Published

Mark Dankworth

President Business Development Africa at leading pan-African fintech enablement partner at Ukheshe Technologies

For centuries people have crossed borders to live, work, and trade. see more

- 04:00 am

Kneip today announced it has entered into a strategic partnership with ISS FWW (FWW Fundservices GmbH) to make European ESG Templates (EET) available in the German market via ISS FWW.

EETs were launched in June 2022 to facilitate the exchange of ESG data between market participants as required in order to comply with European financial market regulations. Through this partnership, Kneip, a leader in fund data management and reporting solutions for the asset management industry, will provide its Data Collection Service for the EET on behalf of ISS FWW, a leading German fund data distributor based in Munich. The partnership will help to provision transparent, up-to-date and correct ESG data to investors.

Enrique Sacau, CEO, Kneip said: “We are delighted to be partnering with ISS FWW as one of our sister companies at Deutsche Börse Group to leverage our technology and data expertise in order to provide high-quality data to investors in Germany.”

Marc Bonnet, Managing Director at ISS FWW, said: “This strategic partnership will enhance existing cooperation between ISS FWW and Kneip, which has been built on the mutual appreciation of each other’s strengths to benefit clients, and lay the foundation for developing further innovative projects in the near future.”

Related News

- 03:00 am

Financial Risk Solutions (FRS), provider of the award-winning investment administration software Invest|ProTM used by asset owners, life assurance, wealth and investment management companies worldwide, today announced multiple key promotions as part of the company’s expansion plans into new markets.

The promotions are across several departments, including Professional Services, Engineering, Commercial, Marketing and Product.

Paul O’Meara is COO, Tom Curtin has been appointed Head of Professional Services, Cian Twohig assumes the role of CTO, David Kenny is now Head of Commercial, and Monica Kelly is promoted to Head of Product.

Mara Diéras and Darragh Fahy have been promoted to Professional Services Team Managers.

The appointments have been made as FRS continues to expand the Invest|ProTM brand into Australia and North America while maintaining its leading position in Ireland, the UK and the Middle East.

Chief Executive Officer Peter Caslin said:

“FRS is at an exciting point in its global expansion. I congratulate Paul, Tom, Cian, David, Monica, Mara and Darragh on their promotions. These will ensure we continue to provide a top-quality service to our existing customers and new customers on the global stage. We are thrilled to announce these promotions.”

Related News

- 06:00 am

X1, a credit card for digital natives launched by former Twitter employees, has secured $25 million in Series B funding.

X1 Card underwrites consumers based on income rather than credit ratings, allowing it to set credit limits 5x greater than standard card providers. It's appealing to recent college graduates and those with stable incomes but low credit scores.

The card, which has no annual cost, has reached $50 million in monthly transaction volume in six months, Rao said. Rao said the product will emerge in the coming weeks with $25 million in new investment.

Wesley Chan's new venture firm, FPV, led X1's first-ever funding round. Craft Ventures, Spark Capital, Harrison Metal, and SV Angel were joined by Abstract Ventures, the Chainsmokers, and Global Founders Capital.

The X1 Card sets credit limits based on current and prospective income, not credit scores.

The startup's patented technology enables cardholders to cancel subscriptions with one click, stop free trials automatically with auto-expiring virtual credit cards, get quick refund notifications, attach receipts to purchases, and create one-time-use virtual cards.

In beta since October, the card's 500,000-person waitlist and the general public can apply in the following three weeks.

X1 Co-Founder Deepak Rao says:

"We set out to design the world's smartest credit card for a new generation of digital natives like ourselves. We've modernized the whole credit card experience, from limits to rewards to smart tech-driven features".

Related News

- 02:00 am

TIBCO has announced enhancements to TIBCO Cloud™ Integration, its industry-recognised iPaaS offering, powered by TIBCO Cloud™. This expands the potential for integration of applications, data, and devices across hybrid environments, assisting customers grappling in a volatile business world to accelerate business outcomes. TIBCO Cloud Integration delivers remarkably faster automation of business processes and integration of digital assets across the enterprise. By speeding up and simplifying app development, businesses can now respond to market trends even faster, creating a competitive advantage for customers.

