Published

- 05:00 am

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown:

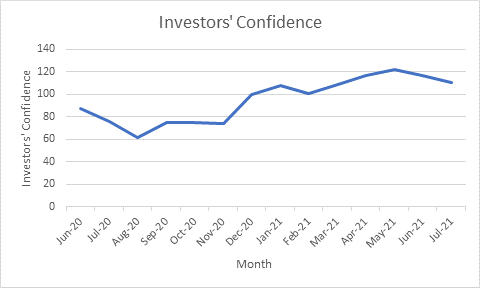

‘’Far from bringing an added dose of confidence to investors, ‘Freedom Day’ appears to be a setback. Investors’ confidence in the UK has dropped by 5% in July, when compared to June, a steeper fall than the 2% registered on average for regions around the globe.

The sharply rising Covid infection rates across the country, and concerns about fresh easing of restrictions, is likely to be behind the drop, which is identified in the HL monthly investor confidence survey*.

Worries are mounting about what the lifting of social distancing rules will mean for economic recovery, if the virus spreads more rapidly. Already many industries from hospitality to manufacturing are struggling to cope with high levels of absence as staff are pinged by the test and trace app, leading to the closure of some venues and a drop in output.

The confusion surrounding quarantine and testing rules for international travel is also leading to fresh uncertainty about the prospects for the aviation and tourism industries, which have been struggling through the worst crisis in their history. The lack of warning about the need for travellers from France to isolate for ten days from today, has thrown holiday plans into fresh mass chaos, with hopes of a boost to summer bookings evaporating.

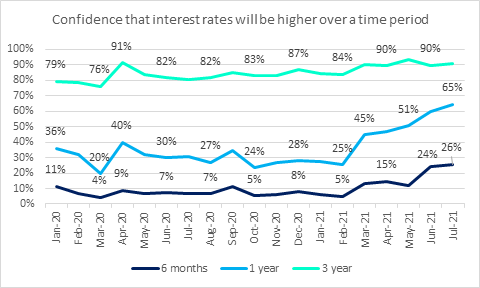

Amidst concerns that infection rates could derail the recovery are worries about inflation heating up and the knock on effect of rising interest rates. 65% of investors believe interest rates will be higher in a year’s time compared to 60% last month. That is the highest level since January 2019. More than a quarter (26%) now believe they could be higher in six months, compared to 24% in June 2021.

Economies have been re-opening with an energy that once seemed unlikely in the depths of the pandemic, which is pushing up inflation. In addition the recession left supply chains broken around the world, leading to some shortages. Companies have also slashed investment during the crisis, so the ability to increase production is limited, which has the effect of pushing up prices even further.

Central banks are largely still talking as a team, stressing that these effects are transitory, kicking the ball of monetary easing down the pitch. But it’s clear investors, watching from the side lines, are increasingly nervous that price rises are likely to linger for longer. More fear that a swifter rolling back of mass stimulus programmes and the spectre of rising interest rates could dampen economic growth and asset valuations.’’

*The investor confidence index is compiled by surveying clients on a monthly basis. Each month we send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average 10% of clients respond (around 600 clients).

Clients are asked to say how likely they are to invest in a certain sector over time frames of 6 months, 1 year and 3 years, by selecting Very Likely, Likely, Neither Nor, Unlikely or Very Unlikely.

HL Investor Confidence Survey

Global Sectors | % Change July 2021 vs June 2021 |

Asia Pacific | 2% |

European | -1% |

Global Emerging | -4% |

Japanese | -1% |

North American | -1% |

UK | -5% |

Average % Change | -2% |

Hl Investor Confidence Survey July 2021

HL Investor Confidence Survey July 2021

HL Investor Confidence Survey July 2021

Do you think interest rates in the UK will be higher than they are today?

