Published

Mashum Mollah

CEO at Blogmanagement.io

Bitcoin is the oldest and the greatest of all the Cryptocurrencies. They have the highest market capitalization and are far ahead of its rivals. see more

Mashum Mollah

CEO at Blogmanagement.io

-Will Bitcoin Fail in the future? see more

Mashum Mollah

CEO at Blogmanagement.io

How to Get a Credit Card for Your Startup Business see more

Mashum Mollah

CEO at Blogmanagement.io

Bitcoin is the greatest Cryptocurrency in terms of market capitalization. This is also the oldest Cryptocurrency. Millions of people are using Bitcoins to conduct their business transactions. see more

- 08:00 am

TreviPay, a leader in global B2B payments and invoicing solutions, today announced the signing of a definitive agreement to acquire payment platform Apruve. Apruve offers a robust suite of payment solutions for global enterprises that will complement and expand on TreviPay’s existing order-to-cash technology offerings, merchant invoicing solutions, and the geographical reach of TreviPay’s existing B2B networks. TreviPay has experienced unprecedented demand from global enterprise buyers and sellers resulting in 30% organic growth in 2022, and this acquisition furthers TreviPay’s plans to expand its order-to-cash technology offerings and B2B payment network. This acquisition builds on TreviPay’s recent purchase of Baton Financial Services.

“TreviPay provides payment and invoicing solutions for a number of leading manufacturers and OEMs; the acquisition of Apruve will accelerate our advancement in the technology manufacturing vertical and expand our geographic reach into key Asian markets,” said Brandon Spear, CEO of TreviPay. “In Apruve, we have found a team that approaches the market in a likeminded way and shares our vision of simplifying the way B2B suppliers get paid. We anticipate a seamless transition as Apruve brings their customers to TreviPay, and as we continue to provide innovative ways for B2B customers to buy more with invoice-based purchasing.”

TreviPay offers tailored payments and invoicing networks responding to the needs of businesses of all sizes. The TreviPay networks automate the order-to-cash process with omni-channel checkout options, localized B2B invoicing engineered for global expansion, managed receivables and fraud and risk management. TreviPay, which boasts 90,000 buyers and 80,000 seller locations globally, empowers merchants and suppliers to create more profitable and loyal trading relationships.

“We are thrilled to join TreviPay, a global leader in optimizing order-to-cash processes,” said Michael Noble, CEO of Apruve. “Our teams have tremendous synergies and will more efficiently go to market together in the technology manufacturing vertical.”

All Apruve personnel will be retained and Apruve clients can expect uninterrupted service from the same teams. The financial terms of the transaction will remain confidential.

“Looking ahead, I am energized by the opportunities for TreviPay to continue solving challenges in B2B invoicing and payments in a number of industries,” said Spear. “Following a global digital transformation trend that was accelerated by the pandemic, B2B industries are focusing attention on how money flows in the B2B ecosystem. We are helping B2B merchants in manufacturing and many other industries to digitize the more complex payments and invoicing processes for their business buyers.”

