Published

Vikas Srivastava

Chief Revenue Officer (CRO) at Integral

In today’s technology-dominated world of finance, people expect their experience to be easy and convenient. Paying a bill with a smartphone is a familiar example. see more

Adam Holden

CEO at Northrow

Shell corporations are infamous for all the wrong reasons—both from a moral and regulatory compliance perspective. see more

- 03:00 am

Aryza, expert developers of software solutions for the sectors of insolvency, credit and debt recovery, has today announced a partnership with Validis, a market-leading open accounting platform, to develop an open finance solution that will help business lenders obtain better quality financial data from their customers.

The partnership was driven by a growing need across the SME lending world for better visibility over SMEs’ cash flow and finances, through real-time data sets.

Despite SMEs accounting for more than 60 per cent of all private sector jobs in the UK and a rapidly growing sector of interest for banks, these businesses continue to face the challenge of accessing timely finance. Research shows that around 30 per cent of SMEs are initially declined by their banks, forcing them to look for alternative methods, such as P2P lenders, specialised asset finance companies, invoice financing or using credit cards to obtain finance and manage their cash flow.

More recently, SMEs have also been struggling to remain operational and are battling to secure loans from major banks that underestimate their running costs, as inflation reaches a 40-year high and economic uncertainty makes accurate forecasting and cash flow management all the more challenging.

There are numerous research papers indicating that the UK`s SME market is still hugely underserved and there is an obvious need for further innovation within this space.

Andrea Varga, Head of Innovation, Aryza

Leveraging key data sets and predictive analytics continues to play a crucial part in the digital transformation of most banks and a growing number of financial institutions are looking to find alternative ways to enhance their operational efficiencies. With real-time accounting data enabled through Validis, the Aryza Vantage platform is one of the first platforms that delivers actionable insights within a customer-permissioned environment. The use of aggregated data sets allows both fintech and traditional lenders to tailor their banking services to specific business needs and make quicker, more informed decisions whilst retaining customer confidence in their services.

Andrea Varga, Head of Innovation at Aryza said, “There are numerous research papers indicating that the UK`s SME market is still hugely underserved and there is an obvious need for further innovation within this space. At Aryza, our vision is to address the increasing need to digitise the lending process through access to data and actionable insights, and we’re very excited to partner with Validis to help tackle this pressing issue. We wanted to create a truly Open Finance Platform that removes the friction of sharing data and allows both SMEs and lenders to communicate better with each other and financial institutions to become a trusted partners of their customers.”

Paul Thomas, CEO of Validis said, “We’re really excited to announce our latest partnership with Aryza. We have a very powerful joint capability that will support banks and lenders to enhance their lending processes, delivering faster access to finance for their customers and attain sophisticated data and insights to provide improved in-life management. At a time of economic uncertainty, it’s critical that SMEs get the right support at the right time, and this new capability addresses a prevalent industry challenge faced by many banks and lenders in the UK.”

Related News

- 09:00 am

Buy now, pay later (BNPL) firm Afterpay is launching a new monthly payment option that aims to give consumers greater payment flexibility and responsible spending options ahead of the holiday shopping season.

Shoppers choosing Afterpay’s monthly payment option can budget purchases over repayment periods of six or 12 months for purchases between $400 and $4,000, according to a press release Wednesday (Oct. 5).

For consumers, the new instalment options include no late fees and no compounding interest, plus a cap on interest owed as well as transparency on the total owed at the time of purchase. Merchants offering Afterpay benefit by being able to offer more items across a wider range of categories and price tags, without accumulating additional transaction or integration fees.

Merchants can also benefit from the newly expanded Afterpay options by picking up new customers, increasing overall sales and seeing a boost in per-customer sale averages, per the release.

Afterpay’s new monthly payment solution will initially be introduced online, though the company has plans to make the service available for in-person purchases in 2023.

“Our new offering is a natural extension of the Afterpay experience — giving customers a new way to take more control and have more choice in the way they pay,” said Lee Hatton, head of Cash App Asia Pacific. “We look forward to supporting customers with yet another smart budgeting tool.”

Afterpay’s monthly payment option is currently available in the U.S. at Bellacor.com, EyeBuyDirect, FWRD and Your Mechanic, among others, with additional merchant partners coming soon. The company also plans to extend the offering to merchants outside the U.S. in 2023.

The BNPL company aims to give consumers an alternative to the high-interest rates and compounding debt of credit cards. Over 98% of Afterpay transactions never incur a late fee and more than 90% of Afterpay transactions are paid with a debit card, according to the release.

