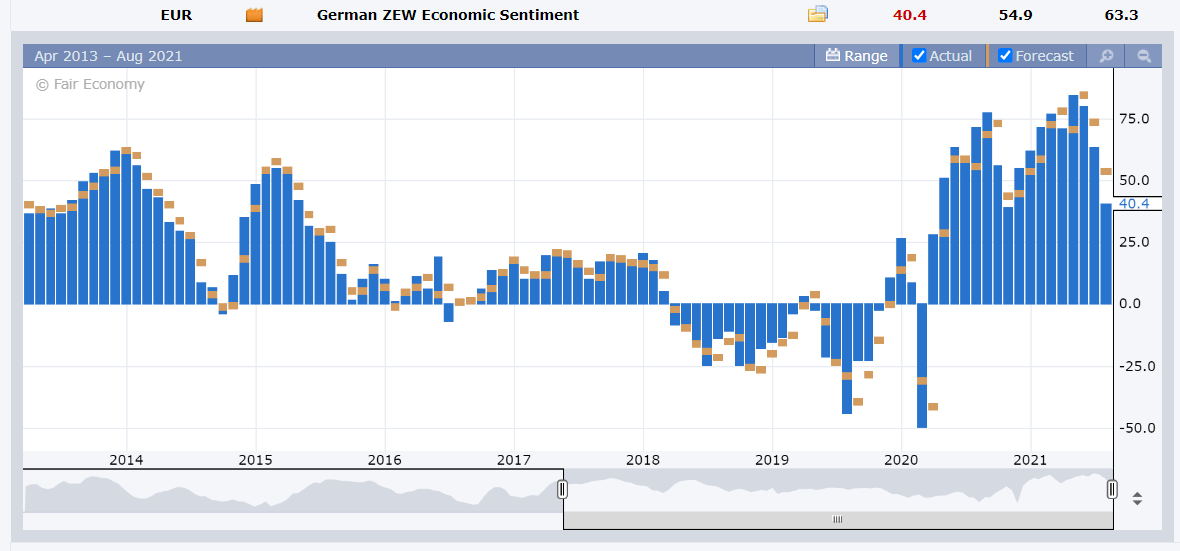

Euro Tumbles as Germany’s Economic Confidence Deteriorates

- Michael Moran , Senior Currency Strategist at ACY Securities

- 11.08.2021 11:45 am trading

Dollar, Bond Yields Extend Rise Ahead of Key US Inflation Data

Summary: The Euro tumbled to 4-month lows after Germany’s ZEW survey showed economic confidence deteriorated sharply in August. The indicator of Investor sentiment in Europe’s largest economy slumped more-than-expected to 40.4 from 63.3 in July. Median forecasts were for a moderate drop to 56.7. The Eurozone ZEW Sentiment Index for August was also lower (below). EUR/USD dropped to 1.1710 from 1.1737 yesterday, before settling at 1.1717 in late New York. The US Dollar extended recent gains following a combination of hawkish comments from Federal Reserve officials and the second monthly increase of over 900,000 jobs. A popular measure of the Greenback’s value against a basket of currencies, the Dollar Index (USD/DXY) rose 0.14% to 93.07 (92.97), its third straight day of gains. Against the Japanese Yen, the Dollar rallied 0.23% to 110.58 (110.37), supported by a 3-basis point climb in the US 10-year bond yield to 1.35%. Sterling edged lower to 1.3837 from 1.3851 yesterday. Resource currencies, the Australian and Canadian Dollars bucked the trend, ending higher against the Greenback. Short covering saw the AUD/USD pair settle 0.22% higher at 0.7345 (0.7332) despite Sydney’s ongoing lockdown due to Covid. A rebound in Brent Crude Oil prices by 2.5% (USD 70.75 from USD 69.30) lifted the Canadian Loonie over the Greenback. USD/CAD slid to 1.2528 from 1.2578. The Dollar was mostly higher against the Asian and Emerging Market currencies. Against the Chinese Offshore Yuan, the Greenback (USD/CNH) ended mildly higher at 6.4885 (6.4860). The USD/SGD pair rallied 0.15% to 1.3595 (1.3575 yesterday) while the USD/THB (US Dollar vs Thai Baht) was flat at 33.47.

US Treasury bond yields were up. The yield on the US two-year note gained 2 basis points to 0.24%. Rival global treasury rates were either flat or edged higher. Germany’s 10-year Bund yield ended flat at -0.46%. Japan’s 10-year JGB yield rose 2 basis points to 0.02%.

Wall Street stocks closed mixed. Risk sentiment was buoyed after the US Senate agreed to a Republican-backed stimulus program. The DOW rose 0.35% to 35,247 (35,113) while the S&P 500 was little changed at 4,433. A fall in US tech stocks pushed the NASDAQ lower.

Other data released yesterday saw Japanese Annual Bank Lending in August drop to 1.0%, lower than estimates of 1.6% and a previous 1.4%. Japan’s Economic Watcher’s Sentiment climbed to 48.4 from 47.6, beating median expectations at 43.5. Australia’s NAB Business Confidence Index slumped in July to -8 from June’s +11.0. The Eurozone ZEW Economic Sentiment Index dropped to 42.7 from 61.2, underwhelming forecasts at 55.3. The US NFIB Small Business Index eased to 99.7 from 102.5, missing estimates of 101.9.

