Published

- 07:00 am

GoHenry, the prepaid debit card and financial education app for kids aged 6-18, has teamed up with environmental organisation the World Wide Fund for Nature (WWF) to launch a special range of Wild Card designs, with £1 from each card sale being donated to WWF and its huge efforts to protect animals and bring our world back to life.

The collaboration will see the launch of five new card designs, featuring pictures of animals including a koala, leopard, lion cub, panda, and snow leopard. All cards can be personalised with the child's name and will be available for one year, with additional designs planned for later in 2023.

Louise Hill, Co-Founder and COO of GoHenry said: “We’re all about helping kids make smart choices with money and now they can help protect wildlife at the same time. We know our young members are passionate about the environment and our new collaboration with WWF can support them in giving to the causes they care about the most.”

Rob Wood, Head of Partnership Communication at WWF-UK said “Our collaboration with GoHenry is a great way to harness children’s natural affinity for wildlife. We hope these cards will help children learn more about nature and inspire a passion for protecting it.”

All GoHenry cards, including customised cards, are printed on compostable polylactic acid (PLA). Producing cards with PLA, which is derived from field corn waste, uses 65% less energy and 68% fewer greenhouse gases than conventional plastic.

Related News

- 04:00 am

A recent survey of 250 finance professionals commissioned by Flywire (Nasdaq: FLYW), a global payments enablement and software company, found that as finance professionals increasingly rely on their enterprise resource planning (ERP) systems for financial data, there’s an opportunity to integrate their ERPs with payment software to improve how their businesses gets paid. Specifically, 89% of the respondents think their businesses could save money if the cross-border receivables process was more tightly integrated with their ERP system.

In its new report, ERP systems and cross-border B2B payments: Expectation vs. reality, Flywire examined how financial professionals are using their ERP systems to process international transactions and improve payment capabilities from international customers.

“In response to what we were hearing in the market, Flywire sought to better understand some of the ways payments processing can help financial professionals augment their ERP strategies,” said Ryan Frere, EVP and GM of B2B, Flywire. “What the data tells us is that there is room for improvement in how businesses are getting paid, especially when it comes to cross-border payments.”

Finance leaders rely on their ERP systems as a single source of truth, are champions of integration strategies

The majority of finance professionals surveyed are satisfied with the accounts receivable functionality their ERP systems provide. They’re performing as a central database and a one-stop shop for transactional data. Regardless of the size of their company, the financial professionals surveyed expressed high levels of satisfaction with major ERP vendors across the board – Microsoft, Oracle, SAP, NetSuite, Sage Intacct, Infor and others.

Yet, finance teams continue to put rigor around improving how their companies get paid in this macro environment, which reveals why tight integration with payment software is crucial. 88% of respondents said with the possibility of a recession, they need to improve their ability to get paid from their international customers. And 67% of the respondents felt that senior leaders did not understand the need for payment software enhancements in their ERP systems. This could affect companies’ efforts to stay ahead of their payments needs as they expand internationally.

Global companies name DSO and localization as challenges in managing global receivables within the ERP system

Most of the survey respondents (74%) are operating globally already, with the balance planning to go global in the next few years. And those with experience on the global stage report far more challenges managing their global receivables through their ERP system than those planning to expand internationally, or those just getting started. The gaps range from payment reconciliation and invoicing in local currencies (where more experienced global companies are almost twice as likely to report problems), to FX, higher Days Sales Outstanding (DSO), local language invoicing, local payment support, and managing refunds and chargebacks.

According to the report, the average DSO for international receivables is 97 days. But with more payment methods and more automation, finance professionals think they could decrease DSO and save their organizations money. 87% of respondents would like to offer additional payment methods in an effort to decrease DSO. And 98% say there are benefits to handling domestic and international payments on the same platform.

According to one survey respondent, “I wish the process wasn’t so difficult on the consumers’ end, because the information and time needed to complete the process takes a while and also sometimes it means I might not be able to manage and organize.”

“There’s untapped value in the A/R function when it comes to cross-border payments efficiencies, and that's not only in time and cost savings for the department itself,” continued Frere. “Finance leaders who grasp the role payments can play in a great customer experience can actually help accelerate their company’s profitability.”

To experience the full report, please visit ERP systems and cross-border B2B payments: Expectation vs. reality

Related News

- 04:00 am

SmartSearch, a leading digital compliance provider, gets smarter today with the launch of a next-generation platform with enhanced functionalities driven by the latest technology and customer feedback.

