Published

- 02:00 am

The financial institution Clearhaus has announced partnership with the popular Spanish fintech PaynoPain.

Now, Clearhaus, licensed to operate in Europe, will be providing payment rails for parts of PaynoPains transactions on the continent. PaynoPain performed more than 36 million transactions in 2019.

“Just like us, Clearhaus is known for its innovative technological capacity at an international level. We believe our collaboration will clearly benefit Spanish online stores,” says PaynoPain CEO, Jordi Nebot.

Recently, PaynoPain and its payment gateway product, Paylands, has concentrated on helping small companies start selling online and overcome the COVID-19 crisis. But the Spanish fintech is also known for its techsavvy collaborations with hotels and its micropayment solutions for bankless populations in third world countries.

The staff of the two fintechs have yet to meet each other physically due to COVID-19. But as initial talks began, there was immediate chemistry. Both companies are established in 2011 and thus share an innate appetite for rethinking the current payment infrastructure with an API-first approach.

“In spite of the geographical distance, PaynoPain and Clearhaus come from the same place. We are young, technology-focused fintechs wanting to improve the payment industry to the benefit of businesses and consumers,” says Clearhaus CEO, Claus Methmann Christensen. - “Spain is a thriving online market and we are looking forward to serving the Spanish online stores alongside PaynoPain,” says Claus Christensen.

Clearhaus is already active on the Spanish payments scene, albeit to a lesser extent than in its Nordic home markets. However, in the hands of 47 million Spaniards, of which 30 million are avid online consumers, Clearhaus is looking to multiply its engagement in the Iberian peninsula.

Related News

- 01:00 am

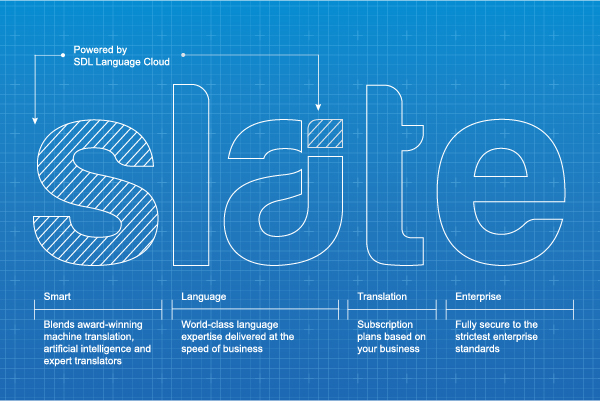

SDL (LSE: SDL), the intelligent language and content company, announces the launch of SLATE – Smart Language Translation for the Enterprise – its new self-service platform that delivers a truly transformed experience in online translation. Professionals in any part of your business can now, with a few clicks, directly access secure, world-class neural machine translation and optional expert human review, with transparent service levels, delivery times and simple pricing.

Through the intuitive, self-service online platform, SLATE provides all parts of the business with access to SDL’s world-class and secure neural machine translation, covering dozens of languages including some of the world’s most difficult, like Chinese, Korean and Russian. For additional peace of mind, for example, if you are publishing a document, SLATE enables you to upgrade the experience easily to human review or revision delivered by SDL’s trusted network of over 17,000 expert translators – all within the same application. A monthly subscription based on typical document volumes means predictable spend and most content is processed instantly. You know instantly how much it will cost and when your content will be delivered. What is more, SLATE works with many different formats, from Microsoft Word documents and PDFs, to Adobe InDesign files, and even subtitles for videos.

SLATE is a best-in-class solution that will truly transform how business users translate content. To experience SLATE for yourself, visit us at https://www.slateai.com.

“SLATE was fast and brilliant – it was instant, professional, and the output looked exactly like the original,” said Carolann Conway, Executive Assistant to Chief Legal & Regulatory Officer, Ryanair DAC. “No one that received the document had negative feedback on the quality of content. I appreciate that I can get my document professionally translated right away with no hidden costs, no wait time for a project quote, and no extra work for me. SLATE is foolproof.”

Built for business users across marketing, financial, legal and other regulated and security-conscious industries, SLATE’s key features include:

- One-click access to document translation and support for dozens of languages

- Always on, always available

- Automatically translates whilst preserving document formats

- Ideal for regulated industries as it is secure by design and does not allow for content sharing or re-use between users or by the system.

