Published

- 06:00 am

hi, the Web3 financial super app and ecosystem, and Animoca Brands, the company advancing digital property rights for gaming and the metaverse, have joined forces by entering into a memorandum of understanding (MoU) for strategic partnership. As part of the partnership, subject to agreement of definitive terms, Animoca Brands will invest US$30 million in hi and collaborate on a number of exciting initiatives. The two companies’ shared vision aims to amplify the utility of fungible tokens and NFTs within the Web3 space.

The partnership is expected to lead to deep integration between Animoca Brands’ ecosystem and hi’s innovative services that are driving Web3 mass adoption. With a strong focus on boosting the hi ecosystem, anchored by the hi App – a cutting-edge financial super app for Web3 – and the hi Protocol (hiP) – a scalable, EVM compatible, Sybil-resistant layer-2 sidechain for Ethereum – the two companies will work to provide developers with a unique-human authentication mechanism through hiP’s groundbreaking Proof of Human Identity (PoHI) solution.

As an undisputed leader in the NFT space, Animoca Brands will support hi’s vision to deliver real-world use cases for cryptocurrencies and utility tokens, allowing users to directly spend and be rewarded with certain tokens used in the Animoca Brands ecosystem, including SAND, EDU, APE, REVV, GMEE, and others.

In 2022, hi - which has amassed over 3.5 million users with 1 million KYC-ed users - announced the world’s first debit card featuring NFT avatar customization, powered by Mastercard. With the first cards shipping in Q3 2023, eligible cardholders will be able to personalize the face of their debit card with an NFT avatar they verifiably own, and spend their fiat and digital currencies at more than 90 million locations worldwide. Animoca Brands’ portfolio companies could benefit from this unique customisation feature.

Yat Siu, the co-founder and executive chairman of Animoca Brands, said: “We are looking forward to investing in and partnering with hi, which is committed to bridging the gap between the fiat and cryptocurrency worlds. As part of this partnership we will collaborate with hi on its continued development of the hi App and the hi Protocol to drive positive impact for the broader Web3 ecosystem.”

Commenting on the partnership, Sean Rach, the co-founder of hi, said, "hi is proud to work closely with Animoca Brands, especially given its experience in backing some of the earliest and most prominent Web3 companies. By teaming up with Animoca Brands, we will be able to boost the adoption of hi products and services, helping to drive mass adoption for blockchain technology."

Related News

- 01:00 am

Immediate solves liquidity challenges for employees facing unexpected expenses by allowing them to access funds when needed, without waiting for their next paycheck. Earned wage access has become a growing expectation for employers, giving them substantial advantages in staff recruitment and retention. Immediate structures its offering responsibly to create financial stability in the lives of employees.

This funding comes as Immediate enters its fifth year in business, and reflects on the growing momentum the company is experiencing due to employees’ increased financial challenges amidst the current economic climate.

The funding round was led by Castle Creek Launchpad, a joint fund managed by Castle Creek Capital and Launchpad Capital that invests in fintech companies that are transforming financial services through partnerships with regulated financial institutions, including the fund’s 34 community bank limited partners. Also participating in the funding round were strategic investors including BankSouth, a Georgia-based community bank, and Birmingham executives Bryan Statham and Cynthia Johnson. Bryan and Cynthia have experience implementing high growth strategies within early-stage companies and have quickly contributed to the growth and success of Immediate by serving in a hands-on advisory capacity to the business.

The expanded working capital credit facility was provided by SouthPoint Bank, a leading southeastern financial institution. Immediate was drawn to SouthPoint Bank’s exceptional products, services, and their mission to point businesses forward.

“Immediate stands out in Earned Wage Access with a well-designed offering that lets employees manage their lives and employers run their businesses. Partnerships with banks will help employers better address the needs of a modern workforce. We’re excited to back a strong team and product in this vital and growing market,“ said Ryan Gilbert, Founder and General Partner at Launchpad Capital.

