Published

- 06:00 am

Development processes are often complex and non-transparent. In the automotive industry, for example, many thousands of employees in hundreds of teams are usually involved in the development of new vehicles. Engenion from GFT uses AI to create transparency. This allows projects to be carried out much more efficiently.

The project portfolio management software (PPM) helps to significantly reduce product development costs. AI-supported modules utilise experience from past projects and enable improved deployment of the entire team and the corresponding resources. The software thus ensures optimised use of budgets.

"Thanks to our expertise and solutions relating to AI and data-driven business models, which we have bundled in the GFT AI.DA Marketplace, our clients can integrate the latest technologies quickly and easily," says GFT CEO Marika Lulay. "The launch of Engenion is a milestone, and further solutions will follow."

More efficient product development and robust, success-oriented project management

Engenion is part of the GFT AI.DA Marketplace, a platform that combines predictive and generative AI technologies and data analytics. The GFT AI.DA Marketplace promotes the development and introduction of AI applications by providing a comprehensive collection of use cases, methods, reference architectures and preconfigured solutions. This helps to significantly accelerate the digital transformation.

"Product development is often a long process with many uncertainties. But it doesn't have to be that way," says Kathrin Günther, responsible for GFT's product business. "Engenion uses the latest AI technologies to optimise the allocation of development costs and increase the success rate. Engenion is the lever for more efficient product development and robust, success-oriented project management."

AI enables support in project work

GFT is utilising the latest AI technology to transform the way users interact with their PPM. Through the Engenion Assistant, the data-driven AI assistant for PPM, users can interact with the PPM in a question/answer manner, allowing seamless access to PPM data without having to navigate through the traditional user interface. This tool can answer any questions about projects, budgets, resources or other data within the PPM system. It addresses the different needs of executives, senior management, project managers, portfolio managers, resource managers and team members.

Examples of other use cases are

- a user-guide assistant that provides low-threshold access to technical documentation,

- the automated creation of graphical reports

- or an automated grouping and level assignment of employees based on project participation and deployment time.

When developing products, a large amount of data must be processed. This includes information on past projects as well as that of the new product. The conventional approach with spreadsheet software no longer fulfils the requirements of digital transformation. The Engenion PPM collects all information and combines all systems into one. This enables real-time access to the latest data.

All data in one system: efficient communication across all levels

Engenion promotes agile working on a standardised information basis. An authorisation concept can be used to precisely control who has access to which information and when. Adjusting the values immediately shows the effects on the planned budget and time-to-market. Planning becomes efficient and calculable. The allocation of key personnel to the most important tasks across several projects is efficient and sustainable.

Engenion users benefit from

- transparent tracking of budgets and project costs in a portfolio comparison

- intelligent resource management

- overview of all data, viewable in real time in a single system

- optimised workflows and improved collaboration

- Easy-to-use, intuitive AI-supported interface

Engenion is based on an innovative approach called Object-Activity-Value (OAV), which redefines the structuring of projects along the actual product components and the associated activities. With OAV, projects can be focused on the development of specific products. This enables a granular breakdown of products into their individual parts. By linking activities and resource requirements to the development of these parts, budgets can be allocated directly and transparently for each product or product component.

Related News

- 09:00 am

Onfido, the global automated identity verification provider, today announced the findings of its 2024 Identity Fraud Report and unveiled its Fraud Lab. The report points to the increasing availability of simple-to-use AI tools as the reason for a 31X increase in deepfakes and a 5X increase in digitally forged identities, making it easier for criminals to carry out sophisticated attacks. Onfido’s Fraud Lab has been launched as a response to these trends. With the ability to mass-produce synthetic attacks, it delivers faster, more accurate AI-powered fraud protection to its customers through its Real Identity Platform, saving them over $3.9B in losses.