Related News

Craig Brightly

Head of Sales at Trust Payments

Deferred delivery transactions see more

- 09:00 am

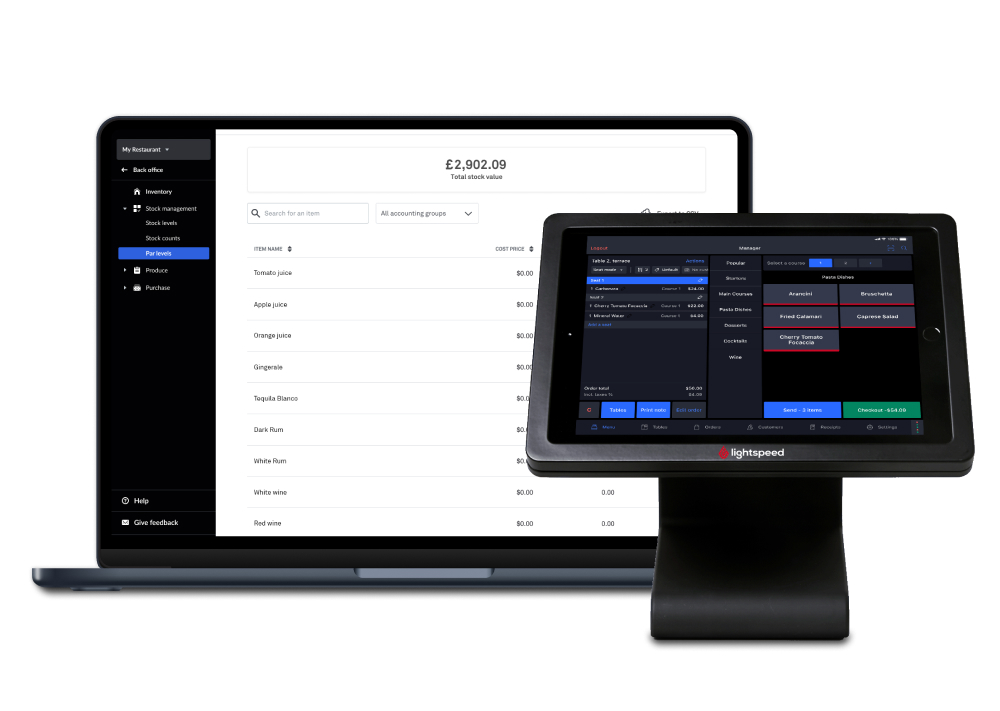

Lightspeed Commerce Inc., the one-stop commerce platform for merchants around the world to simplify, scale, and create exceptional customer experiences, today announces the launch of its new product, Lightspeed Inventory, which is fully integrated into the Lightspeed Restaurant solution.

The new tool offers restaurants greater visibility and control over their stock, allowing managers to steadily cut costs through the acceleration of inventory management processes and the reduction of food waste – an endemic issue that costs the UK hospitality industry a staggering £3.2 billion a year.

Built with solid real-time stock and wastage reporting, Lightspeed Inventory seamlessly allows restaurants to monitor and record stock usage in real-time to make informed business decisions. Businesses can then adjust their orders accordingly to minimise the financial impact of waste, should goods consistently be left to spoil.

The platform also allows for the scheduling of recurring orders and automatic replenishment of ingredients up to restaurants’ desired stock level. Staff can reduce the hours spent on the administrative side of inventory management processes and focus on serving guests instead.

“Inventory allows us to have an accurate stock count across our five franchised locations as well as our sales channels. We’ve got a three-way kind of interaction with our customers: through the app, on the retail side in the shops and when having a glass or bottle in the shop,” said Wieteke Teppema - Commercial Director at Drop Wine.

“We have our in-house sales and then our app sales, which are digital. Being able to have these two separate sales points speaking to each other, and kind of amalgamate the sales data, makes Lightspeed a very powerful tool.”

Additionally, Lightspeed Inventory offers menu pricing suggestions and calculates the appropriate price of each item on their menu, based on the cost of the ingredients ordered – as showcased by Lightspeed’s Food Cost Calculator. This ultimately leads to creating more profitable menus.

Restaurants are then free to track these metrics throughout the menu writing process, from pricing individual ingredients to creating recipe instructions – which can be set with exact quantities to avoid error.

Adrian Valeriano, SVP & MD EMEA, Lightspeed, said:

“At a time when food and energy costs are soaring, restaurants are looking at how they can best streamline business operations to reduce outgoings – before resorting to harsher strategies such as reducing staff or limiting opening hours.”

“The aim of our new Inventory Management solution is to allow customers of Lightspeed across the UK to have ultimate control over their stock, creating an opportunity for them to operate at peak efficiency – with minimal waste of time, food or money.”

Related News

- 06:00 am

For modern consumers, the Klarna icon has become a familiar sight when shopping online. Offering the option to spread the cost of purchases interest-free, its innovative products have enhanced our ability to buy now and worry about how to pay later.

So, it’s no wonder companies like Viva Wallet are eager to partner with Klarna, especially in the run-up to the festive period. We look at the newest fintech partnership and the impact it will have on our holiday spending.

A modern fintech marriage made in heaven

In 2022, the average consumer is heavily reliant on technology to facilitate their purchasing. According to Oberlo, around 2.14 billion of us shop online, with that number growing rapidly year after year. It’s convenient and accessible, and thanks to options like Klarna, it’s possible to spread the cost too.

Thanks to technology, we can do this from anywhere. Many modern-day shoppers see Klarna and other digital tools as essential to their online retail experience. ExpressVPN’s tech survival kit shows just how reliant we are on technology when it comes to everyday tasks like shopping. In the same way, a portable Wi-Fi hotspot allows for on-the-go shopping without draining valuable data, Klarna and its counterparts mean that shoppers can complete their festive gift-buying without emptying their bank balances.

