Published

- White Papers

- 14.11.2016 11:06 am

- Will EMV Standards Impact Fraud Control?

Credit cards have evolved from magnetic strips to chip-and-pin, chip-and-choice, and chip-and-signature cards. EMV is now the de facto global standard for the chip technology embedded in financial payment cards. In the fourth quarter of 2012, there were 1.62 billion chip cards in use across 80 countries.

But has EMV really been successful in bringing down incidents of fraud? This paper explores these facets by examining the EMV standards, rate of CNP fraud post EMV implementation and the impact.

Please fill up these fields in order to read the publication.

Other White Papers

- 05:00 am

Pakistan-based AlHuda CIBE has conferred the “Best Technology Solutions Provider to IMF 2016” award to Path Solutions for promoting global financial inclusion and demonstrating exemplary social responsibility towards a sustainable financial system.

The award was granted to Path Solutions after a rigorous evaluation of a record number of nominations by an internal research team and an award committee at AlHuda CIBE.

AlHuda CIBE is a non-profit organization working for the awareness, promotion, education, training, advisory, consultancy and publication on Islamic banking and finance in Pakistan and around the globe.

Commenting on the award, Mohammed Kateeb, Group Chairman & CEO of Path Solutions said in statement: “We are humbled by this recognition. This award reflects our commitment and dedication to empower our clients not only to secure financial gains but also achieve social goals, and our passion to contributing to economic empowerment and poverty reduction through a wide range of cutting-edge software solutions including Islamic microfinance and advanced delivery channels, among others. We believe that such initiatives confirm that the future of banking lies in coming up with solutions that specifically target the unbanked and the rural communities, achieving wider financial inclusion”.

Path Solutions has been a pioneer in developing a Sharia-based microfinance solution to cater to the unique needs of the Islamic micro-credit and micro-savings industry, a significant progression toward financial inclusion.

Islamic Microfinance provides crucial technology support to Islamic microfinance institutions of all sizes eager to respond to a number of challenges such as limited financial means, cost of reaching the unbanked, lack of scalability and some administrative challenges.

Headquartered in Pakistan, AlHuda Centre of Islamic Banking and Economics (AlHuda CIBE) aims at providing information, analysis and insights into the global Islamic finance industry, with a special focus on Islamic microfinance.

The “First Islamic Microfinance Awards” are a signature initiative of AlHuda CIBE aimed at recognizing industry pioneers and at promoting the concept of poverty alleviation. These are conducted to highlight best practices in Islamic microfinance and celebrate the success of institutions and individuals, with an ultimate objective of promoting social responsibility, gender equality, Sharia authenticity and commitment to Islamic microfinance.

The awards were presented to winning individuals and institutions in a total of 19 distinct categories at the “First Islamic Microfinance Awards” which took place on 9th November, 2016 at Intercontinental Hotel in Nairobi, Kenya. The award ceremony was organized in conjunction with the “6th Global Islamic Microfinance Forum (GIMF 2016)” on 8th & 9th November.

Related News

- 03:00 am

AXELOS, global custodians of ITIL, the world’s most widely adopted service management framework, and IT Revolution, visionaries of the DevOps movement and publishers of The DevOps Handbook, have come together to launch a free online training program, DevOps Awareness Training, in early 2017.

The aim of this pioneering program is to ensure that every IT professional, across a diverse range of organisations, has access to world-class training based on the principles of DevOps. The goal is to create value for customers with small agile teams who are confident in aculture that fosters learning without the fear of failure. DevOps Awareness Training’s content is based on the newly launched, and much-anticipated DevOps Handbook, co-authored by Gene Kim, founder of IT Revolution and the partnership is enriched by AXELOS' expertise in helping professionals to learn about and apply best practice.

The DevOps movement has shown how strong collaboration and focus on continual improvement in IT helps organizations in leveraging IT to create added business value. DevOps Awareness Training will also open invaluable opportunities for improving the way IT services are provided, thus supporting ITIL’s philosophy of Continual Service Improvement. Gene Kim, founder of IT Revolution has played a major role in steering the DevOps movement, and like other leading figures, such as Patrick Debois, Andrew Clay Shafer, Kevin Behr and Jez Humble, he has nurtured the community and gathered and interpreted examples of novel, emergent, and good practices. IT Revolution’s new publication The DevOps Handbook (co-authored by Kim, Debois, Humble and John Willis) provides a comprehensive insight into the movement.

