Published

- 01:00 am

Exactpro, a leading software testing provider for mission-critical financial market infrastructures, today announces the publication of a case study detailing its contribution to the successful launch of the Members Exchange (MEMX) into the U.S. equity market, and subsequent completion of its U.S. stock exchange rollout with the trading of all NMS symbols, through delivering extensive functional testing and test automation to the innovative, customer-centric market operator. The case study is available on the Exactpro website here.

MEMX engaged Exactpro at the early stages of the program for review of the client-facing specifications in order to deliver clear and transparent documentation to the participants. Working in close collaboration with MEMX’s in-house testing team, Exactpro’s work included the initial analysis of the test scenarios and specifications, as well as test designs, bespoke implementation in addition to test planning and monitoring. For the project Exactpro deployed th2, its new next-generation test automation framework, into the testing process not only for active testing, but also for passive data consistency checks and reconciliation.

MEMX’s use of a modified waterfall development methodology and rapid prototyping required frequent test builds. Exactpro designed a detailed functional automated library covering all the required functionalities, and worked continuously to enhance the quality and speed of the regression testing which was continually analyzed by both teams.

Iosif Itkin, CEO and co-founder of Exactpro, said: “Working with MEMX, the fastest-growing US equities exchange, has proved to be an invaluable experience as we continue to deploy our next-generation test automation framework, th2. With this new offering, Exactpro was able to support MEMX’s rapid deployment schedule whilst simultaneously providing the highest levels of system quality assurance.”

Thomas Toller, Managing Director, Exactpro USA, said: “We have been delighted to partner with MEMX on such an ambitious and innovative project, a natural fit for Exactpro’s services and our continued expansion into North America.”

“MEMX’s close collaboration with Exactpro provided additional operational resilience and contributed to the exchange’s seamless launch, rollout and, ultimately, live trading in all NMS symbols,” said MEMX Chief Technology Officer Dominick Paniscotti. “We greatly appreciate Exactpro’s partnership in working to ensure the exchange’s technology was ready to perform at full capacity from day one.”

Related News

- 09:00 am

Drawbridge, a premier provider of cybersecurity software and solutions to the alternative investment industry, today announced it has named Scott DePetris President and Chief Operating Officer (COO) and appointed him to the Board of Directors. In his role, DePetris will drive Drawbridge’s global strategy and business operations to meet new client and market requirements and continue to scale the business through a period of hyper growth.

“Drawbridge has always been focused on providing our clients the best software, services and industry expertise to manage their critical cybersecurity programs, and we’re thrilled to have a leader of Scott’s stature join our Executive Team and Board of Directors to extend that legacy,” said Jason Elmer, Founder and CEO of Drawbridge. “Scott’s proven track record driving go-to-market strategy and operational excellence for high-growth companies will be invaluable to us as we accelerate our global expansion, expand our technology suite and continue delivering exceptional customer experiences.”

DePetris is a recognized FinTech industry visionary with over 20 years of extensive leadership, go-to-market and operational expertise. He currently serves as Executive Advisor and member of the Board of Directors of Broadway Technology, board member at Salt Financial LLC, and chairman of the Greenwich, CT chapter of the prestigious Young Presidents Organization (YPO). DePetris was a founding member, President and COO and board member of Portware, LLC, a leading developer of broker-neutral automated trading software for global equities, futures, options and FX. He spearheaded the sale of Portware to FactSet Research Systems, Inc. He recently served as the Chief Operating Officer at Broadway Technology and earlier in his career he was the co-founder and senior vice president of ExchangeLab, Inc., an intellectual property development company for financial service technologies which incubated and commercialized several successful FinTech startups. DePetris began his career as a specialist in equity derivatives at Goldman Sachs and traded energy commodities at ICAP, plc. An active philanthropist, he is a member of the board of directors at LSA Family Health Services, a director at Domus Kids, Inc. and serves as a CT champion for the Me to We Organization.

