Published

- 05:00 am

LPA Group, the capital market technology and innovation leader, today announced the expansion of its French office with two new senior hires: Michael Lemke as Head of Client Delivery Solutions and Vincent Stefanović as Client Director Sales for the Buy-Side.

Based in Paris, Michael and Vincent will join Thomas Geist, Senior Sales Account Manager, in promoting LPA Group’s innovative technology solutions for financial services and supporting the firm’s growth in France, Benelux and Italy.

Michael has over 25 years of experience in supporting financial institutions and corporate treasurers with digital transformation programmes on all operational and functional aspects. He spent several years as an independent adviser and previously worked for Calypso Technology and Murex in project management roles.

Vincent has more than 20 years of business development experience and a proven track record in opening new markets and launching new products for the buy-side, synthesizing complex data, risk and compliance monitoring and reporting market needs for global tier 1 financial institutions. Prior to LPA, He held senior sales roles at DST, Finantix and State Street where he held senior sales roles.

Commenting on his appointment, Michael Lemke said: “LPA delivers state-of-the-art technology for financial institutions. I believe my expertise and network will spearhead the firm’s growth in France and beyond.”

Stefan Lucht, Founder and Managing Partner at LPA commented: “The financial services industry has evolved at an incredible rate in recent years, underpinned by rapid advances in technology. The Covid-19 pandemic has served as a stress test for investments made over the last decade and it has shown that innovative players were much better positioned to weather the storm. This has also resulted in a surge in demand for our products and services across the continent. We would like to welcome Michael and Vincent to the team, whose experience and skillsets give us confidence to help us drive continued growth against this backdrop of opportunity for the business.”

