Published

- 09:00 am

According to tastytrade, there’s always an expected range for your listed prices to reach in any timeframe. When you know the implied price range of the assets you trade, you can determine if prices can reach your mark for a profit or not.

Additionally, the expected volatility within an expiration date tells you when to enter or exit a position. Here’s a look at how implied volatility (IV) works and why options traders use it to aid their decisions.

Volatility and Its Impact

The impact of volatility within your trades depends on if you are buying or selling a position. When volatility is high, those entering the market will favor better because the ranges of prices they encounter are predetermined.

Entering the market when volatility is low isn’t favorable to some investors because IV can shift higher once they enter their positions. The benefits or losses occurred during volatility changes depend on if you have a buy or sell position.

Overall, the higher volatility is, the higher the premium to trade is. The lower volatility is, the less you pay.

What Are the Challenges In Using IV Levels?

The challenge of trading with the help of implied volatility is in timing your market movements. Though a predicted-price range is a reliable tool, when or where prices will spike and fall isn’t as simple to see.

Your IV, being almost necessary for options, is the data your broker gives you without you requesting it. In finding when prices will spike or fall, however, be sure to also keep tabs on your expiration dates.

Volatility and Its Influence On Prices

Volatility is a measurement that determines a range rather than a single price. The rate of your IV reading tells you how likely drastic movements are or how unlikely.

This means that low volatility is found in stable markets, which is when prices move but in steady intervals.

High-IV levels suggest that prices will swing within a wider range whether it’s in a down or uptrend. In this sense, your IV is the measurement of the likelihood of wide or slim movements from current, listed prices.

Inflation, Deflation and Why They Matter

The implied volatility of the options you trade ultimately tells you whether the current prices you find listed are inflated or deflated. In general, deflated prices happen when you determine that prices are lower than market volatility.

Likewise, inflated prices are those that are higher than where market volatility actually stands. Knowing if your prices are inflated or deflated prior to taking a position will help you to minimize your risks. You can also use the measure of inflation or deflation to determine when to exit a position.

Volatility can certainly be profitable when you time the changes of the market perfectly. When you can’t measure things with such exactness, look to your listed IV to establish a range regarding the prices you expect to trade with.

Related News

Roy Kirby

Head of core products SIX at SIX

When one thinks of utilities – you immediately think of gas, water, and electricity, items you must have but are not excited about. see more

- 02:00 am

Andy Coyne, Co-Founder and Chief Product Officer at Cobalt, said:

“The ECB’s announcement that it is starting its digital euro project is a welcome development and it makes sense that it wants to spend two years in an investigation phase to address key issues regarding design and distribution. It’s vital that the Euro CBDC will be interoperable so that PvP or atomic settlement becomes possible between currencies, and the industry can enjoy the many benefits this will bring. These include the 24/7 operation of a digital ledger aligning central and commercial bank operations with the global economy, the cost of issuing cash decreasing, forgeries becoming impossible and settlement becoming central bank backed with the commercial banks facing their clients.

“It’s also important that as an industry, we don’t just focus on CBDCs as these only come into play at the end of a transaction when the central bank’s ledger is updated. The big problem is the old, cumbersome technology which is the spaghetti within many financial institutions’ back offices and crucially, is poor at linking to other systems. The data that banks use is inconsistent and extremely difficult to decipher, leading to multiple errors which require manual intervention. In my view, the industry should also be focusing shared infrastructure and tokenisation at bank level as this would provide fast, secure technology, standardised, clean data and much-needed interoperability throughout a transaction, potentially saving banks billions every year.”

Related News

Mark Bodger

Director at ICit Business Intelligence

Digital transformation helped many UK organisations survive the unprecedented shock of COVID-19. see more

Ivan Kot

Customer Acquisition Director IT Solution Manager at Itransition

The personal finance industry is booming right now, bolstered by a smashing $44.1 billion funding the year before. see more

