Published

- 05:00 am

NEC Corporation has expanded its collaboration with Amazon Web Services, Inc. (AWS) in areas that include global 5G and the digital government in support of accelerating digital transformation for customers.

In November 2020, NEC and AWS concluded a corporate-level strategic collaboration agreement, and have been developing offerings and strengthening delivery capabilities since then. NEC will now expand this collaboration and strengthen efforts in the following areas:

1. Global 5G

NEC aims to develop an end-to-end 5G offering and to provide it globally by combining NEC's high-performance cloud-native open 5G mobile core, OSS/BSS solutions, local 5G use cases etc., and AWS cloud and edge solutions. NEC will accelerate telecom carriers' cloudification of network workloads and enhance digital transformation for enterprises by deploying 5G-based infrastructure and applications at the network edge. This combined solution stack will be supported by NEC's system integration services to enable customers to efficiently deploy and scale 5G networks, enhance automation and drive significant improvement in operational economics.

2. Digital government

NEC has been certified as an AWS Government Competency Partner based on the strategic collaboration that started last year and its achievements for governments to date. Going forward, NEC will further strengthen its relationship with AWS and focus on developing and providing a menu of offerings to accelerate the digital transformation for government activities in Japan.

3. Hybrid cloud

By collaborating with AWS, NEC aims to develop and provide a menu of offerings that connects on-premises and cloud environments securely, at high speed, and with low latency. This will contribute to the acceleration of digital transformation through modernization that utilizes the customer's existing information technology (IT) assets.

To accelerate these initiatives, the NEC Group has increased the number of AWS-certified engineers to 2,000 at present, aiming for 3,000, double the number from the start of collaboration in 2020, and firmly maintains one of Japan's largest delivery capabilities for cloud projects. Going forward, NEC will continue to strengthen these positions and to ensure that it responds to customers' digital transformation demands.

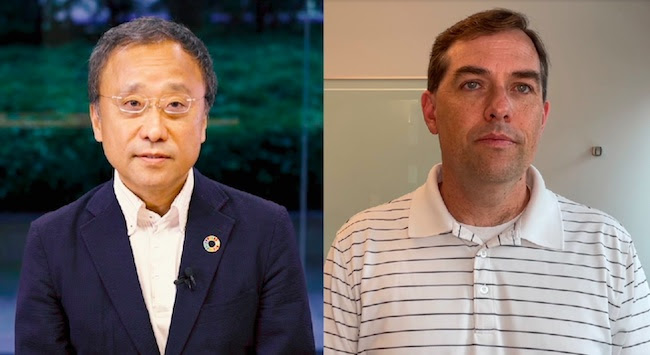

Comments from both companies on this collaboration are as follows.

"NEC is pleased to announce the expansion of its strategic collaboration with AWS. Last year, NEC announced this global collaboration as the first of its kind between AWS and a Japanese company. It has been a great year, seeing many successes in the areas of government, modernization and in the skill enhancement of NEC engineers. NEC is now expanding the collaboration with AWS in the areas of global 5G, digital government and in enhanced hybrid cloud offerings. With the strong global support from AWS, NEC will help drive digital transformation in the government sector and across industries as part of orchestrating a brighter world," says Toshifumi Yoshizaki, Executive Vice President at NEC Corporation.

"We are delighted to deepen our relationship with NEC. AWS welcomes NEC's commitment and delivery of solutions built on AWS to deliver high-quality solutions that accelerate customers' digital transformations. We look forward to NEC's continued expansion of offerings and further expansion of delivery capabilities to optimize these transformations," says Doug Yeum, Global Head of Alliances & Channels at Amazon Web Services, Inc.

Related News

- 06:00 am

GBG, the global expert in digital identity, helping businesses prevent fraud and meet complex compliance requirements, has announced a partnership with SEON. With this partnership, GBG strengthens online fraud prevention for banks, fintechs, and digital banks by using email, IP, phone and social media as alternative data for fraud detection, while meeting compliance and data privacy needs. SEON's technology is fully integrated into the GBG Intelligence Center.

