Published

- 04:00 am

On the year of Sberbank’s 180th anniversary, the board has decided to launch long-term stock option programs to motivate its most effective employees. In the first cycle of the program, 1,000 key employees – from experts to vice presidents – will receive part of their remuneration in Sber shares.

Long-term motivation programs for employees that have a key impact on the overall performance will facilitate the implementation of Sber’s ambitious goals outlined in Strategy 2023.

The programs will be implemented in three-year cycles with annual interim payments, cycles will be launched on an annual basis. Sber’s banking and financial infrastructure will be engaged.

The launch of the first program cycle will not require the purchase of Sber shares from the market, as existing shares in Sber Group will be used.

Herman Gref, CEO and chairman of the executive board, Sberbank:

“The long-term stock incentive program for employees is an effective global practice for talent retention and development. We are glad that this year Sber’s most valuable employees have been given the opportunity to become shareholders and will be able to influence the company’s development in the future”.

Related News

- 05:00 am

In 2021, over 14 million Indians used CoinSwitch to learn, buy, trade, or sell crypto assets in a simple, secure, protected environment, making us the largest crypto platform in the country. At the beginning of the year, we were serving just over 1 million users.

This was also the year CoinSwitch became a learning app for crypto enthusiasts trying to learn the art of investing. An average user spent 27 minutes per day on the app to buy, trade, and sell crypto assets and read informative articles on the platform, a sharp rise from 13 minutes at the beginning of the year. This number was driven by users spending several weeks reading articles on Kuberverse, our learning initiative before they invested in the first crypto asset.

Catering primarily to retail investors, CoinSwitch registered a 3500% rise in transaction volumes as more Indians started their crypto investing journey as crypto-assets became mainstream worldwide. Most traded crypto assets on our platform include BTC, DOGE, ETH, MATIC, ADA.

Crypto adoption saw an encouraging growth among Indian women. As of today, 15% of our total user base comprises women.

Delhi, Kolkata, Pune, Mumbai, Lucknow, Patna became the early crypto adopters.

Nearly 60% of our user base is less than 28 years old. While many Indians are starting their asset investing journey, increasingly 45-year old plus stock market enthusiasts are experimenting with this high-risk, high reward asset class.

Related News

- 06:00 am

- Ethereum has outperformed Bitcoin in the debut year of the Evai AI driven crypto ratings

- Artificial Intelligence protocol identified SAND as a top performer as early as July 2021

- LUNA rating jumped from B2 to A3 signalling the beginning of an upward price movement

- Free-to-use ratings platform has democratised the financial ratings model for crypto users

The British FinTech company behind a new AI driven crypto ratings platform called evai.io have released their first ratings report assessing the $2.3 Trillion cryptocurrency sector in 2021 with a special focus on analysing the performance of leading crypto, NFT, DeFi and Metaverse tokens in Q4 2021.

Launched in May 2021, the Evai.io free to use platform uses a combination of world-renowned economic research, machine learning and Artificial Intelligence to assess the financial health of over 1,000 cryptoassets. Ratings on the platform are generated daily against several key economic factors that are evaluated by AI and machine learning, before each asset is awarded one of eleven possible ratings, from A1 down to U.

The Evai A1 rating (“A1”) denotes cryptoassets of the highest technical and quantitative characteristics. B rating refers to cryptoassets that have a solid composition, while C rated assets are below average, and the lower categories of D and U relate to cryptoassets that are either distressed or unrateable due to a lack of fundamental data needed to process a rating accurately.

Moving beyond the media headlines and social hype, did the Evai autonomous rating protocol free from human bias detect underlying value in the fast-growing cryptoasset sector in 2021? Key findings from the report have been summarised by the experts at Evai.io.

Top 10 Cryptoassets

- Bitcoin and Ethereum have been consistently tracking at B2 in 2021, but during the last 30 days of the year Bitcoin has posted a downgraded rating average of C2.

- In 2021 Bitcoin and Ethereum both posted new all-time highs of $69,044 (BTC) and $4,878 (ETH) respectively. The new highs put the lows of the historic 2020 coronavirus crash firmly in the rear-view mirror as institutional investors continued to enter the market this year.

- In the last 30 days XRP posted a significant improvement in rating entering the B3 category having averaged C2 over the previous 90 days.

Metaverse Ratings

- Decentraland (MANA) has held firm in the B rating category in 2021 and also featured in the A3 category. In the last quarter of 2022 MANA has spent over 90 days rated B3 and above.

