Published

- 07:00 am

1Q2021 result before tax of €1,463 million; capital position remains strong at 15.5%

- Net interest income up on 4Q2020, supported by the benefit from TLTRO III, which more than offset liability margin pressure.

- Robust growth in fee income of 9.1% year-on-year, especially on investment products.

- 1Q2021 had a low level of risk costs. Expenses were under control, but included some incidental costs due to restructuring.

Lending and customer deposits increase

- Net core lending growth of €17.8 billion in 1Q2021 as TLTRO funds were applied to support the economy; net customer deposits grew by €8.1 billion, reflecting ongoing impacts of Covid-19 pandemic and lockdowns.

- Primary customer base was stable at 13.8 million in 1Q2021, reflecting impacts of the pandemic.

CEO statement

“ING delivered a strong performance in the first quarter of 2021. The sharp rebound in net profit compared to the year-earlier period was driven by a good increase in fee income and lower risk costs,” said ING CEO Steven van Rijswijk.

“Our fee-generating business was boosted by the growth of investment products, particularly in Germany and Belgium. ING’s lending franchise demonstrated its strength in the first quarter, including through our success in converting European Central Bank TLTRO financing into lending to benefit our customers as they continue to deal with the effects of the Covid-19 pandemic, thereby supporting the recovery. On risk costs, we remain cautious and are taking into account expected delays in credit losses.

“We continued to adapt our business to serve customers better and to ensure we’re focusing on the best growth opportunities for the future. We’re advancing our digital and mobile-first strategy in response to the strong rise in the use of digital channels by our customers. In the Netherlands, this is resulting in a reduction in the number of branches and an increase in the number of service points, for which we’ve taken a restructuring provision. We also announced that we’ll discontinue retail banking activities in Austria and the Czech Republic in order to focus on markets where we can achieve better scale and profitability.

“During the quarter, ING closed a record of more than 50 green deals in a growing number of sectors as clients increasingly focus on making their businesses sustainable and linking their efforts in this area to their financing. With our strong ESG profile, we’re well positioned to support them in these endeavours. This is exemplified by the €10.1 billion revolving credit facility we helped to arrange for AB InBev, the largest-ever sustainability-linked loan.

“Also, to strengthen our focus on becoming a data-driven digital leader in banking, we separated the technology and operations roles at the management board level, appointing a chief technology officer. We also recently welcomed our new ING Group chief risk officer (CRO) and new head of Wholesale Banking (WB) who bring fresh perspectives and diverse backgrounds to our executive and management boards.

“I’d particularly like to thank our employees for their continued commitment, flexibility and hard work to support our customers in these challenging times.”

Related News

- 04:00 am

Financial institutions and their directors have to navigate a rapidly changing world, marked by new and emerging risks driven by cyber exposures based on the sector's reliance on technology, a growing burden of compliance, and the turbulence of Covid-19, according to a new report Financial Services Risk Trends: An Insurer's Perspective from Allianz Global Corporate & Specialty (AGCS). At the same time, the behavior and culture of financial institutions is under growing scrutiny from a wide range of stakeholders in areas such as sustainability, employment practices, diversity and inclusion and executive pay.

"The financial services sector faces a period of heightened risks. Covid-19 has caused one of the largest ever shocks to the global economy, triggering unprecedented economic and fiscal stimulus and record levels of government debt," says Paul Schiavone, Global Industry Solutions Director Financial Services at AGCS. "Despite an improved economic outlook, considerable uncertainty remains. The threat of economic and market volatility still lies ahead while the sector is also increasingly needing to focus on so-called 'non-financial' risks such as cyber resilience, management of third parties and supply chains, as well as the impact of climate change and other Environmental Social and Governance (ESG) trends."

The AGCS report highlights some of the most significant risk trends for banks, asset managers, private equity funds, insurers and other players in the financial services sector, as ranked in the Allianz Risk Barometer 2021, which surveyed over 900 industry respondents: Cyber incidents, Pandemic outbreak and Business interruption are the top three risks, followed by Changes in legislation and regulation – driven by ESG and climate change concerns in particular. Macroeconomic developments, such as rising credit risk and the ongoing low interest rate environment, ranked fifth.

The Allianz Risk Barometer findings are mirrored by an AGCS analysis of 7,654 insurance claims for the financial services segment over the past five years, worth approximately €870mn ($1.05bn). Cyber incidents, including crime, ranks as the top cause of loss by value, with other top loss drivers including negligence and shareholder derivative actions.