“We are extremely excited to launch this new on-demand service designed to support professionals in departments and enterprises, who have pressing needs for high quality translation and want it delivered in a simple, automated way,” said Christophe Djaouani, EVP Regulated Industries at SDL. “SLATE has simplified the process, improved efficiency and thereby reduced the time to market for our customers. Built for business, it has tight security that conforms to strict industry standards, making it highly-suited for users in regulated industries. We look forward to rolling this service out and supporting a segment of the market that has long been neglected.”

Operating under a monthly subscription model, other benefits of SLATE are that it significantly reduces the up-front financial commitment for customers and eliminates the typical wait time for project quotes and invoices. SLATE offers three levels of service starting with ‘Automatic,’ backed by SDL Machine Translation, which is sufficient for the majority of tasks, to the human optimized stages of ‘Review,’ focused on accuracy, and ‘Revision,’ that combines correcting for accuracy along with stylistic improvements, resulting in professionally edited output. https://www.slateai.com

Benefits of SLATE

- Accessibility and ease of use: Subscription model, registration in minutes, gives instant access to powerful professional translation

- Built for business: Minimizes duplication of work, reduces time needed to produce content across multiple languages, increases efficiencies and lowers costs

- Secure: Proven, GDPR-compliant, fully secure online environment with client content never exposed, re-used, or shared without explicit permission

- Intelligent, learns and adapts: Specialized Linguistic AITM continues to learn, based on revisions and reviews, and improves and adapts to your individual requirements over time

- Built on a foundation of innovation: Capitalizes on SDL’s 20+ years of technology innovation and is backed by the innovative SDL Language Cloud foundation as well as award-winning SDL Machine Translation technology

- Built on a foundation of expertise: Services are provided by SDL’s in-house translators, trained to deliver professional translation services to 90 of the world’s top 100 brands

Related News

- 02:00 am

OneStream Software, a leading provider of corporate performance management (CPM) solutions for mid-sized to very large enterprises, has entered into an alliance with Grant Thornton LLP, one of America’s largest accounting and consulting firms.

Through the alliance, OneStream and Grant Thornton will help companies digitally transform and streamline financial operations by unifying their disparate silos of financial information onto the OneStream XF platform. As a result, companies can simplify financial planning, forecasting and analysis, while also improving financial close and reporting activities and decision-making capabilities.

In addition, Grant Thornton will also deliver its Unified Financial Model offering on the OneStream XF platform. The firm’s Unified Financial Model offering enables financial scenario planning using factors such as revenue data, expense analytics and human capital information to generate projected financial statements including profit and loss reports, balance sheets and cash flow forecasts.

The benefits of the alliance between OneStream and Grant Thornton are substantial for chief financial officers as they transform their finance functions into strategic business partners to departments across their enterprises. Finance support for operational decisions is invaluable given the historic business disruptions wrought by COVID-19 and its economic impact — in addition to the strains and challenges of digital transformation during normal times.

“To put it simply, this alliance means Grant Thornton and OneStream can help enable companies to make educated business decisions and deploy comprehensive financial solutions on a leading performance-management platform,” said Chris Lilley, national managing principal of Business Applications at Grant Thornton.

Lilley goes on to explain that Grant Thornton’s decades of consulting and implementation experience will make it easy for companies to migrate from multiple legacy systems and cloud-point solutions onto the unified OneStream platform.

OneStream Software Vice President of Global Alliances Stephanie Cramp highlights her company’s compatibility with Grant Thornton as being integral to the alliance: “Grant Thornton is helping drive the digital transformation of the finance team with its highly respected services and its strong commitment to quality — and focus on putting its customers first. This complements OneStream’s strengths and our own mission to deliver 100 percent customer success. These similarities have helped forge a powerful alliance that is already delivering results.”

Grant Thornton’s Joseph Coniker, a Business Consulting principal, echoes this sentiment: “Like Grant Thornton, OneStream Software is helping some of the largest companies and C-suite business leaders worldwide to digitally transform financial operations into modern finance functions that support decision making across the entire enterprise. This close alignment led to our alliance and is already benefiting our joint customers.”

To learn more information on the Grant Thornton-OneStream alliance, visit: www.onestreamsoftware.com/about/onestream-partners and www.grantthornton.com/onestream.

