Published

Juan Miguel Pérez

CEO and Co-Founder at Finboot

Repsol and Saudi Aramco’s recent announcement that they have teamed up to build one of the largest zero emission synthetic fuel production plants in the world is a significant step towards Repsol’s see more

- 05:00 am

MayStreet today announced the closing of a Series A financing round led by Credit Suisse Asset Management's NEXT Investors, a leading Fintech growth equity group that invests in high-growth private businesses that interact with the financial services industry.

The $21 million investment will be used to accelerate MayStreet’s growth through the full globalization of its industry-leading market data infrastructure platform across asset classes, further product development and the expansion of the company’s sales and marketing presence. In addition, as part of the investment, trading technology and market data industry veteran Rishi Nangalia will join the MayStreet board.

MayStreet was founded in 2012 by software engineers with deep expertise in building market data systems for some of the world’s most performance-dependent market makers and proprietary trading firms. MayStreet’s market data platform provides a simple way for organizations of all sizes to manage their capital markets data needs now and into the future. Combining ultra-low latency architecture with high-precision, full depth-of-book data, MayStreet enables its clients to gain deeper insights into how global capital markets operate. The platform delivers both real-time and “near-time” intraday historical data, transforming clients’ firm-wide workflows ranging from trade execution and surveillance to instant market analysis, end-of-day reporting, historical back testing and more.

Credit Suisse Asset Management's NEXT Investors identifies growth equity investment opportunities in private technology and services companies globally where the team has domain expertise and actionable edge.

Commenting on the investment, Patrick Flannery, MayStreet CEO and Co-Founder, said: “For firms across our industry –banks, quantitative investment firms, traditional asset managers, trading system vendors, etc. – the race is on to figure out how to most effectively extract value out of the ocean of market data that gets created each day. From our standpoint, this is an incredibly exciting problem to solve, which is why we’ve worked so hard these past eight years to develop, in conjunction with some of the world’s most demanding users of market data, a sophisticated platform to do just that. Credit Suisse NEXT Investors sees the world in a similar way, and we are thrilled to have the opportunity to work with them to further scale our business.”

“We have been following MayStreet’s progress and believe the technology they’ve developed is truly differentiated,” said Greg Grimaldi, Co-Head and Portfolio Manager of NEXT Investors at Credit Suisse Asset Management, who will be appointed to the MayStreet board of directors. “The ability to efficiently leverage market data enterprise-wide is clearly becoming more and more critical each day, and we believe that MayStreet is incredibly well-positioned to help firms across the capital markets modernize their infrastructure to meet these challenges.”

In addition to joining the MayStreet board, Mr. Nangalia will be a strategic advisor to the firm. He most recently served as Global Head of Buy Side Trading at Refinitiv, which he joined as part of its acquisition of execution management system (EMS) provider REDI Global Technologies. At REDI, Nangalia served as CEO, leading the firm from its 2013 spinout from Goldman Sachs to a consortium of global investment banks and investment firms until its acquisition by Refinitiv in 2017. Prior to REDI, Nangalia spent 12 years in various product, business development and strategy roles within Goldman Sachs’ electronic trading businesses.

“Throughout my career, I have witnessed countless examples of legacy market data infrastructure that have caused a substantial drag on performance for firms of all types,” Nangalia noted. “MayStreet brings a powerful and scalable solution to these problems, and I’m looking forward to helping the whole team at MayStreet accelerate the growth of the impressive business they’ve built.”

The financing round is the latest significant milestone for the firm. In November, MayStreet became the data provider for the SEC’s MIDAS system through MayStreet’s acquisition of certain Thesys Technologies assets. With the deal, the SEC joined a growing list of MayStreet customers that includes many of the world’s leading financial institutions.

Related News

- 09:00 am

Ingenico Group (Euronext: FR0000125346 - ING), the global leader in seamless payments, today reveals that within 18 months of going live, its Russian Payments Solution has outperformed all expectations with impressive payment volumes and customer adoption. It is now one of the fastest growing payments offerings from Ingenico ePayments, providing unique local acquiring and payment capabilities for international businesses selling online to Russian consumers in digital goods, retail, travel and more.