Digitilisation is accelerated by the COVID-19 pandemic, where digital banks in Asia Pacific reported a threefold increase in their customer bases in 2020 as compared to traditional banks. Mature economies like Singapore and Hong Kong have established high fintech adoption rates, and developing countries like Vietnam, Cambodia and the Philippines are gearing to achieve financial inclusion with 70% of Filipino adults by 2023 to provide financial access to low-income households, gig economy, small businesses, and new-to-bank GenZ.

As Financial Crime 4.0 continues to exacerbate, the partnership with SEON enables GBG to increase effectiveness in combatting modern day fraud by validating the most active and present-day e-lifestyle based consumer touchpoints such as email addresses, IP location, social media, phone and SIM data to detect fraudulent anomalies in account application and loan origination, as well as to onboard new-to-bank population. Financial institutions (FIs) can look to reducing fake and malicious email address usage to as low as 0% and increase detection of suspicious IP-related applications and transactions by up to 80%.

Remote Fraud Management with Accuracy and Automation

FIs utilising the GBG Intelligence Center, a key module in GBG's flagship end-to-end financial crime management solution - Digital Risk Management and Intelligence platform, benefit from enriched data intelligence to augment fraud detection and prevention accuracy by reducing manual work for FIs, false positive and false negative rates.

SEON adds to the performance of the Intelligence Center with its track record of zero false positives for email, phone and IP. Especially as fraud costs increasingly outweigh fraud management spend, this partnership helps risk management teams to increase efficiency by reducing time spent on manual tasks (eg checking of email, phone and IP data) by up to 50%. Furthermore, as remote working arrangements continue, the ability to automate fraud detection and prevention with a high degree of accuracy remains crucial. This partnership will further strengthen GBG's capabilities to support enterprises with agility and flexibility.

Dev Dhiman, Managing Director of GBG, APAC, says, "To effectively address the rise in digital financial crime simply means that fraud detection and prevention measures need to be constantly modernised. This partnership with SEON continues to expand GBG's datasets to better combat against identity crime, in particular synthetic ID, impersonation, identity theft, account takeover, money muling, and SIM swap fraud typologies."

"Close to half of GBG's customers are in financial services, it's a top priority for us to build a watertight environment to avert any data point from being used by bad actors to commit fraud. By constantly enhancing how our platform performs, we can better protect our customers and build digital trust between financial institutions and their consumers. As the digital economy continues to evolve, the GBG Intelligence Center will continue to grow its strong network of partners to equip all FIs with the best-of-breed data and technology to fight fraud," continues Dhiman.

Double Down on Fraud with AI & Machine Learning

Complementing GBG's artificial intelligence (AI)-driven approach to detect fraud, SEON uses open data and whitebox machine learning, giving businesses complete visibility and total control of how the AI decisions are made.

With SEON's expertise and access to data, the integration with GBG Intelligence Center will provide enterprises with an even more thorough and unified fraud detection process:

- Achieve up to 60% reduction in fraud volume in enterprises

- Wide data coverage in APAC

- 100% GDPR and ISO 27001 compliant to meet data and privacy standards

- Leverages only on proprietary email, IP and phone data going back a decade

- Connected to over 30 social media platforms to uniquely see a comprehensive view of a person's social network footprint with their digital footprint

SEON's APAC customers include Grab, Danabijak, ATM Online, HomeCredit, 10Bet, and Robocash.

Jimmy Fong, Chief Commercial Officer at SEON, added, "The ability to identify fraudulent behavioral patterns also means businesses can discover hidden revenue opportunities. SEON's AI adapts to any business model, learning how it operates to create fully transparent and visible rules. This creates a scalable fraud prevention solution for all online business types, whether as a payment service provider, payment gateway, neobank, Buy Now Pay Later (BNPL), gaming, anti-money laundering and more. The combination of GBG and SEON is a modernised solution for a fast-moving digital age, set to create greater agility to mitigate growing risks of fraud brought on by the pandemic, while smoothening and automating financial crime management processes without compromising user experience."

