Published

- 08:00 am

Commenting yields falling and further dollar weakness following US Nonfarm Payrolls data, Mike Owens, Global Sales Trader at Saxo Markets, said: “US Nonfarm Payrolls came in much weaker than expected for August. We saw bond yields fall and further US dollar weakness immediately after the release as the miss infers a later starting point for the FED to start tapering bond purchases.

“There was also a much higher than expected wages increase of +4.3% vs. +3.9% YoY, which pushes against the central bank narrative that current inflation is transitory. The readings should be market positive for equity prices in the short term, especially for high-growth and technology stocks, although we’re seeing little initial reaction from index futures.”

Related News

- 04:00 am

10 Interconnected, cloud- and carrier neutral data centres will be built across the length and breadth of the continent in an unrivalled $500m investment in Africa’s digital future |

|

Africa’s leading carrier-neutral co-location data centre provider, Africa Data Centres (www.AfricaDataCentres.com), has announced plans to build large hyperscale data centres throughout Africa, including the North African countries of Morocco, Tunisia and Egypt. The project will involve building 10 hyperscale data centres, in 10 countries, over the next two years – at a cost of more than US$500m. It is being funded through new equity and facilities from leading development finance institutions and multilateral organisations. Africa Data Centres CEO, Mr Stephane Duproz, explains that the finance for the roll-out has been provided by equity and loans to Africa Data Centres’ parent company, Liquid Intelligent Technologies, to fully fund the expansion. Explaining the ambitious initiative, Duproz says, “We have already begun to acquire land in these countries and plan to roll-out very quickly to meet the needs of our existing and new customers. This is just the beginning for us.” The expansion will more than double Africa Data Centres’ already significant footprint on the continent. “Examining Africa’s growth trajectory has allowed us to make investment decisions on new locations and confidently commit to expanding selected existing locations, resulting in the largest investment of its kind in history,” explains Duproz. Growth “This commitment to Africa, through the continuous deployment of capital-intensive infrastructure projects, has pivotal knock-on effects for the communities and economies we serve,” says Duproz. “All our data centres are world-class – built to the same, global market-leading standard and offer a reliable, resilient, secure and interconnected base. “This allows multinational organisations to confidently enter the market, knowing their future growth is assured and they have access to open carrier systems to the rest of the continent. Additionally, without access to always-on, high-speed data centre facilities, the private sector cannot compete globally and will see slowed growth locally; equally important is the impact IT services have on the public sector – from healthcare to transport infrastructure.” Africa Data Centres’ investment is a reflection of, as well as a catalyst for the continued direct foreign investment into the continent and the positive growth of local organisations. Duproz says industries especially likely to be buoyed by Africa Data Centres’ expansion are the banking and growing fintech sectors, insurance and medical organisations, the public sector, hyperscale cloud providers and content providers. These industries, he says, are highly sensitive to data speed, security, guaranteed uptime and are exacting when it comes to reliability and trust in their providers. The SME market too, he says, has found a significant opportunity for growth by plugging into the digital ecosystems that data centres provide. “Our experience from across the continent is that the strategic value of data centres has both immediate and long-term effects on the economy and the communities they serve. Job creation is something we are passionate about at Africa Data Centres and the equation is a simple one: digitisation boosts economies, and successful digitisation requires data centres. Data centres are digital ecosystems, acting as magnets to organisations – and as the digital ecosystem grows within the data centre, so the local economy grows in the real world. The impact of a data centre is long-lasting, with immediate job creation stemming from the physical build and enduring economic growth once operational.” Sustainable, pan-African, neutral, interconnected “We are Africa’s largest network of data centres – and we are growing perpetually. All of our facilities across the continent will remain interconnected, allowing our tenants to take advantage of our vast footprint. Furthermore, we guarantee carrier-neutrality – meaning our tenants benefit from competition, redundancy and reliability. And, perhaps most importantly, is our commitment to sustainable, clean builds. We invest heavily in innovative grey-water systems, waste disposal and renewable energy sources, ensuring our carbon footprint is drastically reduced, our reliability is uncontested and while building economies, we’re aiding the environment”, says Duproz. Africa Data Centres has already begun the implementation of its roadmap with the construction of both new facilities and the expansion of existing facilities underway. Distributed by APO Group on behalf of Africa Data Centres. |

