Published

- 07:00 am

Nexi, European leader in the digital payment market, has signed a five-year agreement with IBM (NYSE: IBM) to modernise its core payment processing platform with IBM z16 technology and IBM Storage System. The collaboration supports PayTech’s strategic growth plan by accelerating the modernization of services, data and processes so digital channels and applications can be run reliably and securely, to the point of being quantum-safe.

Customer demand for digital banking services is rapidly increasing as regulatory and compliance requirements evolve and we move closer to a cashless society. Nexi is responding by modernizing its technology to help elevate customer experience across its expanding client base which includes more than 1000 financial institutions and more than 2 million merchants. Nexi, together with its partner banks, manages c. 170 million payment cards and c. 29 billion acquiring and transactions across Europe.

The modernization will focus on transforming Nexi's core technology infrastructure that sits at the heart of its business as the foundation for operations and digital payment services. An important part of Nexi’s business strategy is to evolve its technology platform to a hybrid cloud architecture so digital channels and applications can securely run across any technology environment. Under the agreement, IBM will work closely with Nexi to provide the technologies and to add the expertise needed to support the improved efficiency of the group's digital payments services and the growth of its workloads.

"The agreement with IBM is part of our infrastructure modernisation plan and allows us to improve operational efficiency and drive innovation while offering higher levels of resilience and security to respond even more effectively to the ever-increasing needs of customers," comments Giuseppe Dallona, Nexi Group's CIO.

In addition to optimizing technology platforms and improving efficiency, a core objective is to respond even more effectively to the needs of its customers - Individuals, Companies, and Financial Institutions - with digital payment services that are increasingly simple, fast and secure.

Supporting the sustainable growth of Nexi, the IBM z16 is designed with energy efficiency in mind, allowing Nexi to achieve greater performance with less energy used. IBM technologies have steadily improved their energy efficiency, such as increasing the maximum system capacity per KW of a mainframe by more than 100 times in 14 generations. As a result, Nexi may see a reduction in infrastructure energy consumption by 25% and heat dispersion by another 25%. This may help reduce CO2 emissions, boosting the accomplishment of Nexi’s sustainability goals. IBM Storage Systems provide the greatest reliability, improving performance and minimizing space and energy consumption, leveraging innovative Flash technology.

“Thanks to this collaboration, IBM will support Nexi on its growth path by providing resilient, secure and efficient technologies alongside a deep understanding of the financial sector. This will help Nexi accelerate the modernization of digital payments to improve the customer experience while helping reduce the emissions of CO2 to foster a sustainable digital transformation”, says Nico Losito, Vice President, IBM Technology, Italy.

Related News

- 07:00 am

Worldline, a global leader in payment services, is proud to announce that it has been given Top Employer status for 2023 in Europe and Asia-Pacific by the Top Employers Institute, a global authority that recognises excellence in people management.

Recognition endorsing Worldline’s global leadership in HR best practices

Worldline participated in the Top Employer audit to assess its Human Resources best practices and level of long-term commitment and efforts in setting exemplary managerial and people practices within the company.

In 2023, the Institute recognised more than 2,000 Top Employers in over 120 countries/regions across five continents. This is an in-depth external audit of Human Resources and People Management practices. The Top Employers Institute programme certifies organisations based on the participation and results of their HR Best Practices Survey* which covers six HR domains, consisting of 20 topics.

Worldline is proud to be certified in a total of 16 countries. These include Australia, Austria, Belgium, France, Germany, India, Italy, Malaysia, the Netherlands, New Zealand, Poland, Singapore, Spain, Sweden, Switzerland and the Group’s joint venture in Germany, PAYONE, with specific recognition on three best practices: Ethics & Integrity, Business Strategy and Employer Branding.

A new Employee Value Proposition acknowledged

This recognition follows Worldline’s new Employee Value Proposition (EVP) which was built in close cooperation between several departments and Worldliners. The new EVP was defined in response to employee feedback, the business and the market whilst taking into account Worldline’s purpose and ambitions as a business at the heart of the global payment technology industry. It aims to further attract candidates by raising awareness of the employee journey they can expect whilst better-defining applicant targets.

A commitment to improvement

Worldline is highly conscious of encountering fresh challenges in the future, especially within the identified areas where improvements can be made and as such continues to deploy dedicated action plans.