- 05:00 am

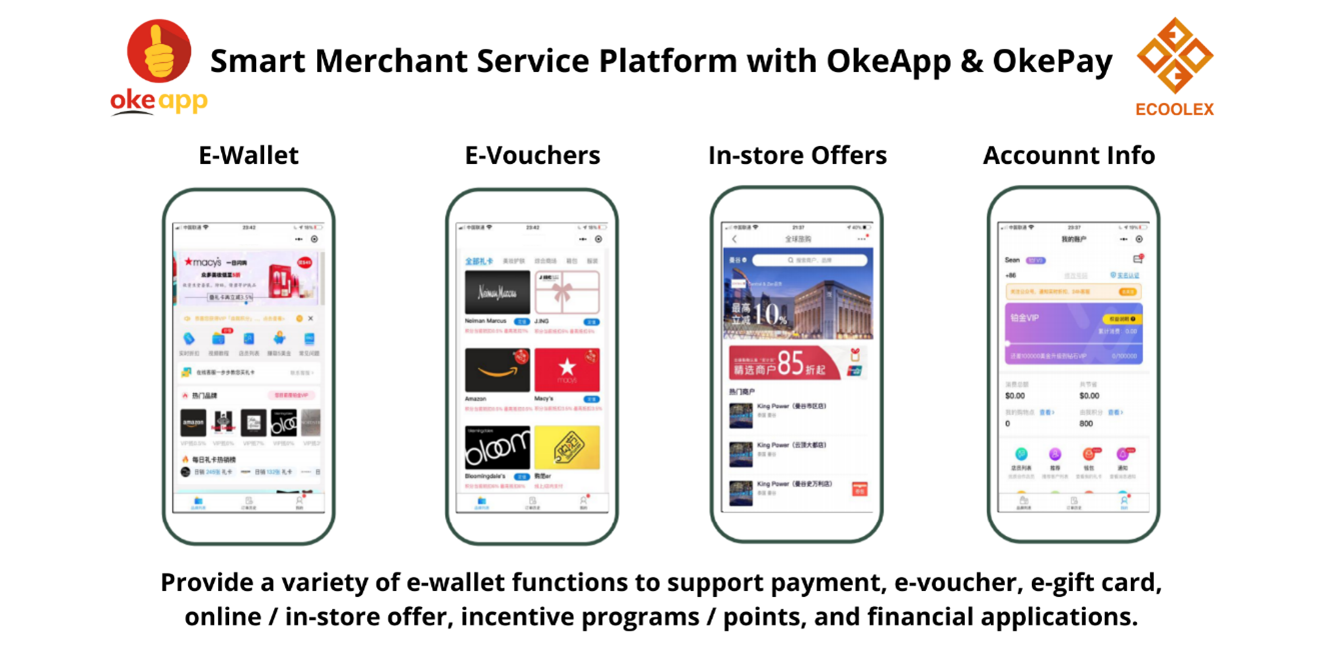

Readen Holding Corp. (OTC Pink: RHCO), a Venture Capital Corporation, today announced that they have signed a Letter of Intent (LOI) for acquiring majority shares of Ecoolex to have controlling interests. The acquisition will boost OkeApp to a flying start, as Ecoolex will instantly bring in existing merchants and partners, which include major network platforms, online travel agencies (OTAs) and financial institutions.

As a cross-border consumer services and multi-channel provider, Ecoolex (www.ecoolex.com) has innovated traditional virtual card / voucher and cross-border payment and created a cross-border consumer financial services platform with transactions of hundreds of millions RMB through global financial institutions and network platforms. Ecoolex has signed multiple contracts with major players in retail, travel and fintech industries as strategic partners, namely Ctrip (www.ctrip.com) and UnionPay (www.unionpayintl.com), etc., creating various discount and voucher programs for cross-border and overseas customers. These collaborations will be fully supported in OkeApp and OkePay, as both voucher and payment systems will be seamlessly integrated in a complete solution to benefit both Consumers and Merchants.

OkeApp, the revolutionary super app launched by RHCO’s wholly owned subsidiary Oke Partners, is a totally unique solution for Consumers and Merchants. As the Consumers will gain notable discounts using the OkeApp, no direct payment fees are applied to the participating Merchants. The Merchants will reap the benefits of online and offline marketing campaigns provided by the OkeApp. In addition, the OkePartners who contribute to recruiting Consumers, will get cash rewards with any transactions made by such Consumers through the OkeApp with the participated Merchants.

RHCO has originally forecast to sign between 8,000 and 10,000 new Merchants on the OkeApp platform within the next twelve months in Hong Kong, which will eventually bring 4 million payment transactions per month. With the acquisition and the joining force of Ecoolex, OkeApp will be enhanced to welcome cross-border consumers from Mainland China and other countries and paving the way for OkeApp to expand to other regions.

The acquisition will also further optimize the utilization of OkePay, a comprehensive back-end Payment Platform operated by RHCO, which accepts standard credit and debit cards, such as Visa, MasterCard, AMEX, UnionPay, along with Alipay, WeChat Pay and other mobile wallets and e-vouchers.

The LOI outlines RHCO’s offer to take over 51% of Ecoolex shares with total investment accounts to US$5.45 million, which includes 45 million restricted shares of RHCO, along with a cash funding injection of RMB 10 million (approx. US$1.54 million) into Ecoolex.