Related News

- 09:00 am

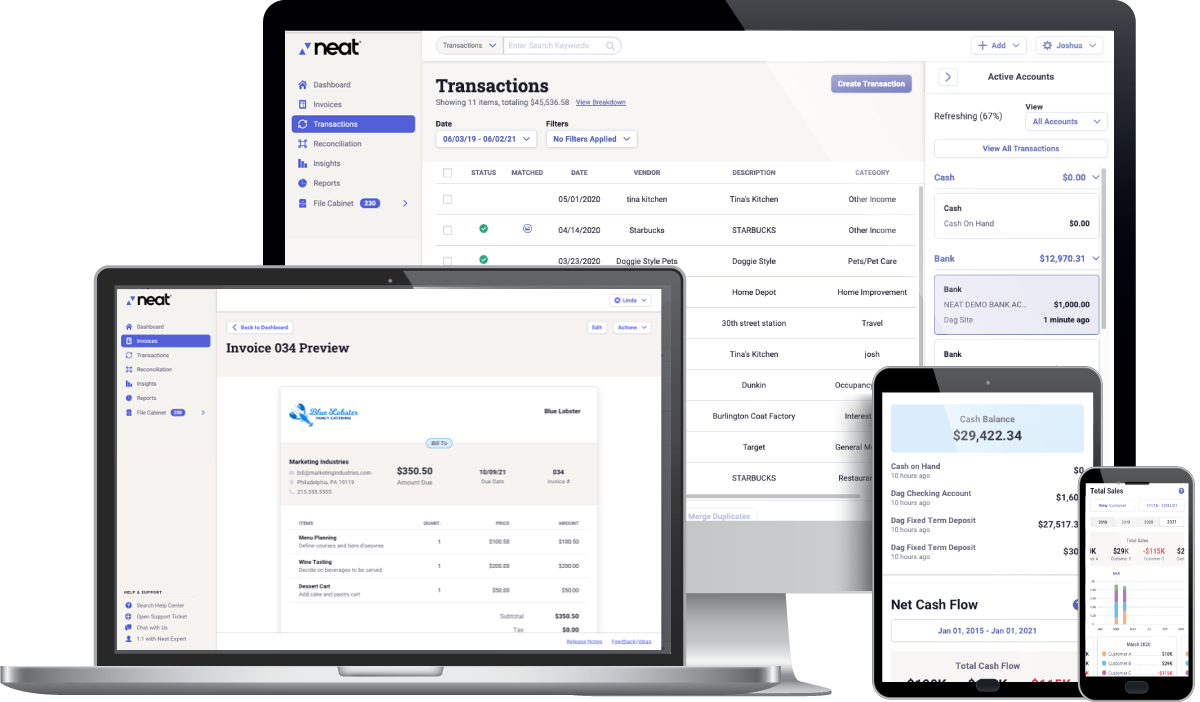

NeatInvoices Puts the Ability to Create, Send, and Manage Invoices in the Palm of Your Hand

The Neat Company, a recognized leader in financial data management for small businesses, is now offering an easy-to-use accounts receivable solution designed to help small business owners improve cash flow by streamlining their invoicing process and facilitating digital payments. Available now, NeatInvoices lets users create, send, and manage an unlimited number of invoices from their desktop or mobile device while enabling prompt customer payments via credit/debit cards or bank transfer.

“Healthy cash flow is the lifeblood of any small business, and it requires invoicing and receiving payments as quickly as possible. As a former small business owner, I know there is little time to deal with billing, let alone digitizing these traditionally paper-based processes. Their time is rightfully focused on delivering products and services,” explains Garrett Baird, President & CEO of The Neat Company. “NeatInvoices makes invoicing so straightforward that it can be done from anywhere in minutes. By integrating digital payments capabilities into the invoice, NeatInvoices reduces time to cash from weeks to days with significantly less time spent doing bookkeeping.”

NeatInvoices empowers small businesses to issue customized professional invoices and accept secure online payments. Customers can pay an invoice with just a few taps using online banking credentials or a debit/credit card. Small businesses can see invoice status at a glance and send one-tap payment reminders right from the Neat mobile app. With NeatInvoices, it’s easy for small business owners to know which customers have paid and who may need a nudge.

NeatInvoices streamlines billing by enabling small businesses to:

Quickly create and send invoices from desktop or mobile phone. Simply pick a customer, choose the products or services delivered, check the box for applicable taxes, and hit send. Even customizations such as including discounts or customer-engaging notes are simple.

