Published

- 02:00 am

Senior professionals are concerned about the state of spend management and a lack of business expense visibility across multiple solutions in their organisations, despite the technological improvements that have made paper processes and manual work a thing of the past.

A new report, from Payhawk and Insights For Professionals (IFP), finds that 36% of respondents were extremely or very concerned about the amount of corporate spending in their organisation. Meanwhile, only 51% of senior professionals said their spend management effectiveness was ‘very good’.

Companies of all sizes are facing challenges with their corporate spending and human error topped the list with 29% of respondents citing it as a major challenge. The survey, which was commissioned by Payhawk - the company that makes business payments easy - found the other challenges were time wasted on reconciliation, resistance to change, ineffective software, and inefficient and/or legacy processes.

Hristo Borisov, CEO and Co-Founder of Payhawk said, “Corporate spending used to be managed with piles of paper, and receipts and invoices that were filed by hand. Those days are long gone, and businesses can be proactive in their approach to spend management. However, despite the massive improvements that have come with digitalisation, companies are still facing numerous challenges and senior professionals are right to be concerned about the current state of corporate spending.”

The IFP research focused on uncovering attitudes to corporate spending and surveyed over 100 senior professionals in the US and the UK across more than 11 industries, including finance, health, education and manufacturing. The company size of those interviewed ranged from 250 employees to companies with over 25,000 employees.

Aside from the challenges companies face, senior managers expressed how important visibility was and how understanding how money is being spent is a crucial part of their role. Of all the professionals surveyed, 51% said they had ‘very good’ visibility into company spend, but this figure dropped to 38% for professionals in large organisations.

Borisov added, “Senior professionals are bogged down with inefficiencies and a lack of up-to-date, accurate information about their corporate spending. With the right processes in place, and right information at their fingertips, they will be able to make clear, strategic decisions about how their organisation’s money is being spent. With greater automation and efficiencies in place, they will have more time to focus on more important things.”

The report noted that organisations will have to invest in spend management initiatives to overcome the current challenges they face. The majority of those surveyed said they would invest in the next year, with 22% stating they planned to invest $500,000 and $1 million in such initiatives. Through such investment, the respondents said they aimed to have better internal spend controls, improve efficiency and minimise risk. “By having the right technologies and initiatives, every organisation can improve their spend management process,” said Borisov.

Related News

- 08:00 am

Viva Wallet, a leading European cloud-based neobank, now enables UK merchants to seamlessly and securely accept in-person contactless payments with Tap to Pay on iPhone and its Viva Terminal iOS App. Tap to Pay on iPhone accepts all forms of contactless payments, including Apple Pay, contactless credit and debit cards and other digital wallets, using only an iPhone and the Viva Terminal iOS App — no additional hardware or payment terminal needed.

Tap to Pay on iPhone and the Viva Terminal iOS App allow contactless, instant payment acceptance for products, services and more, elevating the way transactions are made. The Viva Terminal App is suitable for any business, of any size, in any sector; from the hotel pool bar service to the shop-in-shop marketplace, to freelancers and sole proprietors, allowing customers to pay onsite or on the move.

"Accepting payments has never been easier. All you need is your iPhone and the Viva Terminal App; a combination that delivers ultimate convenience, simplicity, and time-efficiency, maximizing business performance, and optimizing customer experience. We are excited that we can now offer Tap to Pay on iPhone to our UK business customers, enabling them to reach their full potential," notes Haris Karonis, Viva Wallet's Founder & CEO.

Tap to Pay on iPhone enables Viva Wallet's customers to use a payment solution that is easy to set up and use. On an iPhone XS or later running the latest iOS version, merchants can download the Viva Terminal App on the Apple App Store to start using Tap to Pay on iPhone within minutes. At checkout, the merchant will simply prompt the customer to hold their iPhone or Apple Watch to pay with Apple Pay, their contactless credit or debit card, or other digital wallet near the merchant's iPhone, and the payment will be securely completed. The Viva Terminal App is compatible with any existing bank account, featuring, amongst others, advanced encryption and security protocols.

Tap to Pay on iPhone uses the built-in features of iPhone to keep the businesses' and customers' data private and secure. When a payment is processed, Apple doesn't store card numbers on the device or on Apple servers.

