Published

- 09:00 am

Manchester-based embedded finance specialist, BankiFi, has today gone further than ever in articulating its vision for the future of digital banking through the publication of its informative, new whitepaper, entitled ‘Embedded banking but not as you know it’.

Amidst growing uncertainty within the broader fintech market, embedded banking continues to stand out as an area of high growth and opportunity. In the past year, the sector has witnessed a huge uplift in user adoption rates, with companies in the field continuing to receive sizeable investment from some of the world’s most reputable venture capital firms. This interest has also generated demand for research around the concept.

In response, BankiFi has published an illuminating whitepaper, which is now available to read for free on its website. Officially launched at Sibos 2022 in Amsterdam, the whitepaper, entitled ‘Embedded banking but not as you know it’ provides a comprehensive, easy-to-digest history of digitization within the banking industry, from the earliest wave of adoption during the 1990’s, all the way to modern day solutions.

As BankiFi’s whitepaper explores, banks have recently fallen behind tech-first platforms when it comes to providing customers with convenient access to the digital banking services that they really want, despite the advancements in digitization within the field. Notably, the sector looks to be losing the fight over who, or perhaps what will be considered the ‘front door’ for the digital services required to run a business – a battle it must find a way to win.

In publishing the whitepaper, BankiFi can offer guidance to those working in, or alongside the sector. The thought-provoking report makes the case that legacy banking institutions are particularly well-suited to meeting the banking needs of small-to-medium-sized businesses (SMBs). In fact, as the whitepaper highlights, banking companies already possess all the tools they need to lead in this area.

Speaking on the publication of the new whitepaper, Mark Hartley, Founder and CEO of BankiFi commented: “The road to embedded banking has been long, and winding, but now that it’s here there’s no reason why banks should be ignoring it. In our whitepaper, we chronicle that journey, highlighting how this innovation is only the latest in the world of digital banking, following a long lineage of technological updates.

“The paper makes it clear how the two worlds of banking and SMB are changing, which has created something of a vacuum across both fields, particularly as it pertains to how digital banking services are delivered. If managed correctly, a wealth of SMB banking opportunities will reopen for legacy banks, including considerable potential for customer acquisition. However, the next few years are going to be make or break, so those who are prepared to embrace change are advised to do so now.”

At its core, BankiFi aims to put banks back at the heart of business. The company’s technology platform is designed to provide banks with an integrated set of services – accounting, invoicing, and payments – based on the processes that their customers use to run businesses. Built with usability in mind, BankiFi’s platform allows SMB owners to focus on what they do best, which is running their business.

Similarly, by onboarding BankiFi’s platform, banks can reimagine their value proposition on the digital front, shifting to a more customer-centric approach and away from the product-centric approach that has dominated the sector for years. This move can help banking businesses to improve levels of customer engagement, while simultaneously increasing revenues and reducing operational costs.

To read BankiFi’s new whitepaper, please visit: https://www.bankifi.com/embedded-banking-not-as-you-know-it

Related News

- 01:00 am

Surecomp® today announced that it has successfully completed a pilot of automated ESG scoring and tracking in its flagship trade finance solution RIVO™. Based on an unrivalled dataset of more than one thousand transactions, covering more than seven hundred corporates, hundreds of goods and trade routes, ESG scoring can now be applied at a single trade finance transaction level.

Using the power of the collaboration platform RIVO™, the trade finance ecosystem of financial institutions, corporates and shipping companies can connect to a world-class range of ESG rating agencies, like Scope Group, Coriolis, WindWard, KYGTrade and more. This approach allows transactions to be independently scored according to pre-defined criteria based on data feeds from the ESG partners. This is a key step forward in enabling all parties - including those deeper within the trade and supply chain ecosystem - to mitigate the reputational and financial risk of engaging in unethical trade while empowering them to actively manage their trade-related ESG profile and monitor the environmental and social impact of their business.

Participating in the technology pilot of the sustainable trade framework proposed by the International Chamber of Commerce (ICC), Surecomp is pioneering the implementation of a comprehensive ESG score for each individual trade finance transaction. Consolidating market-leading data from best-of-breed ESG rating agencies, the scoring algorithm cuts through the complexity of combining partial ESG inputs from various sources and on multiple domains to provide one transaction-based rating in a convenient manner.

“We are delighted to support this innovative initiative with both corporate ESG Impact Review and our extensive data on maritime routes and vessels, taken from our Ship Review flagship product," says Ralf Garrn, managing director at Scope Group.

