Published

- 03:00 am

(JCN Newswire) - JCB International Co., Ltd., the international operations subsidiary of JCB Co., Ltd., and Checkout.com, the global payments processing platform, today announces the next evolution of their partnership with the rollout of J/Secure(TM) 2.0 which is compliant with EMV(R) 3-D Secure (EMV 3DS) to Checkout.com's merchants in the UK.

As Europe's leading payment service provider for enterprises, Checkout.com is the first licensee partner in the UK to go live with J/Secure(TM) 2.0, JCB's authentication programme for card-not-present transactions. J/Secure(TM) 2.0 makes online commerce more secure by adding an important identification step in the online purchasing journey, which enables cardmembers to directly authenticate their card with the issuer.

In 2017, JCB and Checkout.com announced their merchant acquiring partnership across 36 European countries and the UAE. With the recent rise and demand for customers to move to online retail spend, JCB and Checkout.com have extended their collaboration in the UK to include EMV 3DS, in the form of JCB's J/Secure(TM) 2.0 for ecommerce transactions going forward. EMV 3DS is a security protocol designed to provide an additional safety layer for online credit and debit card transactions to prevent fraud. According to the recent research by Checkout.com, the UK is losing more than $2 billion annually due to legitimate transactions being rejected as fraudulent purchases[1].

This platform will provide a safe and convenient gateway for JCB's 140 million global cardmembers to process their online payments. In addition, it will enable retailers to reduce cart abandonment and serve as an opportunity for incremental sales from new target markets and customers. This will also further enable Checkout.com's merchants to facilitate secure international card transactions, whilst boosting sales and reducing disputed transactions.

The ecommerce industries which will benefit from this solution include those in luxury retail, courier services, technology, and online money transfers, to name a few. With this extended partnership and the implementation of J/Secure(TM) 2.0, JCB and Checkout.com unlock the ever-growing ecommerce gateway to Asia for online retailers across Europe. JCB data shows that JCB cardmember spend in Europe from 2016-2019 increased by over 300%[2], with the most prolific spending peaks being in the months of January, July and December in 2019[3].

Vladi Artope, Head of Financial Partnerships at Checkout.com, commented: "We are pleased to be the first payment service provider to launch J/Secure(TM) 2.0 to merchants in the UK. The pandemic has accelerated trends that we have long witnessed in the shift to ecommerce. Our long-standing partnership with JCB ensures that merchants are able to securely welcome business from JCB's 140 million cardmembers, providing a seamless checkout experience for consumers and increasing revenues for our merchants."

Nick Fisher, General Manager, Sales and Marketing UK, JCB International (Europe) Ltd., said: "The expansion of our partnership with Checkout.com across Europe was driven by our established commitment to support ecommerce internationally. Additionally, online shopping is a trend which has seen a dramatic rise in recent months. This integration will allow us to streamline the digital payment journey for our cardmembers and to facilitate secure transactional exchange between our cardmembers and Checkout.com's online retailers, especially as we move into the recovery and growth stages in the aftermath of the pandemic."