“Drawbridge has experienced a remarkable period of technology innovation and customer success and proven itself as a trusted partner to alternative investment firms as they strive to navigate today’s increasingly complex threat landscape,” said Scott DePetris, President & COO of Drawbridge. “The market opportunity in front of Drawbridge is immense, and I’m excited to join the company as we continue this period of hyper growth. I look forward to working with Jason and the exceptional Drawbridge team to advance our business strategy, further grow our global footprint and continue to raise the bar for cybersecurity software and service excellence.”

The appointment caps a period of significant momentum for Drawbridge as it continues its impressive global growth, fortifies its market leadership in cybersecurity and continues to add talent across the company. Drawbridge recently announced several executive appointments including Darrell Tucker as Managing Director, Client Services and Simon Eyre as Chief Information Security Officer, and secured a growth equity investment from Long Ridge Equity Partners in early 2021.

Related News

- 04:00 am

Cellulant (www.Cellulant.io), a leading Pan-African payments company, unveils its new brand identity and affirms its commitment to partner with global, regional and local businesses to accelerate Payments’ digitisation across Africa.

Over the last couple of years, Cellulant has evolved to become more than just a business but an idea and belief that Africa should build Africa’s future.

“Refreshing our brand identity is both an acknowledgement of a new chapter as a business but also an affirmation that our mission and commitment to Africa still stands. Cellulant continues to be shaped by a belief that the success of people and businesses in Africa is the foundation of transforming the continent. This belief has seen us scale across multiple countries, evolve and innovate around the solutions we offer to the market and build a great digital payments ecosystem serving millions of Africa,” states Divine Muragijimana, Cellulant’s Head of Brand.

Cellulant believes that solving for the payments sector is not a novelty in Africa. Digital payments pose the most significant opportunity to bringing fundamental transformation for African economies at large. Only 38% of Africa’s 1.2 Billion population will have a bank account by 2022, and cash still commands 90% of all transactions in Sub-Saharan Africa. However, due to the Covid-19 pandemic, there is a shift towards digital payments driven by businesses’ need to stabilize their revenues and increased preference by consumers to use contactless payment solutions.

To respond to the emerging need for cashless payments, Cellulant is accelerating digital payments adoption by connecting digital money capabilities with the need for businesses to receive broader payment options and offer sophisticated payments experiences to their consumers.

“Over the years, we have learned that it is no longer a question whether digital payments will become ubiquitous across Africa but rather, how fast we can accelerate the adoption of local payment options. Therefore, by unifying the payment experiences for both businesses and their consumers, we can unlock hundreds of millions of consumers and allow them to transact digitally in their local context. We do this by removing layers of complexity to an already complex financial system- simplifying the way people pay and get paid,” said Akshay Grover, Cellulant’s acting Group CEO.

Cellulant has partnerships with global payments service provider such as Adyen, PayU and Smart2Pay; powers payments for global and regional businesses in several sectors such as Emirates, KLM, Ethiopia Airlines, Kenya Airways, Microsoft, Deezer, Bolt, Jumia, Kikuu, Glovo, Simbisa, Multichoice; and thousands of local businesses across Africa.

Related News

- 03:00 am

Pico, a leading provider of technology services for the financial markets community has attained Outsourced Provider Audit Report (OSPAR) attestation in Singapore, highlighting Pico’s strong record of robust governance and operational excellence.

Pico successfully completed an external audit, conducted by RSM, in accordance with criteria set out by the Association of Banks in Singapore (ABS), a non-profit organization representing the interests of the commercial and investment banking community. Compliance with ABS Outsourcing Guidelines assures financial institutions that Pico maintains an equivalent level of governance, rigor and processes required by the Monetary Authority of Singapore (MAS). This attestation builds on Pico’s strong technical excellence and adherence to internationally recognized industry leading standards, such as SOC2 and NIST, that further strengthens Pico’s commitment to providing trusted financial services solutions.

“Achieving OSPAR certification underscores Pico’s commitment to embedding excellence in our globally comprehensive technology solutions,” said Roland Hamann, Chief Technology Officer & Head of APAC at Pico. “The Association of Banks in Singapore plays a significant role in spearheading best banking practices. Our continued alignment to their guidelines, as well as our investments in operational and implementation excellence have been intrinsic to our success in Singapore and beyond.”

