Published

- 08:00 am

ALLDATA Europe GmbH, an affiliate of ALLDATA LLC, announced it has signed a reseller agreement with CAB Group AB. Headquartered in Sweden, CAB Group AB has branch offices in Norway, Germany, and Finland. Its software systems and services streamline repair processes for customers in the automotive repair and estimating sectors, including more than 3,000 workshops in Northern Europe. The agreement enables ALLDATA to serve CAB Group AB customers with OEM mechanical and collision repair information available through ALLDATA Repair.

"ALLDATA is pleased to expand through Western Europe and to serve the collision market with ALLDATA Repair," said Kevin Culmo, General Manager and Managing Director, ALLDATA Europe GmbH, and Group Vice President, ALLDATA LLC. "ALLDATA is the only company in Europe providing a comprehensive source of original manufacturer information for collision repair encompassing body and frame information, handling of new materials, evolving technologies, electronic systems and sectioning and structural procedures." Culmo adds, "Our relationship with CAB Group AB is ideal, because we focus on improving workshop efficiency and optimizing the workflow with innovative solutions. With ALLDATA Repair, the CABAS-enabled workshops will have a unique set of tools to streamline their repair processes and improve profitability."

"At CAB Group, everything we do is about optimizing the line," said Krister Werner, Director Business Unit Motor, CAB Group AB. "CAB Group workshops process millions of estimates annually through our CABAS claims estimating system in Northern Europe. The ability to offer ALLDATA Repair directly to our customers supports our mission to create efficiency and repair quality. As the predominant provider of solutions to more than 3,000 CABAS workshops in Northern Europe, CAB Group continuously delivers new solutions to streamline the entire repair process. Werner adds, "The agreement with ALLDATA exemplifies our commitment to provide customers with innovative solutions to make them successful."

ALLDATA provides unedited OEM repair and diagnostic information, advanced searching capability, wiring diagrams, maintenance interval and service schedules, and more within a single easy-to-use portal. In addition to mechanical repair information, ALLDATA Repair contains original manufacturer collision procedures making it the most complete source of OEM automotive information in the industry. Available in five languages, the European version of ALLDATA Repair contains 22 brands with more than 450 makes, 28 million pages, and 25,000 engine combinations. ALLDATA sells direct to workshops and through a network of more than 20 partners in more than seven countries.

"ALLDATA has served the automotive collision industry in the U.S. for years, and now we are expanding further into Europe," explains Mitch Major, President of ALLDATA, LLC. "CAB Group has a sophisticated workflow system from estimate to repair. With ALLDATA Repair OEM mechanical and collision information, we can help ensure safe, accurate, and reliable repairs to CAB Group's workshop network. ALLDATA remains focused on helping automotive workshops and technicians do the job right. With ALLDATA Repair, CABAS workshops have a competitive advantage through a combination of technological solutions."

Related News

- 07:00 am

Broadridge Financial Solutions, Inc. announced today that it has appointed Eric Bernstein as President of Broadridge Investment Management Solutions.

Broadridge Investment Management Solutions supports more than 225 global hedge funds, asset managers, family offices, fund administrators and prime brokers. Its modular suite of investment management solutions combines portfolio management, order management, risk management, reference data management, data warehouse reporting and reconciliation functionality in a single, multi-asset, completely integrated application.

“Eric brings nearly two decades of experience in global businesses serving the asset management and capital markets segments and is a proven leader in building strategic client relationships,” said Charlie Marchesani, President of the Global Technology and Operations division of Broadridge. “As asset managers focus on driving growth and margin expansion, Broadridge is committed to providing innovative solutions and best-practice services that enable our clients achieve operational advantage.”

“I am excited to join Broadridge, a global financial technology leader which is at the forefront of addressing industry needs and supporting clients with scalable and innovative solutions,” Bernstein said. “I look forward to driving our continued focus on helping our investment management clients achieve operational excellence and sustain future growth.”

In this role, Bernstein will be responsible for driving our global business growth in investment management solutions, leading day to day and strategic execution of client and market-focused solutions, and world-class service delivery.

Previously, Bernstein spent 17 years in financial technology, leading divisions at Linedata, Sophis and most recently, at eFront. As eFront's Chief Customer Success Officer, Bernstein had global P&L responsibilities for account management, global support, product management and the Pevara Data Business, which covered more than 850 clients. Prior to that role, he was Chief Operating Officer of the Americas at eFront.

Related News

- 02:00 am

Pendo Systems is proud to announce they’ve surpassed two major milestones as they prepare for their formal launch in Q3 2017: the successful completion of their first full deployment of the Pendo Data Platform for a major Global Bank; and their certification as a Women’s Business Enterprise (WBE).