“When you join Worldline you enter into a technology company that offers a unique digital, business, international and purpose experience. I am very proud of all of the countries included in this year’s prestigious Top Employer lists. Our inclusion is a demonstration of our strong, long-term people focused vision. Worldline’s values of Innovation, Cooperation, Empowerment and Excellence resonate in everything we do, from our long-term PayTech strategy to the smallest of daily interactions between colleagues.” says Philippe Mareine, Chief People Officer and Head of Corporate Digital Acceleration at Worldline.

“Exceptional times bring out the best in people and organisations. And we have witnessed this in our Top Employers Certification Programme this year: exceptional performance from the certified Top Employers 2023. These employers have always shown that they care for the development and well-being of their people. By doing so, they collectively enrich the world of work. We are proud to announce and celebrate this year’s group of leading people-oriented employers: the Top Employers 2023.” said Top Employers Institute CEO David Plink.

Related News

- 09:00 am

Global identity verification provider ID-Pal has named Sara West, an industry veteran in the B2B software and payments space, as the company’s new commercial director.

West will also become a member of ID-Pal’s Executive team and in her new role will be responsible for the strategic development of ID-Pal in the UK market, where ID-Pal formally launched in 2022, as well as support the delivery of ID-Pal’s ambitious overseas expansion plans. West has a proven track record of leading commercial teams to manage and grow strong client partnerships, delivering high-value revenue growth and quality commercial engagement and brings over 20 years of expertise within the technology sector to ID-Pal.

Her appointment is driven by increased demand for ID-Pal’s award-winning identity verification solution in the UK, which now attributes to over 30% of ID-Pal’s revenue.

West joins ID-Pal from W2 Global Data, where she served as Chief Commercial Officer since 2017 and was also appointed to its Executive Board of Directors in 2019. Before W2, West, who studied Marketing & Business at Harper Adams University, held positions at FIS, as Head of Card Sales Debit and Prepaid and at allpay Limited, as Card Services Director. Her previous experience also includes over eleven years at digital security company Oberthur Technologies, where she had commercial responsibility for a number of key Banking and Pay TV clients as well as securing new client opportunities in the banking sector.

West has established herself as a true industry connector, having started an Industry Networking Group ‘Harben & West’ which won an Industry Contributor Award from the Payment Association as well as more recently involved in establishing ‘Payment Industry Group’. She is passionate about developing relationships amongst peers within the payments and fintech space as well as mentorship to enrich not only industry members careers, but the future of the industry itself.

Her move comes at an exciting time for ID-Pal, following a year of rapid growth, with the company seeing both its global customer base and global team doubling in size in 2022, following the completion of a Series A funding round in July, led by Inspire Investments.

On joining ID-Pal as commercial director, Sara West said:

“I am thrilled to be joining the team at ID-Pal. The growth it has seen in just 12 months pays testament to its market-leading proposition: In a world that is increasingly digitalized and aware of the risk of fraud, providing a simple, secure and convenient identity verification solution is powerful. This is an exciting new chapter for the company and I look forward to leading ID-Pal’s growth globally and driving it to the next level of commercial success.”

On the announcement Colum Lyons, founder and CEO of ID-Pal, comments:

"The strength of our offering delivered impressive results for us in 2022. Appointing Sara to lead our commercial team will allow us to continue this momentum under her strategic direction and extensive experience, enabling us to support more organisations globally with our world-class identity verification technology.”

ID-Pal’s ISO 27001-certified identity verification solution, is a fully customisable off-the-shelf solution that allows organisations of any size, and in any sector, to verify identities and addresses within seconds. Configurable in any language, across 200 countries and jurisdictions, ID-Pal currently serves over 30 sectors globally, providing Anti-Money Laundering and Know your Customer (KYC) compliance as either a standalone or integrated solution.

Related News

- 01:00 am

Bottomline, a leading financial technology provider for banks and businesses around the globe, has announced a new line of fraud defence for companies. Now available to companies directly, Bottomline’s Confirmation of Payee (CoP) for Business helps better protect companies against potential fraud by verifying the owner of the bank account receiving funds.

Authorised push payment (APP) fraud losses reported by UK Finance stood at £583 million for 2021 (up 22% from 2020) and £249 million for the first half of 2022. “While the UK’s Payment Systems Regulator (PSR) has already mandated that financial institutions incorporate CoP into their consumer banking services to help prevent APP fraud, we believe more can be done,” said Colin Swain, Bottomline’s Global Head of Platform and Product Transformation. “Using our API first technology, companies of all sizes can now better safeguard their own business payments using CoP for Business.”

