Published

- 07:00 am

Andrew Yates, CEO at FullCircl commented, “Being recognised as a finalist for such a prestigious industry award is tremendous praise. The fact that finalists and winners are entirely decided based on reviews from customers is even better. Having won the RegTech Partner of the Year award in 2019 and 2020 as DueDil, we’re excited to be back again, this time with a new brand, a broader proposition, and delivering even more value to regulated businesses. Keep voting!”

Related News

- 02:00 am

Axyon AI, a leading AI provider for the asset management industry, today announces the appointment of Mr. Massimo Tosato as Advisory Committee member.

Harnessing his extensive experience in the asset management and fintech industries, and as an entrepreneur himself, Mr. Tosato will join Axyon AI’s committee to support the Italian AI fintech with its growth and development.

Axyon AI provides asset managers with superior and accurate AI and deep learning predictive solutions to enhance their investment strategies' performance by accessing robust AI-powered forecasts and AI-based strategies. The company announced the completion of its €1.6 million funding round led by the Fondo Rilancio Startup (Relaunch Start-up Fund), managed by CDP Venture Capital SGR, with ING, UniCredit, Geminea and Metes as co-investors in July 2022. It collaborates closely with the renowned AI and computer sciences faculty at the University of Modena and Reggio Emilia.

Mr. Tosato brings with him a wealth of experience, after holding a number of senior roles within Schroders PLC, including Chief Executive at Schroder Investment Management Ltd, and Executive Vice Chairman at Schroders PLC. An entrepreneur, Mr. Tosato has also founded several successful companies, including investment banking and private wealth management boutique firm, Cominvest-Compagnia Internazionale di Investimenti. In the not-for-profit sector, he served for 30 years on the board of Columbia University’s Business School, in New York City. He currently serves as Chairman of the Board at M&G Group ltd, M&G Investment Management and M&G Alternative Investment Management, and as non-Executive Director of the London listed M&G PLC.

Daniele Grassi, CEO of Axyon AI, comments: "We are proud to announce the appointment of Massimo Tosato. He is an industry reference, and his combined expertise in both asset management and entrepreneurial ventures will be a great addition for us as we continue to expand on an international scale.”

On being appointed as an advisory member, Mr. Massimo Tosato comments: “I’m delighted to be able to support this impressive young company. AI has an incredible potential to improve results and consistency of performances and has proven to be a crucial ally to the evolution of Asset Management.”

Related News

- 06:00 am

Ondato, a technology company that streamlines AML and KYC processes, has begun marketing its highly accurate, AI-powered OCR (Optical Character Recognition) technology as a stand-alone solution for other ID vendors. Ondato’s OCR automatically identifies and uses relevant personal information from identity documents during onboarding.

The powerful, precise and swift technology, which is embedded in Ondato’s own identity verification and business onboarding solutions, is now available as an API integration for use by third parties. It reads and digitalises over 10,000 document templates in less than a second with up to 99.8% accuracy. It automatically feeds the data to any system - a CRM for example - database or tool, delivering significantly faster KYC and AML compliance during onboarding by organisations anywhere in the world and across all sectors.

OCR is a technology that automatically reads data from documents - or photos of documents - containing text. It makes it easier and faster to read and check papers, which otherwise have to be verified manually by staff during onboarding and other vital business processes. The technology is evolving rapidly today, fuelled by the application of Artificial Intelligence to add greater accuracy and new automation capabilities.

Ondato’s AI-powered OCR is effective on nearly all languages and alphabets, including special characters, non-latin scripts, and on ideograms used in writing systems such as Chinese, and can be used across 186 countries. Accuracy is as high as 99.8% on materials of European origin and even poor-quality source documents can be made legible.

Liudas Kanapienis, CEO and co-founder of Ondato, says: “We know the challenges other ID vendors have when training their OCR engines to perform accurately across multiple languages and scripts, and a never-ending tide of new document templates. Ondato’s in-house AI- and ML-powered OCR specialises in ID documents, unlike OCR from other providers, and is now best-in-class. It gets more accurate every day and without human interaction automatically learns new document types based on pre-existing logic. Our technology is so flexible that we can add new documents or characters in just two weeks and instantly achieve over 90% accuracy. We are now opening up this solution to any organisation, including our competitive market. We believe, that quality of service provision in KYC is crucial as we all work with a vision to make digital world a fraud-free space.”