“This is a first-of-its-kind collaboration to look at the individual component parts of trade in relation to assessing ESG,” says Dr. Rebecca Harding, CEO of Coriolis. “We look forward to continuing our collaboration with Surecomp and providing industry-leading accurate data on sustainable trade.”

“Having access to aggregated ESG data always provides better visibility and enables companies to establish controls over its trade counterparties. Solutions like RIVO™ aim to add visibility in this regard,” comments Valérie Bècheras Delhumeau, VP of Group Trade Finance & Contract Engineering at Schneider Electric. “It’s not just about improving the efficiency of processes to drive growth, it’s imperative to secure the future of our planet and society.”

“We are extremely proud to be the first trade finance solution provider to offer ESG scoring to both banks and corporates on an individual transaction basis,” explains Enno-Burghard Weitzel, Surecomp’s SVP Strategy and Digitization. “Our mission is to help drive sustainable global trade by enabling customers to optimize their trade process as easily as possible. A growing number of financiers is providing preferential rates to sustainable finance. At the same time, external stakeholders are requesting greater transparency on the ‘sustainable’ portfolio of both banks and corporates. Providing access to real-time ESG data enables our customers to be compliance-ready, and to optimize their overall business beyond the narrow trade finance scope.”

Related News

- 03:00 am

Aite-Novarica Group today announced the launch of a new study, commissioned by ClearBank, that reveals one in five fintechs are losing $11m per year in product delays due to BaaS (Banking-as-a-Service) providers. The report “Confusion, cost, and compliance: The bifurcation of BaaS and Embedded Banking” reveals that fintechs are increasingly reliant on their BaaS providers to speed time to market, boost revenues, and meet compliance demands. However, as fintechs scale and look to offer more complex services, BaaS providers are struggling to keep up. This is resulting in lost revenues, rising costs, and at worst intervention from the regulator, as fintechs start to churn towards Embedded Banking providers.

Aite-Novarica Group interviewed 20 major fintechs in the UK and Europe with at least 50 employees and average annual revenues of $25m between June and September 2022. BaaS is defined as the distribution of regulated banking products by distributors, often aggregators, which may be licensed or non-licensed. Whereas Embedded Banking is defined as the integration of banking services only by a bank-licensed provider directly into the experience of the end user. The research aims to unpack the growing market confusion between BaaS and Embedded Banking, the benefits and disadvantages of working with a BaaS provider, and establish the appetite and motivations to move to Embedded Banking.

Key findings from the report include:

Speed to market, new services, and compliance are driving BaaS

- BaaS today is a ubiquitous tool utilised by 82% of fintechs, with BaaS-related services representing, on average, 45% of a fintech’s overall revenue stream.

- Accelerating time to market and adding services (60%) are the primary drivers of BaaS adoption.

- A third of respondents (33%) cited regulatory scrutiny as an emergent driver.

- While the initial investments into BaaS were driven by technology and capability, they are increasingly being driven by regulatory demands.

BaaS is primarily used for payments and accounts, but more complex demands are emerging

- 76% of fintechs identified domestic accounts and payments as primary BaaS uses. A further 59% of respondents identified FX conversion services.

- In the next two years, fintechs are looking to offer more complex BaaS capabilities including:

- Investments (56%)

- Crypto services (50%)

- Wealth management (38%)

- Today BaaS is primarily used for payments and accounts, but fintechs are looking to BaaS providers to enable them to offer more complex services in the future.

Market needs are evolving beyond BaaS due to complexity and compliance

- 73% of fintechs said the primary benefit of working with a BaaS provider was boosting internal capabilities, largely operational, vs. only 27% who cited customer-facing benefits.

- When we asked respondents what are the top three macro issues that will guide their future use of a BaaS provider they indicated:

- Speeding up time to market (44%)

- Accelerating growth (44%)

- Revenue-driving services (50%)

- These priorities speak to a shift from internal to customer-facing capabilities for fintech, which can only be supplied by Embedded Banking providers.

- As fintech priorities shift towards investments, crypto, and wealth management, BaaS aggregators and EMI license holders will be incapable of directly managing the governance processes and stringent regulatory controls associated with these services.

Lost revenue, increased costs, and regulatory intervention for fintechs due to BaaS issues

- 47% of fintechs experienced product delays which resulted in an average of $10,900,000 in missed revenue annually due to poor BaaS performance.