“As Immediate continues to make progress towards our mission of positively impacting the financial well-being of 1 million American workers by 2025, we recognize the need to surround ourselves with investors who have scaled companies to the heights we expect to achieve. We could not be more excited about this group of investors, who are not only providing Immediate with funding, but also with invaluable advisory and industry expertise that will undoubtedly expedite the growth trajectory of our company.

The future is bright for Immediate and this round of funding – especially in a volatile economic climate – is a validating indication that we are well-positioned as a leader in the rapidly growing financial wellness market,” said Matt Pierce, Immediate Founder and CEO.

Related News

Gilbert Verdian

Founder and CEO at Quant

Blockchain technology has long been lauded for its promise of decentralisation, security, and scalability. But despite these lofty ideals, adoption has been slow. see more

- 06:00 am

The Board of Monument Bank is pleased to confirm that regulatory approval has been confirmed for the appointment of Mrs Fiona Pollard as the successor to Mr Niall Booker as Chair of Monument Bank. This completes an orderly succession process which has been in train for the last six months and came into effect as of 26 July.

Mr Booker indicated to the Board late last year that he would like to step down to focus on his other interests and that after four years in the role and with Monument Bank successfully achieving its banking licence and starting its deposit taking and lending journey, now was an appropriate time to do so.

Mrs Pollard was selected as the Board’s preferred candidate subject to regulatory approval after an extensive appointment process run by the Senior Independent Director, Sir Andrew Likierman. She has served as an independent Non-Executive Director of the Bank since September 2019 and chairs the Bank’s Remuneration and Nomination Committee. Fiona has held a varied portfolio of Non-Executive Director roles including Chair of Melton Building Society and the VisitEngland Advisory Board. In her earlier banking career, she worked for Barclays, Daiwa Europe Bank, NatWest Capital Markets, and Goldman Sachs.

Commenting on the appointment the CEO of Monument Bank Mr Ian Rand said: “I would like to thank Niall for all he has done for Monument over the last four years. He has provided wise counsel and used his considerable banking experience to help shape and guide us through the licensing process, our early lending journey and the development of our Lifestyle offering. He has been an excellent Chair and played a pivotal role in our success and we are very grateful to him for everything he has achieved and wish him all the best for the future.

“We are very pleased that Fiona will be Niall’s successor as Chair of Monument. She has shown an exceptionally broad ranging skill set through her deep knowledge of the financial services sector. Her leadership, vision and market knowledge of savings and property lending have served Monument very well to date and we are looking forward to working with her in the new role.”

