Published

- 05:00 am

Leading specialized payments platform, Paysafe (NYSE: PSFE), announces it has signed a global multi-year agreement with Amazon Web Services (AWS) as part of its strategy to become a fully cloud-based payments provider. Through this collaboration, Paysafe is migrating its broad portfolio of mission critical workloads, including eCash solutions, paysafecard and Paysafecash, and its digital wallets, Skrill and NETELLER, to AWS to develop new cloud-native merchant payment and consumer wallet products for its business and consumer customers. The first milestone of the collaboration has already been completed with the transition of Paysafe’s eCash solutions to the cloud.

The move to AWS supports Paysafe to leverage data to drive customer acquisition and engagement, as well as to run and scale products and applications for its North American and European operations in a highly reliable manner. Collectively, Paysafe’s solutions are actively used by more than 15 million people across more than 120 countries and support thousands of businesses to offer popular alternative payment methods.

Paysafe’s partners will also benefit from its cloud-first approach, making it easier for merchants and other third parties to connect to the Paysafe Network using an API-based integration. The real-time transactional processing powered by AWS will allow merchants to offer a frictionless customer experience at the point of sale.

Roy Aston, Chief Information Officer at Paysafe, commented: “Deploying AWS as one of our major cloud providers will bring wide-ranging benefits to our business, both in terms of scale and innovation. Our focus is to deliver new, innovative products and features into the marketplace twice as fast as before and also to scale, and expand our geographical footprint. We’re excited by the year ahead as we leverage the power of technology across the business, through a combination of our own in-house product development as well as our work with strategic organizations, such as AWS. We are also focused on areas such as machine learning, risk management, and customer insights.”

As part of the agreement with AWS, Paysafe is creating a centralized, curated, and secured repository for all of its consumer and merchant data using Amazon Simple Storage Service (Amazon S3), AWS analytics, and AWS security to build a data lake to store, protect and organize their data. This scalable data lake will use AWS’s analytics services to further enhance the consumer experience, as well as to help Paysafe quickly and cost-effectively identify, prioritize, and evaluate risks in near real-time.

“We are delighted to support Paysafe as they leverage AWS to offer frictionless customer experiences and uncover real-time insights,” said Scott Mullins, Managing Director, Worldwide Financial Services Business Development at Amazon Web Services, Inc. “Paysafe continues to bring innovative payment solutions to market that help merchants rapidly develop and implement new products and meet evolving customer needs, and we look forward to our continued collaboration with them across their digital initiatives.”

Related News

- 01:00 am

Fusion Risk Management, Inc. (“Fusion”), a leading provider of operational resilience, risk management, and business continuity software and services, today announced that it has further strengthened its offerings to help financial institutions meet and exceed new Bank of England, PRA, and FCA regulatory requirements which take effect in early 2022, in addition to the recently formalized guidance shared by the Basel Committee. Fusion consulted with regulated firms, industry advocacy groups, and supervisory authorities to bolster necessary processes in anticipation of the regulations, enhancing its already comprehensive operational resilience approach.

Fusion continues to grow rapidly and now counts five global systemically important banks (GSIBs), 50% of the top 10 largest US domestic banks, and more than 120 leading financial institutions globally as customers. Fusion’s collaborative ENGAGE customer community fosters a common understanding and best practices between those working toward greater operational resilience in financial services. Weekly more than 90 organizations meet to discuss their most critical issues, often led by regulated banks and financial services participants.

“Financial institutions today must navigate an increasingly complex and demanding regulatory environment, and they need a partner that understands the landscape and anticipates their operational resilience needs,” said Michael Campbell, Chief Executive Officer, Fusion Risk Management. “Many institutions do not have the necessary processes and framework to adequately respond to new resilience regulations. Fusion’s proven track record as a provider of best-in-class service ensures our customers stay ahead of regulatory expectations. Our community of customers are at the leading edge of operational resilience, including risk management, third party management, cyber security, disaster recovery, business continuity and we’re proud to help them remain resilient regardless of unforeseen occurrences.”

“Fusion’s mission has always been to keep businesses in business and safeguard our customers’ ability to deliver on their brand promises, regardless the disruption,” said Rich Cooper, Global Head of Financial Service Go-To-Market, Fusion Risk Management. “Financial services providers in particular trust the Fusion Framework System to maintain a robust operational resilience program that exceeds regulatory requirements and optimizes their operational efficiency. We take pride in meeting our global customers’ needs and look forward to continuing to provide ever evolving solutions. We are pleased that our capabilities are tested, available, and ready to implement today.”