Related News

- 05:00 am

Leading global payment solution provider Checkout.com becomes one of the most valuable fintechs globally. Today the company announces a $150m Series B funding round, tripling the value of the online international payments business. The $5.5bn valuation reflects a growing business demand for transformative online payment solutions that perform across all geographies and channels. Checkout.com’s online transaction numbers had already increased by 250% comparing May ‘19 and May ‘20. With an exclusive focus on online payments, global lockdowns have further accelerated Checkout.com’s growth as businesses have rapidly pivoted online.

The Series B funding was led by Coatue, along with participation from existing investors, including Insight Partners, DST Global, Blossom Capital, and Singapore’s Sovereign Wealth Fund, GIC. Unlike many other rapidly growing businesses, Checkout.com has been profitable since 2012. It will use these funds to further strengthen its balance sheet, bringing available cash to over $300m. Checkout.com will also invest in the development of new innovative products, including its upcoming advanced Payouts solution and the capability to accelerate settlement times. The Series B fundraise follows a record-breaking $230m Series A in May 2019, which was Europe’s largest fintech Series A round of funding ever.

The eight-year-old London-headquartered company already powers many of the world’s leading enterprises, adding 500+ merchants to its books in the last twelve months including Grab, Revolut, Careem, Glovo, Robinhood, Farfetch, Klarna and Remitly. Checkout.com’s proprietary technology offers enterprise businesses seamless and reliable global payment processing. The business offers direct access to domestic acquiring across payment methods and geographies. This is achieved through a single, unified integrated platform that gives enterprise businesses better performance and more control through advanced data features, fraud management tools, and comprehensive reporting.

CEO and Founder, Guillaume Pousaz said: “I’m thrilled to welcome Coatue to our cap table. As meaningful investors in late-stage tech companies such as Instacart, DoorDash, Bytedance and Chime they bring a wealth of experience in building world-class businesses driven by operational excellence. They share our vision for a future of connected payments which made them an obvious choice as partners for us. The way money moves into and out of businesses is changing rapidly. I believe that by solving financial complexity, you can radically unlock innovation -- starting with digital payments. At Checkout.com, we’ve built a technical architecture that enables pioneers to reinvent industries and redefine their relationship with consumers. Now more than ever, we are confident of our mission to build the connected payments that businesses deserve.”

Kris Fredrickson, Managing Partner at Coatue, said: “We have followed the business’ explosive growth and are inspired by Guillaume’s vision for the future of payments. We’re incredibly excited to partner for the next phase of the Checkout.com journey.”

Checkout.com processes over 150 currencies and offers access to all international cards and popular local payment methods to merchants through its proprietary integrated platform. Checkout.com employs over 750 staff across 13 offices globally.

Checkout.com has been advised in this transaction by Wilson Sonsini Goodrich & Rosati. Checkout.com has acquired two businesses this year, ProcessOut in February and Australian start-up, Pin Payments, in May.

Related News

Ali Luffman

n/a at n/a

The risk to reward ratio is the most important factor for retail traders. see more

Stephan Wolf

CEO at Global Legal Entity Identifier Foundation (GLEIF)

GLEIF showcases how the LEIs should be included within digital, machine-readable financial documentation on the basis of ESMA’s ESEF mandate, to enhance trust and ease data agg see more

- 01:00 am

ING announced today that Steven van Rijswijk, currently member of the Executive Board and chief risk officer of ING, will succeed Ralph Hamers as CEO and chairman of the Executive Board. The Supervisory Board has appointed Steven van Rijswijk effective 1 July 2020. As announced earlier, Ralph Hamers will leave ING to join UBS, where he will become CEO later in the year.

Hans Wijers, chairman of the Supervisory Board of ING said: “We are very pleased to appoint Steven, following a broad and rigorous selection process. With almost 25 years at ING, of which three on the Executive Board, Steven has shown to have the right combination of experience, leadership skills and deep understanding of our business to lead ING into the next phase of our strategic direction. Again, we want to thank Ralph for his contributions, preparing ING for the future with his vision and customer focus. Having been the longest serving CEO of ING, we wish him well in his next role.”

Steven van Rijswijk (Dutch, 1970) was appointed to the Executive Board at the Annual General Meeting of shareholders in 2017. Steven joined ING in 1995 and held various positions in the Mergers & Acquisitions, Equity Capital Markets and Capital Structuring and Advisory teams. In 2012 he was appointed global head of Corporate Clients. He became global head of Client Coverage at ING Wholesale Banking in 2014, being responsible for relationship management, transaction services and corporate finance for corporate clients and financial institutions in over 40 countries.