- ENJ has experienced the biggest spread of ratings amongst the Metaverse tokens on the AI driven Evai ratings platform. While the 90-day average for ENJ is B2, the token has also featured in the A3 rating band and more recently during the downturn appeared as low as C2. During the last 30 days ENJ has retained its B2 position.

DeFi Ratings

- The DeFi market cap has grown from $21 billion in January 2021 to over $153 billion representing an increase of 599%.

- In December 2021, the Evai unbiased ratings driven by Artificial Intelligence and Machine Learning picked up on signals ahead of the market as Terra (LUNA) jumped from B2 to A3 signalling the beginning of an upward price movement.

- Avalanche (AVAX) has sustained a solid B1 rating across the final quarter of 2021, while other Top 5 cryptoassets in the DeFi sector have fallen into the C category range.

NFT Ratings

- The relentless appetite for NFTs in 2021 has seen the market grow to $48.5 billion marking a steep incline of growth from 2018 when the market cap was approximately $48 million.

- In July 2021, SAND was upgraded from the B1 to A3 rating and the price sat below a dollar at $0.67. Over the last 5 months SAND reached its ATH high of $8.40 and now sits around $6.00

- During the final quarter of 2021 Evai has identified a downturn in ratings amongst the Top 5 NFTs with Axie Infinity (AXS), Theta (THETA) and Tezos (XTZ) all posting downgraded ratings from the B ratings category to the C category. Traders using the Evai platform may look to take up positions on these tokens when they next achieve B ratings status.

Top Performers

- TECH (TIME) – upgraded from C2 to B1 rating on 3rd August 2021 ($17.97). 305% price increase from August 2021 to 23 December 2021 ($72.91)

- BORA (BORA) – upgraded from B1 to A3 on 6th August 2021 ($0.21). 447.6% price increase from August 2021 to 23 December 2021 ($1.15)

- Circuits of Value (COVAL) – 90-day rating average movement from B2 to B1. 564.6% price increase from 24th September ($0.01747) to 23rd December 2021 ($0.1161)

- Measurable Data Token (MDT) 90-day rating average movement from B1 to A3. 194.8% price increase from 24th Sept 2021 ($0.03309) to 23rd Dec 2021 ($0.09754)

- Platoncoin (PLTC) – 90-day rating average movement from C1 to A3. 70.8% price increase from 11th October 2021 ($0.4643) to 23rd December 2021 ($0.7932)

Assessing the results of the first Evai.io cryptoasset ratings report, Matt Dixon, CEO and Co-Founder said: “2021 has played host to another spectacular year of growth in the cryptoasset market as the number of assets has reached over 13,000 with the market cap pushing over the $2 Trillion mark. The rise of NFTs and new era of the Metaverse have expanded the number of entry points available to investors beyond Bitcoin and a handful of well-known cryptos”.

He added: “As new and existing investors continue to seek reliable and unbiased sources of information to assess the value of digital assets, we wanted to take a look back over the debut year of the Evai ratings to evaluate the performance of our AI and machine learning driven ratings. Removing human bias and hype, we have begun to demonstrate the valuable role independent ratings can play for investors in this fast-moving sector”.

To find out more about the evai.io unbiased AI and machine learning powered crypto ratings and how to use them as part of your cryptoasset investment strategy head to evai.io and the official YouTube channel for platform demonstrations, latest news and interviews with thought leaders and innovators in the crypto space.

Related News

- 08:00 am

Amman, Jordan: Cities and Villages Development Bank (CVDB) has gone live in a record time of five months, on ICS BANKS Universal Banking software solution from ICS Financial Systems (ICSFS); the global software and services provider for banks and financial institutions.

The Cities and Villages Development Bank is a publicly owned bank that finances Jordanian municipalities for the development of their infrastructure. CVDB provides long-term financing to establish both; services and productivity projects, through the local councils. The bank administrates and guarantees loans held between the councils and any other party, to support and provide the councils with essential services. The Bank continues as well to contribute to the development process of the local councils, by providing adequate funds, experiences, services, technical and administrative skills within the government’s effort in developing and reforming the municipalities.

Cities and Villages Development Bank (CVDB) Director-General; Osama Al Azzam commented:

“Today, we focus on the digital transformation of the fundamental functions of the bank to achieve our vision of: “a smart development bank that promotes sustainable local development." As a long-standing public bank, one of the challenges we face is shifting our traditional business structure to digital. After the profound business and technological advancements provided by ICS BANKS from ICSFS, I am able now to say that we are now riding the digital transformation wave.”

