Published

- 03:00 am

Judo Bank is now live on the nCino Bank Operating System platform, providing a single digital engagement experience for its customers and employees

nCino, Inc. a pioneer in cloud banking and digital transformation solutions for the global financial services industry, and Accenture, a global consulting firm with leading capabilities in cloud and digital transformations, today announced they have helped Australian-based SME challenger bank Judo Bank implement a new banking platform by deploying the nCino Bank Operating System®.

Judo Bank is now live on nCino’s Bank Operating System platform, providing a single digital engagement experience for its customers and employees. Together, these solutions create an agile, scalable, single end-to-end platform for Judo Bank, an SME-focused business bank.

Lisa Frazier, chief operating officer at Judo Bank, said nCino’s cutting-edge solutions were a perfect fit for the SME business bank whose strategy is to bring back the craft of relationship banking. “Judo Bank's relationship-based model of getting to know our customers, understand their business and build trust with them, regardless of their location, has been particularly critical during the pandemic,” said Frazier. “At Judo Bank, our relationship bankers are passionate about our SME customers and spending quality time with them to deeply understand their business. However, their time is finite. Therefore the systems that support them need to take administration off their plate, support communications and generate fast decisions for customers. We’re really excited about the way nCino’s cutting-edge technology facilitates this approach – enhancing the way we continue to listen, support and provide finance to more of Australia’s SME businesses.”

The execution of the cloud-first transformation was led by Accenture, leveraging its nCino expertise and proven track record of helping financial institutions optimise and digitise their processes. The integration was run remotely due to the COVID-19 pandemic, demonstrating the efficacy of cloud-based software solutions.

“Regardless of geographic location, the fact remains that financial institutions must embrace changing customer dynamics and make their digital offerings their top priority,” said Laura Valmorbida, a managing director within Accenture’s Financial Services practice in Australia. “Judo Bank’s successful cloud implementation helps it deliver an improved, tailored experience that will provide them a significant advantage in the market.”

“COVID-19 forced financial institutions to adapt to a new and critically important digital first market, which Judo Bank has embraced and is now realising the benefits of,” said Mark Bernhardi, general manager of APAC at nCino. “The partnership with Judo Bank and Accenture further underscores that it takes a culture of innovation and collaboration to enable a financial institution to continue to meet their customers' ongoing needs. We are so proud of the incredible teamwork from all three parties and are thrilled to continue our work with Judo Bank.”

Related News

- 02:00 am

JPay will pay $6 million in consumer redress and penalties

The Consumer Financial Protection Bureau (CFPB) today took action against the prison financial services company JPay for violating the Consumer Financial Protection Act (CFPA) by charging consumers fees to access their own money on prepaid debit cards that consumers were forced to use. JPay also violated the Electronic Fund Transfer Act (EFTA) when it required consumers to sign up for a JPay debit card as a condition of receiving government benefits – in particular, “gate money,” which is money provided under state law to help people meet their essential needs as they are released from incarceration. The consent order severely limits the fees JPay can charge on release cards going forward, allowing only inactivity fees after 90 days without card activity. The order also requires the company to pay $4 million for consumer redress and a $2 million civil money penalty.

“JPay siphoned off taxpayer supported benefits intended to help people transitioning out of the corrections system,” said CFPB Director Rohit Chopra. “JPay exploited its captive customer base to charge unfair fees that harmed the newly released and their families.”

JPay, a Delaware company, headquartered in Miramar, Fla., is a dominant provider of financial services to prisons and jails nationwide. JPay is owned by the private equity firm Platinum Equity Partners. Since 2011, JPay has provided approximately 1.2 million debit release cards to consumers. JPay calls itself “a highly trusted name in corrections,” but the company leveraged its relationships with state and local departments of correction to impose fees on consumers exiting the prison or jail system. JPay’s fee-bearing debit release card replaced cash or check options previously offered by state departments of correction. In doing so, JPay charged fees to people being released from prison or jail who often have few resources outside of the balance of their prison or jail trust or commissary accounts. In addition, JPay provided consumers with inaccurate or incomplete information about the fees it assessed.