“It’s essential for organisations to focus on data to overcome today’s many business challenges. Properly leveraging data can empower businesses to turn those challenges into opportunities,” said Randy Menon, senior vice president and general manager, Connect and TIBCO Cloud, TIBCO. “TIBCO Cloud delivers scalable, adaptable solutions that drive integration between all systems, operations, and processes. Together, we enable our customers to unlock the power of real-time data."

TIBCO Cloud features new innovations that further accelerate app, data, and device connectivity via a SaaS-delivered digital platform. These updates deliver significant value to customers, such as:

Delivering solutions faster with intelligence, embedded from design to deployment, enables developers to accelerate integration development using smart guidance for optimal technology approaches and design patterns. New enhancements also speed up data integration initiatives using AI/ML-based smart mapping technology, making mapping recommendations derived from deep learning of a developer's mapping choices.

Increased agility with unified decision management and governance empowers business users to consolidate enforceable decisions across the organisation with ease. This enables users to delegate decision authority to a shared service within TIBCO Cloud and reduce inconsistent decision-making.

Rapidly capturing business value from events, new features simplify the development of an event-driven architecture. A new API Modeler allows for the easy design of AsyncAPIs for Apache Kafka®. Teams seamlessly share and discover event-driven APIs via an embedded registry in TIBCO Cloud, and events are easily published and subscribed to during solution development via point-and-click functionality, rather than through the development of custom code.

With this announcement, TIBCO forms a new partnership with Automation Hero to add intelligent document processing capabilities into automation applications, enabling customers to unlock valuable data that was previously difficult to access. “As a market leader in automating any document-centric process, we partnered with TIBCO to enable enterprise customers to create and realise enormous business value from unstructured data. This data is often trapped in documents and traditionally requires significant manual labour to extract,” said Stefan Groschupf, founder and chief executive officer, Automation Hero. “We look forward to publishing and making available the combined solution via the TIBCO Cloud Integration marketplace to make state-of-the-art AI document processing available with just a few clicks.”

“TIBCO’s ability to connect and integrate everything from any source has been a major factor in helping our business dramatically reduce the time-to-market for new automation and integration initiatives,” said Fabio Tormen, chief information officer, Venchi. “The flexibility TIBCO Cloud Integration provides is one of the primary reasons we can now quickly and easily connect with new partners and accelerate our growth in new markets.”

Related News

- 02:00 am

5ire Raises USD 100 Million in Series A Funding at Valuation USD 1.5 Billion, Turns Unicorn

5ire, a fifth-generation level 1 blockchain network and the world’s first and only sustainable blockchain, announced that it has raised $100 million in Series A funding from UK-based conglomerate SRAM & MRAM. This investment makes 5ire the fastest growing blockchain unicorn in India and the only sustainable blockchain unicorn in the world, valued at $1.5 billion.

TurnKey Lender raises $10 million in new funding round with OTB Ventures and appoints former Intel Corporate Vice President Christian Morales as Chairman of the Board

TurnKey Lender, a global fintech B2B Software-as-a-Service (SaaS) company specialising in AI-powered lending automation solutions, has closed a US$10 million new funding round. The investment round – a mix of equity financing and debt – was led by OTB Ventures, with the participation of early backers including Germany’s development finance institution DEG and Vertex Ventures.

Plenitude Receives Strategic Investment from Growth Capital Partners

Plenitude, the Financial Crime, Risk and Compliance (FCC) specialists announced a strategic investment from Growth Capital Partners (GCP), the private equity firm focused on investing in outstanding growth companies in the technology and services sectors. The investment will support the further build-out of new capabilities and offerings and will accelerate Plenitude’s expansion plans.

Gnosis Safe Rebrands as Safe, Raises $100M

Safe (previously known as Gnosis Safe), a leading digital asset management platform, announces it has raised $100 million led by 1kx. Initially developed as an internal tool, Gnosis Safe has organically become a critical infrastructure for web3 as a means to securely manage digital assets. Following a successful community vote to spin off from Gnosis, the Gnosis Safe project is rebranding to Safe and announcing a strategic funding round of $100 million led by 1kx.

