Published

- 09:00 am

Bags the title of ‘The Female Economy FinTech of the Year’

LXME – India’s first financial platform for women ,won the title ‘The Female Economy Fintech of the Year’ at the Financial Alliance for Women Hackathon. This serves as a global recognition for the start-up that focuses on empowering women with financial freedom.

The Financial Alliance for Women is a New York headquartered members’ network of financial organizations dedicated to championing the female economy. As a unique network with members from over 135 countries, the alliance believes in the ambition of unlocking the full value of the female economy.

As a part of the Alliance Hackathon initiative, LXME will be given the opportunity to connect with incumbent banks with a strong interest in supporting women customers. The second edition of the Hackathon was focused on financing the section comprising majority of women owned/led businesses. Falling between traditional SME lending by banks and traditional microfinance by MFIs, this target group will acquire solutions provided by the hackathon to leverage its deep expertise in serving the women’s market to support fintechs, develop solutions for women business-owners’ access to finance and non-financial services to accelerate their business growth.

On accomplishing the feat, Priti Rathi Gupta, Founder, LXME said, “We are thrilled and humbled to be recognised by a globally-recognised community like the Financial Alliance for Women. A platform like the Alliance Hackathon identifies the wealth of opportunities that can be explored by fintech by empowering the female economy. At LXME, it has been our constant endeavour to counter societal stigma towards women and investing and empower them. We are delighted to receive this award and have our beliefs and goals recognised on a global stage.”

Delighted that jury chose LXME as the Female Economy Fintech of the Year, the Financial Alliance For Women team added, “The platform is an answer to a huge challenge out there in terms of building and supporting mass market women’s investment capabilities. Women’s lower life time earnings, longer life expectancy and self-reported lower levels of investment know-how translates into a huge gender gap in asset levels. LXME is solving for that and we believe that the platform is a game changer.”

The Hack was judged by a panel of global leaders in the financial services/fintech space and was hosted in partnership with the Monetary Authority of Singapore (MAS) and on the APIX platform.

Fintechs were invited to customize their solutions to the following markets—Colombia, Brazil, Nigeria, Kenya, Singapore and all four South Asian countries—Bangladesh, India, Pakistan and Sri Lanka.

The evaluation parameters included idea validation, innovation & prototype, impact on women’s market, business model, competitiveness and scalability, team and female founders.

Related News

- 01:00 am

Heading into the festive season, it is more important than ever to ensure that computer and smartphone users are protected from increases in brute force attacks, instances of banking malware, and cryptocurrency threats.

ESET, the global cybersecurity leader, has launched a new version of its consumer security line-up, which does just that along with its brand new ESET HOME feature. This web or Android-based platform is placed at the centre of the suite of ESET consumer solutions – allowing users to manage the security of all their Windows and Android devices from one seamless and convenient interface.

Smartphones are central to people’s lives, with multiple internet-connected devices in their homes. Simple and efficient protection and management of these devices is critical amidst a steadily increasing tide of cyberattacks.

This updated consumer offering from ESET includes ESET NOD32 Antivirus, ESET Internet Security, and ESET Smart Security Premium, which can all now be centrally managed from a single point by ESET HOME.

The ESET HOME’s on-the-go security management and oversight functions allow users to add, manage, and share licenses with family and friends, as well as manage Anti-Theft, Parental Control and Password Manager via the web portal.

Booming cryptocurrencies have brought out the cybercriminals

Banking and cryptocurrency threats have continued to grow.

This malware category has experienced an increase of 18.6%, according to the ESET Threat Report T1 2021. Beyond stealing cryptocurrency or gaining access to crypto-wallets, cybercriminals use malware to gain access to users’ computer resources without them knowing, opening the door to many potentially unwanted applications.

Additional features in the ESET suite of products have improved its Banking & Payment Protection with extra security for customers accessing web-based cryptocurrency wallets and banking websites. Android banking malware is a growing threat for users to be aware of and protect themselves against.

Steve Flynn, Director of Sales and Marketing at ESET South Africa, says: “The rise of Android banking malware apps is worrisome because these are not just some annoying ad display apps; their victims can actually lose their savings, with little to no chance of ever recovering them. For users, mobile phone protection is as important as protecting their computers, and this is a critical driver.”