As fraud continues to plague banks, companies and consumers, Confirmation of Payee frees up needless manual effort by giving companies a new tool to check payments are directed to legitimately owned bank accounts. Closing another gap against fraudsters, instant and batch transactions are automatically verified via direct-to-source bank account checks rather than via intermittently updated third-party bank account databases.

New to the market and one of few direct-to-business offerings, CoP for Business offers a viable alternative to traditional bank account verification methods. It provides over 90% coverage of personal and business accounts so finance teams can feel confident they are dealing with the genuine account holder, stopping fraud in its tracks and avoiding the costly headache of clawing back incorrectly processed or irrevocable payments.

“In 2022, 29% of companies interviewed in the Business Payments Barometer admitted they were victims of fraud, claiming a 10% increase in fraud losses versus 2021. So, beyond what banks offer, it’s on companies to ensure their payments are safe and legitimate. CoP for Business gives them peace of mind and the arsenal needed to wage war on financial fraud,” continued Swain. “Uniquely, CoP has over 90% bank account coverage, meaning fewer manual checks for corporate fraud teams. With the PSR forecasting CoP bank account coverage to extend beyond 99% by October 2023, the benefits for companies are clear to see.”

Related News

- 04:00 am

Newly launched Filipino digital bank GoTyme Bank has partnered with global cloud banking platform Mambu to deliver an innovative digital banking solution that is aiming to improve access to high-quality financial services for Filipinos.

Singapore-based Tyme Group, which has partnered with Gokongwei Group to launch GoTyme Bank in the Philippines, has had a long-standing relationship with Mambu, with the organisations working together for many years in South Africa, where Mambu powered South Africa’s TymeBank to transition into a fully-fledged digital bank.

Nate Clarke, President and CEO of GoTyme Bank, said: “With the knowledge gained from transitioning TymeBank in South Africa to a fully digital bank, we knew we needed GoTyme Bank to be ‘born in the cloud’ in order to have the capacity to scale efficiently, so Mambu’s SaaS cloud-native, API-first banking platform was the obvious choice for us. We understood what the Mambu platform was capable of and we were confident it would enable us to ‘lift and shift’ the TymeBank digital bank concept from South Africa to the Philippines, a market very similar in some ways, but very different in others, particularly in terms of the regulatory landscape.”

In a similar approach to TymeBank in South Africa, GoTyme Bank in the Philippines offers next-level digital banking services via kiosks set up in retail outlets belonging to Robinsons Retail Holdings Inc under the Gokongwei Group. GoTyme Bank will have 500+ kiosks in operation by the end of 2023. These GoTyme Bank kiosks, which will be opened right across the country, will enable access to secure, convenient and high-quality financial services to the millions of Filipinos who are currently excluded from the formal banking system.

Continued Clarke: “Access to electronic payments has radically improved over the past few years in the Philippines, but access to basic accounts is only the beginning of what is required. Today, less than 3% of Filipinos have access to affordable credit such as a credit card, less than 3% have access to insurance, and less than 3% have access to high-yield investments such as stocks. Every year, millions of smart, employed Filipinos fall short of their potential because they do not have access to high-quality banking products. At GoTyme Bank, we are here to unlock the financial potential of all Filipinos through next-level banking.”

Werner Knoblich, Chief Revenue Officer at Mambu, added: “TymeBank in South Africa has proven to be incredibly successful in serving a customer base with similar levels of financial exclusion as the Philippines. Mambu and Tyme Group’s prior experience working together meant that we truly hit the ground running in the Philippines, and didn’t need to ‘reinvent the wheel’ in a lot of instances. The result is an innovative, unique and customer-centric digital bank that has been designed specifically to meet the needs of Filipinos. Like the Tyme Group, our focus with everything we do is making banking better for everyone and improving access to financial services, so this partnership is rewarding on many levels.”

Products and services on offer to customers via GoTyme Bank at launch include a free Visa debit card for in-person and online purchases, bank transfers via the mobile app, and a valuable rewards program, Go Rewards, via partner Robinsons. Enabling digital transactions is of particular importance to Filipino customers, with the Philippines identified as one of the world’s leaders in the digitisation of financial services, as reported by the Philippine News Agency. This increase in digital transactions has been driven both by the pandemic and by Bangko Sentral ng Pilipinas (BSP)’s commitment to reaching 50 per cent of total transactions being digital by 2023.

