Published

- 09:00 am

Global financial technology company SumUp has today announced its decision to join 1% for the Planet and commit 1% of future net revenues to environmental causes such as preventing deforestation, building renewable energy infrastructure, practicing regenerative organic agriculture, conserving water, diverting waste, and creating more sustainable materials.

SumUp’s vision is to create a world where small merchants can be successful doing what they love, and the company over the past ten years has become a leading financial services company, building a global network of over 3.5 million merchants and partners throughout Europe and the Americas.

SumUp is now leveraging its success to play a leading role in protecting our environment. By dedicating a portion of revenue to support environmental causes, SumUp will provide much needed financial support to develop impactful, long-term solutions to improve the world we live in.

“It is our duty as individuals and organisations, not only for ourselves but especially for our youth and future generations, to take action,” says Marc-Alexander Christ, co-founder of SumUp. “We believe that our mission of serving small merchants includes an obligation to help protect the world they live in. We are grateful we are in a position to be able to pledge a portion of our net revenues to environmental organisations, and we hope it’s only the beginning. Ideally, SumUp’s pledge will inspire other technology companies to increase their efforts to protect the environment we all share.”

1% for the Planet is an organisation designed to bring businesses and people together to increase smart environmental giving and ultimately create a healthier planet.

Kate Williams, CEO of 1% for the Planet, explains, "Currently, only 3% of total philanthropy goes to the environment and only 5% of that comes from businesses. The planet needs bigger support than this, and our growing network of business members is doing its valuable part to increase giving and support on-the-ground outcomes. We're excited to welcome SumUp to our global movement."

SumUp’s announcement comes amid a successful year of innovation, expansion and growth for SumUp. The company recently bolstered its US expansion plans through its $317 million acquisition of Fivestars, which provides loyalty, marketing, payments and other services to thousands of small merchants in the US. The acquisition came after a $895 million debt raise in March of this year.