Other key updates in the new product suite include:

- Protection improvements — Banking & Payment Protection will now have the option to run by default, protecting any supported browser with a hardened mode. Ransomware Shield has been bolstered with enhanced behaviour-based detection techniques. Exploit Blocker has been improved to cover additional malicious techniques.

- ESET HOME — Parents can use ESET HOME to share licenses with family and friends or to monitor their children’s online activity and control their screen time in Parental Control (via the ESET HOME web portal).

- LiveGuard — Integrated with ESET Smart Security Premium, LiveGuard provides an additional proactive layer of protection against never-before-seen types of threats, shielding users from the malware before its code executes. This service, personalised for each user, analyses suspicious files, including documents, scripts, installers and executable files, in a safe sandbox environment.

- Password Manager — Available with ESET Smart Security Premium, Password Manager has been completely redesigned for improved security and ease of use. Password Manager is available in all major browsers as a browser extension and on Android and iOS devices as a native application. New features include support for KeePass and Microsoft Authenticator.

Carey van Vlaanderen, Chief Executive Officer at ESET Southern Africa, affirms that online security is a non-negotiable nowadays, not only for protecting users’ devices but all of those at home, too. “The updated product suite, including our new LiveGuard feature and the unique ESET HOME platform, puts users firmly in control of their home cybersecurity needs and instils them with the confidence needed to manage multiple devices on the go,” she explains.

She concludes, “After more than a year and a half of being heavily reliant on technology and more connected than ever, and with the threat landscape constantly evolving, it is vital that our consumer users are protected with cutting-edge solutions that are easily accessible and provide the best in class user experience.”

Related News

- 05:00 am

New technology often seems fantastic on paper yet has little impact in the life of the average person. A new tipping solution for fuel pump attendants, however, does both.

When asked to fill up a fuel tank as motorists do in the movies, few South Africans would know what to do beyond pulling their tank lever from inside the car. Fuel station attendants are as much a part of our culture as braais and ‘howzit’.

And yet, a BusinessTech poll of over 7000 respondents in 2018 showed that 37% of motorists don’t tip pump attendants.

Engen aims to change this with its new ‘Tip an Attendant’ function. Ukheshe technologies, Telkom and Engen have collaborated to create the QR solution which allows motorists to tip attendants and cashiers for efficient service by simply scanning a QR code using their Engen 1app or any payment app that supports Masterpass QR payments.

Real solutions for real people

When a petrol attendant’s QR code is scanned, and a tip is made it automatically is deposited into a Telkom Pay digital wallet. This digital wallet allows the attendant to either withdraw the money from Pick ‘n Pay, a CashExpress ATM or purchase airtime, data and other VAS services. They can also purchase goods at any merchant that supports QR code payments or any e-commerce store using a virtual card. The app utilises Eclipse, Ukheshe’s ready-to-use enablement platform.

Fuel pump attendants and Quickshop cashiers will be assigned a lanyard with a personal QR code. After registering for a Telkom Pay Wallet through WhatsApp, they can start receiving tips from customers paying on the Engen 1app.

“One reason for the poor tipping rates for pump attendants is that people often simply don’t have cash on hand to do so,” says Clayton Hayward, CEO of Ukheshe Technologies. “This solves that problem – for both the attendant who relies on a tip to supplement their income, and the mortified motorist who is digging around for cash in their car.”

According to wage data from Indeed and PayScale, petrol stations employ around 70,000 people across the country, with many pump attendants earning under R30 per hour. With many South Africans now favouring contactless payment methods due to the pandemic, attendants’ only means of increasing their income - through cash tips - is diminishing.

‘’We’re delighted to continue to build our relationship with Telkom and broaden the reach of the Eclipse API in a meaningful way.” Engen’s 1app offers a safer customer service experience, as there is no touching of devices, cards or cash required. You will also no longer need to carry cash or cards to make your fuel purchases, and loyalty points will automatically be registered with Engen’s respective loyalty partners, Clicks Clubcard and FNB eBucks,” says Seelan Naidoo, Engen’s General Manager: Retail.

