Published

- 03:00 am

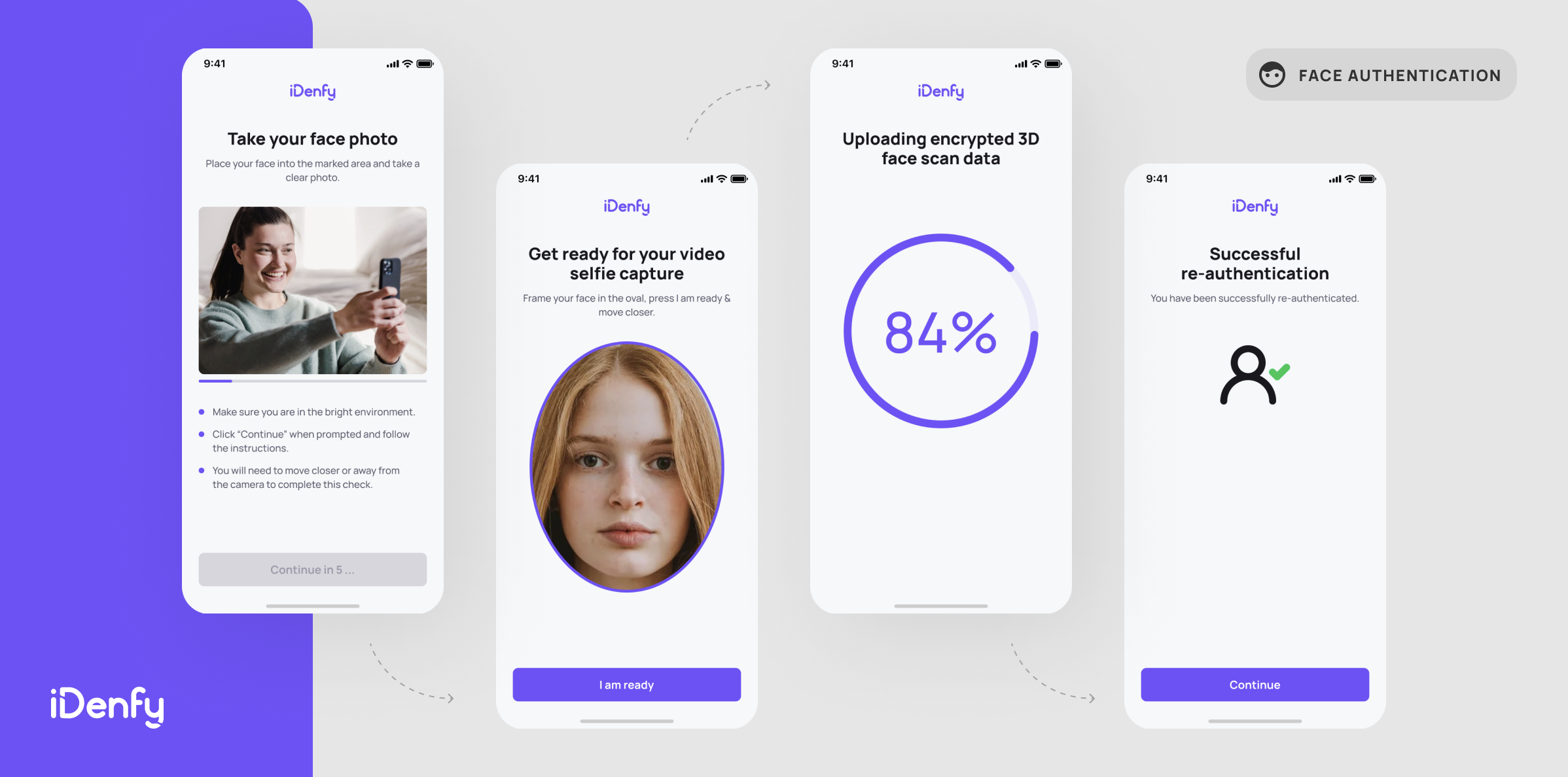

The global digital identity verification and fraud prevention company, iDenfy, introduced a new feature to its automated ID verification toolkit, Face Authentication. The newly launched service will help authenticate existing customers by eliminating account takeover threats.

iDenfy explains that many businesses strive to design a seamless onboarding experience for their customers, making it as fast and easy to use as possible. A great example is the Fintech industry, which is booming and leaving traditional banking behind. Despite that, the identity verification company continues to argue that some enterprises concentrate on the speed factor and are tempted to weaken the security part of their identity verification process.

The Federal Trade Commission (FTC) reports that each year, fraudsters steal at least 9 million identities around the world. Once this data is breached, cybercriminals open many doors: from making purchases and wiring funds to selling the data on the Dark Web. According to iDenfy, mitigating identity fraud in the digital world isn’t an easy task, as there’s a constant threat of account takeover when performing high-value transactions or changing sensitive account data.

