Published

- 08:00 am

HyTrust Inc. announced enhanced capabilities for its workload security platform to support organizations with virtualized, public, private or multi-cloud environments for popular cloud technologies including Amazon Web Services, IBM, EMC, Intel, Microsoft and VMware. This release includes HyTrust DataControl 3.2 and HyTrust CloudControl 5.0, both of which address key operational and security risks facing the next generation of data center transformation. With the HyTrust platform, organizations can reduce risk, automate compliance, reduce costs and ensure availability in virtualized and cloud environments.

As software-defined data centers (SDDCs), hyper converged infrastructures, and multi-cloud environments become the building blocks for data centers, organizations must implement security solutions that allow for seamless deployment in complex public and hybrid cloud environments. At the same time, they must also protect organizational data and operationalize secure workflows. New data center build-outs often highlight security issues and the gap that often exists between the needs of infrastructure, operations and security teams. By breaking down the barriers between these teams, HyTrust eliminates alignment gaps between departments to allow security to be built into infrastructure and meet the demand for agile, secure and scalable workload deployment.

“IT environments are getting more complex. The industry has moved from a one cloud fits all to a multiple cloud approach,” said Eric Chiu, president and founder, HyTrust. “HyTrust’s workload security solutions make these fairly unexplored, multi-cloud environments a more trustworthy place for enterprises to operate. With the latest enhancements to DataControl and CloudControl, we are strengthening trust within a multi-cloud infrastructure and the SDDC, providing modern IT organizations with the solutions they need to remain secure in today’s rapidly evolving environment.”

The HyTrust workload security platform allows organizations to take full advantage of SDDC and multi-cloud environments without jeopardizing security. By providing support for leading virtualization, public cloud and hyper converged infrastructure, HyTrust assures organizations that they can deploy SDDC security controls and encryption with flexible key management across the leading cloud and virtualization platforms.

HyTrust DataControl – offers powerful encryption with easy to use, scalable key management to secure the entire compute, network and storage stack throughout its lifecycle, from deployment and migration to sanctioned decommission. It’s the only encryption/key management solution that allows an organization to dynamically encrypt and rekey virtual machines. HyTrust DataControl accelerates workload encryption by using technologies like Intel AES-NI to make encryption a transparent operation that doesn’t impede performance and availability. New capabilities in HyTrust DataControl include:

- Any-cloud ready: Easy to deploy, manage and run in any type of cloud environment, whether it’s private, public or hybrid. HyTrust supports public clouds like Microsoft Azure, Amazon Web Services, IBM SoftLayer, VMware vCloud, as well as private clouds such as VMware (NSX and ESX), and hyper-convergence private clouds such as EMC, Nutanix and Simplivity.

- Zero downtime, zero touch encryption: Empowers IT organizations to consistently meet system-level agreements by never requiring applications to go offline and using policy-based intelligence to ensure re-keying of workloads happens automatically.

- Real-time forensics: Analytics ensuring data risk exposures are highlighted quickly and easily for operator override action or automatic scheduling.

- Secure boot protection: Protects organizational data by not allowing any system to boot or access data disks for unauthorized virtual machines or users.

- Military-grade data encryption: HyTrust DataControl Encryption is FIPS-140-2 Level 1 Certified and FIPS-140-2 Level 3 capable with built-in HSM support providing government agencies and security savvy enterprises confidence that their data is safe in the cloud.

HyTrust CloudControl – the standard for advanced access controls, forensic logging and policy enforcement in VMware environments, allowing organizations to automate security and compliance requirements mandated by a broad range of industry standards including PCI-DSS, HIPAA, NIST and SOX. HyTrust CloudControl enables the use of technologies including Intel Trusted Execution Technology (TXT) and CIT (Cloud Integrity Technology) to ensure enterprise-class controls and policy enforcement for workload integrity. New features in HyTrust CloudControl 5.0 include:

- New security posture dashboards (with drill downs): Provide analysis and trending of privileged user access, compliance and protection of resources.

- Enhanced logging and reporting functionality: Includes heat maps, automatic capture of configuration changes, snapshot views and simplified formatting of log data providing our customers deeper and richer analytics and trending of privileged user access, compliance posture and level of resource protection.

- Secondary workflow approvals for NSX: Supports a second level of approval to sensitive actions, made by privileged users within the NSX environment.

- Extended capabilities for NSX REST APIs: Allows for enhanced security operations.

“HyTrust has been focused on securing virtualization since it’s founding. With its CloudControl and DataControl portfolio, it continues to help customers enable multi-cloud workload security for a breadth of data center platforms,” said Jon Oltsik, senior principal analyst, Enterprise Strategy Group.

Related News

- 01:00 am

Chase and Phillips 66 have signed a multiyear agreement for Phillips 66 to accept Chase Pay at its Phillips 66®, Conoco® and 76® branded locations across the United States, the companies announced.