Into the future

In June this year, Telkom also launched Africa’s first Mastercard virtual card for use on WhatsApp, again utilising Ukheshe’s Eclipse API. It enables Telkom Pay customers to make e-commerce payments without a physical card. Engen employees will also have access to this functionality, as well as the full range of Telkom Pay innovations.

The Engen and Telkom partnership, powered by Ukheshe, is just one step in our march towards the digital financial economy of the future – one that will empower millions of people, including those without bank accounts, to access the digital economy and transact online.

Engen’s vision is to extend the ‘Tip an Attendant’ solution outside the Engen environment, enabling its customers to use the Engen 1app to tip anyone that provides great service – whether a car guard or a waiter, says Naidoo.

Telkom Financial Services Managing Executive Sibusiso Ngwenya says the company is thrilled to be on board. “I believe it’s a sentiment we all share as South Africans - that great service deserves to be rewarded. We've seen many a story on social media about someone in the service industry going above and beyond. They deserve to have the favour returned, and now, there is an easier means to do so.”

Adds Hayward: “We are thrilled to assist Telkom and Engen in making such new, innovative products possible. As a leading fintech enablement partner, Ukheshe has always aims to create a more inclusive digital financial ecosystem and improve financial access – and this is just one of the ways we’re doing so.”

Related News

- 09:00 am

ING announced today to offer a compensation to our Dutch retail customers with certain revolving consumer loans where the variable interest rate did not sufficiently follow market rates. With this step, ING reacts to a number of rulings by the Dutch Institute for Financial Disputes (Kifid) regarding similar products at other banks.

We have investigated the relevance of these rulings for our floating-rate credit products in the Netherlands. This is expected to concern approximately 10% of the contracts for these products. The Dutch Consumers’ Association (Consumentenbond) has reacted positively on ING’s intention and is prepared to further discuss the execution and details of the scheme, which is expected to be completed before the end of 2022.

ING will book a provision of €180 million in its third quarter 2021 results for the compensation and costs of executing the scheme. More details on the compensation for our customers can be found on ING’s Dutch website www.ing.nl.

Related News

- 07:00 am

Recently, HambitPay, a crypo payment platform from Singapore, announced the launch of its global partnership program.

Unlike coinbase, binance, etc., which initially centered on exchange business and only later derived payment business, HambitPay has been focusing on the research and development of crypto payment technology since its establishment, capitalising Singapore's geographical advantages as an international financial center, and promoting a new payment ecosystem in Southeast Asia and the world beyond. The global partnership program launched this time is also a leap forward towards this goal.

Blockchain is an emerging industry that aggregates many tracks, and HambitPay choose to go all in on crypto payments for good reasons. A spokesperson of Hambitpay said that HambitPay values the huge market potential that is about to explode for crypto payments. According to the report "Digital Assets Primer: Only the first inning" released by Bank of America, the cryptocurrency and decentralised financial services industry has grown "too large to ignore." With a market capitalisation of $2 trillion and nearly 220 million users, the crypto sector alone is a spectacular size among digital assets. When we look at the digital asset market as a whole, the global digital asset management market is expected to reach $102.2 billion by 2026, according to a report by Indian market research firm Valuates Reports.

Hambitpay believes that digital payment has roughly gone through three stages of development:

1. Birth stage: With the development of the Internet, the first "online banking" payment initiated by traditional banks is the 1.0 stage of digital asset payment. People first need to have a bank account before they can open the corresponding online banking account. At the same time, in order to ensure the security of network assets, security hardware (such as network shields, etc.) is also required.

At this stage, online digital assets are linked to real assets in centralised financial institutions such as banks, and are characterised by slow transaction processing, small cross-platform transaction scope, the need to be linked to a bank account, and high fees.

2. Mobile payment stage: With the development of the mobile Internet, the payment 2.0 stage arrived with applications backed by a large user base, such as PayPal and Alipay. At this stage, people only need to have an application account, then they can make transactions and payments online, offline, and between different platforms.

The payment 2.0 stage is still under continuous development and improvement. People can not only conduct transactions in payment applications, but also through the API interface in various applications and mini programs.