UK Fintech Lightyear Launches in 19 EU Countries and Raises $25M

Today, the new investment platform Lightyear announces a $25M Series A equity round led by Lightspeed Venture Partners. The company’s seed investors, Mosaic Ventures, Taavet+Sten and Metaplanet also took part in the round alongside a number of new and existing angel investors. Joining Lightspeed in this new investment round is the Virgin Group – an organisation that champions driving positive change through new technologies and joins Series A as an investor.

Fintech Startup WonderLend Hubs Raises USD 1.6 Million in a Seed Round Led by Inflection Point Ventures

WonderLend Hubs, a NoCode PaaS solutions provider has raised USD 1.6 million in a Seed Round led by Inflection Point Ventures. Designed and deployed in an affordable “pay as you use” microservices API architecture, its LPaaS caters to enterprises as well as newly born lenders & originators, driving lending innovation via new product/variant-launches, or accelerating existing products, particularly in under-served segments, whilst its ICM PaaS caters to automating channel incentive management for enterprises.

Penfold Announces Launch of Latest Crowdfunding Round

Penfold, the digital pensions platform, announces the launch of its latest crowdfunding round, following significant growth of the business and the launch of its workplace pension platform in late 2021. Individuals can register now for early access on 25th July 2022 via Penfold’s crowdfunding page, with the round opening to the general public on 26th July 2022. As a modern pensions provider, Penfold is on a mission to disrupt the industry and provide savers with a next-generation platform that delivers a better user experience and gets people saving more for retirement.

Motive Partners Raises $2.5 Billion

Motive Partners ("Motive"), a leading specialized private equity firm focused on financial technology, announced the successful final close of its second flagship fund, Motive Capital Fund 2 (the "Fund"), with total capital commitments of $2.54 billion for the Fund and its affiliated co-investment vehicles. The Fund employs the same investment strategy executed in Motive Partners' inaugural flagship fund.

wefox Closes $400M Series D Round at $4.5B Post-money Valuation

wefox, the Berlin-based insurtech, has successfully closed a Series D funding round of $400m (comprising equity and debt) and increased its post-money valuation to US$4.5bn. Mubadala Investment Company led the equity raise with participation from Eurazeo, LGT, Horizons Ventures, OMERS Ventures and Target Global.The round sees wefox increase its valuation from US$3bn to US$4.5bn in 12 months, bucking the trend currently experienced in the insurtech market and more broadly across the tech sector.

Fuell Closes €1.5M Investment Round

Madrid fintech Fuel reinvents B2B financial services through a corporate credit card that brings together equipment, means of payment and accounting for the first time. A card designed for the needs of a successful business, according to Eduardo Ortiz de Lanzagorta GonzálezFuell CEO. This Madrid fintech has just completed a €1.5 million funding round led by Y Combinator and Fin Capital. American business angels Michael Levinthal and Andy Cohen also participated in the round, and have already invested in fintech companies Concur, Divvy and Clara.

Kadmos Raises €29M in Series A Funding Round Led by Blossom Capital to Streamline Payment Processes for Cross-border Workers

Kadmos, the end-to-end salary payments platform for cross-border employers, has raised €29 million in a Series A funding round led by Blossom Capital. The investment round, which follows an €8.3m Seed round in December, also included existing investors' Addition and Atlantic Labs. The funding follows significant levels of demand for the product. Kadmos is already working with several high-profile shipping companies and has built a robust waitlist ahead of full-scale customer onboarding this summer.

Insurance Startup YuLife Raises $120m

After raising $120 million in a Series C fundraising round led by Dai-ichi Life Insurance Company, the UK-based insurance company YuLife is poised for global expansion. YuLife's life insurance product allows policyholders to do ordinary wellness activities to earn YuCoin, which they can use to purchase gifts for themselves, friends, and family, or to better the world by planting trees and donating to charity.