Related News

- 02:00 am

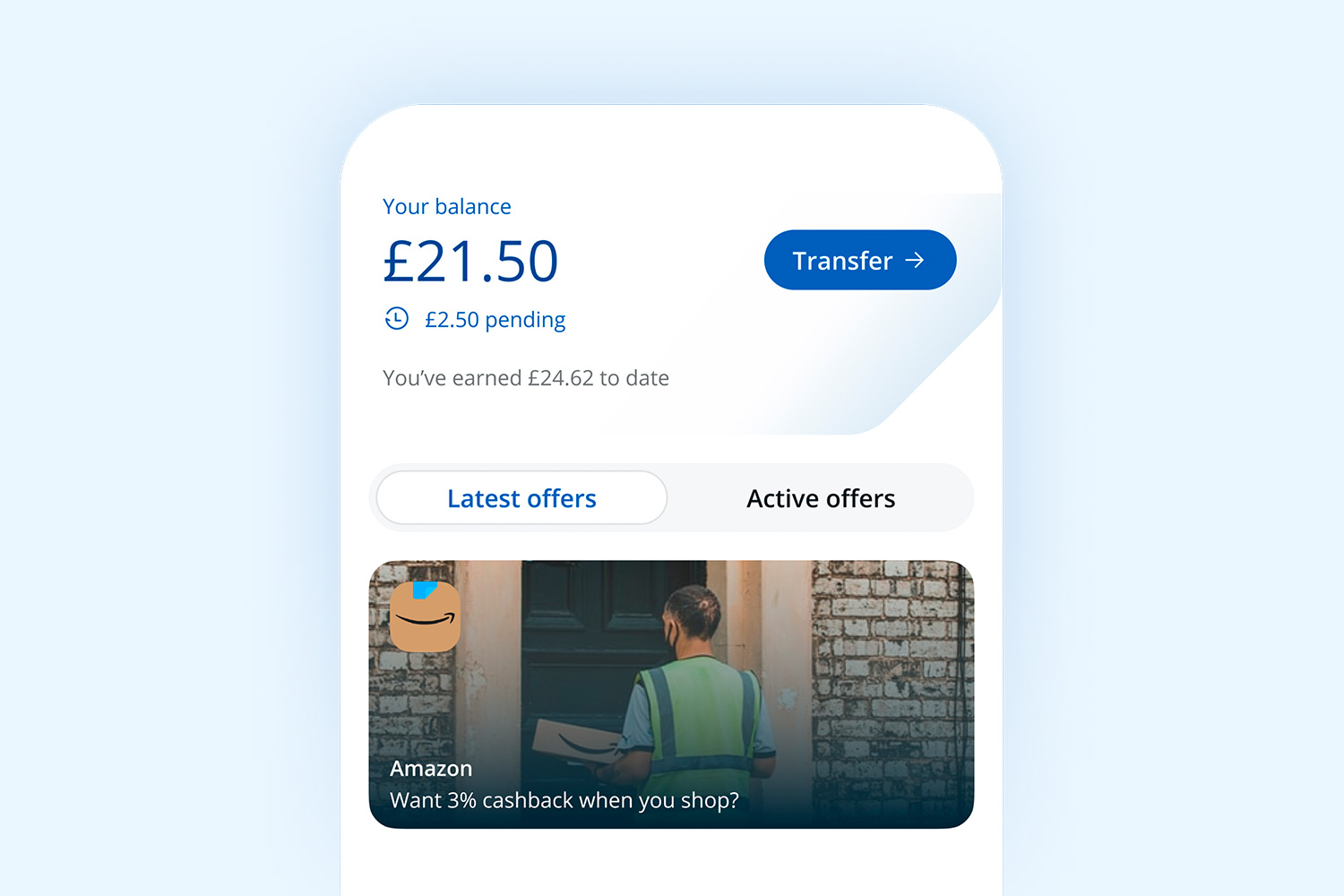

Digital bank Chase today announced it is offering 3% cashback on Amazon.co.uk spend until the end of 2021, to help customers make more of their Amazon purchases this festive season.

The Chase current account already offers customers 1% cashback on all eligible debit card spend for 12 months*, but beginning today, Chase customers can benefit from an increased cashback offer of 3% on online purchases** from Amazon.co.uk. The promotion will run from 18th November through to 31st December, and will be applicable to up to £5,000 spent on the site.

Customers can earn the 3% cashback when they use their Chase debit card to make purchases at Amazon.co.uk, including digital downloads, Amazon Prime subscriptions, and items sold by third-party merchants through Amazon.co.uk’s marketplace.

In order to start earning this additional cashback, customers must activate the offer in the Chase app via the Rewards hub.

Deborah Keay, Chief Marketing Officer of the digital bank says: “The festive season is fast approaching and we know consumers are already busy shopping for the holidays. We want to help everyone to have an even more rewarding festive season this year, so we’re delighted to be expanding our fuss-free rewards programme so Chase customers earn a little extra back while they spend with Amazon in the run-up to the holiday period.”

JPMorgan Chase launched its new digital bank in the U.K. under the Chase brand earlier this year, offering a range of simple, rewarding features to help people budget, manage money, spend and save.

Additional rewarding features include:

- Small change round-ups on which customers can earn 5% interest: customers can save as they spend by rounding up their debit card purchases to the nearest £1, and depositing the small change into a separate account where it will earn interest at 5%***.

- Fee-free debit card use abroad: customers won’t be charged any fees by Chase when using their card while travelling, including for cash withdrawals at ATMs abroad.

- A U.K.-led customer support team: with just a few taps in the Chase app, customers will be connected to a specialist – 24 hours a day, 7 days a week.

New customers interested in taking advantage of the Amazon offer can open a Chase current account quickly and simply by downloading the Chase app.

Related News

- 03:00 am

Moody’s Analytics today announced that its Portfolio Risk Analytics has been selected by Hargreaves Lansdown, to support the ongoing development of their investment proposition.

Hargreaves Lansdown will be leveraging Moody’s Analytics’ award-winning Economic Scenario services and Portfolio Risk Analytics (PRA) software to support the construction of multi-asset solutions.

Using the Moody’s Analytics scenario modeling solution, Hargreaves Lansdown will now have access to comprehensive forward-looking modeling capabilities, embedded in Portfolio Risk Analytics, a flexible cloud-based financial modeling solution that allows asset managers, advisers, and product providers to create forward-looking risk and return analyses for multi-asset investment portfolios.

“We’re thrilled to be working with Moody’s Analytics to help deliver enhanced risk-adjusted outcomes for our clients,” said Mona Christensen, Head of Product Governance at Hargreaves Lansdown. “Having flexible, versatile, and holistic risk management solutions at our fingertips will enable us to make better informed decisions in an ever-changing environment. This, combined with Moody’s Analytics’ depth of expertise, cutting-edge technology, and modeling capabilities is what stood out to us.”

