Published

- 03:00 am

Qumulo, the breakthrough leader in radically simplifying enterprise file data management across hybrid-cloud environments, today announced that Raynault VFX has partnered with Qumulo and AWS to innovate its rendering workflow, enabling the company to quickly scale to over 1,000 render nodes within a few minutes.

“Since we deployed the Qumulo File Data Platform, the game changed. The platform lets us spin up one thousand computers within hours, not days or weeks. And we’re confident we can scale to three thousand nodes”, said Simon Ouellet, Pipeline Developer at Raynault.

Raynault moved from a legacy rendering host to AWS. Working with AWS Thinkbox Deadline and Qumulo® Cloud Q, part of the Qumulo File Data Platform, Raynault more than tripled the pilot project’s 300 cloud render nodes to over 1,000 nodes within the same short timeframe.

Whenever the company needs to build a render farm, it simply orders extra nodes in AWS and easily launches render jobs using AWS Thinkbox Deadline. Once the frames are rendered, they are quickly copied back to Raynault’s on-premises storage.

This level of scalability boosts the creative team’s productivity, enabling artists to quickly order high-quality VFX renders and efficiently meet critical client deadlines.

Teams from Raynault, AWS, and Qumulo worked closely together to build the rendering stack. Qumulo customer success was extremely responsive during the pilot project and remains highly available today with near-immediate engineer response 24x7.

Related News

- 06:00 am

New research from BNPL provider, Clearpay, has shown that despite being the generation hit hardest by the pandemic, Gen Z and Millennials are the most financially savvy generation in the UK – with 68% of Gen Z and 61% of Millennials budgeting and saving more responsibly than their older counterparts.

The Accenture report reveals that in addition to topping up the piggybank, young people are also more cautious with debt. While as many Millennials have credit cards as Gen X did at the same age, their outstanding balances are 10% lower. This follows recent research from The Bank of England that reveals that consumer credit growth fell by 9.9% annually – the biggest slump since records began in 1994.

And when it comes to investing in the future, younger generations are the leaders in the uptake of remote banking and investment apps, with nearly three times as many young people (59%) using online apps to invest their money than older generations (19%). Millennials and Gen Z are also over 80% likely to use contactless, over 30% likely to use mobile payments and over 50% likely to use BNPL.

Damian Kassabgi, executive vice president for public policy at Clearpay says, “There are often misperceptions that young people are bad at saving and investing their money. However our research has shown that they are actually more cautious than many of their older counterparts and more committed to responsible spending.

The pandemic has prompted a surge in customers looking to spread out the costs of products without being subjected to extortionate interest rates and payment terms. Young people have seen the value of flexible payments and therefore it’s not surprising they are leading the charge in the payments revolution and becoming more spending savvy as a result.”

As the UK finally starts to emerge from lockdown, it seems that Gen Z were the generation hit hardest by COVID-19, with 11% losing their jobs during the pandemic vs. just 4% of Millennials, Gen X and Baby Boomers. Since 2020, Gen Z were furloughed at double the rate of older generations – as social distancing rules and lockdowns proved more likely to affect employment across hospitality and retail trade.

In addition to this, wealth has also fallen by 10% over the last decade for younger age groups, whereas for age groups 55+, wealth has increased by as much as 30%. The drop is driven by property ownership falling by 23% and student debt quadrupling over the last 10 years.

This means, home ownership is becoming less attainable for younger Brits, as housing costs have increased six times as fast as income. In the last 20 years, house prices have nearly tripled while median income has increased by only 30%. Therefore, 44% fewer Millennials own homes as Baby Boomers did at their age, while Gen Z are nearly 50% more likely to rent than Gen X.

Damian Kassabgi added, “During the pandemic, we have seen an 134% increase in customers opting to use our service, with 95% of customers choosing to pay via their debit instead of credit options. Over the last 12 months we have seen a definite shift towards more flexible payment options that help customers to budget and save towards their future.

Unlike some BNPL providers on the market, Clearpay specifically allows for responsible spending and our inbuilt protections mean that customers cannot fall into a revolving debt trap. We do not charge interest, late fees are capped and we automatically pause an account if a single payment is late.”