Harmed Families by Violating Consumer Financial Protection Laws

The CFPB concluded that JPay engaged in unfair, deceptive, and abusive acts and practices in violation of the CFPA. The CFPB also concluded that JPay violated EFTA and its implementing Regulation E. EFTA and Regulation E prohibit certain companies and government benefits entities from conditioning the receipt of a government benefit on opening an account with a particular financial institution.

Specifically, the CFPB found that JPay:

- Abused its market dominance: JPay charged consumers unavoidable fees for prepaid cards used to return money owed to consumers at the time of their release from incarceration. Consumers could not protect their interests in the selection and use of JPay’s cards because they were denied a choice on how their own money would be given to them upon release. JPay did not provide a reasonable way for consumers to close their card accounts to obtain their card balances without paying fees. By assessing fees on these captive consumers, JPay took advantage of them and caused harm.

- Illegally required consumers in certain states to receive protected government benefits on debit release cards: In California, Colorado, and Georgia, just-released individuals were required to establish an account with a financial institution as a condition of receiving their gate money. JPay violated EFTA and Regulation E by illegally requiring consumers just released from incarceration to establish accounts with a particular financial institution to receive their gate money.

- Charged fees without authorization: Contrary to the terms stated in certain cardholder agreements, consumers were charged fees before the debit release cards were loaded with additional funds.

- Misrepresented fees to consumers: In certain states, the fees disclosed in the cardholder agreement were different from fees described on a separate “green sheet,” or were misleadingly omitted from the “green sheet.” Between approximately 2014 and 2017, up to 176,000 consumers received green cards that were inaccurate, incomplete, or both.

Enforcement Action

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the CFPB has the authority to take action against institutions and persons that violate federal consumer financial laws. The consent order issued today requires JPay to:

- Stop charging most fees: The order prohibits JPay from violating the CFPA, EFTA, and Regulation E. Among other provisions, JPay cannot charge any fees on release cards, except an inactivity fee after 90 days of inactivity.

- Refund harmed consumers: JPay must pay $4 million to compensate consumers harmed by its unfair and abusive acts.

- Pay a civil penalty: The order also requires JPay to pay a $2 million civil money penalty to the CFPB, which will be deposited into its Civil Penalty Fund.

Read the CFPB’s consent order.

Read the full Statement of CFPB Director Rohit Chopra on this action.

Related News

- 05:00 am

The Board of Banking Competition Remedies Ltd (BCR) today announces the results of the Capability and Innovation Fund Pool F grant process.

The Capability and Innovation Fund Pool F was open to organisations that meet the same eligibility criteria as previous Pool A, B, and C bodies, which can be found here.

The grants, which have a combined value of £12.5 million, are awarded as follows:

- £5m – Codat Limited

- £5m – Cashplus Bank – see further information here

- £2.5m – Swoop Finance Limited

The successful applicants will shortly be invited to enter into a Capability and Innovation Fund Agreement with BCR. As part of the application process, each applicant provided public commitments stating what it will deliver with the CIF funds. These can be found here.

We had 33 applicants applying for 43 grants in this pool.

BCR’s assessment and decision-making processes were completed on time and adhered to the assessment criteria pre-determined in the design of BCR.

Aidene Walsh, Lead Director on the Capability and Innovation Fund workstream, said: “BCR received a number of excellent applications, but we selected awardees we felt could achieve the largest impact in a short period of time. These organisations are successfully leveraging emerging technologies, such as open banking, to provide new and exciting solutions for SMEs, including: cardless payment solutions, the provision of market infrastructure to level the playing field for lending providers, frictionless payment reconciliation, as well as an automated process for achieving funding for growth SMEs.”

BCR decision-making

As with each previous Pool, BCR engaged business and technology consultancy, Baringa, to receive and analyse the applications via a rigorous and detailed process. The evaluation team decided which applications should be recommended to the BCR Board for consideration and final decision.

Applicants were advised that, while all assessment criteria should be addressed, BCR was particularly interested in applicants that can deliver on their commitments by the end of December 2022 which is the term of the CIF Agreement, and achieve positive impact within the SME market.

More information on the Capability and Innovation Fund decision-making process can be found here.