As specified by Domantas Ciulde, the CEO of iDenfy, such actions should be secured using additional verification methods but without the hassle of a complex multi-step procedure. To simplify the journey for the customers, iDenfy claims to have created a smart feature using the most reliable biometric authentication data – the face. Based on identity verification market research and the demand for user-friendly Know Your Customer (KYC) solutions, iDenfy designed a new facial recognition implementation.

According to the enterprise, the customer completes the whole process in three simple steps. First, they need to go through the standard identity verification using their face. Then, the customer performs simple head movements. Lastly, after receiving the ID verification results, due to the new Face Authentication feature, the service will instantly tell whether the customer performing face authentication is the one who completed identity verification in the first place.

iDenfy’s goal is to prevent fraud and simplify identity verification, which led the company to create the Face Authentication feature. As said by iDenfy, the new service welcomes back the customers without them having to go through the full, lengthy identity verification process. As an illustration, iDenfy compares its new feature to a standard password or Two-Factor Authentication (2FA).

“Instead of passwords that are difficult to remember, customers can be onboarded easier using our new facial recognition technology. Our module can be integrated into any onboarding flow within a few hours. We also customize our solution to match brand guidelines and make it more familiar for the customers.” — explained Domantas Ciulde, the CEO of iDenfy.

Related News

- 09:00 am

Worldline, a global leader in payment services, announces it has renewed and strengthened its partnership with retailer Morrisons, through a new PIN Pad offering - Lane/3000.

Morrisons joins a growing list of Worldline customers in the UK adopting the Lane/3000 PIN Pad as a core part of its in-store payment system. The Worldline Lane/3000 PIN Pad will help Morrisons manage the millions of multi-lane, self-check and restaurant transactions that are processed each day, enabling consumers to pay faster at the tills and reduce overall waiting times.

Worldline has proudly been supplying the PIN Pad interface between Morrisons and its card-holding customers since the introduction of PIN verification. Ensuring reliability and a great customer experience, the L/3000 PIN Pads are fully compliant with the latest PCI regulations, guaranteeing maximum security to all encrypted debit/credit card transactions. The deployment of the new Worldline Lane/3000 PIN Pad commenced in Morrisons’ stores in September 2021.

Morrisons processes millions of encrypted card transactions each day and has invested in the latest Lane/3000 PIN Pad technology, which possesses faster transaction speeds, to ensure customers enjoy a swift, secure and frictionless checkout experience for years to come.

This announcement further strengthens Worldline’s strategic partnership with one of the largest retail chains in the UK. This highly successful relationship has benefited both parties involved, as well as crucially, customers for the past ten years.

Lee Jones, Managing Director Northern Europe, Merchant Services at Worldline, said: “Morrisons is a much-loved household name across the UK, and we are delighted to announce the extension of our partnership which will ensure speedy and reliable payments for all Morrisons customers. We are very excited to see the new Lane/3000 being rolled out across stores, enabling Morrisons and its customers to benefit from a fast, seamless and secure solution.”

Kate Lavery, Technology Director - Customer & Colleague at Morrisons, said: “We are delighted to be extending our longstanding and valued partnership with Worldline. The Lane/3000 peds provide a secure offering for us and an enhanced customer experience across the retail business.”

Related News

Dynshaw Italia

Chief Financial Officer at Soldo

Environmental concerns, economic turbulence, the cost-of-living crisis, and global trade issues are just some of the macro issues businesses are facing today. see more

Dynshaw Italia

Chief Financial Officer at Soldo

Environmental concerns, economic turbulence, the cost-of-living crisis, and global trade issues are just some of the macro issues businesses are facing today. see more

- 07:00 am

A review by the Financial Conduct Authority (FCA), conducted over 2021, has raised concerns over the financial crime controls of challenger banks, finding a rise in the number of Suspicious Activity Reports (SARs).

The review included an in-depth focus on six challenger retail banks, primarily consisting of digital banks covering over 8 million customers.

The FCA found that, despite some evidence of good practice, such as innovative use of technology, challenger banks were not verifying customers to the required level of compliance, which created an environment of heightened risk for financial crime to occur, not just during onboarding but through the entire customer journey.

Amongst the concerns, the FCA noted that some challenger banks did not carry out sufficient customer due diligence to obtain basic customer details required for associated checks, as well as insufficient enhanced due diligence for those in higher risk circumstances.

As a result, the FCA has requested that challenger banks review these findings and make improvements where necessary to bolster their defences against financial crime.

Dr Henry Balani, Global Head of Industry and Regulatory Affairs for Encompass Corporation, commented:

“The rapid rise of challenger banks offering digital services to millions of customers brings the risk of increased financial crime, which must be met head-on. As regulators scramble to introduce new guidance to prevent fraud and money laundering, it is also important for challenger banks to be proactive in their approach to addressing these issues.