Christopher Bennett, Chief Technology Officer at GoTyme Bank concluded: “With the Mambu / Tyme Group digital banking model now proving successful in two countries, planning is underway to launch similar digital banks in other parts of Asia. Powered by Mambu’s world-class cloud banking platform, we want to see our customer-centric digital banking concept have a positive impact on financial inclusion right across the Asia Pacific region.

“By utilising Mambu’s cutting-edge platform and leveraging the country-wide reach of the Gokongwei Group’s ecosystem, GoTyme Bank has the unique opportunity to become deeply integrated into the lives of Filipino consumers.”

GoTyme Bank will roll out a number of innovative new products and services through the banking app in the coming months.

Related News

- 05:00 am

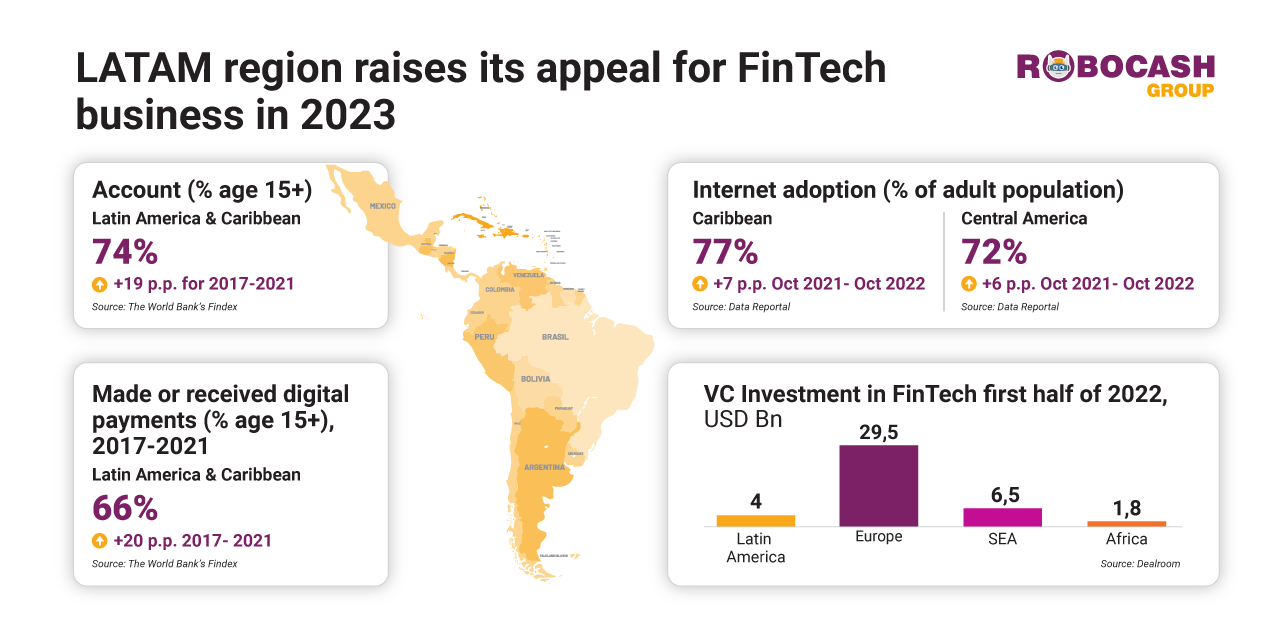

The fintech services in Central and Latin America are already experiencing a real boom in terms of consumer demand for fintech solutions. The unique demographic situation gives a way to a large prospective audience of consumers that use fintech services. Latin America and the Caribbean collectively have 669 million population, a high level of urbanisation that contributes to maximum fintech penetration (82.5%), and an average age — 31 years, corresponding to the period of maximum consumer activity.

Internet penetration is rapidly increasing in Central America and the Caribbean region. Comparing the October 2022 figures to the results of 2021, internet penetration increase in the Caribbean was +7 p.p. (to 77%), and in Central America - +6 p.p. (to 72%). Other regions are showing a much slower pace of development: Central Asia - +4 p.p., Southern & Northern America and Western Asia - +3 p.p.