| 6 months | 1 year | 3 year |

Jan-19 | 25% | 66% | 92% |

Feb-19 | 20% | 57% | 90% |

Mar-19 | 18% | 48% | 88% |

Apr-19 | 17% | 49% | 86% |

May-19 | 21% | 59% | 92% |

Jun-19 | 22% | 57% | 91% |

Jul-19 | 16% | 46% | 85% |

Aug-19 | 17% | 38% | 81% |

Sep-19 | 15% | 40% | 81% |

Oct-19 | 9% | 30% | 80% |

Nov-19 | 10% | 35% | 78% |

Dec-19 | 15% | 44% | 84% |

Jan-20 | 11% | 36% | 79% |

Feb-20 | 7% | 32% | 79% |

Mar-20 | 4% | 20% | 76% |

Apr-20 | 9% | 40% | 91% |

May-20 | 7% | 32% | 84% |

Jun-20 | 7% | 30% | 82% |

Jul-20 | 7% | 31% | 81% |

Aug-20 | 7% | 27% | 82% |

Sep-20 | 11% | 35% | 85% |

Oct-20 | 5% | 24% | 83% |

Nov-20 | 6% | 27% | 83% |

Dec-20 | 8% | 28% | 87% |

Jan-21 | 6% | 27% | 84% |

Feb-21 | 5% | 25% | 84% |

Mar-21 | 13% | 45% | 90% |

Apr-21 | 15% | 47% | 90% |

May-21 | 12% | 51% | 94% |

Jun-21 | 24% | 60% | 90% |

Jul-21 | 26% | 65% | 91% |

Data from the HL Investor Confidence Survey

Related News

- 07:00 am

Bybit, hitherto the world's largest derivatives-only cryptocurrency exchange, has announced its expansion into the crypto spot trading market.

Bybit Makes Audacious Stride Into Spotlight

Bybit's new spot trading platform opens to all on July 15 at 6AM UTC, and comes with zero maker fees. Upon launch, BTCUSDT, ETHUSDT, XRPUSDT and EOSUSDT will be supported. More trading pairs will follow shortly.

A spot trade allows traders to buy and sell the crypto asset "on the spot" and at the current market rate once an order is filled. In the spot market, ownerships of crypto assets are transferred directly between buyers and sellers. Crypto spot is not only a foundational starting point for new market entrants, but a complementary vector for derivatives traders engaging in hedging strategies.

Bringing World Class Liquidity and Reliability to Spot Trading

Bybit has proven itself to be the most reliable, stable and usable exchange of the bull run. Unique among major exchanges, Bybit experienced no overload nor downtime throughout.

Liquidity is arguably the be-all and end-all attribute for asset exchanges. Bybit's derivatives trading platform has the world's best liquidity and tightest spread. Traders are ensured the best quote and best execution in the market even during extreme volatility.

Bybit's retail focused products and customer support focused services will help lower the entry threshold to crypto trading to a whole host of new customers around the world, allowing them to seamlessly enjoy the immediate delivery of crypto trades.

"It has been Bybit's utmost privilege to have enjoyed the ardent support of our community and partners as we continue to grow and improve," said Ben Zhou, co-founder and CEO of Bybit. "We are excited to bring with us to spot trading the world class liquidity and reliability derivatives clients have come to associate with Bybit."

Related News

- 01:00 am

Infinicept, a leading provider of embedded payments, today announced the launch of its Partner Network to help software and fintech companies get payments going their way. The Partner Network is designed to meet the evolving needs of companies as they embed payments into their digital experiences, providing them with a curated set of trusted providers, so they have full control over their payments journey.

As embedded payments become a strategic imperative for software companies, Infinicept believes that optionality is a must. Infinicept’s Partner Network approach puts software companies first, delivering transparency and choice to power embedded payments in a way that works for them. Infinicept’s “platform agnostic” approach enables its customers to work with a variety of payment processors, gateway and terminal providers and token services.

“For decades, some areas of the payments industry have thrived on kick-backs, side-door deals and an impenetrable fog of misinformation and confusion,” said Todd Ablowitz, co-CEO and co-founder of Infinicept. “Our approach is to create transparency and provide the right partner solutions for each software company. We’re enabling them the choice and freedom from being ‘locked in’ to some middleman – whether you’re a payment facilitator, integrating payments, or somewhere in between.”