Since selecting Singapore as its Asia headquarters in 2017, Pico has enjoyed strong demand for its products and services from onshore clients as well as EU and US based trading firms expanding into the region. Last year the government of Singapore deemed Pico’s mission critical services as “essential”. Pico has also been at the forefront of developing Singapore’s world-leading FX hub, through infrastructure deployments that have supported major forex players as they rapidly established their market presence.

Fueling Pico’s growth has been the accelerated expansion of its comprehensive connectivity and venue presence across APAC serving electronic trading participants, all supported by local teams. Today, Pico is live in Hong Kong, Japan, the Republic of Korea, Taiwan, and China with imminent plans to add Australia to its APAC footprint.

Pico has built a financial services trading cloud infrastructure with mission critical exchange connectivity spanning 47 data centers traversing all key global market centers in the Americas, Europe and Asia. Its resilient proprietary network, PicoNetTM is a globally comprehensive, low-latency and fully redundant network interconnecting all major financial data centers around the world and access to major public cloud providers. The combination of Pico’s global infrastructure and data services with its analytics and machine intelligence solution Corvil Analytics, contributes to clients being equipped with cutting-edge solutions to meet ever-changing market conditions.

Related News

- 09:00 am

MENA-based BaaS provider and modern card issuer processor NymCard partnered with e-money platform and card issuer, Instapay to help MENA’s fintech’s expansion plans across Asia. The strategic partnership allows NymCard to enable its MENA clients to start scaling across Asia starting with Malaysia.

NymCard’s modern open API platform will power MENA and Malaysian fintechs by enabling them to launch innovative payment card programs at speed.

“Agility and speed are essential for fintechs to scale across multiple countries and regions. As such, we are providing the crucial connectivity and technology building blocks between fintechs, issuing banks, relevant card schemes, and regulators to launch innovative card programs where each offers a unique proposition to the end consumer. We are very excited about our partnership with Instapay and we are looking forward to enabling our MENA clients expand to Asia while also serving local fintechs in Asia to innovate and scale across the MENA, to capitalise on the growth of embedded finance.” -” said Omar Onsi, CEO and Founder of NymCard.

“Our partnership with NymCard will give fintechs an opportunity to leverage strengths of both Instapay and Nymcard to launch and grow their business. Modern issuer processors like NymCard are vital for the payments ecosystem. They provide state-of-the-art technology and help build the next generation payments platforms. By leveraging the capabilities of NymCard’s platform and unique capabilities of Instapay’s payments platform, we will allow our clients to innovate and scale at a much faster rate,” said Rajnish Kumar, CEO, Instapay Technologies. ‘Our partnership with NymCard will also enable us to take our Payroll Card solutions, which is specially designed for companies with low-income workers, to the Middle East markets.’

Progressive fintechs need modern tech infrastructure to build their payment card products without having to integrate with complex legacy payment systems. NymCard will take on the heavy lifting allowing fintechs to seamlessly integrate with critical resources to facilitate the launch of card programs. Utilizing NymCard’s existing partnerships as well as its open and customizable APIs to embed advanced payment functions is a game changer for businesses of all sizes.

NymCard’s platform powers multiple use cases that are just emerging in the MENA market. This includes real-time payments, alternative authorization flows, multi-currency wallets, corporate expense cards, on-demand delivery services, buy now pay later offerings, youth banking models, among many others.

Related News

- 09:00 am

TruNarrative has been chosen by the Rational Group, home of the cutting-edge FX and payment companies RationalFX and Xendpay, to boost its customer onboarding and identity verification processes and deliver a seamless customer experience.

Established in 2005, RationalFX is a market-leading foreign exchange and international payments company. RationalFX has facilitated over $12 billion of international payments for their 180,000+ registered clients across over 170 countries.

TruNarrative’s SaaS platform enables businesses to detect fraud and identify risk via a single API. Their technology is trusted across the globe to strengthen fraud detection and compliance in a range of industries including, banking, lending, online gambling, eCommerce, and payment services.

Rational FX went to market for a solution that could consolidate their group-wide customer onboarding, compliance and financial crime prevention strategy.

