Dollar Dips; Risk, EM Currencies Rally; Bond Yields Climb

- Michael Moran , Senior Currency Strategist at ACY Securities

- 01.09.2021 06:00 am trading

Stocks Flat, Data Mixed Ahead of Crucial US Jobs Report

Summary: The Dollar Index (USD/DXY), a popular gauge of the US currency’s value against a basket of 6 major currencies dipped to 92.65 (92.70). Month-end adjustments, mixed economic data ahead of Friday’s crucial US Payrolls report saw more long Dollar bets unwound. US Federal Reserve President Jerome Powell sounded a cautious note on employment at the Jackson Hole Economic summit last week. While Powell also signalled that the US central bank could start tapering its bond purchases this year, traders kept their radar on Friday’s US Payrolls report. The Kiwi (NZD/USD) outperformed, soaring 0.74% to 0.7050 from 0.6998 yesterday. It’s bigger cousin, the Aussie (AUD/USD) rallied 0.36% to close at 0.7315 (0.7295). The Euro climbed above the 1.1800 barrier to settle at 1.1808, up from 1.1798 yesterday. Sterling was little changed at 1.3755 (1.3762). The USD/CAD pair edged up to settle at 1.2613 against 1.2608 yesterday. Against the Yen, the Greenback settled at 110.00 from 109.93. The US Dollar fell the most against the Asian and Emerging Market currencies. USD/CNH (Dollar-Offshore Chinese Yuan) slid to 6.4540 from 6.4645 while the USD/THB pair slumped 0.67% to 32.24 from 32.50 yesterday.

Global bond yields settled higher. The benchmark US 10-year treasury yield was up 3 basis points to 1.31%. Germany’s 10-year Bund yield rose to -0.39% from -0.43% yesterday. The UK 10-year Gilt yield climbed to 0.71% from 0.58%. Japanese 10-year JGB rate was unchanged at 0.01%.

Wall Street stocks were mostly flat. The DOW settled at 35,422 (35,445) while the S&P 500 was last at 4,530 from 4,533 yesterday.

Data released yesterday saw New Zealand’s July Building Permits ease to 2.1% from an upwardly revised 4.0% (3.8%). Japan’s July Unemployment rate improved to 2.8% from 2.9% and estimates at 2.9%. New Zealand’s ANZ Business Confidence Index slumped to -14.2 from -3.8. China’s August Manufacturing PMI eased to 50.1 from a previous 50.4, missing forecasts at 50.2. Chinese August Non-Manufacturing PMI slid to 47.5 from a previous 53.3, missing estimates at 52.8. Australia’s July Private Sector Credit (m/m) climbed to 0.7% against forecasts at 0.5% and (y/y) to 4.0% from 3.1%. Australia’s Q2 Current Account Surplus eased to AUD 20.5 billion against forecasts at AUD 21 billion. Japan’s August Consumer Confidence Index slipped to 36.7 from a previous 37.5. Japanese Housing Starts in July rose an annual 9.9% from a previous 7.3%, beating estimates at 4.8%. French Q2 GDP grew 1.1% from a previous 0.9%. Germany’s August Unemployment Rate eased to 5.5% from 5.7% and estimates at 5.6%. Eurozone August Flash CPI (y/y) rose to 3%, beating forecasts at 2.8%. Eurozone August Core CPI (y/y) was up to 1.6% from a previous 0.7% and estimates at 1.5%. Canada’s Q2 GDP (y/y) slipped to -1.5% from a previous 1.4% and (m/m) to -0.2% from -0.3%. US June House Price Index (m/m) fell to 1.6% from 1.7%, missing forecasts at 2.1%. US Chicago PMI in August dropped to 66.8 from 73.4, missing estimates at 68. US Case Shiller Home Prices (y/y) climbed 19.1% from a previous 17%, beating expectations at 18.6%.

- NZD/USD – The Kiwi rebounded 0.74% to finish at 0.7048 from 0.6998 yesterday. The Flightless Bird, as commonly referred to by FX traders found its wings and soared against the Greenback to an overnight peak at 0.7069 before easing at the New York close.

- EUR/USD – the shared currency rallied to finish above the 1.1800 level for the first time since early August, at 1.1808. EUR/USD jumped to an overnight high at 1.1845 before easing in late New York.

- AUD/USD – The Aussie rallied on the back of short-covering and the Kiwi’s strong rally. The Australian Dollar closed at 0.7315 from its opening at 0.7295 yesterday. The Aussie Battler jumped to an overnight high at 0.7341 before easing to it’s New York close.

