Published

- 01:00 am

SFC Capital and FINTECH Circle are partnering to find the next top 10-20 fintech startups or scaleups. SFC Capital has assigned £1.5m in funds which will be distributed among the selected startups. The final list of startups will be revealed by mid April 2022.

Candidates must be UK based eligible for the UK Government’s Seed Enterprise Investment Scheme (SEIS). The scheme is designed to help companies raise money at the start of their growth journey by offering tax reliefs to individual investors who can buy new shares in a company founded less than two years ago.

FINTECH Circle and SFC Capital are looking for solutions to the real and burning problems across financial services that are yet to be solved. Judges will be looking at the founding teams’ vision, previous experience and unique capabilities to execute the company’s business plans.

Companies that wish to apply have until the 30th January 2022 to submit their application here

SFC Capital is the UK’s leading SEIS investor and seed-stage investor. Founded in 2012 SFC Capital combines an angel syndicate with its own funds to provide investors with diversified exposure to SEIS- and EIS-qualifying businesses.

Based in London but active across the UK, SFC Capital has a track record of backing high-growth businesses in parts of the UK where access to early-stage equity capital is often scarce. SFC is committed to promoting investment into startups with diverse founders, with 40% of SFC’s portfolio in the last 12 months being into companies with female founders or leaders.

FINTECH Circle is the number one community for fintech startups and scaleups globally reaching an audience over 130,000. FINTECH Circle’s mission is to create the world’s leading fintech ecosystem and a platform connecting finance professionals, investors and entrepreneurs. FINTECH Circle supports businesses and entrepreneurs in their growth journey by helping them raise funding, providing access to events worldwide as well as bespoke masterclasses and scale up programmes.

FINTECH Circle has published several educational books – including The FINTECH Book, The WEALTHTECH Book, The INSURTECH Book, The PAYTECH Book, The AI Book, The LEGALTECH Book and FinTech for Dummies, all published by Wiley – and has also partnered with ITN Productions to produce film documentaries such as Responsible Fintech.

Stephen Page, SFC Capital Chief Operating Officer:

“There is no better partner than FINTECH Circle to find the next cohort of leading UK fintech startups. We have worked with FINTECH Circle in the past and it has always been a pleasant and successful experience. Finding the future of fintech and investing in impressive startups are the types of things SFC Capital lives and breathes for, so we could not be more excited about this new adventure.

Susanne Chishti, FINTECH Circle CEO & Founder:

“We are very excited to be working with SFC Capital again to invest into the best UK fintech startups. The fintech sector has been booming over the last years and we have seen lots of innovation across various fintech sub-sectors. The future of finance is driven by tech innovation and FINTECH Circle is at the center of the global ecosystem with our fintech thought-leadership reaching our 130,000 FINTECH Circle community. We are delighted to help the best fintech entrepreneurs with £1.5 million startup capital to be deployed by the end of March 2022.”

Related News

- 08:00 am

The industry’s best in class Fintech co-creation event, powered by Europe’s leader in payments

The e-Payments Challenge is Worldline’s annual hackathon bringing together worldwide payments ecosystem stakeholders, including fintechs, start-ups, banks, merchants, as well as Worldline’s talented team of technology experts.

The challengers, which is made up of Worldline’s major corporate customers, will propose real-life scenarios and the associated business challenges to start-ups (the disruptors), who will in turn be asked to co-create smart solutions to address these challenges, whilst leveraging Worldline’s (the enabler) e-payments expertise and assets.

Contestants will be tasked with creating solutions for the various challenges. Worldline will select participating Fintechs from applicants from across all disciplines of payment technology - and beyond.

A wide range of business areas will be covered, including the omnichannel experience, digital currencies, financial sustainability and the cashless society.

As a result of the co-creation process, start-ups and corporations will create a suitable solution that significantly shortens their go-to market cycle. All Fintechs will have the opportunity to work closely with sponsoring and/or participating companies, and bring their ideas to life using Worldline’s considerable assets.