The fifth annual Identity Fraud Report highlights the increasing role of AI in perpetrating fraud, as fraudsters turn to online tools and generative AI, such as deepfake apps. Businesses are countering deepfakes by leveraging biometric verification powered by deep learning to detect the presence of a real person, which remains an effective deterrent, creating an AI vs AI showdown. This year, ‘easy’ or less sophisticated fraud also continued to rise, up 7.4% from 2022 and accounting for 80.3% of all attacks. This indicates a persistent trend of quantity over quality, as fraudsters look for minimum effort and maximum reward by launching multiple attacks simultaneously – enabled by broadening access to automated AI-powered tools.

“The confluence of cheap, genuine identity documents appearing on the Dark Web, combined with simpler and free generative AI tools, has created a gangster's paradise,” said Simon Horswell, Senior Fraud Specialist at Onfido. “Creating large-scale, convincing attacks at the click of a button has never been easier for malicious actors, who increasingly use AI to attack en masse. It's become an AI vs AI battleground, where only defensive AI that’s trained on the latest attack vectors at scale can keep up with the evolving threat landscape.”

In the space of just six months, Onfido’s Fraud Lab has helped improve its fraud detection rates on documents by 5X and on biometrics by 9X. Its team of experts, including former police and border agents, collect and label data while measuring fraud detection performance against multiple attack vectors on both document and biometric verification solutions. Training AI models to achieve optimal performance is challenging when only a few new attack incidents are available, so the team dissects the one or two samples they uncover, labeling their key signals. The lab’s unique forensic environment then allows the experts to recreate synthetic derivatives, such as 3D documents or deepfakes in sufficient numbers to generate viable datasets for both training and evaluation. The lab also provides the ability to analyze the anatomy of global fraud rings, enabling Onfido to detect and stop over 267 to date.

“A machine learning model needs around 3,000 fraud samples for effective training. Obtaining these quantities in a short space of time used to be near impossible, which left businesses exposed,” said Vincent Guillevic, Head of Fraud Lab at Onfido. “The Fraud Lab enables real-time data analysis for fraud specialists to identify fraud patterns and emerging trends, while allowing us to create as many as 10,000 synthetic IDs in as little as 30 minutes, so we can now train and benchmark our algorithms quickly and cost-effectively, to provide best-in-class fraud prevention.”

Digital Forgeries and Video Fraud are developing, fast

As the increasing availability of AI tools makes digitally manipulated images even quicker and cheaper to produce, the Identity Fraud Report finds that digital document forgeries jumped 18% in 2023 – with roughly 5X more digital forgeries than observed in 2021, while physical counterfeits declined 17%.

According to Gartner: “Although generative AI is not new, the accessibility of tools using generative AI and the public awareness of its capabilities have accelerated massively.”

Onfido’s Identity Fraud Report also revealed that by far the biggest attack vector used to try to spoof a biometric liveness check is the submission of a video displayed on a screen. This accounts for over 80% of attacks. In fact, video fraud has increased almost 4X year-on-year. This also reinforces the emerging trend of fraudsters turning to techniques like deepfakes or the lesser convincing cheap fakes as a means of attack.

Elsewhere, fraudsters have placed more emphasis on biometric fraud with the average rates twice what they were in 2022. Meanwhile, document fraud overall has leveled out to pre-pandemic levels as bad actors increasingly use a genuine document – obtained on the Dark Web – to bypass the document verification check and rely on AI to switch or swap the face for the biometric scan.

Onfido’s Identity Fraud Report also revealed:

National IDs top criminals hit list: In 2023, fraudsters targeted National ID cards more than any other document, accounting for 46.8% of all document fraud, followed by passports at 26.7%. Not all National ID cards are for international travel and therefore don’t adhere to International Civil Aviation Organization (ICAO) guidelines, making them less robust in terms of protection, and easier targets for fraudsters.

Scalable attacks launched on Financial Services: less sophisticated fraud accounted for 79% of attacks against financial services. By using easy and scalable models fraudsters can determine what sticks before using that loophole to attack en masse. The flood of attacks can also distract organizations from the rarer, but more sophisticated fraud.

Biometrics see markedly lower fraud compared to documents: Biometrics still see a markedly lower rate of fraud compared to document-only checks — which see a 3x higher attack rate. This shows biometrics continue to act as an effective deterrent, particularly solutions with a liveness element.