As well as its global text capabilities, Ondato’s technology can also read QR (Quick Response) codes, VIZ (Visual inspection zone), PDF417 barcodes, and MRZ (Machine readable zone) encrypted information, and cross-checks the information between all of those to return only validated data. Additional document template requests can be fulfilled within five working days.

To ensure compliance with data protection regulations, such as the European Union’s GDP legislation, data is only stored on Ondato’s customers’ servers once the process is complete. If needed for audit purposes, Ondato also offers a cloud repository for storage. Additional security, fraud, and spoofing checks can be carried out as needed.

Related News

- 09:00 am

Today, ConsenSys, a market-leading Web3 company, revealed that MetaMask, the world’s leading self-custody wallet, and MoonPay, the leading web3 infrastructure company, have expanded their offering in Nigeria. Users of MetaMask in Nigeria can now use instant bank transfers to purchase crypto directly within the MetaMask mobile app and the Portfolio Dapp, resulting in a more seamless experience that is cheaper, faster, and more efficient.

Buying and selling crypto in Nigeria can be challenging, with an estimated 90% of attempts to buy crypto using a credit/debit card declining. However, adding more localized payment methods, such as instant bank transfers, will improve the situation, enabling Nigerian users to access web3 more efficiently and obtain tokens conveniently without setting up an account with a centralized crypto exchange. This will reduce decline rates and provide a user-friendly experience.

We are committed to providing seamless experiences for users in Africa, starting with Nigeria and expanding the rollout of this feature to Kenya, Botswana, and South Africa in the coming month. Our collaboration with MoonPay is a step towards achieving this goal by providing users with a more convenient on-ramp experience in these countries.

The growing popularity of MetaMask in Nigeria is a testament to the increasing adoption of crypto in the country and the potential for further expansion of digital assets in Africa.

The Chainalysis 2022 Global Crypto Adoption Index shows Nigeria has been climbing the charts regarding grassroots crypto adoption. Almost 12.4 million people, 5.7% of Nigeria’s population, are estimated to own crypto assets. In addition, Nigeria is among MetaMask’s top markets globally, ranking third in mobile active users. It is also among the top ten countries regarding visitors to metamask.io.

“This is an essential next step in a critical market that has embraced crypto and web3 but faces serious challenges when using fiat to crypto on-ramp. We are reducing friction and bringing down barriers to keep supporting Nigerians as they onboard into web3,” said Lorenzo Santos, Senior Product Manager at MetaMask.

“Our partnership with MetaMask will enable us to provide Nigerian users with Bank Transfers, a widely used payment method across Nigerian e-commerce businesses. We hope this integration opens the doors for Nigerians to fund their self-custody wallet through a simplified user experience.” added Zeeshan Feroz, Chief Product & Strategy Officer of MoonPay.

A widely accepted and real-time payment infrastructure obstacle for crypto transactions in Nigeria would boost the Nigerian crypto market. With this integration, the complexity of purchasing crypto, especially in Nigeria, is replaced with an easy solution. Furthermore, MetaMask users can become their own bank through self-custody, directly controlling their assets.

To fund your MetaMask wallet with MoonPay in Nigeria:

Login to the MetaMask mobile app or Portfolio Dapp.

Click or tap the Buy button, select Nigeria as your region, then choose Instant Bank Transfer.

Enter the amount desired and the token you wish to purchase

Select the MoonPay quote

Checkout inside MoonPay widget

Done! You have successfully bought crypto directly in MetaMask and can now explore web3 easily.

Related News

- 03:00 am

This is the seventh edition of FT 1000: Europe’s Fastest Growing Companies – a list of the fastest growing companies in Europe. iBanFirst, the reference for new generation international payments, ranks for the fourth consecutive year on the list, rising from 815th to 378th place.

This Financial Times award recognizes iBanFirst's long-standing robustness, having achieved over 70% growth every year for the past 4 years. This growth is made possible thanks to iBanFirst's rising appeal to thousands of businesses (iBanFirst is conducting more than €1.5 billion transactions each month) while benefiting from a level of customer loyalty and recommendation (Net Promoting Score of 63) that is among the highest in its category (Bain 2022 study).