Related News

- 02:00 am

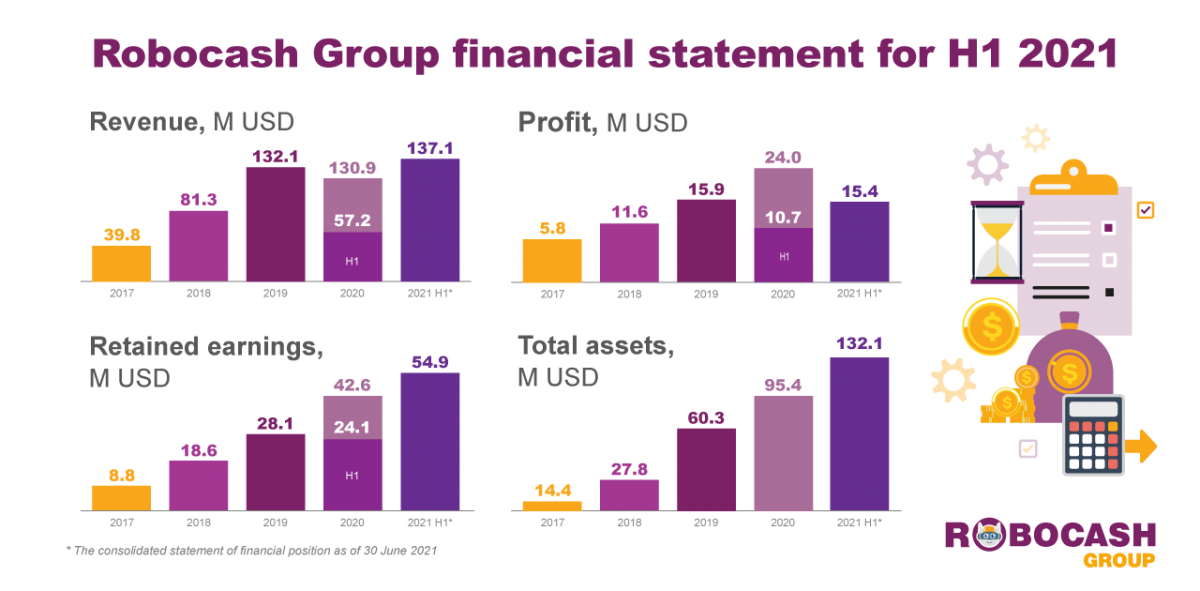

Robocash group, a global fintech holding, has published its consolidated financial statement for the six-month period of 2021. The Interim Condensed Consolidated Financial Report was reviewed by a Big 10 auditor FBK Grant Thornton in accordance with International Financial Reporting Standards.

Robocash Group aimed to accelerate the growth by doubling its disbursement volume and revenue. By H1 2021, the group had disbursed 326.5 M USD worth of loans, exceeding last year's results for the same period by 134.1%.

The group ended the first half of the year with a net profit of USD 15.4 M, and revenue of over USD 137.1 M generated during the period. Robocash Group has exceeded the results of the same period last year by +43.9% and +144% respectively.

Sergey Sedov, CEO of Robocash Group commented: "The growth at which our business has been developing is staggering, and we have no intentions of stopping. We will continue to strengthen our leading positions in Russia, Kazakhstan and the Philippines. At the same time, we intend to further scale our Buy Now, Pay Later and Salary Loans solutions. Finally, we aim to launch our own neobank in the Philippines, offering a variety of financial lifestyle products to the un- and underbanked."

Related News

- 08:00 am

Encompass Corporation, the provider of intelligently automated Know Your Customer (KYC) solutions, today announces the appointment of Nicola Pickering as VP Customer Success & Delivery.

Nicola, a senior leader who has worked across client success management, programme delivery and product design, joins the Encompass executive team in this newly-created role. She will be responsible for leading the company’s global Customer Success and Delivery Services functions, ensuring an evolving list of customers continue to get the best from the Encompass product.

Nicola comes to the business having spent more than eight years with industry leader FICO, steering client success and, latterly, business operations. She has also held positions at National Grid and Capital One, among others.

The appointment comes as current Head of Customer Success & Delivery, Dr Henry Balani, transitions into the role of Global Head of Industry and Regulatory Affairs. A noted academic with a strong research background, Dr Balani will be at the forefront of cementing Encompass’ voice and authority through research and market activity.

Wayne Johnson, CEO and co-founder, Encompass Corporation, said: We are delighted to have someone with Nicola’s business leadership experience join the team at such an important time in our growth journey.

Her knowledge and understanding of how to deliver the best possible service for customers will be crucial as we scale globally. I am looking forward to seeing our customer-facing teams continue to flourish under her guidance. I know this, combined with Henry’s new role, which will see him use his vast expertise to help us further our impact across the market as thought leaders, will stand us in good stead moving forward.

Nicola Pickering added: I am delighted to join Encompass on their journey to be the solution of choice for the automation of KYC. It is clear that our people and our customers are at the heart of Encompass’ values, as is shown by this newly-created Executive-level role, which puts customers at the forefront once again. I am honoured to be part of leading what is an incredible team.

Related News

- 06:00 am

Spearhead of Basel III reforms, William Coen, joins Baton’s Senior Advisory Board, as company scales to meet industry demand for effective risk mitigation

Baton Systems (“Baton”), the market solution transforming asset movements and settlements, has announced that William (Bill) Coen, former Secretary General of the Basel Committee on Banking Supervision, has joined the firm as a Senior Advisor.

Coen’s appointment comes as Baton scales to support growing demand for secure technology-led solutions to mitigate operational and settlement risk, reduce capital usage and address intraday funding requirements.

Coen’s deep and comprehensive understanding of prudential standards were developed over a 35-year career in financial regulation, which included serving with the Board of Governors of the Federal Reserve System and a 20-year tenure at the Bank for International Settlements (BIS) in Basel, Switzerland. While serving as Secretary General and Chairman of the Basel Committee's Policy Development Group, Coen spearheaded the Basel III post-crisis reforms.