With this impressive wealth of knowledge behind it, DevOps Awareness Training will combine interactive learning, animation and simulation exercises. Drawing on The DevOps Handbook, on IT Revolution’s previous bestseller The Phoenix Project (over 250,000 copies sold worldwide), and on contributions from trusted DevOps experts, it is reinforced by AXELOS’ knowledge in the field of ITSM as described in ITIL. Responding to the growing need for professionally designed learning modules (based on a standard and continually updated syllabus) that teach IT practitioners about the benefits of DevOps, DevOps Awareness Training will offer a grounding in the principles of DevOps, covering such important topics as its culture, architecture and technical practices.

Presenting at the DevOps Enterprise Summit in San Francisco on November 8, Kaimar Karu, AXELOS’s Head of Product Strategy and Development, said:

“Both AXELOS and IT Revolution believe that, in today’s world, the focus of DevOps needs to be on collaboration and learning. With DevOps practices still constantly evolving, the time is not yet ripe for a qualification program with formal exams, but it is crucial for IT practitioners from all backgrounds to have a solid understanding and appreciation of the movement’s principles.

Every ITSM professional can benefit from an improved awareness of DevOps practices. Likewise, professionals in the DevOps community will benefit from leveraging the service mindset and the guiding principles that underpin the ITIL framework, as outlined in the ITIL Practitioner qualification. In the spirit of open collaboration – and in view of the very important need for both communities to expand and sharpen their awareness of the combined power of DevOps and ITIL – we have decided to create a program that is free of charge for practitioners, so absolutely everyone can access it.

The Official DevOps Awareness Training syllabus is flexible and powerful, allowing training providers to develop their own value-add training programs, either as simulations or extended classroom-based courses, which can be accredited against the syllabus. Additional modules, providing in-depth knowledge, can be built as an extension to the core, and the program will be accompanied by an interactive online assessment which helps individuals to better assess the areas where further learning is required. The results of these assessments will also play a vital role in guiding AXELOS and IT Revolution as we create new syllabuses that respond to the real-time needs of IT professionals.”

Gene Kim, founder of IT Revolution and co-author of The DevOps Handbook and The Phoenix Project, said:

“DevOps and Agile are transforming the technology workforce. Of the eight million developers and eight million operations professionals employed globally, a vast majority are at risk of being left behind. Initiatives like these are critical to ensure that technology professionals have the skills needed in the marketplace, and I'm thrilled to be a part of this effort.

DevOps and ITIL should aim to more than peacefully coexist. Without a doubt, ITIL is the most powerful and entrenched orthodoxy in large, complex IT organizations. With over three million certified IT professionals and many (if not most) Fortune 500 companies using ITIL, this represents an unparalleled opportunity to help reach a significant portion of the technology workforce. For these reasons, I’m excited about the partnership between IT Revolution and AXELOS to use The DevOps Handbook as a way to increase DevOps awareness and training.”

Related News

- 06:00 am

Alibaba Group Holding Limited (NYSE: BABA) announced that more than USD 7 billion (RMB 47.5 billion) of gross merchandise volume (GMV) was settled through Alipay on Alibaba’s China and international retail marketplaces within the first two hours of the 2016 11.11 Global Shopping Festival.

"Chinese consumers purchased more in the first hour of 11.11 this year than the entire 24 hours in 2013, reflecting the incredible evolution of our global shopping festival. This unprecedented level of engagement demonstrates both the consumption power of Chinese consumers and their embrace of online shopping as a lifestyle,” said Daniel Zhang, chief executive officer of Alibaba Group.

In the hours leading up to the official midnight start of November 11, millions of viewers watched the Alibaba Group 11.11 Global Shopping Festival Countdown Gala live online and on mobile devices via Youku Tudou, and the Tmall and Taobao apps. The gala was televised live across China through Zhejiang Satellite TV, as well as in Hong Kong and Macau for the first time.

“This year, we innovated new ways for consumers watching the live broadcast of our countdown gala. Viewers were able to influence the production of the show in real-time through their mobile phones,” said Chris Tung, chief marketing officer, Alibaba Group. “Consumers in front of their televisions were shaking, tapping, scanning, chatting, browsing and buying with their mobile devices, creating a seamless and truly immersive entertainment experience.”