Based on the latest, future-proof technology, the platform includes a seamless new interface as well as a host of features and a level of configurability never before available.

The streamlined service improves on what is already an industry best match and a pass rate of 97%, and Triple Bureau reliability,

SmartSearch’s clients across, finance, legal, accountancy, property, gaming, banking, insurance, investment, property development and cryptocurrency now have access to bespoke configurability and automation, improved compliance standards, audit-ready reporting, row-level encryption and strengthened perpetual KYC – creating a new standard in cost-effective seamless compliance which saves clients more time and transforms the customer experience.

Stress-tested for reliability, the enhanced platform has already carried out more than six million searches for clients worldwide during beta testing.

After a surge in money-laundering crimes carried out by increasingly sophisticated criminals, the imposition of thousands of new sanctions on Russia after its invasion of Ukraine and a growing number of high-profile breaches, the weight of compliance on regulated firms have become increasingly onerous.

SmartSearch’s enhanced platform brings an unmatched single-source digital solution to this challenging compliance environment.

Guy Harrison, SmartSearch CEO, said: “We are thrilled to unveil our enhanced platform. As the go-to solution for AML and risk management, this development sees SmartSearch increase its advantage in the digital compliance solutions market.

“With advanced features and improved usability, our development work marks a significant step forward in response to the demands of the modern age. The platform sets a new industry standard, cementing SmartSearch's position as a trailblazer in a new era of compliance technology.”

From the ability to rapidly onboard new customers to managing the ongoing risk and compliance through each customer’s lifecycle, with perpetual Know Your Customer (pKYC), the platform mitigates risk and frees up valuable resources for teams.

It helps firms retain an ‘audit-ready’ status, safeguarding against fines and reputational damage from potential breaches that are both costly and time-consuming. Being audit ready is crucial when dealing with investigations by the regulator.

The platform identifies people on sanctions, Politically Exposed Persons (PEP), Special Interest Persons (SIP), Ultimate Beneficial Owners (UBO), and Relatives & Close Associates (RCA) in seconds.

SmartSearch’s digital compliance solution supports more than 6,000 clients and 55,000 users across the world, helping them deploy millions of complex identity checks in seconds through a single platform.

The platform is already trusted by one in three of the UK’s top 200 law firms, 1 in 2 of the top 100 accountancy firms and more than 1,000 property companies.

Related News

- 02:00 am

Luxoft, a DXC Technology Company, and ITRS, the leading provider of real-time estate monitoring and observability software, today announced the launch of a strategic partnership aimed at developing and delivering advanced monitoring tools for banking and capital markets platforms.

Their combined solutions provide a comprehensive view of legacy and cloud-based systems to help banks overcome the challenges of an ever-changing regulatory and technological landscape, enabling clients to mitigate operational risks, enhance resilience and maintain compliance.

The partnership combines Luxoft's vast experience deploying and managing bespoke and third-party applications with ITRS's long-established reputation for developing dynamic solutions that address the complexities of modern IT systems and enable its 4,500 clients worldwide to reclaim visibility and control of their infrastructure and applications. To begin with, the partnership will focus on the Temenos and Murex platforms before expanding into other areas.

Ihyeeddine Elfeki, Luxoft’s Global Head of Trading and Risk Solutions commented, "While working with ITRS on various projects, we realized we share the same vision. Banks need to detect and prevent business service failures before they occur. This requires all layers of their systems to be monitored from base infrastructure up to the application level, including the end-to-end business transaction flow. We’re thrilled that our collaboration will deliver unique business service monitoring capabilities for the most widely used platforms within financial services companies."

Guy Warren, CEO of ITRS added, "In an increasingly complex IT environment, it’s essential the capital markets and banking sectors have access to monitoring solutions that provide end-to-end visibility of transaction and business service performance and Luxoft’s deep domain knowledge and expertise in implementing and managing complex platforms is widely recognized. This partnership will both strengthen our ability to deliver advanced monitoring solutions and extend our market reach, while continuing to provide cutting-edge solutions to our clients."

Related News

- 09:00 am

11:11 Systems (“11:11”), a managed infrastructure solutions provider, today announced a new case study with Automated Financial Systems (AFS).

In business for over 50 years, AFS is the global leader in providing real-time, end-to-end commercial lending solutions to the world’s top-tier institutions as well as regional and de novo clients. Uniquely positioned to support business and technology transformation for its clients, AFS operates the world’s largest and only fully integrated commercial lending system, with 25 of the top-100 banks using AFS products and services.