- 7% encountered unforeseen cost rises to the tune of $690,000 annually.

- 40% saw services go down and 33% have lost customers.

- 20% of fintechs have faced regulatory intervention due to their BaaS partner.

Fintechs are leaving BaaS providers and embracing Embedded Banking

- 31% of fintechs have changed their BaaS provider and 23% are currently planning to.

- 25% of fintechs said they will be using an Embedded Banking provider in the future - despite confusion in the market between the two categories

“The term BaaS is loosely defined, and often confused with another fast-growing term: Embedded Banking,” said Enrico Camerinelli, Strategic Advisor at Aite-Novarica Group. “Why does this matter? As fintechs look to deliver customer facing benefits and reduce their regulatory burden there is a clear difference between the two. Embedded Banking not only allows fintechs to embed licensed services directly into the user experience, it also embeds the mechanisms that automatically control regulatory compliance – rather than shift this responsibility onto the fintech as is the case with many BaaS providers.”

“The next two years will see a clear separation between BaaS and Embedded Banking providers as the market bifurcates,” concludes Camerinelli.

“Many BaaS and Embedded Finance offerings are no longer meeting the needs of their customers. They don’t offer the precision customers are demanding, and they can make it unclear what protections are in place to keep consumer funds safe,” said John Salter, Chief Customer Officer, ClearBank. “There must be a change to provide fintechs with the level of service they require and ensure account holders are aware what type of safety their money is afforded. We commissioned this research to better understand the state of the BaaS and Embedded Finance market, and how it can be improved. As a result, we’ve revealed some crucial issues and uncovered an appetite across European fintechs to move towards a new category, namely Embedded Banking.”

Related News

- 05:00 am

Resistant AI, the AI and machine learning financial crime prevention specialists, and ComplyAdvantage, the financial industry’s leading source of AI-driven financial crime risk data and detection technology, today announced the general availability of their solution for fighting financial crime across the U.S. and Europe.

Financial crime is a multi-trillion-dollar problem. According to the United Nations, the estimated amount of money laundered globally in one year is 2 - 5% of global GDP, or 800 billion - 2 trillion US dollars. While the cost of fraud and money laundering to financial organizations and other businesses is significant, the cost and damage to economies and society as a whole are immeasurable.

Adding Resistant AI's capabilities to ComplyAdvantage's transaction risk monitoring platform extends anti-money laundering (AML) and anti-fraud protections offered to financial institutions and other businesses by:

- Enabling them to detect previously unknown patterns of behaviour and identify new risks faster.

- Delivering alert prioritization so organizations can focus on the highest-risk areas and make the best use of their investigative resources.

With these capabilities, organizations can transition to a more dynamic approach to financial crime that uncovers novel behaviour as it happens.

“Effectiveness and efficacy are key to scaling,” comments Valentina Butera, Head of AML and AFC Operations at Holvi. “Integrating an AI-driven transaction monitoring solution means we can grow our customer base without growing our headcount at the same rate. With Resistant AI and ComplyAdvantage, we can manage our known risks more efficiently while also identifying and adapting to previously unknown risks.”

Martin Rehak, founder and CEO at Resistant AI, commented, “We are delighted that our joint solution is now available to drive game-changing efficiency gains. Alert prioritization, the ability to make systems more effective and identify previously unknown risks enables the most effective use of investigative resources and ensures a true risk-based approach.”

"In a complex, rapidly shifting world, criminals continue to find new ways to exploit financial services to launder the proceeds of their crimes. At ComplyAdvantage, we are passionate about giving our clients the best tools to protect themselves - and their customers - from these bad actors and fight back. The addition of Resistant AI's capabilities will allow our clients to do just that.” said Charlie Delingpole, founder, and CEO at ComplyAdvantage.

Today’s announcement coincides with the launch of a new thesis paper on AI in transaction monitoring. Co-authored by ComplyAdvantage and Resistant AI, it explores how customers like Holvi can increase the speed and accuracy with which they monitor transactions for fraud and other financial crime risks.

Related News

- 03:00 am

Deutsche Bank and Kyndryl, the world’s largest IT infrastructure services provider, today announced a new agreement under which the bank will extend one of the largest and longest-running vendor contracts in the financial industry.

