Published

- 06:00 am

BankiFi and progressive financial institution Axiom Bank, N.A. are joining forces to make banking better for small-to-medium size businesses (SMBs) across the United States. The new partnership also represents BankiFi’s first North American client since its stateside launch in July.

As part of its continued efforts to support SMBs around the world, BankiFi has announced the launch of a new partnership with Axiom Bank. Moving forward, Axiom Bank’s SMB customers will be able to better track and manage their business finances using BankiFi’s leading embedded banking services. BankiFi’s Open Cash Management platform has been built with speed in mind. The system will help to put Axiom Bank and its associated digital channel back at the heart of relationships with business customers.

BankiFi’s Open Cash Management platform can be seamlessly integrated with major accounting packages popular across the U.S., including QuickBooks and XERO. In addition, the system can handle the collection, matching, and reconciliation of invoice payments submitted through various payment networks in a quick and efficient manner.

Speaking on the new partnership, Mark Hartley, Founder and CEO of BankiFi commented: “We are really pleased to announce this new agreement with one of North America’s leading community banks. Currently, community financial institutions in the US are facing threats from fintech platforms, national banks and accounting package vendors that are offering a competitive suite of payment solutions to SMBs. However, through BankiFi, these valuable institutions can fight back, regaining the trust of North American SMB customers and providing them with the tools that they need. That's why we're so pleased to have a community bank of the stature of Axiom place its trust in us. The partnership is testament to the power of our service, and the result of much hard work across the entire BankiFi team. It's a huge step in helping to support banks around the world to fight back, and will provide SMB owners across North America with the banking services they require to thrive.”

The new partnership forms part of Axiom Bank’s plan to grow its SMB client base nationwide. Axiom Bank and BankiFi will work to continually update their offering to customers by adding new functionality to an already industry-leading platform. In doing so, the two companies aim to fill a void within the suite of digital financial workflows designed for the SMB vertical. The solution allows payments to be collected faster and data integration to be automated, and provides valuable business insights.

Speaking on the new agreement, Mike Coyne, Chief Information Officer at Axiom Bank, commented: “Many SMBs across the U.S. are struggling right now and need help to keep their heads above water. And many banks are unable to offer this support effectively, having seen their role in the financial ecosystem diminished in recent times. As such, there’s now a real need to put banks back at the heart of business, and to do this, we need to offer SMB owners the services that make a real difference in their lives.”

John Zazzera, Chief Operating Officer at Axiom Bank, commented: “By incorporating BankFi’s innovative Open Cash Management platform within our existing BaaS framework, we’re able to go further than ever before in our support of our SMB customers. It’s a huge positive for us and supports our drive to attract more SMB customers from across the U.S. We’re excited to work with the BankiFi team and look forward to a highly prosperous relationship.”

Related News

- 08:00 am

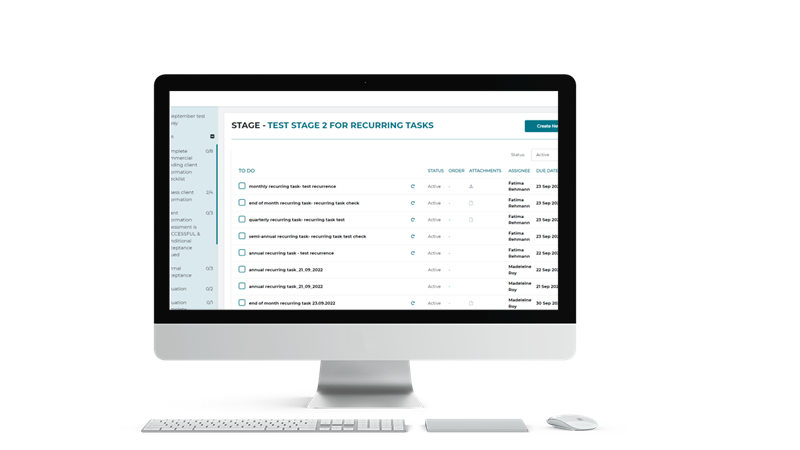

Phundex is pleased to announce a significant release, in line with the product roadmap of regular enhancements planned for 2022.

