Published

- 09:00 am

D-Wave Systems Inc. (“D-Wave”), a leader in quantum computing systems, software, and services, and the only company building both quantum annealing and gate-based quantum computers, and Mastercard today announced a multi-year strategic alliance to champion the acceleration and adoption of quantum computing solutions.

Mastercard and D-Wave will collaborate on the research and development of quantum-hybrid applications in areas such as consumer loyalty and rewards, cross-border settlement and fraud management. The collaboration will use D-Wave’s annealing quantum computers and quantum hybrid solvers through the Leap™ quantum cloud service to deliver real-time access to quantum applications safely and securely powered by Mastercard’s network.

“We are heralding in the next wave of computing. Just like the creation of the PC, the emergence of the internet and the proliferation of smartphones and voice assistants, it is our belief that quantum will have a far-reaching and industry-disrupting impact, especially in the financial services sector,” said Alan Baratz, CEO of D-Wave. “D-Wave and Mastercard have a shared vision of harnessing the power of technology to positively affect business and society. This alliance supports that vision by delivering quantum innovation that will tackle increasingly complex problem sets across applications like optimized loyalty programs, fraud management and anti-money laundering in financial services and, ultimately, unlock more value for customers.”

“People expect hyper-personalized experiences. Quantum computing’s unique ability to analyze huge numbers of potential combinations can deliver optimal solutions that will improve efficiency and provide choice,” said Ken Moore, Chief Innovation Officer at Mastercard. “Our work with D-Wave will explore the endless applications of quantum computing for practical, real-world financial services applications.”

Related News

- 09:00 am

The International Center for Strategic Alliances (ICSA), organizers of Connected Africa 2022- Africa’s Leading Telecom and Digitization Summit. is all set to go live with the 2nd Edition of the Summit, which is themed around Championing Connectivity in the Digital Era.

The One-day Summit will witness inputs from leaders and experts from the Telecom Industry. The Summit goes live, on the 29th of September 2022 in Cape Town, with a concurrent virtual stream with almost 450+ delegates in attendance.

“Effective management of spectrum is key to maximising the opportunities that mobile connectivity brings forth. Ensuring that required spectrum resources is available, under conducive conditions, will lower broadband costs, increase coverage and boost connectivity” said Mr. Mohammed Thoufiq, Director – Partnerships at ICSA

“The 2020s will witness strong growth in the number of Africans connected to mobile networks. As 4G and 5G grow together, through the decade to come, spectrum preparation can enable cost efficiency and promote growth,” he added

This year’s Summit will deliberate on, and focus on developing solutions to, critical ICT issues. The Summit is a not to be missed opportunity for experts, business people, and practitioners to discuss practical and cost-effective solutions to developing the ICT business. Connected Africa is an ideal platform for networking with industry players; senior managers, decision-makers, and practitioners operating in the industries and making the most of banking technologies.

The Summit will witness insights and inputs from leaders like Patricia Obo-Nai Vodafone Ghana; Shoyinka Shodunke MTN Nigeria; Ayham Moussa MTN Congo; George Njuguna, Safaricom, Kenya; and many more who will touch upon key areas like Energizing the Data Economy, Collaborating at the EDGE – Enhancing Data Throughput, Connectivity to the Metaverse and Beyond, The New Hubs of International Connectivity, Cyber Resilience, EDGE and Data Cloud, Transitioning from 4G to 5G – Enabling Digital Transformation, ICT Infrastructure Providers Supporting IoT Deployments, Connectivity to Power the Future of Work.

The Connected Africa 2022 will bring together the best minds from leading institutions to engage in an open, constructive dialogue with peers, industry subject matter experts and policy czars. It will offer the latest and actionable insights, networking opportunities, and a chance to learn from the best in the business and get ahead of the competition.