The annual shopping event kicked off earlier today at 12:00 a.m. China Time. Early highlights included:

- Within the first 5 minutes, total GMV settled through Alipay exceeded USD 1 billion (RMB 6.8 billion)

- In the first hour, total GMV settled through Alipay was USD 5.2 billion (RMB 35.3 billion)

- In the first two hours, total GMV settled through Alipay was USD 7.2 billion (RMB 48.6 billion), and mobile GMV settled through Alipay accounted for 84% of total GMV

For additional content from the event, please follow the Alibaba Group official Twitter account at https://twitter.com/AlibabaGroup, or visit theMedia Resources page on Alibaba corporate news site Alizila with background, factsheets and content related to this year’s 11.11.

GMV for the 11.11 Global Shopping Festival is the total value of orders settled through Alipay on Alibaba’s China and international retail marketplaces. It is reported on a real-time basis and includes shipping charges paid (where applicable). Transactions related to international brands, defined as brands created outside of Mainland China, and user data are limited to Tmall.

All GMV, mobile GMV and other figures presented in this press release are unaudited and subject to adjustments.

Related News

Product Profile

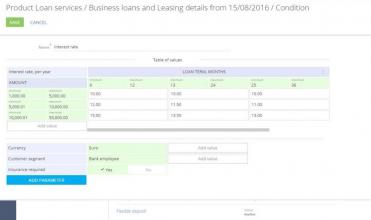

Screenshots

Product/Service Description

Bpm’online is a global provider of award-winning CRM software that streamlines customer-facing processes and improves operational efficiency. Bpm'online financial services is a powerful CRM designed for corporate and retail banks and financial institutions to manage a complete customer journey and enhance customer experience. The users of bpm’online financial services highly value its process-driven CRM functionality, out-of-the box best practice processes and agility to change processes on the fly. Bpm’online financial services offers products that are seamlessly integrated on one platform connecting the dots between banks’ business areas: retail banking and front-office, corporate banking, marketing.

Customer Overview

Features

- 360° customer view

- Customer segmentation

- Opportunity management

- Product management; product-segment matrix

- Customer weight ranking

- Account management

- Customer lifecycle management

- Omnichannel communications

- Product catalog with the possibility to configure product and pricing parameters

- Consulting and transaction contact-center with the workplaces for bank tellers, agents, supervisors

- Case management

- Knowledge management

- Contracts and documents

- Loan origination processes: unsecured loans, mortgage, auto loans, and others

- Lending application processing, managing loan applications from agents or partners

- Fraud prevention

- Verification and underwriting

- Loan maintenance

- Monitoring pledged assets

- Managing loan paperwork

Benefits

- Align marketing, sales and service on a single CRM platform for banks' business processes

- Gain the agility to change processes in the CRM faster than ever

Platform & Workflow

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

- 06:00 am

BT today announced it is accelerating its investment in dynamic network services by integrating a range of new technologies that will make it easier, faster and safer for organisations to move towards a cloud-based IT consumption model and succeed in their ambitious digital transformation journeys. Those services will leverage technology, systems and tools from BT and its best-of-breed ecosystem of partners. They will combine with the existing portfolio of network services to reinforce BT’s ability to be the leading global cloud services integrator for its multinational customers by covering areas such as self-service VPNs, flexible bandwidth, virtual services and more.

As part of that investment, BT has selected Nuage Networks from Nokia to contribute technology for its future software defined WAN service.

As large organisations in the UK and around the world rapidly increase their use of cloud services and seek to maximise the opportunities of their digital future, they want to be able to access specific network services with maximum flexibility and agility, while maintaining the highest degree of security. BT’s ongoing investments in dynamic network services respond to that demand through the development of innovative sets of capabilities, based on new programmable technology that leverages Network Function Virtualisation (NFV), Software Defined Networks (SDN) and Software Defined Wide Area Networking (SD-WAN). Those investments add to BT’s network services portfolio and execute on BT’s strategic vision of delivering the broadest possible range of network services to customers to meet their diverse connectivity needs.