Matthew Seymour, Head of Buy-Side Solutions at Moody’s Analytics, added: “We are proud that our risk analytics tools and modeling services are helping the team at Hargreaves Lansdown to enhance their investment products for 1.6 million clients. Their decision reflects our goal to meet the evolving needs of investment managers as they confront new challenges and opportunities in the post-pandemic recovery.”

Related News

- 06:00 am

Fintech Connect, the UK’s largest fintech show, today revealed the agenda for its 2021 programme. This year’s line-up for the Leaders Summit includes CEOs from major European challenger banks such as Starling and Ziglu. The virtual event will feature speakers from major banks, challenger banks, fintechs, big techs and brands such as Facebook, Uber, and Barclays. Speaker highlights include:

Leaders Summit

- Anne Boden, CEO and Founder, Starling Bank

- Mark Hipperson, CEO and Founder, Ziglu

Virtual Event

- Ashok Vaswani, CEO Consumer Banking and Payments, Barclays

- Russell Pert, Director, Head of Industry, Financial Services and Travel, Facebook

- Marijke Nijhoff, Head of Product - Digital Payments, IKEA Group

- Andrew Murphy, Group Operations Director, John Lewis Partnership

- Alberto Cozer, Senior Global Digital Innovation Manager, Nestlé

- Arka Sircar, Director of Strategy, TSB Bank

- Vinayak Thakur, Group Product Manager, Risk and Payments, Uber

- Alison Harwood, Head of London Branch, Varengold Bank

For the first time ever, the event will be split in to two separate formats, an in-person, invite only, Leaders Summit, taking place on the 30th of November and an accompanying virtual event which will take place from 1st December to 2nd December.

“2021 has been another remarkable year for fintech. As we adjust to a world forever changed by the Covid-19 pandemic, it’s important that we come together as an industry to share our experiences and understand how best we can work together to ensure the industry reaches its potential,” said Laurence Coldicott, Director of Content at FinTech Connect. “This is why we’re running a hybrid event this year to ensure that the event is as inclusive as possible.”

“The in-person Leaders Summit will bring together a select number of industry leaders who are at the forefront of the innovation taking place at banks, fintechs and merchants. And the virtual event will allow delegates to congregate regardless of location to network and attend key sessions that explore the most pressing issues our industry has to address,” concluded Coldicott.

The Leaders Summit will be held at Central Halls in Westminster and feature talks by executives such as Anne Boden, CEO of Starling Bank who will look at the reimagining of financial services post the new normal, and CEO of Ziglu, Mark Hipperson discussing whether digital currency is part of the UK’s future. There will also be a panel discussion on the topic of diversity, inclusion, and sustainability with senior figures from the London Stock Exchange Group, Lloyds Banking Group, Morgan Stanley, Mettle and Yobota all taking part.

Premiering at the event will be the ITN Productions film, Responsible Fintech, presented by FinTech Circle CEO, Susanne Chisti. Filmed in the lead up to COP26, the programme explores the impact the fintech sector is having on the race to net zero and the sustainability agenda.

The subsequent, online virtual event will have content sessions split into four pillars - DX Connect, PayTech Connect, Blockchain Connect, and Regtech & Security Connect. Each area will feature key speaker sessions and panel discussions with experts in their respective fields discussing everything from the role of blockchain in the global supply chain, to how corporations are embracing B2B payments in an ever-changing market. You can register to attend here: https://www.fintechconnect.com/events-london/

Related News

- 06:00 am

- Only 35% of Brits are satisfied with the loyalty rewards they get from their bank; while 37% of credit card holders don’t know what interest rate they are getting

- 56% of young people (18-24 year olds) are interested in a credit card from their favourite high street brand and 55% are willing to take a credit card from their favourite band or artist

Railsbank, the leading global Embedded Finance Experiences platform, has today revealed consumer dissatisfaction with the loyalty benefits they currently receive from financial services providers as well as growing interest - especially amongst younger people - in accessing credit, loans and investments from non-traditional brands.

Only a third of Brits (35%) are satisfied with the loyalty rewards they presently get from their bank; while 37% of credit card holders don’t know what interest rate they are getting on their cashback or other rewards.