Pascal Mauzé, Head of Communication, Marketing & Sales performance at Worldline, says: “As a global paytech company that is based on a strong open-innovation approach, Worldline is determined to assuming its key role of enabler in the payments industry. We aim to unite payments operators from both the corporate and start-up worlds, to help them co-create the future of payments.

“More than ever in the current global economic environment, Worldline is committed to design and operate leading digital payment and transactional solutions that enable sustainable economic growth and reinforce trust and security in our societies. I am confident this years’ event will bring many innovative and solid solutions to support our strong and on-going commitment to the industry.”

Discover this year’s edition challenges

Adopt the digital currency

· Challenge #1 - Corporate gift card based on proprietary digital currency

Drive financial sustainability

· Challenge #2 - Delivering a digital corporate expense management, customer onboarding & payment solution

Master the omnichannel experience

· Challenge #3 - Secure phone call payments for hospitality bookings

· Challenge #4 - Enabling budget-diverse payment on the Mobility Application

· Challenge #5 - Revolutionizing experience of employee benefits administration and spending

· Challenge #6 - Digital identity-based payment in an e-commerce application

· Challenge #7 - Eliminating fraud on voice-based payments

· Challenge #8 - Offering a seamless online payment flow in physical boutiques and pop-up stores

Provide a touchless experience

· Challenge #9 - Implementing e-Invoicing

· Challenge #10 - Payment & Loyalty made seamless

Speed up the cashless society

· Challenge #11 - Digital credit card for limited purposes

· Challenge #12 - Enable a seamless account-based payment experience in physical stores

Related News

N/A

N/A at N/A

Remember how a decade ago people used to say, "there’s an app for that" (an Apple trademark in fact)? see more

- 06:00 am

Fintech start-up, Hydr has developed its proprietary invoice finance platform to integrate with more major cloud accounting software providers including Sage and QuickBooks.

After launching exclusively with Xero in May, the Hydr platform can now be accessed by millions more SMEs in the UK who want to leverage their unpaid invoices to optimise cash flow and help fuel their growth.

Users of Sage, FreeAgent, KashFlow, QuickBooks and Xero who sign up with Hydr can get paid almost immediately for the work they have completed and invoiced, rather than having to wait out long payment terms and even having to consider extending their borrowings to maintain working capital.

Customers who link their account to the Hydr platform can expect a class-leading, seamless integration. No duplication of data is needed, they simply continue to raise their invoices with their cloud accounting provider as normal and Hydr will do the rest, funding approved invoices within 24 hours.

Hydr co-founder, Nicola Weedall said,

“We’re so pleased to have achieved this product milestone. The impact of long payment terms and late payments is affecting millions of small businesses in the UK; many are navigating CBILS repayments and ramping up post-Covid trading which can put a strain on working capital. We feel so strongly that getting paid early is the best way of optimising cash flow, far better than extending borrowings.”

Hydr co-founder, Hector Macandrew said,

“Invoice finance in years gone by has often been complicated and time consuming to apply for, complex to manage and opaque in pricing. It is absolutely ripe for disruption and cloud accounting and open banking has made this reinvention achievable. With our simple, transparent and fairly priced proposition, it is now more accessible and attractive to small businesses than ever. We encourage more businesses to consider it.”

Hydr helps small businesses optimise their cash flow with fully digital onboarding that takes just 15 minutes. Hydr’s platform connects with a company’s data and financial information creating a seamless digital experience without the need for the company to submit any additional paperwork. Funding decisions are given in real time and Hydr pays 100% of the value of an invoice (rather than the traditional 70-90%) within 24 hours, minus a transparent, fairly priced fixed fee. Once quoted, the fee never, ever changes and includes credit insurance.