For the last two decades, AFS kept its IT operations largely in-house, developing and hosting its own software. This meant the team was solely responsible for maintaining the company’s business continuity efforts, which included operating two data centre locations in Pennsylvania. The in-house system became increasingly burdensome to maintain – in both money and time – causing a strain on resources.

As part of a larger IT modernisation project across the company, the team selected 11:11 for Disaster Recovery as a Service (DRaaS) for Zerto. In addition to providing continuous data availability, simplifying day-to-day management and freeing up IT resources, 11:11 met AFS’s industry-specific regulatory requirements, including a dedicated compliance team, which the team can lean on to understand the complexity of maintaining these regulations.

Read the 11:11 and AFS case study here.

Related News

- 03:00 am

Remittances are not only a lifeline for millions of migrant workers and their families, they are also vitally important for the prosperity of many developing economies around the world. As the amount of global remittance inflows continues to reach new records1, 53% of surveyed consumers are turning to digital apps to send and receive funds around the world.

Visa today unveiled its “Money Travels: 2023 Digital Remittances Adoption” research report, a survey of over 14,000 consumers across ten countries, revealing that digital remittances are quickly becoming the most popular way to move money internationally, when compared to going to a physical bank or branch (34%); sending cash, checks or money orders by mail (12%); or giving money to another person who is traveling to their home country (11%).

In conjunction with the study, Visa launched “Money Travels,” a new podcast series unearthing how payment-related topics unfold differently in various places around the world and highlighting the stories of real people, payment experts and partners.

“Fast, easy and secure payments can make a profound difference to families, communities and economies around the world,” said Ruben Salazar, Global Head of Visa Direct. “This new research shows incredible acceleration of digital payments, but there is still more the industry can do to bring streamlined remittances within reach for more migrant workers and their families who rely on these lifeline payments to do everything from pay for food, education, or even unforeseen medical costs.”

The Money Travels: 2023 Digital Remittances Adoption study examines how consumers send money abroad, diving into the rates, methods, and reasons for sending and receiving these lifeline payments. Highlights include:

- Digital remittances are the preferred method amongst surveyed consumers across all surveyed countries. 60-70% of surveyed remittance users across North America have used an app-based digital payment method to send/receive money internationally, whereas only 10-15% of surveyed U.S. remittance users rely on cash, checks, and money orders. Similarly, sending money through digital apps is the most popular method for 69% and 65% of surveyed consumers in Saudi Arabia and the United Arab Emirates, respectively, compared to digital from a physical location, cash, or check.

- Adoption of app-based digital payments is high, with low barriers to usage. Three-quarters of surveyed remittance senders in Mexico and Peru have used app-based digital payment methods, while two-thirds of recipients have used an app. Additionally, in Europe, 62-67% of surveyed consumers across France and Poland who have sent international remittances have used digital methods.

- Remitter pain points include but are not limited to high fees and issues with calculating exchange rates. In total, 38% of surveyed consumers on the send side in the United Arab Emirates report fees being too high when sending digital remittances, and 37% of surveyed consumers on the send side in Singapore report issues with calculating the exchange rates.

- App-based digital payments are considered the most secure method by a strong proportion of remittance users across countries. In Singapore, a key remittance country on the send side, three out of five (61%) surveyed consumers reported using digital-only means for sending money internationally thanks to ease of use and security (53%).

- Rates of sending and receiving remittances vary widely by country. Of the countries surveyed, Poland, Mexico, Peru and the Philippines receive remittances at higher rates than sending them. France and Singapore see higher send rates.

- Sending more money, more often, is easier than ever. Over half of those who have sent money internationally do so about once per month or more often in the United Arab Emirates (71%), Saudi Arabia (64%) and the Philippines (48%). Among those who have received money 80% do so at least a few times per year in Saudi Arabia, followed by the Philippines (77%), and Mexico (72%).

Visa works in collaboration with global remitters such as Brightwell, Maya Philippines, MoneyGram, Paysend, Remitly, Western Union and Xoom to help enable efficient money movement through digitized remittances. “One of our visions for Visa Direct is to create new opportunities for financial inclusion and wealth building by helping to simplify cross-border payments and streamline the way money travels,” continued Ruben Salazar.

A new “The Connective Power of Remittances” Nonstop Guide explores the rise of digital remittances, the tales behind these types of payments and how the digital revolution is helping streamline remittance payments.