This partnership forms part of GBG's commitment to protect and provide FIs with end-to-end digital fraud and compliance solutions. The GBG Intelligence Center, with SEON incorporated, will be available to FIs across APAC, including Vietnam, Cambodia, the Philippines, Malaysia, and Thailand.

Related News

- 09:00 am

New Australian SME Lender completes accelerated delivery of nCino’s cloud-based platform

nCino, Inc. (NASDAQ: NCNO), a pioneer in cloud banking and digital transformation solutions for the global financial services industry, today announced that TruePillars, a specialist SME lending company headquartered in Melbourne, Australia, is live on the nCino Bank Operating System®. TruePillars selected KPMG Australia as their delivery partner, who in conjunction with the nCino team in Australia, were able to transform the TruePillars’ lending process rapidly and get their users live on the nCino platform in only 12 weeks.

“As a start-up in the Australian financial services ecosystem, we knew we needed partners who could get us up and running quickly, who were flexible and who understood our business,” said John Baini, Co-Founder and CEO of TruePillars. “nCino and KPMG exceeded our expectations at every turn, from kick-off to go-live. The nCino platform is modern, highly flexible and configurable, and was delivered with speed and accuracy, making the entire implementation process as seamless as possible. We are looking forward to a long and successful partnership.”

Thanks to a rapidly growing client base, TruePillars needed a platform that would allow it to scale and support a higher volume of transactions without additional headcount. They also sought to streamline processes and workflow, approve loans more quickly and serve their diverse customer base more efficiently. TruePillars selected the nCino Bank Operating System – an end-to-end cloud-based platform that manages the entire loan lifecycle – to provide a more seamless lending experience for their clients, from loan origination to renewal, while maintaining strong credit oversight and suitable approval rates.

KPMG Australia has established an alliance with nCino to support Australian banking clients through the deployment of nCino’s Bank Operating System to provide a seamless experience across devices, channels and products while driving increased efficiency, transparency and regulatory compliance. With significant banking and technical expertise, KPMG led the implementation, working closely with TruePillars and nCino, to deliver an accelerated and out-of-the-box solution. The process included an integration with a leading e-signature provider to increase automation and improve the customer experience.

“nCino has always been laser-focused on transforming financial services through innovation, reputation and speed,” said Mark Bernhardi, General Manager of APAC at nCino. “This project, in particular, exemplifies that mission in action. We are thrilled to partner with TruePillars and KPMG, and we’re proud to have played our role in helping this company to achieve their vision of creating a lasting, positive impact on the Australian financial services landscape and providing a faster and easier lending experience for their clients.”

“We are incredibly proud of this project, as it demonstrates that digital transformation can be delivered at pace,” added Alex Moreno from KPMG. “Our banking and nCino expertise, supported by strong engagement from TruePillars’ senior management team, allowed us to work with nCino to execute with speed, control and operational excellence.”

Related News

- 03:00 am

Consent Order against Student Loan Originator for Deceptive Practices Sends Clear Message to ISA Industry

The Consumer Financial Protection Bureau (CFPB) took action today against an income share agreement (ISA) provider for mispresenting its product and failing to comply with federal consumer financial law that governs private student loans. Better Future Forward, Inc., through its affiliated companies, provides students with money to finance their higher education, in the form of ISAs, under which students agree to pay a percentage of their income for a set period of time or until they reach a payment cap. Better Future Forward falsely represented that the ISAs are not loans, failed to provide disclosures required by federal law, and violated a prepayment penalty prohibition for private education loans. Under the CFPB’s order, Better Future Forward is required to provide disclosures that comply with federal consumer financial law, eliminate the prepayment penalties, and stop misleading borrowers.

“The ISA industry has tried to evade oversight by claiming that its products are not loans,” said CFPB Acting Director Dave Uejio. “But regardless of the name on the label, these products are credit and have to comply with federal consumer protections. The ISA industry cannot pretend that core consumer protection laws do not apply to their products.”