The success of the solution is credited to Ingenico’s deep understanding of the Russian financial system and partnerships it has built within the Russian banking ecosystem. Through these partnerships Ingenico developed a unique solution with local access to the Russian financial system and payment landscape providing local acquiring, local payment methods and multi-currency processing capabilities.

Ingenico has rapidly grown its new solution – up to a billion in USD flow in its first 18 months - and is seeing impressively high payment approval rates. By working with leading acquiring banks such as Sberbank and Alfa Bank, Ingenico has seen impressive approval rate increases of up to 20% for customers. A high approval rate is crucial for online businesses as it leads to more online sales, lower shopping cart abandonment and returning customers.

The Russian Payments Solution offers Mir (Russia’s domestic card scheme) and Russian e-wallets Qiwi and Yandex.Money. It supports domestic payments in multiple currencies in addition to the Rouble, including EUR and USD reducing the risk for Russian issuers. It is fully compliant with MirAccept, Russia’s equivalent of the 3D Secure authentication mechanism. Ingenico is also regularly adding new capabilities including a BSP feature for airlines with local acquiring, single report and single remittance.

The solution’s capabilities and outstanding performance have allowed Ingenico to successfully process 100 million payments from Russian consumers buying products overseas. Its success was further driven by an extraordinary performance during China’s Singles Day 2019, reporting record breaking transaction volumes and payment authorization rates. Already, the company has onboarded 10% of its overall merchant customer base, helping companies like All Nippon Airways, SHEIN, inCruises, Air China and Joom accept payments from Russia with ease.

Ingenico launched the Russian solution in 2018 as part of a strategic approach to help businesses target high growth markets including Brazil, Russia, India and China. Apart from growing fast, these countries have significant barriers to entry. Their unique domestic ecommerce ecosystems demand specific solutions tailored to local preferences. Ingenico is delivering solutions for these markets expeditiously as it sees massive opportunity.

Daria Nikolaeva, PR Manager for Europe at Joom, the fastest-growing shopping application in Europe, who were recently onboarded onto Ingenico’s solution, said: “Russia has historically been a tough ecommerce market to crack. With Ingenico’s unique and tailored solution we’re operating in this fast-growing market with ease.”

Mike Goodenough, General Manager, EMEA at Ingenico ePayments, said: “The first 18 months have been exceptional for our Russian Payments Solution as it is unlike any other available on the market. It’s a remarkable example of how we connect sellers and buyers. While Russian ecommerce is rapidly growing, we can support you to grow and scale further.”

To learn more about Ingenico’s offer for Russia visit: https://bit.ly/2TgKBgm.

More insights on Russian ecommerce: Cracking the Russian market

Related News

- 05:00 am

Today, leading technology, finance and nonprofit companies join forces to announce the launch of PayID, a universal payment ID to simplify the process of sending and receiving money globally – across any payment network and any currency. GoPay, Ripple, Blockchain.com, BitPay, Brave, Flutterwave, Mercy Corps and others have collaborated on the development of PayID through the Open Payments Coalition, a multinational alliance of industry leaders.

PayID brings together companies across all industries with an open solution for payments, marrying traditional finance, and the new world of fintech under one standard. More than 40 global companies and nonprofits reaching more than 100 million consumers worldwide have joined the Open Payments Coalition to break down the proprietary silos and standards that exist in payments, accelerate the adoption of digital payments, and change the way money is sent around the world today.

Though existing solutions have attempted to connect individuals across networks, no standard has yet achieved global reach and adoption. With support from companies across industries, PayID is the first global solution to address the biggest pain point in payments, uniting the many, closed payment networks that exist today.

PayID allows individuals to send and receive money across any payment network using an easy-to-read address versus one that’s awkward and unintuitive - such as a bank account, routing or credit card number. Most have experienced the frustration and inconvenience of sending money between different bank accounts or payment apps — with PayID, sending money is as simple as sending an email directly to friends and family, no matter which provider is used.

Whether a bank, payment provider or processor, digital wallet, or remittance provider, PayID is designed for any business that sends or receives money. Implementing PayID is simple, and makes it possible for companies to access more networks, consumers, and currencies to expand their businesses globally.