Ongoing monitoring

BCR retains a focus on monitoring and compliance of all funding recipients once funds have been awarded. Progress against each applicant’s public commitments will be updated on a quarterly basis with the first reporting update due in January 2022. The commitments provide a publicly accessible record of delivery.

Awardees report regularly to BCR, including meetings as necessary. The HM Treasury-appointed Monitor, Mazars, reports to HM Treasury on progress and is fully briefed on BCR meetings with awardees.

Richard Anderson, Chair of BCR, said: “Pool F applicants have demonstrated the resurgence in demand for access to alternative lending and payment solutions in the UK SME marketplace. This Pool has seen very innovative propositions leveraging market infrastructure such as open banking which will really start to level the playing field not only for providers but also for SMEs who will be able to take advantage of best of breed solutions from multiple providers without creating a significant admin burden for themselves. As with previous rounds, it has been difficult to narrow the awards down to a small number of outstanding winners and BCR looks forward to monitoring their progress as they implement their programmes and contribute to creating further competition in the provision of services for UK SMEs”.

Related News

- 03:00 am

· Awareness of net zero is becoming significant (at nearly 60%), although only around half of smaller businesses say decarbonisation or reducing environmental impacts is a near-term priority

· 35% of smaller businesses state cost as a barrier for reducing carbon emissions

· 11% of UK smaller businesses – equivalent to around 700,000 businesses – have accessed external finance to support net zero actions, and 22% say they are prepared to do so in the next five years

The British Business Bank reveals today that, based on its estimates, smaller businesses[1] account for almost a third (30%) of all current UK greenhouse gas emissions (including emissions from households, industry and government) and around half (50%) of total emissions from UK businesses.[2]

Its latest research report, Smaller businesses and the transition to net zero, highlights the potential collective influence of UK smaller businesses and the considerable contribution they could make to wider net zero objectives if they all made changes to reduce their carbon footprint. The report, one of the most in-depth so far in this under-explored part of the market, incorporates results from fresh data via a bespoke, nationally representative survey of 1,200 smaller businesses, and analysis of public data sources.

Over three in four businesses (76%) are yet to implement comprehensive decarbonisation strategies, capabilities and actions, according to Bank estimates. One example of this is that just 3% of smaller businesses surveyed say they have measured their carbon footprint in the past five years and subsequently set an emissions reduction target.

The early stages of transition

There is limited proactivity from businesses to improve their own knowledge and capability, for example, with more than half (56%) in the survey saying they have taken no actions to change this.

However, when asked about physical actions, it is encouraging to see that the vast majority (94%) say they have taken at least one action to reduce their emissions, though they tended to be low-effort ones, such as installing a smart meter.

Overall, the most common motive for taking action, mentioned by just over half (51%) of businesses, was that it ‘made financial sense’, speaking to the need to align net zero and financial objectives for businesses in the transition.