Hydr works with small businesses registered in England in Wales that sell products or services to other businesses (B2B). To find out how Hydr can optimise your cash flow without extending your borrowings, visit https://hydr.co.uk/

Related News

- 01:00 am

J. Christopher Giancarlo, the crypto and blockchain veteran commonly known as ‘CryptoDad’, joins CoinFund as strategic advisor

CoinFund, a blockchain-focused investment firm with the goal of shaping the global transition to digital assets, is pleased to announce that J. Christopher Giancarlo, the former Chairman of the Commodity Futures Trading Commission (‘CFTC’) will join CoinFund as a Strategic Advisor. In addition to his former role as Chairman of the CFTC, Giancarlo is a respected market commentator and author. His support and advocacy for cryptocurrencies has led him to be commonly referred to as ‘CryptoDad’.

Speaking on the appointment, Jake Brukhman, CoinFund’s founder and CEO, said “It is a distinct honor to work with Chris as CoinFund’s strategic advisor. As crypto regulation and legislation is being formed in real-time in the United States, Chris stands out as one of the most authoritative experts and commentators when it comes to Web3 and crypto adoption, as well as capital market structure.”

CoinFund’s President, Christopher Perkins, added “Chris was a driving force in supporting innovation at the CFTC, and continues to serve as a trailblazer and advocate for thoughtful crypto and web3 policy in the United States. With his track record, market reputation, and credentials, he will bring great value to CoinFund, our founders, and our portfolio of investments.”

Chris Giancarlo, commenting on his appointment: “I am delighted to join the CoinFund team. They have been company builders and a strong partner to founders since their inception and have been helping to drive digital asset adoption in capital markets. I look forward to working with the management team as they help this new asset class achieve mainstream adoption.”

Giancarlo was first nominated as a CFTC Commissioner by President Barack Obama and unanimously confirmed in June 2014. He was subsequently nominated as CFTC Chairman and again unanimously confirmed in August 2017. He departed the CFTC in July 2019 following the expiration of his five-year term.

Giancarlo’s term is remembered for the CFTC’s support of the first bitcoin derivatives products in 2017, an early iteration of today’s bitcoin futures ETFs. Giancarlo is also respected in the international regulatory community as being an advocate for cryptocurrencies. Giancarlo’s recent book ‘CryptoDad: The Fight for the Future of Money’ depicts his reckoning with the future of the global economy and puts forward the fight for a Digital Dollar.

Before entering public service, Giancarlo served as Executive Vice President of financial services firm GFI Group Inc., leading its private equity funding and subsequent initial public offering, and as Executive Vice President & U.S. Counsel of Fenics Software.

Giancarlo currently holds a number of positions: Senior Counsel at Willkie Farr & Gallagher LLP since January 2020, Co-Founder of The Digital Dollar Foundation (DigitalDollarProject.org) since January 2020, and Board Member at American Financial Exchange, LLC since October 2019. He now brings his years of experience, knowledge and expertise to serve as a strategic advisor to CoinFund. Giancarlo will advise CoinFund on matters of policy.

Related News

- 05:00 am

· Best-in-class app enables near-prime customers to service their card and manage their money effortlessly

· Provides immediate use of a digital card followed by a plastic card in the post within days

Chetwood Financial (“Chetwood”) today announces the launch of Wave, the digital bank’s first-ever credit card, empowering customers to control their spending and manage their finances over the long term.

Designed by customers for customers, the Wave credit card offers flexibility and ease for near-prime consumers who typically have fewer credit options available to them, with less functionality. Those who apply for a Wave card are provided with a pre-approved real rate and their credit limit upfront so they can make an informed decision, without affecting their credit score.

Customers can manage their card through the feature-rich Wave app available on iOS and Android, including:

· Fast and secure access with biometric login, plus document and selfie matching to confirm identity

· Ability to add the card to Apple Pay or Google Pay to make secure payments instantly

· Card freezing and unfreezing capabilities in case of loss or theft

· Changing repayment amounts should customers want to pay more

· Alerts to help customers control spending and monitor outgoings to improve financial behaviour

· UK-based customer support through live chat

Customers are also afforded a three-day grace period for missed payments, providing additional support when faced with life’s unexpected challenges.