Payment 2.0 has brought great convenience to people's lives, but with the development of the market and the changing needs of users, Payment 2.0 is also facing some problems.

- Due to the centralising trend of payment platforms, transaction and payment fees are increasing, which affects the free flow and further development of digital assets.

- Payment 2.0 is still based on real bank accounts for transactions, so in an environment where cross-border payment and fiat currency payment are of limited capacity, it still cannot meet the needs of global payment of today.

Payment 3.0: Payment 3.0 marks the future direction of the financial and payments sector. The problems that arose in 1.0 and 2.0 will be solved in Payment 3.0. The solution is to establish a decentralised, digital financial native, and global payment platform.

Platforms of Payments 3.0 must meet the need for security, equality, and globalisation of digital assets. While enabling fast payments, the platform must also have fees low enough to facilitate the inclusion of financially underdeveloped countries and meet the requirements of financial fairness.

From the perspective of digital assets globalisation and financial fairness, decentralised and fair crypto payments have become the prototype for the Payment 3.0. HambitPay has already completed its in-depth layout in terms of technology, products, resources, etc. in this arena.

The prospect which HambitPay brings to users in the era of Payment 3.0

A Higher Degree of Business Globalisation

The last wave of information globalisation, marked by the rise of the Internet, greatly contributed to the development of economic globalisation. The advent of a new era of digital economy, marked by the free flow of capital, is bound to bring about an even greater globalisation of commerce. Through crypto payment platforms such as HambitPay, merchants can receive orders and payments from customers anywhere anytime, expanding their business footprints to any corner of the globe.

Enterprise-Level Commercial Crypto Payment Solution

Unlike the previous peer-to-peer transfer method of cryptocurrencies, HambitPay provides users with an enterprise-level commercial crypto payment solution that supports the simultaneous processing of multiple transactions initiated by different users in different regions, ensuring a smooth transaction experience in just a few minutes. It systematically solves many of the problems previously faced by industries such as cross-border e-commerce, cross-border online gaming, and global social networking, such as long billing periods for cross-border transactions, cumbersome settlement processes, and volatile exchange rates.

Lower Payment Costs Compared to Traditional Methods

For businesses, traditional cross-border payment methods have an average rate of no less than 3%, which has a significant impact on their profits. Crypto payment platforms such as HambitPay, on the other hand, can significantly reduce rates, helping businesses to save on payment costs and secure a more flexible profit margin.

Financial Fairness

The decentralised blockchain technology is currently the best way to achieve financial fairness, and Hambitpay has always been committed to achieving this end. Through HambitPay, qualified individuals or merchants from anywhere in the world can conduct cross-border business activities and enjoy the financial equality and openness brought by crypto payments.

Emerging crypto payment platforms such as HambitPay may help the market make the leap from the early stages of payments to Payment 3.0, helping users to capture more business opportunities through advanced payment methods.

Related News

- 04:00 am

Singapore-based IN Financial Technologies launches INFT, a secured one-stop business solutions platform to start-ups and Micro, Small and Medium Enterprises (MSMEs) through filling the financing and banking gap, which allows entrepreneurs to focus on their core businesses.

We are witnessing a paradigm shift in the business landscape in Southeast Asia. With the rampant emergence and adoption of new technologies, start-up entrepreneurs are the new catalyst for the growth of regional economies. These change-drivers are constantly on-the-go and thus require seamless, hassle- free solutions to manage their businesses more efficiently. Headquartered in Singapore, a financial hub within the region, IN levels the playing field for businesses in any sector to accessible, efficient, transparent financial solutions encrypted in a single platform. During COVID-19, many traditional MSMEs businesses were affected – they are faced with immense pressure to do things differently and to go digital, and many struggled.

IN's solutions are perfectly poised to digitalize and empower these MSMEs via a unified portal and application, and to improve employer to employee's experience in transitioning to digitalization. By providing a whole range of digital solutions aimed at streamlining business mechanisms, entrepreneurs are able to adopt a hands-free approach for the more administrative tasks. IN offers digital solutions to effectively achieve entrepreneurs' needs with the help of technology. Such time and cost-effective solutions work efficiently to give entrepreneurs and their employees a peace of mind, enabling them to better focus on client-facing issues and other aspects which require a more personal touch. This way, MSMEs are better able to concentrate on running their businesses without having to allocate time for menial, time-consuming admin tasks.