For more information about Visa Direct, please visit: https://usa.visa.com/run-your-business/visa-direct/payment-guides/remittances.html

Related News

- 08:00 am

Cohesity, a leader in data security and management, today announced the appointment of Kit Beall to the role of chief revenue officer. A business development and enterprise tech veteran, Beall brings more than 30 years of highly relevant experience to Cohesity, with deep expertise in software, cloud, security, artificial intelligence (AI) and managed services. In this role, Beall will utilise his vast international experience in overseeing all sales and partner functions worldwide.

Prior to joining Cohesity, Beall was senior vice president of global accounts and telcos at VMware, where he was responsible for managing, growing, and advising VMware’s largest and most strategic global accounts, including some of VMware’s key verticals such as financial services. Prior to that, Beall was chief operations officer and senior vice president of global field sales at Uhana, an AI platform for 5G mobile networks. Uhana was acquired by VMware in 2019. Beall also spent 12 years at Cisco, most recently as vice president of sales for the company’s cloud and managed service business, as the company grew from $25B to $50B in revenue.

Beall has a strong reputation for helping customers and partners deliver on business outcomes by embracing technology and cloud services that can play a key role in addressing critical business challenges. He also is known for building and scaling high-performing, diverse teams.

“I’m thrilled to join Cohesity at this important juncture of the company’s evolution. I have long regarded Cohesity as having the best technology in the space, and deeply respect their CEO,founder, board, and management team,” said Beall.

“Cohesity sits at the junction of three of the highest priority business issues today – security, cloud, and data management, and it provides a radically simple yet highly differentiated approach to securing, protecting, and deriving value from data. I look forward to helping customers and partners succeed, and working with this incredibly talented team.”

“I’ve known Kit for many years, and respected his track record of understanding customer pain points and connecting them to technology innovations that drive strong business outcomes. He is results oriented, an entrepreneurial change agent and brings strong customer and partner relationships to Cohesity,” said Sanjay Poonen, CEO and president, Cohesity. “Beyond that, Kit has the unique gift of being both strategically relevant to a customer, while also being deep in operational details - a valuable skill in leading a modern-day field operation. Kit will be a key

member of my leadership team, and I’m delighted to have him on board.”

Related News

- 02:00 am

"With fraud higher than ever before, finding a speedy but safe way to onboard business customers remains a challenge for many financial institutions, particularly as they look to service clients in multiple global markets," said Edwina Johnson, Head of Global at Alloy. "Integrating Kyckr into Alloy's platform will help our clients provide a seamless digital onboarding experience to their customers without increasing the risk of fraud, no matter where in the world they are located."

"Tackling financial crime is the number one priority and it can only be achieved if companies can identify the criminals and meet the increasing scrutiny of regulators," said Ian Henderson, CEO of Kyckr. "Our partnership with Alloy means its customers can automatically validate the status of companies at the respective corporate register in real-time, helping avoid the significant regulatory and commercial risks associated with using poor quality data."

Related News

- 05:00 am

Sumsub, a global tech company that provides customizable KYC, KYB, AML and transaction monitoring solutions, published its Complete Guide to the Crypto Travel Rule today.

The Complete Guide to the Crypto Travel Rule (2023) was prepared by Sumsub’s compliance team to provide an overview of the regulatory landscape regarding the Travel Rule. This guide is intended to help readers understand Travel Rule requirements and typical challenges in implementation. It offers insights on how Travel Rule regulations are developing worldwide and how to build the process of Travel Rule verification to ensure compliance. Sumsub’s experts have also prepared a checklist of things to take into account when choosing a Travel Rule solution.

The Travel Rule refers to FATF Recommendation 16 (wire transfers) in the VA (virtual assets) context. It requires crypto companies, collectively referred to as VASPs (virtual asset service providers), and financial institutions engaged in VA transfers to obtain “required and accurate originator information, and required beneficiary information” to share with counterparty VASPs or financial institutions during or before a transaction. Since the personal data of transacting parties ‘travels’ with their transfers, the regulation is dubbed the “Travel Rule.”

According to the most recent FATF report, 29 out of 98 responding jurisdictions reported having passed Travel Rule legislation, while just 11 have begun enforcement and supervisory measures. However, a further 25% of these jurisdictions are in the process of passing Travel Rule-related legislation.

If a business fails to comply with the Travel Rule, it could face country-specific local, regional or national regulatory sanctions. In Estonia, for instance, the penalty for a legal entity is a fine of up to 400,000 euros.