Regulated as a payment institution under the PSD2 directive, iBanFirst has built an ecosystem of partnerships with all the major financial institutions in an effort to reinvent a payment system that is both more competitive, robust and resilient. For the clients, iBanFirst offers a unique experience that combines the power of its platform with the support of top FX experts.

The company, which is backed by the French public investment bank (Bpifrance) as well as investment funds (Elaia, Xavier Niel) and the global investment firm Marlin Equity Partners, has made ongoing investments in recent months to improve customer onboarding, compliance, and offer a cutting-edge interface experience.

Commenting on the news, Pierre-Antoine Dusoulier, CEO and founder of iBanFirst, said: “This continued presence on the FT 1,000 list for the fourth-year running is extremely rare. It’s proof of our sustained growth and of the confidence of our customers in Europe. It also reflects iBanFirst's relevant choice to focus our expertise on international payments while offering a maximum level of security for our clients' funds thanks to account segregation.”

Related News

- 04:00 am

Terrie Smith, DIGISEQ Co-Founder and Global Ambassador, says: “We’re thrilled to share the benefits of our contactless payment solution with Curve, enabling payments to be made through a spectacular range of unique and stylish wearables readily available on the market.“In addition to payments, DIGISEQ’s solution can also bring a much richer consumer interaction experience with ’Promo-Ready’ – simply tap your wearable against your NFC smartphone to receive offers, upgrade your account, see your account balance, and more. This delivers huge benefits to brands looking to interact more frequently with their customers, and also streamline costs and incentivise more daily transactions.“The past 18 months have been an incredibly exciting time for DIGISEQ, with our technology having been employed to great effect by globally recognised names, including the world-renowned Roland-Garros tennis tournament, designer Philippe Starck, and Spanish LaLiga giants, Real Betis – the partnership with Curve really is the icing on the cake.”

Curve’s founder and CEO, Shachar Bialick comments: “We are very excited to partner with DIGISEQ to deliver new, exciting and innovative ways for people in over 30 countries to use their Curve card. Curve has always been at the cutting edge of consumer finance by helping users supercharge their money. Our work with DIGISEQ will help us bring Curve payments to wearable technology that people already use every day, furthering our mission to become the most consumer-centric financial tool in anyone’s wallet – or ring, bracelet, and anywhere else they choose to use DIGISEQ’s technology.”

Related News

- 04:00 am

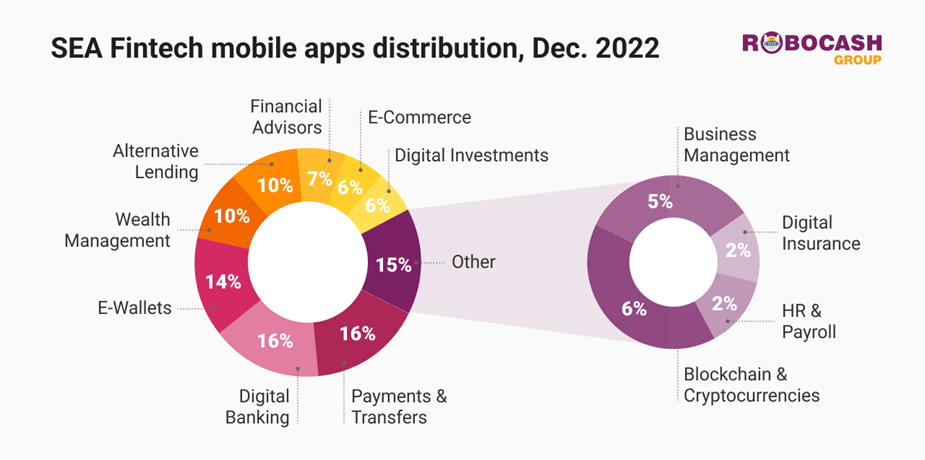

Fintech apps have increased their rate of penetration in Southeast Asia by 3.3 times over the last five years. In 2023, it is to grow by another 2 p.p. , as forecasted by the analytical centre of Robocash Group.

By the end of 2022, the total number of unique FinTech users in Southeast Asia reached 420.5 million people. This is a 3.5% (+14.4 million) increase compared to the year prior.

The penetration of fintech services in the region had experienced a significant boost. At the end of 2022, total penetration reached 81.8%, with the e-commerce sector holding the most weight at 56.6%.