Richard Klitsie, CEO of RHCO stated, this acquisition is an exciting and excellent strategic move for RHCO, as OkeApp will be instantly benefited by Ecoolex’s existing clients, merchants and partners. We are looking forward to work with Ecoolex’s management team and I believe the joint force will definitely realize OkeApp’s potential to achieve an even higher level, boosting OkeApp to worldwide markets at a higher speed.

The newest version of OkeApp will be available for download from Apple App Store and Google Play Store in the coming week.

Related News

- 05:00 am

According to a popular news website there has been more than 35% surge in all over the world when we talk about mobile banking users and their services by the bank’s customers.

It clearly reflects the popularity of mobile banking all around the globe, especially as we have seen a shocking surge in periods of pandemic for financial transactions. Developers have put a lot of effort into mobile banking app development to cater all the services a bank can offer to their customers.

When we talk about mobile banking applications, it acts as the bridge between the customer and the bank to access the banking services on the mobile phone safely. It gives access to most of the services in the reach of your hand in the form of a banking app.

Importance of mobile banking :

1. 24*7 accessibility

Different from traditional banking services, mobile making applications and services have revolutionized the way people access their financial services. To save the customers from standing in the long crowded queue of a physical bank branch near your home and attain the ultimate ease of most of the services at home, a mobile application for banking is brought. The software application of financial institution give the banking access 24*7 for their customers is the main feature of the mobile banking application. This has changed the game giving the power to access almost all of the services via an application whenever and wherever we want.

2. Secure and fast transactions

When we compare with the previous banking system of doing transactions it was a whole lot of different tedious stages that a customer has to face for initiating any transfer funds or to receive it in its bank account. And there is always the risk that an impersonator can imitate you signature to withdraw funds in certain cases. In order to safeguard customers money from fraudsters mobile banking ensures security with their multi level of authentication.

For example in India SBI(State Bank of India) let users use the app with a unique pin to log in their customers for normal activities like checking balance , transactions, etc but to initiate any kind of fund transfer users have to put security password with OTP(one time password ) for completing a transaction successfully. This ensures that only authentic customers complete a monetary transaction barring all the scammers with multiple security arrangements.

3. Instant account opening

This is one of the unique features of a banking application on smartphones that lets new users open a bank account online from the native application without visiting the physical branch by themselves. Especially during the pandemic of covid-19 where major places are shut or under lockdown this feature gives the ultimate service by opening a banking from the native banking application. Eligible Customers fill all the details and upload all the necessary documents required . In the next step banks initiate e-KYC for the authentication of the applicant after successful completion of e-KYC, the customer is good to go and a fresh banking account is created. Therefore customers don't have to hassle themselves with account opening long procedures and sweat themselves by visiting the branch.

4. Spending analysis

With the introduction of automation and machine learning banking applications have evolved themselves in terms of technological advancements and serving more useful features for their customers. One of the features is to get a report of expenditure and saving of an individual. It displays the expenditure analysis reports and categories according to the size of the funds . It also reminds you by notification that you are spending more than the set limie. With the use of the intelligent and smart analysis of the banking application we can set up a budget and monitor our expenditure in one place. People who want to be aware of their financial activities love this feature that helps them to meet their monetary goals in the most efficient way.

5. Pay all bills in one place

Banking apps provide the ultimate solutions for all kinds of bill payment with one click. Traditionally When we have used different applications for shopping, paying utilities, credit card bill payment, fund transfers, tv recharge mobile recharge, broadband bills, etc . But with the development of banking applications all things are done inside the software in one place. This saves a lot of time and effort for paying the necessary utilities and shopping bills without any effort. Later all the transactions can be analysed to get the details about our spending.

Since all the ecosystems are getting digital to match up that level of experience and to retain customers mobile banking applications play a substantial role .

Related News

- 04:00 am

According to the trading activity recorded on high-growth investment trading platform Capital.com, trading in popular meme stocks and cryptocurrencies has dropped month-to-date, while trading derivatives on gold has seen a resurgence.

In the first two weeks of July 2021, gold was the most traded market by clients on Capital.com globally. Gold remained the top-traded market for seven out of 11 trading days this month (between 1-15 July 2021). This marks a significant shift in trading behaviour from the previous month where trading activity in gold was less popular compared to trading activity in so-called meme stocks and cryptocurrencies.

In June, Gold was the most traded market in just one out of the 22 days (between 1-30 June 2021), while derivatives on AMC and cryptocurrencies made up the rest of the month’s most traded markets on the Capital.com platform. Cryptocurrencies are not available to clients who are resident in the UK.

The pickup in trading derivatives on gold reflects a wider change in trader sentiment as markets turn more cautious this week.