Kyndryl will continue to run Deutsche Bank’s Continental European core banking and mission-critical IT infrastructures to support the bank’s technology transformation, to increase flexibility with on-demand scalability and global service availability. Furthermore, Kyndryl will support the bank’s cloud migration strategy as part of its broader effort to adopt public cloud services.

Under the agreement, Kyndryl will support the enhancement of Deutsche Bank’s mission-critical banking infrastructure by integrating automation and security technologies that are a part of the bank’s modernisation strategy and drive efficiency in day-to-day operations. Kyndryl will also pilot hybrid networking solutions in Deutsche Bank’s data centres, further enabling the integration of workflows and tooling. Deutsche Bank will be able to improve data integration across its on-premises IT environment as it prepares for its longer-term cloud journey.

The new agreement with Kyndryl will also support Deutsche Bank’s broader strategy to harness the power of cloud computing. Kyndryl has the flexibility to tap into a broad set of technologies and skills, including its own global strategic partnership with Google Cloud, in support of Deutsche Bank’s specific transformation goals. Additionally, Kyndryl’s nearly decades-long knowledge of Deutsche Bank’s systems will play a part in helping to migrate some of its critical business operations to the cloud.

“Our decision to renew our almost 20-year working relationship with the experts from Kyndryl is based on their experience in operating mission-critical infrastructure services for the financial industry, as well as Kyndryl's continued ability to adapt to the changing needs of the banking and IT industry,” said Gordon Mackechnie, Chief Technology Officer at Deutsche Bank.

“We’ve stood side by side with Deutsche Bank for nearly two decades as they’ve evolved their business and shaped the future of banking. As we continue our work together, we’re committed to helping them deliver reliable and secure services to customers while being their trusted partner to lay a future-forward foundation that helps them bring more innovative offerings to market,” said James Rutledge, Global Head of Delivery, Kyndryl.

“As their trusted partner for nearly two decades, we have deep experience helping Deutsche Bank deliver secure and reliable services to their customers. As we continue our work together, we’re supporting them as they set the pace for digital transformation across the financial industry and evolve their business to deliver new and modern solutions to customers,” said Merlin Jung Managing Partner – Deutsche Bank Account, Kyndryl Germany.

Related News

- 04:00 am

SmartStream, the financial Transaction Lifecycle Management (TLM®) solutions provider, today announces the launch of TLM Aurora Advanced Account Control, enabling clients to be ready for ISO 20022 standards - the new AI-enabled solution will allow customers to manage large, verified data sets, not only for reconciliation purposes but for downstream systems.

Built for ISO 20022 standards, TLM Aurora Advanced Account Control not only accepts larger data sets natively, but it also underpins it with the introduction of a streaming platform allowing for the data to be verified for other areas of the organisation. This sets a new benchmark in terms of real-time and volume handling capabilities, as well as savings in the overall cost of ownership.

Roland Brandli, Strategic Product Manager, at SmartStream states: “When speaking to clients two things are key - reduction of operational risk and lower cost. With our new solution, there is huge potential in achieving both of these objectives. In addition, there is a big opportunity here for unlocking data, not previously available – and we are the only vendor to offer this service. The new solution will seamlessly replace SmartStream’s Cash solution which is currently used in more than 81 countries globally. So far, the response has been incredibly positive amongst new and existing clients”.

TLM Aurora Advanced Account Control has a brand-new user-centric design principle which was developed by the same team who won the prestigious Red Dot Award 2022 for ‘Finance Applications Design’. It is now much simpler to use for the end user with a new task-driven user experience, however, still retains all the depth of functionality that so many customers have been used to in the past.

There was a sustainability focus taken into consideration - by optimising hardware and energy usage using private and public clouds. Also, it allows customers to seamlessly move to the latest technologies without losing any data or configurations in their existing Cash solution and represents the evolution of account reconciliation - by enabling organisations to reconcile any type of cash account, ranging from Nostro, internal, suspense, branch, or GL accounts. Additionally, it provides new features within a technological framework that is fit for the future.

TLM Aurora Advanced Account Control – is a fully web-enabled solution, with the newest security requirements such as single sign-on and multi-factor authentication, which has been completely redesigned to accommodate industry changes such as the move to instant, higher volumes and integrated exception management.

Related News

- 03:00 am

BNB Chain, the world’s largest smart contract blockchain in terms of daily active users, is launching European Innovation Incubator, a three-week virtual program designed for innovative Web3 startups across Europe to build and scale dApps, driving towards a decentralized future. Applications begin on October 10, 2022.