Related News

- 01:00 am

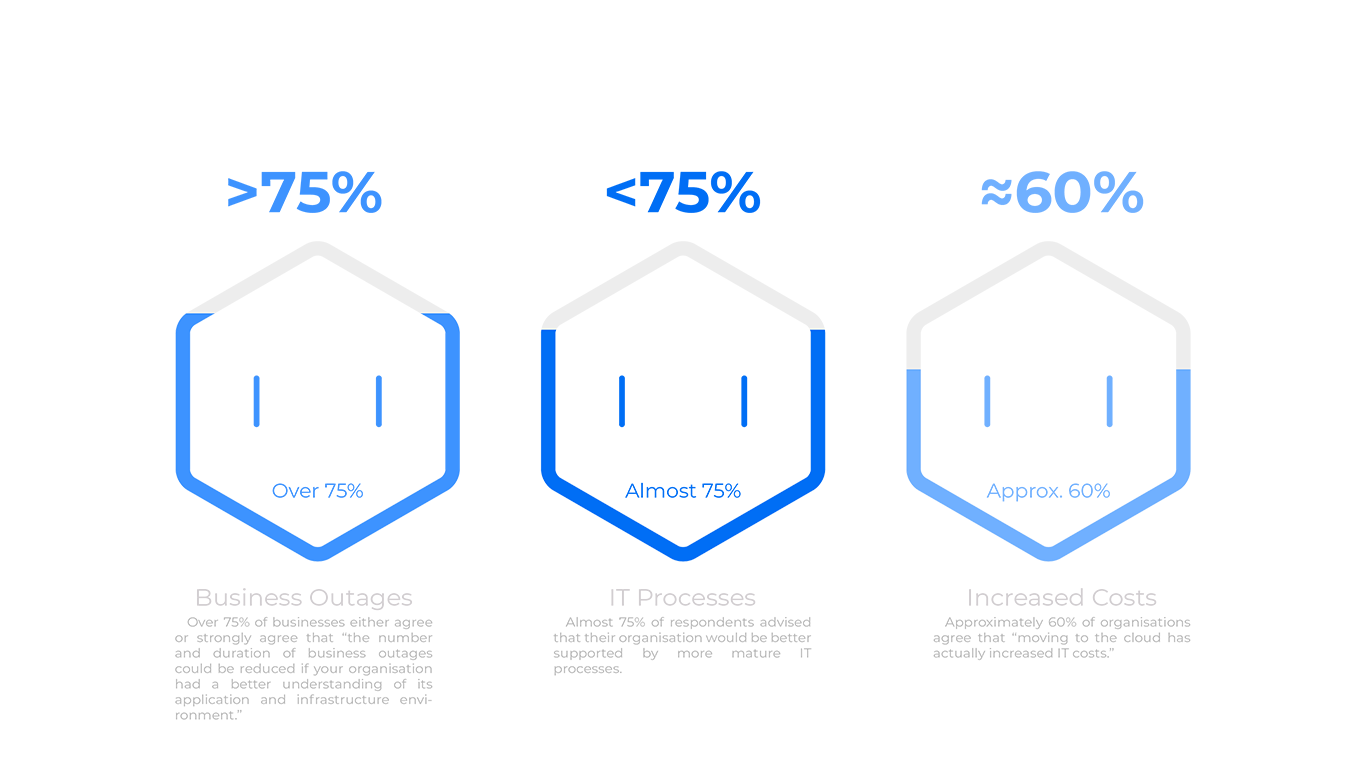

An overwhelming majority of enterprise organisations would be better supported by higher levels of IT process maturity, according to new research by client-side IT advisory CloudStratex.

The survey, which encompassed senior figures across a swathe of enterprises employing 500-10,000+ individuals, identified a number of shortcomings across current approaches towards operational resilience, cloud and legacy integrations, and the (in)efficiency of cloud financial management.

CloudStratex was quick to identify a particularly concerning lack of maturity in the context of cloud FinOps, also known as cloud financial management. Over 70% of respondents were unable to confirm that their organisation doesn’t waste money on cloud subscriptions, with 57.5% stating outright that moving to the cloud has increased their IT costs.

Other notable survey findings include:

75.8% of organisations believe that a more resilient IT environment would increase their business productivity.

Over 75% of respondents were in agreement with the statement: “the number and duration of business outages could be reduced if your organisation had a better understanding of its application and infrastructure environment.”

A majority of respondents reported that their Configuration Management Database (CMDB) is consistently out of date.

Discussing these findings, Adrian Overall, CEO of CloudStratex, said: “I think the key insight to take away from our research is simply that cloud’s purported benefits – often named in terms of efficiency, agility, scalability, and so on – don’t always happen automatically, and certainly not without a price that can be tricky to pay without the right planning and execution.

