Surge in US April Job Openings Lift Dollar, Only Just

- Michael Moran , Senior Currency Strategist at ACY Securities

- 09.06.2021 11:15 am trading

Loonie Dips, CAD Longs Pared into BOC Meeting

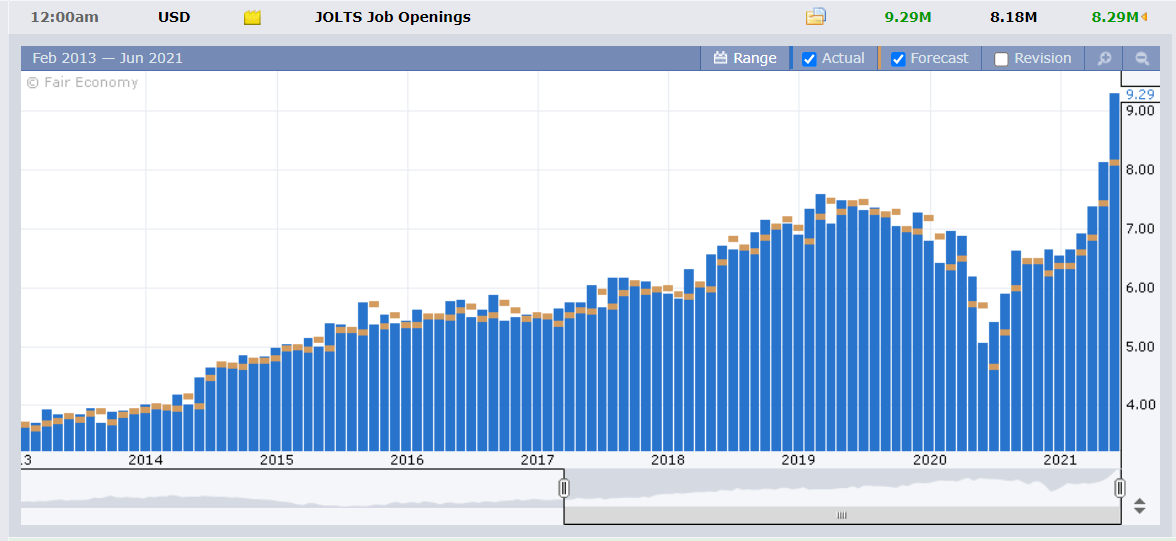

Summary: A surge in US April Job Openings to its highest level since December 2000 (when the series began) lifted the Dollar against its major peers. The US Labour Department’s monthly Job Openings and Labour Turnover Survey (JOLTS), a measure of labour demand, increased to 9.3 million in April, a gain of almost 1 million from March. A favoured measure of the US Dollar’s value against a basket of 6 major currencies, the Dollar Index (USD/DXY) rose modestly to 90.10 from 89.97 yesterday. The Euro eased to 1.2173 (1.2192) in subdued trade. Sterling settled 0.15% lower to 1.4155 (1.4180). Against the Canadian Loonie, the Greenback climbed to 1.2110 from 1.2077 yesterday. The Bank of Canada has its interest rate policy meeting later today (12 midnight, Sydney). The BOC was the first of the major central banks to taper its emergency bond purchases. Markets will be looking for fresh hints for the next policy change from the Canadian central bank. The Australian Dollar (AUD/USD) slipped 0.21% to 0.7739 (0.7758) while its smaller Tasman cousin, the Kiwi (NZD/USD) lost 0.40% to 0.7195 (0.7234). USD/CNH (Dollar-Offshore Chinese Yuan) rallied to 6.4015 from 6.3865, its highest close in 2 weeks. Global treasury yields eased. The US 10-year bond yield settled at 1.538% from 1.57% yesterday. Germany’s 10-year Bund rate eased 3 basis points to -0.23%. Canadian 10-year bonds were yielding 1.45% (1.47% yesterday).

Wall Street stocks edged lower. The DOW settled at 34,609 (34,628). The S&P 500 closed unchanged at 4,227.

Other Data released yesterday saw Japan’s Annual Average Cash Earnings climb to 1.6% in May, from an upwardly revised April of 0.6% (from 0.2%) and beating estimates of +0.8%. Japan’s Final Q1 GDP bettered expectations at -1.0% from -1.2%. Australia’s National Australia Bank’s Business Confidence Index in May eased to 20 from April’s downwardly revised 23. Germany’s Industrial Production (May) fell to -1.0%, missing median forecasts at +0.3%. The Eurozone ZEW Economic Sentiment Index slipped in May to 81.3 from 84.0. Germany’s ZEW Economic Sentiment Index saw a lower print to 79.8 in May from 84.4 in April, underwhelming estimates at 86.0. Canada’s Trade Balance improved to a Surplus of +CAD 0.6 billion in May from April’s Deficit of -CAD 1.3 billion. Finally, the US May Trade Deficit eased to -USD 68.9 billion from April’s -USD 75.0 billion. The US NFIB Small Business Index slipped to 99.6 in May from 99.8 April.