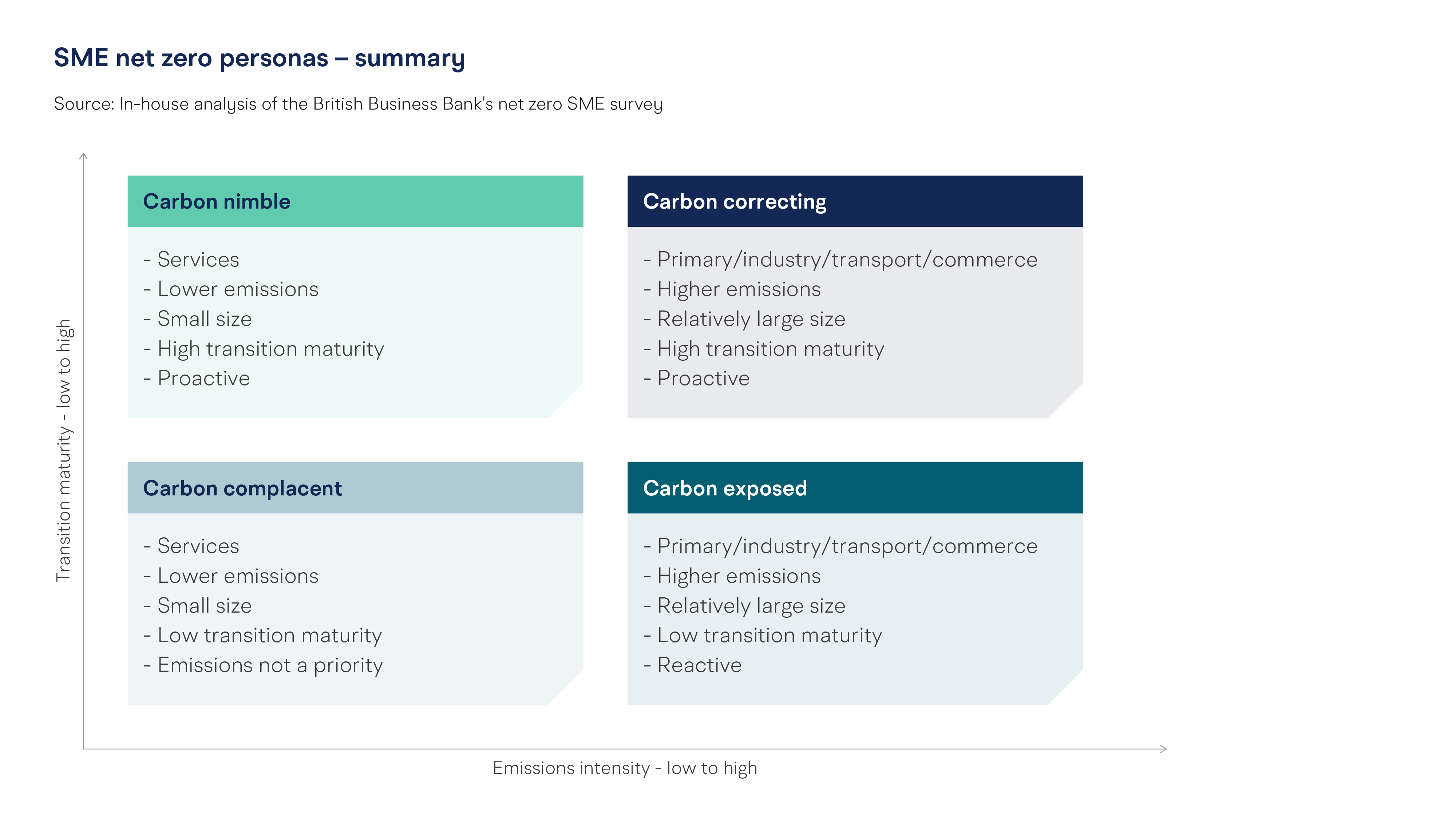

The data reveals around half (52%) of smaller UK businesses fall within the ‘Carbon Complacent’ or ‘Carbon Exposed’ personas established by the Bank based on business characteristics, emissions intensity, actions and attitudes. Businesses falling under these personas are reactive or simply disengaged in their attitudes to cutting emissions and have ‘low carbon transition maturity’.

Awareness is mixed and attitudes split

More than half (57%) of smaller businesses have heard a lot, or a fair amount, about the government’s commitment to reach ‘net zero’ emissions by 2050, and the implications of climate change for their businesses (56%), establishing a strong base for further transition.

However, while nearly half (47%) of smaller businesses state reducing carbon emissions or environmental impacts is a high or very high priority over the next two years, 53% indicate they are not yet ready to prioritise decarbonisation. This split in attitudes demonstrates the need to raise awareness, balance the knowledge gap and ultimately help facilitate change.

Barriers are multiple, complex and business specific

Some common themes have emerged, however – more than a third (35%) of smaller businesses cited costs as a barrier for reducing carbon emissions, particularly upfront capital costs (21%), followed by feasibility (32%), such as lack of control due to tenancy agreements or lack of an appropriate technology. Over one in ten (12%) said that lack of information was preventing them from action.

Finance as an enabler to net zero transition

So far, 11% of the smaller business population - equating to around 700,000 businesses in the UK - have accessed external finance, in the form of loans or equity, to support net zero actions. Looking forward, 22% of the UK smaller business population (equivalent to around 1.3 million businesses[3]) – say they are prepared to access external finance to support net zero actions in the next five years.

