Published

- 03:00 am

wefox, the world’s leading insurtech, has published today the ‘Global Safety Report’. The results show widespread dissatisfaction and lack of trust in the global insurance industry in an era when the customer experience is at a click of a button.

It also shows that despite this sentiment and in the face of insurance rates and the rising cost of living, only 13 per cent of respondents would cut back on insurance, even if they were struggling to make ends meet, demonstrating the resilience of the age-old industry.

Julian Teicke, CEO and founder at wefox, said: “Our first Global Safety Report has shown exactly what we at wefox have known for a long time - the customer experience sucks - because the sector is not keeping up with the needs of today’s consumer.”

“The founding principle of our industry - to keep people safe - is as important today as it has always been. However, we believe that insurance can do more. It needs to go beyond protection and support. We have the power to help keep people safe and prevent risk. That’s the responsibility of our industry.”.

“People are now demanding a better customer experience that is simple, convenient and fast. We are already witnessing how technology is delivering a superior level of customer experience from ordering groceries, booking travel or simply paying for their coffee all at a click of a button. Insurance can do the same,” added Mr. Teicke.

wefox surveyed more than 12,850 consumers in Germany, Italy, Poland, Switzerland, the UK and the US. The results were illuminating. Forty-eight per cent of respondents said the cost of their policies had increased in the last 12 months. Sixty-nine per cent were worried about being able to afford their policies in the future and 55 per cent didn’t think they were getting a good deal from their insurance provider.

Along with a clear appetite for technological change, the wefox Global Safety Report also shows an interest in personalised insurance with 57 per cent of policyholders wanting insurers to use personal data to tailor premiums to their needs. Forty-seven per cent feel their premiums penalise them for factors outside of their control, such as postcode or profession.

Mr. Teicke said: “Insurance is an ancient industry that continues to be crisis resistant. Now is the time for the industry to step up and take care of our customers. The words used by the thousands of consumers we spoke to in compiling this report were that insurance is ‘unfair’, ‘complicated’ and ‘a waste of money’. That’s a long way from ‘protect’, ‘support’ and ‘keep me safe.”

“Technology is transforming industries. Yet the greater part of the insurance industry has ignored the advantages and opportunities that technology can bring. At wefox, we can see that by harnessing the power of technology to drive innovation we can revolutionise the way people not only think about insurance but how they experience it.

“Fifty-five per cent of consumers who took part in our survey want the industry to offer digital and mobile services, just as banks do. Our customers can use these options. We cannot allow the customer insurance experience to continue to suck. The insurance industry has to step up. The time is now,” added Mr. Teicke.

The wefox Global Safety Report comes off the back of a recent series D funding round of $400m giving the company a post-money valuation of $4.5bn, a 50 per cent increase from the 2021 valuation of $3bn.

Related News

- 09:00 am

Liberis, a leading global embedded business finance platform, today announced that they have secured £140m in financing from Barclays Bank PLC and BCI Finance to help secure its global partner expansion and growth plans for the next two years.

This brings Liberis’ total funds raised to £350m, including over £80m in equity funding. In December 2021 Barclays led a £34m funding round for Liberis, which remains one of the largest investments by a UK bank into a leading fintech player.

The new funds will be used to further scale Liberis’ platform, offering fair and increasingly flexible finance solutions to more small businesses through its global partners.

Liberis’ platform applies machine learning to understand a customer’s risk profile and maximum funding options available to them, enabling higher volumes of origination. This has allowed them to fund almost $1bn to over 21,000 SMEs across the UK, Europe and the US, in over 50,000 transactions.

Rob Straathof, CEO of Liberis, commented: “This is a great opportunity for Liberis to continue helping SME growth across the globe, especially in such uncertain times that have been brought upon us by the COVID-19 pandemic. This funding will be crucial to supporting our partners in funding their SME customers to close the ever-expanding global funding gap.”

Sean White, MD of Securitised Products Solutions at Barclays, commented: “Barclays is excited to support Liberis with a new senior warehouse facility, which will allow the business to accelerate growth and continue to support smaller SME businesses with their funding needs.”