To find out more about Clearpay, please visit https://www.clearpay.co.uk/en-GB

Related News

- 04:00 am

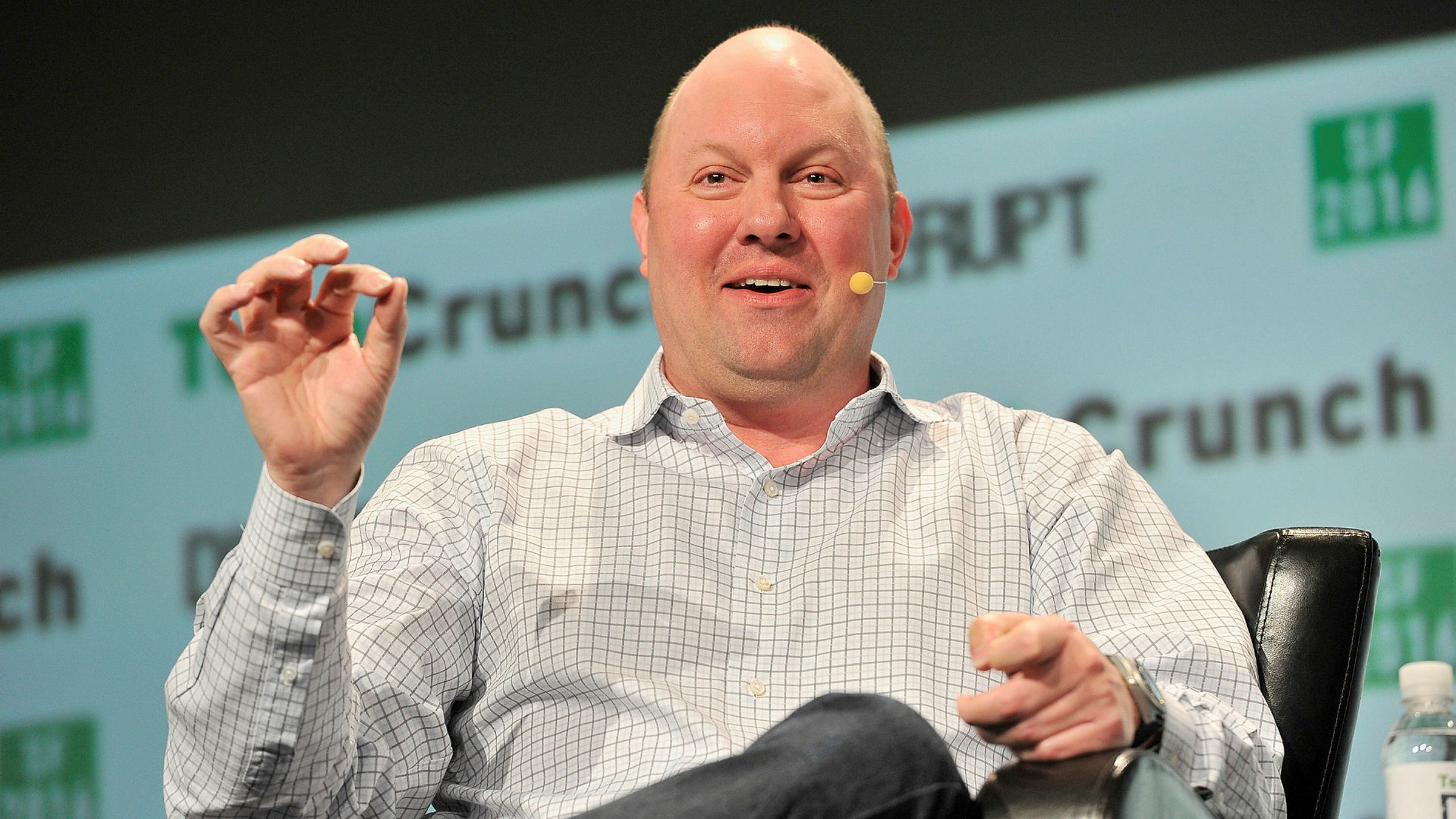

One of the most well-known venture capital firms out of Silicon Valley aims to raise between $800 million and $1 billion to back crypto startups, per the Financial Times. This will be Andreessen Horowitz’s third and biggest foray into the sector, following the $300 million and $515 million crypto funds it launched in June 2018 and April 2020, respectively.