Covid 19 impact

Financial institutions are alive to the potential ramifications of government and central bank responses to the pandemic, such as low interest rates, rising government debt and the winding down of support and grants and loans to businesses. Large corrections or adjustments in markets – such as in equities, bonds or credit – could result in potential litigation from investors and shareholders, while an increase in insolvencies could also put some institutions' own balance sheets under additional strain. "Claims may be brought against directors and officers in the financial services industry where there has been a perceived failure to foresee, disclose or manage or prepare for Covid-19 related risks," says Shanil Williams, Global Head of Financial Lines at AGCS.

Cyber – highly exposed despite high level of security spend

The Covid-19 environment is also providing fertile ground for criminals seeking to exploit the crisis as the pandemic led to a rapid and largely unplanned increase in homeworking, electronic trading and a rapid acceleration in digitalization. Despite significant cyber security spend, financial services companies are an attractive target and face a wide range of cyber threats including business email compromise attacks, ransomware campaigns, ATM "jackpotting" – where criminals take control of cash machines through network servers – or supply chain attacks. The recent SolarWinds incident targeted banks and regulatory agencies, demonstrating the potential vulnerabilities of the sector to outages via their reliance on third-party service providers. Most financial institutions are now making use of cloud services-run software which comes with a growing reliance on a relatively small number of providers. Institutions face sizable business interruption exposures, as well as third party liabilities, when things go wrong.

"Third-party service providers can be the weak link in the cyber security chain," says Thomas Kang, Head of Cyber, Tech and Media, North America at AGCS. "We recently had a bank client suffer a large data breach after a third-party vendor failed to delete personal information when decommissioning hardware. How financial institutions manage risks presented by the cloud will be critical going forward. They are effectively offloading a significant portion of cyber security responsibilities to a third-party. However, by partnering with the right cloud service provider, companies can also leverage the cloud as a way to manage their overall cyber exposure."

Compliance challenges around cyber, cryptocurrencies and climate change

Compliance is one of the biggest challenges for the financial services industry, with legislation and regulation around cyber, new technologies and climate change and ESG factors constantly evolving and increasing. Indeed, the report notes that there has been a seismic shift in the regulatory view of privacy and cyber security in recent years with firms facing a growing bank of requirements. The consequences of data breaches are far-reaching, with more aggressive enforcement, higher fines and regulatory costs, and growing third party liability, followed by litigation. Regulators are increasingly focusing on business continuity, operational resilience and the management of third party risk following a number of major outages at banks and payment processing companies. Companies need to operationalize their response to regulation and privacy rights, not just look at cyber security.

Applications of new technologies such as Artificial Intelligence (AI), biometrics and virtual currencies will likely raise new risks and liabilities in future, in large part from compliance and regulation as well. With AI, there has already been regulatory investigations in the US related to the use of unconscious bias in algorithms for credit scoring. There have also been a number of lawsuits related to the collection and use of biometric data. The growing acceptance of digital or cryptocurrencies as an asset class will ultimately present operational and regulatory risks for financial institutions with uncertainty around potential asset bubbles and concerns about money laundering, ransomware attacks, the prospect of third-party liabilities and even ESG issues as "mining" or creating cryptocurrencies uses large amounts of energy. Finally, the growth in stock market investment, guided by social media raises

mis-selling concerns – already one of the top causes of insurance claims.

ESG factors taking center stage

Financial institutions and capital markets are seen as an important facilitator of the change needed to tackle climate change and encourage sustainability. Again, regulation is setting the pace. There have been over 170 ESG regulatory measures introduced globally since 2018, with Europe leading the way. The surge in regulation, in combination with inconsistent approaches across jurisdictions and a lack of data availability, represents significant operational and compliance challenges for financial service providers. "Financial services may be ahead of many other sectors when it comes to addressing ESG topics, but it will still be an important factor shaping risk for years to come," says David Van den Berghe, Global Head of Financial Institutions at AGCS. "Social and environmental trends are increasingly sources of regulatory change and liability, while increased disclosure and reporting will make it much easier to hold companies and their boards to account."

At the same time, activist shareholders or stakeholders increasingly focus on ESG topics. Climate change litigation, in particular, is beginning to include financial institutions. Cases have previously tended to focus on the nature of investments, although there has been a growing use of litigation seeking to drive behavioral shifts and force disclosure debate. Besides climate change, broader social responsibilities are coming under scrutiny, with board remuneration and diversity being particular hot topics, and regulatory issues. "Companies that commit to addressing climate change and diversity and inclusion will need to follow through. For those that do not, it will come back to haunt them," says Van den Berghe.