Phillips 66 joins a host of merchants in signing up to accept Chase Pay, which gives Chase customers an easy, secure and rewarding way to pay for purchases. The fuel retailer is also a key member of the Merchant Customer Exchange (MCX), a strategic Chase Pay relationship.

To enable Phillips 66®, Conoco® and 76® branded sites to accept Chase Pay at their pumps and in their c-stores, Phillips 66 has also collaborated with Houston-based mobile commerce provider P97 Networks, Inc. and will leverage P97’s cloud-based mobile payment infrastructure.

As a result of these relationships, consumers of Phillips 66’s fuel brands will soon be able to make purchases through the My Phillips 66, My 76 and My Conoco mobile apps of Phillips 66.

“We are excited to work with Chase and P97 to accept Chase Pay at our branded sites, which will offer our customers a simplified fueling experience – one that will enable them to safely and expeditiously purchase our high-quality Phillips 66, Conoco and 76 gasoline on their mobile devices from the comfort of their vehicles,” said Brian Mandell, global marketing president for Phillips 66. “This same convenience will allow customers to take advantage of our reward programs and promotions without having to swipe loyalty cards or use coupons at pumps and registers.”

Phillips 66 is one of the largest fuel retailers in the United States while Chase is the largest U.S. credit card issuer based on loans outstanding. Chase customers have more than 90 million consumer credit and debit card accounts, and nearly 24 million actively use the award-winning Chase mobile banking app.

Chase Pay is live with select online merchants and will be available starting later this year for Chase customers to use at participating merchants’ registers and in apps.

“We’ll work closely with Phillips 66 in enhancing their brand loyalty and making it easier for their customers to buy fuel with their mobile phones,” said Jennifer Roberts, president of Strategic Alliances and Loyalty Solutions for Chase.

“Chase Pay will help deepen the relationship with our common customers by integrating Phillip 66’s loyalty offers and rewards with payments to deliver a seamless experience,” added Tom Nipper, executive director of Global Enterprise Solutions for Chase Commerce Solutions.

Related News

- 01:00 am

Data-driven marketing and loyalty analytics company Aimia has turned to software solutions from SAS Canada, the leader in analytics, to power its advanced data analytics and modelling operations in Canada.

Aimia partners with companies to help generate, collect and analyze customer data and build actionable insights, through its own coalition loyalty programs such as Aeroplan, Canada's premier coalition loyalty program, through provision of loyalty strategy, program development, implementation and management services; and through its analytics and insights business.

"This renewed partnership with SAS is a key part of our strategy to deepen and broaden our data analytics capabilities to the benefits of our clients and members." said Michael Poyser, Vice President, Analytics, Americas Coalitions. "Our ability to generate customer insights from data analytics enables us and our partners to make smarter business decisions and build relevant, rewarding and long-term one-to-one relationships with consumers."

SAS leads in advanced analytics market share (per IDC) and is a leader in agile business intelligence, according to Forrester, and is poised to remain at the top. IDC identified SAS as the top supplier, owning 33.3 percent market share of the 2014 advanced and predictive analytics market, more than twice that of the next-closest competitor. In addition, the IDC report ranked SAS among the top five providers with the highest growth rates in advanced and predictive analytics software.

"As organizations increase their investments and reliance on data-driven marketing and analytics to fuel business growth, SAS's advanced analytics software solutions can provide rich data insights to inform everything from marketing campaigns to supply chain management," said Cameron Dow, President of SAS Canada. "SAS is excited to be partnering with Aimia, to help drive advanced analytics and modelling; these solutions will enable Aimia to build more models, more quickly supporting their goal of making business personal."

Related News

- 08:00 am

Capital One announced the launch of Spark 401k, providing low-cost, all-ETF 401(k) plans designed to empower business owners and their employees to invest for the future. Spark 401k is the latest addition to Capital One's small business solutions suite, which includes Spark Business' award-winning credit cards, best-in-class banking products, and payments and e-commerce tools.

Spark 401k is designed for businesses with fewer than 100 employees to deliver a straightforward retirement planning experience that offers the benefits available to larger companies. These benefits include the ability to build a retirement nest egg with tax-deferred dollars, reduce business taxes, and recruit and incentivize employees. The new Spark 401k leverages the technology and expertise behind Capital One's ShareBuilder 401k, which pioneered the all-ETF 401(k) movement beginning in 20051. Spark 401k also provides access to low-cost ETFs that keep investment expenses under one percent, helping employees further grow their nest egg.