Andreessen Horowitz, much like other funds, is ramping up crypto investments in a bid to ride the sector’s recent tailwind. The rapid rise in retail and institutional demand in recent months is driving crypto startups’ growth, with crypto exchange Coinbase earning more in revenues in Q1 than all of 2020 and BlockFi reaching $15 billion worth of assets held on its platform in March, up from $1 billion in the same month last year. Andreessen experienced impressive returns from its earlier investments in the crypto space and is undoubtedly looking to recreate this success: Its stake in Coinbase, in which it started to invest in 2012, was worth $11.2 billion when the exchange went public in April, more than half the amount of capital the VC raised from investors in its 12 years of operation. Other funds are also increasing their commitment to the space, with Pantera Capital seeking to raise another $600 million following its $175 million crypto fund in 2018, per the FT, and Multicoin Capital raising a second $100 million fund.

Insider Intelligence expects the VC bullishness to drive global blockchain funding to a new record in 2021, in part driven by investments in B2B crypto startups targeting financial institutions (FIs). Global blockchain funding dipped in 2020 to $2.8 billion, but the successive mega-rounds during Q1 among crypto startups have already brought funding volume up to $2.6 billion. The latest announcements by Andreessen and its peers will help further fuel crypto raises in the coming months to set a new funding record in 2021, beating the current record of $6.9 billion set in 2018. With more and more FIs testing new crypto products, business-to-business crypto startups that facilitate these projects will likely be especially attractive to VCs. For example, Fireblocks and Consensys recently raised funding to help FIs issue stablecoins or securities on the blockchain and develop blockchain-powered payments.

Related News

- 07:00 am

Vikram Rangal, Chief Operating Officer of ZebPay, on the launch of crypto-linked indices at S&P:

“The launch of S&P's cryptocurrency indices should come as no surprise. India's crypto industry has been saying for years that crypto is another asset class, so it makes perfect sense for S&P Dow Jones to list it as such. S&P is not trying to legitimize Bitcoin and Ethereum or make them respectable. They're acknowledging the fact that many of the world's leading companies already see crypto as a legitimate and respectable asset class that investors should at least watch, if not diversify into. It's high time India's financial community caught up to the US, tapped into the thousands of crores of economic opportunity those indices represent, and acknowledged publicly what they are already saying in private.”

Related News

- 05:00 am

Tippy, the revolutionary digital tipping platform, today announced it has been selected to join Mastercard Start Path, an award-winning program for fintech innovators. Annually, Mastercard evaluates nearly 1,500 startups for possible participation in Start Path. Less than 2% of applications are accepted into the highly competitive six-month accelerator program.

As a point-of-sale solutions provider, Tippy has spent the last three years providing an opportunity for tens of thousands of salon and spa industry professionals to earn more income. The cashless solution instantly deposits tips into the service professional’s account while reducing significant processing fees for business owners. And using the robust application (available for download on IOS and Android devices), the industry professionals were able to increase their average tip income significantly.

“Our main focus and goals for our service professionals have always been higher tips, immediate access to funds and overall empowerment through new financial tools”, said David Tashjian, CEO of Tippy. “With Start Path, we have the opportunity to accelerate the growth of our platform by using support from Mastercard’s network of innovators and experts and leveraging the success we have had in the beauty industry. This program will be instrumental for us to move forward and be able to empower more by replicating the model in multiple verticals”.

Mastercard will work with Tippy to grow its footprint in other fintech-oriented verticals where tipping is an important source of income for its professionals, including hospitality, health/wellness, and tourism. Leveraging Mastercard’s resources and relationships, the tipping platform will now look to expand not only domestically but also internationally.