CVBD supports local development projects by providing the necessary financing, banking services, consultancy, and technical support. CVDB supports as well the capacity building of local authorities and interested parties through servicing and investing in development projects, and encouraging partnership between the public and private sectors, to improve the authenticity of the local communities.

Managing Director of ICSFS, Robert Hazboun stated:

“We are content to announce another milestone achievement; CVDB’s implementation project started during the second quarter of this year and went live during the fourth quarter of the same year. With our full support, CVDB will be utilising ICS BANKS holistic software suite’s innovative products and services to support the local council’s projects and mobilise their local and foreign financial resources. We assure CVDB that by operating on our innovative technology, they will soon see improvements across their ecosystem.”

ICSFS invests in its software suites by utilising modern technology in launching new products, constructing a secured and agile integration, and keeping pace with new standards and regulations worldwide. ICS BANKS software suite future-proof banking activities by providing a broad range of features and capabilities with more agility and flexibility, to enrich customers' journey experience, hence improving the trust and confidentiality between the customer and the bank. ICS BANKS has always been a pioneer in utilising the latest technology to serve financial institutions. In addition to its embedded Service-Oriented-Architecture (SOA), the system can be deployed on-premises or on the cloud.

Related News

- 05:00 am

Tinkoff has launched the Investment Academy, a country-wide educational initiative aimed at strengthening financial literacy among the population.

The Investment Academy will serve as an aggregator of the best financial courses and investment education programmes that Russia has to offer. It will integrate various financial literacy initiatives, from Tinkoff Investments’ proprietary courses and methodology to content provided by Tinkoff’s strategic partners, which include:

• economics departments at domestic and international universities; • initiatives launched by industry associations;

• key market players such as Moscow Exchange and SPB Exchange, as well as major analytical companies and investment firms.

Users will have access to educational materials about the stock market, financial instruments, capital management, macroeconomics and analytics. Content will be presented in the form of podcasts, video lessons taught by the world’s leading experts, UGC* from Tinkoff’s Pulse social network and other formats.

The Academy is developing specialised and adapted programmes for various population segments: school students, university students, specialists and seniors,

as well as anyone seeking to gain a better understanding of investing and brush up their knowledge in economics and finance. The Academy’s courses and projects will be available to any individual, regardless of whether they are a Tinkoff customer.

The educational initiative was launched as part of Tinkoff Investments’ ESG** strategy to raise the financial literacy of the Russian population. Programme development will be handled by the Department of Knowledge, Tinkoff Investments’ new methodology centre created to support the Academy.

The Academy will see a constant inflow of new courses and other educational content, including the launch of materials for professional investors in the near future.

The Academy’s first courses

As of today, the Investment Academy platform hosts courses ranked by the user’s level of knowledge and experience in investing. Basic beginners’ courses include: • Investing 101

• How bonds work

• How stocks work

• How exchange-traded funds work

These courses are aimed at prospective investors and beginners to help them make sense of how investment tools operate and what influences their price. More advanced courses — such as “Comparing companies” and “How futures work” — are available to investors who have trading experience and have mastered the basics. The courses can be completed in any order.

Every course includes a theoretical module, self-assessment questions and a final exam. Theoretical modules feature self-assessment questions and exercises developed by Tinkoff Investments analysts. Upon completion of every lesson in the course, the user gains access to the final exam.

Dmitry Panchenko, Director of Tinkoff Investments, commented:

“It’s clear to us that people want to learn more about finance and investing — there is strong demand for high-quality, accessible educational programmes. In 2020, as part of implementing our ESG** strategy, we launched our online Investment Textbook. Since then, it has been read by more than 3.6 million people, and more than 1.7 million of them completed the associated course and passed the final exam. Launching a new educational initiative is a logical step in the development of all Tinkoff Investments projects aimed at raising the level of investment literacy in the country. The Investment Academy will become the Coursera of the finance and investment world, integrating various formats of educational content and making them available free of charge to anyone who wants to gain new skills and learn to manage their personal finances.

To support the Investment Academy, we created the Department of Knowledge, a methodology committee tasked with developing content for the online academy. The theoretical module features information that will help unqualified investors pass their test***, in addition to offering practical exercises designed by Tinkoff Investments analysts to help investors navigate risky situations in the future.