Claims trends and its impact on the insurance market

The AGCS report also highlights some of the major causes of claims that insurers see from financial institutions. The fact that compliance risk is growing is concerning, as compliance issues are already one of the biggest drivers of claims. "Keeping abreast of compliance in a rapidly-changing world is a tough task for companies and their directors and officers," says Williams. "Their compliance burden is enormous, and is now accompanied by growing regulatory activism, legal action and litigation funding."

Cyber incidents already result in the most expensive claims and insurers are seeing a rising number of technology-related losses including claims made against directors following major privacy breaches. Other examples include sizable claims related to fraudulent payment instructions and "fake president" scams. Such payments can be in the millions of dollars. AGCS has also handled a number of liability claims arising from technical problems with exchanges and electronic processing systems where systems have gone down and clients have not been able to execute trades, and have made claims against policyholders for loss of opportunity. There have also been claims where a system failure has caused damages to a third party; one financial institution suffered a significant loss after a trading system crashed causing processing failures for customers.

Recent loss activity, compounded by Covid-19 uncertainty, have contributed to a recasting of the insurance market for financial institutions, characterized by adjusted pricing and enhanced focus on risk selection by insurers, but also a growing interest for alternative risk transfer solutions, in addition to traditional insurance. Insurance is increasingly an important part of the capital stack of financial institutions and a growing number are partnering with insurers to manage risk and regulatory capital requirements or utilizing captive insurers to compensate for changes in the insurance markets or to finance more difficult-to-place risks.

"At AGCS, we are committed to engaging with financial institutions to help them mitigate their exposures and develop adequate risk transfer solutions for a sector that is embarking on a major transformation, driven by fast-paced technology adoption and growing ESG issues, while having to master the impacts of the Covid-19 pandemic," says Schiavone.

About Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) is a leading global corporate insurance carrier and a key business unit of Allianz Group. We provide risk consultancy, Property-Casualty insurance solutions and alternative risk transfer for a wide spectrum of commercial, corporate and specialty risks across 10 dedicated lines of business.

Our customers are as diverse as business can be, ranging from Fortune Global 500 companies to small businesses, and private individuals. Among them are not only the world's largest consumer brands, tech companies and the global aviation and shipping industry, but also satellite operators or Hollywood film productions. They all look to AGCS for smart answers to their largest and most complex risks in a dynamic, multinational business environment and trust us to deliver an outstanding claims experience.

Worldwide, AGCS operates with its own teams in 31 countries and through the Allianz Group network and partners in over 200 countries and territories, employing over 4,400 people. As one of the largest Property-Casualty units of Allianz Group, we are backed by strong and stable financial ratings. In 2020, AGCS generated a total of €9.3 billion gross premium globally.

Cautionary Note Regarding Forward-Looking Statements

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words "may", "will", "should", "expects", "plans", "intends", "anticipates", "believes", "estimates", "predicts", "potential", or "continue" and similar expressions identify forward-looking statements.

Actual results, performance or events may differ materially from those in such statements due to, without limitation, (i) general economic conditions, including in particular economic conditions in the Allianz Group's core business and core markets, (ii) performance of financial markets, including emerging markets, and including market volatility, liquidity and credit events (iii) the frequency and severity of insured loss events, including from natural catastrophes and including the development of loss expenses, (iv) mortality and morbidity levels and trends, (v) persistency levels, (vi) the extent of credit defaults, (vii) interest rate levels, (viii) currency exchange rates including the Euro/U.S. Dollar exchange rate, (ix) changing levels of competition, (x) changes in laws and regulations, including monetary convergence and the European Monetary Union, (xi) changes in the policies of central banks and/or foreign governments, (xii) the impact of acquisitions, including related integration issues, (xiii) reorganization measures, and (xiv) general competitive factors, in each case on a local, regional, national and/or global basis. Many of these factors may be more likely to occur, or more pronounced, as a result of terrorist activities and their consequences.

The matters discussed herein may also be affected by risks and uncertainties described from time to time in Allianz SE's filings with the U.S. Securities and Exchange Commission. The company assumes no obligation to update any forward-looking statement.