Organisations are facing unprecedented regulatory pressure to increase their IT resilience, while the glamorous promise of the cloud is now being met with the tricky reality of inefficient or semi-realised implementations with legacy infrastructure and technology.

That’s why we take such pride in our own efforts to help organisations not only correct their current cloud inefficiencies but to leave them capable of standing on their own two feet long after our interventions are implemented.”

Based in London, CloudStratex specialises in outcome-focused consultative practices, helping its clients sustainably achieve operational resilience, integration, and efficiency across their IT environments and businesses more broadly.

The advisory firm is also committed to providing and leveraging the next generation of IT leaders through its Talent Academy, a scheme that has seen CloudStratex playing its part in addressing the UK’s IT skills gap.

Related News

- 06:00 am

Partnerships

Blockpass and BlockOn Capital Partner over India Blockchain Week

Blockpass, the Safe Network for Crypto, announced a partnership with BlockOn, the worldwide blockchain venture builder & firm. As part of this move, Blockpass will provide information, updates and coverage of BlockOn's events, and BlockOn has invited Blockpass to speak at its India Blockchain Week event, which covers a whole host of themes from NFTs to Governments to Start-Ups over its 7 days.

Mastercard Engage Program Expands with Payment and Lending Ecosystem Partners to Streamline Open Banking for Fintechs, Merchants and Lenders

Mastercard announced an expansion of its Engage partner network to include its open banking services, offering customers easy access to several technology partners that can quickly build and deploy open banking solutions for payments and lending decisions at scale. According to Mastercard’s 2022 New Payment Index, 83% of consumers globally use digital tools for at least one financial task, and more than half use technology for five or more tasks.

Worldline and Casio Enter into Strategic Partnership to Simplify Card Acceptance for Merchants in Japan

Worldline, a global leader in payment services, and Casio Computer announced they have agreed on a strategic business alliance to facilitate card payments and cashless shopping in Japan, a market with huge potential to overturn its conservative retail landscape. The strategic business alliance between Worldline and Casio, which went live recently in Japan, aims to revolutionise the currently rather cumbersome payment acceptance ecosystem.

United Trust Bank Asset Finance Chooses Workato to Power Connectivity and Integration to its New Alfa Digital Platform

United Trust Bank (UTB) has chosen the leading enterprise automation platform Workato to provide the software integration layer which will enable the Bank to connect and integrate a wide variety of powerful tools and apps to its new core Asset Finance digital platform. UTB recently announced that it was partnering with software specialist Alfa to transform the Bank’s Asset Finance operations with an integrated digital solution improving broker service and supporting UTB’s ambitious growth plans.

Finastra and HSBC Collaborate to Bring Banking as a Service FX Capability to Mid-tier Banks

Finastra and HSBC announced that they are working together to distribute HSBC’s FX services via Finastra’s FusionFabric.cloud platform under a Banking as a Service (BaaS) experience. This collaboration will take advantage of the best elements of modern API-driven connectivity with licensed institutions’ secure, regulated infrastructure.

Unocoin Collaborates With CleverTap to Offer Its Users Omnichannel Customer Experiences

CleverTap, the modern, integrated retention cloud, announced it has partnered with Unocoin, India's first crypto exchange, to optimize, accelerate their user engagement, and provide a seamless omnichannel customer experience. Through this collaboration, and by integrating CleverTap's solution into its app, Unocoin is now equipped to better understand user behaviour and has the ability to create segments based on user activity, demographics, and other parameters.

Argyle and DigiSure Partner to Supercharge Screening and Risk Assessments for Gig Drivers

Argyle, the leading employment data platform, announced its partnership with Protection-as-a-Service provider DigiSure. Through this partnership, Argyle and DigiSure enable vehicle rental and subscription platforms to screen new customers with one turnkey solution that takes advantage of the availability of historical employment data to lower risk, and onboarding cost and offer a better service for their customers.