Latin America & Caribbean show the fastest growing pace in the number of made or received digital payments +20 p.p. growth in 2017-2021 (up to 66%), While East Asia & Pacific - +17 p.p., Europe & Central Asia - +9 p.p., Middle East & North Africa - +9 p.p. (up to 53%), and North America - only +2 p.p.

Commenting on the results, the analysts added: “The market supply for fintech solutions in this area is not yet fully capitalised. The interim data for 2022 shows the decline in the volume of VC Investment in FinTech: USD 4 Bn in the first half of 2022 compared to USD 9.3 Bn in total in 2021. For comparison, for the first half of 2022 Europe was capable of almost matching the results for the entire 2021 ($23.1 and $29.5 billion, respectively). The same can be said about Africa ($1.4 and $1.8 billion) or SEA ($6.2 and $6.5 billion). Considering the current market state of Central and Latin America, the year of 2023 promises to bring an explosive growth for the fintech industry in this macro region.”

The full report can be accessed by the link:

https://docs.google.com/document/d/1iInhLJAf0gSGyVhNNWzg3kAzfe1t63E4xGnFBDo17yA/edit?usp=sharing

Related News

- 02:00 am

Effectively develop and govern machine learning models for appropriate implementation and to help overcome issues surrounding data and explainability.

The potential of machine learning (ML) for model development has grown vastly over the last few years and financial institutions need to ensure that they are able to capitalize on the significant benefits of cost and time reduction that ML can offer, and gain every competitive edge they can. Moreover, the expected rise in regulation around the use of this technology as a result of it being implemented more widely across the financial industry makes it critical for firms to develop a clear understanding of what this means for their practices and gain the practical knowledge required, to ensure their models remain compliant. Lastly, as ML models require a high level of investment and expertise, it is crucial for financial institutions to implement them appropriately to secure a high ROI from this investment.

The GFMI Development, Implementation and Management of ML Models conference will offer case studies on how financial firms have overcome challenges when applying machine learning in model development. The significant challenges that will be addressed will be data bias and explainability. Experts in the field will discuss solutions such as the introduction of hyperparameters, the utilization of traditional models and ensuring adequate infrastructure to monitor machine learning models is in operation. The focus will also be drawn to ensuring attendees gain practical knowledge to ensure that their models will fall in line with regulations, allowing for the establishment of more robust and accurate models.

Attending This Premier marcus evans Conference Will Enable You to:

Identify the appropriate context of when to deploy machine learning for model development

Analyse the best practices to manage and cleanse data

Examine why issues of explainability and interpretability often occur for model development teams and learn how to combat these challenges

Optimize machine learning compliance with regulation

Investigate the necessary frameworks that need to be developed for machine learning models

Explore how traditional models can co-exist alongside machine learning models

Best Practices and Case Studies from:

Arthur Maghakian, Managing Director, Data Science and Machine Learning, Goldman Sachs

David Wang, Managing Director, Artificial Intelligence and Financial Engineering, State Street Corporation

Surnjani Djoko, Senior Vice President, Specialized Analytic Group Manager, Citi

Stefan Szilagyi, Model Risk Examination Manager, Federal Housing Finance Agency

Nengfeng Zhou, Senior Lead Quantitative Analytics Consultant, Wells Fargo

Ankur Goel, Senior Vice President, Head of Consumer Modeling, PNC

For more information and registration discounts please contact: Ms Ria Kiayia, Digital Media and PR Marketing Executive at riak@global-fmi.com or visit: https://bit.ly/3DRSnWx

Related News

- 09:00 am

PayPoint today announces two new additions to its digital voucher range with Google Play and life:style, available immediately.

PayPoint currently works with a number of leading brands such as Amazon, Love2shop, PlayStation and Xbox. Today’s announcement further increases the choice of vouchers available to consumers across its network of 28,000 UK retailer partners and brings them additional opportunities to earn commission.

Google Play

Google Play is an online store for apps, games, books and more. According to Google Play Store analytics, there are 20 million subscribers on YouTube Music and Google Play combined.

PayPoint retailer partners can now sell ‘pin on receipt’ vouchers for Google Play worth anything between £1 and £200. This allows even those who do not have a bank or debit card to top up their Google Play account with a simple code printed straight onto a receipt.

life:style Gift Cards

life:style, part of Motivates, the reward and recognition group, is the UK’s most flexible gift card. Offering access to more than 150 of the country’s top brands, these physical vouchers can be pre-loaded with any amount between £20 and £100 and are intended to be given as a physical gift card to the customer to take away to present as a gift, improving the gifting experience for consumers. On every transaction PayPoint retailers will earn 3% uncapped commission.