We focus on client-driven design and functionality. Regular feedback and requests from clients have shaped the enhancements delivered in this latest release.

"We started on this release in June and extended our regular monthly release cycle to be able to provide increased functional enhancements to our clients", said Heather Anne Hubbell, CEO of Phundex. "We are very happy to be solving challenges raised by our clients over the past 12 months.”

Phundex helps you to streamline and simplify administration and transaction management in a centralized hub, dramatically reducing time, complexity and costs through better connectivity and collaboration.

Platform Enhancements

Platform enhancements in this release include:

Sharing documents with guests directly from the data room

New temporary user licensing and the ability to switch users between regular and temporary users

Copying completed documents and forms across Stages and Pathways – allowing you to move existing information to new processes and transactions

Recurring Tasks – you can now set tasks to recur across extended timelines, automatically emailing team members when the next recurrence arises

Ability to retain documents and data forms – this allows you to retain replaced documents and forms in the data room even when you remove them from a specific task

Pathway Enhancements

We have reviewed our Pathways, updated the Pathway Template documentation and enhanced a number of Pathways. We have also added more templated documents to existing Pathways and new Pathways including:

• Data Protection Checklist

• Data Sharing & Subject Access Checklist

• Human Resources Department Requirements Checklist

• HR Onboarding

• HR Offboarding

HelpDesk and FAQ’s Enhancements

The Phundex Platform includes an online HelpDesk, with handy tips, videos, FAQ’s and details about each of our Pathways. We have updated our solution articles, adding more detailed information, screenshots, video help and documents to download. The HelpDesk includes all resource material from our website and a chat feature to request more bespoke information or ask about additional features.

"Phundex is the platform for faster, more efficient financial management, getting you to market sooner".

"Prioritizing steps and repeating transactions without missing out steps can be extremely labour intensive," observes Phundex founder Heather-Anne Hubbell, a former lawyer and banker who has worked extensively in the banking and finance industry. "Phundex enables efficient prioritization and the ability to replicate steps and transactions, simplifying the process and providing transparency and better governance".

Request a demo today at support@phundex.com, You can find a more detailed description of the release contents and additional resources on LinkedIn Phundex | LinkedIn or at our website https://phundex.com/resources/

Related News

- 07:00 am

SmartStream, the financial Transaction Lifecycle Management (TLM®) solutions provider, today announces the launch of SmartStream Air version 7 - to further control exception management using advanced cloud-native AI technology. This is a first in the industry, with AI exceptions management processes learning from user behaviours; it is designed to help reconcilers to focus on other tasks, which in turn helps businesses reduce costs when managing their reconciliations.

SmartStream Air’s AI for exception management will populate fields automatically, set labels, and run automation - all based on the processes it has learned. In addition, it will be able to provide suggestions to the user or fully automate the process - significantly improving STP rates.

Currently, exception management is controlled by the users or user-defined automation rules. In contrast, the new version learns from a user’s day-to-day actions when managing exceptions and proposes how the exception attributes should be populated. It will help with the cumbersome and work-heavy exception management process by learning directly from user actions or historical data – and when the model is trained, the AI can predict fields and workflows for managing exceptions.

Jethro MacDonald, Product Manager - Artificial Intelligence & Machine Learning, SmartStream, states: “Our new SmartStream Air version 7 will massively reduce the time spent working on managing exceptions that arise from unmatched data, or data integrity issues. AI technology will automatically classify the priority, assign it to relevant teams, add labels including statuses, and populate exception detail fields, allowing reconcilers to manage their work more effectively. We feel this is what the market has been waiting for and we are proud to be the first to deliver such capabilities”.

SmartStream's goal is to integrate AI exception management into its suite of industry-leading middle- and back-office processing solutions, this means that its established client base will experience the operational benefits that advanced AI-enabled technology brings.

Related News

- 03:00 am

On display at Sibos is the latest innovation in Mastercard’s expansive services suite which will be used by banks, corporates, and governments to gain greater visibility into payment flows, enabling collaborative, data-driven business decisions

Businesses often struggle with visibility into how and where they spend money—and with which suppliers. In a recent poll of treasury professionals, 91% of respondents noted they still used spreadsheets for forecasting1. To address this need, Mastercard today announced the launch of Global Treasury Intelligence, a cloud-based analytics platform that enables organizations to execute more effective and sustainable financial strategies, and support corporate priorities such as cash management, risk assessment and ESG goals.