- USD/JPY – Against the Japanese Yen, the US Dollar edged higher to finish at 110.00 from yesterday’s 109.93. The climb in the US 10-year bond yield buoyed the USD/JPY pair. Overnight the Greenback hit a low at 109.59 before rallying at the finish.

On the Lookout: Today sees another data dump as markets await the US Payrolls report on Friday which will be crucial to future Fed policy. Data just already released today saw Australia’s AIG Manufacturing Index in August drop to 51.6 from a previous 60.8. The Australian CBA Manufacturing PMI in August rose to 52.0 from July’s 51.7. Japan’s Q2 Capital Spending climbed to 5.3% from a previous -7.8% and forecasts at -6.2%. Data to follow will kick off with Japan’s Jibun Bank Manufacturing Index for August (no f/c given, previous was 53.0). Australia’s Q2 GDP Growth Rate follows (q/q f/c 0.5% from 1.8%, y/y f/c 90.2% from 1.1%). China releases its August Caixin Manufacturing PMI (f/c 50.2 from 50.3 – ACY FInlogix). European data starts with Germany’s July Retail Sales (y/y f/c 3.7% from 6.2%, m/m f/c -0.9% from 4.2%); The UK releases its August Nationwide Housing Prices (y/y f/c 8.6% from 10.5%, m/m f/c 0.2% from -0.5% - ACY Finlogix); Switzerland follows with its SVME August PMI (f/c 67.3 from 71.1); French Markit Manufacturing Index for August (f/c 57.3 from 58.0), German August Markit Manufacturing PMI (f/c 62.7 from 65.9), Eurozone August Markit Manufacturing PMI (f/c 61.5 from 62.8) are next; the UK releases its Final August Markit Manufacturing PMI (f/c 60.1 from 60.4). Italy releases its July Unemployment Rate (f/c 9.7% from 9.7%); the Eurozone July Unemployment Rate follows (f/c 7.6% from 7.7%). Canada releases its August Markit Manufacturing PMI (no f/c previous was 56.2). The US releases its Final August Markit PMI (f/c 61.2 from 63.4), US ISM Manufacturing August PMI (f/c 58.6 from 59.5 – ACY Finlogix), US July Construction Spending (m/m f/c 0.2% from 0.1%). Whew…

Trading Perspective: The US Dollar has eased from 93.55 (August 20) to 92.65 yesterday as long USD bets continue to unwind ahead of Friday’s US Payrolls report. Comments from Fed Chair Jerome Powel last week on US employment were cautious. Month-end adjustments also lifted the currencies against the Greenback. US data releases this week have mostly missed expectations. Today sees the release of global Manufacturing PMIs which are forecast to ease following the recent Covid-19 resurgence. Yesterday, China’s August Manufacturing PMI eased slightly more than forecast but still managed to stay above the 50 level, at 50.1. It was mostly risk on with stocks managing to cling to near record highs. The caveat was higher global bond yields. The US 10-year yield climbed 3 basis points to 1.31%. Other global yields were also higher. Germany’s 10-year Bund yield was up 5 bp to -0.39%. At current levels, the Dollar should find support against its rival.

- AUD/USD – The Aussie jumped to an overnight high at 0.7341 before slipping to close above the 0.7300 barrier at 0.7315. Yesterday the AUD/USD pair opened at 0.7295. On the day, immediate resistance lies at 0.7340 followed by 0.7370. Strong resistance lies at 0.7400. The Aussie had immediate support at 0.7300 followed by 0.7280 and 0.7255. Look for the Aussie to consolidate in a likely range today between 0.7285-0.7325. Prefer to sell rallies.

- EUR/USD – the shared currency extended its gains versus the Greenback to 1.1808 from its 1.1798 open in Asia yesterday. EUR/USD soared to an overnight peak at 1.1845 before easing in late New York. The overnight low traded was 1.1795. The Euro has immediate resistance at 1.1830 and 1.1860. Immediate support can be found at 1.1780 followed by 1.1750. Expect a likely trading range today between 1.1780-1.1840. Prefer to sell on Euro strength today.

- USD/JPY – Against the Japanese currency the Greenback edged higher to 110.00 from 109.93. The rise in the US 10-year bond yield buoyed this currency pair. USD/JPY has immediate resistance at 110.10 (overnight high traded was 110.08). The next resistance level lies at 110.25 and 110.50. Immediate support can be found at 109.80 and 109.40. Expect consolidation in a likely 109.80-110.30 range today. Prefer to buy on dips today.