This is the first step in creating a truly open payments network. PayID was built for all - it’s open-source, free, and simple to integrate with the security and privacy that everyone from large financial institutions and global nonprofits, to ride-hailing apps and neobanks require. In addition, it provides an end-to-end Travel Rule compliance solution for satisfying both FinCEN requirements and FATF recommendations.

To learn more and start using PayID visit www.payid.org.

The Open Payments Coalition

The founding members of the Open Payments Coalition are:

BitBNS, BitGo, BitPay, Bitrue, Bitso, Bitstamp, Blockchain.com, Brave, BRD, BTC Markets, CARE

CipherTrace, Coil, CoinField, Coinme, Coinone, Coins.ph, Crypto.com, DeeMoney, Dharma, Dwolla, FlashFX, Flutterwave, Forte, GateHub, GiveDirectly, The Giving Block, globaliD, GoPay, Huobi, Independent Reserve, Liquid, Mercury FX, Mercy Corps, ModusBox, PolySign, Standard Chartered Ventures, Sygnum, Tangem, TRISA, Unstoppable Domains, Uphold, Wyre, XUMM

“The international, cross-border payments industry has been ripe for disruption and we see PayID playing a pivotal role in achieving that. We are excited to facilitate borderless, frictionless instant transactions for free for users.” - Gaurav Dahake, CEO, BitBNS

“PayID is solving a big UX hurdle that digital assets adoption has been facing. Crypto can modernize finance and payments beyond account numbers, and BitGo is supportive of this initiative.” - Ben Chan, CTO, BitGo

“BitPay supports the mission of PayID and its efforts to make it easier for businesses to accept blockchain payments across the world.” - Sean Rolland, Director of Product, BitPay

"PayID is one of the biggest leaps forward for cryptocurrency adoption that we've ever seen. The ability for users to share their addresses through a pronounceable and memorable format will help demystify the payment process for millions and pave the way for cryptocurrencies to be used by businesses in a wide variety of industries. As an exchange, we're excited to see how it will help our users send their funds with certainty and cut down on potentially costly mistakes. We're very proud to be playing a small part in advancing this technology." - Curis Wang, Co-Founder and CEO, Bitrue

“One of Bitso's main areas of focus is usability in crypto. PayID is a big step forward in allowing people to have a simpler interaction with cryptocurrencies.” - José Quintana, Head of Strategy and Operations, Bitso

“This is an age of unprecedented financial innovation and we’re excited to be moving from focusing on tech and infrastructure to presenting both businesses and consumers with accessible solutions that simplify the way we move money. As the world’s longest-standing crypto exchange, that has been one of the goals for us at Bitstamp since 2011 and we’re excited to support PayID and expand this initiative beyond cryptocurrencies to payments of all kinds." - Nejc Kodrič, CEO, Bitstamp

“At Blockchain.com it has been our mission for almost a decade to democratize access to finance and to empower people to remain in control of their money. As we surpass 50m wallets, we're continuing to focus on creating experiences that make crypto easy and safe to use. Initiatives like PayID enable a future where sending money is as easy as sending an email. We're supportive of initiatives like PayID that have the potential to bridge the worlds of crypto and traditional finance, opening up the opportunity for greater adoption and use." - Xen Baynham-Herd, COO, Blockchain.com

“PayID will accelerate a founding principle of BRD's mission, and that is to make global payments simpler for everyday consumers. Similar to the popular BRD wallet, PayID is committed to being open and free to the world. The BRD team was able to integrate PayID with little effort and make it available to our nearly 5 million users across 170 countries.” - Adam Traidman, CEO and Co-founder, BRD

“It was an easy choice for us to join the Open Payments Coalition. In 2018, Australia was introduced to the New Payments Platform which allowed funds to be transferred domestically in an instant. PayID is a crucial next-step in infrastructure that will bring ease of payments to an international audience.” - Caroline Bowler, CEO, BTC Markets

"As one of the world's leading aid agencies, CARE is at the forefront of innovation to modernize humanitarian response for an era of unprecedented challenges. PayID offers an easy, flexible, and cost-effective payment option for donors to contribute to CARE's mission and to join in the fight against global poverty and new threats like COVID-19. CARE is proud to join forces with global companies and nonprofits to channel payments innovation directly into accelerating global breakthroughs and meeting the most pressing humanitarian challenges of our time, including opening up access to formal financial services for millions around the world." - Michelle Nunn, President and CEO, CARE USA