“This regulatory shift has jolted the crypto industry: businesses have had no clue how to implement this new FATF recommendation, because FATF does not prescribe anything specific and prefers the so-called functional and technology-neutral approach in its guidance. However, in the long term, we are sure that an optimal solution will be found, and then the implementation of the Travel Rule will become global and more or less unified, except, of course, for countries where cryptocurrencies and VASPs are banned. For example, we can find such regulatory efforts on the EU-level, including the draft amendment to the EU regulation ‘on information accompanying transfers of funds and certain crypto-assets,’ which, if adopted, will provide a pan-European standard for the Travel Rule,” explained Tony Petrov, Chief Legal Officer at Sumsub.

Prior to releasing this guide, Sumsub launched its Travel Rule solution for the crypto industry, offering a full compliance toolkit for the whole customer lifecycle. Sumsub's Travel Rule solution covers all the necessary actions, including KYC/AML checks and counterparty VASP verification. The platform also provides a tool for transaction monitoring (KYT) which detects any suspicious activity in real-time.

“The recent bank failures of SVB, Signature, and Silvergate—all of which service the crypto industry—have concerned the public. Flagstar’s acquisition of Signature notably excludes its crypto deposits. But crypto has little to do with the reasons these banks failed, or the reasons Credit Suisse failed, now taken over by rival UBS. The sad consequence of the situation will be that crypto businesses will have a tougher time finding a partner bank. While some critics are eager to blame crypto, questions should be asked about the leadership issues, lack of risk management and compliance procedures in these financial institutions,” added Petrov.

To learn more about the Crypto Travel Rule and download the guide for free, please visit: https://sumsub.com/guides-reports/complete-guide-to-the-crypto-travel-rule-2023/.