Related News

- 05:00 am

Viamericas Corporation, an international, licensed remittance company, has joined as a founding member of the new Financial Inclusion Consortium for Central American Remittances (FICCAR) launched by the Partnership for Central America (PCA) to support the mission of increasing financial inclusion for people in Central America. As part of the consortium, Viamericas is pledging to increase the number of remittances sent directly to bank accounts by 20% over the next five years.

Viamericas provides international money transfers at over 5,000 locations across the United States. Customers send money safely, quickly and affordably from the United States to more than 80 countries using the Viamericas money transfer platform. The company has supported customers’ long-term financial health and security for over two decades, emphasizing Central America.

“Making it easier for consumers to send remittances directly to bank accounts instead of cash distributions encourages savings that can better secure their families’ futures,” said Paul Dwyer, Co-Founder and CEO of Viamericas. “As industry leaders in international remittances, Viamericas is honored to commit to the FICCAR initiative to advance financial inclusion in Central America.”

FICCAR’s mission is to collectively advance financial inclusion in El Salvador, Guatemala and Honduras. In this region, only 40% of adults have a bank account. Greater participation in the formal financial system helps households build assets and small businesses to grow. Direct-to-account remittances reduce the cost to the sender and increase the security of the funds arriving at the receivers.

Related News

- 01:00 am

Aaron Holmes, CEO at Kani Payments, commented: “Joining the FIS Fintech Accelerator is the latest exciting stepping stone in what’s already been an impressive and successful story for our ambitious company. We’re proud of our progress so far and are excited to be able to further develop our offering and charge into new markets and territories with the support, insight, and knowledge we will gain from the team at FIS and the Venture Center as part of this programme.“We are certain that the insights we will gain from the FIS Fintech Accelerator will be invaluable, not only to Kani Payments, but also to our existing and prospective customers who have come to rely on the efficiencies created by our unique platform. We strive to save even more businesses vast amounts of time, and help them to tackle the problem of the increasingly complex digital payments, regulation, and compliance requirements so that they can spend more time focusing on building superb fintech products and services.”

Related News

- 01:00 am

UK-based FinTech Stubben Edge Group is pleased to announce the launch of the Small Business Pro (SB Pro) platform delivered by the company’s market-leading business title, smallbusiness.co.uk.

SB Pro is a groundbreaking, business membership that provides entrepreneurs, sole traders, and small businesses with an extensive array of essential rewards, cashflow, sales, and protection tools to simplify their business management, improve cash flow, and foster growth – ultimately saving them time and money.

At launch, the subscription-based solution will comprise:

▪ CRM system - a simple and effective customer management system where businesses can manage pipelines but also appointments, quotes, and invoices.

▪ Affordable and reliable low-cost payment solution with fees from 1.25%.

▪ Smart savings – enabling businesses to earn interest on business cash through easy to set up and manage, FSCS-protected bank accounts.

▪ Access to business finance – via a dedicated funding platform to a selection of trusted UK lenders through one quick application process.

▪ Tailored insurance – offering legal and employee protection, including jury service cover, criminal defense insurance, and £10,000 personal Term Life insurance cover.

▪ Healthcare app – enabling 24/7 virtual GP, employee wellbeing, and other healthcare benefits.

▪ Templates and advice line - 24/7 legal and tax advice line with access to experts. ▪ Opportunity every month to win £2,500 cash grant to help grow the winning business and local networking events for all members.

Chris Kenning, Stubben Edge Group CEO, said, "SB Pro will be transformative for SMEs looking to lower the cost of doing business. Most systems are often complicated and costly, rendering them largely inaccessible – SB Pro changes this. By providing entrepreneurs with these tools at affordable rates, we are ultimately creating a pathway for better customer acquisition and retention over time. We are delighted to be bringing this to the market at a time when SMEs are facing incredible challenges. This is further testament to our commitment to championing the entrepreneurs who are the backbone of the UK economy”.