“As the fintech landscape evolves at an unprecedented speed, Mastercard provides the infrastructure and assets to help fintech innovators grow and ultimately bring more people into the digital economy,” said Amy Neale, Senior Vice President, Fintech & Enablers. “Through Mastercard Start Path, we’re partnering with Tippy on their path to scale and providing the technology, expertise and resources to help drive a more inclusive economy.”

Tippy recently completed a set of APIs allowing points-of-sale in each of its targeted verticals to integrate and offer Tippy’s solution on a much broader scale.

“We couldn’t be more excited about the partnership traction we’re having with POS’s in both the beauty space and other verticals,” said Terry McKim, co-founder and CIO at Tippy. “And with tools like QR codes and Mastercard’s Click to Pay, our presence in the tipping space will flourish.”

For more information about Mastercard Start Path, visit https://startpath.mastercard.com/.

Related News

- Product Reviews

- 06.05.2021 05:32 pm

1. What does the product do?

Finzly’s BankOSTM platform is a cloud-native, robust, scalable platform that encourages an open ecosystem, giving banks and credit unions the freedom to:

Choose from Finzly’s array of products, including payments, digital account opening, foreign exchange, and many more;

Leverage other fintechs of their choice; or

Build their own differentiating products using the platform’s SDK and APIs.

The platform easily integrates with FIs’ existing core, giving them the choice to uphold their legacy services while being able to launch new products and services to compete with fintechs and new market entrants.

Finzly’s Payment Hub is an award-winning payment services hub that frees banks from managing multiple systems and vendors by efficiently connecting to multiple payment networks through intelligent payment routing and open payment APIs into a single user interface. Apart from supporting legacy payment networks like ACH, it also comes with built-in payments rails to enable the rollout of real-time payments through The Clearing House’s RTP Network and the soon-to-come FedNow from the Federal Reserve.

2. Who needs the product?

Banks, credit unions, correspondent banks and fintechs can take advantage of Finzly’s modular banking solutions, powered by a robust platform that helps build the bank of the future. Using Finzly’s unified platform, fully loaded with banking services, FIs can offer Banking as a service (BaaS) to downstream banks and other fintechs, thus opening new revenue streams.

3. What is special about the product?

BankOS allows FIs to consolidate all their solutions aligned to their business model into one central platform. This not only streamlines API integration to fintechs, but also reduces operational costs through pragmatic vendor contracts, while establishing the perfect infrastructure for innovation. FIs can embark on innovation without ripping or replacing their existing cores, while leveraging the easy integration features of BankOS to the existing legacy cores.

4. What features are relevant?

Open Banking APIs

Real-Time Payments

Fedwire and ACH Payments

Global Payments

Interoperability of Payments

Customizable Payment Workflow

Cloud Services

AI-powered KYC for Digital Account Opening

Real-time Verified Deposits

Built-in Regulatory Compliance

Better Back-Office Controls

White-Labeled Applications/Cards

Banking as a Service (BaaS)

Deposit as a Service

5. What awards have recognized the product?

In the 2020 Finovate awards, Finzly’s Payment Hub was awarded “Best Enterprise Payments Solution,” while BankOS was named a finalist for the award category, “Best Back-Office/Core-Service Provider.”

During the FinovateFall 2020 conference, Finzly’s demo of BankOS was awarded “Best of Show.” Additionally, Finzly was awarded “Best of Show” at the FinovateWest 2020 conference for the company’s low-code, adaptable workflow engine, Finzly Flow, and its contactless digital account opening (DAO) solution.

6. What are some real case examples?

Fulton Bank Streamlines Foreign Exchange and Trade Finance Operations with Finzly FX STAR and EXIM STAR

Lead Bank Taps Finzly’s Award-Winning Payment Hub to Modernize its Payment Capabilities

Texas First Bank Selects Finzly’s Award-Winning Digital Account Opening Solution

Other Product Reviews

- 06:00 am

oneZero, a global leader in multi-asset enterprise trading technology solutions, today announced three new post-trade Regulatory Vendors with direct access to oneZero’s Data Source data.

IHS Markit, TRAction and Tradefora today join other vendors already on the platform, including the previously announced partnerships with EMIREP, SteelEye and Point Nine. The news provides clients with more options for integrating with a vendor that best fits their regulating needs – which can mean using multiple vendors across jurisdictions at the same time.