Related News

- 09:00 am

Improved Automation Allows Business Users with Direct Insights to Develop and Deploy Apps

TIBCO Software Inc., a global leader in enterprise data, empowers its customers to connect, unify, and confidently predict business outcomes, solving the world's most complex data-driven challenges. Today, TIBCO announced several milestones for its TIBCO Cloud™ Integration iPaaS (Integration Platform-as-a-Service), including process automation updates and new accelerators.

Key industry analyst firms recognise TIBCO Cloud Integration as a market leader; most recently Nucleus Research named it a Leader in the 2021 iPaaS Value Matrix, and specifically the top Leader in usability. TIBCO is redefining the iPaaS landscape – traditionally used to connect back-office applications and data – allowing users on the business front lines to quickly and easily streamline manual processes or develop entirely new automated processes without writing code. Users are able to seamlessly embed business data within these processes, reducing their reliance on IT. These capabilities help address challenges across processes, like driving customer intimacy, operational excellence, or reinventing your business.

“On the front lines of the fight against COVID-19, our teams are working around the clock to minister to the community and provide safe, comprehensive care. By partnering with Powerhouse Consulting and TIBCO, we were able to simplify and automate complex business processes and workflows using TIBCO Cloud Integration, including retrieval of patient data and provision of critical information. This enabled eligible citizens to get vaccinated as expeditiously as possible,” said Shaunna Shiers, director of operations, Primary and Urgent Care, Catholic Medical Center. “As a result, we were able to stand up a support centre for patients 100% faster, in a matter of days – not months – thereby accelerating the vaccine rollout, and helping to protect our most at-risk patients and their families – a major advance forward on the road to recovery.”

The TIBCO Cloud Integration iPaaS solves key business issues by connecting the enterprise with greater speed, especially as customers look to accelerate digital business initiatives, adapting to market conditions driven by the COVID-19 pandemic. New integration accelerators help customers address various challenges, from tracking and tracing shipments, to managing public transportation infrastructure, all easily accessible within the TIBCO Cloud Integration Marketplace. These accelerators alleviate the need to develop custom integration applications from scratch and ultimately connect businesses faster. Additionally, the TIBCO Cloud Integration Marketplace includes the ability to support user participation, monetisation for partners and developers, and become a single place for easy discovery of all integration and processes assets.

“Today’s customers need ways to streamline and automate their business processes, enabling them to operate with greater speed, efficiency, and agility," said Randy Menon, senior vice president and general manager, Connect and TIBCO Cloud, TIBCO. "At TIBCO, we focus on empowering everyone in an organisation with easy-to-use tools that allow them to play a key role in ongoing digital transformations. This news showcases how we give all users the power of data insight and connectedness through the ability to deploy applications that have material impact on an organisation and its customers, all within days.”

A newly enhanced AI-driven experience within TIBCO Cloud Integration will help customers connect their business faster and with greater intelligence. With its new smart data-mapping capabilities, any user can rely on machine learning-powered recommendations for connecting fields between disparate data sources based on historical patterns and continuous learnings. Furthermore, built-in intelligent analytics dashboards powered by TIBCO Spotfire® give insights into critical ecosystem metrics, such as API and endpoint usage and API performance, minimising time between critical business moments and valuable digital business insights.

These comprehensive updates to TIBCO Cloud Integration offer customers advanced automation capabilities, with the goal of empowering any user with faster, smarter data.

Learn more about TIBCO Cloud Integration visit the TIBCO website.

About TIBCO

TIBCO Software Inc. unlocks the potential of real-time data for making faster, smarter decisions. Our Connected Intelligence Platform seamlessly connects any application or data source; intelligently unifies data for greater access, trust, and control; and confidently predicts outcomes in real time and at scale. Learn how solutions to our customers’ most critical business challenges are made possible by TIBCO at www.tibco.com.

Related News

- 09:00 am

Younger people’s finances have been hit hardest by the pandemic, and they are increasingly willing to securely share their bank transaction data to get access to financial products that can help them weather the storm, according to the latest findings from Credit Kudos’ Borrowing Index.

Under 35s are three times more likely to have seen their income negatively impacted by the pandemic than older people (36% compared to 13% of over 55s). This fluctuation in income over the previous year has made it difficult for lenders to ensure they are lending responsibly without up-to-date information on someone’s financial situation. However, at the same time financial products that can help mitigate temporary shortfalls, like credit, are increasingly needed - younger adults are far more likely to say they ‘have never needed credit more’ (26% compared to 6% of over 55s).