By automating data ingestion from clients’ Enterprise Resource Planning (ERP) systems, Global Treasury Intelligence provides a view of all payment flows across suppliers, commodities, and lines of business, integrated with relevant third-party data. This holistic view means companies can more efficiently and collaboratively analyze global payments and manage risks. It can be used for narrow applications like identifying opportunities for expansion of commercial cards, as well as broader applications like cash management, source to settle pay strategies, treasury services optimization, supplier ESG scoring, and Know Your Supplier assessments.

“HSBC is an early adopter of Mastercard’s Global Treasury Intelligence because of the insights it gives us into the needs of our clients. By unlocking this data-driven collaboration with our customers, we see how to best help them achieve their goals for treasury,” said Brian Tomkins, Global Head of Commercial Cards, HSBC.

The latest commercial-focused solution from Mastercard, the platform is designed to better support and advance digital payments for existing corporate customers. The platform captures commercial payment flows to support customer product needs today, including purchasing cards, procurement offerings and Travel & Entertainment (T&E) technology.

“The health of the business does not sit in just one team or silo. With Global Treasury Intelligence, we are providing the broad, interconnected views our customers need to make smarter decisions with better outcomes across their enterprises,” said Raj Seshadri, President, Data & Services, Mastercard. “This solution is a powerful addition to our suite of insights and analytics services. The insights it offers will help our customers to realize the full value of innovative Mastercard solutions such as Track BPS and Mastercard Instant Pay.”

Starting today, the analytics platform will be available to customers in most markets around the world and you can view a digital interactive preview of the service here. For those attending the annual Sibos financial conference, Mastercard will be in attendance from October 10-13, during exhibition hours at stand D06 for live demonstrations of the platform.

Mastercard Global Treasury Intelligence was developed in collaboration with Robobai, a global provider of source-to-settle analytics with nearly $1 trillion dollars of spend under management.

Related News

- 01:00 am

UK financial institutions will use new technology to tackle the impact of rising costs, according to a new report from Lloyds Bank.

Three-quarters (75%) of UK financial services firms expect their operating costs to increase over the next 12 months.

When asked how they plan to manage the impact of rising costs, the majority (72%) said they planned to invest in new technology to make their business more efficient.

Investing in technology was the most popular strategy cited by firms, ahead of absorbing costs (46%) and increasing the price of their products or services (38%).

Financial services firms’ wider technology investment plans also remain robust against a challenging economic backdrop, with more than two-thirds (71%) planning to grow investment in their technology systems and core platforms over the next 12 months.

When asked about specific technologies, firms said they were prioritising investment in the Cloud (79%), payments (69%), APIs (66%) and data science, which includes machine learning and artificial intelligence (61%).

The findings are included in Lloyds Bank’s seventh annual Financial Institutions Sentiment Survey, which gathers views from major banks, asset and wealth management firms, insurers and intermediaries across the UK.

Steve Everett, Managing Director, Head of Payables & Receivables, Lloyds Bank Commercial Banking: “It’s encouraging to see that so many financial services firms are alive to the potential for technology to increase efficiency as they, like so many other businesses, combat rising costs in a challenging economic climate.

“But that is, of course, not the only reason financial institutions are investing in new forms of technology. APIs, for example, is being used by firms to improve client experiences in a range of areas – notably in payments – which make the customer journey more seamless, allowing the client to self-service and customise the interface to their needs.”

UK financial services firms cold on crypto

Meanwhile, only a quarter (23%) of financial services firms said they believe the UK should become a technology hub for cryptocurrencies, with almost two-thirds (60%) expecting the value of the global market to fall in the next 12 months.

Peter Left, Head of Prudential Liquidity Management, Lloyds Banking Group, said: “We can expect a lot of crypto tokens to disappear in the coming months and years. But it's the technology and not the tokens themselves that's the real value add in the crypto space. The mechanism using Distributed Ledger Technology (DLT) that's been built to facilitate cryptocurrencies is powerful.”