Related News

- 09:00 am

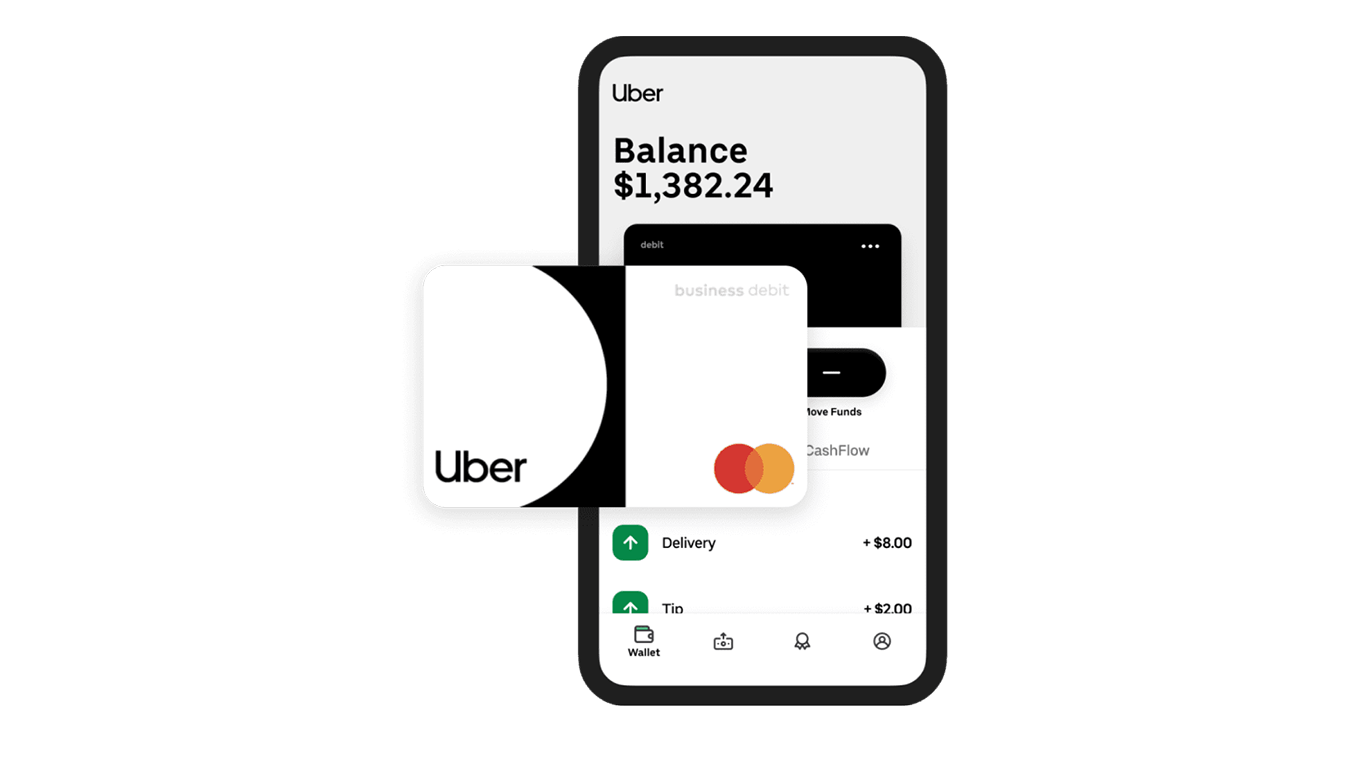

Uber today announced a new partnership with Marqeta, Mastercard and Branch to power the Uber Pro Card, an enhanced loyalty and payments experience that will help drivers and couriers save on gas, fees, and other expenses. Built for drivers and couriers, the Uber Pro Card offers customized perks including up to 10% cashback on gas and up to 12% on EV charging.

“At Uber, we are always looking for new ways to offer drivers and couriers more support on the road,” said Andrew Macdonald, Senior Vice President, Mobility & Business Operations at Uber. “The new Uber Pro Card will allow drivers and couriers take home more of what they earn. Drivers and couriers will now have the ability to get more cash back on gas and EV charging and have their earnings automatically deposited to their accounts after each trip - free of charge.”

Expanding the Uber Pro driver loyalty program, the Uber Pro Card offers Uber drivers and couriers up to 10% cashback on gas purchases when they achieve Diamond status as an Uber Pro driver, along with other exclusive perks and rewards.

The card also comes with a business checking account powered by Branch and designed to enable drivers and couriers to keep more of what they earn. Drivers and couriers that sign up for the card can have their earnings automatically deposited into their Uber Pro Card account after every trip—free of charge. The Backup Balance feature allows drivers and couriers to access up to $150 when they need it most.