Related News

- 01:00 am

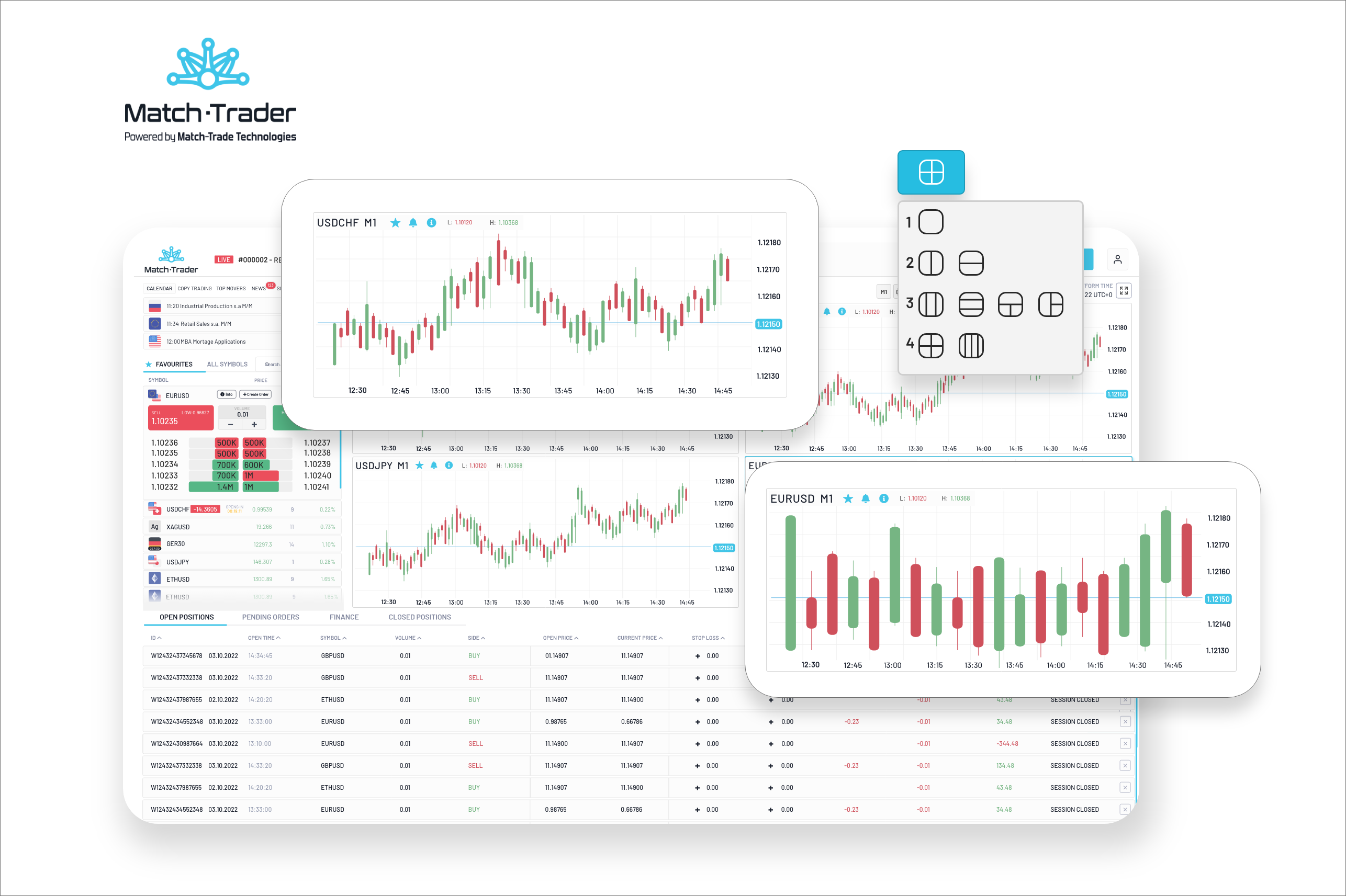

Match-Trader, an award-winning trading platform created by a leading technology provider for Forex Brokers - Match-Trade Technologies, has recently undergone a major refactoring to deliver smoother operation and improved performance for mobile users.

The comprehensive overhaul has leveraged the power of TypeScript, a lightweight and modern programming language, to optimise the frontend elements of the platform, allowing the newly implemented advanced functionalities to operate more efficiently.

One of the significant enhancements resulting from the transition to TypeScript is the seamless integration of Multi-Chart functionality. This highly anticipated functionality enables users to compare multiple charts, analyse various intervals within a single instrument, and execute trades simultaneously on different charts. The solution seamlessly integrates with the market watch, reducing the possibility of accidental position openings and providing a more intuitive experience for novice traders. Multiple layouts are available, allowing users to select their preferred platform view according to the options provided by the Broker, including dark and light modes.

Previously, chart handling required background conversions from the previous JavaScript version, introducing potential bottlenecks. However, with the adoption of the new script, chart operations now exhibit enhanced fluidity, providing a more responsive trading experience. Traders can expect improved accuracy in indicators and a reduced risk of freezing issues.