Related News

- 05:00 am

MoneyLIVE Autumn Festival is the premier pan-European event shaping the future of banking and payments. Join 350+ senior banking and payments leaders to gain new insights, cultivate partnerships, and be part of the discussion setting the agenda for 2023 and beyond.

2022’s headline speakers include:

- Taylan Turan, Group Head of Retail Banking and Strategy, Wealth and Personal Banking, HSBC

- Peter Sjӧberg, Chief Operating Officer, Nordic Region, Santander Consumer Finance

- Anne-Sophie Castelnau, Global Head of Sustainability, ING

- Francois Miqueu, Board member, Former CEO Caixabank Consumer Finance, Caixabank

- Marta Echarri, General Manager Spain & Portugal, N26

- Edwin Van Bommel, Chief Innovation Officer, ABN AMRO

- Jorge Sicilia, Chief Economist, Head of BBVA Research, BBVA

- Rita Liu, Chief Executive Officer, Mode

- Mario Benedict, Global Head of APIs, Open Banking, Partnerships and Integrations, J.P. Morgan

- Simone Dettling, Banking Team Lead, UN Environmental Programme Finance Initiative

Below is just a small taste of what the festival has to offer, with a great selection of topics for you to sink your teeth into:

Open finance and beyond

Get ready for the next phase of open innovation and explore the new business model opportunities in the open finance landscape.

Embedded Finance

Learn how to compete in a super-app-driven world and how to tool-up for the embedded finance boom.

The next digital revolution

Get to grips with how Web3, Blockchain and the Metaverse are set to transform financial services as we know it.

DeFi and digital currencies

Understand the impact of DeFi, grasp the global picture on CBDCs and discover how to enter the digital asset playing field.

Lending transformation

Grasp the power of intelligent automation in lending and uncover what the future of lending holds in the era of connected ecosystems.

Payments innovation

Unearth the latest developments in point-of-sale innovation and discover strategies for success in the evolving payments landscape.

MoneyLIVE are also proud to announce that for this year’s festival, MoneyLIVE has officially partnered with the European Digital Finance Association. The EDFA is the beating heart of European FinTech, uniting over a dozen European national FinTech associations and their several thousand members.

Together with the EDFA, MoneyLIVE will be hosting the catalyst for collaboration networking brunch on day 2 of the festival, which will be introduced by the President of the EDFA, Maria Staszkiewicz. Themed around FinTech and bank collaboration, the brunch will be your chance to meet fellow pioneers in the banking and FinTech landscape, learn from one another, and discover new opportunities for co-operation over refreshments.

Come join the party in Madrid to find out what all the hype is about!

Get your tickets online today >>> https://bit.ly/3CIL8zL

Press contact for MoneyLIVE Autumn Festival

Finola McMahon

Senior Brand Marketing Manager, MarketforceLive

fmcmahon@marketforcelive.co

Related News

- 05:00 am

Today at Sibos 2022 in Amsterdam, Finastra announced a strategic collaboration to integrate its Fusion Trade Innovation software with Contour, the global digital trade finance network, providing banks and corporates with a streamlined end-to-end back-office workflow. Users may access their data through either platform, providing banks with increased efficiency and faster turnaround times when processing Letter of Credit transactions. Ultimately, it opens the door for increased access to trade finance and stronger returns for banks.

Carl Wegner, CEO of Contour commented, “Our partnership with Finastra is an important step forward in breaking down barriers to adoption and increasing access to trade finance. By integrating with Finastra’s Fusion Trade Innovation, financial institutions and corporates will have access to an end-to-end ecosystem of services that will enable them to transact seamlessly and securely.”

Global trade is a multi-trillion-dollar industry that corporates and consumers rely upon daily. To increase efficiencies, many financial institutions have sought a network to support collaborative workflows between trade participants. Finastra and Contour address this need via this new integration, enabling digital adoption while decreasing client costs, reducing reliance on paper transactions, and reducing risk.

Together, Finastra and Contour will further accelerate the adoption of digital trade solutions by linking together the two key components of digital trade finance – a deeply integrated core banking platform for internal processes, and an external decentralized network for bank and corporate customer communication. The solution offers full transparency and visibility, reducing the Letter of Credit lifecycle by up to seven days, freeing up working capital for corporates and improving returns for banks.