“A fast-moving industry that is serving customers around the globe should be setting the standard when it comes to utilising automated technologies in order to deliver AML and KYC checks that can quickly give organisations a complete picture of their customer base.

“Challenger banks lead with technology as part of their digital innovation remit, which can result in regulatory requirements playing second fiddle. They must ensure the same standards are met as those of other regulated banks when tackling the rising tide of financial crime.”

Related News

- 03:00 am

Zimpler, a leading fintech company born in Sweden, announced today that it has gone live in Norway. Following Sweden, Finland, Germany, Estonia, The Netherlands, Latvia and Lithuania, Norway has become the eighth market to offer Zimpler’s account-to-account payments solutions.

The first merchant in Norway to go live using Zimpler is Scandinavian Travel Group, which is currently integrated with Zimpler in Sweden and Finland, through Vitec Travelize. Following this launch, Zimpler will continue to focus its efforts on expanding in the Norwegian market, especially in segments such as travel, e-commerce, and financial services – where instant, secure and easy payments are crucial. Zimpler will offer wide bank coverage in Norway, and customers will be identified through their own verification system called, BankID.

Launching in Norway is a part of Zimpler’s ongoing geographical and product expansion plan, which is particularly focused on the Nordics. Last year, entry into new verticals and markets fueled Zimpler’s growth, and the company marked a 176% increase in transaction volumes, and a 134% increase in revenue year-on-year.

Sylvestre Thenor, Head of Expansion at Zimpler, said: “The payments infrastructure in the Nordics gives us a perfect ecosystem to expand in, and we aim to offer Zimpler solutions throughout the region. The Norwegian market represents a cornerstone for Zimpler in having a strong presence in the Nordics. Norway – where 98% of the population has internet access and 1.3 million customers use online banking daily – offers great opportunities to integrate our products. Especially in segments such as travel, e-commerce, or financial services.”

Johan Strand, CEO at Zimpler, said: “It has been an exciting and eventful couple of months at Zimpler, with announcements of major new partnerships, new investment, and product launches. I am grateful that even in these turbulent times when many of our competitors are forced to make cuts in their operations, we can continue to push our mission of simplifying payments transactions, implement our expansion plans and continue to grow.”

Related News

- 04:00 am

Low-code consumer fintech platform Quiltt announced today that it has raised $4M in venture capital to expand access to financial services technology for consumers by dramatically lowering technical barriers for innovators.

Ruben Izmailyan, CEO and co-founder of Quiltt said, “Quiltt's vision is to make fintech development more accessible so that more growing businesses and startups can create seamless experiences for their customers. We are excited to partner with leading fintech investors who are as passionate about this opportunity as we are."

“With just Quiltt and Zapier, we’re able to conceive and build custom fintech experiences in hours rather than months. Quiltt has given us the ability to experiment and iterate at a rate that was previously unimaginable,” said Joseph Graves, Founder and CEO of Round4Good

Nathan Pinto, Co-Founder & CEO of Credit Mountain said, “Leveraging Quiltt’s pre-built integrations to Plaid and Spade has allowed our engineers to focus on building the best member experience for our customers.”

“As consumers of financial services, we often don’t recognize how many data services and transaction processing systems are involved in each interaction. That is by design, as we would not enjoy an easy end-user experience if we had to interact with these services, but building and maintaining the right underlying connections remains a bottleneck for developers. Quiltt abstracts away the complexity of working with these services so developers can innovate faster and put more great financial experiences in the hands of consumers. We are excited to help Ruben and Mark turn that vision into reality,” said Will Szczerbiak, Partner at Greycroft

"As thematic investors in the fintech space, we see Quiltt solving an important and growing problem for businesses struggling to integrate all the financial data and services they need to satisfy their customers and grow," said Dan Borok, Managing Partner of Newark Venture Partners. "Quiltt's low-code, one-and-done platform is flexible, simple, and consolidates all the data in the fintech stack. Mark and Ruben have the right combination of financial service and startup experiences to make Quiltt a need-to-have tool for businesses and developers across industries."

Founders Mark Bechhofer and Ruben Izmailyan previously built a personal finance app where they learned firsthand about the many challenges of building great financial experiences for consumers. The founding team brings experience from companies like S&P Capital IQ, Chime, Dropbox and Relationship Science. The funding will be used to add data integrations, build new capabilities, and expand the engineering team.

Related News

- 07:00 am

Madrid fintech Fuel reinvents B2B financial services through a corporate credit card that brings together equipment, means of payment and accounting for the first time. A card designed for the needs of a successful business, according to Eduardo Ortiz de Lanzagorta GonzálezFuell CEO.