Infinicept’s Partner Network is comprised of dozens of pre-qualified solution providers, connecting embedded payments companies with the best processors, gateways, acceptance solutions, identity, and credit services providers for their needs. Today, Infinicept has established partnerships and/or integrations with industry leaders including Worldpay by FIS, Payroc, Adyen, FISERV, Merrick Bank, Handpoint Technologies, Mastercard, Discover, LexisNexis, Dwolla, and Very Good Security.

“Infinicept's Partner Network showcases their dedication to freeing software companies from vendor lock-in, while also helping companies maximize the value of their data by retaining both data ownership and the flexibility to choose vendors,” said Mahmoud Abdelkader, CEO and co-founder of Very Good Security (VGS). “VGS is proud to be part of a network that enables payments transformation by empowering software companies to choose what’s best for their payments initiatives.”

“The Partner Network is our latest effort to make the payments process easier for software companies, providing them with pre-qualified options that meet their particular needs,” said Deana Rich, co-founder and co-CEO. “These trusted partners all have different areas of expertise but share our values and goals, working with us to streamline payments services across our range of customers. The Partner Network provides a great channel platform to connect customers and partners together for mutual benefit.”

Infinicept experienced rapid growth in 2020, with an 800 percent increase in yearly payments volume as more businesses recognize the value of embedded payments. Infinicept has more than 250 software, banking and fintech customers in 30 countries and plays a valuable role in an embedded payments market projected to reach $15 billion by 2025.

For more information on the Infinicept Partner Network, please visit here.

Related News

- 07:00 am

In partnership with Versapay, a leading provider of cloud-based payments and accounts receivable automation solutions, PYMNTS.com has published new research examining the digital shift currently taking place within finance departments and the driving forces behind it.

Based on a survey of over 400 Chief Financial Officers, the report, “The Strategic Role of the CFO: How AP And AR Digitization Are Transforming Customer Relationships,” finds that most accounting and finance teams are now digitizing their operations. 93% of CFOs at firms with at least $25 million in revenue report that they are currently integrating digital technologies into their accounting operations. The accounting functions finance leaders are most invested in digitizing are invoicing, payment processing, receivables tracking, and collections.

The research also shows that this mass adoption of accounting digitization is about more than just eliminating manual work or improving back-office processes. 96% of CFOs cite their motivation for digitizing accounts payable (AP) and accounts receivable (AR) processes is to improve relationships with their customers and vendors.

“The past sixteen months have caused a major mindset shift, where lifetime customer value has become a top priority for finance leaders’ strategic objectives,” says Versapay’s CEO Craig O’Neill. “This is driving fundamental change in how companies think about billing and payments, moving from disconnected paper-based processes to a digital, connected experience.”

This change in outlook also applies to how finance and accounting professionals view digitization as a whole. 57% of CFOs say their investments in AP and AR technology are about transformation rather than automation. “A large share of executives see AP and AR digitization as an opportunity to reimagine their processes in better ways rather than simply automating existing manual work,” says PYMNTS’ CEO Karen Webster.

Related News

- 05:00 am

· Tally® is disrupting the monopoly of government-issued debt-based (fiat) currency in bank accounts.

· World’s first to issue customer accounts with individual IBANs (International Bank Account Number) using non-fiat money.

· Tally is a private sector designed ‘foreign currency’ anchored by physical gold and used globally with no transaction charges and no added foreign exchange (FX) margins anywhere in the world.

· Fiat currency challenger that protects savings from inflation and near-zero interest rates.

A revolutionary banking platform and currency anchored to physical gold, designed to protect customers not banks, is the new solution for financially savvy savers.

Tally has been developed in response to a financial climate under major threat from economic instability and inflation and where banks are paying near-zero interest to savers using traditional savings accounts.

Tally, an alternative to mainstream currency, ties physical gold not sterling to a bank account. Each unit of Tally is a weight of gold (1 tally = 1 milligram) used via the Tally banking app and Tally debit Mastercard® to deposit, transfer, save, send and spend.

As the pound and other government issued currencies (also called fiat currencies) lose value, Tally maintains its purchasing power over time, thereby increasing in value relative to pounds. 1 tally equals just over 4 pence at the current gold price.