Related News

Holly Coventry

Vice President of International Open Banking Payments at American Express

The pandemic has been a catalyst for consumers to spend more online and has unlocked an appetite in many to new payment methods. see more

- 06:00 am

Global analytics software provider FICO and Network International, the leading enabler of digital commerce across the Middle East and Africa (MEA), announced today that they have expanded their partnership to bring lenders the most powerful fraud protection and credit management solutions. These solutions, available in hosted mode from Network International, will help financial services providers expand the digital economy across the region.

The two companies have been working together since 2017 when Network International began offering its customers FICO® Falcon® Fraud Manager, the world’s leading credit fraud solution, which protects more than 2.6 billion payment cards worldwide. Now lenders can use Falcon at Network International to protect all retail banking accounts.

Network International is also installing FICO® Blaze Advisor® Decision Management System in its data centres, so that it can offer hosted credit management services to lenders. Banks and other credit providers can use these services to make real-time approvals on credit applications while controlling risk and managing their portfolio of accounts with highly targeted, risk-aware offers and decisions.

Hany Fekry, Group Managing Director, Processing at Network International, commented, “We are delighted to expand upon our partnership with FICO to further strengthen our credit management value proposition to our MEA clients. Over the last few years, we have witnessed the accelerated transition to digital payments in the region, making credit controls for real-time decisions more crucial than ever. As a leading enabler of digital commerce, we continue to anticipate, adapt, and advance upon evolving trends with the global gold standard for fraud decisioning and prevention. We are confident that FICO’s innovative technology-led solutions combined with our local expertise will enhance our solutions portfolio and help cement our leadership position in the market.”

“The low entry cost for our decision management services means lenders of all sizes have access to our world-leading solutions,” said Mark Farmer, who manages partner relationships for FICO in EMEA. “Our solutions will be a great advantage to not only the region’s lenders but their customers as well. We expect our expanded partnership with Network International to result in lower fraud losses, better protection for consumers and ultimately better credit offers.”

Related News

- 01:00 am

IDnow group, a leading European provider of identity proofing and digital identities, has appointed Mike Kiely as its Sales Director for Financial Services. Based in IDnow’s Manchester office, Kiely brings with him decades of experience in data and biometrics, most recently heading up Identity and Biometric sales at GBG, and will drive the firm’s substantial growth ambitions in the financial sector in the UK.

Kiely’s appointment represents the firm’s ongoing investment into the UK market, with ambitions to become a leader in the UK’s financial services industry and a global leader in the sector.

Commenting on his appointment, Mike Kiely said: “As a German business, IDnow has built a platform that meets some of the world’s strictest compliance and regulation requirements, while offering the broadest portfolio of identity proofing methods. As such, it is in an incredibly unique position, able to support businesses in their identity proofing needs who are looking to scale beyond their UK territory, and into geographies that are inherently difficult to penetrate such as France and Germany.”

“For me, this represents a hugely exciting opportunity to work with a talented team; I am able to help drive growth here in the UK thanks to the market-leading identity proofing platform IDnow offers while supporting the business to reach its global growth ambitions with a particular focus on financial services.”

Kiely’s appointment comes after IDnow reported a significant rise in order intake for the first quarter of 2022 of 95%.

IDnow group offers the broadest identity proofing portfolio on the continent via a single platform, from automated to human-assisted, from purely online to point-of-sale. This mirrors the trend towards the acceleration of advanced digital business models from single-product identity verification to comprehensive identity proofing platforms.

Benjamin Haas, Senior Sales Director at IDnow, added: “Since we acquired ARIADNEXT and IdentityTM last year, we have been immersed in our growth plans and in bolstering our position as one of the strongest identity verification and document signing players in Europe. Mike’s appointment signifies our continued efforts to establish a substantial foothold, particularly in the UK’s flourishing financial services sector. Mike’s experience will help ensure our expansion ambitions become a reality, so we’re really excited to welcome him to the team.”