Even ahead of its imminent launch, the Pendo Platform has garnered both recognition and awards such as the Swift Innotribe Top Innovator Award in 2015. Commenting on Pendo’s continued success since accepting the Innotribe Award, Kevin Johnson, Head of Innotribe Innovation Programmes, SWIFT, had this to say:"Where only 10% of all FinTech companies survive after 3 years of operation, over 90% of Innotribe's alumni are still operational or have been acquired. This validates our methodology in selecting the best start-ups, and we are proud to count Pendo Systems as one of our key success stories."

The Pendo Platform revolutionizes the process of accessing data stored across millions of different document types. The Platform is used to gain access and insight to both structured and unstructured data sets, but it is the speed and accuracy with which the Platform can make unstructured data accessible that’s really turning heads.

At the heart of the Pendo Platform is an Indexing and Classification algorithm that makes the data instantly searchable using natural search, thus turning millions of unstructured, and unsearchable documents into a structured database that makes visible mission critical information which was previously both difficult, and time-consuming to access.

On a recently completed project for a major global bank, the Pendo Platform processed 48 million unstructured documents in just seven weeks, making them instantly accessible and easily searchable — a project that had previously been expected to take four years and an army of consultants to complete.

Says Pendo Systems CEO, Pam Pecs Cytron, “The fact of the matter is, data you can’t access or interrogate adds cost to an organization, it’s only when you turn that data into information that you’re able to extract maximum value from it. That’s the beauty of our

platform, access to the data you need to save your business money.”

Pendo Systems is also proud to announce they have been certified as a Women’s Business Enterprise (WBE) through the Women’s Business Enterprise National Council (WBENC), the nation’s largest third-party certifier of businesses owned and operated by women in the US. The WBENC certification process imposes strict requirements to prove a business is woman-owned and managed before granting certification. The primary criteria for a business applying for WBENC certification are that it has a majority female ownership (at least 51% by one or more women) and is managed by women. In addition, women must have unrestricted control of the business, and the highest defined title in the company’s legal documents must be held by a woman.

Pendo is helmed by Pam Pecs Cytron, a veteran financial services executive who serves as Pendo’s CEO and Founder. “We are thrilled that Pendo has earned this honor. The certification process is appropriately rigorous and takes into account many factors including the growth and trajectory of the company,” said Mrs. Pecs Cytron.

Related News

- Product Reviews

- 01.05.2017 02:31 pm

What does the product do?

Ohpen offers a cloud-based and API-based platform that provides BPO services and SaaS solutions to financial service entities, based on the core banking application. The product is oriented at providing infrastructure and taking care of back-end operations. Drawing on the expertise as former retail bankers, the founding team renovated all the processes and built the service from scratch resulting in a “bank-out-of-the-box” solution that is digital-and API-first.

Who needs the product?

The key clients are banking institutions and financial organizations that want to focus on their primary goals and make the daily procedures more efficient and productive. Ohpen cloud and API based platform provides back-end support for financial institutions through managing their infrastructure in compliance with standard regulations, ensuring smooth and safe operations flow.

How user friendly and accessible is the product?

Ohpen’s constantly upgraded solutions reliably back up the savings and investment propositions of the clients. Client organizations can choose to fully outsource back-end office or integrate already existing applications with the Ohpen’s platform. The onboarding process is fast and flexible and is conducted in compliance with standard regulations. Moreover, API can be easily integrated and is entirely web based. Thanks to the mobile application client companies can easily access necessary information to make relevant decisions.

What is special about the product?

Ohpen offers ultimately effective cloud-based, core-banking engine. The company is committed to provide effective administration of retail investment and savings account. It is one instance platform that is responsible for releases and testing. This model enables suggesting a sophisticated subscription payment model, which results in considerable cost reduction. All business modules can be customized to specific business needs, thus supporting front-end using API.

What are the main features of the product?

When clients license the Ohpen SaaS solution, the company takes care of hosting the applications and the maintenance of the infrastructure. Basically, client organizations can run their businesses, leaving the rest to Ohpen team of professionals. Client companies can focus on their front-office work, while Ohpen will take care of the back front routine.