The Uber Pro Card will be available via mobile wallets and enable seamless contactless payments, so drivers and couriers can begin spending immediately. They can track earnings, transfer money to other bank accounts, earn rewards, and manage savings all through the Uber Pro Card app.

The Uber Pro Card is a Debit Mastercard BusinessCard®, offering increased purchasing flexibility, as well as built-in tools and benefits to help drivers and couriers better manage cash flow, record keeping and safeguard their devices. This includes access to Mastercard Easy Savings®, a rebate program to reward small business owners when they spend, and Mastercard Receipt Management, in addition to advanced security features including Mastercard ID Theft Protection™ and 24/7/365 Global Emergency Services.

The Uber Pro Card will also offer Stride, the leading portable benefits platform designed for independent workers, enabling drivers and couriers to access simple, affordable coverage plans – from health to dental to vision. Mastercard and Stride partnered in 2020 to enable greater choice and relevant benefits options to gig and independent workers.

Uber also recently announced other features, including Upfront Fares, which allows drivers to see how much they’ll earn and where they’re going before accepting a trip.

Related News

- 01:00 am

Kyriba, a global leader in cloud-based finance and IT solutions, has announced the launch of Commodities Risk, which is an expansion of the Company’s portfolio of risk applications. The new solution helps Treasury and Risk Managers mitigate commodities risk and better manage market fluctuations with integrated data, analytics and connectivity into Kyriba Treasury and Risk Management. The solution gives companies the ability to reduce price risk and protect their bottom line from the impacts of market volatility.

“Kyriba launched Commodities Risk to support hedging programs, simplify buying and price setting processes and to deliver a more complete liquidity picture,” said Bob Stark, Global Head of Market Strategy at Kyriba. “It is important for our clients to have Commodities, FX, Payments and Treasury functionality in a single platform.”

Key Benefits of Kyriba Commodities Risk

- Commodity Tracking Features: exposure management, trade capture and flexible forward-curve modelling.

- Financial and Hedge Accounting: valuations and hedge accounting entries are automated and integrated with all general ledgers.

- A Single Risk Management Platform: Commodities, FX and Interest Rate Risk are fully integrated with liquidity planning, automated settlements and bank reconciliations.

Commodities Risk adds to Kyriba’s platform to further support corporate Treasurers and Risk Managers to mitigate the impact of rising commodity prices and offer greater defence against pricing headwinds. The Company recently launched Portfolio VaR Analysis to tackle currency risk.

For more information on Commodities Risk, read our fact sheet.

Related News

- 08:00 am

Worldline, a global leader in the payments and transactional services industry, has been selected as a partner and payments provider to Lufthansa Group, a global player in the aviation industry. Worldline builds on its strong heritage in the Airlines & Travel industry with comprehensive solutions tailored to fit the needs of some of the largest and most complex airlines in the industry.

The Lufthansa Group aims to build a robust payment platform which will provide a cohesive and succinct payment offering to their Group, where all group members can take advantage of the services available. The partnership will give Lufthansa Group the possibility to onboard a selection of Worldline solutions, from payment methods to consolidated reporting capabilities and integration with their core platforms. Worldline’s vast experience in acquiring for airlines and its expertise in the travel industry will also help ensure that the Lufthansa Group is best placed to offset and mitigate the risks and challenges that have emerged in recent years across the sector. Worldline will also establish the necessary payments infrastructure to meet the Lufthansa Group’s objectives and position it well as the industry starts to enjoy a rapid growth phase once again.

The deal will see Worldline processing globally for Lufthansa and its sister operations, SWISS, Austrian Airlines and Edelweiss, ensuring the group can take advantage of Worldline’s continued investment in innovation, new markets and airline-specific services including Billing and Settlement Plans (BSP) and Accounts Receivable Conversion (ARC). The Lufthansa Group will make use of Worldline’s unique TravelHub solution, a single scalable connection providing access to over 150 payment methods and currencies, multi-acquiring, tokenisation and a range of fraud services all through a single reporting and settlement channel.

Damien Cramer, Global Head of Travel & Airlines, Digital Commerce at Worldline, commented: “When seeking a new payment service provider, the Lufthansa Group had several critical requirements and objectives. But primarily, they were looking for support from an experienced team of payment experts with the right level of sectoral knowledge and a market-leading suite of payment solutions. We are delighted that they have put their trust in Worldline to help them deliver the success they are targeting.”