Related News

- 04:00 am

Qontigo, an investment intelligence leader and provider of best-of-breed analytics and world-class indices, and Siepe, a trusted provider of technology, data and analytics solutions, have entered into an exclusive partnership to launch Axioma Risk: Elements, a pre-defined selection of data analytics from the award-winning risk management platform, Axioma RiskTM.

Siepe will be offering clients a bespoke configuration of risk analytics across multiple asset classes, with Axioma Risk: Elements providing an entry point for hedge funds, asset managers and other fund managers to integrate a fixed set of fundamental statistics, stress tests and risk settings from the more comprehensive, cloud-native Axioma Risk enterprise software. In addition, Siepe will be able to offer Qontigo’s full suite of portfolio construction tools and risk models along with integration capabilities.

“Flexibility and scalability are two of the key tenets of our solutions at Qontigo,” said Brian Rosenberg, Chief Revenue Officer, Qontigo. “Through the new Axioma Risk: Elements offering, emerging hedge funds who may have had a barrier to entry can now access some of the sophisticated and robust analytics statistics of Axioma Risk, realizing cost efficiencies but without having to sacrifice incisive analysis. Siepe’s leadership in data management and integration have made them a natural partner for us not only for this offering, but also for our other products.”

“Axioma Risk: Elements is a real value-add to our cloud-based platform,” said Charles Chien, Chief Revenue Officer of Siepe. “Adding these critical risk analytics further enhances Siepe’s investment management capabilities, giving our clients a bespoke perspective into their portfolios.”

Axioma Risk is a cloud-native, API-first risk system for multi-asset class risk management. Customizable stress tests, on-the-fly “what if” analyses in addition to factor and full-revaluations are all available on a single platform.

Related News

- 08:00 am

Tinkoff Group, the leading online provider of financial and lifestyle services, has announced its acquisition of a majority stake in Beskontakt LLC, the developer of Koshelek digital wallet, an aggregator of banking cards and retail loyalty programs. The Koshelek app is a leader in its field, reporting the highest number of users of any app in Russia and the CIS. The deal was closed on 29 April 2021 and the transaction terms are to remain confidential.

The Koshelek app is a digital wallet and Russia's only mobile app for aggregating bank cards, loyalty and discount cards, and coupons. At present, it has digitized over 300 million cards and has a user base that exceeds 20 million.

Koshelek helps users to rid themselves of plastic and transition entirely to digital cards. To receive a discount at checkout, the user simply needs to show their discount card on their smartphone screen, and pay with a tokenised debit or credit card by holding the smartphone close to the contactless payment terminal. The application offers retailers access to a new audience, alongside savings on loyalty and discount cards and better customer communication. Koshelek partners with 19 of the 30 largest loyalty programs in Russia.

The Koshelek team, including its co-founders Kirill Gorynya and Filipp Shubin, will remain autonomous and continue to develop the company's business. The company's partnership with Tinkoff will further strengthen the app's position as a leading provider of loyalty programs for Russia’s largest retailers. The company’s current development strategy will remain intact, and the platform will continue to be open and independent in order to encourage new customers to engage with banks that participate in the app’s Koshelek Pay service.

As part of its partnership with Tinkoff, Koshelek will begin integrating user-friendly financial instruments into its service offering, including: "buy-now-pay-later" payment plans, varied cashback options, Tinkoff Target programs and more. The app’s users will benefit from attractive offers and a seamless customer experience within a single mobile app, while its new features will expand opportunities for retailers to develop co-branded programs and boost sales.

Oliver Hughes, Tinkoff Group CEO:

"We are happy to welcome Koshelek into the Tinkoff family. Koshelek has a spirit and DNA that is very close to our own, and this new partnership aligns perfectly with our goal to provide Russians with the best service in the market. Our teams will cooperate closely with one another for mutual gain; Tinkoff will share the groundwork it has laid in business process optimization as well as its expertise in implementing cutting-edge IT solutions to ensure Koshelek continues to develop rapidly. We already plan to integrate Tinkoff's financial service offerings into the Koshelek app, in order to accelerate its development and enable Koshelek to offer its customers great deals and cashback. The Tinkoff and Koshelek teams will present their first joint project at SPIEF 2021. We have no doubt that our partnership will be extremely beneficial to both companies, as well as to our customers, who remain our top priority.”