By the end of 2023, the penetration rate of fintech users is expected to increase from 81.8% to 83.7%. That said, some changes are anticipated in their overall distribution in the SEA. The share of e-Commerce users may increase from 56.6% in December 2022 to 58.3% in December 2023. Meanwhile, the share of Digital Investments will decrease from 1.7% to 0.4%. Notably, strong growth awaits the Payments & Transfers sector - from 2.97% to 5.49%.

Robocash Group analysts comment: “It is worth noting that this is a market assessment under normal circumstances. In addition, the state and regulatory measures present an important factor affecting the fintech market in the SEA. However, the SEA’s fintech market remains one of the most dynamically developing in the world. The region continues to attract the attention of global players and investors, and this trend will continue in the coming years.”

Related News

- 03:00 am

UK-based bank Griffin is building a full-stack, API-first Banking-as-a-Service platform to help fintech to build, launch and scale financial products fast. The bank recently received authorisation with restrictions from the Prudential Regulation Authority and launched its sandbox, a comprehensive test environment that lets developers test their fintech applications and build prototypes.

Griffin has partnered with Cable to build sophisticated automated assurance into its BaaS platform, which will enable Griffin to perform continuous customer checks to ensure regulatory compliance and onboard new customers safely and swiftly. The dynamic nature and combination of Cable’s and Griffin’s technology will help Griffin monitor, identify, and address financial crime control risks.

“We are excited to work with Cable to enhance our BaaS platform,” said David Jarvis, CEO at Griffin. “We partnered with Cable because of their team and innovative technology and comprehensive approach to financial crime compliance. Through this partnership, we can better manage our customers and automate lengthy compliance processes, freeing up valuable time and resources for our customers to focus on product development.”

Alex Nash, MLRO at Griffin, said, “Frictionless onboarding and ongoing monitoring is essential to our business. Cable helps us quickly understand our fincrime risk position and provide actionable insights to address any issues. This helps us build better, longer-term relationships with our customers, enabling us to give them the best possible Griffin experience.”

Cable’s all-in-one financial crime effectiveness testing platform enables BaaS providers and partner banks to manage their fintech programs and meet financial crime requirements through a purpose-built suite of tools, including tech-enabled risk assessments, automated assurance, quality assurance, management information, reporting, and more. Recently, Cable has also announced partnerships with two US BaaS banks, Axiom Bank, N.A. and Quaint Oak Bank.

“We are thrilled to partner with Griffin,” said Natasha Vernier, Cable CEO. “We’ve worked together closely for months and this collaboration is a testament to our shared value for innovative compliance solutions. We look forward to the exciting next phases of Griffin’s growth and to supporting the continued development of their BaaS platform.”

Related News

- 05:00 am

PEXA, the fintech behind the world’s first digital property exchange platform and process, has today confirmed a range of collaborations, as it continues to grow with a focus on making the remortgage, buying and selling process better for UK consumers.

PEXA is working with an initial cohort of industry-leading origination platform providers, including Iress, nCino, Sopra Banking Software and Ohpen, to identify opportunities to enhance the integration of its proprietary platform with lenders and brokers alike, and reduce friction points for all involved in the conveyancing experience. PEXA is also today announcing three new law firms have joined the network as customers: PLS Solicitors, The Partnership, and Dutton Gregory Solicitors. These progressive and technology-focused firms will be onboarded on to PEXA’s platform, allowing them to work seamlessly with lenders that have onboarded with PEXA, benefitting from streamlined administration, quicker processes and greater transparency for clients. Announcing these new customers follows the successful acquisition of national conveyancing firm Optima Legal by PEXA in September 2022.

Plans are already underway to onboard further lenders and law firms in the UK throughout 2023. In 2024, PEXA aims to broaden its proposition to bring the same benefits it has brought to the remortgage process to the sale and purchase process.

Today’s announcement builds on PEXA’s significant progress towards streamlining the property remortgage and completion process since its launch in the UK. PEXA saw its first transaction in September 2022 with the lender Hinckley & Rugby Building Society and conveyancing firm Muve, resulting in the UK’s first ever digitally enabled remortgage transaction. Using PEXA’s proprietary technology meant the parties could orchestrate financial settlement directly from the incoming lender’s account, and seamlessly collaborate to lodge the application for registration with HM Land Registry, streamlining a process that typically takes days into minutes.