Catherine Lewis La Torre, CEO, British Business Bank commented: “Smaller businesses will generally have lower individual carbon footprints than their larger counterparts, but by broadening their vision and committing to action they can collectively produce a significant overall impact.

Action to mitigate the impacts of climate change is at tipping point, and it is crucial for smaller business owners to feel empowered, informed and supported in making the relevant steps to decarbonising their business if the UK is going to meet its wider net zero objectives by 2050.

“More than half of smaller businesses say they’re not ready to prioritise decarbonisation, so clearly more needs to be done.

“The Bank continues to strive to bridge the knowledge gap and work with its partners to improve smaller businesses’ access to the right finance to help them transition to net zero. We hope this report encourages business owners to review their business model, consider where changes can be made and to make the necessary investments to secure a sustainable future for their businesses.”

Small Business Minister Paul Scully said: “Small businesses need to be front and centre in our national effort to reduce emissions, which is why we’re working closely with the government’s British Business Bank to bake our top priority of reducing carbon emissions into the business finance pie.

“We launched our ground-breaking Net Zero Strategy this week and in the run-up to COP26 in Glasgow next month, we are pulling every lever we can to get every part of the UK’s business community on board with the vital need to reduce emissions and build back greener.”

Revised Business Bank mission

The UK has a target to bring all greenhouse gas emissions to net zero by 2050. Supporting this, the Bank has a revised mission to drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by improving access to finance for smaller businesses.

Tackling climate change is the great challenge of our age and the British Business Bank will step up to play its part. We will use the findings of the report we have published today to help shape our plans to support smaller businesses transition to net zero, and we will set out our next steps shortly.

Supporting smaller businesses on their transition to net zero

Smaller businesses are well placed to respond to the opportunities, as well as the challenges of the transition to a net zero economy. The British Business Bank is already supporting smaller businesses in finding the right finance for their transition to net zero, as well as providing funding to businesses that are tackling environmental issues more directly.

Simon Hombersley, CEO, Xampla said: “Reaching carbon neutrality is going to involve disrupting some very big businesses, and the best people to disrupt big businesses are small businesses. Large companies don’t innovate in the way that a start-up can, so that’s how small businesses are going to change the world.”

Shalom Lloyd, Founder and Managing Director, Naturally Tribal, said: “Small businesses are nimble, they’re agile. They can make change very, very quickly, so the support we give small businesses to help reach the net zero target is very critical”

Brendan O’Toole, CEO, Dynamo Motor Company, said; “We are extremely passionate about creating a product that is environmentally friendly and meets the needs of both the drivers and passengers.”

Jake Crute, Founding Director, PlantKind, said: “Small businesses really can make a big difference, and they should focus on the changes they can make now that will produce a longer-term impact. PlantKind products use no plastic, the greenhouse for growing my plants is built entirely from reclaimed materials and they are watered using an underground water tank that collects rainwater. I also donate 1.5% of revenue to offset carbon and am working to achieve B Corp status.”

Sarah Ellerby, Chief Executive, Nova Pangaea, said: “The UK has an opportunity to lead the drive to net zero, specifically for sustainable aviation fuel (SAF). In order to deliver on this net zero target, we will need to lean on smaller scale companies with disruptive technologies to accelerate innovation. This will require significant investment and alignment of finance and stakeholders to deliver this aspirational target.”

James Cleave, CFO at Everflow Group, said: “At Everflow we’re piloting innovative ways of reducing water use and helping businesses to understand how water efficiency plays a part in achieving net zero, with 6% of UK carbon emissions being linked to water use - this includes both treatment and transportation of water and wastewater, as well as heating water. Per capita consumption has doubled since the 1960s. We try a lot of things out on ourselves and ultimately aim to reduce our environmental footprint to neutral or better.”

Related News

- 08:00 am

Currencycloud, the experts in simplifying business in a multi-currency world, have agreed to a strategic partnership with Plaid, open finance network and payments platform, that will deliver new joint solutions to make it easy for firms in the UK, including foreign exchange brokers, Fintech companies and banks, to operate in multiple currencies.

Until now, customers using the Currencycloud Direct white label solution have had to leave the app to make a top-up payment into their account from their chosen bank – a very manual, laborious, and time-consuming process.