Perhaps most significantly, the research also reveals that people are interested in financial products from brands they love or trust, or where the loyalty rewards might be more valuable and relevant to them:

- 39% of consumers are interested in accessing financial services like credit, loans or investments from brands they love and trust;

- 56% of 18-24 year olds are interested in a credit card from their favourite high street brand, 55% from their favourite band and 42% from a favourite sports team.

The findings from Railsbank’s survey of 2,010 GB consumers highlights the scale of the opportunity for brands to engage with younger consumers and build loyalty with seamless embedded finance experiences.

“Where legacy finance might be worried, brands should see opportunity,” said Nigel Verdon, CEO and co-founder of Railsbank. “Interest and cashback has lost its appeal among consumers. What once worked well will not guarantee future success. Forward-thinking brands are already building financial experiences into their customer journeys, delivering better rewards and experiences that young people value.”

The changing face of rewards

Loyalty rewards are important to consumers with 59% stating that they like getting something back in return for their loyalty and 49% seeing a benefit in rewards helping their money go further. Some 38% of consumers feel more loyal to a brand if they receive rewards and 37% are likely to spend more money with a brand that provides loyalty rewards. Only 16% of people believe that rewards have no impact.

When asked which industries offer the best rewards and experiences, 49% of consumers feel that supermarkets currently give them the best rewards. Music (9%), banking (8%) and sports (7%) industries came bottom, presenting a real opportunity for sports teams and music brands to engage their loyal fan bases.

Cashback is found to be the most popular reward amongst the GB population as a whole, preferred by a third of people (33%). However, for 18-24 year olds, discount codes (27%) are clearly preferred; ahead of cashback (19%), free shipping (15%) and points to redeem later (11%).

57% of UK consumers want rewards that reflect their spending behaviour, or tie into their passion, or hobbies. What’s more, young adults are also twice as likely to be interested in alternative rewards options such as charity donations, exclusive access to products and exclusive content compared to the general population. In fact, 52% of 18-24 year olds are interested in a credit card that would actively support sustainability and the environment with every purchase, and 48% would like a credit card which automatically donates to charity with every purchase.

Nigel Verdon added: “It’s clear that consumers want a new type of brand loyalty experience; one which shows that they are understood and valued. Younger consumers are more environmentally and socially conscious and brands who want to build relationships with them need to recognise that cashback and financial rewards are losing their power. Major brands, particularly in the music and sports industry, should think about how embedded finance experiences can support loyalty and give customers better experiences.”

Railsbank launched a new industry category, known as Embedded Finance Experiences, and vision for the future of finance at Web Summit 2021.

Related News

- 05:00 am

Multi-asset trading venue 24 Exchange has selected financial markets data science firm FairXchange for independent execution analytics.

24 Exchange, which launched in 2020, offers all the benefits of an exchange combined with the tighter pricing and lower cost benefits of OTC trading. FairXchange’s Horizon will analyse all relevant transaction and pricing data across the 24 Exchange platform in order to facilitate mutually profitable data-driven discussions with its liquidity providers and liquidity consumers.

Dmitri Galinov, 24 Exchange CEO and Founder said: “We are very pleased to be joining with the data analytics experts at FairXchange. The real-time insights and information the company’s Horizon product provides will enhance 24X’s ability to assess performance and improve the efficiency of our robust institutional-grade platform.”

Guy Hopkins, Founder & CEO, FairXchange added, “24 Exchange is an exciting new entrant to the market, with an impressive multi-asset platform and a highly experienced team. We are delighted to have been selected to provide them with accessible, independent performance data in order to optimise execution and deliver commercial benefits for all counterparties. FairXchange has been appointed as FX data experts but our partnership with 24 Exchange can be expanded into new instruments and asset classes in the future.”

FairXchange specialises in microstructural analysis of financial markets and brings clarity and transparency to execution performance through the provision of independent data. FairXchange is completely independent and has no affiliation with any Liquidity Providers or trading venues.

Related News

- 07:00 am

Leading mortgage technology provider Twenty7Tec today announces that Coutts, the wealth manager and private bank, has added its mortgage product range including fixed rate and tracker products, to the Twenty7Tec SOURCE module.

By adding their products to SOURCE, Coutts is now able to provide information on its product range and criteria to the more than 15,000 daily adviser users of CloudTwenty7, the Twenty7Tec platform.