Related News

- 09:00 am

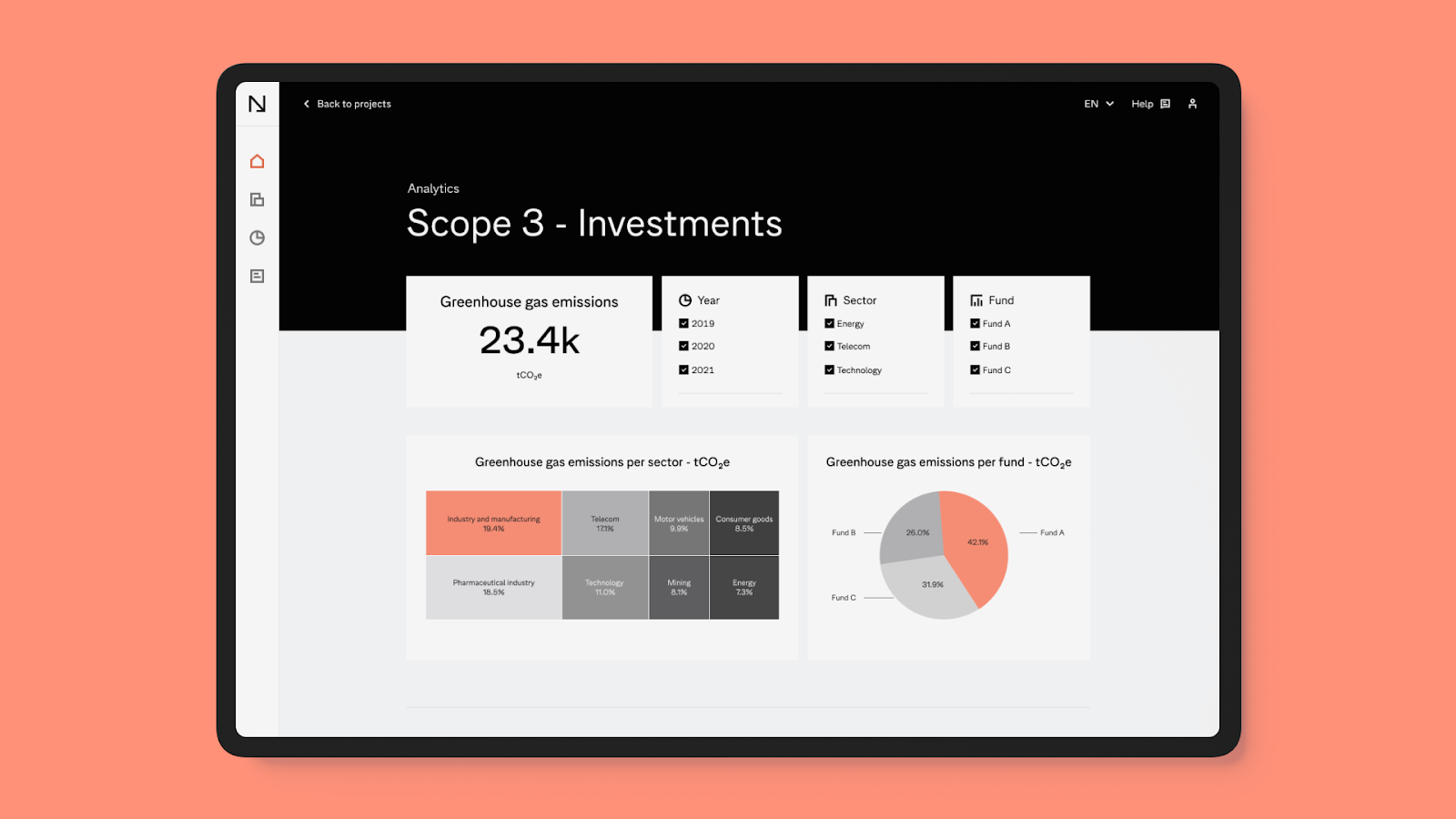

The latest product update from the Normative carbon accounting engine enables financial institutions to comply with legislation and turn their net-zero commitments into pragmatic, science-based transition plans.

“Financed emissions account for 98% of our total carbon footprint. We need to address these emissions to stay compliant with reporting legislation, to understand the sources of risk in our portfolio, and to meet our climate goals.” says Zoë VanderWolk, Investor Relations & Sustainability Manager at ETF Partners, a leading European Climatech Venture Capital firm.

Financial institutions – such as banks, venture capital firms, and private equity – face some of the strictest climate disclosure requirements of any sector. The UK’s Streamlined Energy and Carbon Reporting (SECR) policy requires organizations to disclose carbon emissions information in their annual reports. In the EU, the Sustainable Finance Disclosure Regulation (SFDR) obligates financial market participants to report sustainability impact, including scope 3 emissions. The US Securities and Exchanges Commission (SEC) has also proposed rules that would require climate-related disclosures for investors.

Normative delivers the world’s most accurate carbon emissions calculations through scopes 1, 2, and 3 for enterprises. Its scope 3 emissions calculations are performed with automation-driven data collection and processing, and are broken down into granular insights in the platform’s visualization dashboard.

These comprehensive carbon calculations enable financial institutions to stay compliant with disclosure requirements and to report their emissions in alignment with frameworks like Partnership for Carbon Accounting Financials (PCAF) and Task Force on Climate-Related Financial Disclosures (TCFD). In addition, the unparalleled accuracy of these calculations provides the foundation from which financial institutions can make immediate and verifiable carbon reductions throughout their portfolios.

Normative’s latest product update further automates calculations of scope 3 category 15, also known as “financed emissions”. Defined by the Greenhouse Gas Protocol – the standard for calculating corporate carbon footprints – category 15 covers investments and financial services. This includes activities encompassed by PCAF such as listed equity and corporate bonds, business loans and unlisted equity, and project finance. Category 15 is especially relevant to financial institutions, which have 700 times more financed emissions than directly-generated emissions,according to the CDP.

“Normative’s automated calculations saved us countless hours of manual work while producing our scope 3 footprint. The accuracy and granularity of the data ensured that we had the information necessary to effectively plan and implement our emissions reductions,” Zoë VanderWolk continues.

Complicating the task of disclosure is the complex structure of financial value chains, which include emissions from many “downstream” sources such as equity and debt. To stay compliant with climate disclosure requirements, financial institutions need tools that can comprehensively and efficiently calculate the carbon emissions from their investments and other financial activities.

“At Normative, we help our customers produce science-based and accurate carbon calculations, which empowers them to make emissions reductions where it really counts. Our latest product update is key for financial institutions to stay compliant with legislation and take control of their value chain emissions,” says Kristian Rönn, CEO and Co-founder of Normative.

Normative’s carbon accounting engine enables businesses to comprehensively calculate their emissions. The engine draws from over 30 million data points to translate business activities and financial spend into a comprehensive carbon footprint calculation. Powered by automation, the engine is especially valuable for financial institutions, whose complex value chains are difficult to parse manually.

Read more about how Normative helps firms calculate their financed emissions, as well as the methodology behind the carbon accounting engine, in this article.