The European Innovation Incubator will provide long-term support to startups by bringing the best Web3 resources and training to them through partners and community experts. The program will provide the teams with hands-on sessions and mentorship on technology, design, tokenomics, and go-to-market strategies from BNB Chain's specialists, as well as incubator partners. Exclusive offline meet-ups will be organized in Lisbon, Paris, London, Berlin, Barcelona, and Warsaw for projects, partners, and community members.

The winners will have the opportunity to win up to $50,000 in prizes as well as other ecosystem support such as complementary security auditing and token economics consultation from BNB Chain community and its partners. Winners also get a one-month 100% gas fee incentive, and a strong referral to BNB Chain's Most Valuable Builder (MVB), a long-running global accelerator program designed to support builders.

Zoe Wei, Senior Business Director at BNB Chain said: “We are determined to provide the finest infrastructure to enable European Web3 projects to grow and scale. To effectively build consumer-scale experiences, developers must consider accessibility and scalability – the ease of adoption and usage for both experienced web3 users and beginners. Our objective is to guide European builders in making early commitments to these fundamentals in order to grow large user bases in the long term. The program also provides concrete training and community support to help in bringing the most creative dApps to Web3 in Europe.”

Jump Crypto, Pyth Network, Keyrock, Skyland Ventures, Worldpay, 1Inch, CoinMarketCap, Trust Wallet, Pancake Swap, Salus Security, Nodereal, Polkastarter, MH Ventures, Hash Global, Binance Research, Binance Charity and Binance Labs are some of the prominent partners with strong regional presence that have joined the European Innovation Incubator to provide dedicated support to the builders. Partners like WorldPay and Binance Charity will be vital in helping startups looking to tackle social and fintech challenges such as financial inclusion and environmental risks.

"Crypto is a community, and we believe that knowledge sharing and collaboration fosters a stronger, more resilient, and more advanced crypto ecosystem overall. Jump Crypto is proud to join the European Innovation Incubator and we look forward to providing the next generation of visionary Web3 builders with the resources and support necessary to create the decentralized applications of tomorrow,”a Jump Crypto spokesperson said.

The incubation program is open for European projects that are considering to build or have deployed on BNB Chain. For local networking, at least one key team member of the project must be based in Europe.

Applications open from October 10 to October 23rd 2022, and the Incubation period is from November 21st to December 15th, 2022. Each city's accelerator will also host one offline event as a wrap-up party for the teams and the community.