With a minimum loan amount of £1m, Coutts’ products are aimed exclusively at high net worth clients. Coutts designs solutions that are tailored to a clients’ individual circumstances, taking into consideration their overall financial situation, assets and investments. Coutts helps clients ensure they have the finances in place to move quickly to secure the right property in a complex and fast-paced market, whether it is their dream home, a second house or an investment property.

Nathan Reilly, Director of Lender Relationships at Twenty7Tec, noted “Coutts is a recognised and well-respected brand in the Private Banking and wealth management space, and with our data showing an increasing interest in the high-net-worth market, Coutts is a timely addition to the CloudTwenty7 platform which I'm sure will be well received by our users”.

Oliver Easthope, Head of Mortgage Broker Intermediaries at Coutts added “We are looking forward to working more effectively with our intermediary partners and making our products more accessible to a wider range of clients with more complex income streams.

“As a B Corp, we are also striving to support our clients and their businesses in their efforts to reduce their carbon footprints and offer Green Mortgages to incentivise them to improve the energy efficiency of their homes.

“Those receiving one of our mortgages become a Coutts client which means they are also able to benefit from a host of ancillary services including a multi-currency debit card and access to our concierge service.”

Related News

- 06:00 am

Open Future World, Ozone API and UK Finance are delighted to announce the winners of the world’s first variable recurring payments hackathon. The six week event, sponsored by Accenture, Mastercard, Volt and Worldpay from FIS, was an opportunity for developers, banks, payment initiation service providers and tech platforms to demonstrate potential use cases and propositions that open banking VRPs can deliver.

Over 100 participants registered for the Hackathon and developed some great entries for the five categories of challenge: Sweeping, Subscriptions, Retail, B2B payments and Other.

The winners for each category are:

· Sweeping: Untied. Already a pioneer of account-to-account (A2A) tax payments from their personal tax app, Untied’s concept focussed on helping customers save for tax payments using their existing calculator combined with VRP, to sweep payments and ensure they are in a position to make the payment.

· Subscriptions: Payit™ by NatWest. Their submission showed how VRPs could be used to prevent vulnerable gamers overspending on in-game purchases, with an added feature of allowing a parent to pre-authorise limited expenditure for a child.

· Retail: GlobalCharge with PlayStation™ who presented VRP as an open banking alternative to ‘card on file’ payments - a good example of adding to open banking payments functionality to make it a more viable alternative to cards.

· B2B payments: Yapily with a strong use case to help SMEs collect payments faster.

· ‘Other’: OneBanks who plan to introduce cardless cash withdrawals in their kiosks. The idea combines the trend of digitalisation, the ‘phone as wallet’ and the wastefulness of plastic cards with the reality of continuing demand for cash and its role in financial inclusion.

The full judging panel at the event consisted of Accenture's Amit Mallick, FDATA Global’s Ghela Boskovich, Innovate Finance's Janine Hirt, Mastercard’s Jim Wadsworth, NatWest Group's Stephen Wright, Open Future World's Nick Cabrera, Ozone API's Chris Michael, UK Finance's Jana Mackintosh, Volt's Steffen Vollert and Worldpay's Charles Damen.

Quotes

Jana Mackintosh, Managing Director, Payments and Innovation, UK Finance

Open banking has an exciting future and the winners of the Hackathon show exactly why. Thanks to the creativity and innovation of the entrants, we have been shown how open banking can benefit everyone from businesses to gamers, and solve customer problems from accessing cash, paying tax and collecting payments on time. As the work around open banking continues, UK Finance will continue to provide our support and we look forward to seeing more use cases come to light showing how it can improve our everyday life.

Charles Damen, SVP Payments Strategy, Worldpay from FIS

Providing a frictionless payment experience to consumers is of paramount importance to Merchants to enable the highest conversion rates. With VRP merchants have the opportunity to offer seamless Open Banking Payments for one-off purchases or subscriptions that are secure, fast and at reduced payment processing cost.

Nick Cabrera, Co-founder, Open Future World

We challenged our community to build out potential VRP applications using open banking. Given the timescales involved and the fast pace at which the payments industry is innovating, we are thoroughly impressed that the community responded with some excellent submissions that have real life applications

Steffen Vollert, Chief Technology Officer, Volt

VRPs are arguably the most significant development in Open Banking to date – a statement validated by the quality of the hackathon entries. I was hugely impressed by their ability to showcase VRPs’ real-world potential across a variety of scenarios. Congratulations to the five winners.