Kirill Gorynya, Co-founder of Beskontakt LLC:

"We are confident that this new partnership will not only help Koshelek to scale its market presence but also to increase its value to users by merging all checkout stages - from displaying a loyalty card to processing payment - into a single convenient, safe and easy-to-use scenario. Regardless of their smartphone model and brand, Koshelek users will soon be able to receive discounts, accrue and spend bonus points, pay by instalments, receive cashback and more. I would like to emphasise that Koshelek will remain a completely open and independent platform, ready to integrate the services and solutions of our business partners, including banks and financial institutions."

About the Application

The Koshelek app is a leading card aggregator in Russia and Belarus. The app has over 20 million registered users, of which 11 million do their daily shopping using discount and bank cards stored in the application. The number of digital cards stored in the app by users exceeds 300 million.

Koshelek is a unique communication channel that businesses can use to interact with their customers at point of sale. Koshelek's partners include 19 of the 30 companies with the largest loyalty programs in Russia, including X5 Retail Group, Magnit, Lenta, O'key, Eldorado, Kari, leading manufacturers of FMCG goods and over 60 banks, including the largest players in the financial market. The app has an integrated mobile contactless payment service, Koshelek Pay, which is one of the only payment services available in Huawei’s new smartphones.

The Koshelek app is available in the App Store, the Google Play store and in Huawei’s AppGallery. The App Store named Koshelek among its top 20 apps in 2019 and 2020.

The company has been a strategic partner of Mastercard in the field of contactless payments since 2013. In 2017, Deloitte recognized it as one of Russia's top 10 best startups. In 2019, research undertaken by Skolkovo cited the company as the most innovative startup in the retail sphere, while Business Petersburg (Delovoy Peterburg) named it the best IT project. In 2020, Koshelek won the FINAWARD prize for innovation and achievement in the financial sector, and ranked 3rd in the Services category for the Runet Rating national award for websites and mobile apps.

The developer of the Koshelek app, Beskontakt LLC, was established in 2012 within a corporate investment fund i-Free.