Related News

- 03:00 am

Today the British Business Bank publishes a list of 67 additional companies in which the Future Fund holds an equity interest, taking total equity holdings to 591 as at 30 June 2023.

The rate of conversions in Q1 2023/4 increased compared to the previous quarter, with 67 new additions. Similarly, the number of insolvencies continued to grow in this quarter, with 18 new insolvencies added. This comparative increase in corporate activity is in part due to outstanding Future Fund loans nearing their three-year maturity date as well as wider economic conditions.

Companies in which the Future Fund now holds an equity interest include Belfast-based B-Secur Limited, a biosensing algorithm company that specialises in EKG interpretation; C-Capture Limited, a spinout from the University of Leeds that has patented technology offering a safe, low-cost way to remove carbon dioxide from emissions; Istesso, a drug discovery company developing novel treatments for autoimmunity and fibrosis conditions; and Transcend Packaging Limited, a sustainable packaging company based in Wales.

Ken Cooper, Managing Director, Venture Solutions, British Business Bank said: “The Future Fund was created to ensure a flow of capital, at the height of the pandemic, to companies that would otherwise have been unable to access government support schemes, while ensuring long-term value for the UK taxpayer. The Future Fund is now entering the maturity phase, which signals three years since the first loans were executed. The comparative increase in activity this quarter is in part due to outstanding loans nearing their maturity, as we contact companies with outstanding loans in advance to set out the options available to them.”

Launched on 20 May 2020, and open for applications until 31 January 2021, the Future Fund issued 1,190 companies with convertible loans worth £1.14bn in total. Third-party investors were required to at least match the Future Fund’s investment.

The Future Fund supported UK companies that typically rely on equity investment to fund their growth. By creating a bridge to the next equity funding round, the Future Fund supported these companies through a period of considerable economic disruption and now the recovery.

The scheme used a recognised financial instrument known as a convertible loan. Unlike an equity investment, there wasn’t a requirement under the convertible loan to value the company or the price of its shares, at a time when company valuations had been significantly impacted by Covid-19. Instead, the convertible loans are designed to convert into equity either at the next equity funding round or if the company is acquired through a sale or IPO.

Breakdown of the total portfolio as at 30 June 2023

| As at 30 June 2023 | Previous Quarter | Change since previous quarter |

Loans | 420 | 502 | -82 |

Equity interests | 591 | 529 | 62 |

Cash realisations | 51 | 49 | 2 |

Insolvencies | 129 | 111 | 18 |

Total | 1,191 | 1,191 |

|

Reconciliation of equity interests since last quarterly update

| Total |

Previous published number of equity interests | 529 |

Companies removed from list of equity interests | -5 |

New conversions of loans into equity interests | 67 |

Total | 591 |

Explanatory notes:

Loans: the number of Future Fund investments in the form of a convertible loan.

Equity interests: the number of Future Fund investments in the form of a share. These arise primarily as a result of a convertible loan converting into shares following a financing event. Equity interests also arise following a sale or an IPO in which investors, including Future Fund, receive share consideration in the form of shares in the acquiring entity.

Cash realisations: the number of Future Fund investments that have been realised for cash as a result of a company being acquired. Consequently, the Future Fund no longer holds an Equity Interest or a Loan in those companies.

Insolvencies: the number of Future Fund investments in respect of companies which have entered administration, liquidation or another formal insolvency process as disclosed in Companies House filings.

Please note that the original number of Future Fund investments increased from 1,190 to 1,191 as a result of a demerger of one company.

The British Business Bank will update the list of companies in which the Future Fund has an Equity Interest at the end of each financial quarter – the full list is available here.

Starting from this quarter, the British Business Bank will provide a list of companies which have entered Insolvency – the full list is available here.

Further information on the Future Fund is available here

On 6 July 2021 the British Business Bank published data giving a final, comprehensive picture of how the Future Fund has supported businesses during the pandemic. This is available here.

Related News

- 02:00 am

Financial institutions are ramping up data-driven financial management support, as UK consumers grapple with the rising cost of bills and goods.