" Only thirteen percent of small businesses offer a retirement plan and while many say they want to provide a plan, they often put it off because they think it will be too expensive, burdensome or complicated," said Stuart Robertson, president of Capital One Advisors 401k services, which oversees Share Builder 401k and Spark 401k. "We designed Spark 401k to make retirement planning easier and more accessible for small businesses. With its online plan management and direct access to licensed 401(k) advisors and customer success managers, Spark 401k can help small business owners plan for the future – for themselves and their employees – while they pursue their primary passion, running their business."

Related News

- 06:00 am

KeyBank has added Masterpass by Mastercard to its mobile payments capabilities in response to steadily growing client mobile payment use.

"We know our clients want to be able to choose the banking product that best fits their individual need, and mobile payments is no exception," said Jason Rudman, director of KeyBank Consumer Payments and Digital Banking. "Whether clients prefer to pay via tap, dip or swipe, we want to be our clients' primary payment provider as they determine how they want to make payments. We are excited to offer Masterpass to our clients."

KeyBank's partnership with Mastercard means KeyBank clients will have access to fast, simple and secure digital payments across devices and anywhere they want to shop—online, in app and now in-store.—with Masterpass by Mastercard.

Masterpass simplifies the checkout experience across a wide array of retailers. With Masterpass, clients can check out online or in-app by clicking the Masterpass button and authenticating to complete the transaction. They can make in-store payments simply by tapping at contactless-enabled merchants.

Masterpass stores all payment information, including card details from both Mastercard and other payment networks, shipping information, and payment preferences in one convenient, secure place. It leverages the most advanced methods of payment security available today, including tokenization, which ensures information is protected.

KeyBank clients are making more use of mobile payments than ever before. Year over year, KeyBank has seen double digit growth in client mobile payments. On average, KeyBank clients are signing on and making transactions with their mobile devices three times as frequently as they had done over the past 18 months.

"We're tapping partnerships across the industry to provide our clients with innovative, safe and secure mobile payments options," said Matthew D. Lehman, head of KeyBank Online and Mobile Banking. "KeyBank will continue to bring our clients the best mobile payment options as mobile payments innovate and evolve."

Related News

Product Profile

Product/Service Description

FICO Falcon Fraud Manager provides core analytic processing power to handle an organization’s transactional fraud detection needs such as debt, credit, deposit, ePayments and mobile. It can be used to process events, develop strategies to detect fraud and create cases, and execute associated decisioning across an institution’s products, channels and customers.

FICO® Falcon® Fraud Manager provides deep insight into fraud trends and activity. Powered by FICO’s market-leading predictive analytics, it detects up to 50% more fraud than rules-based systems.

Customer Overview

Features

- Robust neural network models with patented service, account, and customer profiling and monitoring of global entities

- Real-time rule creation, rule simulation, and rule implementation

- Efficient investigations with sophisticated case management system

- Seamless integration with your authorization and payment systems for up to 100% real-time scoring

- Region and portfolio-specific fraud models leverage industry-wide consortium data

- Adaptive models generate fraud scores based on analyst feedback

Benefits

- Detects more fraud with lower false positives to provide minimal impact on good customers

- Delivers earliest possible warning of fraud activity

- Boosts analyst productivity and improves effectiveness of fraud operations

- Identifies fraud sooner to give you more opportunity to reduce losses

- Leverages known fraud patterns to achieve highest fraud detection levels

- Adjusts to your findings about fraud dispositions

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Product Profile

FICO®Siron® Anti-Financial Crime Solutions

Product/Service Description

FICO® Siron® Anti-Financial Crime Solutions consists of flexible and highly integrated software modules for:

• Anti-Money Laundering

• Tax Compliance (FATCA, CRS/AEOI)

• Counter-Terrorism Financing

• Know Your Customer

• Business Partner Due Diligence

The building-block design allows variable combination of the products. This paves the way to genuine cost efficiency, transparent total cost of ownership and solutions that can grow along with the challenges of our customers.

Key Features:

• Coverage of all statutory requirements

• Risk-based approach according to FATF

• Full check of customers and transactions

• No IT-knowledge necessary to configure detection scenarios

• Best-practice research scenarios from more than 1,000 of customer installations

• Multi-clients and multi-lingual user interfaces

• Easy integration with existing systems through standardized and flexible interfaces

• 100% audit-proof documentation

FICO® Siron® solutions consistently follow the risk-based approach and support all phases of the compliance process with integrated solution modules: from business risk analysis and customer risk classification to monitoring of transactions and behavioral patterns, and central case management with risk and compliance dashboards.

FICO® Siron® products are highly standardized and parametrizable. They can be combined at will to create custom solutions. Numerous best-practice scenarios from a large number of customer installations have made their way into our standard research products. They guarantee fast roll-out of professional solutions based on the latest compliance knowledge.

FICO® Siron® technology is robust, interoperable, platform-independent and highly scalable. This facilitates integration of our products into existing system environments and provides seamless interaction with third-party applications and databases. The field of application of our products extends from the lean departmental to a cross- and multi-national group solution.