Launched earlier this week at the British Business Awards, SB Pro offers two plans, with the Sole Traders plan starting at just £39.99 per month and the Businesses plan (1-30 employees) priced at £49.99 per month. The new platform, which will be further exhibited next week at The Business Show in London on the 22-23rd November, is poised to redefine the way small businesses operate, offering a holistic solution that combines affordability, convenience, and a supportive community to help entrepreneurs thrive in today's competitive business landscape.

Related News

- 02:00 am

Rho Labs, a builder of Rho Protocol, an on-chain, non-custodial interest rate futures and swaps market, today announces a successful raise of $2.2M in a pre-seed round, led by Speedinvest. Investors in the round included Keyrock, Re7 Capital, Daedalus Collective, and Dmitry Tokarev, CEO of Copper.co, among others.

The venue, custom-built for rates derivatives, seeks to combine transparency and efficiency of zero-counterparty risk on-chain trading, where collateral and risk are managed entirely on the blockchain, with the familiar experience and accessibility of centralized exchanges.

Traditional rate markets enable institutional-grade risk management for derivative traders and form the foundation for fixed-income and other investment products. Rho aims to create a highly capital-efficient market for crypto-specific rates, such as staking, digital asset lending, and funding rates, to enable the same advantages for institutional crypto traders. A private beta of Rho’s market on Arbitrum will be launched with a select set of global trading partners later this year.

Rho Labs was founded in late 2022 by Alex Ryvkin, formerly the Chief Product Officer of Copper.co, a leading provider of institutional crypto trading infrastructure. Alex spent over a decade in capital markets and FinTech as a sales trader, derivatives structurer, and startup CEO.

Alex Ryvkin, Founder and CEO of Rho Labs, commented:

“Interest Rate Derivatives represent the largest asset class in traditional finance with over $500T in outstanding interest. Our ultimate goal is to introduce this market to the advantages of on-chain trading while offering crypto traders the opportunity to trade the most prominent rates in the ecosystem, as enjoyed by participants of TradFi markets.”

Olga Shikhantsova, Partner at Speedinvest, said:

“Market participants across the world widely use IRDs to efficiently hedge against or to capitalize on future rate changes. Given the apparent importance of rates to the global macro environment, we are very happy to support this project, which seeks to use technology to make rates markets more robust and secure. We are excited to see what blockchain’s role will be in the future of capital markets, and we continue supporting the projects developing this thesis.”

Related News

- 07:00 am

New research released by Tink, the market leader in open banking, uncovers that investment pots have proved to be a financial ‘safety net’ for armchair investors during challenging economic times. This suggests a shift in investing behaviours from long-term ‘set and forget’ portfolios, to needing instant cash to mitigate rising living costs.

This is according to a survey of active retail investors in the UK who use DIY investment platforms. It found that half (50%) of respondents said investing during the pandemic helped to supplement their income, and in more recent times, over half (51%) have cashed in some of their investments to help with the cost of living. What’s more, 42% of retail investors who owned a home have also dipped into their investment pots to reduce mortgage borrowing due to rising interest rates.

In fact, for many, investing isn't an affordable option today. Nearly a fifth (19%) of retail investors surveyed plan to divest their investments in the next six months because they need the cash, while two-thirds (66%) worry about their investments against the current economic climate.

Investments play a key role in day-to-day financial management

While it's clear investment pots are now being used as financial accounts by retail investors, the research also suggests that respondents are engaging with DIY investment platforms on a daily basis, indicating an increasing reliance on them. The survey found the majority (61%) of respondents said that investments play a key role in their day-to-day financial management, with a massive 70% viewing them as a way to future-proof their finances.

However, concerns remain around current DIY investing processes. For example, an estimated two-thirds (66%) worry about losing money on an investment platform because it has taken too long to top up their account, and 70% cite being locked out of investments as a top concern.

UX concerns spark desire for improvements in investing apps

Tink’s findings reveal demand from armchair investors for more seamless, speedy processes when it comes to moving money in and out of their investment account.

For example, when using investment apps, three-quarters (74%) of those surveyed would like to be able to instantly transfer money from bank accounts to investment accounts, without having to leave the platform app/website, with 18% considering switching platforms if this function was available elsewhere.