That’s according to new research by the market leader in open banking, Tink, which finds that over four in ten banking executives believe they have a responsibility to help customers better manage their finances during the cost-of-living crisis. A further 45% surveyed believe they have a responsibility to ensure their products and services are inclusive and accessible.

Beyond being the “good” thing to do, banks also recognise the business benefit in supporting their customers. Over half (56%) surveyed agree there is a commercial rationale for helping people better manage their finances during the cost-of-living crisis. For instance, 42% say it reduces customer churn, 42% believe it drives retention and loyalty and 36% say it lowers customer acquisition costs.

Awareness and appetite for financial management tools growing as consumers look to banks for tailored support

Encouragingly, from the survey of over 2,000 UK consumers, around half (49%) reveal that they trust their bank more than any other financial services provider. However, just over a quarter (27%) currently feel their bank is helping them through the cost-of-living crisis by providing them with tailored financial support, and over a third (37%) would like their bank to do more to help them manage their finances.

When asked what specific tools they are aware of and would like to use, perhaps unsurprisingly it was budgeting tools to help navigate the rising cost of living that topped the wish list:

- Budget management tools (e.g. setting up and managing budgets to limit your spending) - 31%

- Savings management tools (e.g. setting up and managing saving pots) - 30%

- Spending categorisation tools (e.g. categorising spending into groups) - 28%

But the potential of data-driven financial services has not yet been maximised by all

Despite this, some consumers remain in the dark about which financial management tools are on offer in their digital banking app. For instance, an estimated three in ten (30%) are unaware if their bank offers budget management tools, and 35% are unaware if their bank offers categorisation of their transactions.

The research also reveals the top reasons preventing a minority of banks from investing in new data-driven services, including not seeing them as a competitive differentiator for the business (31%), and a lack of skills and resources to develop these products internally (27%).

But even with this lingering hesitancy amongst some banks, the majority are on the front foot and seizing the opportunity to develop and invest in these services. Of those surveyed, 62% are currently working on or would like to be able to offer budget management tools to customers, and 63% for transaction categorisation.

The forward-looking banks currently offering these services are already reaping the benefits. Half (50%) surveyed reveal data-driven financial services have delivered commercial benefits for their business, while another 50% also say it has helped them improve customer experience in particular. Almost half (47%) of the respondents agree that data-driven financial services have helped them better support their customers during the cost-of-living crisis.

The role of fintechs in helping bring these products to market can’t be understated - an estimated 47% of banking executives agree that fintech partnerships are helping them offer new tools to better support customers during the cost-of-living crisis.

Tasha Chouhan, UK & IE Banking Director at Tink, commented on the findings: “As UK consumers brace themselves for ongoing financial difficulty, it’s encouraging to see banks recognise both the responsibility and opportunity in offering data-driven financial services to help consumers manage their finances during this challenging economic time.

“To pick up the pace, financial institutions should continue to invest in building these services, alongside raising consumer awareness of the tools already on offer. Partnerships with fintechs specialising in money management tools are one way institutions can bring data-driven products to market at scale, taking the friction out of integrating them into their core offering.”

Related News

- 08:00 am

Currencycloud, the experts simplifying business in a multi-currency world, has partnered with Malaysia-based GAT Investment Bank to launch GAT Money, an app offering an alternative solution to new clients who need a global banking solution which offers access to competitive FX rates and an extensive cross-border collections and payments network, all in one place.

With access to Currencycloud’s multi-currency virtual accounts, GAT Investment Bank now has a seamless and secure way to collect, convert, pay and manage funds for its largely globally-focused client-base, without the need to integrate with multiple corresponding banks and payment providers. Currently using local USD, EUR, CAD and GBP collections, GAT Investment Bank can provide virtual accounts in more than 35 currencies to its clients, offer real-time FX conversions at competitive rates, and pay out locally to over 180 countries.

Jill Murray, Director of GAT Investment Bank says, “Currencycloud was a clear choice for us. We were looking for a provider who could help us offer our customers the benefits of global banking. Thanks to Currencycloud’s APIs we are instantly connected to an extensive cross-border collection and payment network that allows GAT Money to be our customers’ global banking partner. Currencycloud's local payout function has also enabled us to cater to smaller clients in more countries, giving them access to a global banking service that they otherwise wouldn’t have.”