Related News

Aaron Begner

EMEA General Manager at Forter

As the cost-of-living rises and the UK sees energy bills, food shopping and petrol expenses soar, consumers are changing their spending habits in response. see more

- 08:00 am

Adyen, the global financial technology platform of choice for leading businesses, and Etsy, which operates two-sided online marketplaces that connect millions of passionate and creative buyers and sellers around the world, announced today that Adyen has enabled ten million Etsy buyer donations to the Uplift Fund, administered by the Brooklyn Community Foundation.

Etsy launched the Uplift Fund with the Brooklyn Community Foundation in February of 2021 to give its buyers an opportunity to join them in supporting creators who face barriers to building successful businesses. When US shoppers check out on Etsy, they have the option to round up their purchase price and donate to the Fund via Adyen.

“Adyen’s solution has enabled us to seamlessly engage the Etsy community in supporting our Uplift Fund,” said Morgan Blake, VP of Payments at Etsy. “It’s been amazing to see how a small change in checkout can have such a major impact, especially as the past few years have highlighted the gap in resources available to many communities who are eager to use their entrepreneurial talents.

“Partnerships like this one with Etsy and Adyen encourage and simplify the process for people to give to charitable causes. That’s what we’re seeing here, with the remarkable milestone of reaching 10M buyers,” said Jocelynne Rainey, President and CEO, Brooklyn Community Foundation. “We are thrilled to host Etsy’s donor-advised Uplift Fund to support nonprofits nationwide that work to dismantle barriers to building a successful small business.”

“We’ve seen great traction with Giving and we are thrilled to reach this milestone with Etsy,” said Ingo Uytdehaage, CFO at Adyen. “Etsy has been a key partner in building out our Giving solution, including the round-up feature. By combining strengths with Adyen’s technology and Etsy’s two-sided marketplace, we were able to come together to find a solution that drives impact, in line with the UN’s Sustainable Development Goals. We can’t wait to see what else we accomplish together.”

Giving is a product that enables Adyen’s merchants to accept charitable donations during the online and in-store checkout process, and allows them to strengthen their bond with their shoppers by providing a platform for their preferred charitable causes. By doing so, Giving converts shoppers’ good intentions into additional revenue streams for charitable causes. With a single tap on a point-of-sale terminal or the click of a button at an online checkout, shoppers can donate to the merchants’ charity of choice. Giving transactions seamlessly integrate into existing checkout processes across all payment channels, and shoppers’ donations are reported and settled to the charity of choice directly without impacting the merchants’ existing reconciliation flow.

Related News

- 06:00 am

FXCM Group, LLC (‘FXCM Group’ or ‘FXCM’), a leading international provider of online foreign exchange and CFD trading services has today announced the appointment of Paul Gyles as Chief Marketing Officer.

Gyles, a senior, strategic and transformational leader based in London, brings over 15 years of experience in director-level marketing positions to FXCM. He previously held marketing director roles at online trading provider, IG as well as Sony and, most recently, M&G.

Paul will be responsible for driving the branding and marketing strategy for FXCM, ensuring the leading provider of online FX and CFD trading continues to be client-first, trader driven.

FXCM, recently named Broker of the Year at the Ultimate Fintech Awards, has continually expanded its services throughout 2022, underlining its commitment to a “Client First, Trader Driven” approach. In addition to expanding its CFD offering with the doubling of its French, German and the UK share offerings, the firm also launched Australian single share CFD trading with zero data fees and commissions* to enhance the service provided to clients.

Brendan Callan, CEO of FXCM, said: “Paul has broad marketing and management experience and a proven track record in high-paced financial services and technology environments, so we’re delighted to have him join the FXCM team. It’s an exciting time for FXCM and we’re confident Paul’s wealth of experience and expertise will prove invaluable in ensuring FXCM remains the premier retail broker of choice.”

Paul Gyles, CMO of FXCM, said: “I’m excited to join the FXCM team at a time of growth and expansion. I’m looking forward to driving the firm’s branding and marketing strategy, ensuring its best-in-class offering continues to stand out in a competitive market.”