Sam Kemp, Managing Director at BCI Finance, commented: “We have been partnered with Liberis since 2015 and are delighted to again be evolving our support for the business as it scales. Alternative finance providers such as Liberis, focused on reducing the barriers to accessing working capital, play a vital role in providing SMEs with the funding that they need to operate and grow. This is particularly important during periods of economic uncertainty, and we’re excited to be continuing to work with the Liberis team as they further extend their global reach.”

Liberis’ global partner network consists of e-Commerce platforms such as Klarna and acquirers such as Barclaycard, Worldpay from FIS, Clover, and Global Payments. These partners integrate with Liberis to offer up to 1 million SMEs personalised revenue-based financing for up to £1m. Payments are linked to a company’s transactions, enabling them to pay for the funds more comfortably, in line with income.

Alongside support from Barclays and BCI Finance, Liberis is backed by investors including UK-based venture builder Blenheim Chalcot and US-based growth investor FTV Capital.

Related News

- 09:00 am

RazorpayX, the neo-banking arm of Razorpay today announced its partnership with Zaggle, a B2B SaaS FinTech company to provide businesses with an easy-to-use plug-and-play solution to enable Flexible Benefits Program further enhancing the employee experience. This partnership will enable businesses to manage all employee tax benefits and perks on a single dashboard, automating the entire process in a hassle-free manner. RazorpayX Payroll is already equipped with the means to manage Flexible Benefits under its compensation structure, and with this partnership, it will be providing additional perks to users under one umbrella.

RazorpayX Payroll is the first and only platform to completely automate salary disbursals and compliance payments and with this partnership, it is now the First to introduce a holistic Flexi Benefits experience combined within the same payroll software. The employee tax benefits are in tandem with Zaggle’s Zinger Multi Wallet Card which covers all benefits such as petrol, food, communication, and more within one card. One of the biggest benefits of this integration is the automation of the proof verification and due diligence process via this card. This one-of-its-kind integration will enable employees to save up to INR 40,000 more in tax while adhering to Income Tax guidelines. Additionally, the card is configurable with as many as 99 different wallets, providing flexibility in customizing solutions to businesses.

Shashank Mehta, Vice President & Head of RazorpayX, said, “RazorpayX has always kept Founders at the heart of products and therefore strives for the simplification of financial processes to save them time and money. While RazorpayX Payroll offers an out-of-the-box fully automated 3-click salary disbursement solution with built-in compliances, we now take it a notch higher by elevating the employee experience via our partnership with Zaggle. Currently, none of the payroll software in India has integration and offering that is entirely automated and hassle-free. Under this partnership, we ensure 7x faster processing of benefits as well as a 96% reduction in the paperwork required. With it, businesses and employees can make the most of their tax component with 100% visibility and control over expenditure and savings and boost employee productivity by over 50% ridding them of a manual process that would otherwise take hours of time.”

Raj N, Founder & Chairman, Zaggle said, “With the rapid rise in digitization, Zaggle has witnessed exceptional growth in the past few years. The company’s growth is a result of our deep understanding of the market, and innovative products, and this partnership with RazorpayX is a testament to that. We have been emphasizing user experience, personalization, and intuitive design to upgrade our offerings. We are confident that RazorpayX customers will now get access to best-in-class solutions that will not only digitize the organizations’ spends, but also enable employees to save taxes.”

Mr. Avinash Godkhindi, MD & CEO, Zaggle, said, “We are excited to announce our partnership with RazorpayX. Through this partnership, organizations can now help employees save tax with Zaggle’s flexible employee benefit plans. They can now simply digitize their employee tax benefits program with a single card that can replace food coupons, food cards, fuel cards, travel vouchers, and gift cards. We have been expanding our range of products and constantly bringing about innovative solutions. Through this partnership, the two teams will work together closely with an aim to enhance the overall efficiency of organizations.”

RazorpayX currently serves over 30,000 businesses and in the last year has processed UPI transactions to over 20% of all UPI registered users in India. The neo-banking platform has seen over 200% growth in its Payouts business. RazorpayX Payouts helps businesses to move money at scale across customers, vendors, suppliers, and partners via API-enabled banking. The platform has disbursed payouts with an annualized money movement of over $30+ billion. In addition to Payouts, RazorpayX has witnessed similar growth across its other products such as Vendor Payments, Tax Payments, Payroll, Payout Links, and Corporate Credit Cards.