It’s little wonder, then, that cloud-based neobank Viva Wallet has recently announced a partnership with them, with the intention of accommodating a greater number of consumers. It will use Klarna to grow its existing portfolio of payment options.

Interestingly, Klarna’s buy-now-pay-later model will be accessible both to those who shop online and in-store. The partnership will ensure thousands of merchants across Europe can offer customers a more diverse line-up of payment options – and the chance to pay via a series of instalments rather than all at once.

This will provide greater flexibility for consumers and arguably make the merchants offering it an attractive prospect for shoppers who’d rather spread their costs. Certainly, it will be a tantalising option for business owners, with Klarna’s 150 million active global users and two million transactions per day attesting to its appeal.

Diverse payment options

Source: Unsplash

This marriage of fintech giants means Viva Wallet will now offer customers over 30 payment options to choose from. These range from major international payment providers to more locally based payment schemes.

Interestingly, Viva Wallet will use its POS app to turn Android phones into innovative card terminals, enabling payments with Klarna to be supported when shopping in-store as well as online. A smart checkout will also be available to e-shops, empowering users to pay when and how they choose to.

Options will include the ability to pay in three instalments, in 30 days, or at the point of purchase, and there will also be finance products covering terms of anywhere between three and 36 months.

According to Viva Wallet’s eCommerce director, Alexandros Pappas, the two companies hope this partnership will help them achieve their common goals; namely, to make payments simple, frictionless, and tailored to the modern consumer. As schemes go, it’s ambitious, yet we can’t help but feel like we’re looking at the future of the online payment industry.

Related News

- 01:00 am

New data from the 2022 Cyber Security Insights Report from leading global intelligence and cyber security consultancy S-RM has found that cyber security budgets are set to increase an average of only 11% over the next 24-36 months. With high levels of inflation, this means UK organisations will effectively be facing cuts to their cyber budgets to 2025, with 13% of those surveyed across the UK expecting budgets to decrease over the next 24-36 months.

S-RM’s report also shows that, on average, cyber security spending represents over a quarter (26%) of organisations’ annual IT budgets in 2022. The research also marks a 5% year-on-year average growth in cyber security budget, when compared to survey responses in 2021.

Heyrick Bond-Gunning, CEO of S-RM, comments:

“We’ve seen a lot of market disruption over the past year, but one thing that hasn’t changed is the importance of investing in cyber security to not only protect your business, but also to foster future growth.

“However, our findings show that, after inflation is taken into account, budgets are set to barely increase in the coming years, and that is a point of worry as cyber threats increase, insurance coverage shrinks and compliance considerations continue to evolve. Decision makers need to be proactive in defending against cyberattacks, or they could find themselves racing to mitigate damage and cost in the future.”

Factors driving spend

Some of the key reasons for budgetary increases included:

- Maintaining security against evolving threats (40%),

- Responding to changes in regulations and compliance (38%)

- Increased focus on cyber security at board level (38%)

The research also found that smaller companies are more likely to allocate between 40-60% of their IT budgets to cyber security. 20% of companies with an annual revenue of between $500m and $1bn currently allocate this proportion of their IT budget to cyber security. This compared to just 10% among companies with $1bn-$5bn in annual revenue.

Jamie Smith, Board Director and Head of Cyber security at S-RM added:

“Cyber security is an issue that exists beyond just board level, and resources must be allocated throughout a business to best defend against malicious intent from threat actors.

“Cyber security departments cannot achieve the results they need to if budgets don’t afford them the necessary resources. The fact that smaller, agile businesses are dedicating more resource to this area should be a clear sign for larger companies not to let investment get tied up in bureaucracy.”

UK-US comparison

The average percentage of organisations' IT budgets allocated to cyber security across the UK (25%) and the US (26%) are fairly consistent. However, the average predicted increase to cyber security budgets over the next 2-3 years differ slightly across markets surveyed, with the UK reporting an anticipated increase of 8%, and 14% across the US.

A higher proportion of UK decision makers anticipated that cyber security budgets may increase in the future due to the need to respond to changes in regulations and compliance (42% in the UK vs 35% in the US). In comparison, a higher proportion of US decision makers felt that cyber budgets might rise due to their organisation increasing its focus on resilience (43% in the US compared to 29% in the UK).

Related News

Tage Borg

Chief Technology Officer at Scrive

In the first half of 2021, criminals stole a total of £753.9 million through fraud, which represents a 30% increase compared to H1 2020. see more