Establish payment options that are easy for customers to quickly execute—credit/debit card or bank transfer.

Keep it simple. Neat has identified and eliminated the unnecessary clicks and taps that complicate other small business accounting tools. For example, one-tap reminders and automatic matching of payments streamline the customer experience.

With NeatInvoices, small business owners can create and send an unlimited number of branded invoices with no subscription costs. Powered by Neat’s merchant payment provider, WePay (a Chase Company), users only pay standard processing fees when accepting secure payments by credit/debit cards or bank transfers. To learn more about NeatInvoices, please visit: https://www.neat.com/neatinvoices.

Related News

- 03:00 am

The world’s number one business coaching franchise ActionCOACH has partnered with Children with Cancer UK to help raise money for the charity. Throughout September, which is Childhood Cancer Awareness Month, Action Coaches across the UK are raising funds by delivering seminars for business owners – and 100% of the ticket price is being donated to the charity.

Children with Cancer UK lost 40% of its funding in 2020 due to the pandemic, impacting both the research and welfare projects they crucially support and deliver. They are the leading national children’s charity dedicated to the fight against childhood cancer. Julie Wagstaff, UK Co-founder of ActionCOACH, is thrilled to be launching the initiative.

“I think everyone has been affected by cancer at some point in their lifetime,” said Julie. “But childhood cancers are particularly agonising to encounter and it’s a shocking statistic that on average 12 children and young people in the UK are diagnosed with cancer every day. We’re determined to help raise both awareness and funds for a brighter future for the children and families touched by cancer. We understand that children are the dreamers and entrepreneurs of the future, and that’s why we want to encourage business owners to get involved and help us make an impact on so many families across the UK.”

Around 4,500 children and young people are diagnosed with cancer every year in the UK, with it being the leading cause of death in children aged one to 14 years old. Survivors can face a lifetime of serious health issues as a result of the intensive treatment used to treat their cancer, so the charity’s funds also focus on research for new therapies that are safer, kinder and with fewer toxic side effects. So far, the ActionCOACH UK network of 200+ coaches has raised over £27,000 for the charity, but they don’t want to stop there.

Cliff O’Gorman, CEO of Children with Cancer UK said: “We are so grateful for the fantastic support of ActionCOACH UK and their ongoing commitment to fundraise for Children with Cancer UK with such a great initiative. We are delighted that they share our mission to improve survival rates for children and young people diagnosed with cancer. The impact of this partnership is far reaching as it will help us continue to fund vital, life-saving research and find kinder, safer treatments with fewer toxic side effects.”

If you would like to find out where your nearest session is taking place, please visit https://actioncoach.co.uk/featured-events/children-with-cancer-uk/

Related News

- 08:00 am

The number of users attacked with QakBot – a powerful banking Trojan, in the first seven months of 2021 grew by 65% in comparison to the same period in 2020 and reached 17,316 users worldwide, demonstrating that this threat is increasingly affecting internet users. This rise has drawn the attention of Kaspersky researchers to the subject, leading them to review updates to the latest version of this Trojan.

Banking Trojans, when they have successfully infected a targeted computer, allow cybercriminals to steal money from victims’ online banking accounts and e-wallets – which is why they are considered one of the most dangerous types of malware. QakBot was identified as early as 2007 as one of the many banking Trojans. However, in recent years, QakBot’s developer has invested a lot into its development, turning this Trojan into one of the most powerful and dangerous among existing examples of this malware type.

In addition to functions that are quite standard for banking Trojans, like keylogging, cookie-stealing, passwords, and login grabbing, recent versions of QakBot have included functionalities and techniques allowing it to detect if it is running in a virtual environment. The latter is often used by security solutions and anti-malware specialists to identify malware via its behavior. Now, if the malware detects it’s running in a virtual environment, it can stop suspicious activity or stop functioning completely. In addition, QakBot tries to protect itself from being analysed and debugged by experts and automated tools.

The other new and unusual function spotted by Kaspersky researchers in recent versions of QakBot is its ability to steal emails from the attacked machine. These emails are later used in various social engineering campaigns against users in the victim’s email contact list.