"Compliance solutions provide a critical component of mitigating compliance risk, and we look forward to using PayID to identify and reduce exposure to illicit finance. Our aim has always been to make the digital payments space safe for everyone, and we are excited to lend our expertise and tools towards helping PayID bring the dream of a trusted, open payments network to life." - Dave Jevans, CEO, CipherTrace

“Coil's goal is to break down the barriers that prevent creators from being easily paid for their work. PayID is another important initiative towards creating broader interoperability, not only for creators but for payments and financial access broadly.” - Stefan Thomas, Founder and CEO, Coil

"We are excited to be a part of this initiative and are hoping for other crypto exchanges to join and utilize PayID for an easier, safer, and compliant future of cryptocurrency." - Reza Bashash, CTO, CoinField

“As the largest cash on-ramp in the U.S, Coinme is excited to support the launch of PayID and provide the market with an easy and trusted payment experience." - Neil Bergquist, Co-Founder and CEO, Coinme

“We are certain that blockchain innovates our daily lives, and we are joining the PayID alliance as a partner to align with our vision of ‘bringing blockchain into the world.’ PayID is expected not only to simplify the experience of money transfer but also to bring innovation to our daily financial life in the long term. We will do our best to support its successful landing as a partner.” - Kevin Cha, CEO, Coinone

"We are excited to support the launch of PayID, which is in line with our shared vision of making financial transactions simpler and more accessible for everyone. PayID is a significant step in driving interoperability in the financial ecosystem and simplifying the process of sending and receiving money through multiple online platforms worldwide." - Lisa Kienzle, Head of International Growth, Coins.ph

“Though the global payments ecosystem has expanded on the promise of simplifying the transfer of money, it has also resulted in siloed, closed and complex networks that often make sending money more difficult. PayID will help ease these growing pains with a single easy-to-read ID that works on any network, a capability of significant value for cryptocurrency users who often transfer money across multiple platforms and geographies. Crypto.com’s involvement in the Open Payments Coalition allows us to better connect our 2M+ users across more payment platforms worldwide.” - Kris Marszalek, CEO, Crypto.com

“As Thailand’s leading fintech player, DeeMoney is committed to leveraging cutting edge technologies that ultimately ensure enhanced customer experience. PayID allows us to further democratize the movement of money while providing a seamless experience. We are thrilled to be a part of this movement.” - Aswin Phlaphongphanich, CEO, DeeMoney

“PayID addresses a complex issue of standardization between platforms on a global scale. Exchanging value between platforms starts with exchanging payment instructions based on user preference in a secure way. PayID is laying important groundwork for others to build upon and we’re excited to support interoperability initiatives like PayID because we believe it’s important to open the value layer of the internet for developers worldwide.” - Ben Milne, Founder and Chairman, Dwolla

"FlashFX is excited to join the global PayID Open Payments Coalition and to be involved in pushing for a global PayID solution. Creating interoperability between networks is a great next step forward in increasing the ease of making cross-border payments.” - Nicolas Steiger, Co-Founder, FlashFX

“An open payment network will play a key role in the next generation of games supported by community economics. By being free, open source, and easy to implement, PayID provides the games community with a frictionless solution that will benefit players and game developers around the world.” - Chris Jimison, Vice President of Engineering, Forte

"The Giving Block is excited to join the Open Payments Coalition to make it easier for donors to support their favorite causes and for nonprofits to accept donations across platforms. PayID will be the first solution to unify typically closed payment systems to create a truly open and unified global payment network." - Alex Wilson, Co-founder, The Giving Block

“Excited to see PayID pushing a solution for wallet/account routing and interoperability!” - Greg Kidd, Co-Founder and CEO, globaliD

“As the leading fintech company in Indonesia, GoPay is excited to join this global consortium. Blockchain technology represents a potential opportunity through which we may eventually be able to offer improved services to our users and it is therefore an area that we are happy to explore further. We remain committed to working in partnership with all stakeholders including local regulators, to utilise technology to increase financial inclusion throughout Southeast Asia.” - Hassan Ahmed, Head of Strategy, GoPay

