Published

- 08.12.2015 -- 09:39 am

Financial IT speaks to Vince O'Brien at Sibos 2015.

Other Videos

- 07.12.2015 -- 01:24 pm

Financial IT speaks to Sergey Metelskiy, International Sales Director, Diasoft at Sibos 2015.

Other Videos

- 07.12.2015 -- 01:22 pm

Financial IT speaks to Sanela Hodzic, Head of Strategy and Marketing, Calypso Technology at Sibos 2015.

Other Videos

- 07.12.2015 -- 01:20 pm

Financial IT interviewed Hans Tesselaar, Executive Director of BIAN.

Other Videos

- 07.12.2015 -- 01:18 pm

Financial IT speaks to Michael O'Loughlin, Director Global Payment Solutions, CGI at Sibos 2015.

Other Videos

- 07.12.2015 -- 01:16 pm

Financial IT speaks to Herve Lacorne, CEO of Trade Solutions at Sibos 2015.

Other Videos

- 04.12.2015 -- 01:13 pm

Financial IT speaks to Ian Kerr, CEO, Bolero at Sibos 2015.

Other Videos

- 04.12.2015 -- 11:09 am

Financial IT speaks to Hank Uberoi, CEO, Earthport at Sibos 2015.

Other Videos

- 05:00 am

Profile Software, an international financial solutions provider, is participating in the 3rd Annual Retail Banking Forum taking place at the Renaissance Wien Hotel, Vienna, Austria (09:00-18:40) on the 26-27 November 2015. The company’s team will engage with the professional delegates in an interactive presentation about the company’s client-centric solutions for the banking industry.

With the participation of leading financial services institutions in Europe, the forum aims at presenting the key trends and upcoming changes in the sector including technology innovations. Some of the areas that will be covered include:

- The development of branches

- The mobile evolution offering new opportunities to banking institutions

- The Gen-Y expectations from financial services organisations

- The regulatory environment and

- The technology developed meeting the challenges of the industry

Profile Software will have the opportunity to meet with the professional delegates and senior executives from banks and financial institutions to present its innovative approach delivery to the new challenges, offering award winning solutions to the industry, such as:

- FMS.next, the universal banking platform that effectively covers the areas of Core Banking, Private Banks, Leasing and Financing, Collections while introducing to the market its pioneering crowdfunding solution, that combines banking and investment management functionality

- IMSplus, the award-winning investment management platform that accommodates the requirements of Wealth Management, Asset and Fund Management, Insurance Investment Management, Family offices, Custody, as well as Personal Banking & Brokerage organisations

- Axia, the web-based, omni-channel solution that is suitable for the Wealth Management industry and for any type and size business. It provides flexible deployment options and pricing without the need for internal IT infrastructure. In addition the platform incorporates a powerful client onboarding solution to streamline the client acquisition process while offering a unique client experience and an intuitive design.

Backed by leading industry advisors, the event is designed to uncover today’s solutions and tomorrow’s challenges. Find out more and register to the leading event for the banking sector here

Related News

Product Profile

Screenshots

Product/Service Description

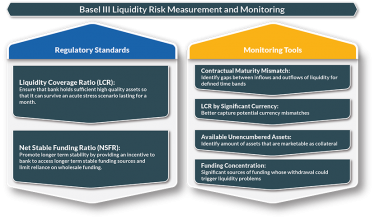

LCR aims to ensure that a bank maintains an adequate level of unencumbered, high-quality liquid assets that can be converted into cash to meet its liquidity needs for a 30 calendar day time horizon under a significantly severe liquidity stress scenario. Fintellix LCR covers all three aspects related to LCR, HQLA, Cash Inflows and Cash outflows, with an exhaustive coverage of banking products and securities with respect to LCR requirements.

The NSFR is designed to ensure that long term assets are funded with at least a minimum amount of stable liabilities in relation to their liquidity risk profiles. Equipped with tools for stable funding classification, Fintellix makes the bank’s ability to track, report and complete all NSFR related requirements seamlessly.

Customer Overview

Features

- Robust platform offering.

- Derived Dimension Engine for multiple classification requirements.

- Flexible Object element framework for assigning multiple types of weights based on Business Rules.

- Configurable business rules for all reporting logic.

- In-built Reporting

Benefits

- Flexible on-demand reporting.

- Extensibility and Scalability.

- Platform Agnostic.

- Improved Business Performance.