The Multi-Chart feature makes the platform even better for analysis. It lets traders adjust each chart separately by changing instruments, indicators, and time intervals. Plus, there are helpful drawing tools. Comparing and analysing instruments is now much more manageable. Personalising the charts is great because you can monitor different time intervals for the same instrument in real time and find connections between different instruments. This is a big deal for traders who rely on charts for market info. It's an innovative tool that attracts investors and gives brokers a competitive edge - explained Jacek Czarniawski, Head of Product Development at Match-Trade Technologies.

Another notable outcome of the platform-wide refactoring is the enhanced visual consistency achieved by utilising a unified script. This cohesiveness contributes to a more polished user interface. The focus on visual alignment is particularly beneficial for mobile users, who constitute nearly 70% of the platform's user base.

Price updates in the market watch and session closures, among other instrument-related aspects, now load instantly on charts without any noticeable lag. This optimisation is especially noteworthy in the context of the Progressive Web App (PWA) functionality, enhancing the application's responsiveness. All these improvements aim to provide users, especially those with slower internet connections, a seamless trading experience and superior performance.

Furthermore, the latter release has introduced several new features to the platform. Implementing Two-Factor Authentication (2FA) adds an extra layer of security for traders, curbing concerns about account safety when accessing the platform from different devices. This additional safeguard aligns with industry standards and is especially crucial for platforms used in cryptocurrency exchanges.

Introducing a guest mode is another significant feature, particularly from a broker's perspective. It allows users to explore the platform without the need to create an account, providing a considerable advantage for many traders. Moreover, the forthcoming integration of OAuth, enabling login through Google or other selected social media accounts, will simplify the account creation and login processes, helping brokers improve conversion rates.

Previously introduced Investor access, now coupled with the 'share my trade' feature enabling the sharing of a graphic detailing each closed position with a comment, empower traders by promoting information sharing within the trading community and supports brokers in attracting more clients.

In addition to the recent integration with ZuluTrade, the platform's internal social trading mechanism has been significantly expanded by introducing subscription fees for money managers, allowing them to charge a fixed fee for sharing their trading signals. This enhancement aims to increase the platform's attractiveness to signal providers, facilitating brokers in attracting a larger client base and promoting greater engagement among existing clients.

To ensure a seamless deployment for clients, the Match-Trader development team conducted thorough testing before implementing the changes. Over 100 employees participated in an internal contest, rigorously evaluating the new version to identify and resolve any bugs or issues.

The refactoring of the Match-Trader trading platform represents a significant milestone in its evolution. The improvements driven by adopting TypeScript and introducing new features underscore the platform's commitment to delivering a superior trading experience to its diverse user base. With the smoother operation, enhanced mobile performance, and expanded functionalities, Match-Trader aims to empower traders and further establish its position as a leading solution in the forex industry.

Related News

- 06:00 am

Tuum, a leading next-generation core banking provider, and Numeral, a leading bank orchestration platform, today announce a strategic partnership to empower financial institutions and fintechs to efficiently launch and expand across Europe and the UK, leveraging a robust and resilient pan-European payment infrastructure and the rapid speed to market of new offerings and services enabled by both solutions.

The partnership between Tuum and Numeral introduces a modern core banking platform that seamlessly connects to the EU, UK, Nordics, and CEE payment rails via partner banks, enabled through a single API connection. Numeral's cutting-edge platform is specifically designed for fintechs and financial institutions building payment products on top of their banking partners. Through a single API and central dashboard, Numeral's platform enables seamless bank integrations, faster payments, and real-time data visibility on accounts and payments.

A recent survey conducted by Numeral on European consumers revealed that customers are 83% more likely to use financial services that offer local IBANs instead of foreign ones. Moreover, 25% of consumers reported experiencing IBAN discrimination when using a foreign IBAN. This discrimination negatively impacts customer trust for financial services that don’t offer local IBANs.