*FXCM can be compensated in several ways, which include but are not limited to adding a mark-up to the spreads it receives from its liquidity providers, adding a mark-up to rollover, etc. Commission-based pricing is applicable to Active Trader account types.

Related News

- 07:00 am

Dufrain, the market-leading data management services and data analytics consultancy, today announces that it has secured investment from Phoenix Equity Partners (“Phoenix”), a UK growth-focused private equity firm, to fuel the next stage of its growth as part of a management buyout.

Founded in 2010, Dufrain helps its financial services and banking clients discover, manage and optimise their data to gain valuable insights and make better-informed business decisions. The business employs more than 170 data experts, providing a comprehensive set of data management solutions from its offices in Edinburgh, Manchester and London. Dufrain’s strategic approach and reputation for service excellence have seen it become a trusted partner to clients of all sizes across the banking and insurance sectors, among others.

Dufrain has delivered year-on-year revenue growth of 40% over the past two years. Phoenix’s investment will allow the business to continue this growth trajectory by expanding its footprint across multiple geographies and sectors as well as investing in its in-house technology solutions.

Joseph George, CEO of Dufrain, commented:

“Every organisation faces challenges in terms of extracting value from the data they have or could have available. This management buyout will enable the leadership team to continue to build and invest in the business as we pursue our ambitious growth plans. We look forward to drawing on Phoenix’s expertise to help us achieve our plans over the coming months and years.”

Chris Neale, Partner at Phoenix, said:

“The data services market is large, global and growing quickly. Dufrain is perfectly placed to capitalise on this as the leading independent data solutions provider in the UK. Over the years that we have been following Dufrain we have been impressed by its fantastic culture, strong client relationships and first-class quality of work. We are very excited to have the opportunity to partner with Joseph and the team to help achieve our shared vision.”