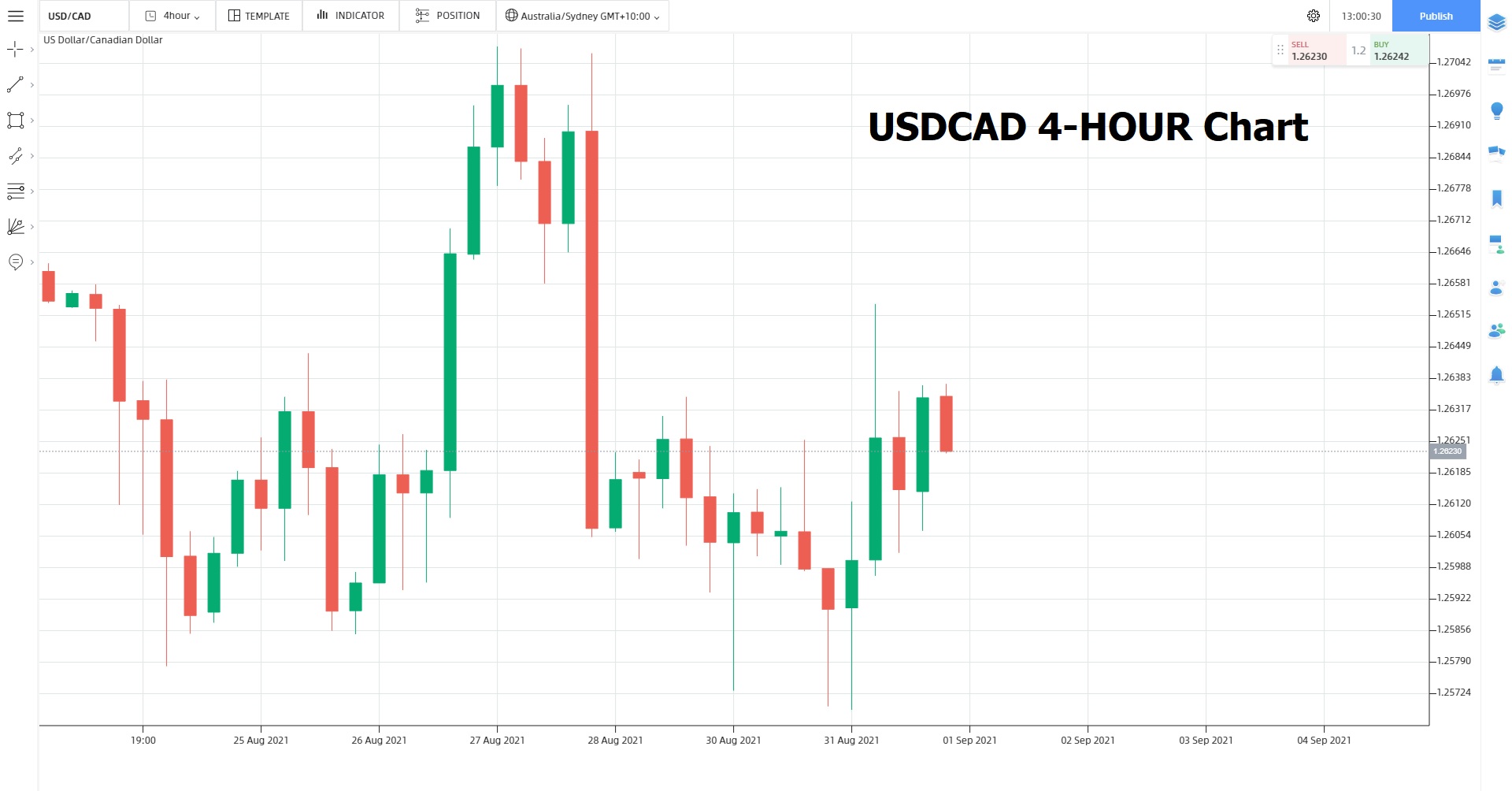

- USD/CAD – The Greenback edged higher against the Canadian Loonie to 1.2613 from 1.2608 yesterday, only just. Oil prices slipped with WTI down 1% to USD 68.53 from USD 69.13 yesterday. Canada’s Q1 GDP missed estimates. Yet the USD/CAD pair was little changed. The overnight high traded was 1.2653 before sliding in late New York. Immediate resistance for USD/CAD lies at 1.2630 and 1.2660. Immediate support lies at 1.2580 followed by 1.2550. Prefer to buy on USD dips in a likely 1.2590-1.2660 range today.

(Source: Finlogix.com)

Happy trading and Wednesday all.