Despite this demand, the under 35s are nine times more likely to have been turned down for borrowing since the pandemic began. Almost one in five (18%) adults aged 18-34 say they have been turned down for credit since March 2020, compared to just 2% of people aged 55. Nearly six in ten (57%) under 35s who have been turned down for credit since March 2020 believe it was due to a lack of information on their credit report, but 58% were not told why or how to improve their chances of being accepted.

In order to ensure lenders can offer affordable credit, responsibly, to those who need it, lenders not only need up-to-date information but more comprehensive information. Open Banking helps lenders get a much clearer, up-to-date, understanding of a borrower’s financial situation, allowing people to prove their creditworthiness and increase their chances of being accepted. As a result, under 35s are increasingly likely to be willing to securely share their bank transaction data in this way if it could help them be accepted for a loan – increasing 21% since April 2020.

Freddy Kelly, CEO and co-founder at Credit Kudos said: “The Covid-19 crisis has put a huge amount of strain on people’s finances, with younger adults particularly impacted. Financial products, like credit, can help people cope with a temporary shortfall when used responsibly, but we’ve found the younger generations are also most likely to struggle to access credit, with poor information on traditional credit reports a major cause. "

“With the pandemic hitting the younger generations particularly hard, and with many younger people having a thin credit file as they haven’t borrowed much previously, many lenders have been unable to assess them using traditional credit data. But this doesn’t necessarily mean they can’t afford to repay. Open Banking allows lenders to get a true picture of someone’s financial health and make a more informed decision and, in less than a year, our data has shown a marked increase in demand among borrowers for this technology.”

Paul Harrald, Head of Curve Credit, said: “When offered responsibly, credit can be a lifeline for people - helping them cope with unexpected expenses and take advantage of new opportunities. Young people more than ever need affordable forms of regulated credit to help them get by, but this can only happen if lenders have the right information to understand affordability. That’s why our soon-to-launch Curve Credit solution will use Open Banking so we can get a true picture of a borrower’s situation and support them to more easily manage their monthly outgoings. ”

Related News

- 09:00 am

RealtyServer, the global provider of Multi Listing Platform Software to Real Estate Boards, and Syngrafii, the global eSignature company which provides the ability to execute original biometric ink signatures onto hard copy or electronic documents, today announced a channel and technology partnership that will include RealtyServer integrating Syngrafii’s iinked Sign™ eSignature and Video Signing Room™ solutions into its platform.

RealtyServer software, deployed in 14 countries, is designed to optimize efficiency and simplify the technical environment that serves Multi Listing Platform Associations, Brokers and Sales Professionals. The RealtyServer Systems product suite includes Xposure™ the latest in Multi Listing Platforms for the real estate sector, which allows Agents to search, list, and manage listings within its intuitive structure. The Private Client Services™ product provides the advantage in client satisfaction and lead generation.

“This channel partnership builds on our commitment to provide REALTORS® with the best technologies that continue to build on professionalism and client satisfaction within our industry” said Darren Schneider, CEO of RealtyServer. “Integrating Syngrafii technology will not only provide our clients with the utmost in compliant eSignature tools – it will also have a positive effect on consumer confidence during the remote signing and recording of the buy sell process.”

“Our collaboration with RealtyServer is an exciting opportunity for Syngrafii to introduce its suite of remote signing technologies to the real estate sector, initially in British Columbia, and then across Canada. Integrating iinked Sign™ and Video Signing Room™ technologies will provide real estate professionals, Buyers and Sellers with an efficient, easy to use document management process, along with enhanced consumer protection via recording of critical parts of the transaction. This will allow real estate professionals to focus on giving their clients increased service while still being able to expand the number of property sales and leases closed,” said Matthew Gibson, Syngrafii co-founder and CEO.

Syngrafii has over 45 granted and pending applications for its pioneering e-Signature iinked Sign™; robotic LongPen®, and Video Signing Room™ technologies. The Syngrafii VSR™ all-in-one electronic signing solution enables compliant signing, witnessing, and secure storage of documents in a live video-conferencing session that accommodates multiple document signers. VSR™ preserves the biometric protection of a traditional signature, mitigates the risk of fraudulent behaviour, provides enhanced consumer protection, and supports businesses’ increased technology needs for remote collaboration.

The Syngrafii platform is also available as a hosted White Label and on Client Cloud Solution.