Better Future Forward is a nonprofit organization based in Virginia. Better Future Forward offered consumers several versions of ISAs, under which providers advanced money to consumers to finance their education expenses. In exchange for the advanced money, the borrowers promised to make payments based on a percentage of their income until they repaid a defined amount, or a specified period had elapsed. Falsely Representing Education-Finance Products

The CFPB found that Better Future Forward falsely represented that its ISAs are not loans and do not create debt, in violation of the CFPA. The organization also failed to give certain required disclosures and imposed prepayment penalties on private education loans, in violation of TILA, Regulation Z, and the CFPA. The violations involved the companies’ student-loan-origination activities, which included:

- Falsely representing that its ISAs are not loan products and do not create debt:Better Future Forward deceived student borrowers, telling them that the agreement by which they had to pay a percentage of their income over a certain threshold in exchange for funds for their post-secondary education was not a loan and did not create debt.

- Denying consumers information necessary to fully evaluate their financial options: By operating as if their agreements were not “credit” or “private education loans,” Better Future Forward failed to provide disclosures for private education loans as required by federal consumer financial law.

- Subjecting consumers to fees or penalties for early repayment or prepayment:Better Future Forward imposed unlawful prepayment penalties on its private education loans.

Enforcement Action

Under the CFPA, the CFPB has the authority to take action against institutions violating federal consumer-financial laws, including those engaging in unfair, deceptive, or abusive acts or practices. The consent order issued today requires Better Future Forward to:

- Stop deceiving consumers about the nature of their products: Better Future Forward must stop stating that its ISAs are not loans or do not create debt for consumers.

- Provide consumers disclosures about their products as required by federal consumer financial law: Better Future Forward must provide disclosures required by the Truth in Lending Act and its implementing Regulation Z for closed-end credit, including disclosures about the finance charge, the amount financed, and the annual percentage rate, as well as disclosures required for private education loans.

- Not object to bankruptcy discharges: Better Future Forward must continue its practice of not objecting to any discharge of a student’s ISA in bankruptcy, including not contesting that repaying a student’s ISA would present an undue hardship.

- Reform its ISA contracts: Better Future Forward must not impose a prepayment penalty on a private education loan and, for certain ISAs, must recalculate the payment caps to eliminate the prepayment penalty.

- The CFPB did not impose financial penalties against Better Future Forward after considering its responsible conduct, namely that it demonstrated good faith and substantial cooperation beyond that required by law.

Related News

- 09:00 am

The Tillful iOS app will provide small business owners and entrepreneurs access to exclusive funding opportunities and free financial management services.

This week, Tillful announced the launch of its new free iOS mobile application. Tillful's mobile app is the first in the market to offer a real-time business credit scoring platform that leverages alternative data.

It makes credit information and business credit scores much more accessible and actionable as well as offers exclusive access to funding for the platform's more than 25,000 existing small businesses.

"We are more committed than ever to ensuring that small business owners get the credit they deserve," says Ken So, founder and CEO of Tillful and its parent company, Flowcast, Inc. "The expansion into mobile was a natural extension of our mission to empower underserved business owners and deliver direct value for our users. We are committed to our mission of increased financial literacy and access to financial products for the small business and founder communities."

Since launching a year ago, Tillful has facilitated over $10M in business funding for SMEs across the U.S. With over 40 different online lending and fintech partners, Tillful meets the needs of a diverse spectrum of credit profiles spanning industries such as construction, retail, hospitality, logistics, and e-commerce.

Traditional credit scoring systems rely on static data, which can paint an incomplete, imperfect picture of true creditworthiness, often to the disadvantage of already underserved businesses. Alternatively, the Tillful Business Credit Score uses real-time connected bank and transaction data to find cash flow patterns that indicate a more accurate and up-to-date picture of a company's financial profile and creditworthiness as a business borrower. This, in turn, allows Tillful to connect these businesses with the right lending and funding opportunities they need to succeed.

Tillful's lead Data Scientist Alex Keller explains why their model is different. "At Tillful, we believe that more inclusive predictive models must begin with explainability and transparency in mind so that lending decision-makers understand the implications of how their credit scoring systems define creditworthiness."