We will continue to actively develop our educational initiatives. In 2022, we plan to launch a website and a dedicated mobile app that will be available to all users, not limited to Tinkoff Investments clients.”

Tinkoff Investments continues to develop educational initiatives across various formats that are aimed at boosting financial literacy. These include Pulse, a social network for investors with over 1.6 million users, The Greedy Investor podcast with more than one million listeners to date, and several YouTube projects: Money Never Sleeps (28 million views), Tinkoff Private Talks (1.4 million views), Investerika (1.7 million views), and the new show Investments and the City.

Related News

- 04:00 am

This year, Robo.cash platform attracted € 42M of investments, exceeding last year's figures by more than 3 times. The growth was also strengthened by several milestones that the company hit throughout the year.

Over the past year, the Robo.cash platform has grown significantly in a number of ways. Thus, since January, net deposits have increased more than 5 times and amounted to record 4 M euros in November. According to the latest survey among platform investors, 69% have Robocash's share in the portfolio of up to 25%.

On average, 780 new investors have joined Robocash every month this year, and currently there are more than 21,800 in total. Germany is traditionally the absolute leader in terms of geographical division.

Also, in September, the company reached a new milestone of 300 M euro in funded loans. The fourth quarter was particularly marked, growing by 29% QoQ and confirming the general upward trend in the activity of P2P investors at the end of the year.

“The results we have achieved this year show that our business model has perfectly adapted to the current economic conditions. We, in turn, will maintain the set level and continue to strive to provide investors with a favorable ratio of risk and profit.” - comment Sergey Sedov, CEO Robocash Group.

Related News

- 06:00 am

As 2021 draws to a close, Richard Gardner released a statement on what’s next for the burgeoning digital assets space. Gardner serves as CEO of Modulus, a US-based developer of ultra-high-performance trading and surveillance technology that powers global equities, derivatives, and digital asset exchanges. His ideas have been published by Forbes, Reuters, CIO Magazine, NASDAQ, Business Insider, The Detroit Free-Press, and dozens of other regional and industry-related publications.

“If 2021 was the year of cryptocurrency, then 2022 will be the year of custody and CBDCs,” noted Gardner. “Over the course of the past twelve months, cryptocurrencies really came into their own. Institutional investors came on board. Even regulators and longtime naysayers decided, finally, that digital assets were here to stay. Even though the fundamentals and technology are strong, there are some kinks still to be worked out. Custody is one such area. In 2022, the industry will realize that cryptocurrency and digital assets simply cannot reach its true potential without competent custodianship.”

“Custody, I think, has eluded the spotlight thus far because, in traditional finance, it is simply an administrative afterthought. When you purchase traditional assets, you typically don’t spend much time considering the custody process. With digital assets, it is very different. It isn’t solely an administrative function. Now, it also becomes a security function. Your custodian is responsible to keep your digital assets safe from malfeasance and incompetence. If you can’t trust that your assets are safe from hackers and other bad actors, you can’t seriously expect cryptocurrency to really expand to its fullest potential,” said Gardner.

“Self-custody is an option, but, frankly, it is impractical. It requires a level of technological expertise that many Main Street investors lack. And, for institutional investors, it simply isn’t in their wheelhouse. They need a custodian they can trust. But who? Consider the existing field. The leading providers have serious security concerns. One such company has been named in a lawsuit which alleges that they are responsible for the loss of $70 million in digital assets. That’s not a custodial situation that the industry will earnestly be able to accept --- particularly as institutional investors continue to come on board. Now that cryptocurrency is here to stay, 2022 will be the year that the industry gets serious about custody. I expect that you’ll see companies with a penchant for security step up and fill the void,” said Gardner.

Modulus is known throughout the financial technology segment as a leader in the development of ultra-high frequency trading systems and blockchain technologies. Modulus has provided its exchange solution to some of the industry’s most profitable digital asset exchanges, including a well-known multi-billion-dollar cryptocurrency exchange. Over the past twenty years, the company has built technology for the world’s most notable institutions, with a client list which includes NASA, NASDAQ, Goldman Sachs, Merrill Lynch, JP Morgan Chase, Bank of America, Barclays, Siemens, Shell, Yahoo!, Microsoft, Cornell University, and the University of Chicago.

“Beyond custody, I think 2022 is going to be the year where we start to see all of the work central banks have put into developing their own digital currencies finally come to fruition. In 2021, they worked hard to develop the infrastructure. 2022 will be the year that many central banks will begin their beta tests and make their launch. All in all, 2022 will be an exciting year for fintech.”