Last year, PEXA also announced Shawbrook Bank as the second lender in the UK to begin transacting remortgage cases through its platform. This was PEXA’s first collaboration with a retail bank and means PEXA’s customers in specialist mortgage markets benefit from an improved experience and faster completion times.

PEXA has also collaborated with the Bank of England to develop PEXA Pay – only the seventh net settlement payment scheme to clear through the Bank of England, and the only one dedicated to property transactions. The Bank of England is acting as the settlement service provider. The development marks the culmination of significant investment committed to the UK by PEXA, and the first step towards rolling out the system widely to transform the UK mortgage market.

PEXA has committed to more than A$100 million so far, and has established digital integrations with HMLR and the BoE. The company’s expansion into the UK market follows its success in Australia, where it has facilitated over 15 million property transactions worth circa AUD $3 trillion.

James Bawa, PEXA UK Chief Executive Officer, commented: “We have made significant progress to date in transforming the property market for consumers, lenders and law firms. The raft of collaborators we continue to engage with at pace is testament to the shared vision the industry holds in needing to change.

“We are delighted to be able to collaborate with the likes of Iress, nCino, Sopra Banking Software and Ohpen, which all share our entrepreneurial spirit. Embracing a digitised remortgaging process will reduce the time, risk and costs involved, for consumers, lenders and firms alike. This couldn’t come at a more critical time, so we are pleased to have found such progressive technology collaborators who are as eager as PEXA to usher in a new era of efficiency.

“We are also so pleased to welcome three new law firms as customers: PLS Solicitors, The Partnership, and Dutton Gregory Solicitors. Their willingness to be early adopters, and their ability to provide unique industry and business insights, will considerably shape our product development and offering.

“But, we are just at the beginning. We’ve invested a great deal into transforming the UK property market and improving the remortgage process. As we build to reach a critical mass in the remortgage market, we want to bring the same benefits to sale and purchase, to deliver on the potential digital payment and conveyancing can make to the broader property market.”

Related News

- 08:00 am

Daniel Baeriswyl, Founder and CEO of Science Card, says: “When I was a PhD student, I observed that important research projects were often underfunded, a common problem in academia that leads to many scientists abandoning vital research due to lack of funding. Science Card was born specifically to bring research closer to the source of money. Our mission is to combine a payment account with the ability to fund scientific research, and that creates a very powerful way to increase the pace of innovation by more efficiently diverting money to research projects, at speed.“Science Card’s customers generate an immediate and positive impact by funding research into better healthcare, cleaner energy, education and other projects that benefit society. In return for our customers making micro-grants, they gain part of the intellectual property of that research, and stand to directly benefit from creating change for society as a whole.“Enfuce is the perfect partner for Science Card. They provided the whole package of services, technology and expertise that we were looking for. Enfuce has unrivalled card processing infrastructure, an API that can be easily integrated into our existing services, and fantastic service from their incredibly knowledgeable team. Their deep commitment to sustainability was also a massive draw for us. Building a completely new B2C and B2B proposition like Science Card could only have been achieved with Enfuce and global tech innovator Mastercard. The support of these two hugely important and influential partners, who like us believe in using technology as a force for good, is invaluable and will drive our future growth together.”

Monika Liikamaa, Co-Founder and Co-CEO of Enfuce, says: “Science Card’s unique proposition has the potential to make profound transformational changes in society. Enfuce’s core commitments to sustainability and creating positive change in society are well aligned with Science Card’s vision to make the world a better place. To launch and run a brand new B2C card use case like this requires flexible and customisable issuing and processing functionality, vast expertise of meeting compliance and regulatory challenges, and a stable platform that’s designed for future-proof growth. Enfuce’s exceptional capabilities in all these areas make us the go-to partner for game-changing payment solutions, and we can’t wait to see how our partnership with Science Card will create influential scientific innovation for the good of society.”

Denise Johansson, Co-Founder and Co-CEO of Enfuce, says: “Science Card isn’t like any other card programme – nothing like this has existed before in the market. We immediately recognised how Science Card had the ability to engage users with a compelling incentive to fund vital science projects that can make huge differences in all areas of society. Science Card is not just a payment account, it’s a whole new infrastructure for innovation funding, and Enfuce’s technology platform will underpin its growth. We’re delighted to be part of such a crucial initiative that will let people actively fund scientific progress and own a piece of the future.”