David Jones, Chief Market Strategist at European investment trading platform, Capital.com said: “The nagging worry for investors at the moment is still inflation. This goes some way to explain activity by our clients this week - Gold was one of the top-traded assets by our users. Traditionally seen as a hedge against inflation and uncertainty, the yellow metal hit its best levels for a month on Thursday (15 July 2021) - although it is still around 12% off its all-time high set last August.

"This was despite, or perhaps, because of, comments by the Federal Reserve Chairman Jerome Powell saying that inflation had notably increased, and would stay relatively high for a few months before returning back to normal. It has been a frustrating time for gold bugs in the past 10 months, with investors lured away by stock markets continuing to grind higher.The rise in the price of gold this week may be a suggestion that some traders think that this temporary inflation aberration may last a little longer than central bankers expect.

"The Bank of England this week struck a more cautious tone with the Deputy Governor for Banking and Markets suggesting that the central bank had underestimated the rapid bounce in inflation. I don't think this worry is going away anytime soon and it is something that could deliver some market volatility as the year goes on. Investors may have become complacent at the relative calm we have had this year and if history teaches us anything about markets it is that it seldom stays like that for long.”

Related News

- 07:00 am

GLANTUS ANNOUNCES ACQUISITION OF TECHNOLOGY INSIGHT CORPORATION (TIC), SOLIDIFYING POST-IPO GROWTH STRATEGY AND FURTHER EXPANDING INTO U.S. MARKET

Glantus, a provider of Accounts Payable automation and analytics solutions, has acquired Technology Insight Corporation and the business and certain assets of Technology Insight Europe Limited. Technology Insight Corporation has developed its own proprietary AP analytics solution, Datashark, that digitizes the recovery audit process.

This acquisition will provide an immediate boost to Glantus’ earnings per share and represents a major next step in our post-IPO growth strategy.

“We’re delighted to be joined by the TIC team on this journey – this is the first acquisition of many that we will undertake following our successful IPO. Our goal is to become a leader in AP technology through a mix of strong organic growth and acquisition, and the addition of TIC is another key step in that exciting process.”

- Maurice Healy, Founder & CEO, Glantus

The acquisition of TIC will provide presales, implementation, and technical support to the entire U.S. team, and will make the provision of Glantus services more effective and efficient. In addition, it provides Glantus with enhanced management and sales capability along with a greater geographic spread of customers in the US.

Karl Andersson, Founder and CEO of TIC, will remain within the enlarged Group as SVP of Acquisitions & Development.

“We recognize that customers are increasingly looking at automation and AI to drive further efficiencies in their financial processes. With Glantus, we now have the advanced technology platform and the team behind us to delivers additional services to our customers.”

- Karl Andersson, Founder & CEO, TIC

CUSTOMER BASE, REVENUE IMPACT, AND SCALE

TIC brings with it 35 global enterprise customers, making the joined consolidated enterprise customer base close to 100. TIC derives revenue from two streams: subscription and transactional.

RATIONALE

TIC brings exciting additional resources to Glantus:

Technology Insight Corporation customers will see the benefits of Glantus automation and AI technology in enhancements to the services offerings later in 2021.

Related News

- 04:00 am

** The new cloud native PayPort+ technology – powered by Vocalink and Form3 - offers enhanced performance, ease of integration, and seamless connection into the UK’s Faster Payments network **

Mastercard has launched its next generation real-time payments gateway service PayPort+, which provides flexible access into the UK’s real-time payments infrastructure for Financial Institutions and Payment Service Providers.

The solution, powered by Vocalink, a Mastercard company, and Form3, a technology partner, combines the benefits of cloud native technology with the highest levels of security, availability, and operational services standards. Mastercard has selected Form3 as the technology partner for the implementation of its new PayPort+ platform.

Gregor Dobbie, CEO of Vocalink, a Mastercard company, said: “Now more than ever, people and businesses need to be able to rely on the payments network for speed, convenience and security – not just in the UK but around the world. The launch of our next generation PayPort+ service, which we built in collaboration with Form3, is a part of our multi-rail strategy to enhance payment flows for our customers and modernise payments for everyone.”

PayPort was launched in 2016 to offer financial institutions, large and small, connectivity into the UK Faster Payments network. Through this next generation of PayPort+ these institutions will benefit from flexible connectivity options, including MQ, Restful APIs and Microservices.

PayPort+ is now live with two UK financial institutions, including Nationwide Building Society, processing real-time payments into the UK Faster Payment service.

Michael Mueller, Chief Executive Officer at Form3 said: “We are delighted to see this first service delivered as a result of our partnership with Mastercard. We look forward to supporting more financial institutions as we roll out the service"