Related News

- 09:00 am

Collctiv, a group payment app that allows friends, families, businesses, charities, and community groups to collect money together, is celebrating a major company milestone after reaching $20 million in processed transactions.

Since its launch in September 2019, the community-focused fintech from Manchester has grown organically and continues to go from strength to strength on the back of its $1.6 million pre-seed funding investment.

Collctiv was created to help organisers manage groups more easily and to collect money for the planning of events, as well as social activities. The app also provides a lifeline to businesses and groups who need to collect money remotely for special occasions and celebrations.

Three years on from its launch, and with an average monthly growth rate of 16%, Collctiv now boasts an impressive community of 400k users, including 13.5k companies. In particular, the business has had a noticeable impact on sectors including education, travel, retail and hospitality.

Now, as society embraces a return to normality, Collctiv is poised to continue its rapid growth. As of 2022, fintech is active in 88 countries and accepts payments in 63 different currencies.

Collctiv is the brainchild of Amy Whitell and Pete Casson, who serve as the company's co-founders. Together, they have used their combined technical prowess to build an app, which helps to bring people together all in the pursuit of a common activity, interest, or celebration.

Co-Founder and CEO, Amy Whitell, said: “Collecting money can be painful and time-consuming, and often leaves the organiser out of pocket. That’s why we’ve created Collctiv. Our solution helps to solve a real problem and it is making it easier for groups to collect and spend money, using the power of online to power the offline.

"As we emerge from the Covid-19 crisis, we’re noticing that people around the world are increasingly focussed on uplifting the communities that mean something to them. In fact, we experienced a surge in demand during the height of the pandemic as people looked for ways to collect money together for common causes.

“That uplift put us in a great position as a company, and we are already ahead of target and really excited for the year ahead. With the world of organised events returning to normal, we hope to further this growth imminently. As always, our goal is to continue solving problems for organisers across the globe.”

Related News

- 05:00 am

Chase, the largest co-brand card issuer in the U.S., and DoorDash, the local commerce platform, today announced plans to launch the first-ever DoorDash credit card, with Mastercard as the exclusive payments network for the new card. The DoorDash Rewards Mastercard will allow cardmembers to unlock benefits and earn rewards on purchases both on and off the DoorDash platform.

“Connecting people with the best of their neighbourhoods is core to our mission, and we’re excited to unlock even more of that value for customers with this first-of-its-kind credit card,” said Usman Cheema, Senior Director of Global Partnerships at DoorDash. “We are thrilled to deepen our relationship with Chase and continue building more everyday shoppable moments for consumers on and off the platform while empowering the local communities we serve.”

“Chase and DoorDash have worked together since 2020 and we’re excited to provide exclusive benefits through their first-ever credit card,” said Ed Olebe, President of Chase Co-Brand Cards. “The new card is designed for those who love the convenience and options DoorDash provides and want to earn more where they are spending, whether ordering from the broad range of categories available on DoorDash or spending in-person at a favourite neighbourhood store.”

“Mastercard recognizes that today, people are seeking out financial products, technology and benefits that add more value to their everyday lives,” said Sherri Haymond, executive vice president, Digital Partnerships at Mastercard. “Chase and DoorDash share in this vision, and we’re delighted to extend our relationship to deliver a credit offering that meaningfully connects people to the businesses around them, while also providing a one-of-a-kind payments experience.”

The DoorDash Rewards Mastercard is a World Elite Mastercard® and will offer customers rewards and perks to provide even more value, selection and convenience, including complimentary 24/7 concierge service and access to Mastercard Priceless® Experiences.

The new co-branded card expands the current relationship between all three parties. Since January 2020, Chase and DoorDash have worked together to offer a range of complimentary DashPass membership perks to Sapphire®, Freedom®, and Slate® cardmembers in addition to most Chase co-brand cardmembers. DashPass is the industry-leading membership program that more consumers are using to unlock the best of their neighbourhood delivered for less on DoorDash. Mastercard and DoorDash first introduced card benefits together in April of 2021.