Related News

- 06:00 am

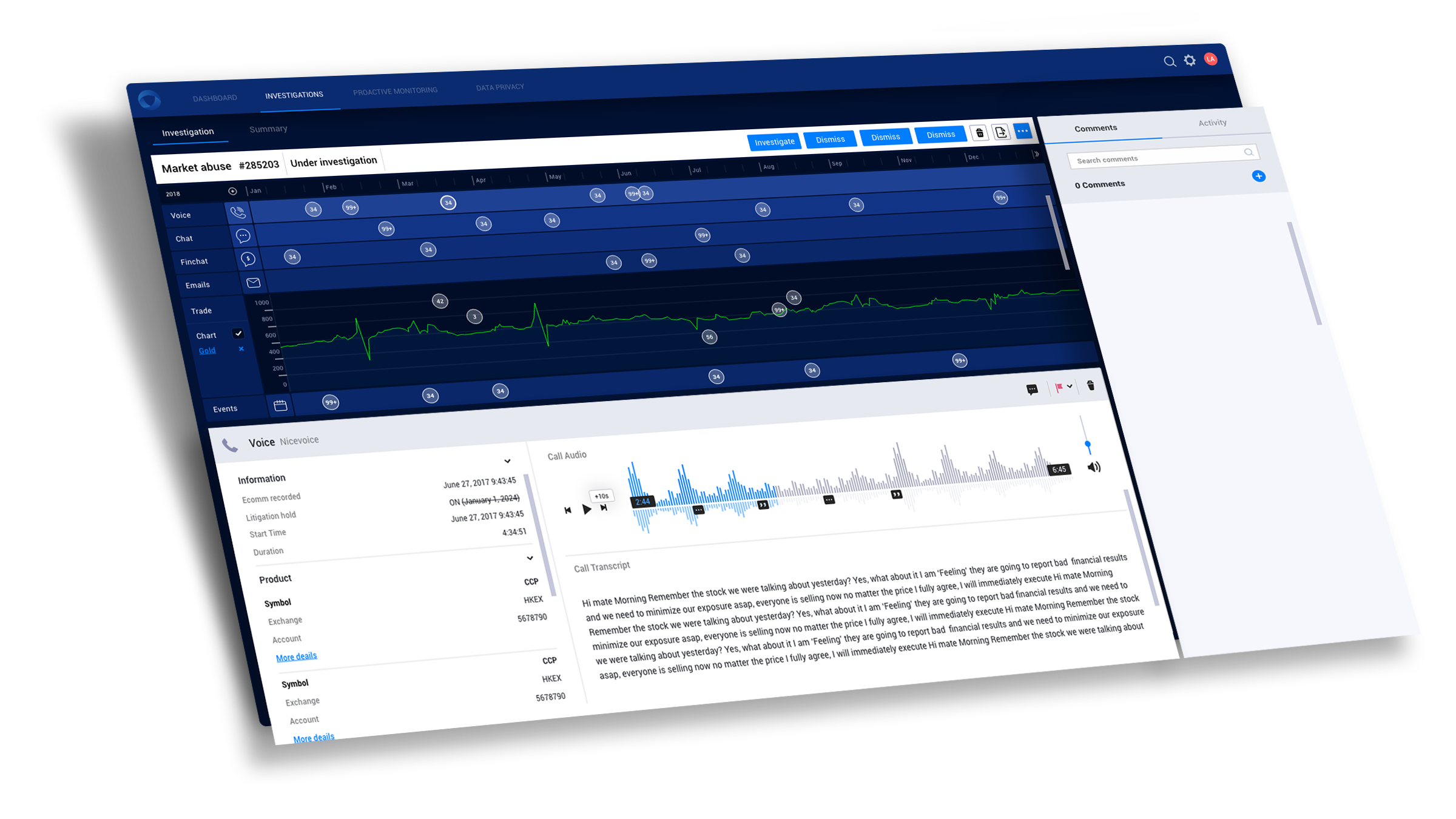

Specialist RegTech provider Shield today announces the addition of its Trade Intelligence layer as part of its communications compliance lifecycle platform. By utilizing AI and closely matching trade data with all relevant communications, firms can retrieve and report on specific trades faster, easier, and more accurately, along with easy sharing of this information with the appropriate regulators, to comply with investigations and avoid potential fines resulting from fraudulent or prohibited behaviours.

Roie Mandler, Head of Surveillance at Shield commented, “Trade Reconstruction is an essential capability for any regulated financial institution, but in an age of complicated regulations and ever more complicated electronic communications, this can present a ‘needle in a haystack’ situation where it is virtually impossible to achieve manually within stipulated timescales – which can be as little as 72 hours. Our platform’s automated approach saves the compliance team significant time in finding all relevant data, then presents the filtered results to the compliance officer for review and easy sharing with all stakeholders.”

Using a powerful custom-tailored, out-of-the-box model, the Shield platform considers all elements of a trade (Who, When, What), making accurate and reliable deductions through an automated approach that understands the context, jargon, and slang (including a unique ability to define aliases and commonly used synonyms in conversation) to find the related communications relevant to that specific trade. This integrated approach combines purposely built machine learning algorithms with fuzzy matching capabilities to detect products and companies in relevant parts of communication - such as small talk, news and commentary, alias usage, discreet communications relationships and more.

Shield also makes it simple to understand and present this data effectively, with personalized advanced workflows and case management to conduct Trading investigations, assign tasks and collaborate in one easy-to-use, user-centric platform. It can be deployed as a stand-alone solution and can be customised according to the organisation’s size, languages, and trading protocols.

Roie adds, “With remote work on the rise, new communications channels, less floor-side supervision, and volatile markets, do you really know what your traders are up to? It has never been more important to be able to accurately reconstruct trades in their entirety to ensure your business and its employees are conducting themselves legally and honorably. Reconstructing trades is the first step towards true Trade Intelligence, which is likely to continue evolving and providing even greater insights in the future, helping to ensure firms always have the trust of their customers and the regulators.”

For more details on the Shield platform or to schedule a demo to see it in action, please contact Shield via email: info@shieldfc.com or visit www.shieldfc.com.

Related News

- 04:00 am

Fintech firm Monva has today announced the launch of its personal loans comparison service. Alongside the brand’s existing smart comparison credit card and energy services, both launched in late 2020, this latest development is part of Monva’s ongoing mission to revolutionise the price comparison experience for today’s modern user, using customer data for good and automating mundane tasks.

Monva is the brainchild of CEO Steve Wiley and COO Stuart Wakefield, who previously held senior executive positions at MoneySuperMarket, MBNA and Virgin Money, with decades of experience in Fintech and financial services. Its personalised service helps users make smart decisions which are right for them, while its technology and automation means there are less forms to fill in, making it easier to compare and buy. Monva’s customers also receive state of the art guidance and support through Mo, the Money Virtual Assistant, which guides users through the comparison search, assists buyers in making their decisions and uses AI and machine learning to alert users to new personal offers.

Commenting on the launch, CEO Steve Wiley said: “We are thrilled to unveil Monva’s latest price comparison service for personal loans. Using Monva, customers will now be able to compare loan options from leading providers and access personalised offers without affecting their credit file.