Related News

- 02:00 am

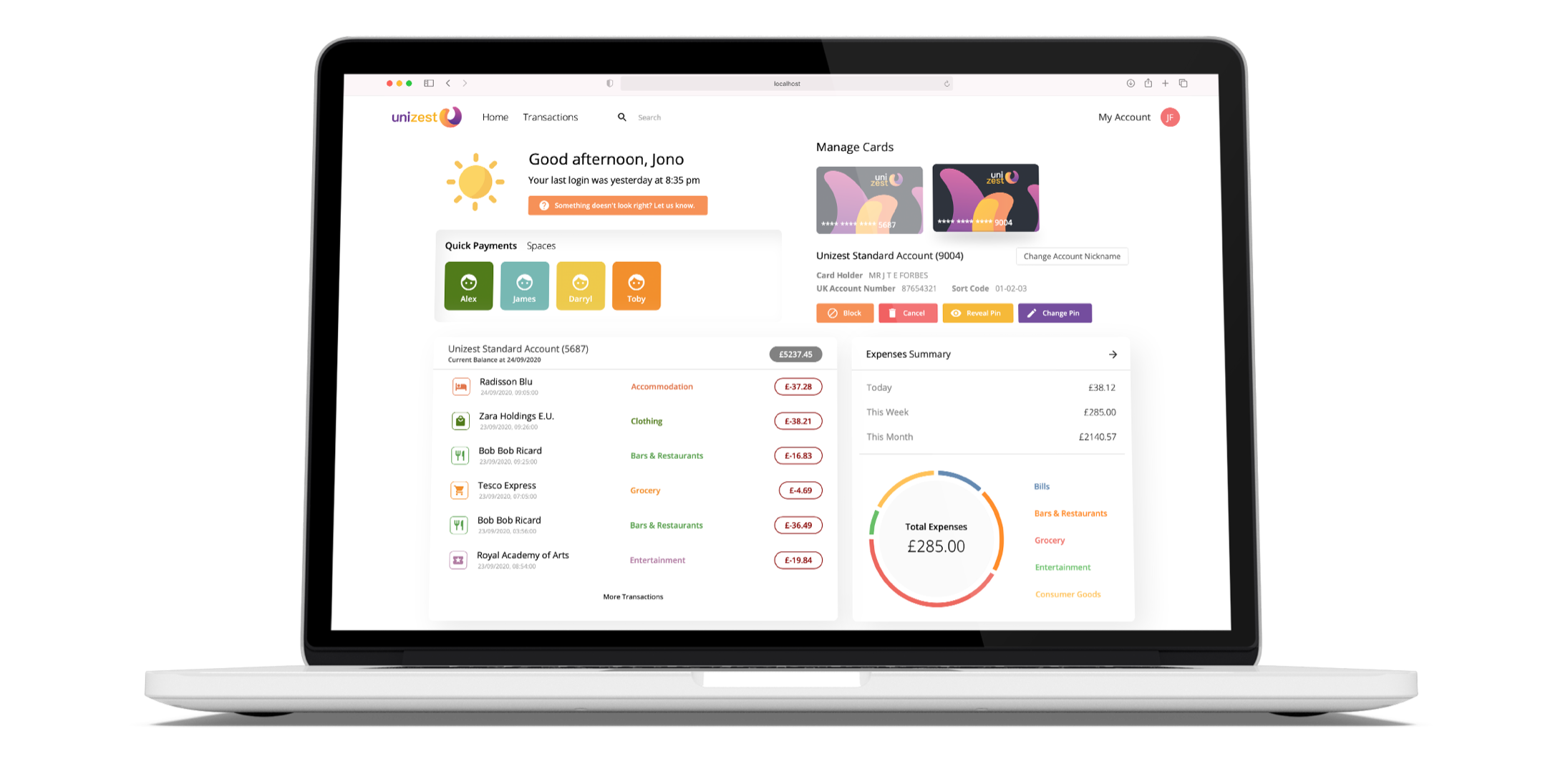

Newly formed Neofin Ventures - founded by fintech experts Matt Oldham, Tony Shawcross and Chris Donnachie - has secured a total of £300,000 in funding via Worth Capital’s The Start-Up Series and angel investors, allowing Neofin Ventures to relaunch Unizest, a provider of e-accounts for new residents to the UK. The renewed Unizest brand will enter the market with support from established industry leaders Mastercard and Railsbank.