Related News

- 09:00 am

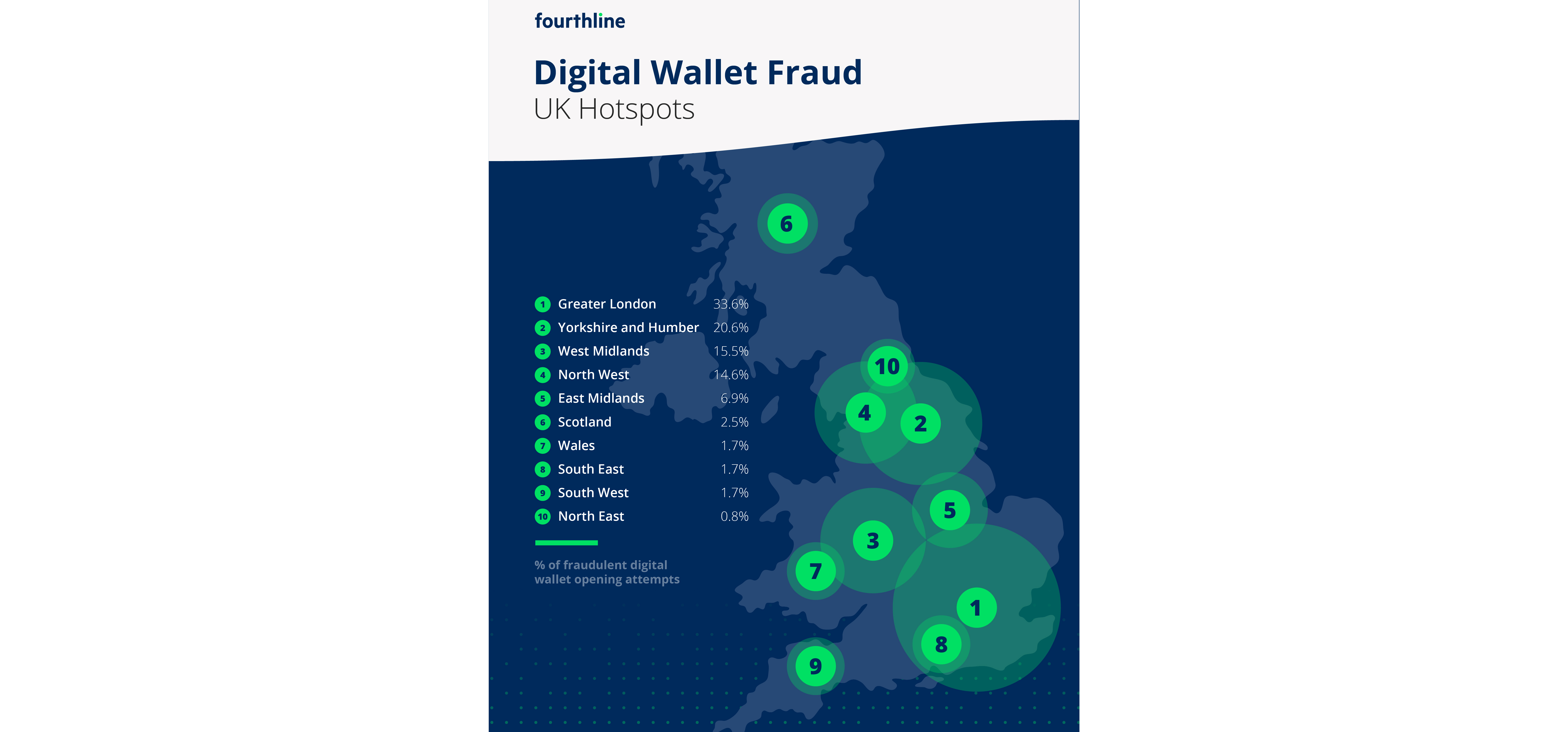

Fourthline, the digital identity and verification specialist, has released findings from its Digital Identity Fraud Analysis Tool, which looked specifically at the different ways fraudsters have attempted to create digital wallet accounts in the UK over the last six months. The UK Digital Wallet ID Fraud Pulse, analysed data over the period January 2021 to June 2021, to reveal criminals most commonly used counterfeit driving licences when attempting to open a new digital wallet account.

Digital or mobile wallet payments have skyrocketed in the UK - used for just under a third of all online transactions in 2020, according to payment processor Worldpay. This explosion in usage presents an opportunity for fraudsters to use counterfeit or tampered ID to create illegal digital wallet accounts. As the real identity behind these fraudulent accounts is unknown, the accounts can be used to launder money; for bribery purposes, wider scams and tax evasion; as well as making purchases and transferring money.

Fourthline analysed anonymised data from digital wallet account openings in the UK over the last six months. Its UK Digital Wallet ID Fraud Pulse reveals that:

1. Driving licences most commonly frauded ID document

- Driving licenses are the most common counterfeited identity document used to open a fraudulent digital wallet in the UK (55.2% of all fraud attempts)

- This is followed by a passport and non-UK national ID cards (both 18.4%) and residence permit (7.8%)

2. London is counterfeit ID hotspot for digital wallets

- Greater London is the counterfeit ID hotspot for digital wallet opening attempts in the UK: 33.6% of all fraud attempts were recorded in Greater London, followed by 20.6% in Yorkshire and Humber.

- The West Midlands experienced the next highest amount of fraudulent digital wallet openings (15.5%), followed by the North West (14.6%) and East Midlands (6.9%).

- Meanwhile Scotland (2.5%), Wales, the South East and South West (all 1.7%) and North East (0.8%) have the lowest amount of fraudulent digital wallet opening attempts.

3. Characteristics of a digital wallet fraudster: Mid to late 20’s male most common profile

- Nine in ten fraudulent digital wallet opens have a male profile (89.1%)

- The most common age profile of a fake digital wallet account opening is aged between 26 - 30 years old (27.7%) followed by age 22- 25 years old (18.5%);

- According to UK Finance, nearly 40 per cent of 25-34-year-olds and close to 30 per cent of 16-24-year-olds were registered to use mobile wallets.

- Criminals tend not to create older fake profiles – the least common age profile for a fake digital wallet account opening is aged between 56 - 60 years old (0%) followed by 61- 65 years old and 51-55 years old (both 1.8%).

- According to UK Finance, the proportion of people in the 65+ age group registered for mobile payments is lowest with just under 5%.

Krik Gunning, Co-founder and CEO of Fourthline comments: “The shift to storing our identity in digital wallets brings greater convenience and control of our sensitive personal data. Yet fraudsters are pushing to exploit the freedoms digital wallets provide. Providing the highest levels of security and compliance at account sign up is crucial to pinpointing digital wallet fraud and preventing fraudulent account openings.”