In the past years, Steven played a key role in the strengthening of ING’s gatekeeper role and the progress of ING’s model, data and analytics capabilities. As of 2018, he also chairs a European inter-bank working group on the transition from Eonia to a new euro risk-free rate, also providing fallback rates for Euribor. Steven holds a master’s degree in business economics from Erasmus University Rotterdam. His appointment has been approved by the European Central Bank.

Steven van Rijswijk said: “I am very proud and thankful for the confidence the Supervisory Board has expressed in me. After working so many years with our colleagues and customers around the world, I’m looking forward to further build on our efforts to strengthen ING and enhance our position as one of Europe’s leading digital banks. I want to thank Ralph for his tireless commitment to ING and excellent cooperation in the past years on the Executive Board and wish him well for the future.”

Ralph Hamers said: “I congratulate Steven on his appointment. Having worked with him over many years I am convinced that he will sustain the steps we have taken to prepare ING for a digital and mobile future. Again I want to thank the many talented and dedicated colleagues and friends I have worked with over the past 29 years.”

The selection process for a new chief risk officer is underway. Until the appointment of a successor, Tanate Phutrakul, CFO of ING, will temporarily assume the responsibility for risk on the Executive Board. The day-to-day risk management activities will be performed ad interim by Karst Jan Wolters, currently chief risk officer of ING Wholesale Banking who will report to Tanate Phutrakul.

Since first joining ING in 1986, Karst Jan Wolters (Dutch, 1963) has held a range of front office and risk functions, including head of Global Credit Restructuring and global head of Credit & Trading Risk. In 2017 he was appointed as CRO of ING Wholesale Banking. During his career he also worked at Dutch bank NIB and as a financial economic expert at the Dutch national police. Further announcements on the CRO succession process will be made if and when appropriate.

Related News

- 02:00 am

IDnow (www.idnow.io), a fast growing European identity verification provider, has seen demand for its AI and video identity software in the UK’s financial services sector more than double since the start of the year as growth in scams linked to COVID-19 continue to rise.

As of 23:59hrs on 7th June, Action Fraud announced that over £6.2m has reportedly been lost by Brits to coronavirus-related scams. With a significant increase in consumer online activity, from opening food delivery accounts to streaming services, new account fraud is becoming a major challenge for firms to overcome. As a result, IDnow’s technology will prove critical in a business’ ability to validate a person’s identity quickly and confidently and limit this increased risk of fraud at such a turbulent time for both consumers and firms.

IDnow, which is headquartered in Munich, Germany, provides AI-based technology that can check all security features on ID documents, enabling the identities of more than seven billion customers from 193 different countries to be verified.

Charlie Roberts, Head of Business Development, UK, Ireland & EU, IDnow, comments: “The figures released by Action Fraud prove how vital highly secure and reliable identity verification is, especially as the coronavirus crisis continues to drive increased online purchases. The UK’s financial services sector is in need of technological innovation when it comes to ID verification, something that plays to our strengths. With the right level of digital identity verification, such as video based identity products, the sector will be in a stronger position to support businesses who have a duty of care to protect their customers from risk of fraud while ensuring they remain resilient during this pandemic.”

Since launching its solutions in the UK in November last year, IDnow has seen enormous demand from organisations for its AI-based product AutoIdent which can check all security features on ID documents. In particular, it has seen increased demand from regulated sectors such as financial services. As this industry faces increased regulatory pressure, IDnow’s expert knowledge of German regulation, which is considered one of the most highly regulated markets globally, has become critical.

The hybrid solution works by combining a unique process of automation and human intervention including manual reviews with video based on-boarding– leveraging state-of-the-art machine learning technology and a network of identity and fraud specialists.

Charlie added, “Some of the biggest names in the UK’s financial services sector are turning to us as they seek the reliability of our German technology and our adherence to the BaFin regulations, the highest standards in the industry.”

Paul Kenny, Head of Lifecycle Optimisation at Allied Irish Banks (AIB), commented: “As a bank, we have to meet a lot of regulatory requirements. IDnow is a trusted partner in the fields of security and compliance and helps us deliver fast and efficient video onboarding for our customers.”