Related News

- 07:00 am

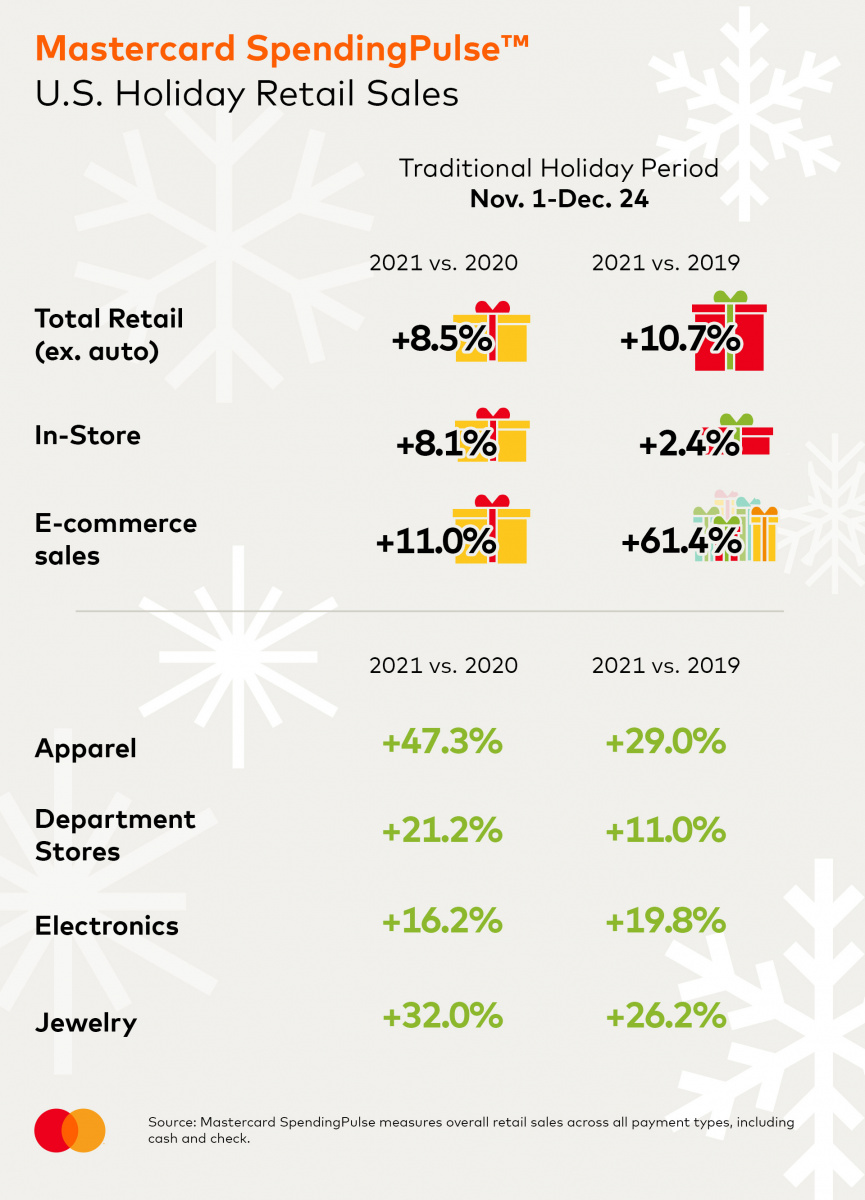

It’s been a resurgent season for retailers as consumers stocked their carts with gifts and gadgets. According to Mastercard SpendingPulseTM, holiday retail sales excluding automotive increased 8.5% year-over-year this holiday season, running from November 1 through December 24. Notably, online sales grew 11.0% compared to the same period last year, the preliminary insights show. Mastercard SpendingPulse measures in-store and online retail sales across all forms of payment.

“Shoppers were eager to secure their gifts ahead of the retail rush, with conversations surrounding supply chain and labor supply issues sending consumers online and to stores in droves,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “Consumers splurged throughout the season, with apparel and department stores experiencing strong growth as shoppers sought to put their best dressed foot forward.”

Findings from Mastercard SpendingPulse underscore the strength of the holiday shopper across channels, with consumers returning to stores (+8.1% YOY), and e-commerce continuing to expand, up 11.0% compared to 2020. Additional key findings include:

- Consumers shopped early: Continuing a key trend from 2020, U.S. consumers shopped earlier than in years past, as retailers offered special promotions early and then again later in the season as shoppers raced to secure “guaranteed by Christmas” shipping offers. Looking at Mastercard’s expanded holiday season, total retail sales were up +8.6%* YOY for the 75 days between October 11 and December 24.