Recognising the challenges non-UK workers and students face when opening a bank account in the UK, which can be a difficult to navigate and time-consuming process, the founder trio formed Neofin Ventures to offer a simple tech-based solution to this age-old problem building on Unizest’s technology.

Originally set up for international students, Unizest’s e-account solution will now be broadened to include new workers to the UK who can apply and set up their e-account before they leave their home country. Upon arrival to the UK, customers will then receive their Debit Mastercard.

“We aim to create the best start for people arriving in the UK for work or study. Healthcare, construction, and agricultural workers coming from overseas fill a crucial gap in the UK’s economy and industry recovery, however, they face numerous challenges when trying to do something as simple as opening a bank account."

“The issue creates friction and a gap between being able to work and being able to start. This can cause frustration for employers and stress for workers. At worst, it can lead to vulnerability as overseas workers are the most at risk of exploitation at work,” says Matt Oldham, co-founder at Neofin Ventures and mentor at Barclays Fintech Accelerator Techstars.

Unizest will partner with those involved in bringing people to the UK, such as recruiters and other agencies, to make the process as simple as possible and remove one of the barriers to making the first step into a new life in the UK.

Neofin Ventures co-founders Matt, Tony and Chris each have a minimum of 25 years experience in the financial services, business and banking technology sectors, including flagship names such as Visa, Mastercard and Amex. Their collective expertise and industry relationships have yielded interest and support from leaders in the world of finance.

Support from industry leaders

The funding round was led by Worth Capital as part of its The Start-Up Series competition. Neofin Ventures won the competition and went on to secure £200,000 from the Start-Up Series Fund.

Matthew Cushen, founding partner of Worth Capital, says: “Fintech is a popular sector for seed investment, but we have always been wary of investing in this frenzied space. Too often we see great tech solutions desperately searching for a problem to solve, or products and services in highly competitive spaces where the cost of acquisition is high but revenue generation is challenged - you can see this with many of the so called challenger banks. Unizest has a clear target audience, both the workers and students planning to come to the UK and the recruitment agencies and others that help them to get here. Then the difficulty of setting up accounts prior to being in the UK is a knotty problem for them all. The team has a route to that target audience that should end up with a very low cost of acquisition. And they have a product and brand proposition forensically tailored to their type of user, along with a team that has delivered in the past.”

The investment was further supported by a number of angel investors.

Sharing the same value of ‘creating the best start for people’, Mastercard and Railsbank are supporting Unizest’s re-entrance to the market.

Edoardo Volta, Head of Fintech at Mastercard UK & Ireland, says: “We believe in giving everyone, everywhere access to the digital economy with the means to pay, and be paid. It is great to be working with Unizest as they offer this innovative solution for underserved new to the UK workers.”

Louisa Murray, COO UK and Europe of Railsbank, the leading global Banking-as-a-Service platform, adds: “Advancing financial inclusivity was one of the main reasons why Railsbank was created, so it is good to be involved with Unizest, whose team has set out to provide e-accounts for new residents to the UK, helping their introduction to the country. We congratulate the team on the funding and the relaunch, and really look forward to working with them over the coming years.”

Under Neofin Ventures, Unizest is set to launch in June. Its services will be accessible through the website and as a downloadable app on iOS and Android.

Related News

By Matthew Woodley

Relationship Manager at emerchantpay at emerchantpay

After a year that will shape our lives in many ways for years to come, cryptocurrencies finally appear to have made their mark and look to be here for good. see more

- 06:00 am

Creatio, a global software company that provides a leading low-code platform for process management and CRM, today announced the company received the SOC 2 certification. The SOC 2 compliance verifies that Creatio adheres to providing the highest security and confidentiality levels to its customers.

SOC 2 attestation reports follow the American Institute of CPAs (AICPA) Trust Service principles and criteria. They give detailed information and assurance about the controls at Creatio relevant to security of the systems the organization uses to process users’ data and the confidentiality of the information processed by these systems.

“The SOC 2 compliance certification is a critical milestone for us. We are committed to our customers’ success and it’s fundamental to ensure our users’ data security and confidentiality. Being certified by an independent audit firm once again underscores the trustworthiness of the Creatio product line,” said Katherine Kostereva, Founder and CEO of Creatio.

Creatio helps organizations create low-code companies by providing a platform that allows for automating business ideas in minutes. The company combines an intuitive low-code platform, best-in-class CRM and a robust BPM in a single solution to accelerate sales, marketing, service and operations for mid-size and large enterprises.