Related News

- 04:00 am

VizyPay, a leading payment processing company for America’s small businesses, was named one of Iowa’s Top Workplaces by Des Moines Register for the second consecutive year. The company also received the Values speciality award for its strong commitment to its three pillars of culture, transparency and advocating for small business. The list is based solely on employee feedback gathered through a third-party survey administered by employee engagement technology partner Energage LLC. The anonymous survey uniquely measures 15 culture drivers that are critical to the success of any organization: including alignment, execution and connection.

“Receiving this honour for a second year in a row shows we’re doing something right,” CEO of VizyPay Austin Mac Nab said. “We focus on developing our team to be the best people they can be in and out of the office. Our professional development, opportunities for growth on top of our inspiring culture truly sets us apart from other startups in Iowa.”

“Earning a Top Workplaces award is a badge of honour for companies, especially because it comes authentically from their employees,” said Eric Rubino, Energage CEO. “That's something to be proud of. In today's market, leaders must ensure they’re allowing employees to have a voice and be heard. That's paramount. Top Workplaces do this, and it pays dividends.”

Related News

- 05:00 am

Esusu Financial Inc. today announced a new collaboration with Fannie Mae to help renters build credit by incorporating on-time rent payments into renter's credit scores as part of its strategy to advance equity in the housing market. Through this relationship, Fannie Mae will incentivize its borrowers to report on-time rental payments to the three major credit-reporting bureaus through Esusu's rent reporting platform. The platform will automatically unenroll renters when missed payments occur, preventing harm to those who struggle financially.

Beginning today, Fannie Mae will cover the first full year of service fees for Esusu’s platform plus discounted fees thereafter for any borrower who enrols. Together the program will help to participate Multifamily property owners increase on-time rent collections, reduce evictions, and, most importantly, scale their Environmental Social Governance (ESG) efforts in a manner that is easily tracked and accretive.

“Fannie Mae is committed to implementing scalable solutions to help renters build their credit history and improve credit scores by providing access to its Multifamily Positive Rent Payment Reporting pilot program,” said Michele Evans, Executive Vice President, Head of Multifamily, Fannie Mae. “Working with Esusu, we hope to bolster equitable access to credit for individuals and families while adding value for owners and operators.”

Historically, rent doesn't support credit building in the same way a mortgage does, with fewer than 10% of renters seeing their on-time rental payment history reflected in their credit scores. This legacy model puts the approximately 44 million renting households in the United States at a significant disadvantage when building their credit profile, a major factor when seeking additional financing options.

“The reporting of a renter’s positive rent payments to credit bureaus has been shown to have a positive impact on credit scores, and for renters, with no established credit score, it could help them establish a credit history,” said Jonathan Gross, Vice President – Multifamily Strategy & Impact, Fannie Mae.

Positive Rent Payment Reporting is available to Fannie Mae Multifamily property owners looking for ways to help their renters. Fannie Mae and Esusu share in their long-standing commitment to building a more equitable multifamily housing ecosystem and finding solutions to advance renter financial access and sustainable housing opportunities.

“Over the past year, we have seen what Esusu’s rent reporting platform can do for Related Affordable residents to help improve their financial health,” said Jeffrey I. Brodsky, vice chairman of Related Companies. “We are thrilled to have extended our partnership with this forward-thinking company to better serve all 50,000+ Related Affordable residents.”

“Esusu and Fannie Mae share the common goal of bolstering diverse, successful, and equitable communities,” said Samir Goel and Wemimo Abbey, Co-Founders and Co-CEOs of Esusu. “Today, there are still systemic barriers to access for millions of people looking to create a pathway to financial stability. Working with Fannie Mae enables Esusu to create opportunity pathways for those who have historically been deemed credit invisible while also laying the foundation to access other financial instruments that contribute to generational wealth-building opportunities that come from good credit.”

Fannie Mae borrowers can learn more about enrolling with Esusu and how to gain closing cost benefits and discounts at Esusu Rent.

Related News

- 08:00 am

Cloudflare, Inc. (NYSE: NET), the security, performance, and reliability company helping to build a better Internet, today announced a new funding program for startups in partnership with leading venture capital investors. The Workers Launchpad Funding Program will provide up to $1.25 billion of financing to startups building applications on Cloudflare Workers, a highly scalable serverless computing platform that allows developers to build or augment apps without configuring or maintaining infrastructure.