NatWest Markets Partners with Google Cloud to Bolster its Data Capabilities and Customer Experiences

Founded in 2016 as the investment arm of Natwest Group, NatWest Markets helps its corporate and institutional customers manage their financial risks and achieve financial goals while navigating changing markets and regulations. Beyond providing products and solutions centred across currencies, rates, and financing, the company's mission is to actively support customers in their transition to achieving broader environmental and societal goals.

Innovative Credit Provider Tymit Introduces Instant Payments with TrueLayer

TrueLayer, Europe’s leading open banking platform, announced that the innovative credit firm Tymit is delivering an enhanced experience through instant bank payments for its Credit and Booster customers. Tymit was founded as a flexible approach to financing purchases and managing a monthly budget, creating a viable alternative to credit cards or loans.

Personetics Partners with Japan's Leading Innovator in Digital Banking, iBank

Personetics, the leading global provider of financial data-driven personalisation and customer engagement solutions for financial institutions, announced a new partnership with iBank Marketing Co., Ltd., a widely recognised as Neobank in Japan. By adding Personetics’ capabilities to its offerings for regional banks, iBank with the support of TIS, a leading systems integrator in Japan, intends to help more of Japan’s regional banks move to the digital space and bring a digitalised banking experience to more Japanese bank customers.

iDenfy Partners with IPRoyal to Provide a Seamless Digital Identity Verification Experience

The certified identity verification, fraud prevention and compliance company, iDenfy, announced a new partnership with IPRoyal, a wide-range proxy service provider. iDenfy will be responsible for verifying customers' identities through its biometric ID verification implementation on IPRoyal’s network. As cyberattack numbers are rising, it’s expected to have high security standards in today’s digital scenery.

Launches

OSTTRA Launches New Solution to Digitise Paper Confirmations

OSTTRA, the global post-trade solutions company, announced the launch of a paper digitisation solution that enables market participants to reduce the amount of time it takes to process paper confirmations for complex over-the-counter (OTC) derivative transactions from hours to minutes. The new solution significantly enhancesthe existing paper trade workflows for Investment Managers on OSTTRA Trade Manager.

Mollie Launches Technology Partner Program

Mollie, one of the fastest growing payment service providers in Europe, announced its new Technology Partner Program today. The program aims to help SaaS platforms and technology companies grow their customer base, reach new markets, and improve customer retention. Supporting partners at each stage, Mollie’s Technology Partner program is designed to provide the best possible experience to platforms by providing them with tools to grow their business.

Minima Launches Innovation Challenge To Explore Global Impact Of Decentralized Blockchain

Minima, the first cooperative, ultra-lean, blockchain network that enables anyone to run a complete node on a mobile or IoT device, launched The Minima Innovation Challenge in partnership with EdenBase, UK’s first fund with a supergrowth hub and an ecosystem, investing in the next generation of game-changing companies, powered by frontier technologies.

SAP Fioneer Announces New Vertical Product Strategy to Cater for Banking and Insurance Customer Needs

SAP Fioneer, a leading global provider of financial services software solutions and platforms, has announcedthe launch of a new vertical product strategy which significantly reshapes its offering to customers. Adopting a vertical approach, three platforms will provide IT solutions tailored to a specific market and customer needs enabling them to navigate an increasingly complex financial landscape.

Tink Launches Settlement Accounts to Simplify Real-time Bank Payments for Merchants

Europe’s leading open banking platform, Tink, has announced a significant upgrade to its payment stack with the launch of settlement accounts, a new feature that aggregates PIS settlement. Starting in the UK with a wider European roll-out to follow in the coming months, this launch enables real-time payment confirmation, instant refunds and payouts, integrated reporting, and more.

Sumsub Launches Identity Verification Solution on Salesforce AppExchange

Sumsub announced it has launched its identity verification solution on Salesforce AppExchange, empowering customers to smoothly onboard and verify their global users. Founded in 2015, Sumsub provides an all-in-one technical and legal toolkit to cover KYC/KYB and AML needs. It offers a powerful platform for converting more customers, speeding up verification, reducing costs and fighting digital fraud.

GTreasury Launches ClearConnect; Technology Enables Financial Data Connectivity for Treasury Teams and CFOs

GTreasury, a treasury and risk management platform provider, announced the launch of ClearConnect. Featuring more than 80 API calls in a dozen key categories, ClearConnect offers the most robust connectivity suite available to treasury teams and the office of the CFO. The solution provides immediate access to the comprehensive data required for confident and actionable treasury insights and ensures the fidelity and security of that data.