The audit of the company services was performed by Yusufali & Associates (Y&A), a US-based CPA public accounting firm specializing in Audits and Consulting including SSAE18, Fed Ramp

and HIPAA Audits.

“Working with the Creatio team was truly a memorable audit experience. The information security team did not want to settle for anything but excellence and professionalism, with no compromises of quality or security. They worked hard and smart to ensure that they met all the SOC II Principles and Trust Services Criteria. Moreover , they aimed higher and also exceeded the expectations for the COSO Requirements. We are very pleased to have had the opportunity to Certify them with the SOC II Type I Certification,” said Yusuf Musaji, Founder, CEO and Managing Partner of Yusufali & Associates (Y&A).

Related News

- 01:00 am

Softline has received Linux and Open Source Databases Migration to Microsoft Azure advanced specialization, confirming Softline's proven track record and expertise in migrating workloads based on Red Hat Enterprise Linux (RHEL) or SUSE virtual machines, as well as open source MariaDB, PostgreSQL, MySQL and NoSQL databases to Microsoft Azure.

Softline is a global Microsoft Azure Expert Managed Service Provider (MSP), providing cloud migration services globally for all migration stages of an organization’s transition to the cloud, including assessing readiness, scope of work and design.

Earlier this year, Softline earned Azure Expert MSP status and the global Azure Global Delivery Center supports Softline’s project implementations. Planning for further infrastructure maintenance in the Azure cloud is underway and will result in Softline providing support services such as monitoring, management, handling security incidents and environment optimization.

Manoj Kumar, Vice President of Cloud Managed Services WW at Softline: “In February, Softline received Microsoft Azure advance specialization for Windows Server and SQL Servers Migration to Azure, demonstrating deep knowledge, extensive experience and proven success in migrating Windows Server and SQL Server-based production workloads to Microsoft Azure.

“In March, by earning Linux and Open Source Databases Migration to Microsoft Azure advanced specialization, Softline has once again proven our deep expertise in migrating production workloads running on Red Hat Enterprise Linux (RHEL) or SUSE virtual machines (and/or MariaDB, PostgreSQL, MySQL and NoSQL databases in Microsoft Azure).”

Rodney Clarke, Corporate Vice President of Global Channel Sales at Microsoft: “The Linux, Open Source Databases to Microsoft Azure advanced specialization highlights the partners who can be viewed as most capable when it comes to migrating workloads running on open source technologies over to Azure. Softline clearly demonstrated that they have both the competency and the experience to offer clients a path to successful migration to the cloud.”

Related News

- 01:00 am

Confluence Technologies, Inc. (“Confluence”), a global technology solutions provider delivering innovative products to the worldwide money management industry, and J.P. Morgan (NYSE: JPM) today announced a new development in their partnership to deliver a multi-asset portfolio analytics solution.

The enhancement completes the global coverage of Delta across all asset classes, further cementing Confluence’s standing in the industry, and enabling front-to-middle office decision makers to manage risk and performance. Confluence is already a market-leader in fixed income attribution according to a recent report conducted by Aite Group.

Delta first became available to J.P. Morgan clients in June 2019 during the first phase of the collaboration between J.P. Morgan and StatPro, prior to Confluence’s acquisition of StatPro in October 2019.

For Confluence, the expanding partnership is illustrative of the company’s continued growth following its acquisition and integration of StatPro last year and reaffirms Delta’s position as a key contributor to J.P. Morgan’s data and analytics platform.

Richard Crozier, Head of Product for Data and Analytics at J.P. Morgan’s Securities Services, said of the collaboration, “The integration of J.P. Morgan’s fixed income data and expertise with the Delta product represents the next stage in our ongoing collaboration with Confluence, and a huge step forward in increasing value to our clients globally. This new phase of our partnership will ensure that we continue to offer robust and comprehensive portfolio analytics tools, a critical part of delivering a full range of integrated solutions to our clients.”

Today's announcement is part of J.P. Morgan's commitment and strategy to deliver the needs of buy-side clients by providing clients access to a choice of solutions across the investment lifecycle, including front-to-middle office capabilities in data, analytics, and risk.

“We’re looking forward to our continued partnership with an impactful global leader like J.P. Morgan,” said Dario Cintioli, Managing Director - Delta Division at Confluence. “The combination of their U.S. asset data and analytics capabilities with our award-winning cloud-based Delta platform fills a gap in the market for a best-in-breed fixed income solution while completing its multi-asset coverage range.”