Related News

- 06:00 am

Industry leaders are encouraged to weigh in on technologies and topics shaping the payments market

The Secure Technology Alliance invites experts specializing in emerging payment technologies and industry advancement strategies to submit a speaking proposal for the 2022 Payments Summit.

Speakers will be communicating directly to a group of industry decision-makers who play an active role in influencing the future of payments. Each year hundreds of leaders from financial institutions, global and domestic networks, retailers and payment solution organizations converge on the Payments Summit to share insights and overcome cross-industry challenges.

Merchants, issuers and technology providers are encouraged to propose thought-provoking presentations or panels that address topics related to the current payments landscape, contactless payments and new advancements in FinTech.

The 14th Annual Payments Summit will be held February 28 – March 3, 2022, at the Little America Hotel in the heart of Salt Lake City, Utah, alongside the U.S. Payments Forum All-Member Meeting. Payments experts interested in speaking at the event should submit a proposal by October 26, 2021. For more information, visit https://www.stapayments.com/call-for-speakers/.

The conference welcomes vendor-neutral, insightful presentations focused on the use of payment innovations, secure authentication technologies and the following trending topics:

- Developments in biometrics

- Payments and the Internet of Things (IoT)

- EMV, mobile and digital payments

- Pay-at-the-pump technologies

- Digital currencies

- Response to the global chip shortage

- Secure online transactions

- Ecommerce trends, including buy now pay later, mobile wallets, peer-to-peer transactions and buy online, pick up in store transactions

“As the economy bounces back from the COVID-19 pandemic, the payments industry is adapting to a rapid shift in consumer preferences and significant development across the ecosystem,” said Jason Bohrer, executive director of the Secure Technology Alliance. “The 2022 Payments Summit will provide speakers with a unique opportunity to share actionable steps fellow payments professionals can take to get ahead of these challenges. The robust list of highly relevant topics planned for the upcoming Payments Summit makes it a crucial event for key players in the payments sector.”

Related News

- 03:00 am

Annual list recognises leading tech companies using artificial intelligence to transform financial services

Jumio, the leading provider of AI-powered end-to-end identity verification and eKYC solutions, today announced its inclusion in the 2021 AIFinTech100 list. This annual list showcases the world’s most innovative solution providers developing artificial intelligence (AI) and machine learning technologies to solve challenges or improve efficiency in the financial services sector.

Jumio uses a unique hybrid approach of AI, machine learning and biometrics to thwart fraud, simplify compliance and determine if users are who they claim to be. Jumio pioneered the ID + selfie approach and leverages hundreds of millions of domain-specific data points to inform its AI models. Utilising real-world production data instead of academic datasets helps eliminate some of the bias built into off-the-shelf data sets that other solution providers use to develop their AI modeling. This real data results in better, more informed, bias-free AI, which in turn leads to faster, more accurate verifications.

“AI is built into the core of what we do,” said Labhesh Patel, Jumio CTO and chief scientist. “Being included in the AIFinTech100 list validates our efforts to provide secure, AI-powered solutions for financial services providers to safely onboard customers, confirm user identity and stop fraud in its tracks.”

The standout companies were chosen by a panel of industry experts and analysts who reviewed a study of over 1,000 fintech companies undertaken by FinTech Global, a data and research firm. The solution providers making the final list were recognised for their innovative use of technology to solve a significant industry problem, or to generate cost savings or efficiency improvements across the financial services value chain.

To learn more about Jumio and it’s award winning AI-powered solutions, visit jumio.com.

Related News

- 05:00 am

Cabital, a new wealth management platform that offers crypto-based savings products, has chosen Sumsub’s all-in-one KYC/AML toolkit. This integration aims to conduct secure checks of potential crypto investors in just 2 minutes—all while ensuring 100% compliance with Europe’s strictest demands.

Based in Lithuania, Cabital offers crypto-based savings products that promise interest rates as high as 12%. To stay in line with European AML/CTF principles and Lithuania’s domestic requirements, Cabital needed to find a secure and compliant solution for customer verification and due diligence. They also needed to ensure that identity checks wouldn’t hamper conversion, which is why they chose Sumsub’s solution in particular.