Related News

- 09:00 am

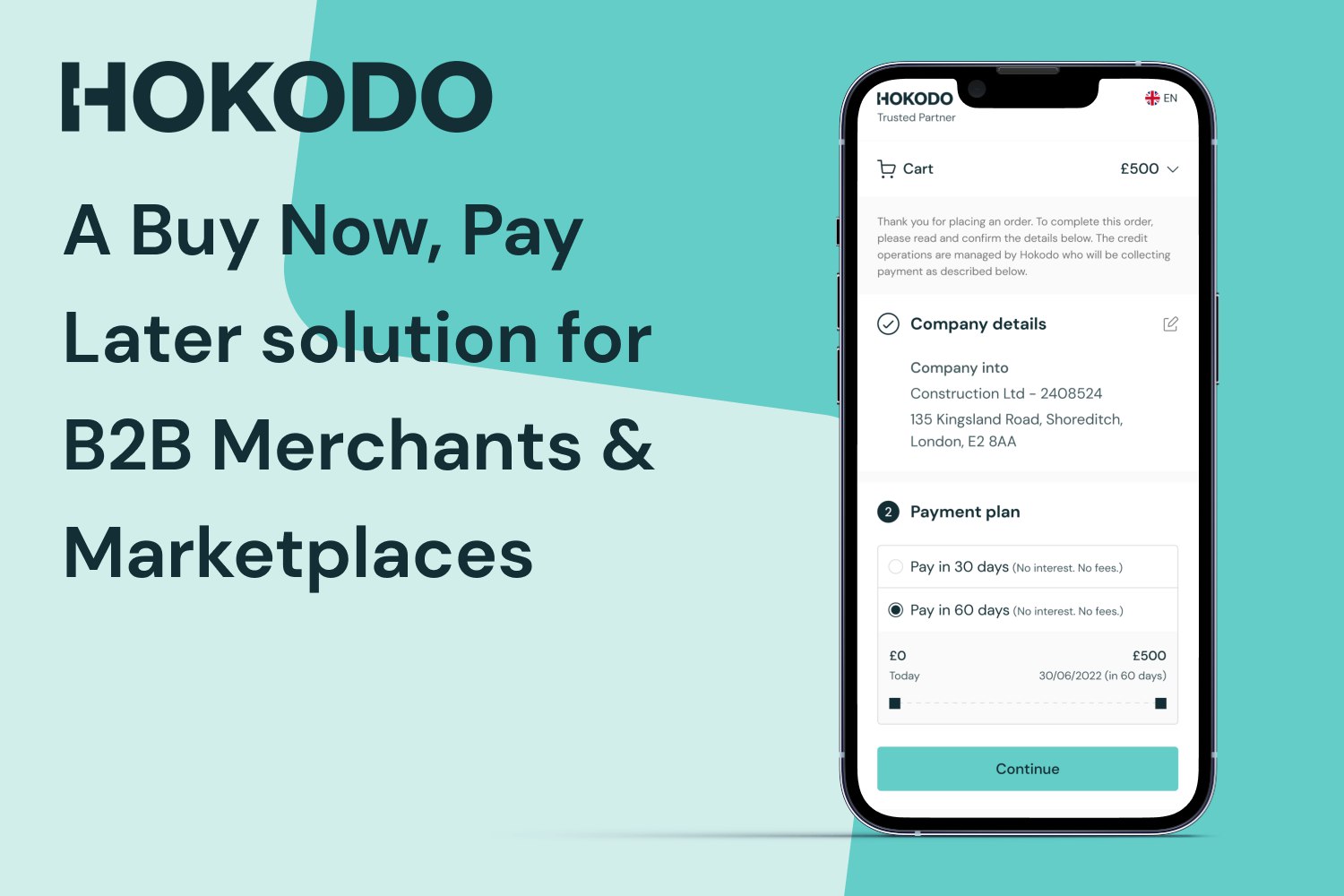

Leading B2B Buy Now, Pay Later (BNPL) provider Hokodo has today announced a new plug-in for the multinational e-commerce platform Shopify. This integration will enable B2B merchants with a Shopify webstore to offer instant credit terms to their limited company and sole trader buyers, while getting paid upfront and remaining protected from the risk of non-payment and fraud.

This integration is the first of its kind, positioning Hokodo as the only viable choice for Shopify’s B2B merchants who want to offer customers the ability to defer payment by up to 60 days. The plug-in is available to Shopify merchants operating in the UK, France, Spain, Belgium and the Netherlands.

“Our new Shopify integration has been designed with the merchant experience in mind, and can be installed in just a few steps with no development work required,” says Sami Ben Hatit, Hokodo’s co-founder and CTO. “This will be welcome news to SME merchants who don’t have the technology resources to spare for several weeks long integration.”

Sellers who offer Hokodo’s deferred payment solution at the checkout have seen an uplift of 40% in conversion rate and a 30% increase in basket size. Meanwhile, business customers benefit from the opportunity to ‘buy now, pay later’ on their purchases, ultimately promoting healthier cash flow for both parties.

How it works

1 A Shopify merchant instals Hokodo’s plug-in to make credit terms available to their business customers.

2 The customer visits the Shopify store of the merchant.

3 At the checkout they choose to pay later.

4 Hokodo’s bespoke APIs run real-time eligibility checks on the buyer’s credit score and fraud risk.

5 The buyer selects their preferred payment terms and settlement method (credit card, direct debit, bank transfer etc.), and confirms their order.

The customer pays Hokodo back in line with their payment terms, while the merchant receives upfront payment when delivery of the goods is confirmed. Hokodo handles the collections process, and thanks to backing from Lloyd’s of London, merchants are always protected against non-payments.

Related News

- 02:00 am

The protections and purchasing power of contactless payments took a step forward as Mastercard announced the approval of the first cards for issuers that are compatible with the new EMVCo® contactless specifications designed to protect against attacks from both traditional and quantum computers.

Quantum computing, which uses principles of quantum physics to solve complex problems exponentially faster than today’s supercomputers, holds great promise but also risk – bad actors could harness quantum computing to break the encryption that protects key systems. Though that possibility is likely years away, Mastercard experts have long been exploring the potential impact of quantum computing, and in January 2021 the company introduced quantum-resistant Enhanced Contactless specifications.