- EUR/USD – The shared currency was sold down in Europe following the release of worse-than-expected results from both German and Eurozone ZEW Economic Sentiment Indexes. The Euro hit an April low at 1.1710 from yesterday’s opening at 1.1737, settling at 1.1717.

- USD/JPY – The Greenback grinded higher against the Japanese Yen, settling at 110.58 in late New York from 110.37 yesterday. The three-basis point lift in the benchmark US 10-year bond yield boosted this currency pair. US two-year bond rates were also higher.

- AUD/USD – the Aussie Battler continued to benefit from short-covering, climbing to close at 0.7347 from its 0.7332 opening yesterday. The Australian Dollar slid to an overnight low at 0.7316 before rallying to settle higher. A fall in the NAB Business Confidence Survey and Sydney’s extended Covid lockdown prevented further AUD/USD gains.

- USD/CAD – A rebound in Crude Oil prices by 2.5% to USD 70.75 from USD 69.30 pushed the Greenback lower against the Canadian Loonie. The USD/CAD pair slid 0.4 % to 1.2527 from its 1.2577 opening yesterday.

On the Lookout: Today is all about the US July CPI report (released at 10.30 pm Sydney). Germany and Italy also release their inflation data. Expectations for the US Headline inflation report are (m/m f/c at 0.5% from previous 0.9%; y/y forecast at 5.3% from 5.4%), Core CPI (m/m f/c 0.4% from 0.9%; y/y forecast 4.3% from 4.5%). Other data released earlier in the day kick off with Australia’s Westpac Consumer Confidence Index for August (no forecasts, previous was 108.8). China releases its July Annual Vehicle Sales report (no forecasts given, previous was -12.4%). Europe kicks off with Germany’s July Final CPI report (m/m f/c 0.9% from 0.4%; y/y f/c 3.8% from 2.3% - ACY Finlogix). Italy releases its July Final Inflation data (m/m f/c 0.3% from 0.1%; y/y f/c 1.8% from 1.3% - Finlogix). US Federal Reserve Atlanta President and FOMC member Raphael Bostic is due to speak at an online event.

Trading Perspective: The US Dollar continued to climb against most of its Rivals, extending gains made following the robust US Payrolls report and hawkish rhetoric from Fed officials. Today’s US inflation numbers are expected to slow down following last month’s CPI rise where consumer prices soared to their fastest pace in 13 years. Any inflation number in the US better than forecast will set the stage for a Fed taper next month. And boost the Greenback even higher. Inflation in Germany and Italy is expected to rise from previous reports. Any misses in the European data will heap more pressure on the Euro. Fedspeak will also have more impact on the US currency. Traders have been driving the Dollar higher on expectations that the Fed will set the stage for a taper next month. And market positioning has been accumulating more Greenbacks.

- EUR/USD – The Euro finished on a weak note, closing near it’s overnight and 4-month lows at 1.1717. In early Asian trade this morning, the EUR/USD pair has been sold down to 1.1715 before rebounding to settle at 1.1722. Immediate support for the shared currency lies at 1.1710 (which was the overnight low). The next level of support is found at 1.1685 followed by 1.1650. Immediate resistance can be found at 1.1740 (overnight high 1.1743). The next resistance level lies at 1.1780. Look for consolidation in a likely 1.1710-1.1760 range prior to the inflation reports. The Euro still feels heavy, so the preference is to sell rallies.

(Source: Finlogix.com)

- AUD/USD – The Australian Dollar bucked the trend, climbing to finish up 0.25% at 0.7345. The overnight low traded was 0.7316. Immediate support on the day lies at 0.7315 followed by 0.7275. The overnight high traded for the Aussie Dollar was at 0.7356. For today, immediate resistance can be found at 0.7360 and 0.7390. The Battler shrugged off a much weaker than expected NAB Business Confidence report as well as the ongoing lockdown in Sydney. Look to sell rallies in a likely range today between 0.7310-0.7360.

- USD/CAD – The US Dollar slid against the Canadian Loonie to finish 0.4% lower at 1.2525 from 1.2575 yesterday. The 2.5% rebound in Brent Crude Oil prices boosted the Loonie and weighed on the Greenback. Last week Canada’s Employment report underwhelmed on all counts, contrasting with that in the US. Immediate support for USD/CAD lies at 1.2520 (overnight low) followed by 1.2490. Immediate resistance can be found at 1.2550 and 1.2590. Look to buy dips in a likely range today of 1.2520-1.2620.

- USD/JPY – Higher US bond yields drove this currency pair up. The Greenback rose to an overnight peak at 110.60 before easing to 110.55 at the New York close. USD/JPY has immediate resistance at 110.60 followed by 110.90. Immediate support can be found at 110.30 (overnight low traded) followed by 110.00 and 109.70. Expect the USD/JPY pair to be supported on dips. That said, there’s just as much value selling rallies. Look to trade a range between 109.85-110.85.

Happy trading and Wednesday all.