Cloudflare is partnering with 26 leading venture capital firms including Altimeter Capital, Altos Ventures, Amplify Partners, Bain Capital Ventures, Bessemer Venture Partners, boldstart ventures, Cowboy Ventures, Decibel, Emergence Capital, FirstMark, Greylock Partners, IVP, Lightspeed, Meritech, New Enterprise Associates (NEA), Norwest Venture Partners, Pear, Root Ventures, Scale Venture Partners, Signal Peak, Silverton Partners, StepStone Group, Threshold Ventures, U.S. Venture Partners, Venrock, and Vertex Ventures US to support developers using Cloudflare Workers to build their applications. Any private company globally that is building on Cloudflare Workers is eligible to apply for the program. If selected by the participating venture capital firms, companies may receive a cash investment from these participating firms, as well as mentorship and support from Cloudflare.

“If there’s one thing venture capitalists look for in the companies they fund, it’s the potential to achieve significant scale. Startups that build on Cloudflare Workers are building on a platform made to automatically support serious scale,” said Matthew Prince, co-founder, and CEO of Cloudflare. “While we can provide the technology, we’re thrilled to partner with some of the leading venture capital firms on the Workers Launchpad Funding Program, who will potentially invest more than a billion dollars in funding towards great startups built on Cloudflare Workers as they scale.”

Today, hundreds of thousands of developers around the world rely on Cloudflare Workers to build and deploy applications without configuring or maintaining costly infrastructure. With Cloudflare’s network spanning more than 275 cities in over 100 countries around the world, developers can deploy code close to their users, bringing the speed, performance, and scale of Cloudflare to their customers. Since 2017, more than 500,000 developers have built on Cloudflare’s developer platform and launched more than three million applications.

Startups applying for the program will be eligible for potential investment from investors, the Cloudflare Startup Enterprise Plan, which includes Cloudflare Workers, Cloudflare for Teams, Cloudflare Stream, and additional core security and performance offerings, as well as exclusive events.

Companies see success building with Workers

In 2021 Cloudflare acquired Zaraz, representing its first acquisition of a company built on its own technology, Cloudflare Workers. “When we began building Zaraz, we chose to rely on Cloudflare Workers because we understood how critical a decision it was to find the right platform that could help us launch faster and also scale with our business,” said Yair Dovrat, product manager for Zaraz at Cloudflare and former CEO and co-founder of Zaraz. “We were blown away by the developer experience, performance, and security that Workers offered and ultimately joined the Cloudflare team to help push the standard for a better Internet more holistically.”

"Our use of Workers has greatly expanded, and it's now become a critical part of our software. Workers perform a lot of key functions for our app, and we're looking into more potential uses right now,” said Sergey Tselovalnikov, API Platform Lead at Canva.

Related News

- 03:00 am

Tabby, the Middle East’s leading payments and shopping app, and Paymob, the leading omni-channel payments facilitator in MENAP, announce their partnership to fuel growth for retailers in Egypt by enabling businesses across Paymob’s network to benefit from Tabby's split in four, interest and fee-free payment solution via Paymob’s gateway.

Together, Tabby and Paymob create a seamless Buy Now Pay Later solution for both in-store and online retailers.

The partnership between two leading regional financial technology companies creates an innovative ecosystem that delivers value to merchants and exceptional customer experiences while bolstering the burgeoning e-commerce landscape in Egypt. Accelerated by the rise in digital adoption during the COVID-19 pandemic, as well as favourable government policies, e-commerce in MENA is predicted to reach US $48 billion by the end of 2023.

Ahmed Khalil, Tabby Egypt’s General Manager, said:

“Today there is a strong demand for greater financial freedom and flexibility to enable consumers to make their purchases. Retailers need the technology infrastructure that allows them to plug and play solutions that offer financial freedom instantly at checkout, without interest or fees. Partnering with Paymob allows our technology to be instantly accessible to their network of over 120,000 retailers in Egypt.”

Paymob’s Executive Vice President for Global Business Development, Omar El-Gammal, said:

“The variety of innovative, customer-centric digital payment methods in the MENA region is skyrocketing. Paymob is leading the way in empowering merchants in the digital economy by giving them access to the most innovative payment methods available.