“The Coronavirus pandemic has heavily impacted many individuals’ finances over the past two years, meaning that access to safe alternative sources of credit has never been more important,” says Andy Mielczarek, CEO of Chetwood Financial. “At Chetwood, we strive to create tailored products that help make people better off. With the launch of Wave, customers are able to take an important step closer to achieving their financial goals, from paying off larger balances, to learning how to become more financially responsible for the long term.”

During the Beta testing phase of Wave, Chetwood worked closely with ClearScore to ensure the credit card and its features were performing as expected and fulfilling customer needs, actively responding to initial customer feedback to further improve the product. Feedback provided by the credit card’s first 2,000 customers through ClearScore has been very positive, with 96% of those who responded describing the application process as ‘very easy’ or ‘easy’, and 98% of customers rating the Wave card as a 4-5 out of 5 for overall satisfaction.

The Wave credit card will offer credit limits of £250-£1,750 to new applications, increasing up to £10,000 over time based on customers’ eligibility. Customers can opt-in and out of credit limit increases and decrease their limit at any time through the app.

As part of the Wave offering, Chetwood has also launched a Repayment Calculator to encourage better financial behaviour and help customers understand how interest works on credit cards. By using the easy in-app tool, customers can see how paying a little extra than the minimum payment each month can reduce the amount of interest and clear their balance quicker.

Wave is the fourth banking product launched by Chetwood, having brought its first lending product LiveLend, the world’s first dynamic loan, to market in November 2018. The LiveLend Reward Loan uses technology to adapt to customers’ good financial behaviour, reducing their loan rate when their credit score improves. The product helps encourage customers to further improve their financial position whilst offering a fast, fair and flexible way to borrow.

Related News

- 02:00 am

French fintech VC Truffle Capital leads new capital round supported by early-stage investors.

Backed by the capital raise, Belgian startup Cake is writing the recipe for the future: independent banking app Cake will disappear from February 2022 and make way for European expansion with services aimed at retailers and brands (via Cake for Business) and banks (via Cake for Banks).

Appealing marketing platform for businesses

Cake for Business is firmly established in Belgium. The marketing platform that allows retailers and brands to offer cashback discounts in a targeted way to segments of consumers, based on their historical purchasing behavior, is running at full speed. There are now more than 100 commercial partners, including Schoenen Torfs, JBC, Veritas, Deliveroo and Lukoil.

Belgian consumers have already earned over 800,000 euros in automated cashbacks through the Cake platform, including 125,000 euros in December 2021.

In addition to this ability to offer cashback discounts to consumers, Cake also provides market insights to brands and companies based on the anonymized processing of consumer purchases behavior.

Cake for banks

Since its launch in early 2020, just before the corona crisis, Cake has continued to reinvent itself. The challenges associated with the implementation of PSD2 regulations were met by directly implementing Cake cashbacks into existing banking apps. This led to the launch of Cake for Banks at the beginning of last year.

With this, Cake offers European banks plug and play solutions to integrate their cashback module into their own banking apps within a matter of weeks. This enables banks to offer an additional service to their customers, differentiate themselves from competition and generate a new revenue stream on top of their existing business model by taking a commission on each cashback. Cake hereby takes care of the cashback offering and the administrative handling of it with the commercial partners.

The first integration into an existing banking app was completed by early August. Under the name “Mooi Meegenomen van Cake”, all customers aged 16 and above of banking and insurance group Argenta can choose to receive small refunds for purchases they pay with their Argenta account at Cake’s partners. Once customers have activated the refunds in their trusted Argenta app, everything is automatic. As such, they don’t have to do anything.

“As a start-up, we are constantly looking for the right product-market-fit. From the beginning, we chose a flexible approach that keeps a close eye on the market. The successful launch at Argenta has confirmed that our Cake for Banks solutions meet a significant demand from the market. Both from banks, bank customers and commercial partners.”

Davy Kestens, CEO of Cake

This resulted in an exponential growth in the number of users of Cake cashbacks, followed by an increasing number of commercial partners.