With Numeral's extensive bank integrations and Tuum's modular core banking platform, financial institutions and fintechs can access EU and UK payment schemes such as SEPA, Bacs and FPS as indirect participants, by integrating with multiple UK and EU partner banks. This provides access to partner banks local virtual IBANs or issuing their own local IBANs fostering increased customer trust and combating IBAN discrimination effectively.

Building a resilient payment infrastructure is paramount for financial services companies. Recent instances of bank failures have highlighted the vulnerability of relying on a single partner bank. In such cases, if the partner bank's payment systems cease operating, businesses cannot send or receive payments on behalf of their customers.

Tuum and Numeral joint proposition enables financial institutions to partner with multiple banks and build a robust and resilient payment infrastructure without the need to build additional integrations and operate complex systems. This approach mitigates the risks associated with relying solely on one bank and ensures uninterrupted payment services for customers.

Édouard Mandon, CEO of Numeral, stated, “Given how scale impacts unit economics in the fintech and financial services industry, building a pan-European payment infrastructure is critical for financial services and fintech companies to access a broader market, acquire more customers and achieve profitability. But doing so internally turns valuable resources away from core products, similar to how building a core banking system internally can be a risky, lengthy project. Tuum’s approach to modular core banking is completely aligned with ours: financial services companies should be able to build systems that correspond to their specific needs from readily available building blocks. That’s why we are delighted to announce our partnership with Tuum today.”

“Becoming pan-European is a game-changer for financial institutions. However, venturing into new geographies is not without its challenges. One is the strain on resources. Establishing operations across different countries demands substantial capital and operational expense,” comments Jean Souto, VP Global Partnerships of Tuum. “With Tuum and Numeral's joint proposition, companies can now harness the power of a modular core banking platform and a pan-European bank orchestration platform. This synergy enables them to efficiently launch their services, minimising resource requirements while rapidly scaling their operations throughout Europe and the UK.”

Related News

- 06:00 am

TransBank, one of Mongolia’s pioneer banks, has successfully migrated its card management system to TranzAxis, an award-winning payments platform from Compass Plus Technologies. TransBank’s decision to migrate its card management system to TranzAxis was driven by its desire to bring its card operations in-house, empowering the bank to independently develop and launch customer-centric card products and services at greater speeds.

Over the past 26 years, TransBank has established itself as one of Mongolia’s leading institutions, and identified that in order to maintain this position, it needed to transition away from its previous card management solution that ultimately could not deliver the customer-centric products the bank was seeking to offer. After conducting a thorough search of the market to find a reliable solution that could enable it to overcome these constraints, TransBank decided to utilise TranzAxis, significantly reducing its time-to-market for new card products and services whilst strengthening the security of its customer’s transactions.

The project was delivered smoothly and ahead of schedule in just two months, marking the complete installation and configuration of the new card management system, the complete migration of TransBank’s Visa, UnionPay and domestic debit and credit cards, and the activation of customer cards in the production environment.

"We are delighted to have partnered with Compass Plus Technologies to deliver this project," said Gantulga Tserenlkham, Vice president in New projects at TransBank. "The transition to an in-house card management system has significantly enhanced our ability to meet the evolving needs of our customers. TranzAxis offers us the freedom to develop tailored card products and services, positioning us for continued success in Mongolia’s competitive banking landscape. Right from the start of the project, their team of experts demonstrated a profound comprehension of our present circumstances and future objectives, and we looking forward to working together to achieve them."

"We are delighted to collaborate with such a forward-thinking business like TransBank and support the delivery of their vision," commented Nikolay Korovin, Sales Account Manager at Compass Plus Technologies. "With the support of TranzAxis, the bank can now confidently deliver innovative card products that meet the ever-changing requirements of their customers. We look forward to helping TransBank expand its market presence and deliver exceptional services to its customers."

Related News

- 04:00 am

Today Mollie, one of the fastest-growing financial services providers in Europe, announces a new integration and joint marketing effort with Klaviyo, a marketing automation and customer data platform that drives revenue growth for businesses of all sizes. Through the new integration, merchants of the two firms can now use their information collected from payment transactions within Klaviyo’s platform to personalise customer communications and marketing email flows to grow revenues. In addition, Klaviyo and Mollie will collaborate with their joint agency partners to empower merchants to leverage this payment information to create more tailored marketing automation strategies.

Klaviyo is an intelligent marketing automation platform that makes it easy for marketers to centralise and use every piece of their customer data to deliver hyper-personalised experiences across all their channels, increasing conversions and revenue. Mollie powers the growth of over 130,000 businesses across Europe by offering advanced solutions to accept payments, online and in-person. This initial integration enables Klaviyo’s customers access to Mollie’s unique set of APIs to personalise their marketing email flows, whilst enhancing revenue.

This initial integration will see merchants benefit from a reliable, complementary tech stack, harnessing transaction data to improve email marketing automation to:

- Close the loop on reporting, generate insights by user behaviour, and reveal growth opportunities.

- Help companies to understand their customer base and create targeted marketing campaigns.

- Create and distribute personalised emails at scale: based on cross-sell, up-sell, seasonality and purchase behaviours and more.

Transaction and order data collected by Mollie allows Klaviyo customers to sync and enrich their customer profiles, easily organise new customer information, and create audience segments. It also facilitates the creation of custom email flows that are triggered in real-time based on events and metrics. The integration also supports merchants in building personalised campaigns based on customer subscription status such as: when their subscription starts, when it’s about to expire, when it needs to be renewed, when their payment did not succeed, and more.

Emna Everard, Founder and CEO of Kazidomi shares, "I am thrilled to share how we leveraged the seamless integration between Mollie and Klaviyo to improve our marketing campaigns. With our custom-built e-commerce platform, the integration allows us to effortlessly enrich our campaigns with payments data.

At Kazidomi, our mission is to offer a wide selection of high-quality, natural, and organic products providing customers with a convenient and affordable way to maintain a healthy lifestyle. By syncing the Mollie data with Klaviyo, for example, we can follow up on failed payments but also collect valuable customer data, allowing for precise targeting and personalised offers, making the shopping experience even more tailored and convenient.”

‘Marketing automation not only improves customer retention, but creates new revenue streams. Access to Mollie’s transaction and order data allows our joint customers to improve the quality of experience of their end-customers. We’re delighted to be working with Mollie - a key provider for merchants across Europe, offering reliable and secure payment processing. Our integration enables our customers to connect the power of payments to the automation tools they already love,’ said Rich Gardner, SVP of Global Strategic Partnerships at Klaviyo.

Philippe Daly, at Mollie said, ‘We’re excited to integrate with Klaviyo, a company that not only offers the ‘best in class’ marketing automation solutions, but understands the value in access to simplified, smart customer data. An interoperable tech stack is a crucial contributor to growth for merchants of all sizes, and that’s why our integration is available via direct API for custom-built platforms, as well as popular e-commerce platforms - including BigCommerce, Shopify, Salesforce Commerce Cloud, WooCommerce, Wix and Prestashop - to enable as many customers as possible to benefit from this integration.’

Related News

- 06:00 am

Hitachi Payment Services, India’s leading integrated payment solutions provider, has entered into an agreement to acquire the Cash Management Business of Writer Corporation, a multi-business enterprise.

In the Cash Management industry, Writer Safeguard - the Cash Management Business of Writer Corporation, has been providing comprehensive cash services including ATM cash replenishment and retail cash pick-up services to corporate clients in India since 2001. Writer Safeguard has a network of close to 40,000 touchpoints including ATMs and Retail spanning 25 states across 1,500 locations serviced by a workforce of over 10,000 people.

The acquisition will transform Hitachi Payments’ market standing by integrating the cash management business into its overall service offerings, positioning it as a one-stop payments and commerce solutions provider. It will enable Hitachi Payments to provide comprehensive ATM services to financial institutions, while on the merchant side it would complement Hitachi Payments’ digital offerings. By offering a unified and single platform for all merchant-related payment and commerce needs, the acquisition will further strengthen Hitachi Payments’ value proposition to merchants and serve as a catalyst in accelerating digital adoption.

Tatsuro Ueda, Vice President and Executive Officer, CEO of Financial Institutions Business Unit, Hitachi, Ltd. said “As the movement of digitalization accelerates globally, Hitachi is committed to provide future-ready solutions that effectively meet the varied needs of our customers especially in India, where digitalization is progressing rapidly in rural areas. This acquisition will enable us to expand our service offerings and further strengthen our position in the Indian market. Specifically for the merchant ecosystem, we will be able to provide a distinctive value proposition and further drive digital acceptance by becoming a one-stop solution provider, catering to the diverse needs of merchants.”

Sumil Vikamsey, Managing Director & Chief Executive Officer – Cash Business, Hitachi Payment Services, said “The acquisition of the Cash Management Business of Writer Corporation will complement Hitachi Payments’ vision of becoming a leading payments and commerce solutions provider, offering holistic, reliable and cost-effective solutions across the payments value chain. In line with our overall strategy, the deal creates opportunities for us to broaden our service offerings and provides us a unique position to drive growth and innovation in the Indian payments landscape.”

Dayle de Souza, Managing Director, Writer Business Services, said “Over the last two decades, Writer Corporation has created a rich legacy in the Cash Management Business through pioneering technologies, operational efficiencies and superior risk management practices. As one of the founding members of the Cash Logistics Association, the company has played a pivotal role in bringing global standards to the Cash Management industry in India. We are confident that the transfer to Hitachi Payments will bring new possibilities for this business. We will continue to retain and grow the ATM Managed Services business as a part of the overall service portfolio to our corporate clients.”

Hitachi Payments is a pioneer in the payment industry in India, offering a comprehensive range of payment solutions including ATM Services, Cash Recycling Machines, White Label ATMs, POS Solutions, Toll & Transit Solutions, Payment Gateway Solutions and innovative offerings such as SoftPOS, POS Value Added Services and next-gen mobile based merchant platform enabling end-to-end services. The company is committed to delivering exceptional customer experiences and driving financial inclusion across India.

Completion of the acquisition is subject to customary closing conditions.

Related News

- 07:00 am

Onmeta, India’s leading fiat on-ramp & off-ramp solution provider, announced today, that it has become the first such solution in India to register with the Financial Intelligence Unit (FIU) of the Finance Ministry of the Government of India. In March this year, the Government of India brought digital assets under PMLA which included crypto businesses to register with the FIU and was widely perceived as a major step towards regulating the sector.

As mandated by the amendments to the PMLA, Onmeta already has a robust yet breezy one-time KYC process. It has also established a comprehensive AML policy including Sanctions screening that identifies and reports suspicious transactions promptly and proactively to the FIU. It also does comprehensive client due diligence and maintains all the relevant information up-to-date and accurate.

Commenting on the development Bharath T, CoFounder at Onmeta, said “We're thrilled to announce Onmeta's registration under FIU, highlighting our commitment to compliance and trust in the VDA sector. We extend our sincere appreciation to the Indian government for their invaluable support in fostering a regulated environment that promotes innovation and industry growth.”

As a pioneer in the fiat-to-crypto On-Ramp & Off-Ramp space, Onmeta has relentlessly focused on simplifying the crypto buying/selling experience for the masses and making the best of the global web3 products accessible to Indian users. As India's crypto industry evolves with the introduction of such pragmatic regulations, Onmeta aims to lead the way in adhering to these new norms and fostering a secure crypto landscape. This latest development should go a long way in instilling confidence in the potential of the Indian crypto ecosystem and encourage more companies to build for India.