They required a comprehensive and agile onboarding and compliance platform capable of multiple customisable journeys and workflows. Their goal was to drive business efficiency, improve match rates and provide their customers with a frictionless onboarding experience whilst remaining compliant with current and future regulation.

The partnership with TruNarrative will allow Rational FX to verify the identity of new customers from across the world, performing IDV (Identity Verification), document verification, selfie and liveness checks.

Integrating with the group’s existing tech stack, including their core platform and front-end systems, TruNarrative will deliver RationalFX the ability to efficiently make informed customer acquisition and business risk decisions with the full customer picture in view.

RationalFX are now able to access the TruNarrative Appstore which delivers the range of data sources they need to take on and monitor their business and private clients across the international markets they operate in.

The TruNarrative platform allows the team at RationalFX to build different on-boarding processes for multiple jurisdictions and rapidly react to risk, market and regulatory changes from within an intuitive user interface.

“We love to partner with firms who go above and beyond to produce a great experience for their customers.” John Lord CEO at TruNarrative “We look forward to delivering RationalFX our technology to help them take on and manage customers in a safe and compliant way”.

“We always want to make our client experience the best it can be. Integrating with TruNarrative reduces the time clients spend onboarding to less than 5 minutes, enabling them to take advantage of our competitive rates on weekends and out of office hours, all whilst providing us with a scalable onboarding solution with enhanced fraud detection measures.” David Morgan,

Related News

- 05:00 am

SEI, announced today it has extended its contract with UK wealth manager Netwealth Investments Limited (Netwealth) for a further five years.

The re-contract builds on an existing strategic partnership between the two companies that began in 2016 and SEI will continue to provide integrated wealth-management infrastructure and custody to Netwealth through the SEI Wealth PlatformSM. The partnership with SEI will continue to support Netwealth’s ambitious growth, and will include integrations and a range of application programming interfaces (APIs) for Netwealth’s electronic trading channels and broader proposition.

The SEI Wealth Platform is part of SEI’s Global Wealth Management Services business, comprised of market-leading, innovative solutions designed to support the future growth of investment and wealth managers globally.

Commenting on the partnership, Charlotte Ransom, Chief Executive Officer of Netwealth Investments Limited, said:

“We are pleased to continue partnering with SEI. It is important for our business to have a partner who can scale to support our growth, as well as collaborate with us on projects to meet some of our key strategic goals. We look forward to our continued strategic partnership.”

Brett Williams, Managing Director of UK Private Banking for SEI, said:

“The last year has highlighted the important role technology, alongside an experienced workforce, will play in the future of wealth management. We are pleased to continue our strategic partnership with Netwealth, who represent such a strong brand in the wealth management industry, and support them with their technology-led approach to providing traditional discretionary and advisory services. This re-contract illustrates our mutual commitment to our continued partnership.”

This news was first announced on SEI’s first-quarter 2021 earnings call.

Related News

- 01:00 am

The Chartered Institute for Securities & Investment (CISI) has announced the appointment of Nandika Buddhipala MCSI as President of its Sri Lanka National Advisory Council (NAC).

Nandika takes over from Nihal Fonseka FCSI(Hon), who became founding President in 2011.

Chief Financial Officer of Commercial Bank of Ceylon PLC since 2008, Nandika will represent and promote local CISI membership and the securities and investment profession in Sri Lanka. The NAC supports the provision of continuing professional development (CPD) opportunities and networking events for local CISI members. He has been serving as a member of the CISI NAC Sri Lanka since 2011.

With over 30 years’ experience in audit and assurance, telecommunications and the banking industry, Nandika started his professional career at KPMG in Sri Lanka, Republic of Maldives and Sultanate of Oman. He has been serving the council of the Association of Chartered Certified Accountants (ACCA, UK) Sri Lanka Branch since 2006 and was the President of Sri Lanka Branch in 2008 – 2010.

Nandika has been a visiting lecturer and a guest lecturer for undergraduate and mainly post graduate level subject areas such as Auditing, Management Accounting, Economics, Finance, Strategy, Corporate Governance and Risk Management at universities including University of Sri Jayawardenapura, University of Colombo, University of Wayamba and University of Peradeniya, Sri Lanka.