Kai Schilb, Head of Payments, the Lufthansa Group, added: “We were looking for a global partner that could offer a strong payments layer to drive innovation, growth and most importantly increase our conversion rates; Worldline’s TravelHub makes this possible for our entire group. Worldline recognised the challenges the industry faces and worked tirelessly with us to create a relationship that encourages future growth and stability to our group.”

Related News

- 06:00 am

SunTec Business Solutions, the world’s No. 1 pricing and billing company, today announced the strategic partnership and integration of its products and solutions with Whatfix, the global leader in the digital adoption platforms (DAP) space, to drive quick adoption of its SaaS products among customers and create a seamless and user-friendly onboarding experience for them.

This integration will help SunTec clients globally to drive product adoption, significantly reduce end-user training costs, increase productivity, and improve time-to-value by offering customers digital guidance that is contextual, real-time, and interactive.

Commenting on this partnership, Amit Dua, President at SunTec said, “Quick product adoption is critical for financial institutions to ensure payback on software investments. The integration of Whatfix with our cloud-based platform SunTec Xelerate will enable the smooth adoption of our products on SaaS. It will ensure a structured and effective customer onboarding process and enhance customer satisfaction. It will truly empower our customers by offering them digital guidance as and when they need it.”

Khadim Batti, CEO and Co-founder of Whatfix said, “With this partnership, SunTec can extract the full value from their software products while empowering customers and businesses. SunTec customers will get access to interactive workflows to accelerate onboarding, product analytics for analyzing and continuously improving adoption along with features to integrate with existing learning and knowledge management repositories. We will work closely with SunTec to further refine our category-leading digital adoption (platform) offering for financial services. I believe our product and remarkable customer service will be key differentiators when it comes to Digital Adoption Solutions. ”

This integration will provide banks and financial services firms with a unified digital adoption experience to extract the full value of SunTec products and solutions while also empowering employees and other stakeholders. This integration will transform the customer experience by broad basing the usage of SunTec Xelerate.

The SunTec Xelerate platform helps banks future-proof their technology investments. This integration will help banks migrate faster to the cloud and ensure seamless SaaS deployments.

Related News

- 05:00 am

It will be used as a laboratory to broaden my experience and to test relevant technological solutions. According to Paweł Gruza, vice president of the management board of PKO Bank Polski managing the work of the management board, in the perspective of a decade, Metaverse may become such a development impulse for the global economy as the emergence of a PC, Internet and smartphones in the past.

"I would like PKO Bank Polski to be ready to make use of the opportunities related to it, and when Metaverse has matured, to set the rhythm in the technological development of the domestic banking sector and the Polish economy – as it has done before. That is why we have decided to enter the Metaverse world and to launch our first branch there," said Paweł Gruza, quoted in the press release.

The bank plans to use the virtual branch to build knowledge and experience which will later be used for the development of its business. PKO Bank Polski also wishes to see in practice what other possibilities are offered to the banks by the presence in the metaworlds.

The bank expects that in the first place, its virtual branch may be used for onboarding new employees and trainings. Due to the shift to the mode of hybrid work, such a solution could allow for improved onboarding of the new personnel.

In parallel, the bank will test the possibilities of creating a new channel of communication with the clients. In the perspective of the next decade, it is also planning to pursue solutions related to confirmation of the clients' identity in metaworlds and is going to test the possibilities of offering banking products there.

The bank attaches great significance to R&D activities and cooperation with start-ups. It offers them - apart from business cooperation - also mentoring and the possibility of scaling the solution on a group of its 11 million clients. This cooperation takes place via its platform, Let`s Fintech with PKO Bank Polski (www.fintech.pkobp.pl).

Related News

- 03:00 am

Trust Payments, a leader in fintech powering truly innovative customer commerce solutions, is thrilled to announce a strengthened management team across the Trust Payments Group with three key promotions.

Eric Levy is promoted to the position of Chief Transformation Officer (CTRO), Laurence Booth to the position of Chief Data Officer (CDO) and Siobhan Wright to the position of Chief People Officer (CPO) under the changes. The promotions will boost the depth of experience in the core management team as the company continues to grow globally.

Levy joined Trust Payments in January 2019 as Global Head of Project Management, while Booth joined in September 2021 as Group Head of Data and Wright joined in July 2019 as Head of HR.

Daniel Holden, Group Chief Executive Officer at Trust Payments, said: “These promotions represent something really exciting for us and they are all real assets for us moving forward. The management team is gaining a wealth of experience in key areas that are going to be crucial to our development as a company.”

Bolstering of the management team comes after a record year of growth for Trust Payments, which reported a 73% increase in revenue in its annual report last year, reaching a total figure of £108.7m.