Customers will also be supported by Mo, our smart technology and money saving assistant, which represents the biggest advancement in the industry yet. Mo guides customers through searches and offers useful tips and information to help individuals make smart choices and find the right deal every time.

This launch is the latest milestone for Monva after a year of incredible progress and comes just weeks after closing our latest fundraising campaign on Crowdcube, exceeding our investment goal by 225% from over 600 investors. We’re excited about the huge opportunity ahead of us as we continue building Monva and developing the next generation of financial price comparison for our users.”

Related News

- 07:00 am

Alviere, the New York-based embedded finance platform provider, has today announced a partnership with Currencycloud, a leading provider of B2B embedded cross-border solutions, to provide its enterprise-class clients with the functionality of Currencycloud’s Spark solution – a multi-currency e-wallet with individual IBANs that allows customers to pay, hold, convert and collect in as many as 38 currencies simultaneously.

Alviere, through its Hive modular API technology, will be able to offer its large corporate clients the ability to embed financial services into their businesses and provide a full range of financial services to their customers.

The sophisticated technology behind both companies, combined with the speed of integration and breadth of offer gives Alviere increased capabilities and new business opportunities, in the form of providing real growth opportunities for their clients as they look to expand globally.

Steven Scofelia, Alviere’s Chief of Staff, commented: “There is a real demand from our customers for cross-border functionality and it’s a strategic component of our growth. We are excited to launch our partnership with Currencycloud to offer a combined solution to existing and new Alviere clients.”

David Heitzman, Vice President of Sales & General Manager of North America at Currencycloud, commented: “There was an immediate synergy between us and Alviere – their customer-focused approach to delivery mirrors ours and it felt like a perfect match from the start. That we both see embedded finance as the next big step for business is fantastic and we are thrilled to support Alviere in delivering that for its clients.”

The Currencycloud Spark solution has been incorporated into Alviere’s Hive solution and is available to existing and new customers today.

Related News

- 09:00 am

Featurespace, the leading provider of Enterprise Crime Prevention software, has received the Queen’s Award for Enterprise: International Trade.

This is the second time the company has received a Queen's Award, the first being in 2018 in the Innovation category for its pioneering work in fraud prevention technology.

One of 205 organisations to be honoured, Featurespace secured the Queen's Award for Enterprise - now in its 55th year - for its outstanding commitment to protecting organisations around the globe from financial crime with its award-winning fraud prevention and anti-money laundering software.

“Having studied and founded a company out of Cambridge, as well as witnessing our expansion to the Americas and Asia-Pacific, this is a tremendous honour and underscores our commitment to excellence and to our customers,” said Dave Excell, founder of Featurespace.

The award follows Featurespace’s launch of Automated Deep Behavioural Networks for the card and payments industry, which provides a deeper layer of defence to protect consumers from scams, account takeover, card and payments fraud, which cost the financial services industry an estimated $42 billion in 2020.

Featurespace was recognised in The Sunday Times’ Sage Tech Track 100, which celebrates Britain’s private technology companies with the fastest-growing sales. The company also recently received a Business Culture Award for “Culture in a Crisis” by demonstrating strength in its strong culture before and during the pandemic.

Related News

- 04:00 am

Cryptocurrencies had a strong start this year, with crypto asset prices, such as Bitcoin, reaching record-heights. However, that caught the attention of cybercriminals.

The Atlas VPN team found that cybercriminals stole around $108.3 million from various blockchain projects in the first quarter of 2021 — a 46% rise from the same period last year. Ethereum DApps, blockchain wallets, and cryptocurrency exchanges were the criminals’ target of choice.

Ethereum (ETH) DApps were the most popular among cybercriminals in the first quarter of 2021. They were affected by a total of 11 breaches and 5 scam events, which amounted to over $86 million in losses.

Blockchain wallets were also commonly attacked. There were 9 blockchain wallet breaches recorded in the first three months of this year, as well as 1 scam event and 2 blackmail cases. In total, they cost victims approximately $19.3 million.

Finally, cryptocurrency exchanges had 4 breaches and 1 scam event. Together cybercriminals collected around $2.9 million from cryptocurrency exchanges in 2021 Q1.

Blockchain-linked hacks are on the rise again

In 2020, blockchain-related breaches declined for the first time in the past five years. However, a new year brings new challenges, and it seems that in 2021 blockchain-related breaches are on the rise once again.