He is a Fellow member of the Institute of Chartered Accountants of Sri Lanka and has been recognized by Institute of Certified Management Accountants of Sri Lanka for his outstanding contribution to the accounting profession.

On his appointment, Nandika (left) said: “It is an honour to take on this role and continue the inspiring leadership which has been shown to our NAC by Nihil Fonseka, for which we are deeply grateful. I look forward to continuing to nurture the growth of our CISI membership and strengthening CPD opportunities in the key areas of knowledge, skills and behaviour.”

Outgoing president (right) Nihal Fonseka FCSI(Hon) said: “I am delighted to have been leading the CISI NAC since its inception and I look forward to supporting Nandika and the committee.”

Kevin Moore, Chartered FCSI, CISI Global Business Development Director said: “I would like to express my sincere thanks and gratitude to our outgoing President Nihal Fonseka for his leadership. As the founding President of the CISI’s NAC in Sri Lanka, Nihal has demonstrated an exemplary commitment to developing professional standards within the financial services profession in Sri Lanka. We also remember Nihal’s support for the very successful initiative involving 5000 young Sri Lankans taking a CISI qualification a few years back, which is still our biggest single project in terms of financial education in schools. We congratulate Nandika Buddhipala MCSI on his appointment and very much look forward to working with him as CISI Sri Lanka NAC president.”

The CISI Colombo office celebrated 10 years in March this year.

Related News

- 05:00 am

The author is Maxim Bederov.

The once strict lines separating traditional finance and crypto finance are melting away. And it could lead to once-unthinkble cryptoasset prices much sooner than any of us believed possible.

When San Francisco cryptoexchange Kraken crossed the Rubicon to win a US bank charter in September 2020, it sparked off an international conversation about the repercussions of the decision. Kraken was joined by Caitlin Long’s Avanti Financial just a month later. In truth the most consequential move of all came on 13 January 2021, when the Office of the Comptroller of the Currency granted cryptoasset custody specialist Anchorage conditional approval for a federal banking licence.

Both Kraken and Avanti won Special Purpose Depositary Institution (SPDI) status under Wyoming law. And while they, like Anchorage, have to put in place certain requirements like raising additional capital, there is a marked difference between state-level banking charters and those conceived at a federal level, as Anchorage now has in its grasp.

There are similarities, of course, between Wyoming’s SDPI and a federal banking charter.

Wyoming requires its SPDIs to maintain 100% of its fiat demand deposits as liquid assets, including cash and US Treasury bonds — this means depositor money won’t be lent out without their permission. This does mean that SDPIs can’t take advantage of the fractional reserve system and generate income by lending out what they receive in deposits. The Wyoming Division of Banking also expects applicants to have initial capital of at least 1.25% to 1.75% of its assets under custody or $10m, whichever is greater.

The OCC’s capital requirements for Anchorage include that it must hold $7m in Tier 1 capital: this is the primary source of funding for banks and consists of shareholder’s equity and retained earnings. At least 50% of that must be made up of what are called “Eligible Liquid Assets”. At all times, Anchorage must maintain $3m of liquidity or 180 days-worth of operating expenses. Regulators will also be allowed to poke around inside the structure of the business and review its capital and liquidity on a quarterly basis.

But the effects of being an SPDI have not yet been widely tested by the market, or by regulators, as this is a relatively new vehicle that the State of Wyoming created in 2019.

And while Kraken says one of its main abilities as an SPDI is to call itself a “qualified custodian” of digital assets, the SEC is still working out what “qualified custodian” means for crypto, which injects a little more regulatory flex into proceedings than Kraken would probably like.

Also: what SDPI status does not do, is entitle it to operate in any other state without applying for and getting approval from that state’s banking regulator.

A federal charter, by contrast, makes it very clear that big banks can all use Anchorage to hold cryptoassets on behalf of their clients. And thinking in a wider sense, the OCC conditional approval puts Anchorage the same sure regulatory footing as every other national banking institution in the United States.

