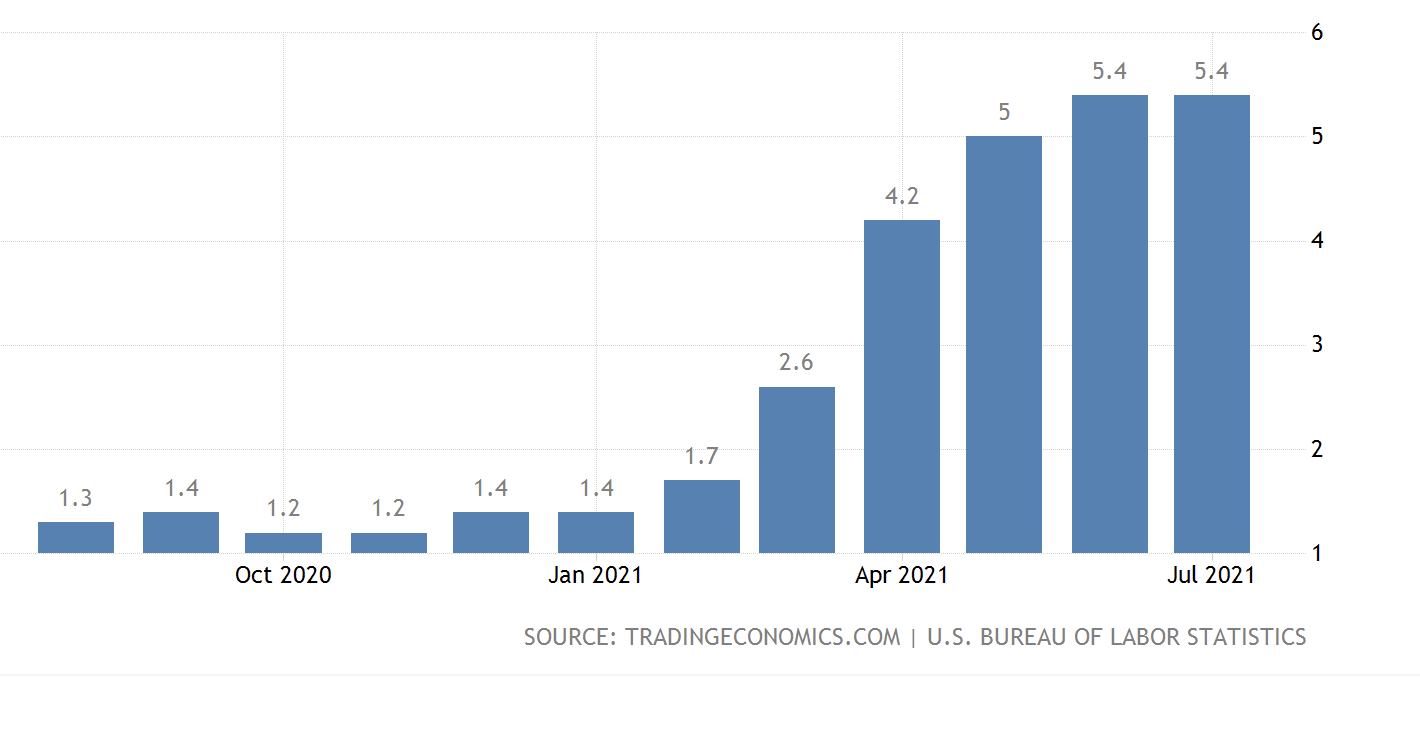

US inflation has been steady at the sky high level of 5.4%, and the consensus expectation is 5.3%.

An outcome above 5%, is an extreme warning of long term damage to the economy. The likely outcome range is 5.2 - 5.6. The risk is to the upside, and regardless of today's number, the trend will be higher through this and into next year. We could even see a +6% outcome in the not too distant future.

