Published

- 08:00 am

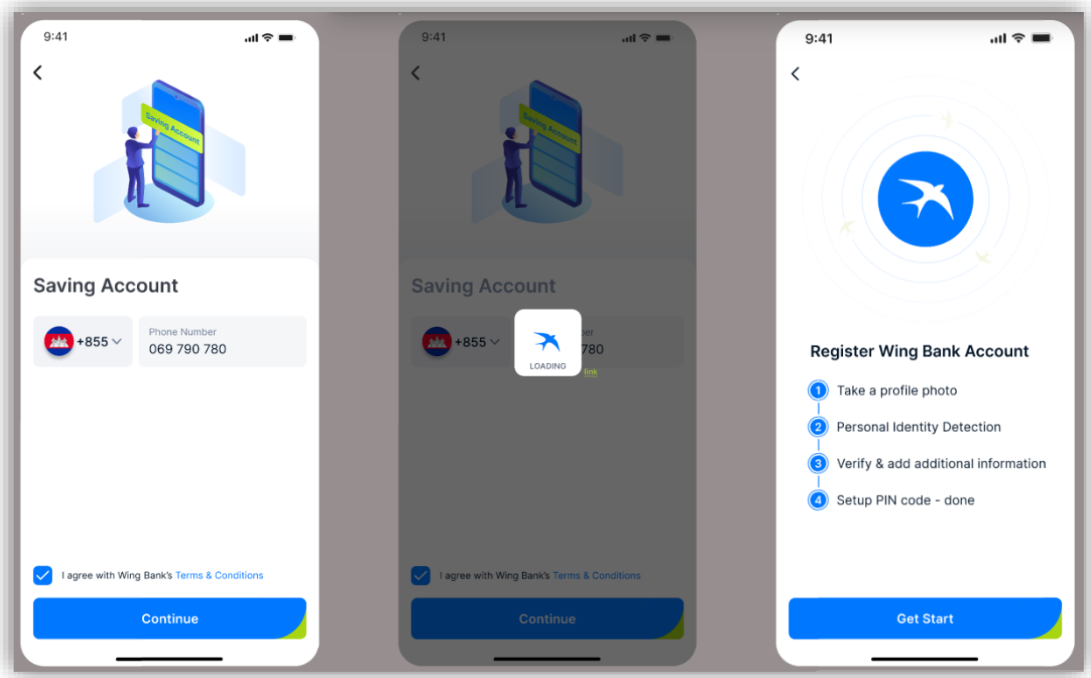

Wing Bank (Cambodia) Plc. has just integrated IPification one-click phone verification for their users in the country. Wing Bank, one of the major digital banking players in Cambodia, is using the solution to streamline new user registration. IPification is the leading global provider of mobile IP address-based identity solutions.

“With its full coverage in Cambodia, we’re very proud to have seen great results in our partnerships with one of the fast-growing financial institutions such as Wing Bank. We’d love to thank Wing Bank for their trust and joining our mobile authentication revolution, it’s amazing to have someone of their stature as a partner,” said Stefan Kostic, IPification CEO.

Having been founded in 2008, Wing Bank is driven by the vision to provide every Cambodian with convenient and secure access to relevant digital solutions for the improvement of their daily lives. With IPification in their arsenal, they aim to deliver on this promise.

Wing Bank continues to lead Cambodia’s digitalization by introducing secure and customer-friendly solutions. With IPification, a one-click authentication and fraud-prevention system, the bank is improving its Customer Experience.

“Our primary priorities in digital banking are convenience and security, and IPification will let us streamline the authentication process for Wing Bank App users while retaining the app's security,” said Han Peng Kwan, CEO of Wing Bank. “We will keep our clients updated on the most recent developments, furthering the kingdom's digital transformation.”

Introducing a one-click mobile identity solution that enables users to verify their phone number, register, and log in within milliseconds. The solution was developed with security, data privacy, and user experience in mind. With this solution, Wing Bank can enhance its mobile banking app's overall user experience. It will replace the current SMS-based, one-time-password (OTP) system during app activation.

IPification is the leading global provider of mobile IP address-based identity solutions, including authentication, phone number verification, and fraud prevention. Wing Bank has integrated its phone number verification solution to improve the security and user experience of the new user registration flow.

To successfully verify their phone numbers, users input their numbers and request verification with only one click, after which their phone numbers are verified within milliseconds. Since it significantly shortens the time necessary to register, it is expected that Wing Bank will increase its user acquisition rates.