New Player StormPay Unveils Payment Offering for Businesses

StormPay, a UK-headquartered fintech company which is building an ecosystem that combines financial and lifestyle services in one place, announced it has signed a distributorship agreement with Safenetpay, an Electronic Money Institution (EMI) which is regulated by the Financial Conduct Authority (FCA). As such, StormPay can now unveil the first phase of ‘StormPay Business’.

Merger & Acquisition

Flywire Announces Acquisition of Cohort Go to Accelerate Growth with International Education Agents

Flywire Corporation (Flywire), a global payments enablement and software company, announced that it has completed the acquisition of Cohort Go, an international education payments provider that brings additional students, agents and essential student services to Flywire. The acquisition will build on Flywire’s existing education business to accelerate the growth of its agent focus and team.

Wealthtech Tifin Acquires SharingAlpha

US wealthtech platform Tifin has acquired SharingAlpha, a fund rating platform consisting of a community of more than 15,000 professional fund investors and analysts across the world. Co-founded six years ago by two Israeli brothers, Oren and Yuval Kaplan, SharingAlpha offers professionals the opportunity to build their own track record for fund selection and asset allocation capabilities.

GoHenry expands into Europe with acquisition of French FinTech Pixpay

GoHenry, the prepaid debit card and financial education app for kids aged 6-18 has acquired French FinTech Pixpay in a deal that will see the financial education pioneer expand into Europe for the first time. Ten years after it launched in the UK creating a new category in financial services, this new deal will enable GoHenry to rapidly expand its two million-plus UK and US member base and accelerate growth across Europe as the company seeks to deliver on its mission to make every kid smart with money.

Job Moves

TS Imagine Strengthens its Marketplace Leadership with Non-exec Board Appointments

TS Imagine, a global leader in trading, portfolio, and risk management solutions for capital markets, announces the appointment of three new board members to support the firm’s rapid growth. As the business builds market share in these sectors, the new board members bring significant expertise in core business areas, including digital assets, securities finance, derivatives, and market structure.

Saltare Strengthens Commercial Team with Hire of Second Commercial Manager

UK-based Saltare, the Early Payment FinTech, has appointed its second commercial manager to grow its customer base with a primary focus on enrolling larger corporations with extensive and diverse supply chains.Chris Wilson, a former small business owner and leadership coach, joins Saltare after owning and running several businesses over the course of his career. Chris will bring valuable first-hand experience in managing business cash flow to the Saltare team.

Red Hat Names Matt Hicks President and Chief Executive Officer

Red Hat, Inc., the world's leading provider of open source solutions, announced that it has named Matt Hicks as its president and chief executive officer. Hicks, who previously served as Red Hat’s executive vice president of Products and Technologies, succeeds Paul Cormier, who will serve as chairman of Red Hat. Known as a hands-on leader within Red Hat, Hicks joined the company in 2006 as a developer on the IT team.

P2P Lender LenDenClub Appoints AU Bank’s Ashish Jain as Chief Business Officer – Investments

LenDenClub, RBI registered NBFC-P2P, India's largest peer-to-peer lending platform, announced the appointment of Ashish Jain as its new Chief Business Officer - Investments. Ashish brings over two decades of market-honed experience across diverse businesses such as FMCG, Mutual Funds, and Banking in the product, business development and sales domain, driving to achieve organizational goals.

Simpl Appoints Somansh Kumar as Director - Platform Integrations

Simpl, India’s leading checkout network, announced the appointment of Somansh Kumar as Director of Platform Integrations. Through this key appointment, Simpl aims to drive merchant quality and their onboarding experience. As the Director of Platform Integrations, Mr. Kumar’s responsibilities include leading the integrations’ charter for Simpl’s 20k and growing merchant partners. He will especially drive merchant quality and their onboarding experience with a laser-sharp focus on integration lifecycle management and post-integration support.