“Our partnership with Tabby is key because it encompasses both physical, in-store and online, e-commerce payments solutions, to provide a better checkout experience, increased conversions and an expanded client base for merchants in Egypt.”

Tabby has helped thousands of merchants across Egypt, the UAE and KSA increase their average order value (AOV) by 33% on average, their overall conversion rate by more than 18% and a +40% increase in the number of returning customers. With more than 2+ million active users and 6,000+ merchants in its network, Tabby is the largest payments and shopping app in MENA.

Since its founding in Egypt in 2015, Paymob’s gateway has offered the largest and most comprehensive number of payment acceptance methods in North Africa. Today, Paymob’s omnichannel payments infrastructure enables over thirty online and in-store payment methods via its gateway, point of sale (POS), and Paymob app products. Paymob aims to make the process of growing a business in the digital economy simple, seamless and agile while delivering a great customer experience to its merchants and cutting-edge products to its partners.

Related News

- 01:00 am

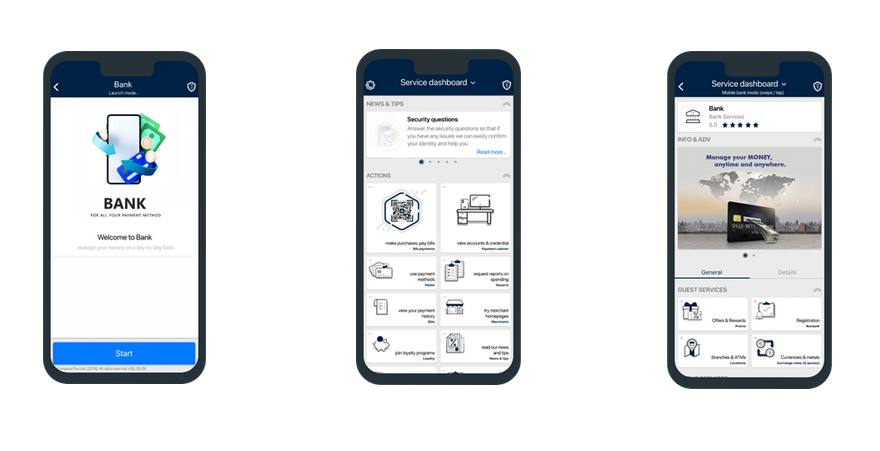

A new mobile-first banking solution, launched by Compass Plus Technologies, will save FIs both time and money when developing a mobile banking app.

The traditional approach to designing and launching mobile banking solutions often involves lengthy developments and costly customisations.

The innovative architecture of Pocket Bank overcomes these challenges. The solution incorporates the use of clever applets within its framework; these applets are scripts that enable access to any banking services, alongside any additional products the FI wishes to offer its customers. As such, Pocket Bank enables access to new services astonishingly quickly; all new scripts are plug-and-play and there is no need to redesign the framework of the app, meaning there is no need for the FI to continuously republish their digital banking app in the app store.

The scripts can be written by FIs themselves and tested in a sandbox environment with complete vendor independence. This removes the headaches and complexities FIs face when trying to develop a digital banking app from scratch and maintaining it.

Pocket Bank essentially strikes the perfect balance between reducing time-to-market for launching a mobile banking app, without sacrificing the ability to customise. As part of a larger digital offering, Pocket Bank enables FIs who are both issuers and acquirers, the ability to bring together mobile banking and all models of mobile payments in a financial super app, inclusive of value-add services such as loyalty and rewards (banking or retail), a merchant marketplace, advertising space and more.

“There are several ways of bringing mobile banking apps to market, all of which usually involve complex, costly and time-consuming developments that often take away from the primary business of the FI and turn them into an IT company that is forced into a constant cycle of developing, testing, debugging and maintaining their apps,” commented Alexey Osipov, EVP, MEA & CRD Managing Director at Compass Plus Technologies, who has been instrumental in bringing the new solution successfully to market. “With Pocket Bank, we’ve drawn upon our 30 years of experience in developing innovative technologies to directly respond to the headaches that FIs face. Our new solution allows FIs to focus on their revenue-generating business and innovative financial products – without being sidetracked.”