It works just like any normal bank account so you can transfer money into your account, pay through the app, or use the Tally debit Mastercard at an ATM to withdraw cash.

But because Tally is not underpinned by any Government-issued currency, such as sterling, it’s being hailed as a much safer form of banking, which provides long term protection for customers' savings by sheltering them from inflation and falling interest rates as the country’s debt balloons.

Cameron Parry, Co-Founder and CEO of Tally, said: “Tally offers an account that protects the value of customer money by holding it securely outside the mainstream banking system. This guards customer savings against not only the devaluing effect of inflation but also safeguards their money against the consequences of ever expanding national debt.

“People should be able to rely on the money in their bank account to hold its value over time and remain in their control. This is fundamental to individual financial wellbeing and promotes saving and productivity in society.

“To do that, we needed to build an independent asset-based full-reserve banking system that works complementary to the system we’ve all been stuck with for the last 50 years.

“Tally is leading the evolution of money accessed via bank accounts, with money designed by savers for savers. It’s a robust and reliable global currency with no hidden fees, and easy to understand how the money holds its value.”

The financial climate in the UK is highly uncertain at the moment. Last week, the Bank of England’s chief economist made a stark warning about inflation, saying ‘levels could be 'nearer 4% than 3%' by the end of the year.

And some economists believe that rock bottom interest rates and unprecedented levels of money-printing – quantitative easing (QE) – could cause the economy to overheat and push prices even higher as Britain rebuilds post-pandemic.

As with any currency, Tally does fluctuate day to day, but as gold historically holds its purchasing power, so does Tally. Over the past two decades, gold has increased in value over 600% when measured in Pounds, or put another way, the Pound has devalued by 87% since January 2000.

Tally is safe, reliable and accounts are issued under a regulated E-Money Institution, and the team behind the financial technology are highly regarded and uniquely experienced in the banking sector.

The allocated physical gold used as Tally is ethically sourced LBMA-approved physical gold, held in an accredited secure vault at Brinks® in Switzerland, and is 100% insured. And the Tally issued and the physical gold it represents is independently reconciled daily by UK audit firm PKF Littlejohn.

Tally’s beta version was released in the UK in mid-2019. The team behind the concept have since evolved and developed the banking architecture and monetary system and are now fast building a loyal customer base.

For more information and to download the Tally app, click here: https://www.tallymoney.com

Related News

- 07:00 am

Risk leaders of global financial institutions must start managing risk in a far more active way to tackle their £multi-billion commitments to digital transformation warns Simon Wills, author of ‘Right time, right place’ a new in-depth report from ORX, the world’s largest operational risk association.

The report, which was created with senior risk leaders of ORX member global banks and insurers, urges operational and non-financial risk management (ONFR) functions to step up like never before and support their businesses as they go through digital transformation, in order to keep up with the pace of change.

‘Right time, right place’ demonstrates that risks are now faster, more complex and more ambiguous than we’ve seen in the past. Events are more interconnected than ever, and impacts are multifarious and interlocked. As a result, risk management needs to be automated, real-time and pre-emptive, and reputation and service resilience must be addressed side by side with financial resilience.

The report also gives a view on what an organisation’s critical assets are and how they are now shifting. No longer is financial loss or capital optimisation the only concern – reputational risk, data loss, customer harm, support for vulnerable customers, and institutional resilience are all becoming more important as services are available to customers 24/7. Cyber risk and a febrile social media environment can also both amplify the slightest misstep.

Digitalisation has been accelerated by the Covid-19 pandemic, but emergent, fast moving technologies such as Cloud Computing, Artificial Intelligence and Machine Learning and widespread adoption and availability of APIs have been driving the transformation for some time.

Simon Wills, Executive Director at ORX comments, “We know that the Covid-19 pandemic has been a wake-up call for risk leaders within global financial services and the challenge now is to recognise and embrace the acceleration of digitalisation and develop new risk management practices to keep up. Many legacy frameworks and out-of-date approaches to risk will leave banks and insurers behind, and that will happen very quickly as digitalisation changes core business practice forever.”