With variable recurring payments, consumers can authorise a third party to make payments from their bank account on a continuing basis. VRPs are widely expected to bring added impetus to the trend towards open banking payments. The Competition & Markets Authority (CMA) is introducing a requirement for the UK’s largest banks to enable VRPs.

For more information, visit vrphackathon.com.

Related News

- 07:00 am

New research reveals speed of response is most important factor for 23% of consumers; highlights perception gap between consumer expectations and brand performance

Twilio (NYSE: TWLO) (LTSE: TWLO), the leading cloud communications platform, published new research highlighting a perception gap between the experiences consumers want and those they actually receive. Over half (52%) of consumers still want better engagement from the brands they interact with - despite many industries delivering improved response times during the course of the pandemic.

To gather industry perception and engagement statistics, social listening was conducted for 98 UK brands on Twitter, taking data from both July 2020 and July 2021, while 2,000+ consumers were surveyed in September 2021.

The perception gap: brand reality vs. customer expectations

With the rapid move from in-person to online interaction in March 2020, the ways in which people interacted with brands underwent a massive change. How brands interacted with their customers in this new world was very much under the spotlight and continues to be in 2021.

However, the analysis shows that brand and consumer perception of what equates to ‘good’ is very different.

For example, whilst speed of response was selected by the highest proportion (23%) of consumers as the most important indicator of ‘good’ customer engagement, the best performing industries in this area did not deliver what consumers perceived as the ‘best’ at customer engagement.

The top industries in which brands improved their response times on social channels were (July 2020 to July 2021):

- Consumer banking: improved by 60% (from 259 minutes in July 2020 to 103 minutes in July 2021).

- Telcos: cut down average response times by 50% (from 306 minutes in July 2020 to 153 minutes in July 2021).

- Retail brands: improved by 29% (from 397 minutes in July 2020 to 283 minutes in July 2021).

- By comparison, other industries were only able to improve their response times by 1-12% over the last year. [Figure 1]

Yet, the consumer perception survey paints a slightly different picture of which industries consumers think are the best at customer engagement [Figure 2]:

- The seemingly good: scores from the consumer research from both years indicate that supermarkets and retail banks were best at customer engagement, with 62% and 41% of respondents ranking these verticals in their top three respectively for 2020; 54% and 37% for 2021.

- And the bad: hotel, airline and telecom companies scored much lower in comparison, with just 3% (hotels), 2% (airlines) and 3% (telecoms), considering these industries as the best at customer engagement in 2020 and a similar story in 2021.

If speed of response is a key indicator of ‘good’ customer engagement, then there is likely an expectation of an alignment between brand reality and consumer perception. It is therefore apparent that speed of response is just one element that consumers look for when judging a brand and that this alone won’t drive positive customer engagement.

Dissecting the disconnect: what makes great customer engagement

With consumers not satisfied by improved speed of response alone, it raises the question: what makes great customer engagement? The research revealed that more is needed to achieve overall excellent customer engagement.

Other highly valued qualities included consistent query handling with one point of contact (15%), customers feeling understood and listened to (10%) and being offered their preferred method of communication (10%).

Over half of consumer respondents (52%) also expressed a change in their expectations for how brands should communicate over the pandemic, including voicing greater demand for flexibility (18%) and more empathy in communications (12%).

David Parry-Jones, senior vice president, EMEA at Twilio said, “Today, every customer interaction counts. While speed of response plays a part in good customer engagement, today’s consumers have high expectations across the board: they also expect flexibility, consistency and the ability to pick up a conversation where they left off.”

“With an ever-increasing number of digital touch points, businesses are presented with a goldmine of customer insights. Ultimately those who win when it comes to customer engagement will be those who leverage this first party data to create truly personalised experiences that reflect customers’ needs," Parry-Jones finished.

Figure 1

Comparison data from social listening analysis of the Twitter feeds of 98 brands for July 2020 and July 2021

Figure 2

Data taken from Walnut Unlimited research conducted in September 2021 and social listening analysis of 98 brands in July 2021.

Related News

- 09:00 am

Xero joins Shopify Plus Certified App Program and launches new Xero & Shopify integration

Xero, the global small business platform, today announced a new integration with Shopify and revealed it has joined the Shopify Plus Certified App Program (PCAP), a select group of partners that supports the advanced needs of Shopify’s global merchants.