The partnership with Plaid allows customers to fund their accounts without ever leaving the platform, simplifying the payment journey. Embedding Plaid’s Payment Initiation Services (PIS) into Currencycloud’s platform means customers will be able to pull money directly into their account from any bank, making the process that much slicker. Following the integration into Currencycloud Direct, the solution will be available across the entire Currencycloud platform.

Currencycloud is always looking for ways to improve the funding process, remove friction and make it easier for customers using the platform to convert and pay money around the globe. Huge progress has been made in this space, with 80% of all incoming credits now available to customers within one second of reaching Currencycloud.

Stuart Bailey, Chief Product Officer at Currencycloud, said: “We are always looking for ways to improve our customers’ experience. The integration of this solution will do just that, removing friction in their experience by keeping them on our platform from the start to finish of each transaction. We’re looking forward to working closely with Plaid to continue to improve the experience for our customers.”

“The internet has made business more borderless than ever before, but it is incredibly difficult to move money across countries. Accepting, settling, and converting payments is complicated, expensive, and can take time. However, fintech companies like Currencycloud are reshaping the processes and simplifying foreign exchange,” said Farid Sedjelmaci, Head of European Partnerships at Plaid. “Combining Plaid’s Payment Initiation Services with Currencycloud’s all-inclusive platform for foreign exchange provides a smooth payment experience that obscures all of the complications with online global money movement.”

Related News

Paul Adams

Head of Acquiring at Barclaycard Payments

From 14 March 2022, Strong Customer Authentication (SCA) will become a mandatory requirement for online payments in the UK, meaning that consumers will no longer be abl see more

Seshika Fernando

VP & GM BFSI Practice at WSO2

Today consumers expect great digital experiences. Financial institutions looking to meet these expectations are under more pressure than ever to innovate — while delivering seam see more

- 04:00 am

eToro, the global multi-asset investment platform, announced today that it has added four more assets to its crypto offering(1).

Cosmos (ATOM), The Graph (GRT), Curve (CRV) and 1inch (1INCH) are all now available on the eToro investment platform, which means eToro’s offering now consists of 36 cryptoassets(2).

Cosmos is an ecosystem of blockchains created as an ‘internet of blockchains’. Investors in the ATOM token hold secure services on the Cosmos platform, for which they are rewarded with transaction fee payments and other distributed staking rewards.

GRT is a crypto which underpins an indexing protocol designed to organise blockchain data and make it more easily accessible to users. Users of the platform must be GRT token holders as the crypto ensures the integrity of the data organised on the platform. In return they earn a share of the network’s fees.

CRV is an Ethereum-based token that powers the Curve.fi decentralised exchange (DEX). The DEX’s protocol makes the exchange of ERC-20 tokens such as stablecoins easier to swap between holders.

The 1inch Network is also a DEX that aggregates liquidity and offers the best rate possible on a range of blockchain based token swaps. Holders of the token can participate in network governance and further development of the exchange.

Doron Rosenblum, VP of Business Solutions at eToro, said: “Crypto is going from strength to strength at the moment as the market grows and new ideas and tokens reach prominence. We see ever-growing interest from retail investors on our platform who believe in the long-term potential of such projects.

“We are determined to keep updating our offering to users to help diversify their portfolios with a broader range of cryptoassets. We will continue to expand our range of cryptoassets with more coins coming soon.

“As always, we urge investors to do their research. All cryptoassets have whitepapers which detail their use case. We strongly encourage our users to be cautious and remember that when investing, it is wise to diversify and only invest in markets and instruments with which you are familiar.”

eToro has been offering retail clients access to the crypto markets since 2013. eToro’s users can easily buy, hold and sell the real underlying assets of all four tokens on its investment platform, using fiat currency.

These are the latest coins to join eToro’s cryptoasset range following the addition of Solana (SOL), Polkadot (DOT) and Filecoin (FIL) in October; Enjin (ENJ), Maker (MKR) and Shiba Inu (represented on eToro as SHIBxM) in July, and Chainlink, Dogecoin, Uniswap, Aave, Compound, Yearn.Finance, Decentraland, Algorand, Polygon, and Basic Attention Token earlier in 2021. For now, all four tokens will not be available to US users.