In fact, retail investors go as far as to say that they would part with more cash for improved user experiences. An estimated one-in-five retail investors would invest more if an investment platform had an easier or more instant onboarding process, while a similar number (18%) would be encouraged to invest more if an investment platform allowed them to make instant payments to their investment account.

Tom Pope, SVP Payments & Platforms at Tink, commented: “During the cost-of-living crisis, armchair investors are leaning on their investment pots as a way to support their day-to-day finances. But with many people today having less available money to invest with, investment apps are competing for a shrinking share of wallet.

“Against this backdrop, investment apps can’t afford to deliver poor user experiences or friction-filled processes. Investors want to be able to transfer money seamlessly between their bank accounts and investment accounts without needing to leave the app or website. By leveraging open banking payments, investment platforms can transform user experiences and support customers as they look to their investments to help them through this period.”

Related News

- 02:00 am

More than two-thirds of regulated firms (70%) do not always complete essential identity checks when taking on new individual customers, new survey data can reveal.

Less than half of regulated firms (46%) ‘often’ complete verification checks, while almost a quarter (21%) of regulated firms only ‘sometimes’ complete verification checks, either manually or electronically. Without proper identity checks of all customers – a requirement of regulated firms within the UK, compliance experts warn that organizations are leaving themselves exposed to financial crime, regulatory action, and reputational damage.

The findings are revealed in a comprehensive new survey of 500 decision-makers in regulated UK businesses across the legal, property, finance, and accountancy sectors. The research was commissioned by SmartSearch, the UK’s leading provider of anti-money laundering (AML) and digital compliance solutions.

Despite the clear mandate for conveyancers and estate agents to complete identity checks on property buyers, three-quarters (75%) of property firms and 7 in 10 legal firms admitted that they do not always complete such checks.

Even with the obligation to carry out identity checks on all clients, three percent of legal professionals still said that they never verify the identity of individuals. One percent of estate agents also made the same admission. Of all the sectors surveyed, accountancy firms are most likely to ask for proof of identity or run a check, but still only 32 percent of firms responded always.

It comes as the latest report from Cifas found that cases of identity fraud rose by almost a quarter last year, and now account for nearly 70 percent of all cases filed to its National Fraud Database.

Major regulators including the Financial Conduct Authority (FCA) and the Solicitors Regulatory Authority (SRA) have consistently taken action against firms for failing to conduct adequate identity checks.

Martin Cheek, a qualified lawyer and managing director of SmartSearch, said: “When a regulated firm is asked how often they verify the identity of customers, the answer should be always. Not only is it a clear regulatory requirement to complete such checks, but it is also critical in protecting the business from financial crime. Rather than a worrying reduction in checks, regulated firms should be increasing checks in line with the rising threat level.

“Just as important is the shift to electronic verification (EV) as criminals continue to find new ways to falsify official identity documents. Such is the risk of forged documentation, a switch to EV is even recommended by the 2020 Money Laundering and Terrorist Financing Act. Rather than flawed and time-consuming manual processes, EV presents a robust, efficient, and cost-effective way to screen both new and existing clients – all while avoiding intervention from regulators.”

The latest survey is the third iteration of SmartSearch’s Electronic Verification Uncovered campaign, which questions firms on their attitudes and approaches to compliance. The campaign argues that regulated businesses should use digital onboarding to ensure they minimise their exposure to financial crime, improve customer experience and meet the requirements of regulators.

The latest EV Uncovered campaigns follow the launch of its next-generation platform, continuing a more than decade-long journey to support regulated firms with their anti-money laundering (AML) compliance. Its digital solution is trusted by more than 6,500 clients and 60,000 users. In addition to more than 2,000 financial services firms and over 1,000 property firms, this includes one in two of the top 100 accountancy firms and one in three of the top 200 legal firms.

The research was conducted by Censuswide with a sample of 501 compliance decision-makers who take on new individual customers and new business clients. The survey fieldwork took place between September 11 and September 18, 2023. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

Related News

- 06:00 am

Temenos today announced a collaboration with Gprnt, a new integrated digital platform launched by the Monetary Authority of Singapore (MAS), to cooperate on technology solutions, explore data integration and foster product development innovation capable of powering the future of sustainable finance.