Danny Vant, Director of Client Services at PayPoint, said: “These additions to our existing voucher offering represent a twofold commitment from PayPoint towards consumers and retailers alike. As well as our dedication towards providing local shoppers with the widest choice of services possible, we are always looking for additional opportunities for retailer partners to increase their revenue.

“This exciting expansion of the vouchers available across our 28,000 strong UK network delivers against both of those objectives and we will continue to bring additional services and products to the fore over the course of 2023.”

Related News

- 08:00 am

UK-based checkout finance platform provider Divido today announces it has appointed Edoardo “Edo” Volta as Chief Revenue Officer.

· Experienced business leader Edo will spearhead Divido’s ambitious growth plans

· Brings more than 20 years of experience in the payment sector with previous roles at Amex, Visa and Mastercard

· Aims to improve scalability of Divido platform to ensure it meets demand as a leader in payments technology

With a career spanning more than two decades in the payments industry and previous senior roles at American Express, Visa and Mastercard, Edo brings an unrivalled wealth of knowledge and passion to his new role at Divido.

Upon joining Divido, Edo said: “My role will be to represent both the business and our customers. I look forward to building relationships with these customers, to listen to what they want, and to make sure it happens by co-creating solutions along with them.

“Divido is a fantastic business in a strong and growing space. Our product is unique in the market and has incredible potential. By bringing lenders and merchants together through the Divido platform, I believe we can truly redefine the future of checkout finance.”

Todd Latham, CEO, added: “Edo is a formidable leader with an enormous knowledge of the payments industry and a track record of building strong customer relationships and growing businesses. Moreover, he lives and breathes our values, and will be an excellent addition to the Divido leadership team. I am super excited to have him onboard.”

Related News

- 09:00 am

In the wake of current macroeconomic conditions, bringing in revenue has never been more important. And yet, struggling businesses may be letting money slip right through their fingers -- at the point of sale, to be exact. To address this, one-third (34%) of financial decision makers at UK businesses plan to invest in their payments infrastructure over the next two years.

The research – from YouGov and GoCardless, a global leader in bank payment solutions which surveyed 503 UK business decision-makers and 2,159 UK consumers – also reveals that over a fifth (21%) of those planning to invest are doing so to keep up with the market trends. Other drivers include introducing new products and services (19%), reducing payment fraud (16%), and keeping up with competitors (16%).

The top areas for investment are digital invoicing (33%), mobile wallets (31%), Direct Debit (28%) and open banking (28%).

Payment investment driven by market trends and payer preferences

Embracing new technology could help stem the tide of customers walking away from an online purchase. The research finds that nearly seven in 10 (69%) UK consumers would abandon the online checkout if the payment process was too complex and six in 10 (64%) would stop their purchase if their preferred payment method wasn’t available.

Business buyers are similarly frustrated. Half (50%) of businesses would stop a purchase if their preferred payment method was unavailable; 56% would drop out if the checkout process is too complex; and 44% get frustrated when they’re required to manually enter payment details at the online checkout.

As new payment technology rolls out, one-third (33%) of financial decision makers at UK businesses said they are likely to try Variable Recurring Payments, powered by open banking, for business purchases as the technology becomes more widely available. Of these leaders, over a quarter (26%) noted that Variable Recurring Payments sound like a better version of Direct Debit and 23% agreed that they sound convenient.

Siamac Rezaiezadeh, VP of Product Marketing and Insights at GoCardless, said: “Payer expectations have skyrocketed in recent years. Customers are not afraid to walk away from a purchase if the experience is poor and businesses need to work harder to keep up. In this environment where every sale counts, merchants can't afford to miss out. While it’s promising that a third of companies plan to take action, we would urge even more businesses to get involved. At the same time, it’s great to see that payers are open to payment innovations. New technology such as open banking payments can deliver the safer, faster, and more seamless checkout experiences they’re looking for.”

The insights into the UK’s paying habits were revealed in a new report, ‘Demystifying Payer Experience’, from GoCardless, which surveyed over 7,000 consumers across the UK, US, France, Germany and Australia, and more than 1,500 business decision-makers in the UK, US, France, and Germany. The report dives deeper into payer preferences, checkout challenges, appetite to try new payment methods and areas of investment for businesses looking to upgrade their payment infrastructure.