Isabel Fernandez, EVP, Lending Business Unit at Finastra said, “We are excited to connect with Contour, an innovative leader in this space, in our journey to orchestrate the digital trade ecosystem for our clients. Finastra is focused on making it simple for our financial institution clients to connect seamlessly to the global trade ecosystem so they can maximize business efficiency and develop new business opportunities. We’re pleased that this collaboration enables corporates, particularly small and medium enterprises (SMEs), access to trade and working capital finance where they transact.”

Visit us at Sibos this year at Finastra booth #E57 and Contour booth #DIS40. Contour is hosting a daily demo onsite at 2 pm CET for anyone who would like to join.

Related News

- 05:00 am

The Hosted Private Cloud powered by Nutanix offer is now deployed in the United Kingdom through OVHcloud’s Erith datacenter (ERI), adding to the existing Canadian, French and German data centres. Hosted Private Cloud powered by Nutanix is a pre-installed solution combining Nutanix Cloud Platform licenses with a 100% dedicated and secure OVHcloud Private Cloud infrastructure.

This scalable and all-inclusive platform benefits from the proven services of the top European Cloud provider and is built on industry-leading software providing customers with a ready-to-use Nutanix hyper-converged infrastructure in just a few hours. It is designed for organizations that want to migrate their applications quickly and easily to the cloud. It also enables hybrid or multi-cloud scenarios allowing scale applications to the Cloud to meet seasonal demand all the while taking advantage of disaster recovery.

Starting now, customers of the UK region can experiment with Hosted Private Cloud powered by Nutanix directly from OVHcloud’s Erith datacenter.

Related News

- 05:00 am

Onfido, the leading provider of automated global digital identity verification and authentication solutions, today announced that Onfido Studio, part of the Onfido Real Identity Platform, has been awarded “Security Orchestration Solution of the Year” in the 6th annual CyberSecurity Breakthrough Awards program conducted by CyberSecurity Breakthrough, a leading independent market intelligence organization that recognizes the top companies, technologies and products in the global information security market today.

Onfido also announced that it had been recognized in the 2022 Fintech 250 by CB Insights, an annual list of the 250 most promising private fintech companies in the world. Onfido’s designation on the list marks its fifth consecutive recognition by CB Insights. Also on the list were Onfido clients Revolut, KOHO, Chipper Cash, and Klarna.

Launched in May, Onfido’s Real Identity Platform reduces the complexity of sourcing and managing multiple identity verification vendors to meet local compliance regulations and can more easily mitigate fraud threats in an increasingly global marketplace. Hailed by companies like TSB Bank, Orange Poland, and Chipper Cash, the Onfido Real Identity Platform helps global companies reduce friction for customers with features like its Smart Capture SDK, while giving companies the flexibility and freedom to scale with Onfido Studio, the no-code mission control for identity verification.

“Most organizations use a combination of low-friction and high-assurance checks, managed by an intelligent workflow for identity verification. However, expanding into new global markets and complying with different AML/KYC compliance regulations in multiple regions can become a headache to build and maintain. This is why we built Onfido Studio,” said Mike Tuchen, CEO of Onfido. “Onfido Studio helps organizations get a more holistic view of their customers and allows them to make faster, more informed decisions about which products or services to offer and when to offer them. We are thrilled Onfido has been recognized by both CyberSecurity Breakthrough and CB Insights for its capabilities to simplify identity for organizations worldwide.”

The mission of the CyberSecurity Breakthrough Awards is to honour excellence and recognize innovation, hard work and success in a range of information security categories, including Cloud Security, Threat Detection, Risk Management, Fraud Prevention, Mobile Security, Email Security and many more. This year’s program attracted more than 4,100 nominations from over 20 different countries throughout the world. Onfido joins an impressive list of top companies and startups from the larger information security industry, including Mastercard, CrowdStrike, Fortinent, Palo Alto Networks, Mandiant, Darktrace, Neustar, Elastic, Aqua Security, AMD, HUMAN Security, and Proofpoint.