METHODOLOGY

The figures are based on an analysis of Fourthline’s data of over 20,000 digital wallet account openings in the UK. The data consists of applicants with a residence address in the UK over the period January 2021 to June 2021. UK regions are derived from postal codes.

Definition of Document fraud: the use of inauthentic government-issued IDs. These can either be counterfeit, where the entire document is fake, or tampered documents, where only certain details of legitimate ID documents have been altered. This can include the substitution of photos, printed and cut copies of genuine documents, altered information on genuine documents (i.e. expiration dates or birth dates) and entirely forged documents made from scratch.

Related News

- 09:00 am

Tata Consultancy Services (TCS), leading global IT services, consulting, and business solutions organization, announced that Commercial Bank of Kuwait (CBK), one of the largest financial institutions in Kuwait, has selected TCS BaNCS™ for Treasury to manage risk better, enhance asset class coverage, and drive future growth.

CBK was looking for a modern, integrated treasury solution to help transform its treasury operations and offer new generation asset classes, enhance risk management, and ensure regulatory compliance. TCS BaNCS for Treasury will help CBK offer a wider range of cash and derivative treasury products, integrate various trading and messaging platforms, manage cash and positions in real time, and offer extensive accounting and reporting capabilities. This front-to-back, cross-asset solution will enable the bank to lay a firm foundation for digitization and expand its customer base.

The integrated solution offers comprehensive straight-through processing, and fully automated confirmation, settlement, clearing, collateral management and dispute resolution along with integrated accounting. It rests on a digital core and comes with standardized and well-documented APIs that can seamlessly integrate with the existing IT landscape of CBK.

Hussain Al Aryan, General Manager, Treasury & Investment Division, Commercial Bank of Kuwait, said, “We have been a premier provider of banking services in the region and the treasury business in a critical part of our bank’s overall revenue stream. We selected TCS BaNCS for its breadth and depth of functionality and successful track record of treasury programs deployed at leading financial institutions in the region. With TCS BaNCS, we look forward to transforming our treasury operations, making our bank future ready, enhancing customer experience, easing regulatory compliance, and bringing in exotic asset classes to our product mix. We believe that our partnership with TCS will help us meet the challenges of the future.”

Venkateshwaran Srinivasan, Global Head, TCS Financial Solutions, said, “We are delighted to partner with the Commercial Bank of Kuwait in their treasury transformation initiative. TCS BaNCS’ comprehensive treasury solution offers much higher levels of straight-through-processing, enhances risk management and compliance and enables superior customer experience. This partnership further underscores our strong commitment to the Middle East market and is a testimony to our deep contextual understanding of the industry and local market practices.”

TCS BaNCS for Treasury is a cross-asset-class solution that is intelligent, agile, and automated. It is a multi-entity, multi-currency solution for front-, middle-, and back-office operations in treasury and trading. The solution supports a range of asset classes such as cash products on the foreign exchange, money markets, fixed income, and equity. It also covers OTC and exchange traded derivative on FOREX, rates, equity, credit, commodities and alongside OTC hybrid structures.

Its powerful and comprehensive functionality, with rich risk analytics, enables institutions to move from country- and asset-class-wise systems to a single platform aimed at proactively managing and monitoring organizational risk exposures. It further helps organizations identify the source of risk through innovative desk-book folders and risk transfer mechanisms. Architected on a robust, state-of-the-art Java EE and SOA-enabled architecture, it facilitates rapid enterprise integration. Following TCS BaNCS’ Digital First, Cloud First philosophy, the solution is platform-agnostic and has the facility to house multiple treasury units under one installation.

Related News

- 07:00 am

Splitit, the company empowering consumers to use their existing credit to spread payments over time, announced a partnership with tabby, the leading Middle East Buy Now Pay Later (BNPL) provider. tabby will integrate Splitit’s instalment payment platform through a white-label solution to allow tabby’s merchants to offer instalments on credit cards. The integration of Splitit will also allow tabby to expand its offering to new merchant categories and those with higher average order values.

tabby will integrate Splitit’s technology into the tabby BNPL platform to seamlessly provide shoppers with an additional option to pay in instalments over time using their credit card. The integration to tabby’s BNPL platform is expected to be completed by the end of Q3 2021.

tabby is the leading BNPL provider serving the United Arab Emirates (UAE) and Saudi Arabia, supporting more than 2,000 merchants, including Ikea, SHEIN, Marks and Spencer, adidas and Toys R Us. In 2020, the eCommerce market was valued at US$11 billion in Saudi Arabia and US$7 billion in the UAE and is expected to double in size in the next five years.1 tabby offers a consumer financing option for shoppers to pay for items in four equal instalments and has a high-profile brand in the region. tabby integrates directly into merchant checkouts or POS systems and does not charge shoppers interest.