“The next evolution in the global payments ecosystem has to be one that allows money, and the transfer of value, to be easy. We are happy to be a part of PayID as it feels like a step in the right direction towards creating a truly open payments network that can be the backbone of a new era of payments. We know, at Huobi, that presenting a new way to transact and transfer value has to be sleek and simple to use. It has to be intuitive and accessible, and where we find ourselves presently, it needs to be interoperable too. PayID is looking to address all of this in an attempt to build a new payments ecosystem and it is exciting to be part of it.” - Ciara Sun, Head of Global Business and Markets and Vice President, Huobi

"PayID’s simplicity will add value to Independent Reserve’s customers by abstracting some of the complexities associated with cryptocurrency and fiat transfers." - Adrian Przelozny, CEO, Independent Reserve

“Payments will need to be interoperable between fiat and cryptocurrency and easy to send and receive across the globe. Quick Exchange, built on top of Liquid’s professional fiat-cryptocurrency exchange, will serve as the flexible payment gateway to connect PayID participants.” - Mike Kayamori, CEO, Liquid Group Inc.

“We anticipate a mass shift from traditional cash and antiquated electronic payment methods to near-instant and very low-cost international payments in the coming years and we are excited to be a proactive part of that change.” - Alastair Constance, CEO, Mercury FX

“Mercy Corps believes in the power of innovation and partnerships to solve the world’s toughest humanitarian challenges. We know when people can access critical financial services, they are better able to absorb financial shocks, manage risks and start and expand businesses. PayID offers an easy, flexible, and cost-effective payment option for our donors to contribute to our mission and for the individuals and small businesses we serve around the world. Partnering with other bold thinkers to explore emerging technologies like digital currency can have a significant impact on transforming financial services for the communities we serve.” - Myriam Khoury, VP of Innovation, Mercy Corps

“As an open source company, at ModusBox we’re a big believer in supporting the open source community, open payment standards and protocols. We feel that PayID will be a valuable technological contribution to advancing the world of payment system interoperability.” - David Wexler, CEO of ModusBox

“PolySign is thrilled to be partnering with global companies and nonprofits to launch PayID, an exciting new identification standard that will change the way the world exchanges value. Finally, frictionless payments will become a reality.” - Jack McDonald, CEO, PolySign Inc.

“The next payments network should be open, like the web, where any company can participate just by building your service on the network. PayID is the beginning of building an open payments network that is designed for people and simplifies the experience of sending or receiving money. Building the open payments network that simplifies payments process will accelerate the growth and adoption of digital payments for everyone around the globe.” - Ethan Beard, SVP of Xpring, Ripple

“SC Ventures, the innovation, fintech investment and ventures arm of Standard Chartered, is happy to join the Open Payments Coalition to develop open and universal standards for payments. In line with the rise of digital transactions and the growth of global platform-based e-commerce, greater cooperation across finance and technology is needed so global digital payments can become a reality.” - Alex Manson, Global Head, SC Ventures

“Tangem advocates for the global payment landscape to join forces toward financial inclusion. Therefore, we prioritized interoperability with most blockchains, friendliness toward multiple developer platforms and an open-source SDK. Today, we are proud to implement support for PayID, which lowers entry barriers to digital currency payments by removing the friction of pesky wallet addresses and insecure QR codes. We see this as a milestone worthy of the title, ‘the DNS for payments.’ Whilst translating domain names to IP addresses was a vital stepping stone for the web, we see this advancement as a milestone for payments. It is an honor to be contributing to writing the history of digital payments.” - Sergio Mello, CEO, Tangem

"By providing a translation layer for PayID's human-readable addresses, we help to enable interoperability—a key factor contributing to PayID's potential for global adoption. Among all of the siloed solutions currently being developed for digital payments, we believe PayID will be among the most successful given the emphasis on usability and easy integration with privacy and security solutions." - John Jefferies, Co-Chairman, TRISA

“We are very excited to be a part of the PayID launch. This system has the potential to connect bank and crypto payments together, bridging the gap between cryptocurrency and fiat money.” - Brad Kam, Co-Founder, Unstoppable Domains

“The federated namespace that PayID is building is potentially a big step forward for the future of payments." - JP Thieriot, CEO, Uphold