The report urges risk managers to consider the following:

- Optimise, active, or both?

ONFR leaders must consider their ambition. Do they only want to “Optimise” (i.e. work more efficiently, reduce the administrative burden risk management places on others, simplify frameworks, deploy innovative tools and practices)? According to the report, this will only allow them to keep pace with the risk profile. To get ahead of the rapidly changing risk profile, ONFR leaders need to consider being more active – which means being on the front foot at all times, pre-empting the risks associated with change initiatives by working with the business to mitigate them in the design and development phase. It means translating the risks into actionable processes for senior management, offering active crisis management, ensuring a sharp focus on the most material risks, and scanning the horizon for the risks that lie ahead. To be active, the risk function needs to be fast, dynamic and innovative – both in the digital tools it deploys but also in how it positions itself in the organisation.

- Strategic capabilities

Banks and insurers need to embed a set of strategic capabilities – technological, cultural, and organisational. The technological enablers revolve around using analytics on data that already exists to see the risks that lie ahead, to get in front of them and to introduce the appropriate control. The cultural enablers involve establishing senior-level relationships and being able to persuade and influence actions before risk events occur. Organisational enablers revolve around skills, for example specialist data science skills, skills in cyber security, and strong scenario development skills.

- Capitalising on new technology

ONFR leaders should consider using the following available technologies to enhance their risk management practices:- Cloud Computing provides a platform to bring together disparate datasets and information to create the portfolio view of risk that is central to ONFR

- APIs break down the boundaries between functions and institutions, allowing risk to take advantage of an ecosystem of innovative providers and scale efficiently

- AI and machine learning underpin some of the most significant innovations in risk management. Activities that were once slow or even impossible, can now be done in real time

- Being the umbrella function

ONFR needs to provide an overarching framework, bringing consistency across specialist 2nd line control functions and working with compliance teams for an integrated approach to non-financial risk management.

Simon Wills adds, “Operational and non-financial risk management functions have had to optimise quickly and it is fair to say that it is now impossible to be successful at change as a business without active risk management. Getting the right skills on the team, embracing innovative technologies and inspiring a culture of change will help risk managers to see the shift they need to be more active and move the risk agenda forward for a digitalised future.”

Related News

- 05:00 am

Clausematch, the award-winning global regulatory technology headquartered out of Canary Wharf, today announced the publication of its ‘Voice of RegTech’ survey. The survey, which was the first of its kind by the company - was carried out between May 2020 and May 2021 with support from the UK Financial Conduct Authority (FCA). A key objective of the study was to gain a better understanding overall of the impact of the Covid-19 pandemic on the RegTech industry.

Almost 40 firms from across the US, Asia, the Middle East, the UK, Australia, and Europe, took part in the survey. These firms ranged from well-established businesses with upwards of 200 employees to smaller businesses, and early-stage start-ups with less than a handful of employees in some cases. The survey respondents were largely CEOs or company founders.

The findings of the survey revealed the following key developments:

The RegTech industry has seen an uplift in sales trends during the pandemic

Financial institutions attitudes towards technology are evolving rapidly

Pressure is increasing for regulators to adopt regulatory technology

92% of RegTech firms said that the pandemic has positively impacted the adoption of cloud-based products.

More than 42% of the RegTech firms that participated in the survey reported seeing a sharp rise in sales trends across the industry over the last six months. This is due to changes in working practices throughout the pandemic which have increased demand for innovative RegTech solutions to improve collaboration and boost efficiency.

Unsurprisingly, the findings of the survey also showed that 50% of demand from all new business for the RegTech industry is from banks. It is a well-known fact after all that traditional financial institutions such as banks have been amongst the slowest to embrace new technologies including the secure cloud. This is likely because of privacy threats traditionally perceived to be associated with cloud-based technology, such as a risk in cybersecurity hackings.

However, this study has demonstrated how attitudes are quickly changing despite previous reluctance. Of those surveyed, 92% of RegTech firms said that the pandemic has positively impacted the adoption of cloud-based products. The outdated processes and legacy technology previously enjoyed by financial institutions are no longer suitable to meet the heavy demands of today’s regulatory landscape.