Says Rohit Narang, Managing Director of APAC, at Currencycloud, “GAT Investment Bank understands the issues faced by their clients, many of whom are importers and exporters who need a cost-effective, near-instant way of making cross-border transactions. GAT Money is the result of this understanding, and we are delighted to be part of their solution.”

Related News

- 04:00 am

Finotta, a provider of embedded fintech for digital banking, announced today a 10% monthly sustained user engagement rate of its Personified Platform – more than triple the industry average.

Average engagement rates vary across different apps but hover well below Personified’s 10%. According to a recent report, an engagement rate between 1% and 5% is considered good.

The driving ethos behind what makes Personified more engaging is Finotta’s exclusive PFG technology. Personalized Financial Guidance offers a new way of looking at financial wellness that encourages positive behaviour for users.

Unlike traditional financial management tools, PFG turns this data into actionable user solutions. For example, rather than intimidating users by reporting how much money they spent on Starbucks last month, Personified encourages them to improve their Financial Health Level by suggesting actions like saving for retirement and celebrating with them when they do so.

According to Parker Graham, founder and CEO of Finotta, “PFG produces a more rewarding experience, meaning customers are more likely to spend time with their banking app. As a result, we’re seeing a sustained 10% user engagement rate, which is more than triple compared to industry competitors and much higher than other apps banks leverage to engage their customers.”

As a result of strong engagement, financial institutions have a proven strategy for driving deposit growth while helping customers improve their financial wellness. Personified details a user’s cash flow, expenses, debt-to-income ratio, and more. It prominently features recommendations in the app to improve financial health, like opening an emergency savings account. Personified also gamifies financial wellness, just like a fitness app. By demonstrating positive behaviours like saving money in a new emergency account or paying down a loan, users can accrue points and badges that work towards financial wellness goals, awards, and more.

Graham also points out that consumers use their mobile devices to access their finances and spend more time on their mobile banking app. A study reveals that 87% of consumers use their banking app at least once per month or more (+2% YoY). As individuals increase the usage of their mobile banking applications, financial institutions must focus on incorporating new features to satisfy consumer needs and stay competitive in the market.

In addition to a sustained engagement rate of 10%, Personified has seen a 57% adoption rate with mobile users. This adoption is leading to a substantial increase in new account openings and deposit growth, critical as banks and credit unions prioritize growth efforts.

Related News

- 08:00 am

Rimes is pleased to announce that they have joined the United Nations Global Compact initiative (UNGC) — a voluntary leadership platform for developing, implementing, and disclosing responsible business practices. Following this announcement, Rimes is now part of a growing group of thousands of companies globally committed to taking responsible business action to create the world we all want.

The UN Global Compact calls companies everywhere to align their operations and strategies with ten universally accepted principles. These ten principles are in the areas of human rights human rights, labour, environment and anti-corruption, and taking action to support UN goals and issues embodied in the Sustainable Development Goals (SDGs). Launched in 2000, the UN Global Compact is the largest corporate sustainability initiative in the world, with more than 15,000 companies and 3,800 non-business signatories based in over 160 countries and more than 69 Local Networks.

François Guyeux, Chief People Officer at Rimes comments, “We are incredibly proud to be joining the world’s largest sustainability network and are fully committed to operating in line with their ten pillars of success. ESG is our north star, and we are taking calculated action with a comprehensive strategy underpinned by clear medium- and long-term science-based targets. We are making ESG core to who we are as a business and how we serve our employees, clients, and communities. Joining UNGC enables us to benefit from a wealth of training and documentation. Still, most importantly, it ensures that we are measuring ourselves against a recognized industry standard and not just jumping on the ESG bandwagon.”

Brad Hunt, CEO at Rimes concludes, “Creating a sustainable business which treats its employees, clients and partners with integrity and respect is non-negotiable and a subject which I and my management team passionately support. Being part of the UNGC program is essential to our growth strategy, as we aim to attract and retain the smartest people available globally. I believe this a key step in making that a reality.”