“This is a great partnership for us at tabby as it allows us to broaden our product offering to existing merchants as well as enter new verticals across the markets we serve,” said tabby founder and CEO Hosam Arab. “Splitit has an elegant solution that will fit nicely within our product and complement our financing options for higher-value purchases.”

“We are delighted to be partnering with tabby to expand their market-leading offering. We’ve always seen our solution as complementary to other BNPL providers, which this new exciting partnership with tabby highlights perfectly. Our global payments platform is the only solution leveraging credit card payment networks, with the flexibility to scale internationally without the need for major on-the-ground support,” said Splitit CEO Brad Paterson.

“Having expanded our platform capability, we can now also offer white-label solutions as a way to enter new regions such as the Middle East by partnering with established players that already have a strong market presence. While we remain focused on further penetration of Splitit’s branded product in the US, APAC and Europe, this provides a new low-cost, high-margin revenue stream which we can easily emulate in other markets,” added Mr. Paterson.

To learn more about Splitit or to partner with Splitit, visit: https://www.splitit.com/partners/

Related News

- 01:00 am

- 85% of respondents at global financial institutions believe Banking as a Service (BaaS) will make an impact over the next year; 40% believe the impact will be significant

- More than 9 in 10 respondents agree that Open Banking is important to their organization; 97% of those that already use Open Banking recognize that it has provided benefits to their business

Finastra research reveals that Banking as a Service (BaaS) and embedded banking services are set to have a notable impact on the industry in the next 12 months. Whilst all markets broadly anticipate this trend - 85% of respondents at global financial institutions - Hong Kong (92%), the UAE (90%) and Singapore (87%) expect the impact to be greatest.

The ‘Financial Services: State of the Nation Survey 2021’, also finds that most organizations are now deriving the benefits of Open Banking and Open Finance, with the latter considered the natural evolution for the sector. Globally, 94% of those surveyed agree that Open Banking is important to their organization, with 63% reporting that it’s enabled them to improve customer experience and 59% stating that it’s helped attract new types of customers.

The research was conducted amongst 785 professionals at financial institutions and banks in March 2021 across the US, UK, Singapore, France, Germany, Hong Kong and the UAE. It explores the Open Banking and Finance landscape, the technology and initiatives set to make an impact in financial services over the next year, and how COVID-19 has impacted the sector.

Other insights include:

- Alongside BaaS, mobile banking and artificial intelligence are identified as the other top technologies which will be improved or deployed in the next 12 months. 95% of organizations are forecasting that they will look to improve or develop technology in this period. The UAE (44%) and Hong Kong (42%) lead the way when it comes to interest in mobile banking, compared to an average of 36% across all seven markets.

- Collaboration remains important to 94% of financial services institutions, though there remain several existing and new barriers surrounding regulation, security, and technology. Complex regulations have been identified as a significant barrier, with 40% of global respondents agreeing. France (47%), Singapore (45%) and Germany (44%) picked this as their number one barrier. An increase in security risk was identified as the top barrier by banks in the US, Hong Kong and the UAE (all 40%), while legacy systems and IT was cited as the top barrier to collaboration in the UK (48%).

- COVID-19 has acted as an accelerator for businesses to adapt and invest in new technology and innovation, according to 8 in 10 global organizations. Respondents in Singapore (87%), the UK (82%) and the UAE (82%) are most likely to agree.

- Financial services organizations are increasingly looking at their organizational purpose. 86% agree that ‘financial services and banking is about more than just finance, and we have a duty to support the communities we are serving’. At Finastra, we call this redefining finance for good.