Related News

- 04:00 am

Continued growth in total sales at + 13%

Double-digit growth in SaaS activities, up 16%

Jump in SaaS order intake to + 22%

Almost 60% of international orders

Sidetrade (Euronext Growth: ALBFR.PA ), an Artificial Intelligence platform dedicated to accelerating the income and cash flow of companies, announces for its third quarter of 2021 a growth in SaaS turnover (+ 16%).

Double-digit growth in SaaS activities, up + 16%

| Sidetrade (in millions of euros) | T3 2021 | T3 2020 | Variation |

| CA SaaS Activities | 6.8 | 5.9 | + 16% |

| Turnover | 8.2 | 7.3 | + 13% |

The 2021 information is unaudited consolidated data.

In line with the first two quarters of fiscal 2021, Sidetrade continues to post double-digit growth momentum for this third quarter, historically the weakest period of the year. Sidetrade achieves a turnover in the third quarter of 2021 of € 8.2 million, up 13% compared to the same period in 2020.

Jump in SaaS order intake to + 22%

In this third quarter, Sidetrade recorded a very strong increase in new SaaS order intake, which will generate additional revenue from annual subscriptions (“Annual Recurring Revenue” or “ARR”) of € 0.95 million compared to € 0, € 78 million in the third quarter of 2020, an increase of 22%. The total value of these new subscription contracts over their initial firm commitment periods (excluding renewal) represents an amount of € 2.42 million (“Total Contract Value” or “ TCV ”)

To these SaaS orders, it is necessary to add 0.63 M € of additional services (implementation, configuration, training, etc.) against 0.38 M € for the third quarter of 2020. In total, all the outlets of orders in the third quarter of 2021 represents a total value of new contracts on an annual basis (“Annual Contract Value”) of € 1.58 million compared to € 1.16 million in Q3 2020 , an increase of 36% .

Almost 60% of international orders

With new signatures recorded in North America such as Bunzl US and Trescal US in Cross-Sell or Expedia and Kal Tire in UpSell, the share of new contracts completed in the United States represents 24% of the total over this quarter , which attests to the promising start of commercial activity already observed in this territory in the second quarter of 2021. Also note the continued international expansion of Sidetrade within prestigious groups such as Veolia (Veolia in Spain, Veolia Water Technologies in United Kingdom) or within the Page Group with the deployment of Sidetrade in the Asia-Pacific region. In total, international SaaS order intake represents more than 58% of the total for this quarter , which demonstrates the enormous growth potential available to Sidetrade for the years to come.

Related News

- 09:00 am

Nutanix has promoted Dr. Markus Pleier to Field CTO EMEA. The promotion is effective immediately and is in response to strong growth across EMEA.

In his new role, Pleier will provide additional focus on Nutanix’s top-tier customers and partners, to form CXO relationships and gather technical feedback to better align Nutanix’s R&D and product strategy with its customers’ needs. He will also engage with marketing teams to aid Nutanix in the field at key marketing and customer events.

Prior to his promotion, Dr. Pleier was Systems Engineering Director for Nutanix in Germany and Austria, where he built a world class Systems Engineering team in the region. He is a graduate computer scientist from the Technical University of Munich, and holds a doctorate in medicine from Ludwig Maximilian University of Munich. Dr. Pleier has more than 30 years of experience in the IT industry and has held leading positions with well-known manufacturers during this time.

Commenting on his appointment, Dr. Pleier said: “Organisations are realising the power of hybrid multicloud and its promise of agility, flexibility and scalability. However, through additional engagement with our top customers and prospects we will enable them to reach their infrastructure goals and deliver desired business outcomes to their end customers. This new EMEA role provides me with a platform to help our customers, prospects and Nutanix to grow successfully in the region.”

Rob Tribe, VP Systems Engineering, EMEA, said: “I am excited that Nutanix can continue to build its pre-sales organisation, applying additional resources to focus on our customers and prospects. Markus’s unrivalled technical ability and his proven track record in building and nurturing customer relationships will prove to be invaluable. I congratulate him on his much-deserved promotion, and I look forward to him repeating his past successes to deliver exceptional results in his new role.”