The secure Baton network is now being used by a number of large financial institutions (including G-SIBs) to facilitate the movement of billions of dollars of cash and securities on a daily basis. Coen’s experience will support the company’s accelerated growth plans and the delivery of robust, zero-friction processes across additional payment and settlement workflows.

Commenting on his appointment, William Coen said: “I’m really pleased to be on-board. Baton’s innovative application of DLT is proving transformational. As a former regulator, it is pleasing to see this secure technology enable banks to reduce settlement risk, while increasing transparency and auditability. I’ve spent the vast proportion of my career developing prudential standards, it’s great to now be involved with a company that is enabling all firms to safely settle their FX trades.”

Arjun Jayaram, CEO and Founder of Baton Systems added: “I’m delighted to welcome Bill to Baton, his familiarity with the regulatory requirements impacting risk management, capital adequacy and funding regulations is second to none. Being at the helm of a rapidly maturing business that is serving clients challenged by these very requirements, in an environment with increasing FX trading volumes and unrelenting cost constraints, Bill’s counsel has already proved invaluable as we embark on the next stage of our journey.”

Coen’s appointment to the Baton Senior Adviory Board adds to an impressive line-up of industry leaders following the recent appointments of former CFTC chairman, Christopher Giancarlo, and Citi’s former Global Head of Futures, OTC Clearing, and FX Prime Brokerage, Jerome Kemp, in the past ten months.

Related News

- 06:00 am

Flanders Investment & Trade (FIT), the official government body for the region, has announced an 183% jump in the number of UK investment projects in the first six months of 2021, compared to last year.

Astrid Geeraerts, Head of Investment at Flanders Investment & Trade in the UK (based at the Belgian Embassy in London) explains the increase; "The rise is a direct result of Brexit, with many UK companies taking the decision to set up a base within the EU so that they only have to manage the bureaucracy of entering the bloc only once."

Flanders offers one of the world's highest concentrations of people, money and industries. One UK company that has made the move to Flanders is Pricecheck, the global wholesaler. Pricecheck set up a legal entity in Antwerp prior to Brexit, as a pre-emptive move. In January 2021, Pricecheck tried to continue to deal directly with countries in the EU, as they had before, but found new challenges to overcome. Each country was interpreting the new rules slightly differently and it became a much more complicated process than before.

Mark Lythe, the Joint Managing Director of Pricecheck commented; "I would definitely recommend Flanders as a route into the EU. Flanders Investment & Trade has been a great source of help and advice and they've simplified a complicated situation so that we now have a reliable and scalable solution for trading with the EU after Brexit."

To help more UK companies FIT is hosting a free webinar on customs procedures on inbound goods, future changes and logistics. It is taking place on Tuesday 14th September at 10am (UK time), it will include speakers ready to share their expertise on how to trade in Europe, including Daan Schalck, CEO North Sea Port and Vice Chairman at Espo, Jeroen Sarrazyn, expert on EU-UK trade at Customs and Excise department at the Ministry of Finance in Belgium. There will also be a session led by Customs and Excise.

Jeroen Sarrazyn explained their involvement: "In Flanders, the Customs administration has a history of a coordinated approach with the importers and exporters. In Customs and Excise we're working hard to ensure that post-Brexit trade with the UK runs efficiently and smoothly."

To register for the event, free of charge, visit http://www.flandersinvestmentandtrade.com/ukwebinar

Related News

- 04:00 am

New Role Adds Investment Expertise to Support TAE’s Growth and Innovation

TAE Technologies announces the appointment of William Coaker as the company’s first Chief Investment Officer.

Coaker comes to TAE with over two decades of senior level experience in the investment field, most recently as Chief Investment Officer for the San Francisco Employees Retirement System (SFERS), a $34 billion public pension plan. During Coaker’s tenure, he earned SFERS a ranking in the top 1% over the past 1, 3, 5 and 7 years versus other public pension plans, posting more than $5 billion in excess returns versus the median public pension. In the last fiscal year alone, SFERS investments returned 33.8%, with the venture capital portfolio returning over 87%, and the overall plan achieving approximately $9 billion in investment gains and $1.5 billion in excess returns.

“TAE is the most transformational business I have ever seen,” said Coaker. “TAE is a platform company at the epicenter of clean energy, technology, software, science, big data, and machine learning. Through TAE’s unique approach to fusion, the company is poised to meet the existential issue of our time—namely, how to meet the vast need for energy, grow economies and improve living standards, while also protecting the environment. These are enormous markets with urgent needs, and I think TAE has the technology to solve them.”