Related News

- 04:00 am

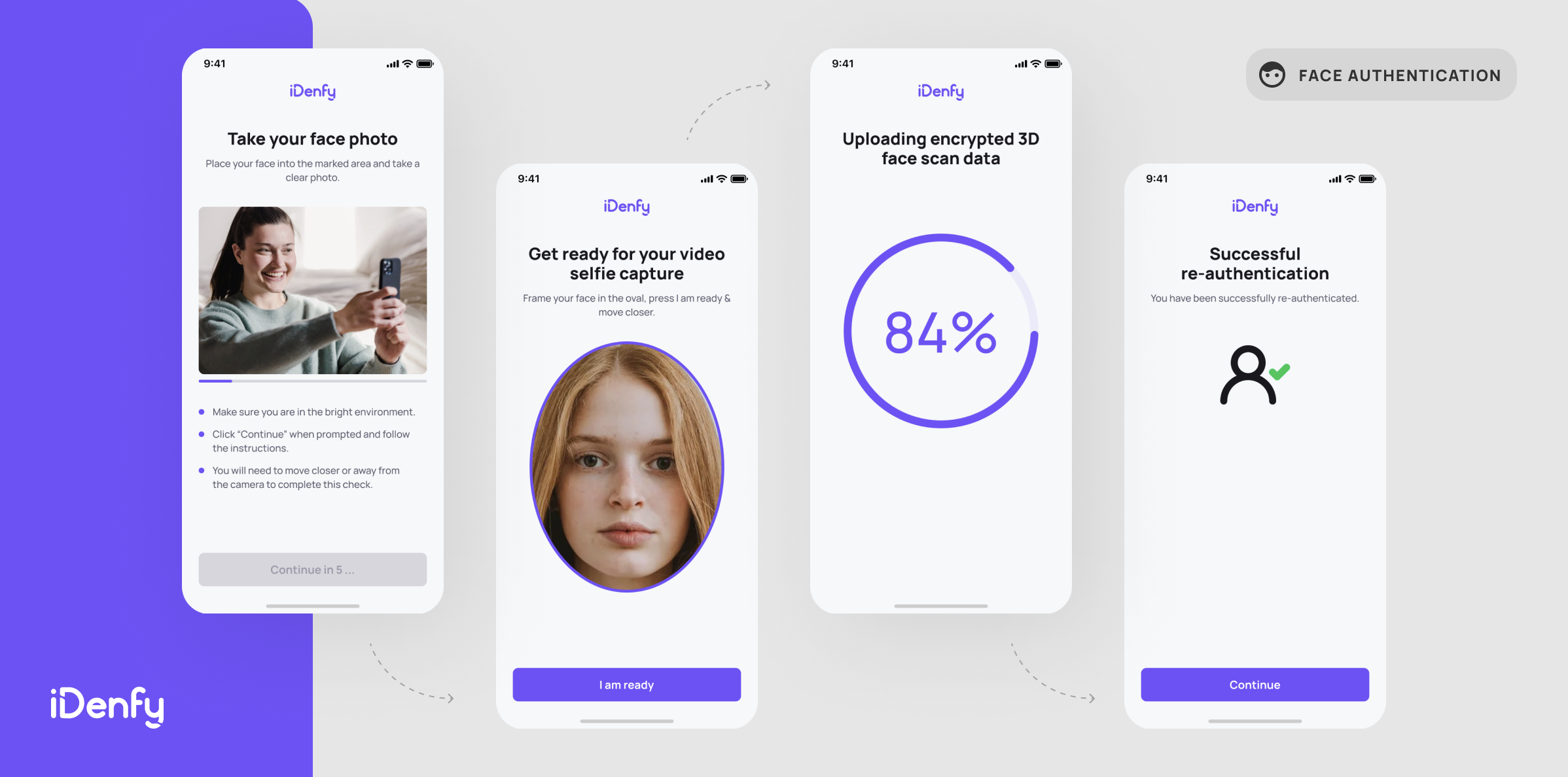

The global digital identity verification and fraud prevention company, iDenfy, introduced a new feature to its automated ID verification toolkit, Face Authentication. The newly launched service will help authenticate existing customers by eliminating account takeover threats.

iDenfy explains that many businesses strive to design a seamless onboarding experience for their customers, making it as fast and easy to use as possible. A great example is the Fintech industry, which is booming and leaving traditional banking behind. Despite that, the identity verification company continues to argue that some enterprises concentrate on the speed factor and are tempted to weaken the security part of their identity verification process.

The Federal Trade Commission (FTC) reports that each year, fraudsters steal at least 9 million identities around the world. Once this data is breached, cybercriminals open many doors: from making purchases and wiring funds to selling the data on the Dark Web. According to iDenfy, mitigating identity fraud in the digital world isn’t an easy task, as there’s a constant threat of account takeover when performing high-value transactions or changing sensitive account data.

As specified by Domantas Ciulde, the CEO of iDenfy, such actions should be secured using additional verification methods but without the hassle of a complex multi-step procedure. To simplify the journey for the customers, iDenfy claims to have created a smart feature using the most reliable biometric authentication data – the face. Based on identity verification market research and the demand for user-friendly Know Your Customer (KYC) solutions, iDenfy designed a new facial recognition implementation.

According to the enterprise, the customer completes the whole process in three simple steps. First, they need to go through the standard identity verification using their face. Then, the customer performs simple head movements. Lastly, after receiving the ID verification results, due to the new Face Authentication feature, the service will instantly tell whether the customer performing face authentication is the one who completed identity verification in the first place.

iDenfy’s goal is to prevent fraud and simplify identity verification, which led the company to create the Face Authentication feature. As said by iDenfy, the new service welcomes back the customers without them having to go through the full, lengthy identity verification process. As an illustration, iDenfy compares its new feature to a standard password or Two-Factor Authentication (2FA).

“Instead of passwords that are difficult to remember, customers can be onboarded easier using our new facial recognition technology. Our module can be integrated into any onboarding flow within a few hours. We also customize our solution to match brand guidelines and make it more familiar for the customers.” — explained Domantas Ciulde, the CEO of iDenfy.