In the wake of the decision, its CEO Nathan McCauley was naturally bullish, predicting that this kind of regulatory certainty will lead hundreds of banks to partner with Anchorage, further fuelling the long-term growth of the cryptoasset market. “It will let all sorts of people come to the table who until now have been hesitant to come in. It marks a big shift in the availability of cryptoassets,” McCauley told Fortune.

Custody the key

When BNY Mellon, the largest custodian bank in the world, announced its own move into custodying cryptoassets, it was this point that it lasered in on.

“The lack of certainty regarding national regulators’ treatment of digital assets is often cited as the main reason for the cautious approach of asset managers towards digital assets.” it said. “However, the reality is that, apart from the uncertainty surrounding the regulatory framework, it seems that the lack of safe, qualified custody is also a significant barrier preventing institutional investors from joining the crypto market in greater numbers. What’s really at stake is ensuring the safekeeping of private keys and crypto-addresses while allowing third-party access to pertinent information stored on the wallet to provide relevant services, such as, asset servicing, delivery versus payment, audit, fund administration, etc.”

There is that openness, as we mention above, allowing regulators and others to come in and poke around in the workings of the bank in a transparent manner.

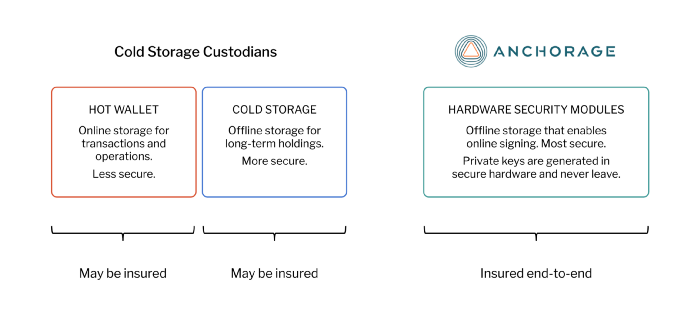

Anchorage, of course, is a digital asset custodian native: it was a custodian before it was a bank, and promises end-to-end insurance that beats anything else available on the market.

It has taken considerable time and effort for crypto-friendly banks to come to the aid of institutional investors. Two names that long-time readers will recognise are Silvergate and Signature. As crypto custody pioneers, these two helped to serve institutions who were scorned by the traditional mainstreamers: like America’s fourth-largest bank Wells Fargo.

The anecdotal anti-crypto stories about Wells Fargo are myriad but include denying business accounts to those who mention the word ‘Bitcoin’, backed by a December 2020 investment strategy report that says cryptoassets may be worth investing in “one day”. Such notions will be little succour to the clients clamouring for cryptoasset exposure. And it’s not just possible but likely that Wells and its ilk will miss out on billions in client cash if they can not remove their blinkers.

The inability or unwillingness for mainstream banks to invest in crypto compliance created a market vacuum quickly filled by smaller fintech and private banks: over in Switzerland and Germany it was the likes of SEBA and Sygnum hoovering up client capital at the expense of larger banks.

Back in the US, we can see the effects of crypto compliance: since its debut on the New York Stock Exchange in November 2019, Silvergate’s holding company Silvergate Capital Corp (NYSE:SI) has experienced explosive growth. Priced at $12 a share at its IPO, the bank has seen its shares rise by over 940% inside two years.

The outgoing OCC Comptroller, Brian Brooks, laid out the future in pretty stark terms after approving Anchorage’s case. “Fiat [currency] will ultimately be a legacy thing of the past,” he said at a public webinar event hosted by Elliptic, arguing instead that banks will transition to being broadly blockchain-based service providers. Certainly his Interpretive Letters allowing federally-regulated banks to custody crypto and to use stablecoins for settling payments would speak to that future.

Brooks’ departure from the OCC does raise the spectre of a markedly less crypto-friendly head coming in to lead the organisation, as part of the shift away from former President Trump and into the Biden administration. Anchorage and their ilk aren’t necessarily worried by this, saying that because the OCC’s decisions were based on existing laws, and not entirely new ones, they are less likely to be reversed.

How might crypto prices respond to digital asset banking?