- Thanksgiving weekend remained key: Black Friday marked the top spending day of the 2021 holiday season yet again. For the Thanksgiving weekend running Friday, November 26 through Sunday, November 28, shoppers drove U.S. retail sales up +14.1% YOY. In-store sales also rebounded, increasing +16.5% YOY while e-commerce sales experienced sustained growth, up +4.9% YOY.

- Smaller boxes had a big impact: Whether consumers were shopping for themselves or for loved ones, the Jewelry sector experienced some of the strongest YOY and YO2Y growth.

- E-commerce sales snowballed: This holiday season, e-commerce made up 20.9% of total retail sales, up from 20.6% in 2020 and 14.6% in 2019. The channel continues to experience elevated growth as consumers enjoy the ease of holiday browsing and buying in the comfort of their own homes.

Related News

- 08:00 am

With the year ending, most of us would be planning for the new year resolutions, and one of the most popular resolutions just next to fitness is financial discipline. But making financial decisions is not a cakewalk. One needs to be pretty well informed about the different asset classes, history, and risks involved before investing their hard-earned money. The market is flooded with newer and attractive investment avenues that one can consider moving beyond traditional options like bank FDs, PPOs and share market. Many of these investment options allow the investors to earn passive income leading to accumulating more wealth as compared to traditional investment options.

We have curated a list of the five best new-age alternative investment avenues to look out for in 2022 that would partner you in achieving your short and long-term financial goals.

Strata, is a tech-enabled real estate investment platform aiming to democratise commercial real estate in India. Strata helps investors to own a fraction of a premium commercial real estate across all metro cities in India. All this is done via a digital platform where the investor can check the property, the investment amount, lock-in period and other details. Since its inception in 2019, Strata has had over 15000 users with an active investor base of over 1500. Strata provides lucrative investment options in commercial real estate with a stable rate of return ranging from 8% to 13%; and has become one of the leading players in the fractional ownership space in India.

LenDenClub is a leading peer-to-peer lending platform that provides an alternate investment opportunity to investors or lenders looking for high returns with creditworthy borrowers looking for short term personal loans. With over a million investors on board, LenDenClub has become a go-to platform to earn returns in the range of 10%-12%. LenDenClub offers investors a convenient medium to browse thousands of borrower profiles to achieve better returns than traditional asset classes. Moreover, LenDenClub is safeguarded by market volatility and inflation. LenDenClub provides a great way to diversify your investment portfolio.

Bitbns is one of the oldest cryptocurrency exchanges in India. Founded in 2017, it aims to bring cryptocurrencies to the masses and restrict them to affluent people. Bitbns has over 3 million traders on their platform, the exchange lists over 300 coins, the highest amongst its peers. The platform also provides various types of investment options like Systematic Investment Plans (SIPs) and Fixed Income Plans (FIPs) in bitcoin. The SIP is similar to SIPs in mutual funds, and it is provided through their Bitdroplet platform. While in the FIP option, the investor can choose to invest in bitcoin for a fixed period of time and are guaranteed the fixed rate of return, this option is only available on the website version of their platform.

Vested Finance is a California-headquartered U.S. Securities and Exchange Commission (SEC) Registered Investment Advisor (RIA) that provides an online investment platform that enables Indian investors to invest in the US stock market. Founded in 2018, Vested Finance has recently raised $3.6 million in seed funding. Vested has also become more accessible to invest in the Indian investors by partnering with brands like Axis Securities, Kuvera, 5Paisa, Angel Broking, among others, to provide their investors with the opportunity to invest in the US stocks.

Kristal.AI is a global digital-first private wealth platform. It enables easy access to high-potential startups and private companies to diversify and enhance investors' portfolios through their private markets. They offer alternative investment options with exclusive private equity, Pre-IPO deals, stocks from multiple global stock market exchanges, and VC funds. The fund's platform uses active strategies that enable clients to access exclusive investment strategies with risk management and periodic reporting. Kristal.AI has advised over 30,000 platform users and funded over 3000 accounts since its inception in May 2020. They have investors from 20+ countries across the world.

Related News

Kyle Drummond

Founder at DirectLoanTranfer

Since the emergence of MFIs, the habit of asking for a loan from friends has gradually faded away. see more