Published

- 01:00 am

Rapid Finance, a market leader in helping small businesses find sustainable and customized financing solutions through a fast and simple application process, announced the availability of its new standalone Software as a Service (SaaS) Regtech module, SMB Disclosure Service, to enable business lenders and financing companies to quickly and easily produce compliant disclosure statements at a state-by-state level.

California has passed the first state disclosure law (SB 1235) for commercial finance providers and that law becomes effective today, while New York is expected to require similar disclosure in 2023. Utah and Virginia also have passed commercial finance disclosure laws. The intent of these laws is to help small business owners be better equipped to understand the costs and benefits of commercial financing offers and to compare different offers to find the best financing solution to meet their specific needs.

For business lenders and commercial financing companies, they will need the ability to produce compliant disclosure statements that meet each individual state’s requirements as part of the application process. With SMB Disclosure Service, Rapid Finance has leveraged application programming interface (API) technology to allow organizations to easily interface the module with their existing origination platforms, accept a variety of inputs, and provide the calculated values to be shown within the correct disclosure statements. Additionally, commercial finance providers have the option of HTML or PDF formats to send the required disclosures to their business clients, with a user interface available to perform some of the more complicated calculations (such APR) and permit providers to use the calculation tool to generate the required disclosures as needed. The SMB Disclosure Service is an offering from Rapid Enterprise, the company’s business segment geared towards developing solutions for financial providers that help small businesses.

“Rapid understands the friction that these new compliance requirements could present for commercial finance providers and brokers,” said Will Tumulty, CEO of Rapid Finance. “With the development of SMB Disclosure Service, we are equipping small business finance companies with the tools they need to help ensure that they can continue to efficiently and compliantly meet the financing needs of their customers.”

Related News

- 02:00 am

Fintech Paylink Solutions has raised over £1,350 for tech charity Computer Aid and mental health charity Mind with its latest Christmas-themed fundraiser.

Mind offers advice and support to empower anyone experiencing a mental health problem. Computer Aid provides access and education to technology to create better learning environments across more than 100 countries.

Paylink Solutions’ Christmas market was the latest of three events this year in aid of both charities, taking the total fundraising to nearly £3,000.

It comes after Paylink Solutions’ CEO Susan Rann took part in the Battersea Half Marathon in November while a company-wide bike-a-thon took place in July.

Joe Clarke, Head of Operations at Paylink Solutions, said: “We’re extremely proud to have raised as much money as possible for two vital charities throughout 2022.

Mental Health is something which is really important at Paylink. As well as raising vital funds for Mind, we wanted to increase awareness around mental health in our workplace.

“As we are a fintech company, we also wanted to raise funds for a tech-based charity too. Computer Aid has helped over 14.5 million people worldwide and we share their messaging, as we also believe technology has become a necessity for education as it creates a better learning environment.”

Related News

- 06:00 am

Chargebacks911, the leading global dispute specialist powering chargeback remediation for large eCommerce businesses and financial institutions, recently announced the release of their 2023 Geek’s Guide to Chargebacks, a comprehensive merchant resource concerning chargebacks and how customer disputes can disrupt businesses this holiday season.

“With the holiday shopping season well underway, we're already seeing American spending approaching pre-pandemic levels,” said Monica Eaton, founder of Chargebacks911. “Merchants should be aware of the rise in chargebacks and other transactional disputes that often accompany card-not-present transactions, particularly during the holidays.”

“While some companies might have automated chargeback solutions in place, many of these products don’t account for the seasonality of shopping trends,” said Wright. “Systems without machine learning typically can’t adapt to the temporary spike in sales during the holidays. That means more fraud will get through, causing a surge in chargebacks 30-60 days later.”

Related News

- 08:00 am

Facctum™, a risktech company specialising in cloud-delivered enterprise risk decisioning technology, announces today the launch of an open API for FacctView™, its sanctions and anti-money laundering (AML) screening platform. The open API will provide institutions of all sizes with access to high-performance compliance controls that can be integrated quickly into their anti-financial crime frameworks.