“In their quest to commercialize fusion, TAE has also developed technologies that provide substantial value in other large, adjacent industries, including electric vehicle design and ultrafast charging; energy efficiency and storage solutions; and an emerging biologically-targeted radiation therapy aimed at treating difficult cancers. TAE is poised to provide clean, affordable, reliable, and abundant carbon-free energy, accelerate the transition to electric vehicles, and improve outcomes for certain cancer patients,” said Coaker. “I am honored to join such a distinguished team that is poised to make a significant contribution to the world.”

“With the confidence we earned in achieving our ‘long enough, hot enough’ milestone, demonstrating our fusion technology on an industrial scale, and receiving robust scientific validation from our independent science panel, TAE is quickly moving toward fusion commercialization. This, along with the ‘fusion-born’ technology applications in energy storage, transmission and e-mobility, presents a unique opportunity for a clean energy future,” said TAE Technologies CEO Michl Binderbauer. “Bill deeply understands the transformational, ready-for-market nature of our technologies and how to communicate with investors and the marketplace. As such, his leadership and vision will play a central role in realizing TAE’s capabilities to make an immense contribution to humankind.”

Coaker has received numerous awards and distinctions in his career. Earlier this year, he was named to the Power100 by AI-CIO. In 2019, SFERS was named Small Plan of the Year by Institutional Investor. Regarded by peers as a futurist investor, Coaker has been a regular speaker at the Milken Conference, Institutional Investor, and Pension Bridge, among others. Coaker believes that the speed, scale, and impact of innovation is being significantly underestimated, and he advocates investing in science, technology, and leaders in innovation to achieve high investment returns.

Related News

- 01:00 am

Worldline, the European leader in the payments and transactional services industry and UnionPay, the payment organisation with the world’s largest cardholder base, are pleased to announce a new agreement that will significantly expand UnionPay’s acceptance scope in the Nordic region.

The strategic agreement between UnionPay International and Worldline, will cater to the needs of Chinese visitors to the region as well as the increasing number of European UnionPay cardholders. The agreement will enable UnionPay card acceptance at some 20,000 in-store merchants across the Nordics via Worldline’s affiliate previously known under the name Bambora.

Worldline is already one of the largest UnionPay acquirers in Europe, and the Nordics constitutes the next step in its strategy to further expand UnionPay card acceptance into new markets. In the DACH countries UnionPay merchant acceptance already exceeds 50%, rising to 90% in sectors such as luxury retail and almost 100% in tourist regions.

In recent years, the Nordic countries have become an increasingly popular travel destination for Chinese tourists and this trend is expected to continue following the recovery from the Covid-19 pandemic, with the number of Chinese visitors to the region in 2017 set to double by 2024, contributing an estimated US$ 1.6 billion. After cross-border travel recovers, Chinese consumers will be able to use their UnionPay card or mobile phone to pay at POS terminals by contactless and complete the payment swiftly and securely.

Helsinki is a hub for direct flights to and from mainland China and flights are also available to and from Stockholm and Copenhagen. To ensure a smooth end-to-end customer experience Worldline and UnionPay will focus on providing a familiar, simple and fast check-out process for Chinese cardholders and European UnionPay cardholders visiting the Nordic countries. With approx. 200,000 merchants in the Nordics, there is significant scope to introduce new e-commerce solutions in the near future.

“As the recovery from the repercussions of Covid-19 gathers pace, Chinese visitors will play a crucial role in revitalising the European tourism sector in Europe. Worldline is pleased to strengthen its long-lasting strategic partnership with UnionPay. By leveraging our relationship with the Nordic merchant community via Bambora, we are ideally placed to significantly boost UnionPay acceptance across the entire Nordic region”, said Daniel Nordholm CEO of Nordics and Head of Worldline’s Merchant Services division for Regional Businesses.

“Maintaining and developing long-term relationships are a significant success factor for UnionPay. Worldline has been our trusted partner in Europe for many years, and we look forward to taking the next step together to plan to build global coverage to better support our UPI issuing business”, said Han Wang, Deputy Head of Europe at UnionPay International.