Front End Suite:

Ohpen offers front-end suite as additional capability to the SaaS service. There is an option to integrate Ohpen’s back-end with Client Company’s front-end office. The front-end suite consists of:

- Fully responsive customer desktop website

- Mobile applications

- Content management systems

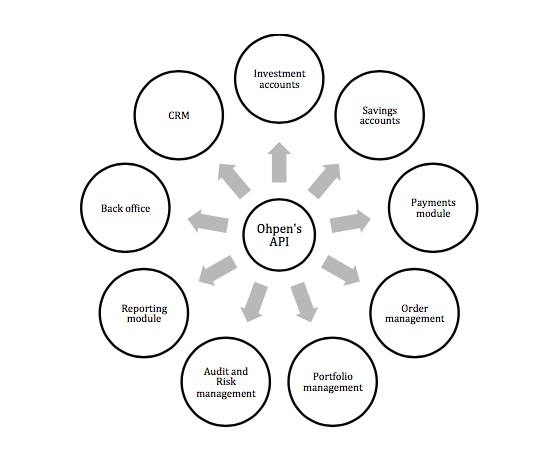

Ohpen Artificial Program Interface consists of the following modules:

- Investment accounts

The investment account module automates the administration of investment accounts. It allows using three service models, such as execution-only fund supermarket, robo advice, and discretionary asset management.

- Savings accounts

This module enhances the administration of both variable interest rate accounts and fixed term deposits.

- Payments module

The payments module enables to process contributions and withdrawals safely to and from saving accounts. Ohpen supports both commercial banking payments and wholesale banking payments.

- Order management

The order platform module is built to maximize efficiency in order execution, based on modified aggregation algorithms, using multiple cut-offs and connections with the relevant transfer agents, exchanges or other trading venues.

- Portfolio Management

This module deals with configuration of suitability testing and subsequent management of model portfolios that are connected to the individual customer accounts, based on risk profiles. Automatic rebalancing, takes place based on life cycling, volatility, fund weightings and many other variables.

- Audit and Risk Management

The risk and audit module combine all necessary features, including market abuse, unusual transactions, prevention of terrorism financing, anti-money laundering and suspicious payments.

- Reporting Module

The reporting module covers several standardized and custom reports for all departments’ needs, such as operations, risk, client services, tax, and general reporting.

- Back Office

The module covers record keeping, client onboarding, customer due diligence (CDD), real time calculations, fee structures and calculations, as well as a smart batch scheduler.

- CRM

CRM module refines efficiency to manage clients, leads, accounts and contact history data. It also provides a dashboard to manage a workload of teams and employees.

Other Product Reviews

- 02:00 am

New Zealand’s leading electronic payment network, Paymark, is partnering with Transaction Network Services (TNS) to reinforce its EFTPOS services with a new range of alternative, feature rich and highly reliable payment solutions.

Shane Ohlin, Chief Information Officer at Paymark, said: “We are delighted to be working with TNS to strengthen the New Zealand marketplace. We are dedicated to providing a high quality range of payments access services to support our merchants across the country.

“IP Dial remains an important access option for our customers and TNS shares our ongoing commitment to this technology. Partnering with TNS allows us to enhance our existing dial up offering while strategically expanding our portfolio and future-proofing our business with new wireless and IP offerings. It is important that we can be agile and responsive to changing market dynamics and we’re confident our agreement with TNS puts us in a strong position. We expect to also reduce our operational and support costs as working with TNS will help to streamline our infrastructure.”

TNS’ Global Wireless Access is a managed roaming wireless POS solution which will offer merchants greater security, coverage and reliability. It combines strongest signal detection with data roaming to overcome traditional blackspots allowing merchants to transact.

The TNSLink for Retail solution will replace Paymark’s OneOffice and RetailZone services for large merchants and offer additional functionality, including secure high speed bi-directional connectivity support for time reporting, inventory monitoring and other back office applications in addition to handling the POS transactions taken instore.

John Tait, Managing Director of TNS’ Payments Division for the Asia Pacific region, said: “We’re delighted to be working with Paymark and boosting the services it offers. Paymark is the leading processor in New Zealand and currently handles 75% of all card transactions in the country. This network includes 140,000 EFTPOS terminals across 80,000 merchants and sees approximately 1.2 billion transactions worth $60 billion carried each year on behalf of more than 50 card issuers and acquirers. We are excited at the role we will play in supporting this significant level of activity.”

New Zealand’s consumers are some of the world’s biggest users of debit and credit cards. Debit card usage, in particular, has soared over the last 30 years, fuelled by low fees and high consumer adoption.

Mr Tait said: “A number of New Zealand telecommunications providers have tried to move businesses off dial PSTN access as they seek to end of life their core infrastructure in favour of new IP and 4G/5G wireless networks. TNS is committed to being the ‘last man standing’ globally in providing dial POS solutions and supporting the long tail of merchants who are still gaining the benefits of this legacy technology. This new agreement with Paymark reaffirms this and demonstrates our continued investment in being a leading solutions provider for New Zealand.”

TNS’ Dial solution provides high availability with advanced node and circuit redundancy, back-up and flexible routing capabilities. It has been designed to deliver all types of transaction traffic, including credit and debit cards, pre-paid mobile top-ups, gaming, alarms, inventory control, order entry and other transaction-oriented applications. It delivers shorter and more cost effective transaction times than general purpose network service providers and supports all known POS protocols. Near real-time visibility, monitoring and reporting is provided by TNSOnline.

The TNSLink for Retail solution uses broadband with 3G/4G back-up or multi-network 3G/4G to provide failover and enable stores to continue to operate if the primary means of connectivity becomes available.

TNS’ Global Wireless Access can provide significant cost and time savings by allowing the bulk provisioning of SIMs, and the use of an advanced management and diagnostics portal gives flexibility and control over SIM deployment.

Related News

- 03:00 am

IBM today announced that any.cloud, which provides cloud hosting for customers across a wide range of industries, including digital media, has chosen IBM Cloud Object Storage for archiving services to help manage the company's massive amounts of unstructured data and help clients derive new insights and value from the data they store on any.cloud, giving both any.cloud and its clients opportunities for new revenue streams. any.cloud also recently tested IBM Watson Video Analytics, as the company seeks to provide new value-added services to clients in order to support video and picture tagging as a service.

The amount of data generated by digital media companies is growing rapidly. Analyst firm IDC projects the world's data growth to reach 163 zettabytes by 2025, with 80 percent of that growth coming from unstructured data created by the digital media industry.iManaging and storing growing digital media content can be both complicated and costly, leading some storage service providers to rethink their strategies in an effort to redefine the value of digital media content.

"We don't want to just offer storage to our customers. At any.cloud, our aim is to add value to our clients' businesses by providing them with safe, reliable and easy-to-use storage on a very large scale," said Gregor Frimodt-Møller, CEO at any.cloud. "One example of this is innovating our approach to data archiving to ensure we can deliver our customers always-on availability in combination with Watsonservices and technology."

Related News

- 01:00 am

Exiger, the global regulatory, financial crime, risk and compliance company, announced today that it has acquired OutsideIQ, the company that developed the groundbreaking cognitive computing and intelligent search platform DDIQ.

Exiger’s acquisition recognizes the urgent need for financial institutions and corporations to right-size compliance resources, manage voluminous data, and respond to regulatory demands. OutsideIQ’s development team and Exiger’s subject matter experts will join forces to use DDIQ to deliver solutions, at the enterprise level, that solve critical financial crime compliance issues—including customer, transaction, counterparty and third-party risk. The acquisition further positions Exiger as one of the leading providers of sustainable compliance solutions.

“Banks have spent the last 10+ years in response mode - reacting to regulators’ demands while trying and failing to contain the cost of compliance,” said Michael Beber, Exiger President and CEO. “The banks have been forced to give up compliant as well as non-compliant customers because they haven’t had the solutions to allow them to distinguish between them cost-effectively. With this acquisition, Exiger is uniquely positioned to implement a solution that meets the compliance demands of regulators and the profitability requirements of shareholders. Our entire Exiger team looks forward to working with Dan Adamson and the entire OutsideIQ team to solve what are clearly, some of our clients’ most important problems.”

“This acquisition reinforces our continuing commitment to best-in-class technology as the fulcrum of our client-centric solutions,” said Brandon Daniels, President, Exiger Analytics. “The global banks know that they are facing an imperative - restructure processes, deploy the right technology, and do a lot more for less while maintaining compliance. The acquisition of OutsideIQ/DDIQ will augment our ability to deliver purpose-built, AI-based solutions that transform how global banks and multi-national corporations meet the evolving expectations of regulators looking for truly measurable and auditable solutions. Exiger will build on DDIQ’s success to deliver enterprise level, RegTech solutions that respond to this shifting paradigm with our focus being to deliver solutions that address transaction alert monitoring, KYC onboarding, counterparty and third-party risk.”

Dan Adamson, Founder and CEO of OutsideIQ, said: “The financial services community clearly sees cognitive computing based solutions as critical to achieving cost efficiency, consistency and global scale in financial crime compliance. Yet, the identification of areas that are ripe for automation and the design of reliable solutions can only be driven by financial crime subject matter experts. We believe that this move solves that dilemma and will allow the combined OutsideIQ/Exiger team to seamlessly bring AI solutions to the financial markets with clear, impactful use cases. This transition is a logical step in our shared view of the dominant role that cognitive computing solutions will play in compliance. We look forward to enhancing what is already a very productive relationship and working closely with the entire Exiger team to bring critical, enterprise level solutions to the FI community.”

Related News

- 04:00 am

ItzCash, India’s largest digital payments company and the leading player in domestic remittances, has further ventured into cross-border remittances through its collaboration with Prabhu Money Transfer India, a leading remittance company in Nepal. With this initiative, ItzCash will enable Nepali diaspora settled in India to remit money back home through its 75,000 agent network spread across 3000+ cities.

India has witnessed significant migration from Eastern, Western and Central regions of Nepal, especially to key Indian cities namely Chennai, Mumbai, Delhi, Hyderabad, Surat, and Ahmedabad. The other key regions for Nepali migrants are Northern Indian states like Himachal Pradesh, Uttaranchal, Punjab, and Haryana. According to World Bank report, remittances from India to Nepal accounted for more than $1 billion for the year 2015.

Mr. Ravi Singh - Chief Business Officer, ItzCash, said, “It is estimated that about 10 percent of total remittances from India are processed through formal channels which underlines the huge existing opportunity in remittances sector. With the new offering, we are aiming to digitise a sizeable chunk of the remittances business through our Phygital network inclusive of over 75,000 physical touch points and digital transfers.” He added, “Our partnership with Prabhu Money will connect customers anywhere in India at their doorstep while strengthening our cross border presence.”

Miss. Kusum Lama, Prabhu Money Transfer, said, “We are extremely proud to be associated with such a renowned brand in India. Our close liaison with almost all the major banks of Nepal enables us to cater to the Indo-Nepal remittance service efficiently. This will facilitate the huge Nepal diaspora based in India especially among the working and labor-class to remit their hard-earned money through a safe and secured network of a reliable partner while delivering a high quality end user experience.”

Related News

- 01:00 am

Temenos, the software specialist for banking and finance, has today announced that the winner of its global Innovation Jam contest is fintech start-up Paykey.

PayKey, winners of the heat in Miami, was selected by a panel of banking experts as being one of the most innovative fintech start-ups.

Speaking of the award, David Arnott Temenos CEO said “Innovation Jam is about scouring the world to find the most innovative fintech developers and working with them to help bring the benefits to Temenos customers. Innovation is moving at a blistering pace in the banking industry and its companies like PayKey that continue to disrupt.”

PayKey will be made available through Temenos’ Market Place which launched last year in recognition of the opportunity for banks and fintech companies to work together. Market Place is an online store of fintech solutions that have been pre-integrated with the Temenos Suites. There are now over 100 fintech solutions available that are certified by Temenos bringing together banks with technology that can revolutionise the business.

Guy Ziv, Vice President of Sales with PayKey said “We are honoured to have been chosen by a community of banking experts as the global winners of the Temenos Innovation Jam 2017 This is another milestone on our mission to put banks exactly where their customers are; on social networks.”

In addition to the overall winner, the Judges Award this year went to Blue Code a cashless payment app. The judges choice was determined by a panel of 3 Temenos experts, 2 representatives from banks and a leading consultancy.

Related News

- 06:00 am

Hamburger Sparkasse (Haspa), Germany's largest savings bank, has extended its successful IT outsourcing partnership with Diebold Nixdorf (NYSE: DBD), a global leader in driving connected commerce, for an additional seven years.

With this agreement, Diebold Nixdorf will support the decentralized IT operations for approximately 6,000 of Haspa's work stations and the management of its self-service network of more than 800 systems, including cash management, network services, file and print services, the operation of servers for a range of applications, the management of middleware and database applications, and a user help desk.

"Drawing on Diebold Nixdorf's expertise, this partnership has enabled us to ensure the consistent availability of our systems," said Rudolf Hoyer, the head of information technology and organization at Hamburger Sparkasse. "In addition, Diebold Nixdorf has been supporting our efforts to further develop our technologies and infrastructure as well as in reducing costs."

"We will continue to rely on Diebold Nixdorf's expertise as we plan the migration of our core banking system," added Frank Rollenhagen, deputy head of information technology and organization at Hamburger Sparkasse.

"The continuation of key partnerships with leading financial institutions, such as Haspa, is a key aspect of our services growth strategy," said Olaf Heyden, Diebold Nixdorf senior vice president, services. "Through our comprehensive services portfolio, we are driving the future of consumer transactions by helping banks fully focus on their customers and facilitating the rapid transformation of financial institutions throughout the world."