Chet Patel, president of global portfolio & marketing, BT, said: “We aim to be the leading global cloud of clouds services integrator for our customers. As part of that strategy, we are now leveraging our expertise in SDN and NFV technology and using the breadth and depth of our global network infrastructure to enhance further our portfolio of dynamic network services. To offer more choice to our customers, we are constantly reinforcing an ecosystem of world-class partners. We are therefore happy to announce today that we will integrate the technology of Nuage Networks from Nokia into our SD-WAN offering. This is an important stage in a journey that will ultimately give BT customers unparalleled choice, security, resilience, service, and agility in the roll out of high performance networks designed for the age of the cloud.”

Today’s announcement follows the recent launch of BT Connect Intelligence IWAN, an innovative managed service that enables organisations to automatically route and optimise network traffic and gain visibility of applications performance without spending more on bandwidth.

The initial launch of BT’s SD-WAN service incorporating Nuage Networks technology from Nokia is planned for early 2017. It is specifically being developed to serve global organisations using a cloud-based IT consumption model and will complement BT’s existing IP and Ethernet VPN offering.

In the coming months, BT will unveil further details of its roadmap for other software-defined services, aligning to the SDN capabilities that are being introduced in BT’s cloud-service nodes. These will enable organisations to control both their network connectivity and hosted applications from a single SDN-automated infrastructure.

Organisations will also be able to choose how they take this control. Their options will include a portal-based self-service or centralised account-driven service management.

Also coming, BT’s SD-WAN services will integrate with new virtual services that will include ‘try before you buy’ capabilities and be consumed on a utility basis. Virtual Customer Premises Equipment (vCPE) capabilities will provide integrated 'branch in a box' services, using the centralised automation of SD-WAN. And, with this, customers will be able to simultaneously control their on-premise and network applications.

Details about BT’s ‘Cloud of Clouds’ portfolio strategy and Dynamic Network Services capabilities can be found here.

Related News

- 06:00 am

Nuvias has teamed up with Riverbed Technologies to offer a unique service that delivers proactive monitoring, alerting and reporting for Riverbed SteelHead™ and SteelFusion™ solutions. The highly flexible and adaptable service provides recommendations to improve WAN acceleration performance, reduce problem resolution times, identify and isolate persistent performance issues and avoid unplanned expenditure to maximise ROI.

Nuvias Managed Service seamlessly integrates with new or existing SteelHead or SteelFusion deployments. Through real-time analysis and detailed quarterly reports the service enables partners to help their customers optimise network traffic based on business priorities and demands, as well as provide vital forecasts based on existing and future system capacity.

Developed by industry leading consultants, exclusively for Riverbed SteelHead and SteelFusion solutions, the service provides a real-time visibility and reporting portal. The service also offers features such as availability monitoring, performance remediation and service reinstatement along with the continual management of all moves, additions, changes and deletions. The service is backed up by 24x7x365 direct access to an accredited Level 2 helpdesk, for partners without in-house consultancy and engineering expertise.

“We have worked closely with Riverbed to deliver a truly innovative, next generation service delivering real value for our partners and their customers,” said Lee Driscoll, regional vice president North for Nuvias. “Nuvias is the most extensively resourced, qualified, experienced and successful Riverbed distributor in EMEA, so we are ideally positioned to support our partners with this exciting new range of specialist services.”

Stephen Smith, vice president of global service provider partnerships at Riverbed Technologies, commented: “Riverbed specialises in providing solutions that help enterprises optimise the performance of their networks and the applications and services that run across them. Riverbed’s SteelHead technology has been recognised as a Leader in ‘Gartner's Magic Quadrant for WAN Optimisation’ eight years running.

“Nuvias is a highly capable value added distribution partner of Riverbed’s and I am delighted to see that they have developed a portfolio of white labelled services capabilities intended to complement our product portfolio and help our partners get to market faster with their own bundled managed service offers that meet and exceed their customers’ expectations.”

Related News

- 02:00 am

Gemalto (Euronext NL0000400653 GTO),the world leader in digital security, is continuing its support for the digital transformation of Intesa Sanpaolo, Italy's most popular retail bank, by supplying its Allynis PIN by e-Channel solution that enables PIN delivery via SMS, web or their mobile banking app. The introduction of the world's first comprehensive e-PIN notification service marks the latest stage of Intesa Sanpaolo's partnership with Gemalto, which is leveraging innovative digital technologies to enhance the customer experience, build competitive advantage and secure greater operating efficiency. By the end of the year, Gemalto's current PIN-by-SMS and PIN-by-Web solutions will be joined by a new PIN-by-App channel, giving Intesa Sanpaolo customers the freedom to access instant PIN notifications and reminders via their mobile phone, tablet or PC.