Related News

- 09:00 am

ACA Group (ACA), the leading governance, risk, and compliance (GRC) advisor in financial services, has enhanced its ability to enable institutions to thoroughly capture mobile device traffic through a partnership with LeapXpert. The partnership delivers expanded enhancements to archival, workflow, and surveillance features across WhatsApp, iMessage, SMS, WeChat, Telegram, LINE, and Signal. The advanced mobile messaging communications capture capabilities provide compliance professionals with the necessary oversight to avoid fines and penalties tied to global regulations.

ACA announced the partnership with LeapXpert at a time when regulatory bodies are putting increased emphasis on how financial firms are communicating internally, as well as with their clients. Last year, the SEC and CFTC fined Wall Street firms a combined $1.8 billion for failing to prevent employees from communicating on messaging channels that are not monitored for compliance. The FCA, ESMA, and FINRA also have rules in place for financial institutions to capture and oversee all mobile communications to detect potential market abuse like insider trading, unlawful information sharing, or other forms of manipulation.

Furthermore, a recent survey of investment adviser chief compliance officers found electronic communications surveillance is a top priority in recent and current SEC exams. The 2023 Investment Management Compliance Testing Survey also revealed that compliance professionals are conservative when communicating for business purposes. Some 42% of respondents are restricting business email and telephone communications, while only 18% permit texting and LinkedIn communications. These results highlight the importance of staying aware of regulatory enforcement priorities.

LeapXpert’s advanced mobile messaging capture capabilities are now available to global buy- and sell-side firms through ACA’s ComplianceAlpha® eComms platform. The ComplianceAlpha eComms module includes a policy-based surveillance engine, relationship forensics, and an integrated archive to enable more effective internal investigations. The simple-to-use regulatory technology helps manage critical items of interest, including case management, complete supervision, and archiving of employee communications. It employs machine learning and natural language processing enabling compliance teams to resolve alerts quickly and defensibly utilizing a comprehensive view of potential high-risk activities and behaviours across their organization.

The LeapXpert Communications Platform enables data capture and governance across voice and messaging channels, including WhatsApp, iMessage, SMS, WeChat, Telegram, Signal, and LINE. Native integration with Microsoft Teams allows employees to communicate with clients through their preferred messaging apps – from within Microsoft Teams.

“Amidst growing regulatory scrutiny, the move to a mobile-first or single vendor solution is paramount to satisfying all components necessary to demonstrate that the duty of supervision has been met,” said Annie Morris, Chief Product Officer at ACA Group. “With LeapXpert, we can offer a highly unified solution to many leading financial institutions and enterprises worldwide, precisely where the fractured multi-channel work experience poses a significant regulatory challenge.”

"We are thrilled to join forces with ACA, a leader in surveillance technology," added Avi Pardo, Co-founder & CBO of LeapXpert. "By combining our advanced capabilities into ACA's ComplianceAlpha eComms module, we have successfully addressed the challenges of mobile capture. Together, our integrated platform offers a scalable solution to meet the growing market demand for responsible business communication solutions for enterprises needing large-scale deployments globally. Now, modern communication channels can be used to conduct business while ensuring peace of mind to compliance teams.”

Related News

- 01:00 am

Fremont, Mi.-based Gerber Federal Credit Union (‘Gerber FCU’ – $225M in assets) has partnered with Mahalo Banking, a CUSO that provides premier online and mobile banking solutions for credit unions, to offer member-centric features and streamline banking service processes for its members.

Gerber FCU is leveraging Mahalo’s banking platform to simplify the banking experience for members. Users of the credit union platform will be able to access a clean, user-friendly design with mirrored features across the online and mobile banking experiences. Members will be able to more easily join the credit union, onboard and fund their account to quickly begin using the credit union’s services. The credit union will also be able to use Mahalo’s platform to offer a more member-centric design through the neurodiversity features including colorblindness view options and left-handed toggle mode to improve usability.

Tina Spoelman, Senior IT Manager of Gerber FCU, explained, “Our goal was to partner with a mobile and online provider to ensure our members would have the modern services necessary for 21st-century banking. In Mahalo, we found a forward-looking partner who will help us unify the features found within our online and mobile offerings to create a more seamless omnichannel experience. We're also excited to implement Mahalo’s Thoughtful Banking™ neurodiversity tools. Ensuring successful platform navigation for those who have visual impairments is an important design aspect that many vendors don't take into consideration, and we are delighted to have a partner that values all member experiences.”