Data Source is an agnostic cloud-based business intelligence toolkit, which unlocks clients’ trade, quote and quote derivative data in Data Source DNA, and turns it into meaningful business intelligence and opportunity analytics in Data Source Insights. Partner vendors in oneZero’s EcoSystem may access the same underlying neutral data from Data Source seamlessly, with no additional effort made by brokers.

oneZero CEO Andrew Ralich commented: “oneZero’s mission is to give our customers greater control throughout the entire trading lifecycle. By offering the widest-possible offering of post-trade Regulatory Vendors, we are giving customers the ability to seamlessly integrate with the vendor of their choice – no matter how their business changes or evolves to market conditions.”

“At IHS Markit, we aim to simplify and ease regulatory reporting using our single platform for multiple jurisdictions. Our clients will continue to enjoy a seamless, albeit enhanced integration between our two platforms. The integration with the oneZero EcoSystem will allow oneZero clients to use our best-of-breed services with no technical integration effort on their side,” said Ronen Kertis, Head of Global Regulatory Reporting at IHS Markit.

"TRAction is committed to the provision of seamless and simple regulatory reporting services, hence our decision to partner with oneZero. This partnership has expanded our access and reach to oneZero's growing customer base, allowing oneZero clients to easily comply with their EMIR, MiFIR, Best Execution, ASIC, MAS and other reporting obligations via TRAction's end-to-end reporting solutions," commented Quinn Perrott, co-CEO, TRAction Fintech.

Pavel Khizhnyak, Co-Founder/CEO, Tradefora commented: “The right regulatory partner can significantly lower the burden of compliance. We are thrilled to be partnering with oneZero today. We build all our products around the concept of best execution, which can’t be done without the ease of access to the underlying data. Integration with oneZero Data Source greatly reduces the integration costs and deployment time of Tradefora’s solutions for oneZero customers.”

Related News

- 06:00 am

FANGMA stocks are enormous market drivers and are often regarded as a proxy for the entire US economy. With products and services found in almost every household giving them a dominant stance in their respective business sector. For investors, engaging with FANGMA companies can become quite tricky since acquiring only one Amazon stock, investors need to reach deep in their pockets. With investing in Evolve ETFs’ FANGMA ETF, investors can participate in the fund’s performance with only a fraction of the cost that was involved if investors would buy these stocks natively.

“These six companies have transformed our world and have been a big driver of growth and returns for our markets,” says Raj Lala, President and CEO at Evolve. “In fact, last year they accounted for more than half of the performance in the S&P 500 and the NASDAQ 100. One of the numerous operational advantages of using this fund is the fact that investors can get exposure to these six companies for a $10 starting share price. This compares with investing almost $7,000 at current market prices to purchase one share of each of these companies.”

“FANGMA companies changed the ways we communicate, work, and entertain ourselves. Their predominant market position enabled them to penetrate every household, and, admittedly, I am myself a loyal customer of all FANGMA companies,” comments Timo Pfeiffer, Chief Markets Officer at Solactive. “FANGMA companies played their cards right for a long period, allowing them to constitute high market entry barriers that possibly further corroborate their leading role even more.”

Related News

- 01:00 am

Integral (www.integral.com), a leading technology company in the foreign exchange market, reported today average daily volumes (ADV) across Integral platforms totaled $43.3 billion in April 2021. This represents a decrease of -19.2% compared to March 2021 and an increase of +23.4% compared to the same period in 2020.

Reported ADV represents volumes traded across the group’s entire liquidity network, including TrueFXTM and Integral OCXTM, in aggregate.

Integral’s global trading network has been designed to meet the execution needs of the widest variety of FX market participants, including banks, brokers, asset managers, and hedge funds. Our clients leverage the deep and diverse FX liquidity available through our platforms and have the choice to trade any execution-style required, all within an integrated environment.

For more information visit integral.com.

Related News

James Booth

VP Head of Partnerships for EMEA at PPRO

While most of the world can’t travel across borders just yet, we can certainly shop across them. see more