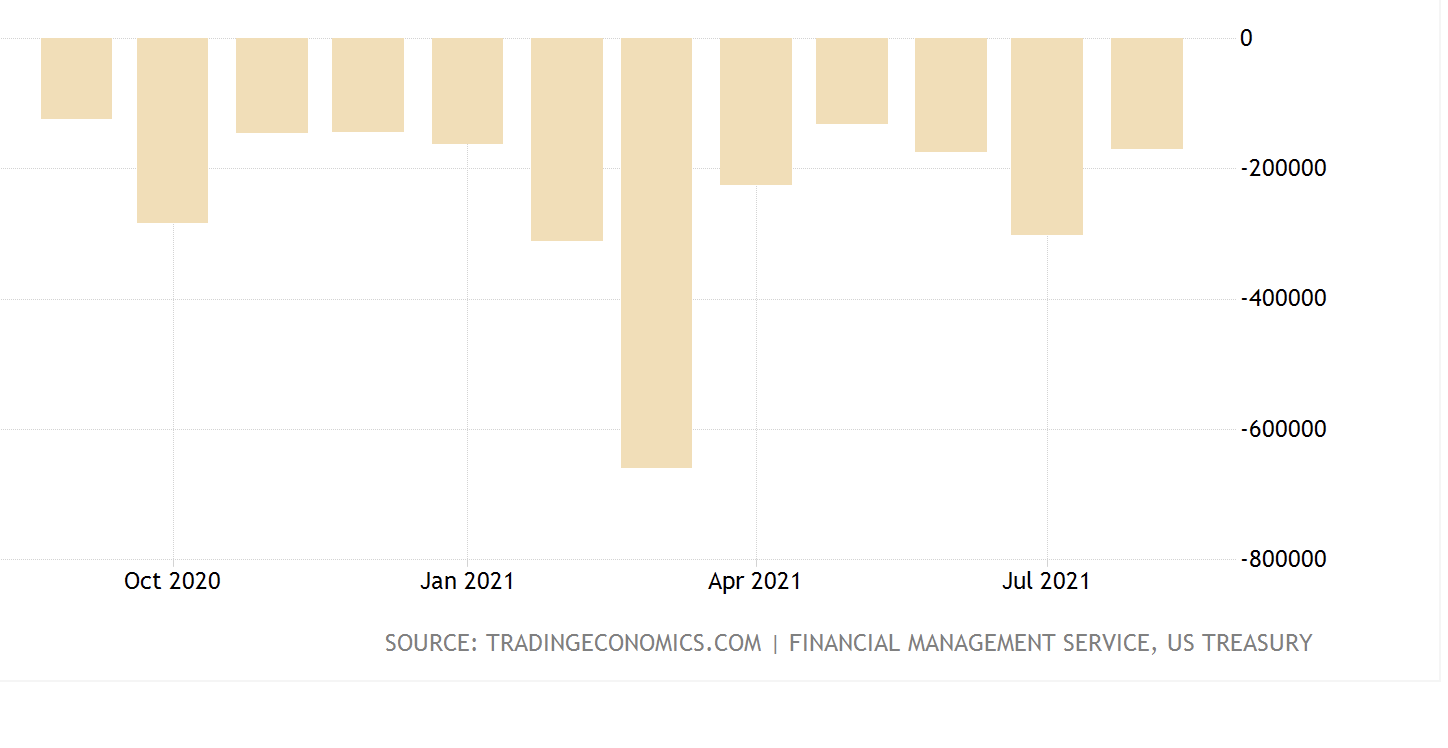

US Government Debt continues at an alarming pace.

Something we are aware of, to be sure, and the cost is extremely low given interest rates, but the party cannot go on forever.

Apple iPhone13 is being launched today and should make for great lock-down viewing for some of us.

Given the daily price action above, there is a warning here, that all the good news is already priced in. A case of 'buy the rumour sell the fact' perhaps. Would be watching support at 146 on the day as a potential near term pivot point.

Apple always maintains the potential for big surprises, but these seem to have diminished in recent years. Regrettably post Steve Jobs and as the company has further matured. It should be a great product and will indeed sell well. Nonetheless, the potential that all the good news is priced, remains.

US500

Is this, yet again, the same obvious pattern? Sharp sell down followed by equally sharp recovery? A lot of people were placing those bets yesterday, in the as expected attempted Monday recovery. While impressive, it was not however, convincing. Caution remains appropriate.

Australian equities and the little dollar could be kicked around a little today, by comments from the RBA Governor.

Overall though, true to his name he is likely to say only gentle things about further tapering and interest rate settings. There will also be reassurances that the economy is expected to bounce back sharply. This is highly unlikely to be the case, but the market will latch on to any such suggestion. His comments could be momentarily supportive of stocks, but the real story will be the US inflation data.