This Madrid fintech has just completed a €1.5 million funding round led by Y Combinator and Fin Capital. American business angels Michael Levinthal and Andy Cohen also participated in the round, and have already invested in fintech companies Concur, Divvy and Clara. The capital raised will be used to consolidate Fuell’s Spanish and Portuguese markets and to launch in Italy.

Fuell helps companies better manage and organize their expenses through company cards and employee reimbursements. The company automates expense management, saving employees, accountants, and financial managers time and money. In just two clicks, the Fuell platform synchronizes expenses within companies’ accounting software. Teams can then monitor employee spending in real-time, track and assign card usage checks by employees, and instantly send money to employees. Users can also currently earn 3% cashback on all expenses made with Fuell corporate cards.

Plus, Fuell automatically converts receipts to invoices to help businesses recover VAT from over 500,000 restaurants, parking lots and taxis. Due to the Tax Agency approval, businesses do not need physical copies of receipts, so if an inspection takes place, businesses can submit digital versions of receipts from the Fuell platform.

Related News

- 05:00 am

Safe (previously known as Gnosis Safe), a leading digital asset management platform, today announces it has raised $100 million led by 1kx.

Following a successful community vote to spin off from Gnosis, the Gnosis Safe project is rebranding to Safe and announcing a strategic funding round of $100 million led by 1kx. The round is also joined by Tiger Global, A&T Capital, Blockchain Capital, Digital Currency Group, Greenfield One, Rockaway Blockchain Fund, ParaFi, Lightspeed, Polymorphic Capital, Superscrypt and 50 other strategic partners and industry experts (see below). The funding is raised for the Safe Ecosystem Foundation, a non-profit organization protecting strategic assets and contributing to the further development of Safe.

The funding round is an important milestone for the development of Safe as a programmable ownership platform, enabling secure management of digital assets, data and identity across DAOs, and retail and institutional users. The funding and strategic alliances will enable Safe to grow an ecosystem of applications and tools on top of its smart contract account protocol.

Unlocking ownership for everyone in web3

Safe gained wide adoption for its self-custody solution used to process over 600,000 transactions and secure digital assets exceeding $40 billion. Additionally, many highly valued NFTs, including 13% of all Cryptopunks, are currently secured using Safe.

Safe has built infrastructure that serves some of the biggest DAO treasuries (1inch, BitDAO), financial institutions (Bitfinex, GSR) and enterprises (Shopify, AB group). Also, individuals such as Vitalik Buterin and Punk6529 (participating in the round as an angel) use Safe to secure their most valuable personal digital assets.

Making web3 accounts smart

Traditional web3 accounts are controlled by a single private key, often derived from a 24-word secret phrase. As long as a user owns this private key, they control the account. However, these private keys regularly get lost or compromised, resulting in the complete loss of the assets associated with the account.

Safe, on the other hand, uses smart contracts accounts that can be individually configured to suit the custody needs of different user groups:

Authentications using multiple private keys (multi-sig) or community-control (DAOs)

Recovery and inheritance mechanisms

Improved transaction experience (transaction batching, gas abstraction)

Transaction checks and hybrid-custody

Spending limits and automation

It’s not a product - it’s an ecosystem

Safe aims to foster a vibrant ecosystem of applications and wallets leveraging Safe smart contract accounts. This will be achieved through grants, ecosystem investments, as well as providing developer tools and infrastructure.

Already today, the Safe ecosystem consists of many teams building on top of Safe. These projects provide specialized solutions across savings (Streams, Linen Wallet), treasury management (Coinshift, Parcel), DAO tooling (Utopia Labs, Orca Protocol), NFTs (Prysm, Castle) and wallets (Rabby, Metamask Institutional).

Related News

- 05:00 am

US wealthtech platform Tifin has acquired SharingAlpha, a fund rating platform consisting of a community of more than 15,000 professional fund investors and analysts across the world.

Co-founded six years ago by two Israeli brothers, Oren and Yuval Kaplan, SharingAlpha offers professionals the opportunity to build their own track record for fund selection and asset allocation capabilities.

Investors can tap into the collective knowledge gathered on the platform from members of the SharingAlpha community and gain input on funds’ chances of generating returns in the future.

Following the acquisition, SharingAlpha will be fully integrated into Tifin’s Magnifi platform, which is a search-powered marketplace for investments.

Oren Kaplan will also join Magnifi as a partner and work closely with Tifin’s recently announced head of international Jason O’Shaughnessy on the integration of the platforms.

“Being able to now offer Magnifi’s investment intelligence and capabilities to non-US investors is definitely an important step in our evolution,” says Dr Vinay Nair, founder and CEO of Tifin.

The acquisition comes just months after Tifin closed a $109 million Series D financing round, bringing its valuation to $842 million.