IDnow has secured deals with some major UK companies, among them several FTSE 250 companies such as BP and GVC, as well as Macropay, Holvi and AIB since it launched in London following a successful $40 million financing round.

With a London office already in at Canary Warf, the company will now move into its new Manchester city centre premises, in line with the Government’s social distancing guidance in the coming weeks. This will see a new team on-site driving new business, UK focused marketing and the firm’s core business functions. In the meantime, the team is working remotely supporting its growing customer base in line with IDnow’s home office policy.

Related News

- 07:00 am

HGC Global Communications Limited (HGC), a fully-fledged fixed-line operator and ICT service provider with extensive local and international network coverage, services and infrastructure, today announced the signing of a Memorandum of Understanding (MOU) with aamra networks limited (aamra), the leading internet and infrastructure service provider in Bangladesh, to stimulate network integration and expansion using SDN technology.

Serving OTT and corporate customers’ cloud business in Bangladesh

Asia has gained the capability of being a new large market in the cloud business. The cloud technology has been helping corporate/OTT (over-the-top) customers in the region with high connectivity and computer literacy. Given that the software-defined network (SDN) is an integral component for cloud-based IT infrastructure, the collaboration between HGC and aamra will enable them to demonstrate their world-class network resources and capabilities to expand their network footprints while utilizing digital technology to support customers such as MNCs to drive regional business expansion with the on-demand and zero-touch services, as well as secure, quick, sustainable and easy flexible cloud connectivity provided.

The collaboration of HGC and aamra stresses the goal of accelerating customers’ digitalisation journey through inter-carrier network orchestration between the ASEAN and global communities on the HGC international marketplace by SDN which follows the MEF standard. Customers will be able to achieve secure direct connect to public cloud such as AWS, Alibaba Cloud, Microsoft Azure and Google Cloud, centrally and on programmatically efficient network configuration; improve and monitor network performance, as well as facilitate their business operations and project management, and leverage cloud service to empower resources and maximize the benefits to their customers. This is especially important for banking and financial institutions that require data transport without going over an open network to adhere to the regulation policy.

Embrace digital network penetration between the East and the West

Bangladesh is one of the fastest-growing economies in the world and is one of the world’s top 10 countries with the largest number of mobile phones in use. Global network infrastructure is the foundation of a digital economy, where network softwarization and virtualization are the main drivers of the next-generation technology like 5G and IoT. The collaboration will enhance digital penetration in the local corporate market and in key verticals, such as public and private organizations, RMGs (ready-made garments), banking and government, and open up opportunities in the rapidly developing market.

Transforming the global network through a SDN platform covering PoPs worldwide is both companies’ continuous key focus and strategy. This alliance will enable local customers and MNCs based in Bangladesh and ASEAN to access HGC’s 30 PoPs in locations including Hong Kong, Myanmar, Singapore, London and Los Angeles, as well as aamra’ s data centres, and PoPs national wide. This will ensure reduced latency and enhanced end-to-end quality while directly connecting the network of MNCs from different industries such as manufacturing and banking to HGC’s global network infrastructure.

Syed Faruque Ahmed, Chairman of aamra said, “I am excited to announce our collaboration with HGC for SDN services. This will bring a revolution in Bangladesh’s IT and ITES sectors. The advent of SDN technology marks a major shift in Bangladesh's IT sector; from hardware to software-based automation and network management, ensuring seamless connections to Global Internet Exchanges and Data Centers worldwide. aamra is proud to be a part of this initiative.”

Ravindran Mahalingam, HGC’s SVP of International Business, said: “HGC is delighted to collaborate with aamra, one of the leading tech conglomerates in Bangladesh. Having been dynamically expanding our digital transformation initiative with inter-carrier SDN interoperability, HGC is dedicated to leading the market through delivering flexible networking infrastructure, as well as diversified ICT solutions to satisfy global requirements for quality, value and reliability and to expand its footprint across continents. We will continue to extend our alliance in ASEAN and South Asia communities to provide customer-centric solutions, to meet the increasing multimedia consumption demand from OTT operators and corporate customers.”

Related News

Juan Miguel Pérez

CEO and Co-Founder at Finboot

Repsol and Saudi Aramco’s recent announcement that they have teamed up to build one of the largest zero emission synthetic fuel production plants in the world is a significant step towards Repsol’s see more