IN aims to provide solutions targeted to aid entrepreneurs in one central app including features such as Manage, Access, Send and Spend. It is designed to solve entrepreneurs' challenges with a suite of solutions designed to satisfy your every business need. IN's 24/7 customer support on the platform offers round-the-clock support specifically dedicated to start-ups to tackle any concerns and queries anytime, anywhere.

While the company promises to deliver exceptional solutions to its clients, it has also resolved to deliver the best value to help them scale exponentially. With international money transfer rates greatly cheaper than traditional banks, a bird's eye view on Spend Management via a smart dashboard, Teams Management feature, highly competitive FX rates, and innovative features like 'pay only when you use' for their cash line financing, their work is truly aligned with the aspirations of entrepreneurs.

IN combines the best of breed synergies from each of these niches and beyond, tailoring them to the specific needs of start-ups and SMEs. IN is ready to deep-dive into supporting its SME partners to navigate these challenges within their first year of operation. Besides helping business owners manage their operations and processes, IN also offers meaningful solutions to better manage their lives. The company has designed the platform with specific communities in mind, e.g., start-up founders, work-from-home entrepreneurs, online traders, and more. Now entrepreneurs can focus on what's most important: growing their business! With the rise in popularity of ESG (Environmental, Social and Governance) practices, IN will be doing its part and championing such efforts through our future suite of ESG focused financing services.

Related News

- 06:00 am

This marks the electric carmaker’s first usage-based insurance (UBI) product after launching a traditional insurance program in California two years ago.

Here’s how it works: In Texas, Tesla’s premiums will be based on its proprietary safety score.

- The scoring system was first used to determine whether a driver could access their car’s “Full Self-Driving” option, and it will now be used to underwrite Tesla drivers who buy its insurance in the state.

- The score is calculated by analyzing the customers’ real-time driving behavior based on five criteria: instances of forward collision warnings, hard braking, turning corners aggressively, unsafe following, and forced Autopilot disengagement.

- The price will be revised every month, with those deemed “average” drivers said to save 20% to 40% on their premiums compared with other providers.

How will it fare against competing UBI offerings? Tesla could potentially offer cheaper and more flexible coverage than insurtechs, but there may be concerns over the scoring system still being in beta.

- Tesla could be cheaper than UBI insurtech Metromile, which charges not only a rate based on driving distance and behavior but also a base rate that takes into account traditional factors like claim history, age, and gender. By contrast, Tesla says it will solely focus on driving behavior and will only charge one rate.

- And monthly renewals make it more flexible than Root, which only uses driver data to change its prices every six months.

- Tesla’s offering is also seamlessly embedded in its cars, whereas competing UBI offerings tend to require either installing a physical device or downloading an app.

- But Tesla says the safety score is still a beta feature that should improve over time. This calls into question whether it rolled out its UBI too early—the firm has a history of rolling out products before they’re fully considered safe. It’s possible the software in its current form may not properly assess driver risk or price premiums.