Facctum developed FacctView as a reaction to the operational challenges caused by rapidly ageing sanctions and AML technology stacks. Traditional on-premises screening software has struggled to keep pace with high-velocity regulatory environments and the consequent increases in workload. In contrast, the technology infrastructure of FacctView provides fast and effective screening that delivers improved risk detection and operation efficiencies. The open API released today is already used in FacctView in a Software-as-a-Service (SaaS), allowing institutions to scale capacity and latency to their operational needs.

Having established FacctView as a SaaS solution, today’s launch provides customers, risktech vendors and payments platforms with new pathways to integrate core Facctum technology into their workflows and expands the range of cloud-enabled solutions for financial crime risk management available through Facctum.

KK Gupta, founder and CEO of Facctum, notes, “Countering financial crime risks has never been more important. However, the challenges of managing these risks effectively and efficiently have become exponentially more difficult. Rapidly evolving risks, new regulatory obligations and the high velocity of change are pushing traditional sanctions and AML tools to the limits. A new approach is needed, one that lowers the speed to closing down risks whilst also delivering operational efficiencies. Today’s open API launch for Facctview is intended to provide rapid, flexible and cost-free access to enterprise-grade technology with a proven pedigree in risk detection.”

Related News

- 09:00 am

Today, Microsoft announced a 10-year strategic partnership with the London Stock Exchange Group (LSEG), a world-leading financial markets infrastructure and data provider. Following LSEG’s acquisition of Refinitiv, a market leader in data services, LSEG has differentiated itself in the market with an end-to-end proposition across trading, execution, data and analytics solutions. Together we look forward to empowering the future of financial markets by delivering next-generation data, analytics and workspace solutions that transform how firms connect, research, analyze, collaborate and transact across the entire financial markets value chain.

Organizations across the capital markets value chain are facing an increasingly complex operating environment with macroeconomic headwinds, stricter regulatory controls and traditional revenue sources becoming more challenging. These conditions are putting greater pressure on firms to reinvent business models and do more with less. However, their legacy platforms, siloed information, limits on scale and data overload hinder their ability to deliver the best client experience, insights and tools. This requires a digital transformation approach underpinned by modern cloud and AI technology. LSEG has already started to address these issues for their customers, and through this strategic partnership, we will accelerate that transformation.

Additionally, capital markets run on data and by investing in the co-creation of new solutions, we will capitalize on the incremental opportunity we have together and support clients in their transformation.

“This strategic partnership is a significant milestone on LSEG’s journey towards becoming the leading global financial markets infrastructure and data business and will transform the experience for our customers,” said David Schwimmer, CEO of London Stock Exchange Group.

Democratizing financial markets data

Foundational to the partnership will be the digital transformation of LSEG’s technology infrastructure and data and analytics platforms onto the Microsoft Cloud. This will include Refinitiv platforms that power over 40,000 financial institutions in 190 countries with data, analytics and insights across millions of active time series databases, daily evaluations, exchange trades and derivatives, equity quotes and significant research on public and private companies.

With this foundation, we will co-create an open, centralized, financial data platform enabling seamless data democratization, collaboration and new monetization opportunities across the financial services ecosystem. This will unlock new offerings for customers to generate more sophisticated and timely insights.

Delivering next-generation workspace experiences

The financial markets community spends a large part of their day working across multiple terminals and platforms, disparate data sets and siloed analytical tools with limited collaboration capabilities. To enhance productivity and time to value, we will work together to co-create an open all-in-one data, analytics, workflow and collaboration solution that will reimagine client experiences for the first time.

This will be realized through the next generation of LSEG Workspace on Microsoft Teams platform that will support in-application rich experiences for understanding trends and analyzing risk and building scenarios while meeting strict security, privacy and compliance requirements.

Additionally, with enhanced Excel integration, customers will be able to create financial models, run data analytics and visualizations using LSEG content delivered in Excel and work seamlessly between LSEG Workspace and Microsoft 365.

The initial focus will be on delivering interoperability between LSEG Workspace and Microsoft Teams, Excel and PowerPoint with other Microsoft applications and a new version of LSEG’s Workspace, accessed entirely within the Microsoft 365 suite, to be added in the future.

Creating intelligent analytic solutions

Today, firms can experience duplicated costs and complexity in harnessing the full power of analytics to unlock models that garner intelligent insights for business decision making. To address this need, we will work together to co-create next-generation analytics and modelling solutions which are cloud-based and will enable powerful model construction, validation, diagnostics and deployment using Microsoft Azure AI, Synapse, Power BI, Excel and Teams with LSEG’s advanced analytics and modelling capabilities.

It will empower investment bankers, traders, wealth and asset managers, as well as risk, compliance, strategy and advisory managers to run hyperscale analytics models against data efficiently and seamlessly. Built on top of Azure Synapse, Azure Machine Learning and Azure Purview, the new cloud-based analytics and modelling solutions will enable users to expose, share and collaborate across proprietary and third-party data securely and confidently, meeting stringent data privacy, security and compliance requirements, eliminating the need to move or copy the data to another location (which can be expensive, time-consuming and introduce security and compliance concerns).

Additionally, quantitative analysts, data scientists and engineers will be able to build custom models to drive their analysis and decision-making seamlessly. Both can help organizations spend less time, money and effort building and maintaining their own infrastructure.

“Bringing together our leading data sets, analytics and global customer base with Microsoft’s comprehensive and trusted cloud services and global reach creates attractive revenue growth opportunities for both companies” said David Schwimmer, CEO of London Stock Exchange Group.

Additionally, we will explore the development of digital market infrastructure based on cloud technology, with the goal to transform how market participants interact with capital markets across a broad range of asset classes.

This partnership represents a significant milestone for the future of financial markets and builds on Microsoft’s investments across capital markets and more broadly across the financial services industry. Microsoft estimates this partnership, and broader market opportunity, could generate an additional $5 billion in revenue for the company over the next 10 years, including the $2.8 billion minimum spend commitments from LSEG for cloud services and support.

Microsoft will also purchase an approximately 4% equity stake in LSEG through the acquisition of shares from the Blackstone/Thomson Reuters Consortium.

“We are delighted to welcome Microsoft as a shareholder. We believe our partnership with Microsoft will transform the way our customers discover, analyze and trade securities around the world, and create substantial value over time. We look forward to delivering on that potential,” said David Schwimmer, CEO of London Stock Exchange Group.

Related News

- 08:00 am

Linedata, a global provider of asset management and credit technology data and services, announced today that Cramer Rosenthal McGlynn, LLC (“CRM”), a US-based value equity manager serving institutions and individuals, chose Linedata to implement a highly adaptable operational model at CRM that positions it for growth, while at the same time keeping in place unique capabilities for the firm.

CRM has implemented robust investment operations that aim to maximize efficiency and mitigate risk by reducing manual processes spread across multiple internal systems, which has been in place for several years, including through the previous vendor. This has allowed CRM to reduce operational costs by more than 50%, including the consolidation of systems and simplifying workflows across Linedata Longview OMS suite, trading, pre- and post-trade compliance, reporting, and operations.

“Our relationship with Linedata has been a true collaboration from the start that has positioned our business for long-term growth,” said Steven Fellin, Chief Financial Officer at Cramer Rosenthal McGlynn. “We continue to work with Linedata with the goal of integrating additional innovative solutions to further streamline our investment processes from idea generation through trade execution.”

Leveraging Linedata’s Asset Management Platform (AMP), CRM configured a comprehensive, easy-to-understand process to manage their account base, facilitate onboarding, and handle trading instructions remotely. The CRM team gains access to new capabilities quickly with continuous integration and delivery (CI/CD), and non-traditional users, such as risk managers and senior management who need to monitor business at a higher, more-macro level, can now do so via Linedata Accumen.

“In today's evolving investment landscape, your asset management technology platform must be adaptable to keep up with the everchanging environment,” added Bob Moitoso, Head of Asset Management North America at Linedata. “We are thrilled to be a strategic partner to Cramer Rosenthal McGlynn, bringing our technology expertise and flexible solutions to improve their operations so they have more time to spend focused on their clients and ultimately driving their business forward.”

Related News

Terry Rourke

Senior Product Marketing Manager at ACI Worldwide

In today’s fast-paced, digital-first world, it doesn’t make sense to have a mobile app without payments. see more

- 04:00 am

Computop, a leading global payment service provider, and ESW, the world’s leading direct-to-consumer (DTC) e-commerce company, announced today that the companies have extended their strategic partnership in several key global markets. Building on its nine-year relationship with Computop in the UK, ESW will now also use its Paygate payment platform for local acquiring within the U.S., Canada, and Australia, with expansion into future markets already planned.

The move reflects growth in the global e-commerce market, with sales expected to exceed $5 trillion worldwide in 2022, and predicted to continue to grow over the next few years. To support this ongoing growth, the need for a streamlined, secure payments process that includes consumers’ preferred payment methods is critical to drive conversions and reduce abandonments for all e-commerce operations.

Together ESW and Computop empower a seamless online payments experience for ESW’s brand and retailer clients, processing cross-border transactions for ESW globally including the UK, U.S., Canada, and Australia. With this extended partnership, Computop’s Paygate platform will now also process ESW’s payments domestically in North America and Australia, including all major credit cards and key digital payment methods (DPMs) used in these countries.

Computop Paygate facilitates payments with maximum security, enabling connections to more than 350 payment methods and acquirers domestically and globally. With Paygate’s connections to many acquirers, brands like ESW have the flexibility to provide their customers with what’s needed for consumer payments in each geography, and the domestic acquiring offered translates into lower costs and increased conversion rates for merchants. Computop Paygate is a single platform that can be easily and cost-effectively used for both national and cross-border transactions, making it well-suited for ESW’s growing global and domestic needs as it provides a comprehensive, end-to-end shopping solution for brands and retailers worldwide.

Jason Macklin, Vice President of Payments for ESW, commented, “A frictionless, familiar, and secure checkout process is one of the foundational components underpinning a successful e-commerce experience. Globally, consumers’ preferred payment options vary significantly, and by expanding our partnership with Computop we can now deliver the localised, preferred payment options that engender trust, help ensure repeat customers and grow customer lifetime value.”

“The significant expansion of ESW’s work with Computop into new countries is a testament to the strength of our long-term relationship in the UK and the Paygate global payment platform,” commented Philip Plambeck, Senior Vice President, UK Sales, Computop. “We are excited to extend our work together to facilitate ESW’s global payment orchestration for these key markets and look forward to future expansion opportunities.”

Related News

- 03:00 am

Continued growth in merchant outlet and EFTPOS terminals numbers worldwide strengthens coverage of all schemes, but acceptance of the largest players differs significantly between regions

82% of payment terminals now accept contactless

While 2021 saw long periods of lockdown and continued retail closures, the second year of the pandemic was overall a positive one for global card acceptance. A controversial view that cashless payments are “more hygienic”, combined with government mandates and incentives such as tax breaks provided a boost. RBR’s study Global Payment Cards Data and Forecasts to 2027 found that the number of card-accepting merchant outlets grew by 2% to a record 88 million, with the number of EFTPOS terminals increasing at an even greater rate, up by 5% to 134 million worldwide by the end of the year.

Contactless card acceptance jumped upwards to cover 82% of terminals. This reflected increased preferences for low-touch payment methods during the pandemic.

UnionPay continues efforts to build acceptance outside of Asia-Pacific

UnionPay remains accepted at more outlets than any other scheme. The majority of the world’s 72 million UnionPay-accepting outlets are, however, concentrated in its home market of China and the wider Asia-Pacific (AP) region. The scheme’s reach in other parts of the world is established but falls short of its coverage in AP; it is accepted at three-quarters of outlets in the Americas and over half across Europe.

RBR’s study identified a surge in UnionPay acceptance in the Middle East and Africa (MEA). Much of this growth was in Saudi Arabia, where there was increased UnionPay card issuance by the country’s banks amid wider efforts to attract Asian tourists to the country.

Global number of merchant outlets by scheme, 2021 (millions)

Source: Global Payment Cards Data and Forecasts to 2027 (RBR)

Outside of China, Visa and Mastercard accepted at 96% of merchant outlets

Visa and Mastercard can be used at 75% of outlets globally, placing the pair joint fourth in terms of acceptance, behind Discover and JCB, which benefit from wider acceptance in Asia-Pacific. If China is removed from the total, however, coverage stands at 96%, unchanged since 2020.

There remain a few European countries that have lower Visa and Mastercard acceptance levels. This is the case in Germany, for example, where high merchant fees and preferences for the domestic scheme push down acceptance. In the Netherlands, sub-brands V PAY and Maestro are, somewhat unusually, more widely accepted than the main brands, but the situation there is set to change as issuers migrate to Visa and Mastercard from 2023.

Local payment methods are challengers to international schemes

RBR forecasts that the number of EFTPOS terminals globally will rise to 165 million by 2027, spread across 109 million merchant outlets. More countries are expected to follow the example of Greece, where card acceptance has jumped upwards in previous years thanks to a mandate for businesses to install EFTPOS terminals.

In some countries, card acceptance is expanding rapidly but this is not translating into surges in card expenditure due to competition from alternative cashless payment methods. Kazakhstan is seeing triple-digit growth in EFTPOS device numbers but these accept domestic QR code payments as well as international scheme cards. The former is benefiting the most from the ramp up in terminals.

Daniel Dawson, who led RBR’s Global Card Payments and Forecasts to 2027 research, commented: “The pandemic provided a real boost to global card acceptance across all regions. We could see disruption to future growth, however, if more merchants and consumers opt to transact via QR codes and smartphones, rather than with international scheme cards and EFTPOS terminals”.

Related News

- 01:00 am

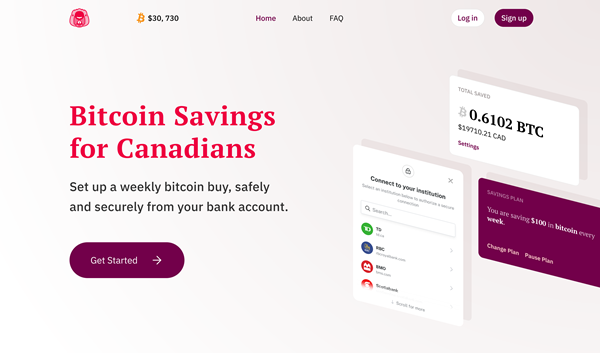

Marking its official launch today, Beaver Bitcoin is a non-custodial exchange that allows Canadians to set up an automatic weekly bitcoin purchase, directly from their bank account. From now until the end of the year customers can try the service for free.

A popular buying strategy that avoids speculation in a volatile market, the goal of an automatic weekly purchase is simple: accumulate more bitcoin over time. Beaver’s chosen method of delivering bitcoin directly to customers adheres to Bitcoin’s core value of self-custody and eliminates the risks associated with custodial exchanges.

“We’ve seen how custodial exchanges can misuse customer funds to engage in highly risky trades. When these exchanges collapse and declare bankruptcy, customers lose everything,” said Aubrey Jesseau, founder and CEO of Beaver Bitcoin. “We see an opportunity to serve Canadians in a way that existing platforms and exchanges have not. We’ve streamlined the experience of buying bitcoin, making it accessible to the next wave of bitcoin adopters in Canada.”

The non-custodial exchange operates by delivering bitcoin to a bitcoin address controlled by the customer, immediately once it is purchased - the exchange never holds bitcoin on behalf of the customer.

An exceptional user experience that appeals to both beginner and seasoned Bitcoiners, Beaver Bitcoin customers can choose their weekly bitcoin buy amount in Canadian dollars, track the status of bank transfers and completed purchases, and pause or cancel their buy at any time. For receiving and holding bitcoin, the company recommends new users try the mobile bitcoin wallet BlueWallet, available in app stores.