“QakBot is unlikely to stop its activity anytime soon. This malware continuously receives updates and the threat actors behind it keep adding new capabilities and updating its modules in order to maximise the revenue impact, along with stealing details and information. Previously, we’ve seen QakBot being actively spread via the Emotet botnet. This botnet was taken down at the beginning of the year, but judging by the infection attempt statistics, which have grown in comparison to the last year, the actors behind QakBot have found a new way of propagating this malicious software,” said Haim Zigel, malware analyst at Kaspersky.

Kaspersky security solutions successfully detect and block all known versions of the QakBot banking Trojan.

Learn more about QakBot on Securelist.

To stay safe from financial threats like QakBot, Kaspersky experts recommend that you:

- Do not follow links in spam messages nor open documents attached to them.

- Use online banking with multifactor authentication solutions.

- Make sure all of your software is updated – including your operating system and all software applications (attackers exploit loopholes in widely used programs to gain entry).

- Use a trusted security solution that can help you check the security of the URL you’re visiting and open any site in a protected container to prevent theft of sensitive data (like financial information).

Related News

- 05:00 am

Data discovery and classification capabilities enhance Varonis' SaaS security solution, DatAdvantage Cloud

Varonis Systems, Inc., a pioneer in data security and analytics, announces Data Classification Cloud for Box and Google Drive. The offering adds data discovery context to complement DatAdvantage Cloud, a solution launched earlier this year that centrally monitors and protects data across multiple Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS) applications.

Join our Varonis Virtual Connect! event, Tackling SaaS Security Risks: A CISO’s Perspective on September 9 at noon ET to hear how Varonis DatAdvantage Cloud helps a CISO from a global communications firm manage cyber risk and be among the first to learn about Data Classification Cloud.

"Varonis has a long and successful track record helping organizations automatically scan and classify sensitive and regulated information in enterprise data stores on premises and in cloud stores like Microsoft 365," says Jacob Broido, VP of Product Management, Varonis. "With Data Classification Cloud, organizations can find exposed sensitive data on additional cloud apps and services to limit their blast radius from ransomware attacks and data breaches."

Key benefits of Data Classification Cloud include:

· Find exposed data. Automatically discover where sensitive data might be hiding in Box and Google Drive. Varonis looks inside files to find sensitive information by matching over 400 classification patterns and shows you where data is exposed to all employees – or anyone on the internet.

· Get high-fidelity results. Varonis generates highly accurate classification results by going beyond regular expressions. We use proximity matching, negative keywords, and algorithmic verification to reduce false positives.

· Monitor and control data access. See which sensitive data is open to too many people, monitor usage, and make smart decisions about how to quickly and safely reduce your SaaS data risk.

Data Classification Cloud complements DatAdvantage Cloud, which correlates identities with privileges and activities across cloud stores, including AWS, Box, GitHub, Google Drive, Jira, Okta, Salesforce, Slack, and Zoom. Organizations can see and prioritize their biggest cloud risks, proactively reduce their blast radius, and conduct faster cross-cloud investigations.

DatAdvantage Cloud and Data Classification Cloud together can help answer critical security and compliance questions like: "Which sensitive files containing PII are exposed via sharing links?" or "Which external users have been granted permissions in any of our SaaS apps?"

Additional Resources

· Register for the webinar.

· Visit the DatAdvantage Cloud product page.

· Request a demo from the Varonis team.

· For more information on Varonis' solution portfolio, please visit www.varonis.com.

· Visit our blog, and join the conversation on Facebook, Twitter, LinkedIn and YouTube.

· Watch and subscribe to Security Forward, Varonis' YouTube show covering the latest infosec tips, tricks, and tools.

Related News

- 02:00 am

Views of Avinash Shekhar, Co-CEO, ZebPay, on the same below:

“Having a clear regulatory framework around cryptos will help investors, businesses, and entrepreneurs to confidently participate in this industry and we’re looking forward to the upcoming guidelines and policies from the government. We hope to see cryptos classifies as an asset class and have laws in place on their taxation just like the other financial markets. There are thousands of different cryptos in the market with different use cases which work on different blockchain platforms. We’re sure the policymakers will look into how they can be used both as an asset class and also take advantage of the underlying blockchains for their use cases to cater improve India’s infrastructure needs in various industries.

We believe having clear laws around cryptos will have a positive impact on investors especially when it comes to the taxation of cryptos. This will also help in keeping bad players out of this emerging technology. Crypto assets are still in their early stages and with clear regulations, we hope to see more Indian investors confidently taking the benefits of an early market.”