These are important steps towards solving common customer pain points and demonstrate a commitment to help ecommerce sellers to get started, grow, and increase efficiencies.

Nick Houldsworth, Xero’s EGM Ecosystem, said "by partnering with Shopify we aim to support our small business community to not only weather tough economic conditions, but manage and grow their businesses via one of the world’s largest ecommerce platforms. This, in turn, enables them to enhance their own customers’ online shopping experience.”

The new Xero & Shopify integration will be available in both the Shopify App Store and the new Xero App Store. This will enable Shopify’s more than 1.7 million merchants to discover Xero’s global small business platform, while also giving Xero customers access to Shopify’s product using the Xero App Store’s new subscription tools and one-click sign-up (where available by region).

The integration helps small business owners save time on admin by reducing the manual data entry and paperwork associated with reconciling and interpreting sales data, giving them an up-to-date view of their finances, cash flow and business performance wherever they are.

“The Shopify Plus Certified App Program is designed to meet the advanced requirements of the world’s fastest-growing brands,” said Mark Bergen, VP Revenue, Shopify. “We’re happy to welcome Xero to the program, bringing their insight and experience in accounting and finance to the Plus merchant community.”

Xero & Shopify Integration app benefits:

· Faster, more accurate data. Know how much revenue and profit is being made each day. Xero will automatically show Shopify sales on a daily basis, along with a breakdown of costs - enabling customers to clearly see how much profit they’ve made.

· Shopify reconciliation in just a few clicks. No more manual data entry. The integration is designed to help save customers time on admin by automatically sending Shopify sales transactions to Xero for easy reconciliation against bank data.

· Easily track cash flow. Get an overview of a business’ performance in real-time with the Xero dashboard. Customers can view long and short term cash flow forecasts and use up-to-date insights to make fast and informed business decisions from anywhere.

The Xero & Shopify integration is available globally in the Xero App Store and in the Shopify App Store, alongside other solutions to help customers integrate Shopify into their workflows. Customers using existing Xero-Shopify integrations will be unaffected.

Xero joins Shopify Plus Certified App Program and launches new Xero & Shopify integration

London— 17 November, 2021 —Xero, the global small business platform, today announced a new integration with Shopify and revealed it has joined the Shopify Plus Certified App Program (PCAP), a select group of partners that supports the advanced needs of Shopify’s global merchants.

These are important steps towards solving common customer pain points and demonstrate a commitment to help ecommerce sellers to get started, grow, and increase efficiencies.

Nick Houldsworth, Xero’s EGM Ecosystem, said "by partnering with Shopify we aim to support our small business community to not only weather tough economic conditions, but manage and grow their businesses via one of the world’s largest ecommerce platforms. This, in turn, enables them to enhance their own customers’ online shopping experience.”

The new Xero & Shopify integration will be available in both the Shopify App Store and the new Xero App Store. This will enable Shopify’s more than 1.7 million merchants to discover Xero’s global small business platform, while also giving Xero customers access to Shopify’s product using the Xero App Store’s new subscription tools and one-click sign-up (where available by region).

The integration helps small business owners save time on admin by reducing the manual data entry and paperwork associated with reconciling and interpreting sales data, giving them an up-to-date view of their finances, cash flow and business performance wherever they are.

“The Shopify Plus Certified App Program is designed to meet the advanced requirements of the

world’s fastest-growing brands,” said Mark Bergen, VP Revenue, Shopify. “We’re happy to welcome Xero to the program, bringing their insight and experience in accounting and finance to the Plus merchant community.”

Xero & Shopify Integration app benefits:

· Faster, more accurate data. Know how much revenue and profit is being made each day. Xero will automatically show Shopify sales on a daily basis, along with a breakdown of costs - enabling customers to clearly see how much profit they’ve made.

· Shopify reconciliation in just a few clicks. No more manual data entry. The integration is designed to help save customers time on admin by automatically sending Shopify sales transactions to Xero for easy reconciliation against bank data.

· Easily track cash flow. Get an overview of a business’ performance in real-time with the Xero dashboard. Customers can view long and short term cash flow forecasts and use up-to-date insights to make fast and informed business decisions from anywhere.

The Xero & Shopify integration is available globally in the Xero App Store and in the Shopify App Store, alongside other solutions to help customers integrate Shopify into their workflows. Customers using existing Xero-Shopify integrations will be unaffected.