Sumsub will provide Cabital with sophisticated and secure 2-minute identity checks, adjustable to the requirements of 220+ countries and territories. Users pass Sumsub’s verification routine in two quick steps: first, they submit a photo of their passport; then, they go through biometric video identification (otherwise known as “liveness”). The liveness step will further enhance Cabital’s security, given its compliance with iBeta, the highest quality standard in facial biometrics. Cabital will also benefit from Sumsub’s automatic reporting, which is easily generated and accepted by European regulators.

The global wealth management market is poised to grow by $318.95 billion by 2025, progressing at a CAGR of 8%. Meanwhile, regulations around wealth management will get more and more complex. This highlights the need for efficient and compliant solutions that ensure both smooth user experience and fraud-proof security.

"Cabital introduces cryptocurrency as an alternative to traditional, rigid investment schemes. The crypto industry is growing quickly and has been considered as a risky venture for a long time. On the contrary, crypto carries a lot of potential and can already provide stable and profitable returns for investors. That said, Sumsub will help us make our wealth management solution even better, providing compliant, quick and enjoyable identity checks for our users, while ensuring security throughout the process.” said Raymond Hsu, Cabital's Founder and CEO.

“Cabital is looking to make crypto investing accessible and easy for everybody. Meanwhile, more and more people are searching for an alternative to traditional savings accounts. We are happy to support their startup and reinforce it with a verification engine that is safe, simple to use, and easy to adjust to regulatory demands in Europe and beyond.”—Jacob Sever, Co-founder of Sumsub.

Related News

- 09:00 am

Many large online retailers are expanding their shops into platforms and inviting other merchants and manufacturers to add their products to the range. However, this model brings with it special demands when it comes to payment transactions and retail systems. In response, Computop, the leading global payment service provider, and empiriecom, the specialist in e-commerce platform solutions have today announced closer cooperation.

As part of the globally active Otto Group, empiriecom develops e-commerce solutions for the group's own as well as external trading companies. The connection of the omnichannel payment platform Computop Paygate to the modular "empiriecom commerce suite" has already proven itself at baur.de and other leading retailers such as universal.at or ackermann.ch.

COMPLETE SOLUTION FOR ALL SALES CHANNELS

With the cooperation now agreed, the partners are preparing for the integration of payment services that will relieve merchants of the regulatory requirements that typically arise during payment processes in online marketplaces. Together, Computop and empiriecom combine one of the leading e-commerce shop systems with a versatile payment solution including additional services such as accounts receivable management. This complete marketplace solution will be available for all e-commerce channels (web, mobile, app) as well as for stationary trade or sales via call centres. The needs of B2B and B2C providers are also addressed.

Stephan Kück, CEO Computop, emphasises: "Due to the ongoing regulatory process for payment, we are positioning ourselves to offer additional services. We are pleased to be able to bring these into our extended partnership with empiriecom to offer large trading platforms the complete package of e-commerce platform and payment solutions."

Ralf Männlein, CEO empiriecom, adds: "Computop and the BAUR GROUP / OTTO GROUP already have a longstanding successful partnership. The bundled joint solutions make it even easier for new clients to get fully integrated complete solutions from a single source and to use them optimally for themselves."

ABOUT COMPUTOP – THE PAYMENT PEOPLE

As one of the very first payment service providers, Computop offers its customers around the world local and innovative omnichannel solutions for payment processing and fraud prevention. The internally developed Computop Paygate payment platform enables seamless integrated payment processes for e-commerce, at POS and on mobile devices. Retailers and service providers have the flexibility and freedom to choose from over 350 payment methods enabling them to specifically tailor their payment options per country. Technologies such as biometric authentication and self-learning algorithms improve security and convenience for retailers and consumers alike.

Computop, a global player with its head office in Germany and locations in China, England and the USA, has been servicing large international companies in the service, retail, mobility, gaming and travel industries for more than 20 years. These companies include global brands such as Amway, C&A, Fossil, the entire Otto Group, Sixt, Swarovski and Wargaming. Computop also provides its payment system to banks and financial service providers as a white-label solution. In total, the certified carbon-neutral company processes commercial payment transactions with a combined value of USD 35 billion annually in 127 currencies. With its individual and secure solutions, Computop makes a major contribution to the future of international payment processing.