Related News

- 04:00 am

Phillip McGriskin has an impressive portfolio of fintech successes, including TransferWise, SuperAwesome and YOTI.

His latest venture, Vitesse, was listed in the Deloitte 50 Fastest-Growing Tech Companies 2019, contracting over 60% of the London insurance market.

The fintech platform is set to revolutionise the insurance payment system, providing near real-time international payments and treasury management solutions for its extensive clientele across 116 domestic markets.

An Aussie-born angel investor has swapped the surf for fintech innovation to launch Vitesse, a FCA and European (DNB) regulated provider of seamless international payments and innovative treasury management solutions for insurance.

Phillip McGriskin, 47, has over 20 years of experience in fintech investments. He has built an extensive portfolio of investments across the fintech world. His ability to spot potential in businesses from as early as ideation has allowed him to be an angel investor for; TransferWise, SuperAwesome, YOTI, and Griffin.io to name a few.

His later fintech venture, Vitesse, a payments platform that enables its insurance clientele to make reimbursements in a matter of minutes instead of weeks, launched in 2013 and currently boasts customers, including Brit Insurance, Mayfair Group, and CEGA Group. It has secured a £6.6 million Series A investment from Octopus Ventures and will be seeking Series B funding in 2022.

A former surfer may be the last person you’d expect to flourish in this field but Phillip puts his success down to his laidback and friendly approach towards the people he works with. He fondly mentions the entrepreneurs that he has invested in as being inspirational leaders in their respective fields and him having confidence in what was to come.

Fundamentally he really focuses on what he finds interesting. With such a diverse background in where he’s worked and his experience across a variety of business lines and roles, that has given him a broader range of interests and opened him up to more new concepts and ventures.

His career began at the young age of 20 working as an insurance broker in Australia. Over his two decades in the industry, he worked across commercial departments in London for companies such as; EarthPort, PaySafe and Envoy Services (that he founded and sold to WorldPay, where he worked as Chief Product and Marketing Officer before co-founding Vitesse).

His passion for fintech stems from the endless possibilities in this sector coupled with the extensive innovation that has been seen over the last years.

McGriskin says; “The fintech industry is only moving forward and the possibilities are growing. “There is a lot more growth to come from online payments. Cash payments have become a tiny percentage of payments made in the UK compared to how popular it was five years ago. Digitalisation is the one thing that will continue to grow and will speed up in the very near future.”

He sees financial technology as an enabler, encouraging companies and people to rethink outdated approaches. As he states “It is giving people the ability to solve legacy issues which have been around for a long time.”

For example, people can now have a claim approved and receive money back onto their debit card within a matter of minutes. It is effortless and that’s just one way fintech is transforming insurance.”

Phillip is currently the CEO of Vitesse: “After building a successful financial services business with Paul Townsend [Executive Chairman of Vitesse] which relied on creating international payment relationships for businesses to receive money; we realised that there were still multiple gaps on the other side of the transaction. The outward bound payment. There were some very specific use cases in the areas of insurance, payroll and corporate payments where service gaps were preventing these businesses from growing to their full potential.

This thinking created Vitesse, listed in the Deloitte 50 Fastest Growing Tech Companies. Vitesse is a dual-regulated provider of near real-time international payments and treasury management solutions for its extensive insurance clientele, supporting in-country payments to over 170 countries in 109 currencies around the world.

Coupled with a regulated, industry-audited solution which gives total control and transparency over funds, Vitesse is changing the game with claims payments and associated claims funds management by providing an efficient capital management solution. They also enable businesses to pay claims via a range of payment types globally such as bank transfer, Visa Direct, and USD eChecks.

“Vitesse brings the strength of the global banking network together with leading technology. We give our customers unparalleled control, transparency and efficiency for the holding and management of funds and liquidity.”

Learn more about Vitesse for insurance at https://vitessepsp.com/insurance/

Related News

- 08:00 am

PT Bank CIMB Niaga Tbk (CIMB Niaga) and PT JCB International Indonesia (JCB), as subsidiaries of JCB International Co Ltd., launched the CIMB Niaga JCB Contactless Credit Card in Jakarta, Friday, 3 September 2021. This credit card with contactless technology was developed in line with the rapid growth of credit card technology and the COVID-19 pandemic situation. The Contactless Credit Card can make it easier for customers to transact as well as become an alternative faster payment solution. Supported by dual liaison capabilities, this credit card can still be used for transactions using the dipping method.

|

CIMB Niaga Consumer Banking Director, Lani Darmawan, said, "CIMB Niaga continues to develop innovative products and services by adopting the latest technology. One of them is through the CIMB Niaga JCB Contactless Credit Card. With this card, customers can transact at various merchants without touching other objects. We hope that this initiative can improve customer experience in the midst of the current situation."