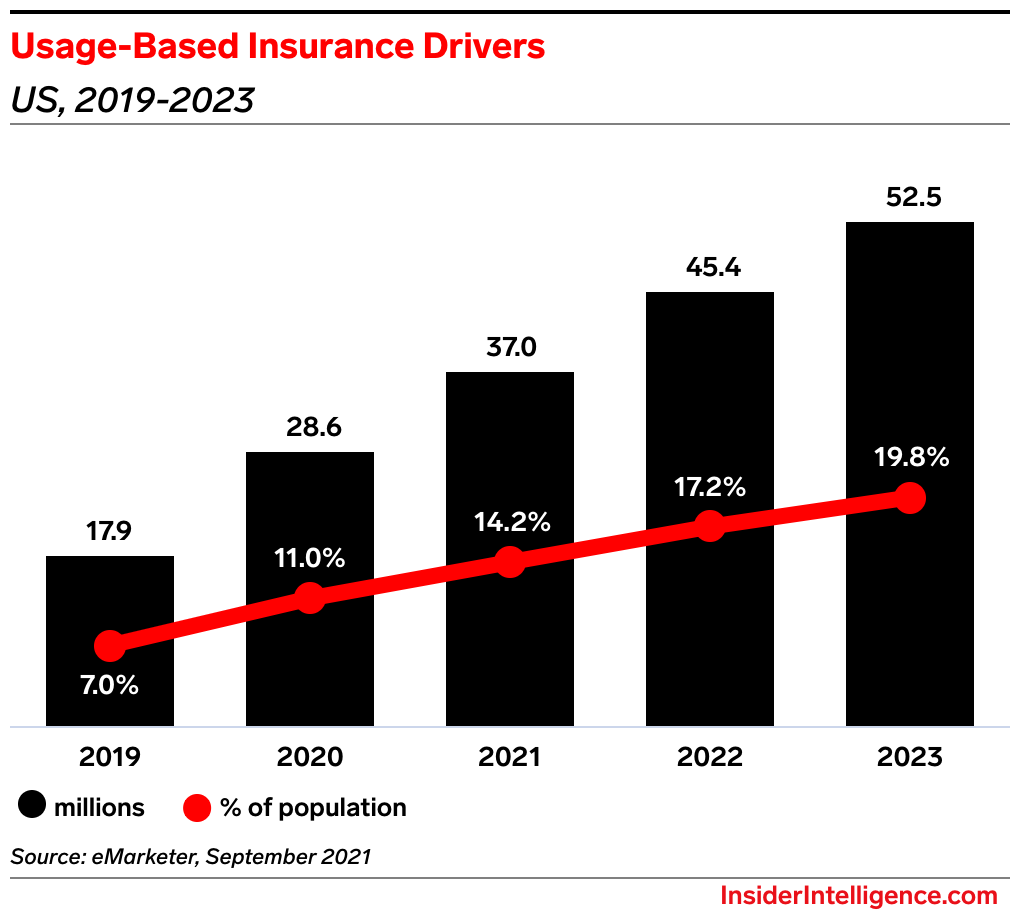

Bottom Line: Irrespective of these concerns, Tesla drivers in Texas will flock to its coverage amid growing demand for such solutions: Our forecast expects 52.5 million US drivers to buy UBI coverage by 2023, up from 37 million this year.

Related News

- 07:00 am

Money Minx, a US-based net worth and investments tracking platform, joined forces with Salt Edge, open banking pioneer, to allow their users in the UK, Germany, and Switzerland to connect all bank accounts and monitor investments with ease – all in one place.

The modern world opens the door for innovation in major parts of people’s lives, and investment is not an exception. Digitalisation creates many new forms of investment, making them affordable and easier for almost every member of today’s society. Investors look for instant and transparent access to financial planning and portfolio management tools to control, track, and compare investments — in real-time. Here Money Minx enters the arena, offering a DIY investing experience with full control over assets, debt and investments from around the world and in any currency. Combined with Salt Edge data aggregation and data enrichment tools, Money Minx expands the boundaries and takes investing to an entirely new, game-changing level.

The collaboration with Salt Edge helps Money Minx to build a “Personal Finance Mission Control” for the everyday investor by implementing PSD2 compliant access to clients’ bank data across Europe. Open banking-enabled live bank feeds offer an easy way to track investments from anywhere and in any currency — all in one simple, user-friendly place. By teaming up with Salt Edge, Money Minx can cover 50 countries globally by integrating with only 1 API instead of having to connect with each financial institution on their own. Salt Edge solutions enable users to connect their bank accounts in Europe to Money Minx in just several clicks. The entire process is automated, eliminating the need to download statements and enter values in Money Minx manually.

When we were searching for a partner we wanted to make sure our users’ data would be secure. Salt Edge turned out to be more established and transparent than its competitors, so our choice was clear. Currently, we are live with Salt Edge in the UK, Germany, and Switzerland. Very soon we plan on opening connections in Australia, France, Spain, and Italy. We believe our approach to investing makes us stand out against the competition and with such a reliable partner and at our side, we have a very bright future ahead.