Stanhope Financial Group Appoints Andrew H Brown as Chief Risk & Compliance Officer

Stanhope Financial Group, an EU (Dublin) based global fintech company that provides businesses with a full suite of banking services, has hired Andrew H Brown as the company’s new Chief Risk and Compliance Officer, following a $10m series A funding round. Brown has decades-long experience in cross-border financial services, most recently supporting platform entities to restructure group activity to balance effective risk and compliance management with supporting business growth objectives and accessing the new opportunities afforded by financial technology.

Related News

- 01:00 am

Crypto firm Coinbase has been granted approval by Italy's financial regulator to operate as a crypto assets service provider.

The Organismo Agenti e Mediatori introduced new requirements for all companies offering crypto trading, custody or other services, in light of the rapid growth of the market.

Coinbase vice president for international and business development, Nana Murugesan, said the company was "proud to be among the first companies to meet these benchmarks".

The regulatory approval will enable Coinbase to continue offering crypto services in Italy and to bring new products to market in the country.

Coinbase currently operates in close to 40 European countries via its offices in Ireland, the UK and Germany and is planning to obtain licences in more jurisdictions.

“Building a constructive relationship with regulators in every jurisdiction in which we operate is incredibly important as we march toward our mission of increasing economic freedom in every corner of the world," said Murugesan.

However, despite the expansion plans, the company has experienced some difficulties in the past year, much like other crypto service providers.

Coinbase shares have plummeted by 81% this year while a fifth of the staff has been laid off. It has also seen its trading volumes fall leading it to fall out of the top ten crypto exchanges by volume.

Related News

- 07:00 am

Stori, a rapidly growing fintech company offering credit card products to Mexico’s underserved population, today announced its latest round of financing of $150 million, which values the company at $1.2 billion. As a result of this latest round of financing, Stori now joins a select group of Mexico-based companies to achieve “unicorn” status.

Stori’s latest Series C-2 financing comes just nine months after raising one of Latin America’s largest Series C rounds and includes a $50 million equity investment from BAI Capital, GIC, and GGV Capital, along with participation from other existing and new investors including Lightspeed Venture Partners, General Catalyst, Vision Plus Capital, Goodwater Capital, Tresalia Capital and Davidson Kempner Capital Management LP. Additionally, Davidson Kempner arranged a $100 million debt facility for the Company.

“Stori’s ability to raise this round during a time of economic uncertainty demonstrates the confidence of investors in Stori and its mission,” commented Annabelle Long, Founding Partner, BAI Capital. “Stori stands out from its competitors with its strong team, disciplined execution, an unparalleled capacity to serve the underbanked populations.”

Founded in 2018, Stori offers credit card products to underserved populations. With more than 1.4 million customers in Mexico, Stori offers every customer the chance to obtain a credit card and build their credit history with no complicated paperwork, no credit history, and no annual fee. The entire user experience – from applying for the card to paying bills – is carried out through the Stori mobile app.

“The Stori team is a rare combination of industry background, hustle and change-the-world attitude. The market demand for inclusive financial products tuned for local markets is clear, and the results are not surprising. We continue to be excited about partnering with the Stori team as they grow across Latin America” commented Hans Tung, Managing Partner, GGV Capital.

Proceeds from this latest round of financing will be used to invest in the growth of the team and extend product offerings beyond the credit card. The company also plans on expanding its geographic reach across Latin America targeting 100 million underserved consumers.

“This new round of investment is a significant milestone and takes us one step closer towards our vision of changing the lives of millions who are currently underserved by traditional financial institutions,” said Bin Chen, Stori CEO and Co-Founder. “By addressing key pain points of our customers with a simple and mobile-first experience, we hope to play a major role in democratizing credit access, making our customers’ lives easier, and supporting economic growth across Latin America.”

Stori joins the ranks of the very few Mexican startups who reached unicorn status, bringing it one step closer to its ambitious goal of serving 100 million underserved customers in Latin America. Marlene Garayzar, Chief Governance Officer and Co-Founder, becomes the first Mexican woman to have founded a unicorn technology startup in the country.

“We are proud to bring financial inclusion to more than 1.4 million customers in Mexico. This important milestone could not have been possible without our incredible teams in Mexico, the US, and Asia, and to all our customers who embraced our brand and product,” said Garayzar. “We firmly believe that everyone deserves the opportunities credit and other financial tools can unlock.”