We have already seen the seismic effects of banks and other supersized financial institutions entering the crypto asset class. At time of writing, Bitcoin is valued at over $55,000 per coin, and price predictions of $146,000 by JP Morgan or $318,000 by Citibank (by December 2021, no less) no longer look quite so outlandish.

Ethereum, which largely powers the DeFi subsector by itself, spiked to an all time high above $2,000 on 20 February 2021, gaining over 840% across the last 12 months. The institutional floodgates are now open: new technologies are coming online all the time allowing banks to borrow and stake digital assets in the same manner as forward-thinking retail investors

Swiss fintech group Taurus, for example, just launched access for banks and exchanges to stake cryptoassets using DeFi platform Aave.

The truly remarkable thing about this whole situation lies with the systemically disruptive element of cryptoassets.

Institutional adoption of cryptoassets through banks that are subject to federal regulation and oversight promises profound changes to financial markets. Not only are much greater levels of capital inflow likely — as we’ve seen with the likes of Tesla, Microstrategy and Square at the crest of the wave of determining appropriate levels of cryptoasset-denominated treasury — it makes the market more accessible to a much broader investor base than those happy few drove the last major Bitcoin bull run in 2017.

It’s perhaps the reason why industry insiders like Kraken’s CEO Jesse Powell believe that the Bitcoin price — supported by the structural aid of digital asset banking — could reach $1m inside the next decade.

If cryptocurrencies do in fact replace fiat currencies like the US dollar, as Brian Brooks so vehemently stated, such incredible price points could be just the start and not the end for crypto assets holders.

Related News

- 03:00 am

Digital transformation alongside automation enablers like artificial intelligence (AI) and Robotic Process Automation (RPA), coupled with the responsible utilisation of data assets will be determining business success factors over the next five years, according to Grant Phillips, Group CEO at e4. While the landscape will be enormously different in the coming years, Phillips says that the brands who will succeed the most are those that move beyond a fascination with the technology itself but to understand how it can address ever changing customer needs and expectations, remembering that winning will be defined by how the technology capability has delivered a world class user experience.

“Looking forward, increasing digital interactions, engagement, digital delivery of services or products will fast become the norm. The further demise of brick-and-mortar and its associated servicing models is almost guaranteed as so many more consumers and business move into the digital world. Seamless digital interactions that are built around user needs will allow organisations to deliver bespoke solutions in near to real time, effectively removing friction in value delivery,” says Phillips.

He says that the approach by financial institutions will need to change as they look to evolve. In this way they will gain a much better understanding of every consumer, recognising too that they are all different: “Traditional financial service organisations will need to look at their customer base differently. Portfolio level segmentation is no longer relevant as consumers demand customised solutions that fit their specific needs, without exception. In the future, digital technology will provide a million different products to a million different customers in near real-time in a channel of their choosing.”

As the country moves closer to the POPIA deadline, which impacts greatly on the consumerisation of data, Phillips says e4 is adequately prepared: “We have been incredibly pro-active in this space and are extremely well prepared. 18 months ago, we formed dedicated teams to ensure that we are fully compliant by the end of June 2021. There are also a number of senior stakeholders involved in this project and it features prominently at board level. From a regulatory perspective, we have ensured that there are a myriad of control processes in place to safeguard not only our own data but that of our clients and their customers. The project has also allowed us to approach data privacy and protection as a differentiator as opposed to a regulatory compliance exercise. With this mindset, we have been able to assist a number of blue-chip organisations, all new partners of the e4 Group, with their POPIA journey”

While digital transformation has been ongoing in most financial service organisations for some time, Phillips says the last two years have created a realisation that e4’s capabilities are more relevant now than ever before: “Front end digital enablement was never viewed as an area of stand-alone value creation by the Group and in turn by our clients. This mindset changed internally a few years ago and led to us developing several value propositions in spaces that are becoming largely industry agnostic and have provided the business with permission to engage in areas we historically wouldn’t have considered. In terms of processes, there is a much greater appreciation that the new way of business is a real-time ever evolving environment and what took 12 to 18 months must now take weeks if you want to stay relevant in this dramatic digital revolution.”