Temenos is the first core banking software vendor to collaborate with Gprnt and will join MAS and partners on the ESG Stage at the Singapore FinTech Festival 2023 to discuss the potential opportunities that Gprnt will open up to better support financial institutions’ balance sheet decarbonization, ESG risk management and regulatory compliance needs.

Gprnt is the culmination of MAS’ Project Greenprint and aims to address financial sector and real economy’s needs in collecting and accessing trusted climate- and sustainability-related data. Potential product co-development use cases with Temenos include enhanced KYC that takes ESG data from verifiable sources through Gprnt platform, and feed directly into bank’s client onboarding. Also augmented data analytics incorporating additional ESG metrics for bank’s loan origination system flow, setting targets for pipeline loans that increasingly will see embedded elements of sustainability.

Tony Coleman, Chief Technology and Innovation Officer at Temenos said: “Temenos has integrated ESG into its operations and product offerings, providing banks with the technology needed to help them transition to a low-carbon economy and achieve their ESG goals. We look forward to supporting Gprnt and exploring opportunities that will help mobilize capital, monitor sustainability commitments, and measure impact.”

Sopnendu Mohanty, Chief FinTech Officer, MAS, said: “Technology is a key enabler for financial institutions to surmount the challenges of green transition and achieve their net-zero targets. Temenos is a global name in developing banking platforms and we are delighted to have them onboard Gprnt to cooperate on initiatives to power the financial sector’s mounting need for better sustainable finance solutions.”

Temenos Banking Cloud, Temenos’ SaaS offering, helps banks decrease energy use and minimize greenhouse gas emissions up to 95% compared to on-premise deployments. Temenos also continues to improve the efficiency of its code to minimize its environmental impact, by 32% improvement in the latest software release validated by GoCodeGreen. With the Temenos Carbon Calculator, an industry-first, Temenos’ clients get CO2 emissions insights from their actual use of Temenos Banking Cloud.

Furthermore, Temenos ESG Investing solution helps banks meet reporting standards while offering products that allow their customers to choose investments based around their own values.

Temenos tops global indices and ratings including a Triple A MSCI ESG rating and a top ranking in Dow Jones Sustainability Indices. Temenos is the only banking technology company to have ambitious carbon emissions reductions validated by the Science-Based Targets Initiative (SBTi).