Customer Overview

Features

- Coverage of all statutory requirements

- Risk-based approach according to FATF

- Full check of customers and transactions

- No IT-knowledge necessary to configure detection scenarios

- Best-practice research scenarios from more than 1,000 of customer installations

- Multi-clients and multi-lingual user interfaces

- Easy integration with existing systems through standardized and flexible interfaces

- 100% audit-proof documentation

Benefits

- Largely automated driving the daily surveillance with as little effort as possible

- System-independently integrated into the IT-infrastructure – investments in additional hard- and software not necessarily needed

- Good performance even for high volume of data

- Easily adaptable to regulatory changes and highly flexible support of any individual definition of suspicion criteria according to the specific risk of the bank

- End user-friendly dialog to bring in the compliance officer’s experience and knowledge of what seems to be suspicious

- Audit trail protocols of all operations and definitions including changes - to protect employees from being accused of carelessness

- Reasonable costs for license and implementation

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

- 07:00 am

A first of its kind, Raphaels Bank Payment Services, a niche payments bank now offers Apple Pay to the bank’s Cash Passport Multi-currency card customers. The Cash Passport Multi-currency card – which is enabled by Mastercard Prepaid Management Services – will be the first facility to transact in up to 10 currencies using Apple Pay and demonstrates a continued commitment to leading innovation in the payments sector.

With security and privacy at the core of Apple Pay, Raphaels Bank believes this is a significant development to give prepaid card programmes a valuable differentiator in the consumer marketplace, as Janet Johnston, Head of Raphaels Bank Payment Services explained:

“The cashless society is set to accelerate over the next few years in line with the rapid growth in contactless payment transactions at point of sale and Apple Pay is playing a crucial role in this space. Whether via card or mobile, we see it as vital to be at the forefront of the digital payment revolution and are excited to be making it possible for prepaid card programmes to use Apple Pay for multiple currencies.”

Graham Perry, President, Mastercard Prepaid Management Services said:

“The addition of Apple Pay to our Cash Passport product marks a step change in digital convergence for our customers. They continue to benefit from the security and simplicity of our multi-currency account, combined with the flexibility and convenience of Apple Pay. We are excited to give our cardholders even more ways to use the product especially with the continued growth in online, cross-border transactions.”

Perry continues: “We continue to work closely with our partner, Raphaels Bank, to innovate in order to ensure our products meet the changing needs of customers.”

“This is another great example of how we’re investing in transforming payments for prepaid card programme managers, giving them a strong selling proposition that keeps pace with the rapidly evolving payments market”, added Janet Johnston. “While many of the big banks have already adopted Apple Pay, we are proud to be one of the first specialist payment banks to offer this facility to our customers for multi-currency transactions.”

For more information on Apple Pay, visit: http://www.apple.com/uk/apple-pay/

Related News

Product Profile

SAS Anti-Money Laundering

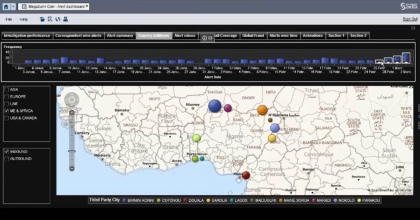

Screenshots

Product/Service Description

The SAS solution allows clients to uncover suspicious financial activity efficiently. Get a complete view of threats across your entire institution. And streamline your monitoring, review and investigation processes. SAS provides a common analytics platform and module-based solutions for enterprise fraud, customer due diligence, anti-money laundering and enterprise case management.

Customer Overview

Features

- Money Laundering and Terror Financing Transaction Monitoring, Watchlist and Sanctions Batch Monitoring, Alert and Case Management with Workflow Governance, Regulatory Report Creation, Management, and E-Filing

Benefits

- High Performance scalability to cover very large transaction volume across many lines of business, Transparent system with open data model and no black box monitoring processes or models, Robust and mature data model provided with the solution, Extensive

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Product Profile

FlexFinance IFRS

Product/Service Description

FlexFinance IFRS. FERNBACH offers a modular solution system. It consists of several blueprints, which in their entirety cover the finance & risk process chain including valuation, financial accounting, reporting and analyses. Each of these blueprints consists of components (“calculation kernels”) which can easily be integrated. One can install selected individual components or the entire range of blueprints. The blueprints for IFRS include the latest rule sets such as IFRS 9 and IFRS 13.

Customer Overview

Features

- FlexFinance IFRS provides, for risk provisioning in particular, a comprehensive catalogue of instruments that includes calculation, simulation, accounting, analysis and reporting. Since different organisational units in a financial institution are usually

Benefits

- Comprehensive IFRS solution which includes valuation of financial instruments, calculation of impairment and hedge management; consolidation with multi-currency capability. • The IFRS solution supports FinRep in accordance with the European Banking Author