Led by credit union industry natives, the Mahalo Banking platform is designed to intuitively meet the needs of today’s credit unions and their members. The platform is also the industry's first online banking solution that has fully integrated comprehensive neurodiverse functionality to better serve the unique needs of all members. Mahalo’s technology offers modern features, deep core integrations and efficient third-party integrations that allow credit unions to better retain and grow their membership base.

Spoelman added, “We are proud to be working with a forward-looking company like Mahalo that is always imagining how they can transform the future of credit union technology. Not only is their team deeply ingrained in the credit union culture, but they also innately understand our local roots and values. We trust they will be a fantastic partner to help modernize our capabilities and streamline our member services.”

“Many credit unions today are searching for the right partner to advance their banking experience and maintain the competitive edge they need,” said Denny Howell, co-founder and COO of Mahalo. “We are delighted to be chosen to serve as Gerber FCU’s trusted digital banking provider. Our team is looking forward to driving the credit union’s technology innovation and empowering them to surpass their member expectations.”

Related News

- 08:00 am

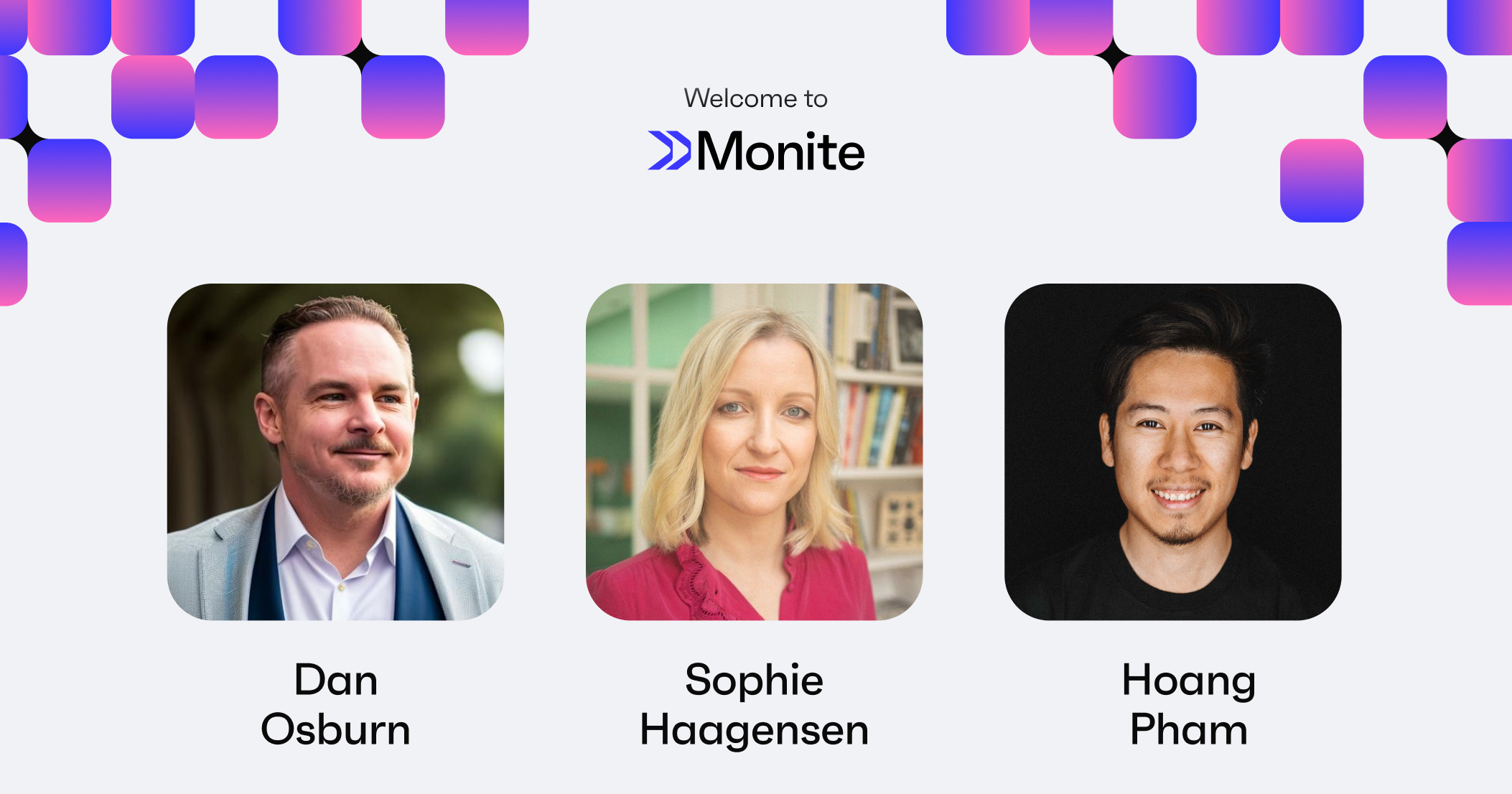

Monite, the API-first embedded finance company that helps B2B platforms capitalize on hassle-free finance automation for their clients, has fortified its commitment to become an industry standard by appointing three accomplished FinTech leaders.

Dan Osburn, a VP of product pivotal to Marqeta’s growth from a $20M startup into a $12Bn public company, assumes the role of Chief Product Officer. Joining the executive team is Sophie Haagensen, formerly COO at KodyPay and part of the founding team at Atom Bank, as Chief of Staff. Additionally, Hoang Pham, renowned for building Mollie's growth team and bootstrapping the company from its early stages to a successful series C funding round, has been appointed as Head of Marketing.

"We are truly honored to have leaders from industry-breaking companies like Marqeta, Atom Bank and Mollie choose Monite as their new workplace. Their decision showcases a remarkable level of trust and validation in our product and mission. With their help, Monite is on its way to becoming an embedded finance category leader. The contributions from Dan, Sophie, and Hoang will drive Monite’s steady growth, foster innovation, and help revolutionize B2B financial workflows alongside our solid tech team”, says Ivan Maryasin, CEO of Monite.