“Our findings show how financial institutions are already benefiting from Open Banking and, new this year, a growing role for BaaS. We believe that these initiatives have already started paving the way to true Open Finance, helping financial services institutions to develop and enhance the services they provide to their customers,” said Eli Rosner, Chief Product and Technology Officer at Finastra. “For BaaS specifically, 81% of global respondents see it as a means to grow business, enhance their distribution channels, shorten time to market and streamline operations. Valuable insight from so many financial institutions sets the tone for the evolution of financial services as banks and their customers adapt beyond the pandemic and, together with the industry support they provide, serve their communities better.”

Access the full report and findings here.

Related News

- 07:00 am

Chirag Shah, CEO, Nucleus Commercial Finance comments:

“SMEs across the country were hoping to reopen on 21st June and had naturally planned for this financially. This delay combined with winding down of government support is undoubtedly a big blow for those businesses who have started making repayments on existing facilities. Our own research found that only a quarter of SMEs were anticipating a delay to reopening, meaning the majority of businesses were caught off guard.

“As we enter the next stage of the lockdown exit strategy, SMEs will need more support than ever and this is where the government has a vital role to play. What businesses need is a clear road map and better communication around delays to restrictions, which will allow them to plan for the future and ultimately their success.”

Related News

- 07:00 am

Related News

- 09:00 am

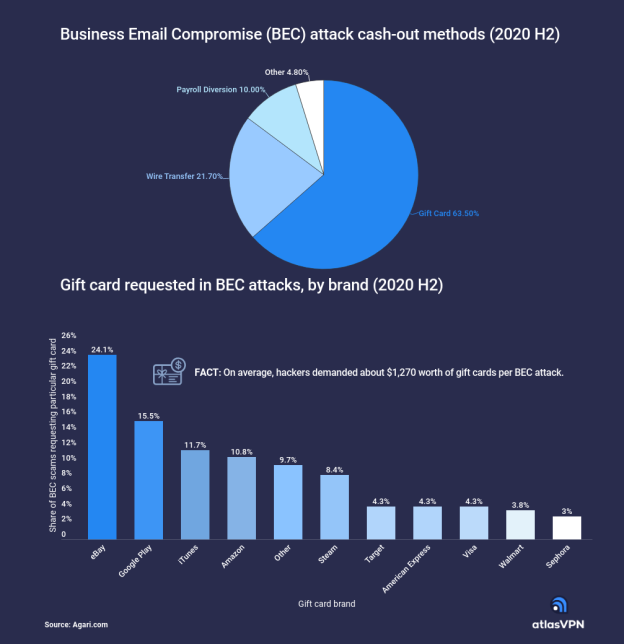

Business Email Compromise (BEC) and cyber attacks are on the increase worldwide. Conveyancing firms, their clients, and other organisations effecting many large non-recurring type transactions are particularly vulnerable to BEC fraud. Ryan Mer, Managing Director, eftsure Africa, a Know Your Payee™ (KYP) platform provider says gaps in organisations’ payment systems not only pose massive financial and reputational risks, but can have serious legal implications as well.

According to a global survey conducted by Mimecast Cyber Security Services in 2020, six out of ten companies globally were infected with ransomware and there was a 64% increase in email threats. An Accenture report from May 2020 confirms South Africa had the third most cybercrime victims globally, resulting in losses topping R2.2 billion.

All too aware of large deposits made to and from conveyancing firms, criminals target and intercept email accounts and scam victims into making payments into the incorrect account. While legislation like the Financial Intelligence Centre Act (FICA) and Protection of Personal Information Act legally requires attorneys and estate agents to responsibly gather and scrutinise an individual’s information, Business Email Compromise remains a threat to any organisation and its clients. In South Africa there is case precedence for firms being held liable for payments that did not reach the intended recipient; a situation that demands email correspondence containing bank details and personal information be handled with caution.

In circumstances where organisations are unable to meet their financial obligations as a result of a BEC attack, third parties may seek compensation for disrupted business operations and other losses, particularly where a firm is found to be in breach of its duty to take adequate measures to mitigate the risks of BEC attacks. It’s critical that attorneys and clients should take additional care in verifying account details before making payments and should be made immediately aware of sudden changes in email addresses and bank details.

Most threats can be avoided with the correct financial controls as well as server, IT and email monitoring processes together with the following measures:

- Be Informed, keep up to date with the latest scams and ensure your employees, colleagues and trading partners are aware of how they work in practice.