The first quarter of 2021 already saw 33 blockchain breaches, including scams, affecting Ethrereum DApps, blockchain wallets, and cryptocurrency exchanges. It signifies a 154% rise compared to Q1 of 2020, when 13 blockchain breaches were detected.

However, the number of blockchain-linked breaches in Q1 of 2021 is still almost two times lower than in the record year of 2019. In the first quarter of 2019 alone, 62 blockchain breaches were detected.

Ruth Cizynski, the cybersecurity researcher and writer at Atlas VPN, shares her thoughts on the situation:

“Due to their nature, blockchain projects remain profitable targets to cybercriminals because fraudulent transactions cannot be reversed as they may be in the traditional financial system. With cryptocurrencies continuing to boom, it is safe to say that we can expect more hacks to pour in by the end of this year. ”

To read the full article, head over to: https://atlasvpn.com/blog/blockchain-hackers-netted-over-100-million-in-q1-2021A

Related News

- 03:00 am

An overwhelming majority of compliance professionals say the lack of guidance and support from regulators is contributing to a significant delay in implementing the latest anti-money laundering (AML) regulations, according to new research released today by LexisNexis® Risk Solutions, the global data and analytics provider. The study reveals that 91% of compliance professionals across the banking, lending, and wealth management sectors believe that better guidance would help their firms make AML programmes more effective.

Despite the Fifth Money Laundering Directive (5MLD) coming into force over a year ago in January 2020, financial services firms admit to being typically only 60% through their implementation programmes. By sector, banks were the furthest behind in their implementation plans (57% complete), followed by lenders (61%) and wealth management (62%). Any delay in compliance with 5MLD regulations puts firms at risk of severe penalties from the FCA, as well as increased risk of being exposed to the proceeds of crime.

The lack of urgency amongst firms comes despite 60% of those surveyed predicting that the regulator will begin to clamp down on non-compliance within the next 6 months. Of this, half (50%) think the clampdown will come in the next 3-5 months.

On the positive side, the research revealed clear support for 5MLD amongst firms, with almost two thirds (63%) of firms agreeing that the Directive will have a positive impact when detecting and preventing financial crime in the UK. Banks were the least optimistic about its impact, with just over half agreeing (56%). Firms were on average expecting to spend between £500,000 to £1 million on their implementation projects.

These insights follow in-depth research conducted by LexisNexis Risk Solutions and Oxford Economics, in conjunction with the Cabinet Office which found that UK financial services firms are already spending a total of £28.7bn on compliance processes annually – almost half of the UK’s defence budget – yet according to the NCA only around £1bn is ever recovered. It also revealed that 70% of firms’ compliance budgets are spent on compliance staff and training. Yet, over 50% of compliance work typically relates to customer due diligence processes and a further 14% to investigations and information gathering, all of which can be easily and cost-effectively streamlined with technology solutions. Meanwhile, the same study revealed AML compliance cost inflation is expected to accelerate over the next three years, by nearly 10%.

Nina Kerkez, Director of UK&I Consulting at LexisNexis® Risk Solutions, comments:

“These two pieces of research together paint a grim picture of the UK compliance landscape – one in which firms are spending considerable time, money and effort on an ineffective system that isn’t coming close to addressing the issues for which they’re intended. Regulated firms are united in being overwhelmed by increasing regulation and unanimous in their plea for more support.

“Yet, despite the ticking time bomb of a regulatory clamp-down, firms appear to be ‘kicking the can down the road’ with short-term fixes – throwing budget at people-power, increasing the size of compliance teams and investing in training to tackle the problem. Unfortunately, this doesn’t necessarily lead to greater efficiency and it avoids the wider issue of needing to re-configure their compliance approach in line with 5MLD requirements, hence the apparent lack of progress shown in the research.

“What both studies clearly show is that firms need to take a step back and consider the longer term benefits of automating their customer due diligence and investigations processes – a step that significantly streamline almost two-thirds of their overall compliance workload, and in doing so free up the human skills and knowledge required to implement robust risk-based activities that will really make a difference.

“This doesn’t need to be a choice between competitiveness and compliance. By committing to digitalising key components of their compliance processes, firms can drive down their annual compliance costs at the same time as streamlining customer onboarding and gaining a better understanding of the risk individuals pose, leading ultimately to better risk decisions, happier customers and more financial crime prevention.

On a positive note, a majority of regulated firms support the aims of 5MLD and agree that it will have a positive impact on financial crime prevention. So, the ‘will’ is certainly there amongst firms, now they just need help with the ‘way’.”