Meanwhile, President Director of PT JCB International Indonesia, Takumi Takahashi, said, "We are delighted that CIMB Niaga is the first bank in Indonesia to implement JCB Contactless through the launch of the CIMB Niaga JCB Contactless Credit Card. This contactless payment is safe and convenient for customers. We believe this new product will contribute to accelerating digitization in the payment industry in Indonesia."

The issuance of the CIMB Niaga JCB Contactless Credit Card is an initiative of CIMB Niaga and JCB to provide an easier, faster and simpler transaction experience. With the contactless method, according to Bank Indonesia regulations, customers do not need to enter a PIN for nominal transactions under Rp. 1 million, while transactions above Rp. 1 million require a PIN. As for the transaction process, customers just need to tap-and-go. This is faster than inserting a card into an Electronic Data Capture (EDC) machine or paying with cash.

In addition, Contactless Credit cards also have the same level of security as dipping cards. Every contactless transaction on the card reader or EDC machine will be processed by the Bank and JCB card processing network through an authorization that is as secure as transactions through the dipping method.

CIMB Niaga JCB Contactless Credit Card customers can use the JCB Contactless feature at more than 100 thousand merchants in Indonesia. In addition, over the past three years, the number of JCB Contactless partners globally has also continued to grow.

Related News

- 03:00 am

The chair of the U.S. financial regulator is right about cryptocurrency trading platforms: they should be regulated, affirms the CEO of one of the world’s largest independent financial advisory asset management and fintech organizations.

The comments from Nigel Green, chief executive and founder of deVere Group, follow a Financial Times interview published on Wednesday with Gary Gensler, chair of the U.S. Securities and Exchange Commission (SEC), Wall Street’s top watchdog.

In the interview he said that while he was “technology neutral”, crypto assets were no different than any others when it came to public policy requirements including investor protection, guarding against illicit activity and maintaining financial stability.

Mr Green says: “It must be championed that the man at the top is taking a future-focused and pragmatic approach to cryptocurrencies – which have a market capitalization of more than $2trillion and which are becoming an increasingly dominant part of the mainstream global financial system.

“Cryptocurrencies, such as Bitcoin, Ethereum, Cardano, XRP, amongst others, are not going anywhere. Crypto is very much here to stay as financial assets and as mediums of exchange.

“Therefore, they must be brought into the regulatory tent and be held to the same rigorous standards as the rest of the financial system. The best way to do this is through the exchanges.”

He continues: “Nearly all foreign exchange transactions go through banks or currency houses, and this is what needs to happen with cryptocurrencies. When flows run through regulated exchanges, it will be much easier to tackle potential wrongdoing, such as money laundering, and make sure tax is paid.”

Gensler’s interview with the FT follows his fresh demands last month that Congress grant the SEC more power to oversee the growing crypto market.

“The watchdog needs more powers over the market as there's a clear direction of travel: both institutional and retail investors are taking Bitcoin and other cryptocurrencies more and more seriously. They are increasing their exposure to them at a faster rate than ever before,” said the deVere CEO at the time.

“The SEC seems aware that digital assets are the inevitable future of money, therefore they require more oversight.”

Nigel Green is both a long-term and high-profile advocate of cryptocurrencies, but also of regulation of the sector. He has publicly supported global financial regulators, central banks, lawmakers and governments who have moved to support introducing it.

“There’s sustained interest in and demand for cryptocurrencies so what's needed is a strong regulatory framework to be established and approved at an international level.

“This will help protect investors, make the sector itself more robust, tackle cryptocurrency criminality, and reduce the potential possibility of disrupting global financial stability, as well as offering a potential long-term economic boost to those countries which introduce it.”

He concludes: “Cryptocurrency regulation is required and, I believe, on its way.

“The work being done by the SEC and other financial regulators around the world is something that everyone who is confident that digital assets are the future of money, as I am, should champion.”