- EUR/USD – finished marginally lower against the broadly stronger US Dollar to 1.2173 from yesterday’s 1.2193 opening. The shared currency traded in a relatively narrow range between 1.21642 and 1.21941. With the ECB meeting on interest rates tomorrow, there was little interest to drive the currency too far either way.

- USD/CAD – The Greenback rallied off its 1.2075 opening yesterday to a 1.2109 finish in New York. Despite higher Oil prices, the Loonie ended weaker against the overall stronger US Dollar. No major changes are expected at tonight’s BOC policy meeting. On Friday, Canada’s May Employment lost -68,000 jobs, underwhelming forecasts at -23,500.

- USD/JPY – rose marginally to a 109.48 finish in New York from 109.25 yesterday morning. The Greenback managed to climb off its overnight low at 109.198 despite a lower US 10-year bond yield.

- USD/CNH – extended its rally to close at 6.4015, a gain of 0.25% and a fresh 2-week high. The Dollar slumped to a 6.3518 low earlier in the week following last week’s tepid US Payrolls gain.

On the Lookout: After another day of cautious, sluggish trade, markets should pick up after tonight’s Bank of Canada policy meeting. While the US Dollar managed to rally off it’s lows yesterday, it still remains in the doldrums following Friday’s disappointing US Payrolls report. Tomorrow’s US inflation report for May would need to be stronger than expected to lift heavy Greenback off the floor. Meantime, today’s economic calendar just saw New Zealand’s Q1 Manufacturing Sales climb to a year on year 4.3% from 2.1%. Later in the day, New Zealand releases its ANZ Business Confidence Index report (1.8 in April). RBA Assistant Governor Christopher Kent is due to speak at a Debt Capital Markets Online Summit (9.30 am Sydney). Australia follows with its Westpac Consumer Sentiment Index which was last at -4.8% as well as Australian HIA New Home Sales for May (April -54.4%). Australian Final April Building Permits follow (previous 18.9% - Finlogix). China follows with its May CPI report (y/y forecast at 1.6% from 0.9% - Finlogix). China also releases its May PPI report (y/y forecast at 8.5% from 6.8%). European data start off with Germany’s April Balance of Trade (surplus forecast to +EUR 16.3 billion from April’s +EUR 14.3 billion - Finlogix). The Bank of Canada expected to keep its Overnight Cash Rate at 0.25% at the conclusion of its policy meeting (12 midnight Sydney).

Trading Perspective: We can expect further consolidation in familiar trading ranges to kick off in Asia today. The Dollar’s rally against its rivals was limp, to say the least. The Greenback continues to trade with a sluggish feel to it. That said, the current market positioning (COT report for the week ended June 1) is short USD/long IMM currencies at a 12-week high (net total - USD 17.7 billion). We reported yesterday that speculators extended their buying in the Euro, Japanese Yen and Canadian Dollars. Against the British Pound, speculative long GBP bets were pared. What will trigger these short USD bets to run for the exits? Most likely a strong gain in Thursday’s US CPI. Forecasts are for a lower number in May from April.

- EUR/USD – Trading in the shared currency was subdued as we await the ECB policy meeting tomorrow. An easing in the US 10-year bond yield was matched by that in Germany. Most data out of Europe yesterday disappointed (Eurozone and German ZEW Economic Sentiment and German Industrial Production). EUR/USD finished at 1.2174 (1.2193 yesterday). Overnight high traded for EUR/USD was 1.2194. Immediate resistance lies at 1.2200 followed by 1.2230. Immediate support can be found at 1.2160 (overnight low 1.21642) and 1.2130. Look for a likely range today between 1.2150 and 1.2200. With the specs long of Euros, the preference is to sell rallies.

- USD/CAD – Ahead of the BOC meeting tonight, the spotlight falls on the Canadian Loonie. The Bank of Canada was the first of the major central banks to scale back its emergency bond purchases (April). Analysts expect that BOC President Tiff Macklem and his colleagues will leave it’s Overnight rate at 0.25%. USD/CAD has immediate support at 1.2070 and 1.2040. Immediate resistance lies at 1.2120 (overnight high 1.21174) and 1.2150. Look for a likely trading range today of 1.2080-1.2130. Keep an eye out as well for Oil prices. The preference is to buy dips, the BOC will not want to CAD to strengthen excessively, and the specs are long of CAD bets. Tin helmets on this puppy tonight, we could be in for a wild ride.

(Source: Finlogix.com)

- AUD/USD – The Aussie retreated after trading to an overnight high at 0.77634, before slipping to close 0.25% lower at 0.7740. AUD/USD has immediate support at 0.7730 (overnight low 0.77317) followed by 0.7700. Immediate resistance can be found at 0.7760 and 0.7790. Look for a likely trade between 0.7720-0.7770 today. Just trade the range shag on this one for now.

- GBP/USD – Sterling edged lower on the back of the overall stronger US Dollar to a 1.4154 finish in New York. Overnight low for the British currency was 1.41209. Immediate support lies at 1.4120 followed by 1.4090. There is immediate resistance at 1.4180 (overnight high 1.41847) and 1.4210. There are no major UK data releases today so Sterling will take its cues from the Greenback. Look to trade a likely 1.4110-1.4190 range today.

Happy Wednesday and trading all.