Capitalizing on his expertise from guiding and scaling product teams in businesses that grew from lean startups to large public companies, Dan Osburn is set to enhance the intrinsic value that Monite delivers to its customers through a wide range of FinTech products. With a background in math and engineering, Dan has made significant contributions to the development of pivotal technologies, and his expansive skillset, coupled with a comprehensive understanding of technical, financial, and support-related functions, uniquely positions him as an industry thought leader. Reflecting on Monite's potential, Dan shares, "Monite is set to make waves in an arena that's experiencing rapid growth and is primed for innovative disruption. Our vision centers around offering an expansive and unified suite of financial products to B2B platforms, with a strong emphasis on user experience. At Monite, we're shaping the future landscape of FinTech”.

Sophie Haagensen is an experienced leader who has operated across organisational disciplines in multiple industries as a founder, executive and NED. Drawing on a decade of FinTech experience, Sophie will oversee Monite’s strategy, execution and operations on the way from startup to scaleup. Whether setting direction or implementing systems and structures from scratch, Sophie is a catalyst for growth in tech-first companies. She comments: “The opportunity embedded finance presents is undeniably huge, and Monite is poised to become a leader in this space. I am hugely impressed by the talent and passion of the team, as well as the genuine commitment to building a positive and productive culture — something that, in my experience, sets great companies apart from the competition”.

Hoang Pham, a seasoned marketing pro who has been previously executing Mollie’s growth for more than 6 years, has now joined Monite to establish the company's brand presence and elevate market positioning. He says: “We are at the right place and time in a wave that’s only just beginning, embedding financial solutions into all kinds of platforms. It’s an incredible privilege to be at the forefront and work alongside such a talented team. The product and tech Monite has built so far are really impressive, when all the pieces fall into place, only great things can happen.” Hoang’s initial focus will be on understanding customers’ challenges and needs and translating them to how Monite portrays itself to target new clients.

The appointments of versatile professionals reflect Monite’s commitment to expand its footprint in the EU and UK while also expanding into the US market and beyond. The new company’s executives will be tasked with building a category-leading company, helping B2B customers embed cutting-edge financial services.