- Review your company practices in relation to password and security controls. Never share passwords across multiple sites or permit weak password.

- Acknowledge the fact that employee email accounts are gateways to sensitive information and attacks and enforce policies restricting what information can be kept in email inboxes prior to secure archiving. eftsure’s secure, digitised payee onboarding platform can assist with the collection and management of payee information.

- Re-evaluate your financial procedures for approving payment release. A platform like eftsure can help limit the risks of BEC attacks by cross-referencing the payments an organisation is about to release with a database of verified bank account details. eftsure’s fully integrated platform will clearly alert to any suspect payments, at point of payment, allowing an organisation to deal with it before making payment i.e.: before the flow of funds have occurred.

Related News

- 03:00 am

A new study by Juniper Research has found that the global value of virtual card transactions will reach $6.8 trillion in 2026, from $1.9 trillion in 2021. Virtual cards, secure digital cards with randomly generated details, will show strong growth as they are increasingly used for B2B payments. The research identified that businesses will value the simplicity of virtual cards, compared to the expensive and slow methods still being used, such as cheque payments, which remain popular in the US.

The new research, Virtual Cards: B2B and B2C Applications, Competitive Analysis & Market Forecasts 2021-2026 Market Research, predicts that outside of the dynamic B2B market, the added security from virtual cards will also appeal to the consumer market. To capitalise on virtual card opportunities, vendors must identify which segment they are targeting and emphasise the most important value-added features, such as ERP integrations or consumer brand partnerships.

For more insights, download the free whitepaper: Virtual Cards ~ The Future B2B Solution Whitepaper

B2B Payments Dominating Transaction Value

The report found that B2B payments will continue to account for the majority of virtual cards transaction value; amounting to 71% of the total value in 2026. While B2B sales occur less frequently, yielding under 1% of transaction volume in 2026, average transaction values are much higher in the B2B segment. This means that vendors must ensure that security features and automation are emphasised to facilitate large payments as efficiently as possible.

Indian Subcontinent Seeing Strongest Growth

The research forecasts that the Indian Subcontinent will be the fastest-growing region over the next five years, with transaction volumes increasing more than tenfold. India, in particular, will present enormous potential for vendors.

This growth will be underpinned by the presence of major vendors in the region, such as SBI and Oxigen Wallet. The high adoption of virtual cards in the buoyant mobile wallets sector will drive eCommerce usage. Additionally, the report identified the requirement by the RBI from October 2020 for users to have control over card use to prevent fraud as a major growth driver.

Whitepaper Download: https://www.juniperresearch.

Virtual Cards Market Research: https://www.juniperresearch.

Related News

- 07:00 am

David Jones, Chief Market Strategist at European investment trading platform,Capital com, said: “It has been a calmer week in markets following the interest rate-inspired fireworks we had at the end of last week. In fact, it has been business as usual for many major assets."

"Crude oil pushed higher again, trading briefly above $74 to set its best levels since October 2018. Both the US and NASDAQ stock market indices hit fresh all-time highs, shrugging off the volatility seen last Thursday and Friday where the threat of rates rising sooner rather than later sent investors heading for the exit."

"Perhaps oil is the maket to watch in the weeks ahead and will give us a hint as to whether investors' nerves are starting to crack. Markets are speculating that crude will hit $100 per barrel, which, let's not forget, famously traded negative in April 2020. When even the pessimists are starting to join the bulls, that's precisely the time to start wondering if perhaps the incredible recovery we've seen across many asset classes has gone far enough."

"It is at times like this of course that markets could be thought to be the most vulnerable - and investors become over-complacent, as riskier assets bounce back from various mini-panics. But traders so far seem happy to step in and buy the dip."

"The spectre of inflation is still out there, with the Bank of England (BoE) adding its voice to the chorus of central bankers aware of the risk of rising prices, but the BoE does not look overly concerned. UK inflation is at a 2 year high but, like its American counterpart, the BoE expects any move higher to be just temporary. It remains to be seen whether this central bank sang-froid comes back to bite these venerable institutions later in the year."

"Meanwhile, the crypto faithful felt more pain this week as Bitcoin dipped briefly below $30,000 - but even that was seen as something of an early summer sale and, so far at least, it has managed to bounce-back by more than 10% in a matter of days.”