Related News

- 05:00 am

- Real-time platform delivers quick approval turnaround, reducing decision times from days to hours

- Fully digital experience transforms SME business funding for businesses and their advisors

- 300% growth in asset finance business volume achieved since implementation

- Lending-as a-service platform helps firm ScotPac’s position as one of few Australian and New Zealand business financiers able to quickly finalise funding for simple and complex deals

Global digital lending platform innovator, Trade Ledger, has joined forces with ScotPac, Australia and New Zealand’s largest non-bank SME lender, to create a market-leading origination and underwriting experience for business funding. The partnership demonstrates the game-changing scope of the Trade Ledger platform for business lenders and their customers, dramatically reducing application turnaround times.

ScotPac is using Trade Ledger’s data-driven lending platform to unlock all types of working capital and business lending products for SMEs who cannot always easily access finance. The Trade Ledger platform was piloted on ScotPac’s asset finance offering and has been a hit with business owners and brokers, achieving a 90% reduction in application turnaround time and a 300% growth in new business volume in the past 12 months.

“Our technology and business data insight, paired with business finance experts like ScotPac, is accelerating and transforming business finance - focusing in particular on the SME and mid-market lending experience, unlocking economic growth with better lending products,” said Martin McCann, co-founder and CEO of Trade Ledger. “Our platform puts the customer experience at the heart of the process and expands credit distribution without increasing risk, unlocking a £1.2 trillion un-served segment of the £7 trillion global SME credit market. The ScotPac partnership demonstrates how effectively our platform can help a lender grow their business.

“Trade Ledger’s platform goes beyond Open Banking. Our ability to match a lender’s customers with the right services and bring new propositions to market quickly is key to our relationship with ScotPac and transforms how business finance can be accessed.”

“ScotPac and Trade Ledger have created a fully digital experience that is simple for the end user, whether they are a small businesses or large corporation. The goal is to transform business funding so it’s easily accessible for SMEs,” ScotPac CEO Jon Sutton said.

“SMEs can quickly access multiple products (including our debtor finance, asset finance and trade finance), to solve their most bespoke or complex funding problems. The value of speed and consistency is massive for business owners, and for our broker and accountant partners.”

Trade Ledger technology sits at core of ScotPac’s new digital lending experience

- A digital credit assessment and onboarding experience built on scalable native cloud architecture, with microservices that allow lenders to rapidly create tailored workflows, rules and logic

- A platform with best-practice compliance and security integrated with external data sources, for data-driven analysis and fast funding decisions

- Daily use of AI and data analytics within the business that improve customer experience and provide growth and efficiency metrics

- Tailored workflows and user workspaces that allow lenders to perform credit assessment tasks with speed and at scale

- A Partner Portal that makes lending decisions super-quick for brokers, accountants and other ScotPac partners, and that also provides them with real-time deal progress and handy templates and resources to make it easier to do business

Using data and tech to reimagine the world of lending for SMEs

The Trade Ledger partnership will completely digitise the front door to every channel and product for ScotPac, with supercharged and secure digital processes that don’t hold business owners back when they are looking for funding, Mr Sutton said.

“The investment in cutting-edge technology is part of our ‘best of both worlds’ approach of providing business owners with a quick, easy digital decision on whether we can fund them, while preserving the deep, relationship-based funding reputation we’ve built since the 1980s. It provides ScotPac clients and introducers with the technology and speed of a fintech, giving each business more control and visibility over their funding deals, but unlike fully online lenders we remain able to handle complex transactions.”

He said the partnership with Trade Ledger is an important tech initiative, one of several planned for ScotPac, who have invested heavily in technology and expanded their product offering and executive team. This is driving ScotPac’s transformation from what has been for more than 30 years primarily a debtor finance business, to become a significant leader in working capital lending in Australia and New Zealand.

“Even with great digital experiences, businesses want and need flexibility – they don’t want to deal with a lender that is a ‘one size fits all’ sausage factory. ScotPac’s investment in technology is allowing us to make nimble decisions to quickly understand each business and make an accurate call on funding”, added Mr Sutton. “ScotPac can handle complex requests to get deals done, and really partner with clients, rather than just make algorithm-based digital decisions about whether or not to fund them.”

Related News

- 02:00 am

The largest technology event in Asia for accountants and finance professionals

Accounting & Finance Show Asia 2021 returns for its 4th edition, bringing together the region’s accounting and finance professionals

In two years of disruption, businesses around the world have adapted quickly to rethink their processes and navigate the challenges. This largest gathering of the year for Asia's accounting and finance professionals will help SMEs, enterprises and accounting firms to build on their digitalisation to date by sharing updates on the latest digital tools and technologies alongside expert advice on how to plan and prioritise for 2022 and beyond.