Related News

- 08:00 am

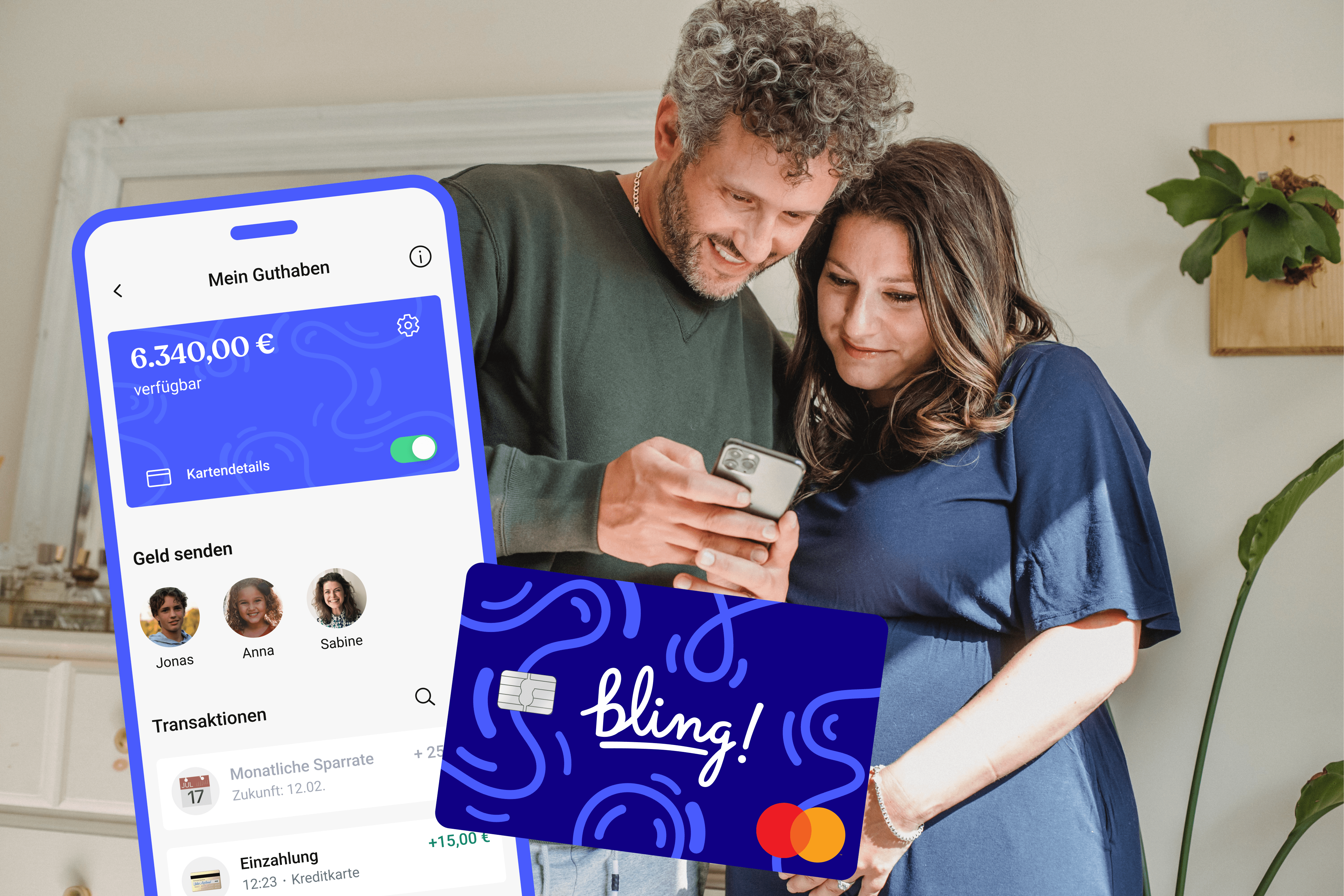

Bling, Europe's first Family FinTech, is reinventing traditional retail banking for families. The launch of Family+ and Parent Card marks the transformation of Bling into a family finance platform for the whole family. Bling’s goal is to provide all family members access to its platform and comprehensive support for their financial needs.

Since its launch last year, Bling, the Berlin-based Family FinTech, has experienced rapid growth and now serves over 50,000 families on its platform. Just a few months after introducing the pocket money solution, Bling launched the Savings Trees in the summer – a family-friendly and educational way to invest money sustainably.

With the launch of the Parent Card, backed by leading VCs (La Famiglia, Peak), the Family FinTech is taking the next step to become the daily companion for the entire family. Nils Feigenwinter (Forbes 30u30 Europe), CEO and co-founder of Bling, says, “With the Bling pocket money card, we are already committed to strengthening the financial literacy of children. Many parents have wished for an equally simple and supportive solution for themselves, and we are fulfilling this wish with the Parent Card.”

The Parent Card was specially designed to facilitate personal finance management for adult family members, regardless of family composition. It is a prepaid Mastercard that parents can easily order through the Bling app with just a few clicks. The card works worldwide and is integrated into the Bling platform, including helpful statistics and a connection to the family task-planner in the app. The Bling app is known for its user-friendly visualizations and information, supporting even those who are less tech-savvy in their use of digital payments.

The Parent Card will be available as part of the newly introduced Family+ subscription, which offers additional benefits, including those for the Savings Trees, Bling's family-friendly investment product. This development marks another transformation step from a pocket money app to an easily understandable and educational family platform.

The potential is underscored by a study commissioned by Bling and Mastercard, revealing that nearly half of parents (49%) are dissatisfied with their bank's lack of responsiveness to their family's needs.