"PayID creates a simple yet powerful standard for human-readable payment addresses layered over a user's payment method such as a card number, bank account, or crypto-wallet address. An open standard like this is important for Wyre, as we specialize in providing robust fiat on and offramps for end users. PayID can help preserve user privacy and simplify any money transmitter's workflow. Wyre is happy to support the ability for 100M+ users to buy crypto and ship it directly to their PayID." - Jack Jia, Director of Institutional Sales, Wyre

“We are really excited to be one of the launching wallets with PayID support. All XUMM users can send to PayID addresses, and later this year we will introduce XUMM profiles with hosted PayID addresses for all XUMM users. We're looking forward to the usability this will bring to both the crypto and non-crypto ecosystem.” - Wietse Wind, Founder, XRPL Labs

Related News

- 09:00 am

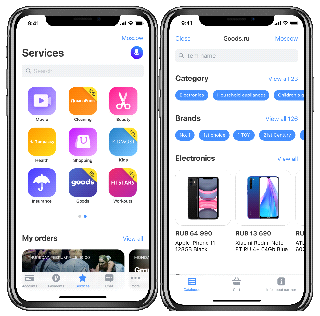

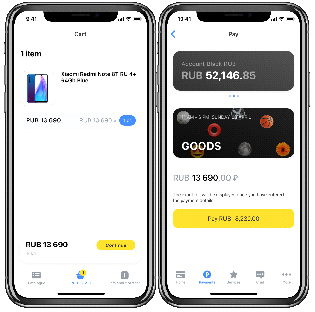

As part of its ongoing effort to expand the range of lifestyle services offered in its super app, Tinkoff announces a partnership with goods.ru, a marketplace that brings together Russia's leading online stores. This will enable customers to shop at goods.ru right from the Tinkoff app and receive 5% cashback for each purchase.

The service is currently running in Moscow and the Moscow Region, and Tinkoff plans to make it available in all Russian regions going forward. At present, customers may select merchandise from 14 categories, including electronics and home appliances, children's goods, pet supplies, books, hobbies and stationery, beauty and personal care, food, and homeware. By the year end, the app will offer the full range of items from goods.ru (more than 1.7 million goods in 16 main categories).

The Tinkoff super app and goods.ru are connected via the bank's Open API using an app-in-app model, giving the partner its own in-app mini-store and access to a personal account for updating the content. Under the partnership terms, goods.ru pays Tinkoff a fee for purchases to be returned to customers as cashback.

Going forward, Tinkoff super app partners will enjoy access to a machine learning-powered recommendation system to facilitate automated order building and promote goods and brands to customers based on their transaction history and other parameters. For example, the algorithm can remind customers about when to make regularly occurring purchases, such as dishwashing detergent, or suggest adding a new product to their diet. These recommendations will appear in Tinkoff Stories and as push notifications. They will also enable partners to manage promos more effectively.

Anna Mikhina, Vice President of Lifestyle Services Development at Tinkoff:

“Thanks toour partnership with goods.ru, we can offer our customers a full-scale shopping experience for almost any merchandise, from household goods to groceries – right in the app and with the added bonus of 5% cashback. This is a win-win for everyone: the users will benefit from a one-stop service for promos, cashback and access to the shopping interface, while goods.ru will get more orders from new customers and tools for effectively targeted promos. Tinkoff's super app is about to become even more "super". What's more, we plan to add other major partners and partner storefronts to our app by the end of the year. In parallel, we are creating a builder tool that will enable fast integration of multiple partners."

At present, Tinkoff super app features 18 lifestyle categories: movies, restaurants, theatres, travel, concerts, sports, fitness, flowers, cosmetics, quests, cleaning services, beauty, health, shopping, kids, insurance, workouts, and goods.ru.

Related News

Ray Brash

CEO at PPS

During his 1962 State of the Union Address, John F. Kennedy declared: “The best time to repair the roof is when the sun is shining”. see more

- 08:00 am

Meritsoft, a Cognizant company, and Taskize, a Euroclear company, are integrating their automated fails operational workload offering and global operational task management solutions to provide an end-to-end Central Securities Depositories Regulation (CSDR) management solution.

Together, Meritsoft’s FINBOS CSDR Manager and Taskize Connect deliver a comprehensive real-time platform for clients and their customers.