ABOUT EMPIRIECOM - BETTER E-COMMERCE

Empiriecom is a German e-commerce software producer with more than 100 employees and develops and operates state-of-the-art e-commerce solutions for online shops in Germany, Austria and Switzerland. The core of its solution portfolio is the "empiriecom commerce suite" (shop frontend, CMS, product search, and checkout for web tab mobile app) with which online retailers can operate modern e-commerce in the cloud and integrate any third-party systems using flexible APIs. Due to the modular architecture approach, the products of the commerce suite can be used individually or in combination. In the professional services sector, empiriecom supports its customers in the integration and individual adaptation of the respective system environment.

With more than 1.6 billion € order turnover per year, the empiriecom commerce suite is one of the largest e-commerce platforms in the DACH region.

Related News

- 06:00 am

Bank drives transformation and navigates dynamic change with advanced payments platform and BPO service to provide its clients best in class technology

Broadridge Financial Solutions, Inc, a global Fintech leader, today announced that Hamburg Commercial Bank is now live using Broadridge’s Payments as a Service – a cloud-based new-generation platform and BPO operation – to transform the bank’s international payments (including TARGET2) processing for corporate clients based on PPI AG´s market leading payments platform.

Broadridge’s Payments as a Service will enable the bank to achieve significantly higher levels of operational efficiency through best-in-class straight-through processing and the dynamic resolution of processing exceptions. It will also provide the scalability to grow, capture new revenue streams and enhance the quality and range of client services without capacity or resource constraints. Hamburg Commercial Bank will also benefit from a more agile response to the ongoing challenges in payments driven by regulatory and dynamic market changes. The operating platform already includes necessary TARGET2 MX and SWIFT MX enhancements, while subsequent phases of the project will add a service for SEPA payments and SEPA instant payments.

"This payment service solution is another important contribution to our transformation and it will make Hamburg Commercial Bank even more efficient. Our customers will benefit from this best-in-class technology platform, which our strong business operations team, together with Broadridge and PPI, will continue to build out over the coming months," said Stefan Ermisch, CEO of Hamburg Commercial Bank. "We are very pleased with the initial production phase, which was completed in the time scheduled, and we are confident that the other production phases ahead will also be successfully implemented. We look forward to continued good collaboration and a long-term partnership with Broadridge and PPI," added Daniel Roth, Head of Strategy & Transformation at Hamburg Commercial Bank.

Broadridge Payments as a Service is an advanced new service in partnership with PPI AG to drive transformational advantages for banks and financial organisations operating in the European payments industry, enabling them to overcome major processing challenges driven by recent and ongoing market changes, and deliver world class service standards. Uniquely designed for the future of the payments industry, it combines PPI’s extendable, modern, core payments processing platform and Broadridge’s best-in-class messaging and transformation service. The platform is hosted in Broadridge’s European data centre and is available on a shared services basis, backed by advanced quality standards including SLAs, security/resilience, capacity and agility, together with deeply knowledgeable payments and technology specialists. Broadridge’s experienced BPO team handles exceptions and customer enquiries, supported by purpose-built ticketing and customer service applications and meeting the highest service standards.

“To address client processing requirements and support the industry with the evolving regulatory and market infrastructure landscape, we have made a significant investment in building out our payments architecture and operating model,” said Samir Pandiri, President, Broadridge International. “We believe there are several hundred banks in Europe that can take advantage of this unique, modern and differentiated service to increase automation, reduce cost and risk, and manage regulatory change.”

“This is an incredibly well-executed programme delivered within a 12-month period,” said Dr. Thorsten Völkel, CEO of PPI AG. “Through strong partnership across the three parties, we have delivered a significant phase that will bring tangible benefits through greater processing efficiency and risk mitigation, scalable client-centric services and support for a fast-track response to forthcoming change requirements.”