Since then, the company has worked with EMVCo to help evolve the innovation into an industry standard for contactless acceptance that provides the best protection for the industry, businesses and consumers while offering the same speed and convenience of today’s contactless payment experience.

“Technology has the potential to open new opportunities for both consumers and fraudsters. That’s why future-proofing security is critical,” said Ajay Bhalla, president, Cyber & Intelligence at Mastercard. “By bringing quantum-era technology to contactless payments, we are taking steps to future-proof security and privacy protection as much as possible. These new cards will deliver that greater peace of mind, while also providing consumers and merchants a seamless transition from today’s contactless experience.”

The number of contactless payment devices will surpass 12.5 billion by 2027, according to Juniper, with the value of contactless payment transactions expected to reach $10 trillion globally by that time.

Mastercard has a long history in developing and enhancing industry standards, as seen in its support and increased innovation around tokenization, 3-D Secure and the password-free checkout option Click to Pay, to name a few.

The new cards are designed to remain compatible with existing acceptance, network and issuer infrastructure and are available from Giesecke+Devrient and Thales. Mastercard will continue to partner with card manufacturers and will work with its customers to set the pace of transition to these new cards in 2023 and beyond.

Related News

- 08:00 am

Mamo, a homegrown UAE-based FinTech and financial services platform for SMEs, has been granted regulatory approval to operate from Dubai International Financial Centre (DIFC), the leading global financial centre in the Middle East, Africa and South Asia (MEASA) region. The licence has been granted by the Dubai Financial Services Authority (DFSA), the independent regulator of financial services conducted in or from DIFC, to carry out the regulated activity of providing money services. The licence allows Mamo to further expand its products and services without user restrictions and provide unmatched security while fully complying with DFSA rules.

As the global future of finance and innovation hub, DIFC offers one of the region’s most comprehensive FinTech and venture capital environments, which includes cost-effective licensing solutions, fit-for-purpose regulation, innovative accelerator programmes, and funding for growth-stage start-ups. The Centre continues to attract companies to establish operations in Dubai by providing the ideal environment to help them shape the future of finance.

Mamo received DFSA authorisation to operate within the Innovation Testing Licence (ITL) programme in June 2021, which enabled it to operate in a controlled regulatory environment to test its business model. What makes this announcement significant is the diligent work by Mamo to successfully exit the ITL Programme and receive Authorised Firm status. The regulation provides frameworks requiring transparency, fairness, and efficiency, that all regulated firms must follow. It also aims to protect businesses, consumers and users of financial (and other) services offered by regulated companies, such as Mamo.

Mamo has built a reputation for being radically customer-centric, with incredibly fast product development times – often launching and announcing multiple new features in a matter of weeks – a refreshing approach from a regional start-up. Presently, Mamo has two products; the rapidly growing Mamo Pay for Business product which has seen exponential uptake in recent months from SMEs and is predicted to grow further with the formal regulatory green light and Mamo Pay, a Peer-to-Peer (P2P) wallet for consumers.

Mamo has its own internally built systems, including cryptographic security protocols, a fraud detection and prevention engine, and a standardised and automated financial transaction management system, minimising human errors and protecting against fraud. On the front end, Mamo has implemented digital Know Your Customer (KYC) that allows users to identify themselves quickly through a user experience that puts the user in control of their personal and private information.

Commenting on the announcement, Imad Gharazeddine, CEO and Co-Founder of Mamo, said:

“We've built a financial services platform that enables both SMEs and consumers to move money faster, more efficiently and more securely in the UAE. Today marks a crucial milestone for our business and a major inflection point in our growth trajectory. Receiving full regulatory approval in DIFC allows us to continue to expand our product stack, offering new features and functionality to our customers. Today’s achievement marks the culmination of years of hard work and innovation, and to have the recognition by a leading regulator inthe DFSA is testament to the quality of our product, providing Mamo and its users security, safety, and peace of mind by licensing us. We are making sure we set a new example for compliance and regulation and are incredibly grateful to the DFSA for their support and guidance through the process.”

Arif Amiri, CEO of DIFC Authority, said: “DIFC’s ongoing commitment to providing MEASA’s most enabling platform for FinTech firms has involved working with the DFSA on the UAE’s first comprehensive money services regime. We are pleased that Mamo, one of our FinTech clients, has been granted approval from the DFSA to operate as an authorised money services firm in the Centre. DIFC will continue to help Mamo and other FinTech firms grow by harnessing opportunities in the region.”