European Expansion

Now that Cake as a Belgian startup has established a scalable business model, targeted both to banks and companies, they are supported by Truffle Capital to further roll out this model within Europe. This French fintech VC, supported by early-stage investors including Seeder Fund, Sambrinvest and Freshmen, leads a new capital round of 4.6 million euro.

“We are thrilled to lead this new round of financing and to support Cake’s international development. We believe that Cake has cracked the customer rewards challenge in the most seamless, frictionless way, providing banks with strong customer loyalty and data monetization, and retailers with some of the highest marketing ROI versus any other channel. Cake’s approach in the rewards market is disruptive and it has everything it takes to become a world leader in this sector.“

Patrick Lord, Senior Partner at Truffle Capital

The consumer banking app, which Cake initially launched with, will be shut down from February, making way for a full focus on banks and businesses. There are already ongoing discussions with several national and international banks regarding the integration of the Cake cashback platform into existing banking apps.

To support this further growth, Cake is actively looking for additional employees, mainly in sales and account management.

Related News

- 05:00 am

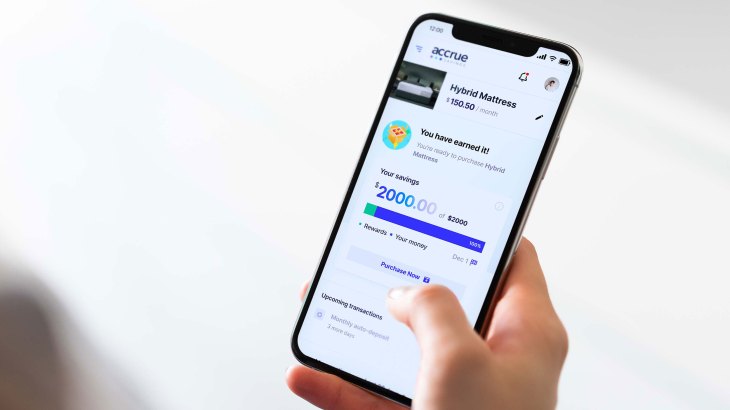

Accrue Savings, the merchant-embedded shopping experience that rewards consumers for saving, has announced it has raised $25 million in a Series A funding round led by Tiger Global, with participation from Aglaé Ventures, the tech investment firm backed by Groupe Arnault, Maple VC, and notable leaders such as UPS CEO Carol Tomé and Fanatics CEO Michael Rubin. Returning investors include Twelve Below, Box Group, Red Sea Ventures, Ground Up Ventures, Good Friends, Silas Capital Ventures, among others.

Launched in November 2021, Accrue Savings empowers consumers to save for purchase while earning cash incentive rewards from the brand along the way. Retailers can finally reward customers who choose saving over debt by making FDIC-insured cash contributions to a customer’s Accrue Savings account when customers meet milestones on their savings journey. Brands that partner with Accrue Savings are seeing an immediate impact on their top-of-funnel marketing efforts. With Accrue Savings, retailers can engage with customers earlier in the consideration phase by offering a savings-based purchase plan on their website and in targeted email or SMS campaigns. By alleviating shopper concerns about debt-based payment plans partner retailers are reducing friction points between consumers and their purchases.

New retail partners now offering Accrue Savings to their customers include Smile Direct Club (NASDAQ: SDC) and Poly & Bark, with more retailers on the way. These brands join Casper (NYSE: CSPR), Camp, Eterneva and more, in providing debt-free ways for people to buy the things they want most.

“The response from retailers and consumers since launch has surpassed our expectations. We’re so pleased to find so many brands that want to offer meaningful payment diversity options for consumers,” said Michael Hershfield, Founder and CEO of Accrue Savings. “Bringing on an institutional investor like the venerable Tiger Global demonstrates the significant opportunity to embed more diverse financial technology to transform the shopping experience for a broader range of customers.”