Intesa Sanpaolo is one of the largest banks in the Eurozone, and adoption of Gemalto's PIN by e-Channel solution is integral to the reimagining of its in-branch and digital banking offer. Over 800,000 codes have already been securely distributed, combining swift and seamless customer service with significant cost savings compared to traditional postal delivery. Customers can activate and use their new credit and debit cards immediately by receiving an immediate notification of their PIN. Reminders can also be sent on request via any of the new channels, reducing the number of transactions cancelled because a customer has forgotten his or her PIN.

"Real-time electronic PIN delivery is a key element of our vision for digital, multi-channel banking," said Massimo Tessitore, Head of Direct Channels, Mobile Payment and eCommerce Department at Intesa Sanpaolo. "With its unique experience, footprint and certification, Gemalto was a natural choice of partner to meet our requirements for security, customer experience, brand image and cost reduction."

"In a fiercely competitive commercial environment, digitalization offers banks a route to improved customer service, market differentiation, reduced overhead and the creation of trusted ecosystems," said Philippe Cambriel, President for Europe, Mediterranean and CIS at Gemalto. "The successful implementation of the e-PIN project for Intesa Sanpaolo reflects our ability to accompany banks through every stage of the transformation process, helping them utilize key assets to create a compelling bank offer."

Related News

- 01:00 am

Cassiopae, the leader in global asset finance software, announces that Hyundai Commercial (HCI) and Hyundai Capital (HCS) are in production with Cassiopae V4.5 leasing and lending software in South Korea.

Hyundai Commercial (HCI) is the commercial finance arm of Hyundai, one of the top five auto manufacturers in the world. The division offers credit finance including industrial financing, corporate financing, and investment financing. The company has been in production with the Cassiopae software since June 2015.

Hyundai Capital (HCS) is the number one provider of consumer financial products in South Korea. As the financial service unit of Hyundai Motor Group, HCS provides auto financing, auto leasing, personal loans, and home mortgages. Hyundai Capital operates in overseas markets including the U.S., Canada, China, Europe, and Russia and Brazil. HCS has been in production with Cassiopae software since the beginning of June 2016 and is now ready to accelerate expansion of its worldwide business using the Cassiopae global finance software platform.

The front-to-back Cassiopae V4.5 implementation for the two businesses involved migrating 19 million contracts and 58 million deals from legacy systems. Every day more than 4,500 Hyundai users interact with the Cassiopae system to manage millions of contracts in service. Cassiopae’s web service architecture enables Hyundai’s branches to connect via self-serve portals. In the first weeks of production HCS confirmed and funded more than 3,500 deals per day.

Mr. Gun Woo KIM (CIO) of Hyundai Capital, Hyundai Commercial and Hyundai Credit Card has said, “Hyundai Capital has integrated auto lease, auto installment and retail loan into one single system based on the Cassiopae solution. This is the first successful case of applying a packaged solution to core financial business in Korea and Hyundai Capital has a plan to deploy this platform to its global business entities.”

Hyundai is leveraging Cassiopae’s automated loan and lease processing, workflow, collateral management, and fully automated payment collection via integrated direct debit and financial settlement and clearing systems.

Cassiopae software supports a wide range of financial products and asset classes for the Korean market including housing loans, loan cards, factoring, complex corporate leases, asset-backed securities (ABS), and non-performing loan (NPL) purchasing. The software meets all of the regulatory and compliance requirements of Korea.

“Cassiopae V4.5 is unique in its ability to provide both agility and scalability for demanding, fast-paced environments,” said Emmanuel Gillet, Cassiopae CEO. “A project of this magnitude demonstrates how the right technology can truly enable the rapid business innovation needed to compete locally and globally. These go-lives are a major achievement for Cassiopae and Hyundai and demonstrate a deep commitment to the project by both sides.”

The HCI and HCS implementations in South Korea are the first major milestones of a multi-year project between Cassiopae and Hyundai that will encompass several business units and countries.

Related News

- 07.11.2016 -- 12:17 pm

Financial IT speaks with Peter Moss,CEO at The SmartStream Reference Data Utility at Sibos 2016.