Related News

- 02:00 am

Cloud-based infrastructures represent clear opportunities for companies to outpace the rest of their industries with increased speed to market, scalability, resilience and sustainability in their digital offerings. For many, the question remains how to get there. Global digital transformation company GFT is expanding its Amazon Web Services (AWS) business division with the appointment of Brigitte Sollie as SVP, Global Head AWS Sales and Strategy to deliver on these ambitions.

Sollie will lead GFT’s team of more than 950 AWS-specific experts and play a critical role in scaling the company’s delivery of cloud infrastructure to meet growing global demand. GFT is a leading implementation partner of AWS, ranking as the top provider in Latin America and the third largest provider of AWS migrations worldwide.

“Cloud computing is no longer a niche topic, but a necessity for companies to compete in their industries. We’ve been guiding companies through their cloud journeys since the time when most still raised their eyebrows at the idea,” said Marika Lulay, CEO of GFT. “The addition of AWS expert Brigitte Sollie to our team is a natural next step as we scale our AWS offering to meet the ambitions of organisations worldwide.”

GFT's AWS Division Features More Than 950 Experts and 650 Certifications

In expanding its dedicated AWS practice, GFT is investing in growing its deep technical expertise and partnerships with AWS-powered technologies. Under Sollie’s leadership, the company will build upon its proven track record of accelerating speed to market and operational productivity through the more than 100 client projects it has completed on AWS.

GFT is an AWS Advanced Tier Service Partner with more than 650 certifications for cloud-based services including coding, database management and cybersecurity. It additionally achieved:

- AWS Financial Services Competency status last year, complementing previous achievements including its

- AWS Migration Competency and

- AWS DevOps Competency.

Former AWS Executive to Grow GFT’s AWS Team and Partnership

Sollie formerly served as Enterprise Executive Strategic Advisor at AWS. In her new role at GFT, she will specifically oversee GFT’s global AWS strategy, manage its multi-year partnership with AWS, and further cultivate executive relationships with AWS clients.

GFT is a partner to some of the world’s leading AWS-based solution providers. In the banking and finance industry, GFT developed BankLiteX in collaboration with Thought Machine. Running on AWS, the solution enables banks to introduce cloud-based, digital entities, such as Standard Chartered’s Mox, in as little as three months. In the insurance industry, GFT is an implementation partner to Guidewire, an AWS-powered core system provider for property and casualty insurers. In the private equity space, GFT partners with cloud-based provider LemonEdge.

“The digital opportunities available to companies once they migrate to the cloud are too large to ignore, but so are the risks of going through it alone,” said Marco Santos, CEO Americas at GFT. “As we partner with companies throughout their digital journeys, from ideation to implementation, we prioritise their ability to scale efficiently by scaling our own expertise alongside them.”

GFT in a Strong Position to Exponentially Scale Global Digitalisation

Sollie has more than 25 years of experience in the IT industry, having represented various lines of business and overseen vendor sales, as well as in her capacity as a technology entrepreneur. Prior to AWS, she served as IBM's strategic digital transformation advisor, specialising in cloud, security and analytics. Sollie additionally held dCIO and CISO roles at the Ohio Department of Public Safety, where she successfully led the organisation’s enterprise Agile transformation, mainframe retirement and data center modernisation.

Sollie's appointment marks an important milestone in GFT’s journey to transform companies’ digital visions into tangible realities. Her leadership, paired with GFT's global expertise, puts the company in a strong position to exponentially scale its clients’ ability to innovate and compete in the digital landscape.

As new SVP, Global Head AWS Sales and Strategy, Brigitte Sollie’s mission is to scale the company’s delivery of cloud infrastructure to meet growing global demand.

Related News

- 02:00 am

ManyPets, the award-winning pet insurance provider, has partnered with Vitesse to facilitate 100% of claims payouts processed through their automated claims system, “Millie”.

ManyPets has made significant strides to improve the claims journey for their pet parents. The percentage of UK claims processed by Millie has increased to more than 40% of all incoming claims. This is delivering a great customer experience with some customers seeing their claim submitted and settled within 24 hours.

Vitesse facilitates all insurtech ManyPets’ payouts processed by Millie. Vitesse helps serve the customers of ManyPets when claiming insurance payments, utilising their unique speedy payout option. This delivery of a non-human claims process simplifies the customer experience and ensures no delay in receiving their money when they – and their pet – need it most.

Vitesse has been working with ManyPets for the past two years and facilitates local claims payout for ManyPets in the UK and the US.

Automation

As an expanding Insurtech, automation and streamlining of processes are key to ManyPets to maintain flexibility in delivering the best customer experience. Back-end integrations and clever APIs increase efficiency and the ability to deliver more automated payments - meaning, as the company grows, there is no impact on their customers as they receive the same excellent level of claims payment service.

Flexibility

As an Insurtech, ManyPets prides itself in having and delivering new services and capabilities to their customers. With no claims process or customer being the same as the last - it’s not always the customer who needs the funds directly - ManyPets can offer extreme flexibility in paying with Vitesse. For example, the funds might need to go to a vet directly, in which case this can be catered for. Vitesse can also pay customers in their preferred currencies and methods.

Growth

The global reach and easy integration that Vitesse offers ManyPets means they can easily facilitate and deliver a quick introduction and ramp-up within new jurisdictions to support the business as they expand and grow. ManyPets consistently focuses on improving their services and solutions to their customers, always putting them at the heart of where they focus innovation.

Vitesse will work alongside ManyPets to develop their offerings so they can achieve this, building new models and processes, looking at new ways to pay, and building extra capabilities.

Whilst Vitesse has worked with many insurers, pet insurance is a new avenue for them. It’s an excellent opportunity to evolve and showcase just how versatile their platform is, helping customers within various insurance sub-sectors to get money quickly.

“We’re thrilled to be working with Vitesse to facilitate our claims payouts,” said Derek Livingstone, Head of Treasury at ManyPets. “Making a claim is the “moment of truth” for insurance customers. Pet parents trust us to pay their claims fast and efficiently at their point of need, and it is great to be able to rely on Vitesse to deliver on our customer promise.”

“It's a true pleasure to work alongside ManyPets,” said Hanif Evans-Ali, Relationship Director at Vitesse. “Having teamed up with various functions, their commitment to finding innovative solutions to daily needs presented in the insurance market is abundantly clear.

Their approach allows us both to highlight operational and cost efficiencies across the whole claims flow, ensuring a solid partnership that we look forward to nurturing in the years to come. We openly learn from one another, which, to me, is a true sign of a valued partnership.”

Related News

- 05:00 am

Mercury® Financial (“Mercury”) today announced the closing of a $200 million debt facility from client funds managed by Neuberger Berman. Mercury will use the funds to expand its credit card business and continue its mission of providing middle-class Americans responsible financial products to improve their lives.

“By analyzing financial data the right way, we can better assess risk and help more qualified Americans better manage their credit.” said James Peterson, Mercury Financial CEO. “We are committed to improving the financial lives of our customers. Neuberger Berman believes in our mission and their partnership will help us reach more underserved Americans, the bedrock of the US economy.”

Mercury caters to 36 million middle-class Americans who are often overlooked by banks. Using proprietary data, the Company’s unique business model leverages over 100 million data points to identify, underwrite and delight its customers with a prime credit card experience. Its digital toolset is built around its patent-pending oculus mobile app, which allows Mercury to engage better with its customers and encourage healthy credit use in a fun and intuitive way. Mercury Financial will use the proceeds of the transaction to originate additional credit card accounts, fund growth of its existing cardmember relationships, and innovate new capabilities to further enhance its customer experience.

“We see a massive opportunity for Mercury to reach our near-prime target market, which so many banks and non-bank lenders ignore.” said Jason Whiting, Mercury Financial CFO. “Regulatory limitations have discouraged banks from approaching this segment, while subprime lenders have traditionally relied on high fee products which often results in continued financial stress. We pride ourselves on being our customers’ bridge to a better credit experience and making a difference in the lives of our 1.5+ million cardmembers.”

“Mercury is a great company with a terrific customer base.” said Zhengyuan Lu at Neuberger Berman. “We are pleased to be a key capital partner for them as they grow and deliver value to their cardmembers.”

“Mercury Financial is driving expanded access to credit and financial inclusion to many underserved Americans.” said Aneek Mamik, Partner at Värde Partners. Värde has been the lead equity sponsor of the business since its founding in 2017.

Related News

- 02:00 am

GlossGenius, a platform designed to handle bookings and payments for salons and spas, today announced that it raised $28 million in a Series C funding round led by L Catterton with participation from Bessemer Venture Partners and Imaginary Ventures.

The round values GlossGenius at $510 million — the startup’s second up-round in the past 12 months — and brings GlossGenius’ total raised to ~$70 million. Founder and CEO Danielle Cohen-Shohet says that it’ll be put toward developing additional products to support business owners in the beauty and wellness sectors, as well as “investing in core areas of the GlossGenius team.”

“As one of the fastest-growing software companies in the space now powering billions of dollars of annual transaction activity, GlossGenius has become a critical gateway for success and social mobility for business owners that have traditionally been underserved by technology,” Cohen-Shohet told TechCrunch in an email interview.

Cohen-Shohet founded New York-based GlossGenius in 2016, after experiencing the pain points of managing a makeup artistry business and engaging with clients. Prior to starting the company, she and her twin sister, Leah, ran a digital receipts point-of-sale venture that they launched in college. Those experiences served as a springboard for Danielle, who learned how to code to build GlossGenius’ MVP.

“Given the many responsibilities that business owners have, they spend countless hours on time-consuming administrative work and processes that keep them from scaling themselves and revenue,” Cohen-Shohet said. “Our product gives businesses complete control over their business, ultimately enabling them to scale themselves and build a unique brand identity and client experience in the same sophisticated way that larger companies would.”

GlossGenius, similar to software like Toast, ServiceTitan and Procore, is a vertical software embedded payments app — but one aimed exclusively at the beauty and wellness spaces. Businesses can use the platform to manage workflows across their back and front offices, including flows related to payments, booking, inventory expenses and marketing.

GlossGenius also offers a card reader, the design of which businesses can customize to match their branding

“Historically, salon, spa and wellness business owners have had limited options — manual tracking with pen and paper or complex, general one-size-fits-all horizontal solutions or hard-to-use legacy solutions,” Cohen-Shohet said. “Many of these options have led to commoditization of small businesses, stripping any opportunity for customization, brand-identity or personality.”

Businesses that choose not to adopt booking tech, though, run the risk of losing out on new clients. According to a 2019 survey of around 1,000 salon and spa customers, only 54% book appointments during a salon’s and spa’s opening hours. Respondents to the poll also cited online booking as the most important feature when visiting a salon’s website.

Whether for fear of missing out on new business or other post-pandemic-related reasons, GlossGenius’ customer base has continued to expand pretty consistently. Cohen-Shohet claims that over 60,000 spas and beauty salons are now using GlossGenius’ platform, which is handling billions of dollars in activity annually.

It helps that, even before the COVID-19 health crisis, spa and salon owners were showing a willingness to adopt new technologies to drive revenue. A 2019 survey of close to 600 spa and salons in the U.S. found that marketing software, point-of-sales systems and cloud software were the top three areas of investment.

“Upon re-opening [after the pandemic], we witnessed increased demand for digital products that could help business owners in our space run better businesses,” she added. “Despite a broader slowdown in tech that many companies are seeing, we’ve seen our sector show resilience and continued growth.”

While GlossGenius’ growth is impressive, it’s up against formidable competition. Fresha, which also sells a beauty and wellness booking platform and marketplace, raised $100 million in 2022. That same year, appointment booking app Booksy landed $70 million. Meanwhile, booking vendor Boulevard similarly secured $70 million in a funding round that closed in late 2022.

It’s cutthroat. Data from Semrush, cited by Fast Company, shows that 76% of the appointment booking market’s online traffic goes to the top five players in the space: Vagaro, Booksy, Mindbody, Styleseat and Fresha.

GlossGenius’ challenge going forward will be continuing to stand out as the field grows increasingly crowded.

L Catterton’s Ian Friedman, unsurprisingly, has faith.

“Given our deep expertise in the beauty space and our investments in disruptive software businesses across consumer verticals, we see a compelling opportunity ahead to serve businesses here with better and more powerful tech,” he said via email. “The overwhelming enthusiasm displayed by GlossGenius’s customers is a testament to the product’s excellence and the company’s position as the go-to platform in the industry.”

Related News

- 01:00 am

Croissant, a fintech platform with a mission to empower intentional commerce, launched today with $24 million in seed funding from a suite of top investors, including Portage and KKR co-founders George Roberts and Henry Kravis. Initial funding was used to accelerate Croissant’s MVP launch via a best-in-class founding team led by Co-Founder and CEO John Howard (formerly of KKR), Co-Founder and CTO John Klose (Amazon, PayPal), and Head of Product Vrishti Mongia (Meta, Moda Operandi).

Croissant seamlessly integrates into merchants’ existing shopping experiences and offers customers a guaranteed buyback value at checkout, boosting conversion and average order value. Croissant’s data science and AI tooling generates the guaranteed buyback values offered to customers, and Croissant fulfills those guarantees. Post-purchase, items become liquid assets within customers’ Croissant accounts that they can later sell with one click. Once customers have sold their items, they are directed back to merchants with new funds to power future purchases, making for higher retention rates and lifetime value.

“Over the past decade, we’ve seen immense changes happen at e-commerce point of sale,” said John Howard. “But rapidly evolving consumer behavior and expectations mean it’s no longer enough for merchants to have a seamless credit card or mobile wallet experience; they need to activate consumer psychology around the purchase decision in empowering, impactful, and effortless ways to truly stand out. Croissant allows merchants to increase sales, consumers to buy more and better, and both to enjoy the benefits of resale without doing any reselling whatsoever. Bottom line – Croissant contributes to a richer, more vibrant commerce experience for everybody.”

Developed partially in response to consumer debt-focused offerings, Croissant transforms the shopping mindset from one of credit-fueled consumption to one of asset ownership, amplifying purchasing power and providing real financial empowerment for users, resulting in higher conversion, average order value, and customer retention. When users later elect to sell, Croissant deploys its exclusive multiple listing technology to handle the tedious resale process within the existing secondhand ecosystem with no involvement required from merchants or customers.

“Only a small percentage of resellable fashion is transacted globally each year, but it’s still a $130 billion market that is rapidly growing,” said Stephanie Choo, Partner at Portage. “To date, retailers are seeing little to no benefit from this ongoing boom. Croissant enables them to harness the interest in and growth of resale to drive new full-price sales with minimal integration and no need to transact within the secondhand ecosystem themselves.”

In addition to Portage, Roberts, and Kravis, major investors in Croissant include Third Prime, BoxGroup, 25madison, and Twelve Below. Croissant’s advisory board of industry leaders includes Rent the Runway Co-Founder and Board Member Jennifer Fleiss; former Chief Merchandising Officer of Intermix Divya Mathur; Lara Meiland-Shaw, a luxury fashion veteran with over 20 years of experience at brands like Louis Vuitton, Moncler, and Saks Fifth Avenue; and Homer and Outdoor Voices Founding Partner Andrew Parietti.

Related News

- 03:00 am

UK and Singapore officials have agreed on a pact for collaboration on FinTech and sustainable finance, emphasising the development of digital assets and currencies as well as sustainable finance, at a meeting in London.

Representatives from HM Treasury and the Monetary Authority of Singapore agreed on global regulatory standards for digital assets and crypto under the Financial Stability Board as well as international standard setters including IOSCO.

The countries also shared insights on the development of the UK Digital Pound and scope for a digital Singapore Dollar, which would facilitate the sharing of data and improved Central Bank Digital Currency foreign exchange.

Responding to the news, Ganesh Viswanath Natraj, Assistant Professor of Finance at the Gillmore Centre for Financial Technology, commented: “International collaboration in key areas such as FinTech is vital for UK innovation as we continue to establish ourselves as a leading centre to do business. Digital assets continue to play a prominent role in FinTech development, and it is promising to see the UK positioning itself as a primary contributor in global regulatory standards, but it is also important that this does not hinder R&D.”

“The development of the digital pound, in particular, can have a transformative impact on the UK economy, boosting financial inclusion, increasing the effectiveness of monetary policy, as well as facilitating more efficient cross-border payments.”

Meanwhile, Sheeraz Saleem, Chief Technology Officer at DKK Partners, said: “It is great to see the UK taking a lead internationally in the development of digital assets in an attempt to lower the cost of foreign exchange and support cross-border trade. At a time when the UK economy is battling rising inflation and interest rates, it is important to explore ways in which government, regulators and the Bank of England can take greater control of the economy, and the knock-on impacts of digital currencies can have hugely positive implications for UK PLC.”

The UK and Singapore also discussed the ‘urgent’ need for scalable financing to support economic transitions to net zero.

Representatives agreed on transparent transition plans that include reduced fragmentation, scalable transition finance and support for sustainability in finance, alongside the support of international global standards from the International Organization of Securities Commissions.

Laimonas Noreika, CEO of HeavyFinance, commented: “Sustainable finance should be at the heart of government and business actions, and it is encouraging to see international discussions around transition finance and international standards as part of this. Collaboration in economic emission reductions is an important step for global governments to improve their climate actions, but it is important that real action is taken off the back of it to ensure a positive climate impact. Sustainable investments such as Article 9 funds is one option that can ensure positive climate action, giving support and funding to carbon reduction projects.”