“Orchestration systems help both to mitigate fraud and ensure better user experiences. By pulling in and coordinating all data and technology pieces, organizations can make better risk-appropriate decisions in real-time or after the fact,” said James Johnson, Managing Director, CyberSecurity Breakthrough. “Onfido Studio represents a true breakthrough in this category, with its orchestration layers acting as mission control for identity verification, enabling organizations to build and optimize multiple identity verification flows using the entire verification suite and no-code workflows. Congratulations to the Onfido team on being our pick for ‘Security Orchestration Solution of the Year’ in 2022.”

Utilizing its Insights platform, the research team at CB Insights selected these 250 winners from a pool of over 12,500 private companies, including applicants and nominees. They were chosen based on factors including R&D activity, proprietary Mosaic scores, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty. The research team also reviewed over 2,000 of Analyst Briefings submitted by applicants.

Onfido has also been recognized this year for its leading AI product, winning CogX’s Best AI Product in Fintech award, as well as being shortlisted for the UK Tech Awards, British Legal Awards, and FinTech Futures Banking Tech Awards. Onfido previously won CyberSecurity Breakthrough Award for Fraud Prevention Innovation of the year in 2021.

Related News

- 03:00 am

Axyon AI Completes €1.6 Million Fundraising Round Supported by CDP Venture Capital, ING and UniCredit

Axyon AI, a leading AI provider for the asset management industry, has announced the completion of a €1.6 million funding round. Fondo Rilancio Startup led the round, with ING, UniCredit, Geminea, and Metes as co-investors. Axyon AI will use this capital to assist its international growth and evolve Axyon IRIS®, its flagship product that provides asset managers with AI-powered market insights and investment strategies.

Digital Bank Zopa in Talks to Raise Another $100M from Investors

UK digital challenger Zopa is in talks to raise $100 million in what could be its final funding round before going public, according to Sky News. The bank is in talks with new and existing shareholders about the raise, which would value it slightly higher than its £750 million valuation at a £220 million round last October. Zopa, a P2P lending pioneer, became a traditional bank two years ago, reaching profitability in April and £2 billion in deposits in August.

Railsr Achieves Series C Milestone

Railsr, the world leading embedded finance platform, has announced that it has closed its Series C round, raising $46m. The Series C fundraise constituted $26m of equity and $20m of debt. The equity portion was led by Anthos Capital, who led the Railsr Series B in July 2021, and includes other existing investors spanning Europe, North America and Asia: Ventura, Outrun Ventures, CreditEase and Moneta. The debt portion of the round was with Mars Capital, a new investor in the company.

Neobanking Platform Juno Raises $18 Million in Series A

Crypto digital banking firm Juno has raised $18 million in a Series A funding round to expand products and operations, and launch its first tokenised loyalty programme. The round was led by Mac Private Equity, the offshore private equity firm owned by Mac McClafferty, and included other well-known crypto industry figures that are part of McClafferty’s consortium of Caribbean investors.

Tally Raises $80 Million in Series D Funding Led by Sway Ventures

Tally, a leading financial automation company, announced it has received $80 million in Series D funding led by Sway Ventures with participation from Menora Mivtachim. The company also announced that Ken Denman, a veteran customer-centric technology leader, has joined Tally’s Board of Directors. Previous investors Kleiner Perkins, Andreessen Horowitz, Shasta Ventures and Cowboy Ventures also took part in this round.

Web3 Security Platform Blowfish Closes $11.8 Million Round

Blowfish announced that they’ve raised $11.8M in funding led by Paradigm, with participation from Dragonfly, Uniswap Labs Ventures, Hypersphere and 0x Labs. They are also supported by angel investors including crypto founders & operators - Naval Ravikant, Nathan McCauley, Will Warren, Amir Bandeali, Francesco Agosti, Patryk Adas, Jeremy Welch, Steve Klebnoff, Raymond Tonsing, Jim Posen, John Johnson and many more.

Currensea Secures Major Investment from Two VCs Bringing Total Raised This Year to £4.55M

Open banking-powered fintech Currensea has secured £2.4m from leading Venture Capitalists Blackfinch Ventures and 1818 Venture Capital which will be used to accelerate the fintech’s ambitious growth plans.Currensea – the money-saving travel card, which removes the bank fees associated with the foreign exchange by linking directly to users’ existing current accounts – has grown rapidly this year.