More than 100 accounting and finance leaders innovating and disrupting accounting and finance in Asia will take the virtual stage across 3 key channels, Digital Innovation: Keynotes & Tech Talks, Digital Practice and Accounting Tech: Adopt, Connect & Grow.

Opening the event on Day 1, Daniel Hustler, Education Manager - Asia, Xero will provide tips on how technology can be utilised to get paid faster and to better manage cashflow at the keynote session. Leaders from AirAsia, Tatler Asia, Motorola Solutions and Western Union Business Solutions will then take over with the first panel discussion on the most important insights, opportunities and risks for finance leaders in 2022 and beyond.

Day 2 kicks off with a keynote session presented by Kevin Fitzgerald, Managing Director - Asia, Xero who will share how accounting firms can shift to the cloud to attract and retain clients. In the afternoon, Cece Leung, Managing Partner, The Entrepreneur CFO, Jasmine Chung, Head of Finance, Foodpanda Hong Kong and Jeremy Li, Finance Director - APJ, Veeam Software will be leading a keynote panel on how some of Asia's fastest-growing companies have planned for scalability with the right technology.

Other featured speakers at Accounting & Finance Show Asia 2021 include:

• Haroon Aslam, Finance Director, GETZ Healthcare

• Alan Wong, CFO, Olive Tree Estates

• Will Farnell, Founder, Farnell Clarke

• Sandra Blankson, Financial Controller, Luther LLP

• Richard Hayler, CFO, Nutrition Technologies

• Samuel Lim, Partner, Axios LLP

• Henry Tan, CEO, Nexia TS

• Charles Chen, Managing Partner, Charles & Partners

• Axel Hauke, Trader/Treasury Manager, Agrocorp International Pte Ltd

• Aly Garrett, Founder, All In Advisory

• Elaine Lim, Director, Agere Accounting

• Heather Smith, Accounting App Hype Girl, Anise Consulting

Running alongside the conference is a virtual exhibition hall where attendees can discover and demo the latest digital solutions. Our fantastic sponsors are ready to show how they can help businesses transform digitally. Meet Title Sponsor Xero, Gold Sponsors BlackLine, Gaviti, Jenji, Practice Ignition, Silver Sponsors Fathom, Inflo, Payoneer, SAP Concur, Unit4, Western Union Business Solutions and more, all at the click of a button.

“The last five years have seen the accounting industry become increasingly tech-savvy, with The Cloud sitting at the centre of innovation. Cloud accounting has enabled greater efficiency, accuracy, transparency, time and cost savings for businesses then ever before, giving accountants and bookkeepers more time to focus on strategic planning, business growth and creating greater value for their clients. We are delighted to be a part of this year's Accounting & Finance Show Asia, and together with other industry experts share our learnings and insights to help practices across Asia achieve greater success,” said Kevin Fitzgerald, Managing Director - Asia at Xero.

The Accounting & Finance Show Asia 2021 is expected to gather over 2,000 accounting and finance stakeholders from Asia and beyond, and is set to be an event driving innovation, growth and collaboration within the industry.

Related News

- 02:00 am

JCB Co., Ltd. (JCB), a leading global payment scheme, and EPIC LANKA (PRIVATE) LIMITED (Epic Lanka), a leading Sri Lankan IT conglomerate, are pleased to announce that JCB has granted the J/Secure(TM) 2.0 Third Party Provider (TPP) Certification to Epic Lanka as the ACS Operator for its service with EPIC ACS.

In addition to being the only locally developed ACS provider in Sri Lanka, Epic Lanka is the first ACS Operator in South Asia to be certified as a J/Secure(TM) 2.0 TPP for its product EPIC ACS. Epic Lanka also has the distinction of being the first company in the world to be certified with EMV(R) 3DS 2.2 certification and the first-ever Sri Lanka-based vendor to be certified by the other international payment schemes for their 3-D Secure ACS solution.

J/Secure(TM) 2.0, JCB's Cardholder authentication program conforming to the EMV(R) 3-D Secure Protocol and Core Functions Specification, is expanding globally and supported by major global suppliers of 3DS Server and ACS. The J/Secure(TM) 2.0 TPP Certification granted to Epic Lanka as the ACS Operator for EPIC ACS will provide more opportunities to the JCB Issuers for secure e-commerce transactions. The ACS functions and characteristics supported by Epic Lanka include 3RI, ACS Attempt, Decoupled Authentication and Acquirer TRA as authentication options.

Note: EMV(R) is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.