The UK and Singapore also agreed to strengthen collaboration on Environment, Social and Governance (ESG) data and promote global coordination and common expectations.

Related News

- 05:00 am

ING today announced the appointment of Görkem Köseoğlu as chief technology officer and member of the Management Board Banking. Görkem will take up his position on 1 September, succeeding Ron van Kemenade, who stepped down effective 30 April 2023.

Görkem is currently the chief operations officer of ING Netherlands, where he leads all the client services activities, the global transformation office, delivery tribes including data management, KYC services, collections, and fraud management.

Görkem joined ING in 2012 as chief operations officer and chief information officer of ING Turkey where he led the transformation agenda, optimizing customer journeys, processes and legacy platforms. In 2018, Görkem became ING Group’s chief analytics officer, setting up the Global Analytics unit, defining the strategies for change and analytics platforms and building a global analytics community.

Prior to ING, Görkem spent over 10 years in the financial institutions practice and business technology practice at global consultancy firm McKinsey & Company. He started his career at Lucent Technologies-Bell Labs. Görkem has a B.Sc in Computer Engineering from Boğaziçi University in Turkey and an MBA from TSM Business School, University of Twente, the Netherlands.

The appointment of Görkem Köseoğlu as chief technology officer has been approved by the European Central Bank.

Danny Nijhuis, currently COO Wholesale Banking, will succeed Görkem in his current role as COO Netherlands.

Related News

- 04:00 am

Fusion Risk Management, Inc., (“Fusion”), a leading provider of cloud-based operational resilience, business continuity, and risk management software and services, today announced a partnership with SecurityScorecard, a global security ratings, response, and resilience company. The partnership provides customers transparency into their overall IT security risk scores and cybersecurity health ratings, delivering a complete understanding of vulnerabilities within their third-party ecosystem.

Increasing cyber threats, attacks on supply chains, and risks introduced by third parties continue to pose a significant threat to organizations across the globe. Software supply chain attacks, including the recent MOVEit attack, continue to cause disruptions throughout the value chain, so it is no surprise that Gartner found that 60% of organizations will use cybersecurity risk as a significant determinant in third-party transactions and business engagements by 2025. Organizations need to strengthen their IT and cybersecurity risk management posture today to drive sustainable growth.

To meet this demand, Fusion has partnered with SecurityScorecard and is integrating the company’s third-party risk intelligence into the Fusion Framework® System™ platform. This allows organizations to continuously monitor critical third parties, understand their impact on important products and services, and proactively identify and mitigate potential issues – all in one centralized dashboard. Organizations can identify their most critical third parties by leveraging vendor scores, ratings, and trend data. Automated alerts notify organizations when there is an adverse change in a vendor risk score or when a risk event occurs, and data drill-down capabilities prompt quick action. The functionality enhances resilience by providing actionable insights and encouraging proactive mitigation and agile responses.

Customers can also now have greater visibility into IT and cyber risks introduced by third-party relationships, enabling shared insights across teams, data-driven reporting, and informed decision-making. Data is aggregated in dashboards that are combined with existing Fusion third-party management data for seamless reporting across the organization. A centralized third-party data view provides transparency into ongoing and potential threats to drive proactive risk management processes, executive-level reporting, and efficient operational resilience strategies.

“Third parties are essential to business operations, but increasing disruptions demonstrate why continuous IT, cybersecurity, and third-party risk management initiatives are necessary,” said Eric Jackson, CPO, Fusion Risk Management. “Thousands of customers, globally, trust SecurityScorecard to measure cyber risk and provide 360-degree insights in order to help stakeholders make quick and informed decisions, strengthen cyber defenses, and minimize IT and cybersecurity risk. We are proud to partner with SecurityScorecard and expand on our native capabilities to offer our customers greater visibility into high-risk third parties and their potential impact on key business functions. While there is no replacement for robust third-party onboarding procedures, the new functionality alleviates manual tracking with 24/7 monitoring and assessments. As the risk and resilience landscape evolves, we will continue to work diligently to help our customers strengthen their overall third-party risk strategies.”

Related News

Chrisol Correia

Chief Strategy Officer and Interim Head of Marketing at Facctum

Following Russia’s invasion of Ukraine last year, we have seen a huge rise in the number and velocity of Russian sanctions, which as a result has also brought see more