“Accrue Savings helps brands reach more customers and gives consumers a responsible purchasing option. It’s a win-win,” said Alex Cook, Partner, Tiger Global. “Michael and the Accrue Savings team are building a unique platform and we’re thrilled to partner with them on the next stage of the journey.”

The new Series A financing brings Accrue Savings’ total funding to nearly $30 million to date and will be used to expand retail partnerships and bolster hiring efforts across all departments, including engineering, sales and marketing.

Related News

Mikkel Velin

Co-CEO at YouLend

Fuelled by the power of embedded finance, embedded lending is pushing the boundaries of SME funding to new frontiers. see more

- 06:00 am

- The AQMetrix ranking acknowledges the platform with the highest rating among neobanks in Spain.

- The commission-free services, the platform's design and imagin's commitment to sustainability are some of the aspects best rated by ‘imaginers’.

- imagin currently has a community of more than 3.7 million ‘imaginers’ and a 16% share of active users in Spain in the mobile banking category, according to data from the latest Smartme Analytics report.

imagin, the digital and lifestyle services platform promoted by CaixaBank, has been ranked as the the neobank with the best quality service in Spain by AQMetrix, the independent consultant specialising in rating mobile applications and digital banking services of entities worldwide, who conducted a specific assessment on the quality of neobanks in Spain.

The ranking acknowledged imagin with the highest rating, AA, among neobanks. In its studies AQMetrix analyses aspects such as the app's availability, performance and functionalities.

Neobanks general score. Source: AQMetrix (Q3 data).

Currently, imagin boasts upwards of 3.7 million users. The platform is the leader among the top neobanks and fintech companies in terms of customers, with a 16% share of active users, as the latest Smartme Analytics study shows.

Active users ranking of mobile applications in new digital banking and fintech. Source: Smartme Analytics (November 2021 data).

This data strengthens imagin's leadership as a digital financial services player. According to data from imagin, ‘imaginers’ especially rate aspects such as the commission-free maintenance, transfer and cash withdrawal services.

imagin’s growth comes in response to the user loyalty boosting strategy arising from the creation of digital, financial and non-financial services, which, unlike traditional banking do not necessarily involve somebody registering as a banking customer. During the past year, a huge amount of digital content and services has been launched on the platform that have attracted a great deal of interest among the imaginer community, based on six major subject areas: sustainability (imaginPlanet), solidarity (imaginChangers), music (imaginMusic), videogames (imaginGames), trends (imaginCafé) and technology (imaginShop).

Solid commitment to sustainability

Among the imaginer community, sustainability is one of the fields that generates the most interest, interaction and involvement of users. Through imaginPlanet, imagin implements a full line of sustainability-based products, services, agreements and initiatives that create a positive impact for the planet and society as a whole. As a result of such actions, imaginPlanet has succeeded in boosting tree plantations to offset upwards of 100 tons of CO2, collecting 1,000 kilograms of plastics and more than 40,000 imaginers have joined in saving on food waste through the partnership with “Too Good To Go”.

This commitment to sustainability, which is part of imagin's strategy and is delivered across the entire business model, has earned the platform a B Corp certification. This guarantees the company's compliance with the highest standards of social and environmental performance, public transparency and corporate responsibility to balance economic benefit with social purpose.

Besides supporting environmental causes, one of the projects that has had the greatest impact on the imagin community is imaginChangers, the programme that enables imagin users to take part in digital volunteering actions through their mobile devices and support charity projects with financial donations.

Digital financial services

At the financial level, the imagin application develops digital products offered to meet the saving and financing needs of users. In all cases, imagin has the key features for the digital native public: mobile only banking (the services are provided exclusively through the app, with no branches and no website, which solely fulfils an informative purpose), with no fees for the user and its own simple and clear language, especially suited to directly communicating with young people.

The imagin offering includes two further applications according to the age of users: imaginKids (intended for children from 0 to 11 years of age and highly focused towards financial education through games), imaginTeens (designed for adolescents between 12 and 17 years of age, with content and services intended for young people who are beginning to require solutions for their first purchases and to start out in managing their personal finances).