In terms of compliance trends, the most dominant trend throughout the pandemic was the increase in remote compliance. 92% of RegTech firms said that they had to shift to a remote working model during the pandemic, while 8% said that they were partly remote working. This new style of working has created new risks for compliance teams. For example, as a result of remote working during the pandemic, many employees have turned to unmonitored communication apps such as WhatsApp to share sensitive information. Survey participants also reported that the pandemic has caused a rise in virtual Know-Your-Customer (KYC) checks, and boosted demand for a streamlined process. RegTech solutions bring everything that a company needs to conduct its business together on one, safe and secure platform.

As financial institutions turn to technology to increase efficiency and ease the compliance burden, there is an increased demand from RegTech firms on regulators to adopt regulatory technology. This can be seen in findings of the survey when participating firms were asked to what extent they would like to see the Regulator take a more proactive role in the promotion of RegTech solutions. The answers were as follows: 15.4% of participants said they wished to see the Regulator take a less active role, 21.3% of participants said they would like to see the Regulator remain moderate in its efforts, and 61.5% of participants said they would like to see the Regulator being considerably more proactive in adopting RegTech.

These findings of the Voice of RegTech survey reveal that the impact of the pandemic on RegTech has been significant, with heightened demand for innovative solutions within the financial services industry and to address the challenges created by the pandemic for compliance teams. RegTech solutions are providing the answers to the difficult questions that more and more businesses find themselves faced with in the current climate of uncertainty.

Related News

- 09:00 am

Leading Polish debt collection firm uses mathematical optimization to determine ideal strategy for each borrower

Ultimo SA, one of the largest debt management companies in Poland and a part of B2 Holdings, will use FICO collections treatment optimization to take the ideal treatment path for each borrower. Using advanced mathematical optimization from FICO, Ultimo will be able to identify the best, most sustainable collections strategy for each borrower, from among dozens or even hundreds of potential options.

More information: https://www.fico.com/en/solutions/collections-optimization

“Our mission is to help people get out of debt,” said Marek Czystołowski, Chief Operating Officer at Ultimo. “We are members of the Association of Financial Companies in Poland, we follow the Association’s Principles of Good Debt Collection Practices, and each year we receive the Association’s Ethical Audit Certificate. As an ethical debt management agency, we need the best way to serve our financial services partners and their customers, and using FICO’s advanced data science will help us do just that. We are complementing Ultimo’s market-leading collections expertise with innovative data science.”

“Debt remediation is at the forefront of the financial services industry’s response to the pandemic,” said Jens Dauner, vice president of FICO overseeing the DACH region and Central Europe. “We are proud to support Ultimo’s ethical debt resolution with our AI-powered optimization. There has never been a more important time to ensure every collections decision is the best possible decision.”

Collections optimization helps organizations of all sizes strike a balance between loss reduction, resource challenges, and operational constraints to help maximize profitability, meet regulatory requirements, and manage customer satisfaction. It can be leveraged across the collections spectrum — from pre-delinquency and early stage collections through later stage and recovery activities. Using collections optimization, lenders and debt collection agencies can easily and confidently choose the best decisions for account placements, settlements, channel selection, and other strategic treatment decisions.

Related News

- 06:00 am

- 17% of UK adults are ‘financially stretched’ – with 10% expecting to see themselves in fall into the same situation in the next 12 months

- Signs that people have become ‘stretched’ include seeing their personal income decrease (21%), having to borrow in order to pay an essential bill (10%) or being unable to pay it at all (7%)

- 7.9 million people (15%)2 experienced periods with no disposable income in the last year

- 12% of UK adults saw their monthly expenses exceed their income in the last 12 months - overspending by £277 a month, on average.

New research from Yolt3, the award-winning smart money app reveals today that 8.7 million UK adults (17%) are ‘financially stretched’. A further one in ten (10%) expect to financially struggle in the next 12 months, despite signs of economic recovery, as many households continue to feel the financial impact of the pandemic.