Hussein Yahfoufi, Co-founder of Money Minx

We are constantly pushing the envelope, aiming to partner with companies which shape the future of financial services. Modern investing is booming, and innovative businesses such as Money Minx are embracing the benefits of open banking solutions to differentiate and create easy and secure investing experience for their customers.

Vasile Valcov, VP at Salt Edge

Related News

- 05:00 am

Collaboration accelerates data availability for lenders via Fusion LenderComm and Synergy DataLake

Finastra, the largest pure-play software vendor that serves the entire financial services industry, and AccessFintech, the data-sharing network optimizing workflow through collaboration, today announced that they have teamed up to bring greater data transparency, efficiency and industry-wide collaboration to the syndicated loan market.

The integration of Finastra’s Fusion LenderComm platform and AccessFintech’s Synergy DataLake accelerates the availability of data to lenders and strengthens internal operations and collaboration between agents, lenders and service providers. It also helps digitize the market, eliminating the need for fax, email and telephone calls and making reconciliation more efficient.

Cory Olsen, Loans Business Manager at AccessFintech said, “Finastra and AccessFintech are natural partners as we are both committed to digitizing the market and making it more transparent. This joint initiative enhances efficiency for both agents and lenders, allowing agents to share data instantly and benefit from centralized workflows and collaboration.”

Amy Walker, VP, Fusion LenderComm at Finastra said, “Our partnership helps to solve the pressing industry challenge for both sides of the market around digitization of data. Finastra and AccessFintech are uniquely placed to deliver greater transparency for the loan market. AccessFintech’s extensive network and proven collaboration capabilities will ensure that we reach all market participants. Together we will drive the loan market forward.”

Fusion LenderComm digitizes and streamlines information exchange for agents and lenders. It is built on APIs via Finastra’s open development platform, FusionFabric.cloud, and is part of the company’s comprehensive suite of lending solutions, including Fusion Loan IQ, the world’s leading commercial loan platform. Overall, Finastra software powers over 70% of the world’s total syndicated loans.

The Synergy DataLake uses shared industry data to simplify and speed workflows, reduce capital requirements, and provide valuable benchmarking insights.

Find out more about Fusion LenderComm here or Fusion Loan IQ here.

Find out more about Synergy DataLake here.

Related News

- 06:00 am

Several honors and awards were recently bestowed on Path Solutions including the latest Best Islamic Technology Provider 2021 award from Islamic Finance news (IFN). For the first time in history, an Islamic banking software provider receives the most awards ever for its contribution to the growth of the Islamic financial services industry.

The highly acclaimed company, Path Solutions received the largest number of votes ever this year, culminating in being awarded the Best Islamic Technology Provider 2021, which further cements this achievement.

According to Andrew Morgan, Managing Director & Publisher, REDmoney Group, Path Solutions was crowned the winner for the 15th year in a remarkable scoring streak. The firm is an unquestioned leader in the technology space, and as the industry slowly recovers post-pandemic, Path Solutions toughed it out to hang on to its title even in the midst of adversity. “Our heartiest congratulations go to the company and its amazing team”, he said.

Commenting on the award, Mohammed Kateeb, Path Solutions’ Group Chairman & CEO stated, “We are extremely proud to have once again won the industry vote in the annual IFN’s Poll as Best Islamic Technology Provider of 2021. This recognition only compels us to maintain our momentum and continue to shape the future of financial services ecosystem and empower the transformation of the industry by providing cutting-edge, forward-thinking and innovative software”.

IFN Service Providers Poll 2021 will be honoring nine exceptional service providers for their invaluable contributions to the global Islamic finance industry at the prestigious Dubai Awards Ceremony on the 31st of October.

It serves to note that IFN is a subsidiary of REDmoney Group, which was established in 2004 to provide media coverage in global markets including emerging Islamic economies, with unmatched insight into global Sharia-compliant markets. It is the longest running and the only fully independent Awards disseminator. The IFN Service Providers Poll is unique in its recognition of the vital role that service providers play in smoothing the path for Islamic finance and setting the benchmark for its ongoing quality, consistency and creativity by supporting the underlying operations that are so crucial to its success.

The results of the IFN Service Providers Poll 2021 are out and can be viewed here: