Published

- 03:00 am

Redline Trading Solutions, the premier provider of high-performance market data and order execution systems for automated trading, today announced its new feed handler for the Quincy Extreme Data (QED) feed. QED is distributed by Quincy Data, LLC via McKay Brothers’ microwave links from 18 co-location centers in the U.S., Europe, and Asia.

“The global footprint of QED points of presence leveraging microwave transmission technology, combined with Redline’s ultra-low latency InRush™ feed handlers, provides an integrated market data solution for latency-critical trading applications,” said Mark Skalabrin, CEO of Redline. “When layered with Redline’s Order Execution Gateway, customers gain a fully normalized ultra-low latency end-to-end trading framework.”

Since 2012, Quincy Extreme Data has delivered pricing information, typically at the lowest latencies, on the most actively traded symbols required for market makers and traders of strategies such as statistical arbitrage. Redline’s InRush ticker plant normalizes this data alongside other required market data and forms composite books that benefit a broader set of low-latency trading strategies.

“QED’s growing adoption demonstrates that traders and risk managers increasingly equate ‘quality market data’ with the lowest latency data available,” said Stéphane Tyč, Co-Founder of Quincy Data LLC. “Redline’s support of QED brings a new choice to firms needing a full tick-to-trade solution optimized for speed,” he adds

Related News

- 05:00 am

Bittium exhibits its Bittium Tough Mobile smartphone at the Virve User Days in Vantaa, Finland, May 2-3. Virve is a nationwide administrative security TETRA radio network, which is used by Finnish authorities and other security operators for secure communications. The Virve User Days event brings together both representatives of the organizations using the network and e.g. equipment suppliers. Due to the increasing need for authorities to use mobile data transfer, commercial LTE networks are being put into operation alongside the Virve network. Bittium provides information security solutions, terminals and systems that can be used in such commercial mobile networks for secure and reliable communications over speech and data connections.

Bittium Tough Mobile is a secure and durable Android-based LTE smartphone combining the latest information security and commercial device technologies. Bittium Tough Mobile incorporates a hardware-based security platform, which enables strong device security as well as deep integration of both customers' own and third party software security solutions. This dedicated hardware is essential for building layered device and software security solutions. In addition, Bittium Tough Mobile’s features include for example a programmable Push-to-Talk button (PTT), glove-usable 5” full HD display, IP67 level water and dust protection, and MIL-STD-810G level shock resistance.

Bittium Secure Suite is a device management and encryption software product that complements the Bittium Tough Mobile smartphone with a scalable set of new software services for remote management, remote attestation and securing the network connections of the device. Bittium Tough Mobile smartphone and Bittium Secure Suite form a unique, complete, reliable system for processing and transferring sensitive and classified material and securing critical communication.

Related News

- 06:00 am

AllianceBernstein (AB) has selected Bloomberg's evaluated pricing service (BVAL) to benchmark and corroborate end-of-day values of its U.S. fixed income portfolio investments.

AB is a leading global investment firm with $498 billion in assets under management. It uses fundamental and quantitative research to assemble a broad array of investment services to a global client base. AB licenses BVAL data to calculate the net asset value (NAV) of its corporate, government and municipal bond investments. Bloomberg provides broad coverage of U.S. fixed income securities, access to in-house evaluator teams and transparency into BVAL pricing models through Bloomberg Terminal screens.

BVAL's unique methodology draws on real-time access to market observations from a wealth of contributed sources that produces credible, defensible and independent valuations for more than 2.5 million fixed income securities and over-the-counter derivatives. The accumulated mass of market data is the main driver of this innovative and quantitative approach, which first corroborates market levels on actively traded bonds and then derives a comparable relative value price for securities that are less liquid. Since the prices are derived algorithmically using the most recent market data, BVAL prices track current market conditions and consistently stand-up to rigid quality tests.

“Regulators now demand a transparent and rigorous process for establishing fair and independent asset evaluations,” said Varun Pawar, global head of Bloomberg's evaluated pricing service. “BVAL meets the needs of the largest and most respected investment managers because we provide transparency into our pricing methodologies as well as unparalleled client support through our practiced team of evaluators.”

BVAL is the primary pricing source for the Bloomberg Barclays bond indices which are widely recognized benchmarks for fixed income investors.

Related News

- 08:00 am

UAE Exchange, the leading global remittance, foreign exchange and payment solutions brand, and OT (Oberthur Technologies) have partnered to launch “gocash” prepaid card of UAE Exchange through the first-ever contactless payment via wearable devices (powered by “Flybuy MiniFOB” technology of OT), at the Seamless Middle East Conference in Dubai on 01 May 2017.

UAE Exchange will be offering the wearable contactless payment option to select 100 gocash prepaid card customers, each loaded with a 100 AED balance, across the United Arab Emirates.

Flybuy MiniFOB technology is a mini contactless card of dimension 2FF SIM-size 15x25mm, including an antenna and a chip with payment functionality. The MiniFOB can be inserted into a prepaid card, silicone, leather wristband, a key chain, jewellery, fitness trackers, watches or any other wearable item / device. The card uses Mastercard contactless functionality and is developed by OT, a leading global provider of embedded security software products and services and an award-winning innovator in the payment sector.

A special piece (keeper) will be provided along with the standard Dual Interface gocash card that will hold the MiniFOB chip. Customers can attach it to their watch, wristband or any wearable item, thus, allowing a seamless, secure and stylish payment option on the go.

Promoth Manghat, Chief Executive Officer, UAE Exchange Group, said: “Contactless payment through wearable devices is soon going to be a common practice. It will simplify the entire payment journey and experience as it offers customers hands-free convenience while saving time. We are glad to partner with Oberthur Technologies for our gocash card, which will have the special contactless chip and provide our customers with a faster and convenient mode of payment.”

Cedric Collomb, Head of Global Offer & Indirect Sales of Financial Services Institutions activity at OT said: “The global market of wearables is nascent and has huge growth potential over the coming years. With its leading position in the payment field, OT is a key and trusted partner to offer wearable payment solutions; thanks to its comprehensive portfolio of products which can answer a full range of customer requirements. We are glad to partner with UAE Exchange, which shares our progressive vision of bringing value to the table, which will enhance customer experience.”

Related News

- 08:00 am

Pangea Money Transfer, a remittance app built for the mobile user, has expanded its service into Honduras. With this addition, Pangea’s application is now available in six Latin American countries, including Mexico, Colombia, Guatemala, El Salvador and the Dominican Republic.

After raising a new round in December 2016, the company has embarked on a rapid expansion process with plans to be available in 16 more countries across three different continents by Q3 2017.

The Pangea app makes it easier for users from the U.S. to quickly and securely send money to friends and family in a few simple steps. The app features an intuitive set-up process that takes only a few seconds, a smooth user interface and a low, transparent fee structure. Registered senders can just login and repeat past transfers in only one click. Within minutes, recipients can get their money in cash at thousands of pickup locations, or have it deposited directly into a bank account or onto a debit card.

“Pangea was created, first and foremost, around the idea that time is money,” said CEO Nishu Thukral. “It was built with simplicity and mobility in mind, so you never have to wait in line or fill out a form ever again when sending money to your loved ones. We’re so happy to now offer our product to more Latin American senders in the U.S., and we hope to soon serve other immigrant populations with the same standards around ease of use.”

According to the Migration Policy Institute, 85 percent of Central Americans in the U.S. come from Guatemala, El Salvador and Honduras, and they represent the fastest-growing Latino immigrant population. In 2016, more than $15 billion in remittances was sent from the U.S. to Central America via formal channels, for more than 50 percent growth in less than five years.

The Pangea Money Transfer app is available for free on iOS and Android, or you can try it out online at GoPangea.com. To inquire about becoming a Pangea partner, click here.

Related News

- 07:00 am

Gemalto, the world leader in digital security, today announces the closing of the acquisition of 3M's Identity Management Business after approval by the relevant regulatory and antitrust authorities[1]. This strategic acquisition rounds out Gemalto's Government Programs offering by adding biometric technologies and more secure document features and it ideally positions the Company to provide solutions for the promising commercial biometrics market.

The Identity Management Business will be integrated into Gemalto Government Programs business. In 2016, the acquired business generated $202 million in revenue and an estimated $53 million in profit from operations.

"With the acquisition of 3M's Identity Management Business, Gemalto makes a strategic move by in-sourcing biometric technology. Combining our market access, technologies and expertise will enable Gemalto to further accelerate the deployment of trusted national identities and to offer strong end-to-end biometric authentication solutions throughout the digital economy", said Philippe Vallée, Gemalto CEO. "I warmly welcome the new teams joining Gemalto and we look forward to working closely together towards success."

Related News

- 06:00 am

ALLDATA Europe GmbH, an affiliate of ALLDATA LLC, announced it has signed a reseller agreement with CAB Group AB. Headquartered in Sweden, CAB Group AB has branch offices in Norway, Germany, and Finland. Its software systems and services streamline repair processes for customers in the automotive repair and estimating sectors, including more than 3,000 workshops in Northern Europe. The agreement enables ALLDATA to serve CAB Group AB customers with OEM mechanical and collision repair information available through ALLDATA Repair.

"ALLDATA is pleased to expand through Western Europe and to serve the collision market with ALLDATA Repair," said Kevin Culmo, General Manager and Managing Director, ALLDATA Europe GmbH, and Group Vice President, ALLDATA LLC. "ALLDATA is the only company in Europe providing a comprehensive source of original manufacturer information for collision repair encompassing body and frame information, handling of new materials, evolving technologies, electronic systems and sectioning and structural procedures." Culmo adds, "Our relationship with CAB Group AB is ideal, because we focus on improving workshop efficiency and optimizing the workflow with innovative solutions. With ALLDATA Repair, the CABAS-enabled workshops will have a unique set of tools to streamline their repair processes and improve profitability."

"At CAB Group, everything we do is about optimizing the line," said Krister Werner, Director Business Unit Motor, CAB Group AB. "CAB Group workshops process millions of estimates annually through our CABAS claims estimating system in Northern Europe. The ability to offer ALLDATA Repair directly to our customers supports our mission to create efficiency and repair quality. As the predominant provider of solutions to more than 3,000 CABAS workshops in Northern Europe, CAB Group continuously delivers new solutions to streamline the entire repair process. Werner adds, "The agreement with ALLDATA exemplifies our commitment to provide customers with innovative solutions to make them successful."

ALLDATA provides unedited OEM repair and diagnostic information, advanced searching capability, wiring diagrams, maintenance interval and service schedules, and more within a single easy-to-use portal. In addition to mechanical repair information, ALLDATA Repair contains original manufacturer collision procedures making it the most complete source of OEM automotive information in the industry. Available in five languages, the European version of ALLDATA Repair contains 22 brands with more than 450 makes, 28 million pages, and 25,000 engine combinations. ALLDATA sells direct to workshops and through a network of more than 20 partners in more than seven countries.

"ALLDATA has served the automotive collision industry in the U.S. for years, and now we are expanding further into Europe," explains Mitch Major, President of ALLDATA, LLC. "CAB Group has a sophisticated workflow system from estimate to repair. With ALLDATA Repair OEM mechanical and collision information, we can help ensure safe, accurate, and reliable repairs to CAB Group's workshop network. ALLDATA remains focused on helping automotive workshops and technicians do the job right. With ALLDATA Repair, CABAS workshops have a competitive advantage through a combination of technological solutions."

Related News

- 05:00 am

Broadridge Financial Solutions, Inc. announced today that it has appointed Eric Bernstein as President of Broadridge Investment Management Solutions.

Broadridge Investment Management Solutions supports more than 225 global hedge funds, asset managers, family offices, fund administrators and prime brokers. Its modular suite of investment management solutions combines portfolio management, order management, risk management, reference data management, data warehouse reporting and reconciliation functionality in a single, multi-asset, completely integrated application.

“Eric brings nearly two decades of experience in global businesses serving the asset management and capital markets segments and is a proven leader in building strategic client relationships,” said Charlie Marchesani, President of the Global Technology and Operations division of Broadridge. “As asset managers focus on driving growth and margin expansion, Broadridge is committed to providing innovative solutions and best-practice services that enable our clients achieve operational advantage.”

“I am excited to join Broadridge, a global financial technology leader which is at the forefront of addressing industry needs and supporting clients with scalable and innovative solutions,” Bernstein said. “I look forward to driving our continued focus on helping our investment management clients achieve operational excellence and sustain future growth.”

In this role, Bernstein will be responsible for driving our global business growth in investment management solutions, leading day to day and strategic execution of client and market-focused solutions, and world-class service delivery.

Previously, Bernstein spent 17 years in financial technology, leading divisions at Linedata, Sophis and most recently, at eFront. As eFront's Chief Customer Success Officer, Bernstein had global P&L responsibilities for account management, global support, product management and the Pevara Data Business, which covered more than 850 clients. Prior to that role, he was Chief Operating Officer of the Americas at eFront.

Related News

- 07:00 am

Pendo Systems is proud to announce they’ve surpassed two major milestones as they prepare for their formal launch in Q3 2017: the successful completion of their first full deployment of the Pendo Data Platform for a major Global Bank; and their certification as a Women’s Business Enterprise (WBE).

Even ahead of its imminent launch, the Pendo Platform has garnered both recognition and awards such as the Swift Innotribe Top Innovator Award in 2015. Commenting on Pendo’s continued success since accepting the Innotribe Award, Kevin Johnson, Head of Innotribe Innovation Programmes, SWIFT, had this to say:"Where only 10% of all FinTech companies survive after 3 years of operation, over 90% of Innotribe's alumni are still operational or have been acquired. This validates our methodology in selecting the best start-ups, and we are proud to count Pendo Systems as one of our key success stories."

The Pendo Platform revolutionizes the process of accessing data stored across millions of different document types. The Platform is used to gain access and insight to both structured and unstructured data sets, but it is the speed and accuracy with which the Platform can make unstructured data accessible that’s really turning heads.

At the heart of the Pendo Platform is an Indexing and Classification algorithm that makes the data instantly searchable using natural search, thus turning millions of unstructured, and unsearchable documents into a structured database that makes visible mission critical information which was previously both difficult, and time-consuming to access.

On a recently completed project for a major global bank, the Pendo Platform processed 48 million unstructured documents in just seven weeks, making them instantly accessible and easily searchable — a project that had previously been expected to take four years and an army of consultants to complete.

Says Pendo Systems CEO, Pam Pecs Cytron, “The fact of the matter is, data you can’t access or interrogate adds cost to an organization, it’s only when you turn that data into information that you’re able to extract maximum value from it. That’s the beauty of our

platform, access to the data you need to save your business money.”

Pendo Systems is also proud to announce they have been certified as a Women’s Business Enterprise (WBE) through the Women’s Business Enterprise National Council (WBENC), the nation’s largest third-party certifier of businesses owned and operated by women in the US. The WBENC certification process imposes strict requirements to prove a business is woman-owned and managed before granting certification. The primary criteria for a business applying for WBENC certification are that it has a majority female ownership (at least 51% by one or more women) and is managed by women. In addition, women must have unrestricted control of the business, and the highest defined title in the company’s legal documents must be held by a woman.

Pendo is helmed by Pam Pecs Cytron, a veteran financial services executive who serves as Pendo’s CEO and Founder. “We are thrilled that Pendo has earned this honor. The certification process is appropriately rigorous and takes into account many factors including the growth and trajectory of the company,” said Mrs. Pecs Cytron.

Related News

- Product Reviews

- 01.05.2017 02:31 pm

What does the product do?

Ohpen offers a cloud-based and API-based platform that provides BPO services and SaaS solutions to financial service entities, based on the core banking application. The product is oriented at providing infrastructure and taking care of back-end operations. Drawing on the expertise as former retail bankers, the founding team renovated all the processes and built the service from scratch resulting in a “bank-out-of-the-box” solution that is digital-and API-first.

Who needs the product?

The key clients are banking institutions and financial organizations that want to focus on their primary goals and make the daily procedures more efficient and productive. Ohpen cloud and API based platform provides back-end support for financial institutions through managing their infrastructure in compliance with standard regulations, ensuring smooth and safe operations flow.

How user friendly and accessible is the product?

Ohpen’s constantly upgraded solutions reliably back up the savings and investment propositions of the clients. Client organizations can choose to fully outsource back-end office or integrate already existing applications with the Ohpen’s platform. The onboarding process is fast and flexible and is conducted in compliance with standard regulations. Moreover, API can be easily integrated and is entirely web based. Thanks to the mobile application client companies can easily access necessary information to make relevant decisions.

What is special about the product?

Ohpen offers ultimately effective cloud-based, core-banking engine. The company is committed to provide effective administration of retail investment and savings account. It is one instance platform that is responsible for releases and testing. This model enables suggesting a sophisticated subscription payment model, which results in considerable cost reduction. All business modules can be customized to specific business needs, thus supporting front-end using API.

What are the main features of the product?

When clients license the Ohpen SaaS solution, the company takes care of hosting the applications and the maintenance of the infrastructure. Basically, client organizations can run their businesses, leaving the rest to Ohpen team of professionals. Client companies can focus on their front-office work, while Ohpen will take care of the back front routine.

Front End Suite:

Ohpen offers front-end suite as additional capability to the SaaS service. There is an option to integrate Ohpen’s back-end with Client Company’s front-end office. The front-end suite consists of:

- Fully responsive customer desktop website

- Mobile applications

- Content management systems

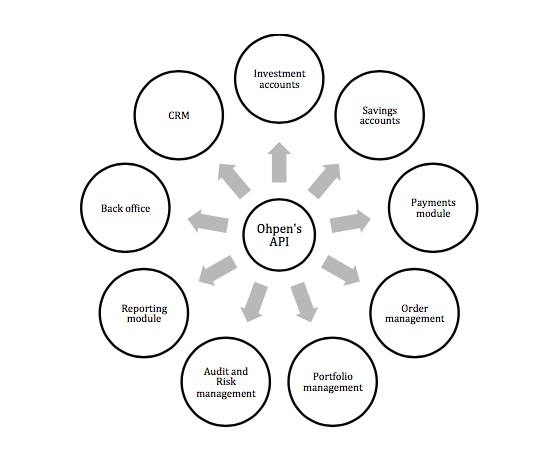

Ohpen Artificial Program Interface consists of the following modules:

- Investment accounts

The investment account module automates the administration of investment accounts. It allows using three service models, such as execution-only fund supermarket, robo advice, and discretionary asset management.

- Savings accounts

This module enhances the administration of both variable interest rate accounts and fixed term deposits.

- Payments module

The payments module enables to process contributions and withdrawals safely to and from saving accounts. Ohpen supports both commercial banking payments and wholesale banking payments.

- Order management

The order platform module is built to maximize efficiency in order execution, based on modified aggregation algorithms, using multiple cut-offs and connections with the relevant transfer agents, exchanges or other trading venues.

- Portfolio Management

This module deals with configuration of suitability testing and subsequent management of model portfolios that are connected to the individual customer accounts, based on risk profiles. Automatic rebalancing, takes place based on life cycling, volatility, fund weightings and many other variables.

- Audit and Risk Management

The risk and audit module combine all necessary features, including market abuse, unusual transactions, prevention of terrorism financing, anti-money laundering and suspicious payments.

- Reporting Module

The reporting module covers several standardized and custom reports for all departments’ needs, such as operations, risk, client services, tax, and general reporting.

- Back Office

The module covers record keeping, client onboarding, customer due diligence (CDD), real time calculations, fee structures and calculations, as well as a smart batch scheduler.

- CRM

CRM module refines efficiency to manage clients, leads, accounts and contact history data. It also provides a dashboard to manage a workload of teams and employees.