There are many experiences which contribute to someone being considered financially stretched. This can include a fall in income (21% of UK adults experienced this in the past year), experiencing periods without access to disposable income for non-essential spending (15%) or having financial worries that impact their mental health (15%). 28% of people who experienced periods with no disposable income attribute inconsistent pay as a key factor, such as shift workers or those on zero-hour contracts.

Many people considered to be financially stretched also struggle with essential bills (such as, rent or utility bills), either having to borrow money in order to meet these costs (10%) or simply being unable to pay them (7%). More than one in 10 UK adults (12%) saw monthly expenses exceed their income in the last year, leading to an average overspend by £277 a month. These figures indicate that many people in the UK, particularly those who are financially stretched, could see rising household debts. This could also become a particular concern as government support schemes such as furlough begin to end.

However, the figures also indicate that being financially stretched is rarely due to financial mismanagement. In fact, those who are stretched financially are 20% more likely to review their household budget and expenses, keeping closer track of their incomings and outgoing than those who are deemed ‘comfortable’ (89% vs 69%).

Pauline van Brakel, Chief Product Officer at Yolt, comments: “Our research shows that despite restrictions easing and signs of economic recovery, the pandemic continues to have a very real impact on the finances of many UK households. This stretched group, despite showing good financial behaviours such as budgeting, are still struggling. This raises particular concerns when you consider the likely withdrawal of government support later in the year.”

“It’s vital that people who see themselves in this position, and those at risk of becoming financially stretched, continue to engage with their finances, in order to avoid a situation where they lose track of essential bills or see their monthly commitments spiral beyond their control. It can be easier said than done, but beyond reviewing expenses and budgeting, where possible consumers should look to reduce debt, as this not only means alleviating financial pressure, but can mean more money in your pocket in the long run. At Yolt, our free app is designed to help you manage your finances and find potential solutions to your money concerns.”

Related News

- 06:00 am

- This was an increase from 87% at the end of 2020, according to Masthaven’s latest Broker Beat research

- 88% are ‘confident’ or ‘very confident’ about the prospects for the market as a whole

- Over three quarters (77%) of brokers expect their sales and revenue to increase this year

New research from Masthaven Bank has found that broker confidence has increased since the start of 2021. The survey of 186 brokers found that almost all (92%) were confident about their prospects for the next twelve months. This was an increase in positivity among brokers since the end of 2020, when 87% of respondents described themselves as confident about their company’s prospects.

Over three quarters (77%) of respondents also said they expect their sales and revenue to increase this year, with close to half (42%) predicting their growth this year to be in the double figures. Just 3% expected their sales to decline.

The brokers surveyed also expressed confidence about prospects for the property market as a whole – 88% said they were ‘confident’ or ‘very confident’ about the market’s prospects for the next twelve months. This was a sizeable increase from the 71% who reported the same level of confidence at the end of last year, perhaps reflecting increasing optimism as the country returns to some level of normality.

Rob Barnard, Director of Intermediaries at Masthaven, said:

“Broker confidence has climbed even higher since the start of the year, reflecting the current strength of the property market, as well as general optimism surrounding the UK’s vaccine rollout and the easing of lockdown restrictions. The industry has worked tirelessly to support homebuyers since the start of the pandemic. This hard work, combined with pent-up demand from early 2020 and government support in the form of the Stamp Duty holiday, has resulted in a booming property market - but there are still challenges on the horizon.”

When asked about the challenges facing their business, just over a quarter (26%) of brokers said that economic uncertainty was the biggest challenge their business is facing, a fall from 30% who said the same in December 2020. A quarter of brokers (25%) reported that they were concerned about lenders' service levels and 16% said they believed that the biggest challenge they face is further local or national lockdowns due to Covid-19.

Rob Barnard continued:

“The government’s various Covid support initiatives will be coming to an end soon, with the furlough scheme expected to wind down in September. The withdrawal of this support will undoubtedly be felt by some borrowers. As the market enters this next phase, brokers and lenders alike will need to work together closely to support all customers, but particularly those who have been affected heavily by the pandemic. Innovation and collaboration will be key in ensuring the industry continues to provide products tailored to customers’ needs.”