Clients will benefit from the following:

- The ability to manage both the CSDR settlement fail and buy-in processes.

- A comprehensive audit trail and fail-resolution workflow that adheres to CSDR’s compliance requirements.

- An integrated solution with visibility into all communications, statements, and invoices, exchanged among counterparts.

- Easy navigation through unfamiliar institutions to find the correct individual needed to resolve penalty queries or report buy-ins.

- Significant improvements on identification and prevention of fails.

- Management of all associated fee calculations (penalty and buy-in) and counterpart/client communications.

- A single solution for counterparties that will enhance market interoperability, accuracy, and fail resolutions.

- Automation of a significant amount of anticipated CSDR workloads, including CSD reporting and cash compensation management.

- Ability for market participants to focus on capturing growth opportunities while remaining compliant.

Kerril Burke, Meritsoft CEO said: “With the February 2021 CSDR deadline front of mind for financial houses, market participants need to be able to mitigate the potential risks and costs of upcoming penalties and buy-ins under CSDR. They must do this through efficient issue resolution while providing business managers and traders with the information required to factor CSDR implications into their decisions. We are pleased to be collaborating and innovating with Taskize to offer market participants this enhanced platform.”

John O’Hara, CEO at Taskize adds: “We are delighted to collaborate with Meritsoft as the company delivers its CSDR Manager solution to the market. Meritsoft clients will benefit from using Taskize’s industry-leading inter-company workflow service. This will enable seamless flows of activity both within and between financial services firms and facilitate adherence to CSDR’s requirements. As the world of regulatory compliance continues to expand, we look forward to identifying opportunities to create value for clients with collaborators such as Meritsoft to service the wider financial services industry.”

Related News

Habib Hanna

Managing Director, Middle East at Diebold Nixdorf

As with every industry in every country, the world of banking has been disrupted to its core in recent months. see more

- 01:00 am

Edoardo Baumgartner has been named as the new Country Manager Germany of SIA, reporting directly to Cristina Astore, Northwest Europe and DACH Region Sales Director.

He has responsibility for strengthening the development of SIA’s positioning in the German market where the company is present since January 2017 through the subsidiary P4cards based in Munich and Nuremberg with about 50 employees.

This appointment is consistent with the objectives of the SIA Strategic Plan, which aims to consolidate the Group's competitive positioning at international level, especially in Germany, in the Card & Merchant Solutions, Digital Payment Solutions and Capital Market & Network Solutions segments.

Edoardo Baumgartner (55) has a degree in Information Sciences and a Master in Business Management from the University of St. Gallen, in Switzerland. He has lived and studied between Italy and Germany. Before joining SIA, he was General Manager at Exceet Card Italy where he worked for 2 years. In the period 2002-2015, he was General Manager and CEO of the Italian Branch at Giesecke & Devrient, which he founded in 2005.

Previously, as Business Development Director at Mastercard Europe, he devoted himself to the development of cards services on the Italian market. At the beginning of his professional carrier, Baumgartner also worked for Europay International and ISSC Italy, an IBM Company.

Related News

- 08:00 am

Reuters Events will be hosting a free online webinar series focused on commodity trading and commodity value chains.

Commodity traders are under pressure to undergo massive transformation. Unprecedented volatility, changing consumer and governmental demands, digital transformation and an intense geopolitical landscape are impacting every commodity stakeholder.

That’s why, on Wednesday June 24, Reuters Events will kick off their 2020 webinar series with a live fireside chat entitled “A View From the Top”. Reuters’ Editor in Charge (Energy, EMEA), Dmitry Zhdannikov will interview Mercuria Energy Trading’s CEO, Marco Dunand, to .

Sign up to tune in live or get the recordings

The fireside chat will address the following key discussion points to provide listeners with C-suite market insights:

• Understand how volatility is affecting the energy markets and learn how to respond effectively

• Discover the unique opportunities in commodities, in a covid-19 era

• Hear the energy sector outlook to help you map your future operational strategy

Can't join live? Register now to get access to the recordings

Furthermore, all webinar registrants will be automatically enrolled for a free pass to the inaugural Reuters Events Commodity Trading Summit (November 16-17, Online).

Reuters Events exists to deliver the intelligence and foster the relationships that shape strategy and safeguard success at leading companies worldwide.